Despite hype china com still risky – Despite hype, China commodities are still risky. This exploration dives deep into the current excitement surrounding Chinese commodities, scrutinizing the underlying factors driving this market fervor. We’ll examine the historical context, analyzing past trends and cycles, and uncovering the role of media and market sentiment in amplifying the hype. Beyond the surface, we’ll dissect the potential biases and misinformation fueling the current enthusiasm.

The analysis delves into various aspects, from financial and geopolitical risks to supply chain disruptions and environmental concerns. We’ll also compare Chinese commodities to alternatives, evaluating pricing, quality, logistics, and regulatory hurdles. Further, the impact of global economic factors and market volatility will be thoroughly examined, considering speculation and potential price manipulation. Finally, we’ll assess the long-term sustainability of Chinese commodities, looking at environmental and social implications, and projecting future trends in supply and demand.

Understanding the Hype Surrounding China’s Commodities

The current surge in interest surrounding Chinese commodities is undeniable. Investors and analysts are closely scrutinizing the potential for significant growth and profit, yet the path forward remains complex and uncertain. This analysis delves into the factors fueling this hype, examining historical trends, media influence, and potential biases. Navigating the complexities of this market requires a nuanced understanding of the forces at play.The recent surge in interest in Chinese commodities stems from a confluence of factors.

Strong economic growth projections for China, coupled with a global demand for raw materials, have created a bullish outlook. Government policies encouraging domestic consumption and infrastructure development are further amplifying the demand. Additionally, the geopolitical landscape and supply chain disruptions have highlighted the importance of securing reliable sources of raw materials, contributing to the heightened attention.

Factors Driving the Current Hype

Several intertwined factors are driving the current interest in Chinese commodities. Robust economic forecasts for China, coupled with a global appetite for raw materials, create a favorable investment climate. Government initiatives promoting domestic consumption and infrastructure projects are further enhancing demand. Finally, global supply chain disruptions and geopolitical tensions have underscored the need for reliable supply sources, reinforcing the significance of Chinese commodities.

Historical Context of Commodity Hype Cycles

Commodity markets have historically experienced cyclical patterns of hype and disillusionment. Past trends show periods of intense speculation followed by corrections. These cycles are often driven by factors such as shifts in global economic growth, changes in consumer demand, and technological advancements. Understanding these historical patterns provides valuable context for assessing the current situation. For instance, the commodity boom of the early 2000s was driven by China’s rapid industrialization, while the 2010s saw a different dynamic, with increasing awareness of sustainability concerns impacting commodity prices.

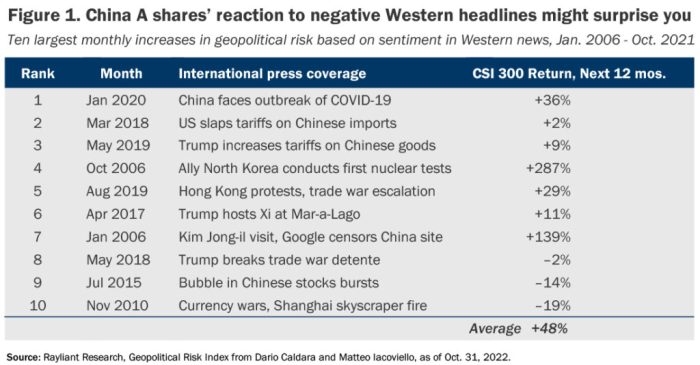

Role of Media and Market Sentiment

Media coverage plays a significant role in shaping market sentiment surrounding commodities. Positive or negative news can rapidly shift investor perception, potentially amplifying or dampening hype. Social media also contributes to the spread of information, often influencing the sentiment of traders and investors. This can lead to both accurate and inaccurate information being widely circulated, potentially exacerbating market volatility.

Potential Biases and Misinformation

Several potential biases and sources of misinformation can contribute to the hype surrounding Chinese commodities. Unreliable sources or those with vested interests may present biased information, influencing investor decisions. The complexity of the market and the rapid pace of information dissemination can also lead to misinterpretations and inaccurate conclusions. Furthermore, cultural or linguistic barriers can create challenges in understanding the nuances of the market, potentially leading to misinterpretations.

Despite all the buzz around China.com, it’s still a risky investment. While exciting news like Intershop announcing a cross-platform e-commerce deal with Compaq here suggests potential growth, the inherent volatility of the Chinese market, coupled with ongoing regulatory uncertainties, means caution is still warranted. The hype might be high, but the risk remains significant.

Comparison of Current Hype to Previous Periods, Despite hype china com still risky

| Factor | Current Hype (2023-2024) | 2000s Commodity Boom | 2010s Commodity Market |

|---|---|---|---|

| Economic Growth | Strong projections for China’s growth, global demand for raw materials. | China’s rapid industrialization, global demand for raw materials. | Continued global demand, but with growing sustainability concerns. |

| Government Policies | Infrastructure projects, consumption incentives. | Government policies focused on infrastructure and development. | Government initiatives focusing on environmental sustainability and supply chain resilience. |

| Geopolitical Factors | Global supply chain disruptions, geopolitical tensions. | Less prominent geopolitical concerns. | Growing concerns about supply chain disruptions and resource security. |

| Media/Sentiment | Rapid information spread, social media influence. | Increased media coverage, amplified by the internet. | Greater focus on sustainability and environmental concerns in media. |

This table highlights the similarities and differences between the current commodity market hype and past cycles. While similar factors like economic growth and government policies are at play, the current context incorporates additional complexities, such as supply chain disruptions and global geopolitical issues.

Assessing the Risks Associated with Chinese Commodities

The allure of China’s vast commodity markets is undeniable, but beneath the surface lies a complex web of potential risks. While the sheer scale of production and trade offers significant opportunities, navigating these risks is crucial for investors and businesses. Understanding these vulnerabilities allows for a more nuanced perspective on China’s role in the global commodity landscape.

Financial Risks

China’s commodity sector is deeply intertwined with its financial system. Fluctuations in commodity prices, driven by factors like global demand and supply chain disruptions, can directly impact Chinese companies and financial institutions. Over-reliance on certain commodities can lead to systemic vulnerabilities. For example, a sudden drop in demand for steel or coal could trigger a chain reaction, affecting related industries and potentially impacting the overall Chinese economy.

Debt levels within the sector also present a significant concern. High levels of borrowing by commodity producers can expose them to financial distress, particularly if commodity prices decline. This can, in turn, lead to financial contagion, impacting banks and other financial entities.

Geopolitical Risks

Geopolitical tensions and shifting global alliances can significantly affect Chinese commodity trade. Trade disputes, sanctions, and political instability in regions crucial for commodity supply chains pose substantial risks. China’s dependence on specific regions for raw materials, such as certain minerals or energy sources, exposes it to vulnerabilities stemming from geopolitical instability. For example, the ongoing tensions in the South China Sea have the potential to disrupt crucial shipping lanes, impacting access to key commodities.

Furthermore, changing trade relationships and shifting global power dynamics could impact China’s access to foreign markets.

Supply Chain Disruptions

China’s role as a major commodity producer and exporter makes its supply chains critically important. Disruptions in transportation, manufacturing, or labor availability can have significant ripple effects. Natural disasters, such as earthquakes or floods, or social unrest can interrupt production and distribution, impacting availability and pricing. For instance, the COVID-19 pandemic caused significant supply chain disruptions worldwide, affecting the availability and price of numerous commodities.

The concentration of production in certain regions or by specific companies further increases the risk of widespread disruptions.

Environmental and Social Risks

China’s rapid industrialization has led to environmental concerns associated with commodity production. Pollution from mining, manufacturing, and processing can have detrimental impacts on human health and the environment. Labor practices in some sectors also raise concerns about worker safety and fair treatment. For example, reports of unsafe working conditions in certain mines and factories highlight the social risks associated with China’s commodity sector.

The increasing awareness of environmental and social issues globally is placing greater pressure on Chinese companies to adopt sustainable practices.

Potential Risks Summary

| Risk Category | Specific Risk | Severity (High/Medium/Low) | Explanation |

|---|---|---|---|

| Financial | Commodity price volatility | High | Significant fluctuations in demand and supply can lead to financial distress for companies. |

| Geopolitical | Trade disputes and sanctions | High | Disruptions in trade relationships can severely impact access to markets and resources. |

| Supply Chain | Transportation disruptions | Medium | Disruptions in logistics and transportation can impact delivery schedules and pricing. |

| Environmental | Pollution from production | High | Environmental damage can have long-term effects on human health and ecosystems. |

| Social | Labor exploitation | Medium | Ethical concerns regarding labor practices can impact reputation and market access. |

Comparing Chinese Commodities to Alternatives

Navigating the global commodity market involves careful consideration of diverse options. While Chinese commodities often present a compelling price point, understanding their relative value requires a nuanced comparison to alternatives from other regions. This comparison extends beyond mere pricing, encompassing quality, reliability, logistics, and potential regulatory hurdles. This analysis will delve into these factors, offering a comprehensive perspective for informed decision-making.

Pricing Comparisons

Chinese commodities frequently offer competitive pricing, attracting numerous buyers. However, this advantage is not universal across all categories. For example, while Chinese steel might be significantly cheaper than Australian steel, the latter often boasts higher quality and stricter adherence to international standards. Therefore, a thorough cost-benefit analysis is essential, considering not just the initial price but also potential long-term costs associated with quality issues or delays.

Market fluctuations and currency exchange rates also significantly impact comparative pricing. The pricing dynamics are highly variable and need to be closely monitored to avoid unexpected cost increases.

Quality and Reliability Differences

The quality and reliability of Chinese commodities can vary considerably, impacting the long-term viability of a transaction. While some Chinese manufacturers consistently meet or exceed international standards, others may fall short, leading to potential issues like product defects, inconsistent performance, or safety concerns. Foreign commodities often come with established reputations for quality and reliability, backed by rigorous testing and quality control measures.

This difference in quality and reliability necessitates careful due diligence, including thorough testing and supplier vetting, regardless of the source.

Despite all the buzz around China’s e-commerce scene, it’s still a bit of a gamble. While USAToday.com reports multi-million dollar e-commerce deals are being made, usatoday com reports multi million e commerce deals , the risks remain high. The market is complex, and navigating the regulatory landscape is tricky, making it challenging for international businesses. So, while the potential is massive, caution is still key.

Logistical and Transportation Implications

The logistics and transportation involved in sourcing from China versus other regions significantly impact overall costs and lead times. China’s vast production capacity and interconnected infrastructure can offer efficiencies, but significant shipping distances and potential port congestion can cause delays and increase costs. Alternatively, sourcing from closer regions may result in faster delivery and lower shipping expenses, but it may also be limited by the production capacity of the alternative regions.

Considering the transportation infrastructure, the total lead time, and the potential disruptions that may occur is critical in sourcing commodities from any region.

Regulatory Hurdles

Regulatory environments surrounding commodities vary significantly between countries, creating potential hurdles for accessing certain commodities. China’s regulatory landscape can be complex, and navigating import/export regulations, customs procedures, and potential licensing requirements is crucial. Regulations in other countries might be simpler but may have other limitations on the amount of commodities that can be sourced. This aspect necessitates careful legal counsel and a thorough understanding of the applicable regulations in both the sourcing and destination countries.

Comparative Analysis Table

| Factor | China | Alternative Regions (e.g., Australia, US) |

|---|---|---|

| Pricing | Often competitive | May be higher but often with higher quality |

| Quality | Variable; requires thorough vetting | Generally higher consistency and reliability |

| Logistics | Potentially complex and lengthy | Potentially shorter and less complex |

| Regulations | Complex; potentially lengthy procedures | Potentially simpler procedures |

| Lead Time | Potentially longer | Potentially shorter |

| Currency Risk | Exposure to exchange rate fluctuations | Less exposure to exchange rate fluctuations (depending on the region) |

Analyzing the Impact of Economic Factors

Navigating the complex world of Chinese commodities requires understanding the intricate interplay of global economic forces. Fluctuations in global economic health, government policies within China, and the dynamic relationship between Chinese production and global demand all significantly impact the pricing and availability of these commodities. This section delves into the specifics of these influences.The global economic climate profoundly shapes Chinese commodity markets.

Periods of global economic downturn often lead to reduced demand for Chinese exports, consequently impacting prices. Conversely, economic recoveries typically boost demand, potentially driving up prices for commodities.

Influence of Global Economic Conditions

Global economic conditions, including recessions and recoveries, directly influence the demand for Chinese commodities. When the global economy weakens, demand for goods, including those from China, decreases, leading to lower prices for Chinese commodities. Conversely, periods of economic expansion and recovery often increase demand for goods, resulting in higher commodity prices. For example, during the 2008 global financial crisis, demand for many Chinese commodities, like steel and raw materials, plummeted, causing significant price drops.

Impact of Chinese Government Policies

Chinese government policies significantly affect commodity exports. Regulations, subsidies, and tariffs directly influence the production and pricing of various commodities. For instance, government policies aimed at reducing pollution can impact the production of certain materials, leading to price changes. Similarly, export restrictions can limit the availability of specific commodities, impacting global supply and demand dynamics. Government support for certain industries through subsidies can bolster production, potentially leading to increased supply and lower prices in the market.

Correlation Between Chinese Commodity Production and Global Demand

The relationship between Chinese commodity production and global demand is often a complex feedback loop. Increased global demand for Chinese commodities typically stimulates production within China, leading to higher output. Conversely, declining global demand can reduce production levels and influence pricing. A key aspect of this relationship is the elasticity of demand. Some commodities are more sensitive to changes in demand than others.

Historical Relationship Between Chinese Commodity Prices and Major Economic Indicators

Understanding the historical connection between Chinese commodity prices and major economic indicators provides valuable insight into the dynamics of the market. Analyzing these correlations allows for better forecasting and risk assessment.

| Economic Indicator | Chinese Commodity Price Trend (General) | Example Commodity | Time Period |

|---|---|---|---|

| Global GDP Growth | Positive correlation (generally). Higher growth often leads to higher commodity prices. | Iron Ore | 2010-2019 |

| US Dollar Exchange Rate | Inverse correlation (generally). A stronger dollar often depresses commodity prices. | Crude Oil | 2015-2023 |

| Chinese Manufacturing PMI | Positive correlation (generally). A higher PMI often indicates higher commodity demand. | Steel | 2012-2020 |

Note: This table represents general trends. Specific correlations can vary based on numerous factors. Further detailed analysis is required to establish precise correlations for any specific commodity or period.

Examining Market Volatility and Speculation

Navigating the Chinese commodity market requires understanding its inherent volatility. While fundamentals play a role, speculation and external factors often amplify price fluctuations, creating a complex landscape for investors. This section delves into the key drivers of volatility, the impact of speculation and short-selling, potential for manipulation, and historical examples of market turbulence.Understanding the dynamics of market volatility is crucial for assessing risk and making informed investment decisions in the Chinese commodity sector.

Price swings can be dramatic, driven by a confluence of factors, ranging from macroeconomic shifts to speculative activity. By analyzing these forces, we can gain a more nuanced perspective on the market’s behavior.

Factors Contributing to Market Volatility

Fluctuations in Chinese commodity markets are frequently influenced by a multitude of factors, including changes in global demand, supply chain disruptions, geopolitical tensions, and government policies. These external influences often interact with internal market dynamics, exacerbating price volatility. For instance, a sudden increase in global demand for a particular commodity can push prices upward, while disruptions in the supply chain, perhaps due to political instability in a producing region, can lead to shortages and price spikes.

Government policies, such as tariffs or subsidies, can also significantly impact market conditions.

Despite all the hype surrounding ChinaCom, it’s still a risky investment. Diversification is key, and looking at how eTrade is branching out into real estate markets with their new initiative, etrade branches out into real estate market , might offer a more balanced approach for investors. Ultimately, though, ChinaCom’s inherent risks still need to be carefully considered.

Role of Speculation and Short-Selling

Speculation and short-selling can play a significant role in influencing commodity prices. Speculators, who bet on future price movements, can drive up or down prices based on their expectations, independent of the underlying supply and demand fundamentals. Short-selling, the practice of betting that a commodity price will fall, can also contribute to volatility by creating downward pressure. These activities can amplify price swings, making the market more susceptible to sudden and unexpected movements.

For example, large-scale short-selling positions can trigger a downward spiral if market sentiment shifts.

Potential for Price Manipulation and Market Distortions

The potential for price manipulation and market distortions exists in any commodity market, including those in China. Manipulation, whether intentional or unintentional, can artificially inflate or deflate prices, creating an environment where market signals may not accurately reflect underlying economic conditions. Such actions can lead to significant losses for those who are not aware of or prepared for these distortions.

For example, insider trading or coordinated actions by market participants can artificially inflate prices.

Comparison of Periods of High Volatility

Comparing periods of high volatility in Chinese commodity markets reveals patterns and recurring themes. Past episodes of sharp price swings often coincide with major global economic events, geopolitical uncertainties, or significant shifts in supply or demand. For instance, the 2008 global financial crisis had a pronounced effect on commodity prices, including those in China. By analyzing historical volatility, we can better anticipate potential future market behaviors.

Scenarios for Chinese Commodity Price Fluctuations

| Scenario | Description | Potential Impact |

|---|---|---|

| Scenario 1: Moderate Fluctuations | Prices fluctuate within a relatively narrow range, largely reflecting changes in supply and demand. | Stable market conditions, moderate investment opportunities. |

| Scenario 2: Sharp Price Increases | Prices experience rapid and significant increases, driven by factors like increased demand or supply disruptions. | Potential for high profits for long positions, but also substantial risk of losses. |

| Scenario 3: Sustained Price Decreases | Prices experience a prolonged period of decline, often due to oversupply or weakening demand. | Significant losses for long positions, potential opportunities for bargain purchases. |

| Scenario 4: Price Volatility with Speculative Activity | Prices fluctuate widely, driven by speculative trading and market sentiment. | High risk of significant losses or gains, difficult to predict accurate price movements. |

Evaluating the Long-Term Sustainability of Chinese Commodities

China’s dominance in commodity production is undeniable, but its long-term sustainability hinges on addressing environmental and social concerns, adapting to evolving global trends, and embracing sustainable practices. The sheer scale of Chinese production necessitates a careful examination of its impact on the planet and its people. Ignoring these factors risks jeopardizing the future of both Chinese and global commodity markets.The environmental footprint of Chinese commodity production is substantial.

Intensive farming practices, resource extraction, and industrial processes contribute to pollution and habitat destruction. Furthermore, labor practices in certain sectors raise ethical concerns about worker safety and fair wages. These issues, if not adequately addressed, could lead to significant reputational damage and long-term economic instability for China. Furthermore, global pressure for more sustainable practices is steadily increasing.

Environmental Implications of Continued Production

The environmental impact of China’s commodity production is multifaceted. Air and water pollution from factories and mining operations severely impact human health and ecosystems. Deforestation for agricultural land and resource extraction further contribute to biodiversity loss. These negative externalities are often not fully internalized within the cost of production, creating an incentive for unsustainable practices. The long-term consequences include decreased agricultural yields, water scarcity, and increased vulnerability to climate change.

Potential Long-Term Trends Impacting Chinese Commodity Supply

Several factors could significantly alter the future supply of Chinese commodities. Climate change is projected to impact agricultural yields, impacting food security and potentially increasing the price of staple crops. Geopolitical instability and trade tensions could disrupt supply chains and lead to shortages. Technological advancements, such as automation and precision agriculture, will impact production methods and labor requirements.

Furthermore, shifts in global consumer preferences towards sustainable and ethical products will likely influence demand.

Comparison to Sustainable Alternatives

Sustainable alternatives to current production methods exist. Organic farming, for instance, reduces the environmental impact of agriculture by minimizing the use of harmful pesticides and fertilizers. Renewable energy sources can replace fossil fuels in industrial processes, reducing carbon emissions. Circular economy models, emphasizing reuse and recycling, can minimize waste and resource depletion. These alternatives offer a path towards more environmentally friendly and socially responsible production.

Long-Term Implications for Global Commodity Markets

The sustainability of Chinese commodity production has significant implications for global commodity markets. If China fails to address environmental and social concerns, it could face increasing pressure from international stakeholders. This pressure could lead to reduced demand for Chinese commodities, impacting economic growth. Conversely, adopting sustainable practices could enhance China’s reputation and increase the demand for its commodities from consumers and businesses concerned with ethical sourcing.

This trend is already being seen with companies demanding sustainable sourcing practices.

Projected Future Supply and Demand of Chinese Commodities

| Commodity | Projected Future Supply (2030) | Projected Future Demand (2030) | Sustainability Trend |

|---|---|---|---|

| Soybeans | Increased, but potentially impacted by climate change | Likely to increase due to global demand | Moving towards organic farming to reduce environmental impact |

| Rare Earth Minerals | Potentially impacted by geopolitical tensions and alternative sources | Increasing demand for technological applications | Developing recycling processes to minimize resource depletion |

| Steel | Likely to remain high, but could be affected by shifts in infrastructure demand | Moderately high demand, depending on global economic growth | Focusing on developing steel from recycled materials to decrease reliance on virgin ore |

The table above provides a simplified projection. Actual outcomes will depend on various factors, including technological advancements, consumer preferences, and geopolitical developments.

Structuring Information for Understanding

Navigating the complexities of China’s commodity market requires a structured approach. This section will provide a framework for organizing the vast amount of information available, making it easier to understand the interconnected factors driving the market and assess the associated risks. By presenting key points concisely, visualizing relationships, and offering practical guides for analysis, we can gain a clearer perspective on the opportunities and challenges presented by Chinese commodities.Understanding the nuances of China’s commodity sector demands more than just superficial analysis.

We need to delve into the interconnectedness of various factors. This includes the interplay of economic forces, market volatility, and long-term sustainability considerations. A well-structured approach, combining concise summaries, visual representations, and practical guidelines, allows for a more nuanced and insightful understanding.

Concise Summary of Key Points

A concise summary of the key points regarding Chinese commodities is essential for a quick overview. This includes the current market trends, the significant economic factors at play, the associated risks, and a comparison with alternative commodity sources. The summary should be readily accessible and highlight the crucial elements for decision-making. For example, a summary might include the rising demand for certain commodities, the influence of government policies, the potential for price volatility, and a comparison with alternative sources to provide a broader perspective.

Visual Representation of Interconnected Factors

A visual representation, such as a mind map or a network diagram, is beneficial for comprehending the interconnected factors influencing Chinese commodities. This representation helps to visualize how various economic forces, political decisions, and market dynamics interact and impact the overall market. The diagram should clearly illustrate the relationships between supply chains, production costs, demand fluctuations, and governmental regulations.

This visual tool provides a comprehensive overview of the intricate web of factors shaping the market. For example, a mind map might have “Chinese Government Policies” as the central node, with branches leading to “Supply Chain,” “Domestic Demand,” and “International Trade.”

Step-by-Step Guide to Assessing Risks

Assessing the risks associated with Chinese commodities requires a systematic approach. A step-by-step guide can provide a structured framework for evaluating potential downsides. This guide should cover market volatility, geopolitical uncertainties, supply chain disruptions, and regulatory changes.

- Identify Potential Risks: Begin by systematically listing potential risks, including price fluctuations, regulatory changes, geopolitical instability, and supply chain vulnerabilities.

- Analyze Probability and Impact: Evaluate the likelihood of each risk materializing and its potential impact on investment strategies or supply chains. Consider historical data, expert opinions, and recent market trends.

- Develop Mitigation Strategies: Formulate strategies to mitigate identified risks. Diversification, hedging, and contingency planning are examples of effective mitigation strategies.

- Monitor and Adapt: Continuously monitor the market and adapt strategies as new information emerges or circumstances change. Regular reviews and adjustments are crucial for maintaining a robust approach.

Process for Comparing Chinese Commodities to Alternatives

Comparing Chinese commodities to alternatives requires a structured process that considers various factors. This process should encompass cost analysis, quality assessments, supply chain reliability, and sustainability measures.

- Define Comparison Criteria: Establish clear criteria for comparison, such as cost per unit, quality standards, production processes, and environmental impact.

- Gather Data: Collect relevant data on both Chinese commodities and alternatives, encompassing pricing, availability, quality certifications, and sustainability reports.

- Analyze Data: Compare the data using the established criteria, highlighting the strengths and weaknesses of each option.

- Evaluate Long-Term Viability: Assess the long-term sustainability and resilience of both Chinese and alternative sources, considering potential disruptions and future trends.

Table Summarizing Various Perspectives on Chinese Commodities

A table summarizing various perspectives on Chinese commodities provides a comprehensive view of the subject. This table should encompass government policies, industry experts’ opinions, and market participants’ observations.

| Perspective | Key Points | Example |

|---|---|---|

| Government | Focus on domestic needs, strategic reserves, and long-term supply security | Implementing import quotas, incentivizing domestic production |

| Industry Experts | Concerns about price volatility, supply chain disruptions, and regulatory uncertainties | Warnings about potential shortages, predictions of price spikes |

| Market Participants | Varied opinions, ranging from optimistic to cautious, depending on individual strategies | Some investors anticipating substantial growth, others emphasizing risks |

Summary: Despite Hype China Com Still Risky

In conclusion, while the hype surrounding Chinese commodities is undeniable, it’s crucial to approach this market with a critical eye. The risks associated with Chinese commodities, ranging from financial instability to geopolitical uncertainties, cannot be ignored. The analysis underscores the importance of careful consideration before engaging in any transactions related to Chinese commodities. Understanding the interplay of economic factors, market volatility, and long-term sustainability is essential for navigating this complex landscape.