E commerce comes to credit card haters – E-commerce comes to credit card haters, challenging the long-held reservations many have about using plastic for online purchases. This shift highlights the evolving landscape of online shopping, where security, convenience, and alternative payment methods are playing increasingly crucial roles.

The traditional aversion to credit cards, rooted in concerns about fees, high-interest rates, and security risks, is being subtly reshaped by the growth of e-commerce. This article delves into the motivations behind credit card hesitancy, explores how online platforms are addressing those concerns, and examines the rise of alternative payment options.

Understanding the “Credit Card Hater”: E Commerce Comes To Credit Card Haters

The rise of e-commerce has brought credit cards to the forefront of many transactions. However, a segment of the population remains resistant to credit card usage, often referred to as “credit card haters.” Understanding their motivations and concerns is crucial for businesses seeking to engage this market effectively.This segment isn’t necessarily hostile, but rather holds reservations about credit cards.

These reservations stem from a range of factors, both practical and psychological. Recognizing these factors can help businesses tailor their strategies to better serve this group and potentially encourage broader credit card adoption.

Typical Motivations and Concerns

The “credit card hater” often harbors a deep-seated distrust of credit card debt. This distrust is often rooted in personal experiences with overspending or difficulty managing debt. Concerns often include the potential for high interest rates, hidden fees, and the ease with which debt can accumulate.

Common Complaints About Credit Cards

Many individuals cite the complexity of credit card terms and conditions as a significant deterrent. Complicated fee structures, fluctuating interest rates, and the potential for unauthorized charges are common complaints. The lack of transparency in these areas contributes to the hesitancy.

- High Interest Rates: High-interest rates on outstanding balances can quickly escalate debt, leading to financial strain. This is a major concern for those seeking to avoid accumulating debt.

- Hidden Fees: Annual fees, late payment fees, and other hidden charges can significantly impact the overall cost of using a credit card, making them seem less appealing.

- Security Risks: Concerns about identity theft and fraud are prevalent. The potential for unauthorized charges and data breaches is a serious deterrent for many.

- Complexity of Terms: The often-complex terms and conditions associated with credit cards can be confusing and intimidating for some users.

Psychological Factors Driving Aversion, E commerce comes to credit card haters

Beyond the practical concerns, psychological factors play a significant role in shaping credit card aversion. A strong aversion to debt, a preference for cash transactions, or a fear of losing control over finances can all contribute to the reluctance to use credit cards.

Demographics Associated with Credit Card Hesitancy

The demographics of credit card hesitancy are varied. While no single demographic profile perfectly captures the “credit card hater,” some patterns emerge.

- Lower Income Households: Lower-income households may be more likely to be wary of credit cards due to the potential for debt and the associated costs.

- Older Generations: Individuals from older generations may have developed a more cautious approach to credit, based on their past experiences and financial knowledge.

- Individuals with Limited Financial Literacy: Those with limited financial literacy may be less comfortable navigating the complexities of credit cards and managing credit wisely.

E-commerce’s Impact on Credit Card Usage

The rise of e-commerce has profoundly altered consumer spending habits, and the role of credit cards in this transformation is significant. Traditional brick-and-mortar retail experiences are increasingly being replaced by online interactions, and this shift has presented new opportunities and challenges for both consumers and businesses. Understanding these changes is crucial for anyone involved in the financial and retail landscapes.E-commerce platforms have fostered a new relationship between consumers and credit cards, blurring the lines between physical and digital transactions.

This shift has been driven by factors such as increased convenience, wider product selection, and the accessibility of online shopping 24/7. Consequently, the frequency and nature of credit card usage have been dramatically reshaped.

Credit Card Usage in Physical vs. Online Retail

The use of credit cards differs substantially between in-store and online purchases. In physical retail, the transaction is often immediate and visible. Consumers can see the tangible product, assess its quality, and make an informed decision based on direct interaction with the item. In contrast, online purchases are often driven by visual representations and detailed product descriptions, leading to a different purchasing experience.

This difference in experience influences how consumers use credit cards.

Advantages of Credit Cards for Online Purchases

Credit cards offer several advantages for online transactions. Their ability to facilitate secure payments is paramount in the online realm, allowing consumers to avoid the risk of handling cash or transmitting sensitive financial information through other methods. Furthermore, credit cards often come with built-in fraud protection and customer support, offering additional layers of security and assistance in case of disputes.

Loyalty programs associated with credit cards can also provide substantial rewards and incentives for online purchases, which are particularly attractive to frequent online shoppers. These rewards can be substantial and attractive for frequent online buyers.

Security Measures Used by E-commerce Platforms

E-commerce platforms employ various security measures to safeguard credit card information. Robust encryption protocols, like SSL (Secure Sockets Layer), are commonly used to protect data during transmission. These protocols scramble the sensitive information, making it unreadable to unauthorized parties. Moreover, these platforms often employ multi-factor authentication to add another layer of security. This may involve requiring a one-time code sent to the user’s phone or email.

These combined measures create a layered approach to data security. Additionally, regular security audits and vulnerability assessments are vital for maintaining a secure platform.

Impact of E-commerce on Credit Card Processing

The increased volume of online transactions has put significant pressure on credit card processing systems. E-commerce platforms need to ensure that these systems can handle the substantial throughput while maintaining security and accuracy. This often involves investing in more sophisticated and robust infrastructure, which can lead to improvements in processing times and reduced transaction fees.

Addressing Credit Card Concerns in E-commerce

E-commerce has revolutionized retail, but it hasn’t been without its challenges. One significant hurdle remains the lingering apprehension some consumers have about using credit cards online. Building trust and alleviating these concerns is crucial for businesses to thrive in the digital marketplace. This section explores strategies to address these anxieties and foster secure and transparent online transactions.While credit cards are a convenient payment method, security and transparency are paramount for online shoppers.

E-commerce is finally catching on with credit card haters. It’s clear that online shopping is here to stay, and with the increasing sophistication of cyber threats, security measures are becoming paramount. Luckily, Lloyds of London offers anti-hacker insurance lloyds of london offers anti hacker insurance to help protect businesses and consumers from online fraud.

This means e-commerce platforms are now starting to feel the pressure to step up their security game, which in turn benefits everyone by making online shopping safer.

This is especially important in e-commerce, where customers are making transactions without physically seeing the merchant or the product. Addressing these concerns directly can significantly increase conversion rates and foster long-term customer loyalty.

E-commerce is finally catching on with credit card haters, and it’s not just about convenience anymore. With the recent news that a congressional committee is hearing about the rise of e-commerce privacy seals, congressional committee hears e commerce privacy seals on the rise , it’s clear that companies are taking user data security seriously. This bodes well for the future of online shopping, ultimately making credit card usage more appealing to those previously wary of online transactions.

It’s a win-win for both consumers and businesses.

Design Strategies to Alleviate Credit Card Apprehension

E-commerce platforms can actively reduce credit card apprehension through thoughtful design elements. Clear and concise explanations of the security measures in place are essential. For example, prominently displaying security badges and logos from trusted security organizations can significantly boost consumer confidence. Using a visually appealing layout that clearly separates payment information fields from other parts of the checkout process also contributes to a more reassuring experience.

Visual cues, like progress bars during transactions, help to manage expectations and keep users informed. Incorporating these strategies directly impacts customer perception of security and trust.

Methods to Reassure Customers about Credit Card Security

Transparency in security measures is key. Providing clear and easily understandable explanations of data encryption protocols used during transactions can reassure customers. Highlighting the use of industry-standard encryption algorithms like AES-256 builds trust and demonstrates commitment to security. Emphasizing compliance with relevant data protection regulations, such as PCI DSS, further reinforces the security measures in place.

Examples of Secure Online Payment Gateways and Their Benefits

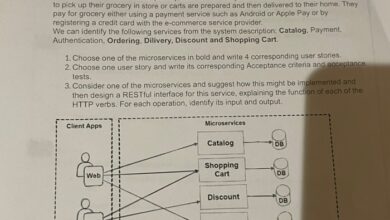

Various secure payment gateways are available for online merchants. PayPal, Stripe, and Square are examples of popular options that offer advanced security features like tokenization, which replaces sensitive credit card information with unique tokens during the transaction. This minimizes the risk of data breaches and enhances security. Using a reputable gateway that implements robust security measures gives consumers confidence in the protection of their financial information.

These gateways are frequently audited and upgraded, ensuring ongoing security measures.

Transparency in Credit Card Processing Fees

Openly disclosing credit card processing fees builds trust and transparency. Providing a clear breakdown of transaction fees and any associated charges, displayed prominently on the website, fosters a sense of honesty and fairness. Customers appreciate the transparency and can make informed decisions about the costs associated with their purchase. Furthermore, offering various payment options (e.g., credit, debit, PayPal) allows customers to choose the method that best suits their needs.

By openly displaying these fees, customers feel more comfortable and less susceptible to hidden costs.

Alternative Payment Methods and Their Role

The rise of e-commerce has coincided with a surge in alternative payment methods, offering consumers more choices beyond traditional credit cards. These methods are rapidly changing the landscape of online transactions, presenting both opportunities and challenges for businesses and consumers alike. Understanding these alternatives is key to navigating the evolving digital payment ecosystem.Alternative payment methods offer compelling advantages that cater to diverse consumer needs and preferences.

E-commerce is finally reaching those who’ve historically shunned credit cards. This is particularly evident in platforms like icanbuy com, which taps into the growing trend of children’s allowances, offering a safe and accessible way for kids to manage their funds online. icanbuy com taps into childrens allowances This innovative approach opens up a whole new world of online shopping for a younger generation, and ultimately, helps to normalize e-commerce for a broader range of people, potentially changing the landscape of credit card avoidance.

It’s a smart move, and could be a game changer for e-commerce’s future.

They often prioritize convenience, flexibility, and sometimes, specific financial goals. This shift in payment preferences is reshaping the way businesses engage with their customer base, demanding adaptation and innovation in their payment infrastructure.

Digital Wallets

Digital wallets, such as Apple Pay, Google Pay, and Samsung Pay, have become increasingly popular for mobile payments. These platforms provide a seamless and secure way to pay for goods and services, often integrated with existing mobile devices. The user experience is typically simplified, requiring minimal input for transactions, and often linking to existing accounts.

Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services have experienced tremendous growth, allowing consumers to purchase items immediately and pay for them in installments. These services offer an attractive option for consumers seeking short-term financing, especially for larger purchases. BNPL platforms typically offer a grace period or a series of smaller, manageable payments, sometimes with interest-free options.

Impact on Credit Card Usage

The proliferation of alternative payment methods is significantly impacting credit card usage. Consumers are increasingly turning to digital wallets and BNPL options for convenience and flexibility, reducing their reliance on credit cards for everyday purchases. This shift is particularly noticeable among younger demographics, who are often more comfortable with digital payment systems.

Future Potential of Alternative Payment Systems

The future of alternative payment systems appears promising. Advancements in technology, particularly in areas like biometrics and artificial intelligence, are expected to further enhance the security and convenience of these systems. Furthermore, the potential for integrating these systems with other financial services, such as investments or loans, is substantial. Examples include integrating BNPL options into broader financial platforms, allowing for more comprehensive financial management through a single app.

Evolving E-commerce and Credit Card Acceptance

The landscape of online shopping is constantly shifting, driven by consumer demands and technological advancements. E-commerce platforms are not just adapting to credit card usage, but actively exploring and implementing innovative payment methods to cater to a wider range of preferences and security concerns. This evolution is critical for the continued growth and success of online businesses.E-commerce platforms are recognizing the need to go beyond traditional credit card processing.

This is not just about offering alternative payment methods, but about creating a seamless and secure online payment experience that anticipates and satisfies consumer needs. Consumers are becoming increasingly discerning about their payment options, demanding flexibility, speed, and security. This shift necessitates a proactive approach from e-commerce companies to ensure their platforms remain competitive and user-friendly.

Innovative Payment Method Examples

E-commerce companies are implementing various methods to enhance the payment experience, moving beyond the limitations of traditional credit cards. Mobile wallets like Apple Pay and Google Pay are becoming increasingly popular, offering a convenient and secure way to make purchases. These platforms use existing smartphone infrastructure to facilitate transactions, reducing the need for manual input and minimizing the risk of fraud.

Additionally, buy-now-pay-later (BNPL) options are gaining traction, offering consumers flexible payment plans that can be particularly appealing for larger purchases.

Biometric Integration Potential

The potential for integrating biometrics into online transactions is significant. Facial recognition, fingerprint scanning, and even voice recognition can be employed to enhance security and streamline the payment process. This technology offers a high level of security, as it is difficult to replicate biometric identifiers. The integration of biometrics is not just a futuristic concept, but a practical approach for enhancing security and reducing the risk of fraud in e-commerce transactions.

Adapting to Changing Consumer Preferences

E-commerce companies are meticulously observing and responding to the changing preferences of consumers. Understanding the diverse needs and expectations of different customer segments is crucial for developing effective strategies. The rise of younger generations, for instance, has driven the demand for quicker and more convenient payment options. E-commerce platforms are recognizing that a one-size-fits-all approach is no longer sufficient, and are adapting their payment infrastructure to meet the specific demands of their target demographics.

Reducing Friction in the Online Payment Process

Minimizing friction in the online payment process is a top priority for e-commerce businesses. This involves addressing concerns related to security, complexity, and usability. Clear and concise information about the payment process, visible security badges, and straightforward checkout processes are crucial for building trust and reducing hesitation among customers. Companies are also actively seeking to optimize the payment flow, ensuring that the process is as efficient and user-friendly as possible.

A well-designed payment system can significantly impact the customer experience, leading to higher conversion rates and increased customer loyalty.

Visualizing the Shift

The landscape of online commerce has undergone a dramatic transformation, driven by technological advancements and evolving consumer preferences. This shift has fundamentally altered how we buy and sell goods and services, with payment methods playing a crucial role in this evolution. This section will explore this transformation through a visual lens, examining the evolution of payment methods, security features, platform types, and user experiences.

Evolution of Payment Methods

The introduction of new payment methods has continuously shaped e-commerce. The following table highlights the evolution of payment methods, particularly credit cards, alongside their introduction and key features.

| Payment Method | Year Introduced | Key Features |

|---|---|---|

| Cash | Ancient Times | The earliest form of payment, limited to physical transactions. |

| Checks | 18th Century | Facilitated transactions with a written order to pay. |

| Credit Cards | 1950s | Introduced the concept of deferred payment, increasing transaction convenience. Early cards focused on retail stores. |

| Debit Cards | 1960s | Allowed direct withdrawals from bank accounts, offering instant payment options. |

| Digital Wallets | 2000s | Mobile payment solutions like Apple Pay and Google Pay, streamlining the transaction process through mobile devices. |

| Cryptocurrencies | 2009 | Decentralized digital currencies that offer alternative payment solutions, but with inherent security and regulatory considerations. |

Security Features Comparison

Online transactions require robust security measures. The table below compares the security features of different payment methods, focusing on credit cards in the online context.

| Payment Method | Pros (Online Security) | Cons (Online Security) |

|---|---|---|

| Credit Cards | Widely accepted, fraud protection through card networks, dispute resolution mechanisms. | Potentially vulnerable to online fraud if security measures are not implemented properly. |

| Debit Cards | Linked directly to bank accounts, potentially lower risk of unauthorized transactions. | Transaction limits might be lower compared to credit cards, depending on the bank. |

| Digital Wallets | Often utilize tokenization to protect sensitive data, convenient for mobile transactions. | Security relies on the security of the mobile device and the wallet provider. |

| Cryptocurrencies | Potentially resistant to certain types of fraud due to decentralization. | High volatility and regulatory uncertainties can pose challenges for consumers. |

E-commerce Platform Payment Strategies

Different e-commerce platforms employ varying payment acceptance strategies. The table below highlights some typical approaches.

| E-commerce Platform Type | Typical Payment Acceptance Strategy |

|---|---|

| Small, independent stores | Often rely on major credit cards and sometimes offer alternative payment methods based on the platform’s budget. |

| Large marketplaces (e.g., Amazon, eBay) | Support a wide range of payment options to cater to a diverse customer base, often including popular digital wallets. |

| Subscription-based services | Frequently use recurring billing and digital wallets for subscriptions, offering convenience for customers. |

| B2B e-commerce platforms | Often utilize business accounts and secure payment gateways, frequently involving invoices and account-based payments. |

User Experience Comparison

The user experience of different payment methods varies. The following table provides a comparison of credit cards versus alternative payment methods in e-commerce.

| Feature | Credit Cards | Alternative Payment Methods |

|---|---|---|

| Ease of Use | Generally well-understood and widely used. | May require additional setup or learning curve. |

| Security | Strong fraud protection mechanisms, but vulnerability depends on online security practices. | Security varies depending on the method and implementation. |

| Cost | May involve transaction fees or interest charges. | Transaction fees may vary based on the method. |

The Future of Credit Cards in E-commerce

The digital landscape of e-commerce is constantly evolving, and credit cards, while still a dominant payment method, face new challenges and opportunities. Predicting the future requires understanding the forces shaping the online shopping experience, from emerging technologies to shifting consumer preferences. This exploration delves into the potential impact of these factors on credit card usage in e-commerce.The ongoing evolution of technology, coupled with changing consumer expectations, will undoubtedly reshape the role of credit cards in online transactions.

Factors like biometrics, AI-powered fraud detection, and the rise of alternative payment methods will influence how consumers interact with credit cards in e-commerce. This dynamic environment necessitates a proactive approach from e-commerce businesses to adapt and ensure a seamless and secure experience for their customers.

Potential Impact of Emerging Technologies

Emerging technologies are poised to reshape the online payment landscape. Biometric authentication, for instance, promises a more secure and convenient checkout process, potentially reducing reliance on passwords and security questions. AI-powered fraud detection systems can identify suspicious transactions in real-time, minimizing fraudulent activity and improving the overall security of credit card transactions. The integration of blockchain technology could offer enhanced transaction transparency and security, potentially bolstering consumer trust in online payments.

These advancements could lead to a more secure and efficient e-commerce experience, potentially increasing consumer confidence in using credit cards.

Improving the Credit Card Experience in E-commerce

E-commerce platforms can significantly enhance the credit card experience by focusing on user-friendliness and security. Implementing clear and concise information regarding transaction fees, interest rates, and other relevant details can build transparency and trust. Interactive tools that provide real-time transaction updates and offer detailed transaction history can empower consumers to better manage their credit card usage. Implementing robust security measures, such as multi-factor authentication and encryption protocols, can address concerns about data breaches and protect sensitive credit card information.

By prioritizing these factors, e-commerce businesses can improve the customer experience associated with credit card payments.

Strategies for Building Trust and Security

Building trust and security in online transactions is crucial for maintaining customer confidence in credit cards. Transparency is paramount; clearly outlining security protocols, data protection policies, and dispute resolution processes instills confidence in consumers. Implementing robust fraud detection systems, employing multi-factor authentication, and regularly updating security protocols are essential to mitigate risks and protect sensitive data. Publicly demonstrating a commitment to security, through independent security audits and compliance with industry best practices, further strengthens consumer trust.

The Role of Regulatory Changes

Regulatory changes can significantly impact credit card usage in e-commerce. For example, stricter data privacy regulations can mandate more stringent security measures, influencing how e-commerce platforms handle credit card information. Changes in transaction fees and interchange rates can also affect the profitability of accepting credit cards for online businesses. Staying informed about evolving regulations is critical for e-commerce businesses to ensure compliance and maintain a competitive advantage.

The interplay between these factors will dictate the evolving future of credit card usage in e-commerce.

Outcome Summary

In conclusion, e-commerce is compelling credit card users to re-evaluate their perspective. By understanding the concerns surrounding credit cards and the innovative approaches being implemented by online retailers, consumers can navigate the online payment landscape with greater confidence. The future of online transactions appears promising, with ongoing advancements in security measures and the rise of alternative payment methods shaping a more seamless and secure experience for everyone.