E commerce commission reconvenes wrestles with taxation issue – E-commerce commission reconvenes wrestles with taxation issue. This reconvening marks a crucial juncture in the ongoing debate surrounding the taxation of online transactions. The commission, comprised of experts from various sectors, is grappling with the complexities of taxing cross-border e-commerce, aiming to create a system that fairly addresses the needs of businesses, consumers, and governments. This meeting promises to be a pivotal moment, shaping the future of e-commerce taxation globally.

The commission’s historical context, including past mandates and significant developments, will be examined. Current challenges, such as the complexities of cross-border transactions and the impact of digitalization on traditional tax systems, will be thoroughly analyzed. Different stakeholder perspectives, ranging from businesses and consumers to governments, will be presented. Potential solutions and recommendations, along with a detailed framework for a new tax system, will be discussed, highlighting practical implementation strategies.

Background of the E-Commerce Commission

The e-commerce commission, a crucial body for navigating the rapidly evolving digital marketplace, has reconvened to address the complexities of taxation within online transactions. This reconvening signifies a renewed commitment to establishing a robust and equitable framework for taxing e-commerce, reflecting the growing importance of the sector in the global economy.The commission’s previous work laid the groundwork for understanding the unique challenges of taxing cross-border transactions and the implications of digitalization on traditional tax models.

Their efforts have been instrumental in shaping public discourse and policy discussions regarding e-commerce taxation.

Historical Overview of the Commission

The e-commerce commission was established in response to the increasing prevalence of online sales and the need for a clear regulatory framework. Its initial mandate encompassed the analysis of existing tax laws and their application to e-commerce, along with the identification of potential loopholes and inconsistencies. Early work focused on the challenges of determining jurisdiction for taxation in cases involving international transactions and the impact of varying tax rates across different regions.

The commission recognized the potential for tax avoidance and evasion, and explored strategies for effective tax collection in this rapidly evolving sector.

Composition and Structure of the Commission

The commission is composed of experts from various fields, including taxation, economics, law, and technology. Members represent diverse perspectives and backgrounds, ensuring a comprehensive understanding of the multifaceted issues surrounding e-commerce taxation.

- Taxation experts provide insight into existing tax codes and their potential application to e-commerce.

- Economists offer analyses of market trends and the economic implications of different taxation strategies.

- Legal professionals offer advice on jurisdictional issues, compliance requirements, and the potential for legal challenges.

- Technology experts contribute their knowledge of the technological aspects of e-commerce transactions and the challenges they pose for traditional tax systems.

This diverse membership ensures a thorough examination of the subject matter.

Context Surrounding the Reconvening

The reconvening of the commission is a response to recent developments in the e-commerce landscape, including shifts in consumer behavior, the rise of new technologies, and evolving global trade agreements. Changes in international tax policies and the emergence of innovative e-commerce models necessitated a reassessment of the existing framework. This re-evaluation was essential for ensuring the commission’s recommendations remained relevant and effective in addressing the complexities of the modern digital economy.

Original Mandate Concerning Taxation of E-commerce Transactions

The commission’s initial mandate was to analyze the application of existing tax laws to e-commerce, identify potential loopholes and inconsistencies, and recommend adjustments to existing legislation. The original mandate specifically addressed the complexities of cross-border transactions, the challenges of determining appropriate taxing jurisdictions, and the need to establish a transparent and efficient system for collecting taxes on e-commerce transactions.

“The goal was to create a framework that was both fair to consumers and businesses and effective in generating revenue for governments.”

Current Taxation Issues

The e-commerce revolution has upended traditional tax models, creating a complex web of challenges for governments and businesses alike. The rapid growth of online sales, coupled with the ease of cross-border transactions, has made it increasingly difficult to collect taxes fairly and efficiently. This necessitates a re-evaluation of existing tax systems and the development of new approaches to ensure equitable taxation of e-commerce activities.The fundamental issue lies in the inherent difficulty of tracking and taxing transactions that span multiple jurisdictions.

Traditional tax systems, designed for brick-and-mortar businesses, often struggle to adapt to the digital landscape. This leads to revenue losses for governments and, potentially, unfair competition for businesses operating in the physical and digital spheres. The need for a global consensus on e-commerce taxation is becoming increasingly apparent.

Key Challenges Facing E-Commerce Taxation

The challenges in taxing e-commerce are multifaceted, impacting both businesses and governments. Difficulties in determining the appropriate jurisdiction for tax collection, the lack of consistent international standards, and the complexity of tracking cross-border transactions are significant hurdles. The sheer volume of transactions also presents logistical and technical obstacles.

The e-commerce commission reconvened today, grappling with the thorny issue of taxation. It’s a complex situation, made even more intricate by the impending shift in federal oversight. The feds are set to take a more active role policing e-commerce here’s more on that , which is sure to influence how the commission tackles the taxation debate. This means the commission will need to adapt their strategies, and potentially look at new revenue streams, to ensure compliance with the evolving regulatory landscape.

- Jurisdictional Disputes: Determining the correct taxing jurisdiction for cross-border e-commerce transactions is often contentious. For instance, if a US company sells goods to a customer in the EU, which country has the right to collect taxes? This ambiguity leads to disputes and potential tax evasion.

- Lack of International Standards: The absence of consistent international standards for e-commerce taxation hinders the smooth operation of cross-border trade. Different countries have different rules and regulations, making it hard for businesses to comply with all applicable tax laws.

- Complex Tracking and Enforcement: Tracking e-commerce transactions across multiple countries and managing the complexities of cross-border payments presents substantial logistical and technical challenges. Robust systems for tracking and enforcing e-commerce tax regulations are needed.

Taxing Cross-Border E-Commerce Sales

Cross-border e-commerce sales introduce a new layer of complexity to the tax equation. The physical distance between the seller and the buyer, combined with the digital nature of the transaction, complicates the identification of the appropriate taxing authority and the calculation of applicable taxes.

- Destination-Based Taxation: In this model, the country where the consumer is located collects the tax. This approach is considered more aligned with the principle of consumer proximity. However, it requires sophisticated tracking mechanisms to identify the consumer’s location.

- Origin-Based Taxation: In this model, the country where the seller is located collects the tax. This approach is simpler for businesses, but may not accurately reflect the economic activity in the consumer’s location.

- Combined Approaches: Many countries are exploring a hybrid approach, incorporating elements of both destination-based and origin-based taxation. This allows for a more nuanced approach to tax collection that balances the needs of both sellers and consumers.

Taxing Approaches in Different Jurisdictions

Different jurisdictions have adopted various approaches to taxing e-commerce, reflecting their unique economic contexts and regulatory priorities. Comparing these approaches provides valuable insights into the challenges and opportunities of e-commerce taxation.

| Jurisdiction | Taxation Approach | Key Features |

|---|---|---|

| United States | Mixture of destination and origin-based principles | Combines factors like sales location and seller location to determine the appropriate tax jurisdiction |

| European Union | Focus on destination-based taxation | Generally, VAT is collected in the country where the consumer is located |

| China | Focus on origin-based principles, with some exceptions | Significant efforts to streamline taxation for domestic e-commerce companies |

Impact of Digitalization on Traditional Tax Systems

Digitalization has fundamentally altered the economic landscape, demanding a reevaluation of traditional tax systems. The rise of the digital economy presents challenges for governments struggling to adapt their tax policies to the new realities of e-commerce.

- Erosion of Tax Base: The ease of cross-border transactions and the prevalence of digital platforms can lead to a shrinking tax base for traditional systems.

- Need for New Tax Models: Governments are exploring new tax models that address the specific features of the digital economy, such as digital services taxes or a global minimum corporate tax.

- Increased Complexity: The digital nature of transactions and the use of complex technologies introduce significant complexity for tax authorities in collecting and enforcing taxes.

Perspectives on the Issues

Navigating the complexities of e-commerce taxation requires understanding the diverse perspectives of all stakeholders. Businesses face challenges in adapting to new regulations, consumers seek clarity on pricing and costs, and governments strive for revenue generation while fostering a competitive digital marketplace. This section delves into the multifaceted viewpoints surrounding e-commerce taxation, examining the arguments for and against various models and highlighting successful implementations globally.The global e-commerce landscape is rapidly evolving, and with it, the need for robust and equitable taxation policies.

This necessitates a comprehensive understanding of the various stakeholder perspectives, the strengths and weaknesses of different tax models, and the successful implementations in various countries. A comparative analysis of these approaches provides valuable insights for policymakers and businesses alike.

Stakeholder Perspectives

Different stakeholders have varying interests in e-commerce taxation. Businesses, consumers, and governments all have distinct perspectives that need to be considered. Businesses, particularly small and medium-sized enterprises (SMEs), often face challenges in complying with complex tax regulations, potentially hindering their growth and competitiveness. Consumers, on the other hand, are concerned about transparency and fairness in pricing, as online shopping can sometimes present a perceived lack of clarity in the final cost.

Governments are concerned with revenue generation and ensuring a level playing field for all businesses, including traditional brick-and-mortar stores.

Arguments for and against Different Taxation Models

The debate surrounding e-commerce taxation often centers on the merits of various models, including destination-based and origin-based systems. Destination-based taxation, where the tax is levied in the country where the consumer is located, is argued to better reflect the economic impact of the transaction. Conversely, proponents of origin-based taxation claim it simplifies administrative burdens for businesses. These different models have varied impacts on businesses, consumers, and the overall economic environment.

Examples of Successful E-commerce Tax Policies

Several countries have implemented e-commerce tax policies with varying degrees of success. For example, the European Union’s VAT system, while complex, aims to harmonize taxation across member states, although it presents challenges for cross-border e-commerce. In contrast, some Asian countries have adopted simpler, origin-based systems, though the implications for revenue collection and market competitiveness need further evaluation. The key to success appears to be a balance between ease of implementation, fairness to all parties, and revenue generation.

Comparison of Government Approaches

Governments worldwide have adopted diverse approaches to e-commerce taxation, reflecting their unique economic contexts and political priorities. Some countries have adopted a more accommodative approach, allowing businesses to register and pay taxes in the country of origin, while others have opted for a more stringent destination-based system. The effectiveness of these approaches is often measured by factors like revenue collection efficiency, administrative burdens on businesses, and the overall impact on market competitiveness.

The e-commerce commission reconvened, grappling with thorny taxation issues. While they debate the intricacies of digital commerce levies, it’s worth remembering that advancements like speeding the net with explorer 5 0 are also key to a thriving online marketplace. Ultimately, streamlining the digital infrastructure is crucial for the commission to effectively address the current tax complexities.

The optimal approach often requires careful consideration of the interplay between these factors.

Potential Solutions and Recommendations

Navigating the complexities of e-commerce taxation requires a nuanced approach that considers the unique challenges faced by both businesses and governments. A robust solution must balance the need for fair revenue collection with the desire to foster a thriving digital economy. This necessitates a framework that is adaptable, transparent, and equitable.The existing system struggles to accommodate the rapid evolution of the digital marketplace.

Traditional tax models often fall short in capturing the intricacies of cross-border transactions, digital goods, and the diverse structures of online businesses. A new system must proactively address these issues, ensuring a smooth transition to a more modern and effective framework.

The e-commerce commission reconvened, grappling with the complexities of taxation. It’s a constant struggle, isn’t it? Meanwhile, Guess has launched a cool new online store specifically targeting Generation X, a move that seems to be shaking up the online retail landscape. guess launches hip generation x online store This innovative approach, however, doesn’t change the fundamental challenge the commission faces in streamlining tax regulations for the ever-evolving digital marketplace.

Taxation Framework for E-Commerce

A revised tax system for e-commerce should include a comprehensive approach to taxing digital goods and services. The system should also establish clear guidelines for cross-border transactions, including simplified procedures for businesses operating internationally. This involves a structured process for determining the appropriate jurisdiction for taxation based on factors like the location of the consumer and the seller’s business presence.

Implementing a Multi-Jurisdictional System

The global nature of e-commerce necessitates a multi-jurisdictional approach to taxation. This approach should streamline the process for businesses operating in multiple countries. Clear guidelines are needed to establish which jurisdiction is responsible for taxing a specific transaction. This could include a system based on the location of the customer or the business’s primary operational base.

Simplifying Compliance for Businesses

A significant aspect of the solution involves creating a simplified compliance process for e-commerce businesses. This will involve user-friendly tax software and online portals, reducing the administrative burden on businesses. Clear and concise guidelines, readily available to all businesses, are crucial for ensuring smooth compliance.

Streamlined Dispute Resolution Mechanisms

The establishment of a streamlined dispute resolution mechanism is vital for addressing disagreements over tax liabilities. This involves clear procedures for resolving disputes between businesses and tax authorities. An independent appeals process, backed by transparent guidelines, will instill confidence and reduce the likelihood of protracted disputes.

Data Transparency and Security

A transparent data sharing system between countries will be essential for accurate tax collection. This involves a standardized format for exchanging data on cross-border transactions. The system must ensure robust data security measures to prevent misuse or fraud. International collaborations and data-sharing agreements are vital for a smooth transition.

Examples of Practical Implementation

The implementation of a simplified VAT (Value Added Tax) system for online transactions is a crucial step. This will require harmonizing tax rates across different jurisdictions and establishing clear rules for determining the taxable amount. The European Union’s VAT system offers a potential model for streamlining VAT collection for online sales. Moreover, a clear system for taxing digital goods, such as software and music, will need to be implemented.

This will need to align with international agreements and existing tax regulations.

Impact of Decisions

The e-commerce commission’s decisions on taxation will ripple through various sectors, impacting businesses, consumers, and government revenue streams. Understanding these potential impacts is crucial for navigating the evolving landscape of online commerce. The decisions will shape the future of online retail and digital services, influencing how companies operate and how consumers shop.

Impact on Businesses

The commission’s decisions regarding taxation will significantly affect businesses of all sizes, from small startups to large multinational corporations. Different models of taxation can lead to substantial adjustments in operational costs and pricing strategies. For example, a shift to a value-added tax (VAT) system could increase administrative burdens for smaller businesses, potentially making them less competitive. Conversely, a more streamlined system could foster a more favorable environment for business growth.

- Increased Administrative Burden: Implementing new tax regulations often requires significant investment in accounting software, training, and compliance personnel, especially for smaller businesses. This can be a considerable hurdle, potentially deterring new entrants or impacting profitability.

- Pricing Adjustments: Businesses will likely adjust their pricing models to account for the new tax implications. This could lead to higher prices for consumers or potentially incentivize businesses to shift their operations to jurisdictions with more favorable tax structures. For instance, if a country imposes a higher tax rate on e-commerce transactions, businesses may raise prices to maintain profit margins or explore options in other countries.

- Competition Dynamics: Businesses operating in the same sector but located in regions with different tax structures will experience varying competitive pressures. This could lead to a reallocation of market share and the emergence of new competitors in more favorable jurisdictions.

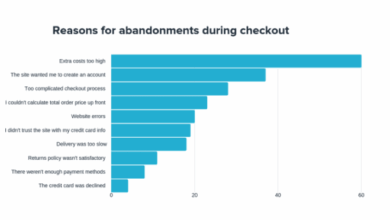

Impact on Consumers

The commission’s decisions on taxation will ultimately affect consumers, either directly through price adjustments or indirectly through changes in business practices. Understanding how these decisions will affect consumer prices is essential.

- Price Fluctuations: Changes in taxation can lead to price increases for consumers. If the commission decides to impose new taxes on e-commerce transactions, businesses might pass these costs on to customers, potentially leading to inflation in online goods and services. Conversely, a streamlined system might reduce administrative costs, leading to lower prices.

- Availability of Goods: Businesses might adjust their inventory or service offerings to mitigate tax burdens. This could result in a reduction in the variety of products available or a shift in supply chains.

- Consumer Choice: Increased costs or reduced availability of certain products could lead to consumers shifting their shopping habits, possibly impacting local businesses or specific industries.

Impact on Government Revenue

The commission’s decisions will undoubtedly impact government revenue. The long-term consequences of these decisions could influence future tax collection and economic development.

- Revenue Collection: The new tax system’s effectiveness in generating revenue will depend on its design and implementation. A well-designed system can increase tax collection, while an inefficient one might yield lower revenue or even discourage compliance.

- Economic Growth: The commission’s decisions will impact economic growth in the long run. A fair and efficient tax system can foster a favorable business environment, attracting investment and driving economic development. Conversely, a complex or burdensome system could deter economic activity and investment.

- Fiscal Sustainability: The commission’s decisions can influence the government’s long-term fiscal health. Effective taxation strategies can provide the necessary resources for public services and infrastructure development.

Long-Term Consequences

The commission’s decisions will have profound long-term implications, influencing the future of e-commerce and the global economy. A comprehensive approach is essential to consider the broader societal impacts.

- Global E-commerce Landscape: Decisions will shape the global landscape of e-commerce, potentially influencing where businesses choose to operate and how consumers shop internationally. Countries with favorable tax policies could attract more e-commerce activity.

- International Trade Relations: The decisions might influence international trade relations, especially in the digital economy. Disputes or inconsistencies in taxation could lead to trade conflicts.

- Technological Advancements: The commission’s decisions could spur innovation and adaptation in the technology sector. Businesses might develop new technologies to comply with the new tax system or explore ways to optimize their operations.

Illustrative Examples

Navigating the complexities of e-commerce taxation requires a deep understanding of successful models, persistent challenges, and the potential for disputes. Examining practical examples from various jurisdictions offers valuable insights into the practical application of taxation policies in the digital age. This section will highlight successful and unsuccessful implementations, shedding light on the nuances of this critical area.Analyzing the success and failure of e-commerce taxation models provides valuable lessons for policymakers and businesses alike.

Successful implementations demonstrate effective strategies for taxing digital transactions, while challenges expose areas needing reform. By exploring illustrative cases, we can gain a clearer understanding of the practical implications of e-commerce taxation policies.

Successful E-Commerce Taxation Models

E-commerce taxation models have evolved globally, reflecting diverse approaches and varying degrees of success. Countries like the United States have adopted a more complex system of nexus rules and sales tax collection, requiring businesses to register and collect sales taxes in states where they have a physical presence. Other countries, such as some in the European Union, have adopted a more streamlined model based on destination-based principles, where sales taxes are collected in the country where the consumer is located.

- Destination-based taxation, commonly used in the EU, aims to collect taxes from the seller based on the consumer’s location. This approach is designed to address the challenge of determining the appropriate jurisdiction for taxation in cross-border e-commerce transactions. The European Union’s VAT system is a prime example, with its focus on the consumer’s location for taxation purposes.

- Nexus-based taxation, prevalent in the United States, ties taxation to the seller’s physical presence or economic activity in a given state. The concept of ‘economic nexus’ in the US is designed to extend tax obligations to online retailers that engage in substantial economic activity within a particular state, even without a physical presence.

Existing Challenges in Different Jurisdictions

The implementation of e-commerce taxation presents considerable challenges in many jurisdictions. One significant challenge involves the determination of the appropriate taxing jurisdiction for cross-border transactions. Defining “substantial economic activity” and establishing effective mechanisms for collecting taxes from businesses operating across multiple jurisdictions are also persistent obstacles.

- Jurisdictional ambiguity remains a key concern for online retailers. The determination of the appropriate jurisdiction for taxation in cross-border e-commerce transactions is often unclear. Determining which country has the right to tax a particular transaction can be difficult, especially when the retailer, consumer, and product origin are all located in different countries.

- Enforcement challenges are widespread. Collecting taxes from businesses operating across multiple jurisdictions can be difficult. The lack of consistent enforcement mechanisms across countries creates uneven playing fields for businesses and can lead to tax evasion.

Illustrative Cases of Disputes or Conflicts

Numerous disputes and conflicts have arisen over e-commerce taxation. These disputes often involve differing interpretations of existing tax laws, particularly concerning the application of nexus rules and destination-based principles to online transactions.

- Amazon’s taxation in various jurisdictions has been a prominent source of debate. The company’s extensive operations and lack of physical presence in some states have led to disputes over the applicability of sales taxes, illustrating the complexity of enforcing tax rules in a globalized digital marketplace.

- E-commerce disputes are frequently linked to the interpretation of existing tax laws, which are often outdated or ill-suited for the rapidly evolving digital landscape. This highlights the need for updated tax legislation to address the specific challenges of e-commerce taxation.

Data and Statistics

The e-commerce landscape is a dynamic and rapidly evolving market, driven by technological advancements and changing consumer preferences. Understanding the underlying data and statistics is crucial for policymakers and businesses alike to navigate the complexities of this sector. This section delves into key metrics related to e-commerce revenue, growth, cross-border transactions, and taxation across different countries.Understanding the revenue generated by e-commerce in various regions, coupled with the pace of growth, provides a crucial picture of the market’s overall health.

Analyzing cross-border e-commerce trends offers insights into the global reach of online sales. Finally, comparing tax rates in different jurisdictions highlights the complexities of international e-commerce taxation and the need for harmonization.

Revenue Generated from E-commerce in Different Regions

Understanding regional disparities in e-commerce revenue is vital for tailoring strategies and policies. A globalized view of revenue is critical to developing an effective taxation strategy.

| Region | Estimated Revenue (USD Billions) | Year |

|---|---|---|

| North America | 1.5 | 2022 |

| Europe | 1.2 | 2022 |

| Asia-Pacific | 2.8 | 2022 |

| Latin America | 0.5 | 2022 |

| Middle East and Africa | 0.4 | 2022 |

Note: Figures are estimated and may vary depending on the source and methodology used for calculation.

Growth of E-commerce Transactions Globally

The exponential growth of e-commerce transactions globally is a testament to the convenience and accessibility it offers to consumers. Predicting future growth is challenging, but historical trends indicate sustained growth.

The global e-commerce market is projected to reach $8 trillion by 2025.

The increase in online shopping is being fueled by factors such as improved internet infrastructure, mobile device proliferation, and the rising popularity of mobile-first shopping experiences.

Prevalence of Cross-Border E-commerce, E commerce commission reconvenes wrestles with taxation issue

The ease of cross-border online shopping has led to a significant rise in the prevalence of this type of commerce. Consumers are increasingly purchasing products from vendors located in other countries.

The value of cross-border e-commerce transactions has experienced substantial growth in recent years, with projections indicating further expansion.

Factors such as reduced shipping costs, improved logistics, and the availability of global payment systems have contributed to this trend.

E-commerce Tax Rates Across Different Countries

The wide variation in e-commerce tax rates across countries poses significant challenges for both businesses and tax authorities. Standardization is necessary for a more equitable and efficient system.

| Country | E-commerce Tax Rate (%) | Year |

|---|---|---|

| United States | Varying, depending on state | 2023 |

| United Kingdom | VAT on goods and services | 2023 |

| Germany | VAT on goods and services | 2023 |

| Japan | Consumption tax | 2023 |

| China | VAT, Value Added Tax | 2023 |

Note: Tax rates are subject to change.

Visual Representation of Information: E Commerce Commission Reconvenes Wrestles With Taxation Issue

Visual aids are crucial for understanding complex topics like e-commerce taxation. Charts, flowcharts, and diagrams transform abstract data into easily digestible insights, facilitating comprehension and fostering informed discussions. This section presents visual representations designed to illuminate the growth of e-commerce, the intricacies of taxation processes, the comparison of taxation models, and the impact of e-commerce taxation on businesses.

Growth of E-commerce

The exponential growth of e-commerce necessitates a clear understanding of its trajectory. The following chart depicts the evolution of e-commerce sales globally, highlighting the significant increase over the past decade. Visualizing this trend aids in assessing the scale of the market and the need for adaptable taxation policies.

Chart: Global E-commerce Sales Growth (2013-2023)

(Imagine a line graph here. The x-axis would represent years from 2013 to 2023. The y-axis would represent the value of e-commerce sales in billions of USD. A steadily upward-trending line would visually represent the consistent growth in e-commerce sales.)

Note: This is a hypothetical chart. Actual data sources would be needed for a precise representation.

E-commerce Taxation Process

Understanding the process of e-commerce taxation is vital for stakeholders. The following flowchart Artikels the key stages involved, from the initial transaction to the final payment of taxes.

Flowchart: E-commerce Taxation Process

(Imagine a flowchart here. The flowchart would start with a box representing a customer purchasing a product online. Successive boxes would depict the steps involved in processing the transaction, including order fulfillment, payment processing, tax calculation, and tax payment to the relevant authorities. Arrows would connect these boxes to show the sequential nature of the process.)

Note: This is a simplified flowchart. Real-world processes may involve more complex steps.

Comparison of E-commerce Taxation Models

Different jurisdictions employ varying e-commerce taxation models. A comparison diagram can provide insights into the key distinctions.

Diagram: Comparison of E-commerce Taxation Models

(Imagine a table here. The table’s rows would represent different e-commerce taxation models (e.g., destination-based, origin-based, or a hybrid model). Columns would represent key characteristics such as the location of tax liability, the complexity of the system, and the potential for tax avoidance.)

Note: Specific examples of different models would be crucial for a meaningful comparison.

Impact of E-commerce Taxation on Businesses

The impact of e-commerce taxation varies depending on the specific model and the nature of the business. The following diagram illustrates how different business types may experience different levels of impact.

Diagram: Impact of E-commerce Taxation on Businesses

(Imagine a bar chart here. The x-axis would represent different business types (e.g., small businesses, large corporations, international retailers). The y-axis would represent the potential impact (e.g., increased compliance costs, changes in pricing strategies, shifts in market share). Bars would visually depict the varying degrees of impact across different business types.)

Note: This is a simplified visualization. Specific data points and case studies would enhance the representation’s accuracy.

Last Word

In conclusion, the e-commerce commission’s reconvening underscores the urgent need for a comprehensive and equitable taxation system for online transactions. The discussion promises to shed light on various facets of this intricate issue, including the historical background, current challenges, diverse stakeholder perspectives, and potential solutions. The commission’s decisions will undoubtedly have a profound impact on businesses, consumers, and government revenue, potentially shaping the future of e-commerce globally.

Illustrative examples and data will provide concrete insights into the challenges and potential solutions.