E loan banks on international lending – E-loan banks on international lending are rapidly reshaping the global financial landscape. These digital lenders are streamlining cross-border transactions, offering a new avenue for businesses seeking funding across international borders. They’re not just about speed and efficiency, however. This exploration delves into the history, advantages, disadvantages, regulatory hurdles, and future prospects of e-loan banks in the global lending market, examining their impact on trade and finance.

This article examines the rise of e-loan banks in international lending, exploring their unique operational models and the crucial role they play in facilitating global trade. We’ll investigate the specific technologies powering these transactions, the security measures in place, and the regulatory framework surrounding their activities. Understanding the strengths and weaknesses of these innovative institutions is critical to comprehending the future of international finance.

Introduction to International Lending by E-Loan Banks

E-loan banks, also known as online lending platforms, are rapidly reshaping the landscape of international finance. They leverage technology to connect borrowers and lenders across borders, often bypassing traditional banking structures and bureaucratic processes. This allows for greater accessibility and potentially faster disbursement of funds for international transactions. This shift is particularly impactful in developing economies where access to traditional financial services can be limited.The evolution of e-loan banks in international lending reflects a broader trend toward digitalization in finance.

Initially focused on domestic lending, these platforms have increasingly expanded their operations to facilitate cross-border transactions. This expansion is fueled by the demand for efficient and accessible financial tools in the global marketplace. The development of robust international payment systems and improved data security has also played a crucial role in this evolution.

E-loan banks are increasingly relying on international lending to expand their reach and diversify their portfolios. This global approach is allowing them to access new markets and potentially higher returns, much like how Starbucks is innovating with new blends. For example, Starbucks Oxygen Media is set to offer a new blend, which could signal a trend in the coffee industry.

This, in turn, highlights the broader trend in financial institutions seeking new avenues for growth and competitive advantage in the international market.

Definition and Role of E-Loan Banks in International Lending

E-loan banks are online financial institutions that facilitate international lending through digital platforms. They act as intermediaries, connecting borrowers and lenders globally, often using sophisticated algorithms to assess creditworthiness and match funding requirements. Their role in international lending involves streamlining the process, reducing paperwork, and potentially lowering transaction costs.

Historical Context and Evolution of E-Loan Banks in Cross-Border Transactions

The history of e-loan banks in international lending is intertwined with the rise of online banking and the development of secure online payment systems. Early platforms focused primarily on domestic lending, but as technology advanced and international trade increased, e-loan banks started to adapt their models for cross-border transactions. This adaptation included developing sophisticated risk assessment tools and partnering with international payment processors.

E-loan banks are increasingly relying on international lending, seeking new avenues for growth. This interconnectedness mirrors the rise of companies like Akamai, who are successfully navigating the complexities of the digital world, particularly by riding the e-commerce wave. Akamai riding the e commerce wave highlights the opportunities in globalized financial markets. Ultimately, e-loan banks face similar challenges and opportunities in expanding internationally.

The emergence of mobile banking and widespread internet access in developing countries accelerated the growth of e-loan banks, providing access to financial services previously unavailable to many.

Key Characteristics Distinguishing E-Loan Banks from Traditional Financial Institutions, E loan banks on international lending

E-loan banks often stand apart from traditional financial institutions in several key areas. They typically have lower overhead costs due to their reliance on technology and reduced physical infrastructure needs. Their operations are often more streamlined, with faster processing times for loan applications. E-loan banks often utilize data analytics to assess credit risk, potentially offering more personalized lending solutions.

Another key characteristic is their adaptability to changing market conditions and emerging lending needs.

Types of International Lending Offered by E-Loan Banks

E-loan banks offer a range of international lending services to cater to diverse needs.

- Loans to Foreign Businesses: These banks facilitate loans for businesses operating in foreign markets, providing capital for expansion, investment, or operational needs. Examples include financing for small businesses starting operations abroad, or funding for international joint ventures.

- International Trade Financing: E-loan banks play a crucial role in streamlining international trade transactions. They offer financing options to support exports and imports, reducing the time and complexities of traditional trade finance processes. This includes facilitating letters of credit and financing international supply chains.

- Cross-Border Investments: E-loan banks enable investors to access opportunities in foreign markets, by providing lending to those investing abroad. These loans support activities like infrastructure development or acquisitions in other countries.

E-Loan Banks’ Advantages and Disadvantages in International Lending

E-loan banks are rapidly reshaping the international lending landscape. Their digital-first approach offers potential benefits in terms of speed, efficiency, and accessibility. However, these advantages come with inherent challenges related to regulatory compliance, security concerns, and operational differences compared to traditional institutions. Understanding these nuances is crucial for evaluating the long-term viability and impact of e-loan banks in global finance.E-loan banks, leveraging technology, aim to democratize access to international lending.

They bypass traditional bureaucratic hurdles and offer tailored solutions for borrowers and lenders, potentially transforming the global financial ecosystem. However, their growth faces obstacles requiring careful consideration.

Advantages of E-Loan Banks in International Lending

E-loan banks introduce significant efficiencies into the international lending process. Their streamlined digital platforms allow for quicker loan approvals and disbursements compared to traditional banks. This speed is often a crucial factor for businesses needing funds urgently for international expansion or operations. The reduced paperwork and reliance on automated processes result in significant time savings for all parties involved.

Furthermore, e-loan banks can offer more competitive interest rates due to lower operational costs, making financing more accessible for smaller businesses and individuals.

- Speed and Efficiency: Automated processes streamline loan applications, approvals, and disbursements, significantly reducing turnaround times compared to traditional methods. This is particularly advantageous for businesses seeking rapid funding for international projects.

- Accessibility and Reach: E-loan banks can potentially reach underserved markets and individuals globally, overcoming geographical limitations that traditional lenders often face. This democratization of access allows businesses in developing countries or those with limited banking relationships to obtain funding.

- Cost-Effectiveness: Lower operational costs associated with digital platforms enable e-loan banks to offer competitive interest rates and fees, making international lending more affordable for borrowers.

Disadvantages of E-Loan Banks in International Lending

Despite their advantages, e-loan banks face substantial challenges in the international lending arena. Regulatory compliance is a major hurdle, as they must navigate diverse and often complex regulatory landscapes across different countries. Security concerns, including fraud prevention and data protection, are crucial for maintaining trust and confidence in the system.

- Regulatory Hurdles: Navigating varying regulations and compliance standards across different countries is a significant hurdle for e-loan banks operating internationally. Different jurisdictions have distinct rules and regulations governing lending activities, creating complexity and potential compliance issues.

- Security Concerns: Protecting sensitive financial data and preventing fraud in a global digital environment requires robust security measures. E-loan banks must implement strong encryption, multi-factor authentication, and other security protocols to ensure the safety of customer information and transactions.

- Operational Differences: E-loan banks often lack the established infrastructure and global network of traditional banks, impacting their ability to handle complex transactions and mitigate risks in international lending. This can manifest in difficulties with international payments and dispute resolution.

Comparison of Operational Models

Traditional financial institutions often rely on extensive physical infrastructure and extensive due diligence processes. E-loan banks, conversely, prioritize digital platforms and automation to streamline operations. This difference in approach results in varying degrees of accessibility and speed in international lending.

- Traditional Banks: Traditional banks generally possess a global network and substantial resources, enabling them to handle complex transactions and manage risk in international lending. However, this established infrastructure comes with a higher cost structure.

- E-Loan Banks: E-loan banks leverage technology to create a more accessible and often faster platform for international lending. This approach allows for quicker loan processing, but may require more robust security protocols to address potential vulnerabilities.

Risk Profiles of E-Loan Banks

The risk profile of e-loan banks in international lending varies significantly from that of traditional lenders. The primary risk factors for e-loan banks include the lack of extensive credit history data for borrowers in new markets and the potential for cyberattacks or fraudulent activities. Traditional banks, with their extensive experience and historical data, typically have more established risk management strategies.

- E-Loan Banks: E-loan banks face higher risks due to limited credit history data and potentially greater reliance on alternative data sources for evaluating borrowers. Cybersecurity threats and fraud are also major concerns.

- Traditional Banks: Traditional banks have a longer track record and access to extensive credit history information, enabling them to better assess borrower risk. Their established infrastructure and experience also provide greater resilience to certain types of risks.

Regulatory Landscape for E-Loan Banks Engaging in International Lending

Navigating the complexities of international lending requires a deep understanding of the diverse regulatory landscapes across different countries. E-loan banks, operating in a digital space, face unique challenges in complying with regulations that vary significantly based on national laws, financial policies, and cultural norms. This involves meticulous research, strategic planning, and adherence to specific requirements in each target market.

Key Regulations Impacting International Lending

Understanding the specific regulations in each country is crucial for e-loan banks to operate effectively and avoid potential legal issues. These regulations encompass a wide range of areas, including licensing requirements, capital adequacy ratios, data privacy, and anti-money laundering (AML) procedures.

| Region | Type of Regulation | Key Requirements |

|---|---|---|

| Europe (EU) | Capital Requirements Directive (CRD) IV | Maintaining minimum capital adequacy ratios, adhering to stringent risk management standards, and complying with data protection regulations (GDPR). |

| United States | Bank Secrecy Act (BSA), Office of the Comptroller of the Currency (OCC) regulations | Complying with anti-money laundering (AML) rules, implementing robust KYC (Know Your Customer) procedures, and adhering to reporting requirements. |

| Asia (e.g., China, Japan) | Specific national banking regulations, foreign investment policies | Obtaining necessary licenses and approvals from relevant authorities, adhering to capital requirements, and potentially complying with specific requirements related to data localization. |

| South America | National banking regulations, foreign investment policies | Obtaining necessary licenses and approvals from relevant authorities, adhering to capital requirements, and potentially complying with specific requirements related to local currency operations. |

Successful Regulatory Compliance Strategies

Successful e-loan banks prioritize proactive regulatory compliance. This includes hiring experienced legal and compliance professionals who are well-versed in international lending regulations. A robust compliance program that includes regular training for employees on relevant regulations, conducting thorough due diligence on potential borrowers, and using sophisticated risk management tools are essential. Furthermore, staying updated on evolving regulations is paramount.

- Proactive Compliance Program: E-loan banks must establish a comprehensive compliance program that addresses all relevant regulations across their international operations. This includes setting up a dedicated compliance team, developing and implementing internal policies and procedures, and conducting regular audits.

- Global Expertise: Hiring personnel with expertise in international banking and regulatory compliance is vital for successful navigation of different jurisdictions. This ensures that the e-loan bank is aware of the nuances and specifics of each regulatory environment.

- Technology Solutions: Employing technology to automate compliance processes, such as KYC verification and AML screening, can enhance efficiency and accuracy.

Challenges in Navigating Varying Regulatory Environments

E-loan banks face significant challenges in navigating the varied regulatory environments for international lending. Differences in regulatory frameworks, licensing requirements, and operational procedures across countries present considerable obstacles. Furthermore, adapting to local customs and regulations is crucial.

- Varying Standards: Different countries have different standards for capital adequacy ratios, loan underwriting processes, and data privacy requirements. These differences make it challenging to maintain consistent operational practices across international markets.

- Cultural Nuances: Understanding local customs and business practices is crucial for successful compliance. This includes recognizing the specific expectations and norms in each country regarding contracts, negotiations, and business relationships.

- Complexity of Procedures: The licensing and approval procedures can be complex and time-consuming in certain jurisdictions. This necessitates a thorough understanding of each country’s specific requirements.

Procedures for Obtaining Licenses and Approvals

The process of obtaining necessary licenses and approvals for operating in different international markets can be complex and time-consuming. This involves meticulous research, application submission, and potentially, audits and examinations. Each country has its own specific application process and timelines.

- Thorough Research: E-loan banks must conduct thorough research on the specific licensing requirements of each target market. This includes understanding the legal framework, regulations, and required documentation.

- Proper Application Procedures: The e-loan bank must adhere to the specific application procedures and documentation requirements of each regulatory authority.

- Time Commitment: Obtaining licenses and approvals can take considerable time, ranging from several months to several years, depending on the complexity of the regulations and the efficiency of the licensing authorities.

Technological Infrastructure and Security in International E-Loan Lending

International e-loan banks face unique challenges in building a secure and efficient infrastructure for international lending. The complexities of cross-border transactions, varying regulatory environments, and the need for robust security measures necessitate a sophisticated technological framework. This infrastructure must support seamless communication, secure data transfer, and compliant operations across different jurisdictions.The technological backbone of international e-loan transactions is multifaceted.

It involves a combination of robust systems and secure protocols that facilitate the entire lending process, from initial application to final repayment. The success of e-loan banks hinges on their ability to create a safe and transparent environment for both borrowers and lenders.

Crucial Components of Technological Infrastructure

The core of a secure international e-loan platform rests on several critical components. These include a high-performance, scalable, and secure database system that can manage sensitive financial information; a robust and reliable payment gateway for processing international transfers; and a sophisticated authentication and authorization system to ensure only authorized individuals can access and modify critical data. Furthermore, a comprehensive fraud detection and prevention system is essential to mitigate potential risks.

This requires sophisticated algorithms and real-time monitoring of transactions.

Security Measures for International Transactions

E-loan banks employ several methods to mitigate security risks in international lending. These include multi-factor authentication (MFA) for enhanced user verification, encryption of sensitive data during transmission and storage, and regular security audits to identify and address vulnerabilities. Employing cutting-edge cybersecurity measures and adhering to stringent security protocols are paramount to maintaining the integrity of transactions.

Innovative Technologies for Enhanced Lending Services

Several innovative technologies are transforming the international e-loan landscape. For instance, blockchain technology can improve transparency and reduce fraud risks in international transactions. Similarly, artificial intelligence (AI) can be used to automate loan processing and risk assessment, leading to faster and more efficient lending decisions. Machine learning algorithms can also enhance fraud detection capabilities by identifying suspicious patterns in transaction data.

These advancements contribute to increased efficiency and security in international lending.

Potential Vulnerabilities and Risks

International e-loan transactions are not without inherent vulnerabilities. Cyberattacks targeting financial institutions, breaches of data security, and the complexity of international regulations are among the key risks. Geopolitical instability, economic fluctuations in different regions, and differing legal frameworks can also create significant challenges. Careful risk assessment and mitigation strategies are vital to ensure the safety and soundness of e-loan operations.

Examples of E-Loan Bank Practices

E-loan banks often utilize secure cloud platforms for storing and processing data, employing encryption protocols for data transmission, and investing in advanced fraud detection systems. These practices help to safeguard sensitive information and minimize risks associated with international transactions. For instance, a leading e-loan bank might use a sophisticated fraud detection system that flags unusual transaction patterns, automatically alerting staff to potential issues.

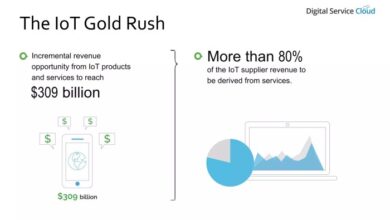

Impact of E-Loan Banks on Global Trade and Finance

E-loan banks are reshaping the landscape of international lending, offering unique advantages for businesses engaging in global trade. Their digital infrastructure allows for faster, more efficient transactions, potentially reducing the friction often associated with traditional lending processes. This increased efficiency, coupled with the potential for lower costs, could significantly impact the global trade ecosystem, particularly for smaller and medium-sized enterprises (SMEs).The role of e-loan banks in international trade finance is multifaceted.

They can provide crucial working capital for businesses involved in cross-border transactions, facilitating imports and exports. By streamlining the approval process and reducing bureaucratic hurdles, they can enable businesses to participate in global markets more readily. This streamlined approach is especially beneficial for companies operating in developing economies where access to traditional finance may be limited.

Impact on the Global Trade Ecosystem

E-loan banks are introducing a more agile and responsive approach to trade finance, reducing the time required for approvals and disbursements. This efficiency can lead to a more streamlined global trade ecosystem, fostering faster turnaround times and ultimately reducing overall costs for businesses. The reduction in bureaucratic processes, characteristic of traditional lending, translates to increased competitiveness in the international market.

E-loan banks are increasingly relying on international lending, seeking new avenues for growth. This mirrors the competitive landscape in the tech world, where companies like Compaq, for example, were trying to catch up with Dell in the e-commerce space, as detailed in this insightful article about Compaq focusing on e-commerce and playing catch-up with Dell. Ultimately, e-loan banks face similar challenges of adapting to a global market, pushing boundaries, and building robust international lending strategies.

Role in Financing International Trade

E-loan banks play a vital role in financing international trade by providing flexible and often faster funding options for businesses. They can facilitate trade transactions by offering pre- and post-shipment financing, enabling businesses to manage their working capital effectively. This agility is particularly crucial for SMEs, allowing them to participate in global trade without the significant upfront capital traditionally required.

Their ability to process information and execute transactions quickly facilitates the efficient movement of goods and services across borders.

Impact on Access to Finance for Businesses in Developing Nations

E-loan banks have the potential to revolutionize access to finance for businesses in developing nations. By leveraging technology, they can bypass traditional financial institutions’ rigid requirements, allowing businesses in underserved regions to access capital more easily. This democratization of access to finance can foster economic growth and empower entrepreneurs in these regions. The ability of e-loan banks to offer tailored financing solutions based on the specific needs of businesses in these markets is a key driver of this positive impact.

Examples of Supporting International Trade Projects

Numerous examples illustrate how e-loan banks are supporting specific international trade projects. One example might be a small agricultural exporter in a developing country, leveraging an e-loan to finance the harvest, processing, and export of their produce. This project might have faced significant hurdles with traditional financing institutions due to perceived risk. However, the e-loan bank, by using readily available data and digital verification, can rapidly assess the project’s viability and provide the necessary capital, thus enabling the exporter to reach new international markets.

Another example could be a manufacturer in a developing nation using an e-loan to procure raw materials from a supplier abroad, facilitating their production process and supporting the overall international supply chain. These are just a few illustrative cases of how e-loan banks can facilitate international trade, potentially leading to increased economic activity in the involved regions.

Future Trends and Developments in International E-Loan Lending

The international lending landscape is rapidly evolving, and e-loan banks are poised to play a significant role in shaping its future. Digitalization, coupled with advancements in fintech, is driving innovation and creating new opportunities for cross-border financing. This evolution presents both exciting possibilities and potential challenges for e-loan banks.The future of international e-loan lending will likely be characterized by increased efficiency, reduced costs, and greater accessibility for borrowers and lenders alike.

These trends are intertwined with the growing adoption of digital technologies and the evolving regulatory frameworks that govern this emerging sector.

Emerging Trends in International E-Loan Lending

E-loan banks are increasingly leveraging technology to streamline the entire lending process, from application submission to loan disbursement. This leads to faster turnaround times and reduced administrative overhead. Mobile-first platforms are becoming crucial for reaching underserved populations in developing economies, enabling access to financial services for those previously excluded. Real-time data analytics and machine learning algorithms are also transforming loan origination and risk assessment, leading to more informed lending decisions.

Growth Potential of E-Loan Banks

The global adoption of digital financial services, particularly in emerging markets, is a key driver for the growth of e-loan banks. For example, countries with underdeveloped traditional banking infrastructures, like certain regions in Africa and Asia, are showing significant potential for e-loan bank penetration. The increasing demand for alternative financing options, combined with the ability of e-loan banks to operate at lower costs, are driving their growth.

Factors Driving and Limiting Growth

Several factors are propelling the expansion of the e-loan banking sector in international lending. Lower operational costs, streamlined processes, and greater accessibility for borrowers are all significant drivers. However, regulatory hurdles and concerns surrounding data security and fraud prevention remain key challenges. Variations in regulatory frameworks across different countries create complex compliance issues for international e-loan banks.

Impact of Fintech Innovations

Fintech innovations are profoundly impacting international e-loan lending practices. Blockchain technology, for example, can enhance transparency and security in cross-border transactions. Cryptocurrencies, while still nascent in mainstream lending, could potentially offer alternative payment mechanisms for international loans. Real-time payment systems, powered by innovative fintech solutions, facilitate instantaneous fund transfers, further accelerating the lending process. Examples include the rapid development of international payment systems and the increasing use of digital wallets, significantly improving the efficiency and speed of transactions.

Technological Infrastructure and Security Considerations

Robust technological infrastructure is essential for e-loan banks operating in international markets. Secure data storage and transmission are critical to protect sensitive financial information from cyber threats. Robust anti-fraud measures and sophisticated risk management systems are crucial to mitigating potential losses. A strong infrastructure must include reliable communication networks, robust data security measures, and advanced fraud detection systems to ensure secure transactions.

Case Studies of Successful International E-Loan Transactions

International e-loan transactions are rapidly evolving, transforming how businesses and individuals access capital across borders. These transactions, facilitated by innovative online platforms, often present unique challenges that require careful consideration and tailored solutions. This section explores successful case studies, highlighting the strategies and technologies employed to overcome hurdles and achieve positive outcomes.

Successful International E-Loan Transaction Case Studies

These case studies showcase the diverse applications and successes of e-loan transactions in international contexts. Each transaction involved specific considerations related to borrower profiles, regulatory compliance, and technological infrastructure.

| Transaction Type | Borrower Profile | Key Success Factors |

|---|---|---|

| Cross-border SME financing for a manufacturing firm in Vietnam | A small and medium-sized enterprise (SME) producing textiles, seeking funding for expansion into the EU market. Had a solid track record and strong local management, but limited international experience and financial reporting. | Comprehensive due diligence, including thorough credit assessments by multiple institutions; utilizing a global network of financial experts to verify borrower’s capacity and commitment; negotiating a secured loan structure; leveraging a blockchain-based platform to manage transaction security and transparency. |

| Funding for a renewable energy project in Brazil | A consortium of Brazilian energy companies and foreign investors seeking funding for a large-scale solar farm project. They possessed significant local expertise but needed international funding and technical support for project development. | International project finance structuring; a well-defined timeline for project completion; extensive risk mitigation strategies encompassing political risk and regulatory uncertainties; engaging reputable international financial institutions to secure long-term financing; utilizing secure cloud-based platforms for project management and documentation. |

| Funding for a tech startup in India seeking to expand into Africa | A high-growth technology company with a strong product but limited access to international funding. They had a strong team but needed to demonstrate their capacity to operate in a foreign market. | Customized due diligence process that considered the startup’s unique business model and market position; leveraging a global angel investor network; a comprehensive financial modeling for the African market; incorporating a dynamic risk management strategy; using a secure international payment gateway. |

Detailed Case Study: Cross-Border SME Financing

This case study focuses on a Vietnamese textile manufacturer seeking funding for expansion into the European Union. The firm, while having a strong local reputation, lacked experience with international transactions. This presented several challenges, including assessing creditworthiness in a foreign market and navigating varying regulatory requirements.

Challenges Encountered

- Evaluating Creditworthiness: Assessing the financial health of the Vietnamese firm required a comprehensive approach. Traditional credit reporting was limited, demanding a deep understanding of the local market, and specialized due diligence. Multiple credit assessments and local partner evaluations were crucial.

- Regulatory Compliance: Navigating differing regulations in Vietnam and EU markets was critical. A specialized legal team with experience in international transactions ensured compliance with all relevant laws.

- Security and Transparency: Ensuring the secure transfer of funds and data across international borders was a key concern. The use of blockchain technology provided a secure, transparent, and auditable platform for managing the entire transaction lifecycle.

Overcoming Challenges

- Global Expert Network: The use of a global network of financial experts, including local contacts in Vietnam and European Union members, was critical to overcoming cultural and regulatory barriers. They provided in-depth knowledge and insight into both markets.

- Secure Technology: A secure cloud-based platform facilitated secure document storage, communication, and data management throughout the transaction. This minimized fraud risks and ensured transparency.

- Secured Loan Structure: The use of a secured loan structure, including collateral, helped mitigate the risks associated with international lending.

Technologies Employed

The use of cutting-edge technologies was integral to the success of these transactions.

- Blockchain technology: This technology enhanced transparency and security, enabling all stakeholders to access transaction details and ensuring immutability of records.

- Secure cloud-based platforms: Facilitated secure document storage, communication, and data management, critical for maintaining confidentiality and reducing fraud risks.

- Advanced risk management software: Enabled sophisticated modeling and analysis of potential risks, ensuring appropriate mitigation strategies.

- Global payment gateways: Facilitated secure and efficient international money transfers.

Conclusion: E Loan Banks On International Lending

In conclusion, e-loan banks are transforming international lending by leveraging technology to overcome traditional barriers. While offering significant advantages in speed, efficiency, and accessibility, they also face challenges related to regulation and security. The future of e-loan banks in international lending hinges on navigating these complexities and adapting to the ever-evolving global financial landscape. Their role in supporting global trade and providing financial access to businesses in developing nations is pivotal.

This evolving landscape promises exciting developments in the years to come.