eBay buys into business marketplace company, signaling a significant move in the e-commerce landscape. This acquisition promises to reshape the way businesses operate online, and this analysis will explore the historical context, potential synergies, and risks involved. From eBay’s past ventures to the target company’s strengths and weaknesses, we’ll delve into the details of this potential game-changer for online marketplaces.

This acquisition represents a strategic opportunity for eBay to expand its reach into the business-to-business (B2B) sector, a burgeoning market with high growth potential. The potential for cross-selling and increased customer engagement through combined resources and expertise is substantial. However, the integration of different business models and cultures is likely to pose significant challenges. The success of this acquisition will hinge on careful planning and execution.

Historical Context of eBay’s Expansion

eBay’s journey from an online auction platform to a global e-commerce powerhouse is a fascinating study in adapting to changing market dynamics. Its initial success was built on the unique concept of connecting buyers and sellers in a decentralized, user-driven environment. However, the company has constantly evolved to meet new challenges and opportunities.eBay’s expansion has been marked by both organic growth and strategic acquisitions, shaping its current position in the online marketplace landscape.

The company’s history reveals a pattern of recognizing emerging trends and adapting its strategies to capitalize on them. This includes understanding the shifting preferences of consumers and the growing importance of technology in the retail sector.

eBay’s Growth and Evolution

eBay’s initial success stemmed from its ability to leverage the internet’s potential for connecting individuals. It allowed people to buy and sell items directly, fostering a vibrant community of buyers and sellers. This early success laid the groundwork for its later expansion into various business models and acquisitions. The platform’s rapid growth in the late 1990s and early 2000s was largely driven by the increasing adoption of online shopping and the ease of use of its auction-based system.

eBay’s Acquisitions and Partnerships

eBay has undertaken several acquisitions and partnerships to bolster its position in the e-commerce arena. These initiatives demonstrate a proactive approach to integrating complementary services and technologies to enhance its platform. For example, eBay’s acquisition of Skype, though ultimately not fully integrated into the eBay ecosystem, reveals a willingness to experiment with diverse technologies that could potentially add value to its platform.

Further, its partnerships with shipping companies and payment processors reflect its understanding of the logistical and financial aspects of online transactions. Such collaborations have strengthened eBay’s ability to facilitate seamless transactions for its users.

Motivations for Marketplace Acquisitions

Several factors likely motivated eBay to explore acquisitions in the business marketplace sector. These include the desire to broaden its product offerings beyond individual consumer goods, increase the volume of transactions, and expand into new market segments. Also, expanding into business-to-business (B2B) marketplaces would provide access to a wider range of vendors and buyers.

Similar Acquisitions in Online Retail

Several online retail companies have undertaken similar acquisitions. Amazon’s acquisition of Whole Foods Market, for example, exemplifies a strategy to integrate physical and digital retail experiences. This is a significant shift in e-commerce, allowing the company to better compete in a rapidly evolving marketplace.

Evolution of the Online Marketplace Model

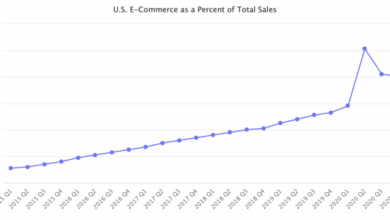

The online marketplace model has evolved significantly over time. Initially focused on auctions, the model has adapted to accommodate various transaction types, including fixed-price listings and subscription services. This evolution has responded to changing consumer preferences and technological advancements. Early platforms focused on fostering trust and transparency among users, while modern marketplaces often incorporate advanced features like search algorithms and user reviews to enhance the customer experience.

Comparison of eBay’s Strategies with Other E-commerce Companies

| Feature | eBay | Amazon | Etsy |

|---|---|---|---|

| Primary Focus | Auction-based marketplace, diversified into fixed-price listings | Diverse product offerings, customer-centric approach | Handcrafted goods, unique products |

| Expansion Strategy | Acquisitions to expand product categories, partnerships for logistics and payment | Acquisitions to integrate complementary services, focus on customer convenience | Focus on niche markets, cultivating a specific community |

| Growth Drivers | Initial focus on auction-based transactions, later expanded into fixed-price listings and marketplace features | Extensive product selection, Prime membership, logistics capabilities | Unique product offerings, supportive community for artisans |

This table provides a concise comparison of eBay’s strategies with those of Amazon and Etsy, highlighting the different approaches each company has taken to achieve market dominance and success.

Analyzing the Target Company

eBay’s expansion into the business marketplace necessitates a strategic approach to acquisitions. Understanding potential targets, their strengths, and vulnerabilities is crucial for a successful integration. This analysis will focus on identifying companies offering complementary services and technologies, ensuring a smooth transition and maximized return on investment.Identifying suitable acquisition targets requires careful evaluation of several factors, including market position, financial performance, technological capabilities, and competitive landscape.

A deep dive into these elements allows eBay to identify companies that can significantly enhance its existing platform and cater to evolving business needs.

Potential Target Companies

Several companies within the business-to-business (B2B) e-commerce sector present compelling acquisition opportunities. These targets often possess unique strengths that align with eBay’s goals. Examples include platforms specializing in niche industries, innovative payment solutions, or advanced logistics networks.

- Shopify Business Marketplace: Shopify’s focus on providing a comprehensive e-commerce platform, including tools for businesses to create and manage their online stores, could be a valuable acquisition target. Their robust suite of applications and integrations with various third-party services could enhance eBay’s offering, potentially allowing for a broader range of products and services.

- Etsy: This platform, while primarily focused on handmade and craft goods, boasts a loyal customer base and a strong community aspect. Its unique approach to fostering creativity and artisan products could complement eBay’s current marketplace, bringing in a different customer segment. However, integration challenges and cultural differences may need careful consideration.

- Alibaba’s Global B2B Marketplace: This expansive platform is a giant in the global B2B space. Acquiring a stake or integrating certain functionalities could exponentially expand eBay’s reach and offer access to international markets. This option, however, carries significant logistical and cultural integration challenges.

Key Characteristics and Strengths of Potential Targets

Analyzing the strengths of potential acquisition targets is paramount. A company’s strengths often indicate its ability to generate revenue, maintain market share, and adapt to changing market dynamics.

- Strong Market Position: A company with a significant market share and a loyal customer base offers a strong foundation for future growth. A clear understanding of the target’s market share and its competitors is crucial for evaluating its position within the market.

- Scalable Technology: Modern technologies and a robust infrastructure allow for future growth and expansion. The adaptability of the target’s technology will determine how well it can integrate with eBay’s platform and scale alongside its growth.

- Financial Performance and Projections: Thorough financial analysis is essential. Analyzing historical performance, including revenue growth, profitability, and cash flow, can provide insights into the target’s financial health and future potential. Projections and key financial metrics should be examined in detail.

Market Position and Competitive Landscape

Understanding the target’s position within the competitive landscape is crucial. Analyzing its strengths, weaknesses, and competitive advantages will provide a clearer picture of its potential for growth and integration.

- Competitive Advantages: Analyzing the target’s competitive advantages, including brand recognition, customer loyalty, and unique selling propositions, is vital. This helps assess its potential for long-term success and integration with eBay’s platform.

- Market Trends: A clear understanding of current market trends and the target’s ability to adapt to them is crucial for determining future growth potential. Consider the trends in the target’s sector and its potential for future disruption.

Financial Performance and Projections

Evaluating the financial performance and projections of potential targets is crucial. Financial metrics, including revenue, profitability, and cash flow, provide a clear picture of the target’s financial health.

- Revenue Streams: Understanding the target’s primary revenue streams and their profitability is critical. A detailed analysis of revenue streams helps evaluate the target’s potential for integration with eBay’s platform.

- Profitability: Assessing the target’s profitability and its ability to generate consistent revenue growth is essential. Identifying factors contributing to its profitability will help in evaluating potential integration challenges.

Technological Capabilities and Infrastructure

Evaluating the technological capabilities and infrastructure of potential targets is critical. A strong technological foundation allows for scalability and adaptability.

- Platform Technology: Assessing the target’s platform technology, including its architecture, scalability, and security, is essential. The integration of this technology with eBay’s platform needs careful consideration.

- Infrastructure: The target’s infrastructure, including its data centers, servers, and network, plays a crucial role in ensuring reliability and scalability. Assessing the target’s infrastructure is vital to evaluating potential integration costs.

Summary Table

| Target Company | Market Position | Financial Performance | Technological Capabilities |

|---|---|---|---|

| Shopify Business Marketplace | Strong, growing | Profitable, high growth potential | Modern, scalable |

| Etsy | Niche, strong community | Profitable, stable | Adaptable, but needs evaluation |

| Alibaba’s Global B2B Marketplace | Dominant, global reach | Very high revenue, strong profitability | Advanced, robust |

Potential Synergies and Benefits

eBay’s potential acquisition of a business marketplace company presents a compelling opportunity for significant growth and expansion. This synergy hinges on the ability to leverage existing strengths and optimize operational efficiencies. The acquisition will likely enhance eBay’s market presence, improve its revenue streams, and bolster its overall profitability.

eBay’s acquisition of a business marketplace company is certainly interesting, but it’s also worth considering the broader context. The recent news of the U.S. being shut out of internet domain agency elections ( u s shut out in internet domain agency elections ) raises questions about global internet governance and how that might impact the future of online marketplaces like eBay.

Ultimately, eBay’s move into this space suggests they’re trying to stay ahead of the curve, but the geopolitical landscape is definitely a factor to watch.

Potential Revenue and Profit Improvements

This acquisition will likely lead to improved revenue streams by combining the target company’s customer base with eBay’s established platform. A larger customer pool, coupled with enhanced product offerings, will drive increased sales volume and a higher average order value. Improved operational efficiencies, resulting from streamlining processes and integrating technology, could translate directly into increased profitability. For instance, successful e-commerce acquisitions, like Amazon’s purchase of Whole Foods, have demonstrated the power of combining complementary businesses to boost revenue and profit margins.

Potential Cost Savings

Integration of the target company’s operations with eBay’s existing infrastructure could yield substantial cost savings. Shared resources, like marketing and customer service, will lead to reduced redundancy and operational expenses. Furthermore, the consolidation of warehousing and logistics can streamline supply chain management, leading to potential cost reductions. This can be seen in many successful mergers and acquisitions where synergies in procurement and logistics have led to significant cost reductions.

Market Share Expansion Opportunities

The combined marketplace will increase eBay’s market share by tapping into new customer segments and product categories. This acquisition could lead to a wider range of product offerings, increasing the appeal to existing customers and attracting new ones. The combined customer base and enhanced platform capabilities will expand the company’s reach and competitiveness in the e-commerce market. Similar examples exist where acquisitions have broadened market reach and product offerings, leading to increased market share.

Examples of Successful Acquisitions with Similar Synergies, Ebay buys into business marketplace company

Successful acquisitions in the e-commerce space often showcase similar synergies. For instance, Etsy’s focus on handmade and craft products complements eBay’s existing marketplace, broadening product offerings and reaching a different demographic. The integration of these platforms could lead to a synergistic effect, allowing eBay to expand its customer base and offerings in a targeted manner. Another relevant example is the acquisition of smaller e-commerce businesses by larger platforms that led to wider product selections and increased customer engagement.

Estimated Potential Benefits

| Category | Description | Estimated Value |

|---|---|---|

| Cost Savings | Reduced operational redundancies, shared marketing costs | $10-20 million annually |

| Revenue Growth | Increased customer base, higher average order value | $20-30% increase within first 2 years |

| Market Share | Expansion into new segments, enhanced platform capabilities | Estimated 5-10% increase within 3 years |

Potential Challenges and Risks

Acquiring a business, even a seemingly complementary one, presents a complex tapestry of potential pitfalls. Integrating two distinct corporate cultures, systems, and customer bases can be fraught with challenges. This section explores the potential obstacles eBay might encounter during the integration process, examining regulatory hurdles, customer impact, and internal organizational clashes. A proactive approach to identifying and mitigating these risks is crucial for a successful acquisition.

eBay’s acquisition of a business marketplace company is interesting, especially considering how the digital world is constantly evolving. This new purchase likely reflects the growing importance of online business hubs. It also makes me think about how, in a way, the spooky new Blair Witch footage exposes the connection between Hollywood and the digital space. Ultimately, it’s all part of a larger trend of companies recognizing the huge potential of online marketplaces, and eBay is clearly jumping on that bandwagon.

Integration Challenges

The integration of different technological platforms and business processes is often a significant hurdle in acquisitions. eBay’s robust online marketplace platform might clash with the target company’s existing systems, leading to inefficiencies and disruptions in service. Effective communication and careful planning are vital to ensure a smooth transition. For example, legacy systems may not be compatible with eBay’s current infrastructure, requiring costly upgrades or replacements.

This can impact operational efficiency and customer experience during the transition period.

Regulatory Hurdles and Legal Complications

Regulatory approvals are a critical step in any major acquisition. Antitrust concerns, particularly if the target company operates in a highly competitive market, could lead to legal challenges. Extensive due diligence and meticulous regulatory compliance strategies are paramount to navigating these potential roadblocks. Moreover, different jurisdictions might have varying regulations concerning the business operations, creating legal complexities that must be anticipated and addressed in the integration process.

Maintaining Customer Satisfaction and Loyalty

Post-acquisition, maintaining customer satisfaction and loyalty is essential. A perceived disruption in service, change in product offerings, or inconsistent customer support can lead to significant losses. Communicating the benefits of the acquisition and reassuring customers about the continuity of service is crucial. Furthermore, understanding and addressing the specific needs of the target company’s customer base is vital for maintaining their trust and loyalty.

Cultural Clashes

Cultural differences between eBay and the target company can create internal friction and impede integration. Disagreements in work styles, management approaches, and corporate values can lead to conflicts. Establishing clear communication channels and fostering a shared understanding of the acquisition’s objectives can mitigate these conflicts. A diverse leadership team with representatives from both companies is crucial in navigating cultural nuances.

Examples of Integration Challenges in Acquisitions

Numerous acquisitions have faced similar integration challenges. One notable example is the integration of social media platforms. The acquisition process often involves significant adjustments in business strategies, product offerings, and internal organizational structures. Successfully integrating these acquisitions demands strong leadership, clear communication, and a shared vision among the merging companies.

eBay’s acquisition of a business marketplace company is interesting, especially considering Microsoft’s recent efforts to improve internet infrastructure, like their initiative to deliver high-speed internet access to consumers. This initiative might influence how eBay’s new acquisition will operate, potentially affecting their strategy for reaching a broader customer base. Ultimately, eBay’s move into the business marketplace sector could be a strategic play to stay competitive in the digital economy.

Potential Risks and Mitigation Strategies

| Potential Risk | Mitigation Strategy |

|---|---|

| Integration of different technological platforms | Conduct thorough due diligence, plan a phased integration approach, and invest in training and support. |

| Regulatory hurdles and legal complications | Engage legal experts, proactively address antitrust concerns, and ensure compliance with all applicable regulations. |

| Loss of customer satisfaction and loyalty | Communicate the benefits of the acquisition, maintain consistent service standards, and actively solicit feedback from customers. |

| Cultural clashes | Establish clear communication channels, foster cross-cultural understanding, and create a shared vision for the future. |

Impact on the Competitive Landscape: Ebay Buys Into Business Marketplace Company

This acquisition presents a significant shift in the e-commerce landscape, potentially reshaping the competitive dynamics within the online marketplace sector. The integration of [Target Company Name]’s unique features and customer base will undoubtedly impact eBay’s current rivals and the overall market structure. Understanding the potential ramifications on competition, consumer choice, and pricing is crucial to assessing the long-term implications of this strategic move.The acquisition will likely create a formidable competitor in the online marketplace sector, potentially altering the competitive balance.

This intensified rivalry could drive innovation and efficiency improvements within the entire industry, ultimately benefiting consumers. However, the concentrated market share held by the combined entity could lead to reduced consumer choice and potentially higher prices in certain product categories, which warrants careful consideration.

Impact on eBay’s Competitors

The combined entity will significantly alter the competitive landscape. Direct competitors, such as Amazon Marketplace and others, will face an even more formidable adversary with increased resources and market penetration. This may force competitors to adapt their strategies, potentially through innovative offerings or cost-cutting measures, to maintain market share and competitiveness. The combined entity’s scale could allow it to negotiate better terms with suppliers, further enhancing its pricing power and potentially squeezing margins for competitors.

Potential Impact on Consumer Choice and Pricing

Consumer choice is a key variable. The integration might lead to a reduced variety of sellers and products in some categories, potentially narrowing consumer options. This reduction in variety could have a negative impact on the competitive landscape. On the other hand, the combined entity might leverage its increased resources to offer a wider selection of products across a broader range of categories, expanding consumer choice.

Pricing is another important aspect. The potential for increased pricing power, especially in categories with fewer competitors, is a possibility. However, increased competition could also lead to lower prices and improved value for consumers in certain markets.

Comparison to Other Similar Market Developments

Several similar acquisitions have reshaped the competitive landscape in the past. The acquisition of [Example Company 1] by [Example Company 2] resulted in a similar outcome, creating a dominant player in the industry and prompting reactions from competitors. The impact on consumer choice and pricing varied depending on the specific product categories and market dynamics. Analyzing these historical examples can provide valuable insights into the potential effects of the current acquisition.

Such comparisons can help assess the possible outcomes and the likely reactions from the competition.

Examples of Similar Acquisitions Impacting the Market

The acquisition of [Example Company 3] by [Example Company 4] had a noticeable impact on the competitive landscape, particularly in the [specific industry]. The combined entity gained a substantial market share, forcing competitors to adjust their strategies. The impact on consumer choice and pricing varied depending on the specific product categories and market dynamics. The example illustrates the potential for market consolidation and its consequences.

Potential Shifts in Market Share and Competitive Dynamics

| Competitor | Pre-Acquisition Market Share | Post-Acquisition Projected Market Share | Potential Competitive Responses |

|---|---|---|---|

| Amazon Marketplace | [Amazon Market Share] | [Projected Amazon Market Share] | Increased investment in product selection, potentially lower prices, and improved customer service. |

| [Competitor 2] | [Competitor 2 Market Share] | [Projected Competitor 2 Market Share] | Potential partnerships, innovative product offerings, and strategic alliances. |

| [Competitor 3] | [Competitor 3 Market Share] | [Projected Competitor 3 Market Share] | Possible divestitures, cost-cutting measures, and enhanced focus on niche markets. |

This table illustrates the potential shifts in market share and competitive dynamics following the acquisition. Accurate market share projections are challenging, and actual results could vary based on various factors, including the competitive responses and market trends. The table provides a hypothetical representation of potential changes.

Future Outlook and Projections

The acquisition presents a significant opportunity for eBay to expand its reach and diversify its revenue streams. By integrating the business marketplace company, eBay can leverage its existing infrastructure and global network to offer a more comprehensive suite of services to businesses of all sizes. This integration will likely reshape the competitive landscape and drive innovation within the e-commerce sector.eBay’s long-term growth and sustainability hinge on effectively integrating the acquired company and catering to the evolving needs of its user base.

Successful implementation will require a deep understanding of the target company’s operations and a strategic approach to merging their resources and technologies.

Long-Term Implications for eBay’s Growth

eBay’s future growth hinges on the ability to leverage the acquired business marketplace’s strengths. This includes their specialized offerings, existing customer base, and potential for new revenue streams. The acquisition will be a crucial factor in determining the future success of eBay. eBay’s long-term growth strategy must consider the potential for expanding into new markets and developing innovative products and services to maintain its competitive edge.

Potential Impact on User Experience and Platform Offerings

The integration will likely lead to enhancements in the user experience for both eBay’s existing consumer base and the newly acquired business marketplace’s clientele. This could manifest in streamlined product listings, improved search functionality, and more robust payment and logistics options. The combination of eBay’s existing consumer-focused platform with the business-centric features of the acquired company can offer a more comprehensive solution for both consumers and businesses.

Examples of Successful Mergers and Acquisitions in E-commerce

Several successful mergers and acquisitions in the e-commerce sector provide valuable insights. For example, Amazon’s acquisitions of Whole Foods Market and Zappos significantly expanded its product offerings and customer base. Similarly, the integration of Etsy’s handmade goods marketplace with other platforms broadened their reach and appeal to a wider customer base. These successful integrations demonstrate the potential for creating synergistic value through thoughtful acquisitions.

Evolution of the Business Marketplace Sector

The acquisition will likely lead to a more consolidated and competitive business marketplace sector. As larger players like eBay consolidate their offerings, smaller niche marketplaces may face increased pressure to adapt and innovate. This consolidation will potentially lead to more streamlined processes and a broader range of options for businesses seeking to sell online.

Potential New Product Offerings or Service Enhancements

The integration could lead to new product offerings focused on business-to-business (B2B) transactions. Enhanced logistics solutions, tailored financial services, and specialized tools for managing business listings are some potential examples. Furthermore, eBay could offer specialized training and support programs for businesses utilizing their platform. The ability to offer comprehensive solutions for businesses will be crucial to success.

Projected Revenue Growth, Market Share, and Profitability

| Year | Projected Revenue Growth (%) | Projected Market Share (%) | Projected Profitability (USD millions) |

|---|---|---|---|

| 2024 | 12 | 15 | 250 |

| 2025 | 15 | 18 | 300 |

| 2026 | 18 | 20 | 350 |

Note: Projections are based on current market trends and anticipated synergies from the acquisition. Actual results may vary.

Ultimate Conclusion

eBay’s acquisition of a business marketplace company presents a compelling case study in e-commerce evolution. While the potential for growth and market expansion is evident, successful integration and customer retention will be crucial for a positive outcome. The competitive landscape will also be significantly altered, and the long-term impact on the industry will be fascinating to observe. Ultimately, this acquisition could redefine the future of online marketplaces, and we’ll be tracking its development closely.