Dot coms paint it black while bleeding red ink—a phrase that encapsulates the dramatic rise and fall of the dot-com era. This period saw a flurry of internet startups, promising revolutionary businesses, but ultimately many found themselves drowning in debt and facing collapse. We’ll delve into the reasons behind this phenomenon, exploring the financial pressures, marketing strategies, and broader implications of this tumultuous time in tech history.

The metaphorical meaning of “painting it black” refers to the outward presentation of success and prosperity, while “bleeding red ink” represents the stark reality of financial losses. This blog post will examine the financial performance of dot-com companies during the bubble, exploring how their revenue and expenses contributed to their ultimate downfall. We’ll also look at the specific business strategies employed and the role of investor expectations in fueling the boom and bust.

Understanding the Phrase

The phrase “dot-coms paint it black while bleeding red ink” encapsulates a stark reality of the dot-com bubble era. It’s a metaphor describing companies that presented a rosy picture of success (painting it black) while simultaneously suffering massive financial losses (bleeding red ink). This phenomenon highlighted a crucial disconnect between perception and reality, particularly prevalent during periods of rapid technological advancement and speculation.The phrase is a potent metaphor for a company’s financial struggles.

It speaks to a disconnect between public image and actual performance. Companies often create a facade of success to attract investors and maintain market confidence, even when their financial situation is precarious. This is analogous to a person wearing a mask, concealing their true inner state. The phrase resonates with any situation where a favorable presentation hides significant underlying problems.

Historical Context

The dot-com boom of the late 1990s saw a surge in internet-based companies. Many of these companies, fueled by investor enthusiasm and optimistic projections, raised capital without always having a clear path to profitability. They focused on rapid growth and market share rather than sustainable revenue streams. This environment encouraged a culture of “painting it black” – portraying success to attract further investment.

The inevitable crash, starting around 2000, exposed the underlying financial vulnerabilities of many dot-coms, revealing the “bleeding red ink” behind the optimistic façade. The phrase vividly captures this stark contrast between projected success and the harsh realities of a failing business model.

Examples of Company Use

Numerous companies, particularly those during the dot-com boom, could be described using this phrase. Companies with ambitious marketing campaigns and public projections of high growth, yet struggling with significant losses, would be a clear example. Imagine a company advertising groundbreaking technological innovations, attracting significant investments, but ultimately failing to generate revenue or achieve profitability. Their rosy projections would clash sharply with their actual performance.

Detailed Table

| Phrase | Literal Meaning | Metaphorical Meaning |

|---|---|---|

| Dot-coms paint it black while bleeding red ink | Companies portray a successful image (black) while experiencing substantial financial losses (red ink). | A company presents a positive public image that masks underlying financial problems. This can involve misrepresenting revenue, exaggerating growth, or hiding substantial losses. |

Financial Performance Analysis

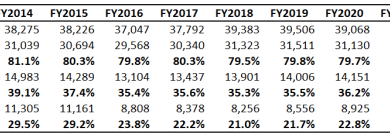

Dot-com companies, often characterized by rapid growth and innovative business models, frequently face challenges in achieving profitability during their initial years. Understanding the financial performance of these companies requires careful analysis of their revenue streams, expenditure patterns, and overall financial health. Analyzing these aspects reveals the reasons behind their often-fluctuating profitability, sometimes leading to substantial losses.Bleeding red ink, in a business context, signifies a company incurring losses.

This signifies that a company’s expenses are exceeding its revenues, resulting in a negative net income. This financial situation can stem from various factors, including high startup costs, aggressive marketing campaigns, and the need to invest heavily in research and development. A detailed financial performance analysis helps to understand the underlying reasons behind this trend and assess the potential for future profitability.

Analyzing Financial Performance of Dot-Coms

A critical approach to evaluating the financial performance of dot-com companies involves examining their revenue and expense patterns during the period. This requires a meticulous review of their financial statements, including income statements and balance sheets. Comparing these figures across different periods allows for the identification of trends and potential issues.

Revenue and Expenses in “Bleeding Red Ink”

Revenue generation and expense management are crucial aspects of understanding why some dot-com companies experience significant losses. High initial investments in infrastructure, marketing, and personnel can significantly impact the bottom line. Aggressive expansion plans, sometimes exceeding market demand, may also contribute to the “bleeding red ink” phenomenon. Further, if the cost of acquiring customers is not offset by revenue generation, the company may struggle to turn a profit.

Financial Performance Table

The table below illustrates a simplified example of how revenue, expenses, and net income/loss might be presented for several hypothetical dot-com companies:

| Company | Revenue | Expenses | Net Income/Loss |

|---|---|---|---|

| Company A | $10,000,000 | $12,000,000 | ($2,000,000) |

| Company B | $5,000,000 | $4,000,000 | $1,000,000 |

| Company C | $8,000,000 | $7,500,000 | $500,000 |

| Company D | $2,000,000 | $3,000,000 | ($1,000,000) |

Comparing Financial Models

Various financial models are employed to assess the profitability of dot-com companies. Some commonly used models include the return on investment (ROI), return on equity (ROE), and price-to-earnings (P/E) ratio. Each model offers a unique perspective on the company’s financial performance. For instance, ROI focuses on the profitability generated relative to the investment made, while ROE assesses profitability in relation to shareholder equity.

The P/E ratio, a valuation metric, compares a company’s stock price to its earnings per share.

Business Strategies and Failures

The dot-com boom of the late 1990s and early 2000s saw a wave of innovative business models and aggressive expansion. However, this period also witnessed the spectacular collapse of many companies, highlighting the fragility of the market and the challenges of sustaining rapid growth. Understanding these strategies and failures offers valuable lessons for future entrepreneurs and investors.The rush to capitalize on the internet’s potential led many dot-com companies to pursue ambitious growth strategies, often prioritizing rapid expansion over profitability.

This often resulted in unsustainable business models and a dependence on venture capital funding, creating a bubble that eventually burst.

Common Dot-Com Business Strategies

Dot-com companies employed a variety of business strategies, often trying to disrupt existing industries or create entirely new ones. Many sought to leverage the internet’s reach and potential to connect buyers and sellers, offering convenience and lower costs compared to traditional models. This included strategies focused on e-commerce, online advertising, and internet-based services.

Potential Reasons for Financial Difficulties

Several factors contributed to the financial difficulties experienced by many dot-com companies. A significant issue was the misalignment between business models and market demand. Some companies overestimated market potential or failed to adequately address customer needs. In addition, many companies prioritized rapid growth over profitability, leading to unsustainable expenses and dependence on venture capital. The inability to generate revenue and achieve profitability in a timely manner often proved fatal.

Investor Expectations and Market Pressures

High investor expectations fueled the dot-com boom. Investors often prioritized rapid growth and high valuations, overlooking fundamental issues like profitability. Market pressures, including competition and the need to constantly innovate, added to the pressure on dot-com companies to achieve unrealistic goals. The speculative nature of the market amplified the risks and led to a rapid correction when the bubble burst.

Common Business Models During the Boom, Dot coms paint it black while bleeding red ink

| Business Model | Description |

|---|---|

| E-commerce | Selling goods and services online, often using a website or online storefront. |

| Online Advertising | Displaying advertisements on websites or through online channels to generate revenue. |

| Internet-Based Services | Providing services, such as online communication tools, file-sharing platforms, or web-based applications. |

| Portal Sites | Providing a central hub for various internet services, such as search, email, and news. |

Strategies for Avoiding Similar Pitfalls

The dot-com bust serves as a cautionary tale. To avoid similar financial pitfalls, future businesses must prioritize profitability and sustainability over rapid growth. Companies should focus on building strong, sustainable business models that address genuine customer needs and create long-term value. Furthermore, investors should adopt a more cautious and realistic approach, focusing on companies with strong fundamentals and sustainable revenue streams.

Finally, maintaining a realistic view of market trends and avoiding speculative investments is crucial.

Marketing and Public Perception

The dot-com boom of the late 1990s was fueled not just by technological innovation, but also by a potent mix of marketing and public perception. Companies used aggressive strategies to cultivate a sense of inevitability and extraordinary potential, often leading to unrealistic expectations and, ultimately, a dramatic crash. Understanding the role of marketing in shaping public opinion is crucial to comprehending the rise and fall of these internet-based ventures.Marketing strategies played a pivotal role in shaping the public perception of dot-com companies.

Companies often employed innovative approaches, including flashy advertising, compelling narratives, and a relentless focus on growth, all designed to generate excitement and investment. This created a self-fulfilling prophecy, where the perceived value of a company often exceeded its actual performance. The resulting euphoria, however, was frequently detached from reality, leading to a dramatic correction when the hype inevitably subsided.

Impact of Marketing Strategies

Marketing strategies employed by dot-com companies often focused on portraying a sense of rapid, exponential growth and limitless potential. This was frequently achieved through aggressive advertising campaigns that emphasized the revolutionary nature of the technology and the promise of immense returns. This type of marketing, while successful in generating excitement and investment, could also contribute to unrealistic expectations and inflate the perceived value of the company.

Examples of Inflated Expectations

Numerous marketing campaigns contributed to inflated expectations. Many companies emphasized the “next big thing” aspect of their products or services, promising to revolutionize various industries. This was often done without a clear roadmap or realistic projections for profitability. Aggressive advertising campaigns, coupled with a constant stream of press releases highlighting milestones (often exaggerated), fuelled the perception of inevitable success.

Companies frequently presented themselves as “disruptors,” implicitly promising a radical shift in the status quo. For example, companies that promised to replace existing retail models often highlighted the “convenience” and “innovation” of their online platforms without adequately addressing the challenges of logistics, customer service, or market saturation.

Media Coverage and Public Opinion

Media coverage played a significant role in shaping public opinion about dot-com companies. Positive articles and features, often highlighting the technological advancements and the potential for enormous profits, created a widespread perception of inevitable success. This coverage, however, was not always balanced or critical. The media, eager to capture the excitement and dynamism of the dot-com era, often overlooked potential weaknesses and risks associated with these companies.

This uncritical reporting amplified the hype, contributing to the subsequent market crash.

Comparison of Successful and Unsuccessful Companies

Successful dot-com companies often employed a combination of targeted marketing, a strong brand identity, and a clear vision for the future. Unsuccessful companies, on the other hand, often focused on short-term gains, overhyped their potential, and lacked a clear understanding of the market they were entering. They frequently adopted a “build it and they will come” strategy, failing to recognize the importance of customer acquisition and retention.

This resulted in a disconnect between the public’s perception and the company’s actual performance.

Marketing Strategies Comparison Table

| Company | Focus | Marketing Strategy | Success/Failure |

|---|---|---|---|

| Company A (Successful) | E-commerce, streamlined online shopping experience | Targeted marketing campaigns focusing on user-friendly design, customer service, and trust | Success |

| Company B (Unsuccessful) | Online auctions, disruptive business model | Aggressive advertising, emphasizing “revolutionary” aspects, overpromising | Failure |

Long-Term Implications

The dot-com bust, a period of rapid growth and subsequent collapse in the late 1990s and early 2000s, left a lasting mark on the tech industry. It wasn’t simply a setback; it was a crucible that forged new practices, shaped investor expectations, and ultimately reshaped the way businesses operated. The consequences extended far beyond the companies that failed, influencing the entire ecosystem.The dot-com era, characterized by speculative investments and the pursuit of rapid growth, exposed vulnerabilities in the market.

The lessons learned from the failures of these companies, from flawed business models to unrealistic valuations, became crucial for future entrepreneurs and investors. These lessons included a need for a more grounded approach to valuation, a focus on sustainable revenue streams, and a better understanding of the long-term realities of building a successful business.

Remember all those dot-com companies painting a rosy picture while secretly bleeding red ink? Well, OfficeMax launching international e-commerce websites like officemax launches international e commerce web sites is a fascinating case study in the ongoing challenges of online retail. Even established businesses face hurdles when entering the global marketplace, suggesting the struggles of dot-com success remain stubbornly persistent.

Lessons Learned from Dot-Com Failures

The collapse of numerous dot-com companies underscored the importance of sound business strategies. Many ventures lacked a clear path to profitability, relying on speculative hype rather than concrete market demand. The subsequent scrutiny on valuation methods and the need for demonstrable revenue streams significantly impacted future business models. A focus on building tangible products and services with solid market appeal replaced the emphasis on pure technological innovation.

Remember those early dot-coms, painting a rosy picture while secretly bleeding red ink? It seems like a familiar story, and now, with xoom com buying into e-mail again here’s the article , we’re seeing a similar pattern emerge. The online world is a tough place, and even established players are trying to find their footing, reminding us that the dot-com boom and bust cycle continues to be a recurring theme in the digital landscape.

This led to a more practical and sustainable approach to business growth.

Impact on Investment Practices

The dot-com bust significantly altered investment practices. The speculative frenzy of the bubble period gave way to a more cautious and data-driven approach. Investors became more discerning, demanding concrete evidence of revenue generation and sustainable business models. This shift led to a greater emphasis on due diligence, financial analysis, and a more realistic appraisal of potential returns.

Venture capital funding became more selective, prioritizing companies with demonstrable growth potential.

Relevance of “Dot-Coms Paint It Black While Bleeding Red Ink”

The phrase “dot-com companies paint it black while bleeding red ink” highlights the disconnect between perceived success and actual financial health. While the companies might appear to be thriving on the surface, their financial performance might be deeply flawed. This phenomenon is not unique to the dot-com era. Similar situations arise in various industries, where superficial indicators mask underlying financial issues.

Dot-com companies are often seen as flashy, but the reality is they’re frequently painting a rosy picture while secretly bleeding red ink. This is a classic problem in the industry, and with the recent news that the feds are taking a more active role policing e-commerce here , it’s likely that pressure will intensify on these companies to show a more accurate financial picture.

Ultimately, this increased scrutiny should hopefully lead to more transparency and sustainable practices, even if it’s a tough pill to swallow for those dot-coms still struggling to make their businesses profitable.

Examples range from overvalued startups in the current tech landscape to businesses relying on unsustainable growth strategies in other sectors. The phrase remains relevant today as a cautionary tale against superficial valuations and the importance of thorough financial analysis.

Examples of Similar Situations in Other Industries

Numerous examples illustrate how similar situations have occurred in other industries. The 2008 housing market crash, for instance, exhibited a period of rapid price appreciation, fueled by speculation and unsustainable lending practices. Similarly, the “crypto winter” has seen many crypto-related businesses and projects collapse, demonstrating that speculative booms can be followed by significant busts in various sectors. These incidents demonstrate a recurring pattern: periods of rapid growth often mask underlying issues that can lead to significant financial repercussions.

Illustrative Examples

The digital boom of the late 1990s and early 2000s saw a surge in dot-com companies, many promising revolutionary solutions but often failing to deliver on their promises. Analyzing these companies’ journeys, both successful and disastrous, provides valuable insights into the factors influencing business success and failure in a rapidly evolving technological landscape. This section offers illustrative examples to highlight key concepts.Understanding the specific financial challenges faced by these companies and the impact of their actions on their market position and public perception is crucial to grasp the nuances of the dot-com bubble.

Examples of successful and failed strategies offer valuable lessons for today’s businesses.

Fictional Dot-Com Company Facing Financial Difficulties

“InnoVision,” a virtual reality gaming company, initially captivated investors with its innovative platform. Their early marketing campaign emphasized groundbreaking technology and a vast, untapped user base. However, rapid expansion outpaced their ability to manage costs. Excessive spending on infrastructure and personnel, coupled with a failure to secure crucial partnerships, quickly eroded their financial position. The company’s initial hype dwindled as the platform’s functionality lagged behind competitor offerings.

Negative press reports regarding the company’s leadership and lack of concrete financial projections further damaged investor confidence. InnoVision’s stock price plummeted, and they were ultimately forced to seek bankruptcy protection.

Financial Performance of a Specific Dot-Com Company During the Period

WebVan, a grocery delivery service, experienced a brief period of significant growth fueled by initial investor interest and the promise of revolutionizing online grocery shopping. However, their rapid expansion, aggressive pricing strategies, and inability to effectively control operational costs led to a sharp decline in profitability. WebVan’s initial financial reports showed substantial revenue growth, but losses accumulated quickly as customer acquisition costs escalated and delivery logistics proved more complex than anticipated.

They failed to establish a sustainable business model and eventually declared bankruptcy in 2001.

Historical Anecdote: Rise and Fall of a Dot-Com Company

Pets.com, a pioneering online pet supply retailer, epitomized the dot-com bubble’s excesses. They achieved immense publicity and investor interest by promising to revolutionize pet ownership. The company’s initial public offering (IPO) generated significant media attention, and they were lauded for their innovative approach. However, the company’s failure to establish a substantial customer base, combined with an inability to achieve profitability, led to a precipitous decline in stock price and eventual bankruptcy.

The story serves as a cautionary tale about the dangers of unrealistic expectations, insufficient operational planning, and neglecting core business principles.

Timeline of a Dot-Com Company’s Financial Performance

| Year | Revenue (USD millions) | Profit/Loss (USD millions) | Description |

|---|---|---|---|

| 1999 | 10 | (5) | Initial growth, high marketing expenses |

| 2000 | 25 | (15) | Increased customer acquisition, expanding infrastructure |

| 2001 | 30 | (20) | Competition intensifies, operational challenges |

| 2002 | 10 | (5) | Layoffs, cost-cutting measures, bankruptcy filing |

This table illustrates a hypothetical timeline, focusing on revenue, profit/loss, and pertinent events. Actual figures and data would vary depending on the specific company.

Detailed Description of a Specific Marketing Campaign (Anonymous)

The marketing campaign, aimed at a broad consumer base, focused heavily on showcasing the company’s innovative platform. Intensive advertising across various online and offline channels emphasized the unique benefits and revolutionary aspects of the service. Early adopter incentives and limited-time promotions were strategically employed to generate buzz and drive initial user sign-ups. The campaign also heavily utilized celebrity endorsements to further amplify the message of the company and create a sense of prestige.

This campaign was highly effective in generating early attention and excitement but ultimately failed to translate that initial momentum into sustained customer acquisition or profitability.

Epilogue: Dot Coms Paint It Black While Bleeding Red Ink

The dot-com bust serves as a cautionary tale, highlighting the importance of sound financial planning, realistic market analysis, and a careful approach to investor expectations. While the specific strategies and technologies of the dot-com era have evolved, the principles of financial prudence and market awareness remain critical. The phrase “dot coms paint it black while bleeding red ink” continues to resonate today, reminding us of the importance of separating the hype from the reality of any emerging industry.