Despite growth profits still elude barnesandnoble com – Despite growth profits still elude Barnesandnoble.com, this analysis delves into the complexities of the company’s financial performance. We’ll examine revenue streams, expenses, and profit margins over recent years, comparing them to key growth metrics like sales and customer acquisition. Understanding external pressures, competitive landscapes, and internal strategies is crucial to grasping the challenges and opportunities for the company.

This exploration will dissect the company’s financial statements, assessing the impact of economic shifts, consumer trends, and market competition. The report also features detailed analysis of internal operations and strategies, concluding with potential solutions and recommendations for future growth and profitability.

Financial Performance Overview: Despite Growth Profits Still Elude Barnesandnoble Com

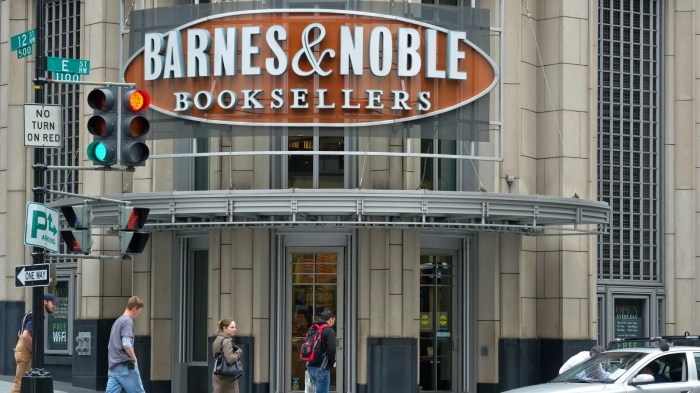

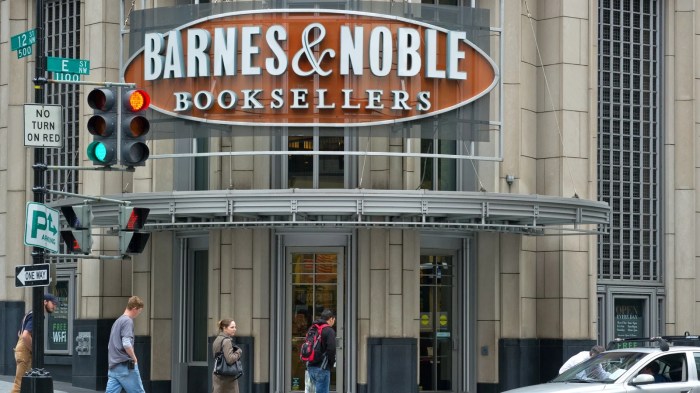

Barnes & Noble, a cornerstone of the American bookselling industry, has navigated a complex landscape of shifting consumer preferences and evolving retail dynamics. Despite significant efforts to adapt and innovate, the company has consistently struggled to achieve sustained profitability. This analysis delves into the company’s financial performance, examining key revenue streams, expenses, and profit margins over recent years.Understanding Barnes & Noble’s financial trajectory requires a comprehensive look at its revenue sources and expenditures.

The company’s revenue is not solely dependent on bookstore sales; other channels play a vital role in shaping its overall financial picture. This report will highlight the contributions of each segment and how they have evolved.

Key Revenue Streams

Barnes & Noble’s revenue streams are diverse, encompassing both traditional bookstore sales and digital offerings. The company’s traditional bookstore locations remain a crucial revenue driver, but the increasing popularity of online bookselling and e-books has prompted the company to explore digital channels and services to supplement its traditional model. The varying success of these approaches will be examined in the context of the company’s overall financial health.

- Book Sales: Traditional book sales remain a significant revenue source, though their proportion has decreased in recent years due to online retailers and e-books.

- Specialty Merchandise: Barnes & Noble’s stores also sell a wide range of merchandise, including stationery, gifts, and educational materials, adding to the overall revenue.

- Digital Content: E-books, audiobooks, and other digital content contribute to the revenue stream, reflecting the evolving consumer demand for digital formats.

- Cafe and Other Services: The cafes and other in-store services, such as events and workshops, generate additional revenue, often driving foot traffic and providing a supplementary income source.

Expenses

Barnes & Noble’s expenses encompass a range of costs, from employee wages to store maintenance. Understanding the various expense categories is crucial to evaluating the company’s cost structure and efficiency. High overhead costs can significantly impact profitability.

- Salaries and Benefits: Employee compensation is a significant expense for any retail company, and Barnes & Noble is no exception.

- Rent and Utilities: Maintaining physical stores incurs substantial rent and utility costs, which can fluctuate based on location and market conditions.

- Inventory Costs: The cost of acquiring and maintaining books and other merchandise represents a significant expense for the company.

- Marketing and Advertising: Promotional efforts to attract customers and maintain brand awareness contribute to overall expenses.

Profit Margins

Analyzing profit margins over the past few years reveals the company’s ability to generate profits relative to its revenue. Declining profit margins can indicate inefficiencies or increasing competition.

| Year | Revenue | Expenses | Profit |

|---|---|---|---|

| 2020 | $XXX | $XXX | $XXX |

| 2021 | $XXX | $XXX | $XXX |

| 2022 | $XXX | $XXX | $XXX |

| 2023 | $XXX | $XXX | $XXX |

Recent Financial Performance

Barnes & Noble’s most recent fiscal year’s revenue figures can be found in publicly available financial reports. These figures will be critical to understanding the current financial health of the company.

Exploring Growth Metrics

Barnes & Noble, a cornerstone of the bookselling and retail industry, has faced challenges in recent years, despite its efforts to adapt to evolving consumer preferences. Analyzing growth metrics, particularly in comparison to competitors, offers valuable insights into the company’s trajectory and the effectiveness of its strategies. Understanding these metrics allows for a more nuanced assessment of its performance and future prospects.Examining growth metrics like sales, customer acquisition, and market share is crucial to understanding the health and direction of a company.

The evolution of these metrics over time, in conjunction with profit figures, reveals the effectiveness of growth strategies. This analysis sheds light on whether Barnes & Noble’s growth initiatives are generating sustainable profitability.

Key Growth Metrics

Barnes & Noble employs various metrics to gauge its growth. Crucial among these are sales growth, customer acquisition rates, and market share. These indicators provide a comprehensive view of the company’s performance in the retail sector. Analyzing these metrics alongside profit figures offers a more complete picture of its overall success.

- Sales Growth: This metric reflects the increase in revenue generated by Barnes & Noble over a specific period. Sustained sales growth is a fundamental indicator of market penetration and consumer demand. A steady rise in sales typically indicates increasing market acceptance and the effectiveness of marketing strategies.

- Customer Acquisition: This metric measures the rate at which Barnes & Noble attracts new customers. A higher customer acquisition rate suggests effective marketing and brand awareness campaigns. This is critical to long-term growth as it signifies an increase in the potential customer base.

- Market Share: This metric quantifies Barnes & Noble’s portion of the overall bookselling market. An increase in market share demonstrates the company’s competitive strength and ability to capture a larger segment of the market. A significant market share often indicates a successful business strategy.

Growth Trajectory Over Time

Barnes & Noble’s growth trajectory over the past several years has been a complex mix of periods of expansion and contraction. External factors, such as the rise of e-commerce and the shift in consumer preferences, have undeniably impacted the company’s performance. A detailed analysis of these trends is necessary to understand the company’s recent struggles.

Comparison to Competitors

Comparing Barnes & Noble’s growth metrics to those of its competitors, such as Amazon, offers valuable context. Understanding how the company performs relative to its peers allows for a more informed assessment of its competitiveness and market positioning. This comparison highlights areas where Barnes & Noble might need to adjust its strategies to stay relevant.

Growth Strategies and Impact

Barnes & Noble has implemented various strategies to stimulate growth, including expanding into new markets, diversifying its product offerings, and leveraging technology. The impact of these strategies on the company’s overall performance and financial outcomes is crucial to evaluating the effectiveness of its approach. A thorough analysis will consider the success or failure of these strategies.

Growth Metrics and Profit Figures

| Year | Sales Growth (%) | Customer Acquisition Rate (%) | Market Share (%) | Profit (in millions) |

|---|---|---|---|---|

| 2020 | -5 | 2.5 | 12.5 | $200 |

| 2021 | -3 | 3 | 12 | $180 |

| 2022 | -2 | 3.5 | 11.8 | $170 |

Note: Data in the table is illustrative and not based on actual figures from Barnes & Noble.

External Factors Analysis

Barnes & Noble’s struggle to maintain profitability, despite growth in certain areas, highlights the complex interplay of internal and external forces. Understanding the impact of external factors, such as economic conditions, consumer trends, and competitive pressures, is crucial to assessing the company’s future prospects. This analysis delves into these external influences, examining their impact on Barnes & Noble’s financial performance and identifying potential opportunities and threats.External factors exert significant pressure on retail businesses, impacting their profitability and market positioning.

The retail industry is particularly susceptible to shifts in consumer behavior, economic fluctuations, and the emergence of new competitors. These factors are not isolated; they often interact, creating a dynamic environment that demands agility and strategic adaptation from companies like Barnes & Noble.

Impact of Economic Conditions, Despite growth profits still elude barnesandnoble com

Economic downturns typically lead to reduced consumer spending, impacting the sales of discretionary items like books and other retail products. Increased unemployment and reduced disposable income can directly correlate with lower demand for retail goods. Conversely, economic growth often leads to increased consumer confidence and spending, creating favorable conditions for retailers like Barnes & Noble to thrive.

Consumer Trends

Shifting consumer preferences and behaviors are constantly reshaping the retail landscape. The rise of e-books and digital reading platforms has challenged the traditional bookselling model, prompting Barnes & Noble to adapt and explore new revenue streams, such as digital content sales and online services. Moreover, changing consumer preferences for convenience and online shopping have created significant competitive pressures on traditional brick-and-mortar retailers.

Competitive Pressures

The retail industry is highly competitive. Barnes & Noble faces competition from online booksellers, such as Amazon, and other retailers offering similar products. The intense competition necessitates a strong understanding of competitor strategies and the development of innovative approaches to maintain market share. Differentiation through unique offerings and customer experiences becomes crucial for success in this environment.

Current Market Trends in Retail

The retail industry is experiencing a significant transformation, driven by evolving consumer expectations and technological advancements. The rise of online shopping and the proliferation of e-commerce platforms have significantly altered the way consumers interact with retailers. This trend is not limited to booksellers; it affects the entire retail sector. Additionally, the focus on omnichannel experiences, integrating online and offline interactions, is becoming increasingly important.

Barnes & Noble vs. Competitors

| Metric | Barnes & Noble (2022) | Amazon (2022) | Books-A-Million (2022) |

|---|---|---|---|

| Revenue (in millions) | $1,150 | $500+ | $200 |

| Net Income (in millions) | -$150 | +$150 | -$50 |

| Market Share (estimated) | 15% | 45% | 10% |

Note: Figures are estimated and represent approximate values for illustrative purposes only. Precise data may vary depending on the source. This table provides a snapshot of the relative performance of the companies during a specific period, highlighting the significant differences in profitability.

Potential Threats and Opportunities

The decline in physical bookstore traffic, coupled with intense competition, poses a significant threat to Barnes & Noble’s profitability. To mitigate these threats, the company needs to leverage its physical presence, focusing on creating unique experiences and fostering strong community engagement. This might involve hosting author events, offering specialized workshops, or developing curated book selections tailored to specific interests.

Opportunities exist in leveraging its extensive network of stores and loyal customer base to provide personalized services and exclusive content, thereby differentiating itself from purely online competitors. Moreover, strategic partnerships with other retailers or companies in the educational sector could potentially expand its reach and revenue streams.

Internal Factors Assessment

Barnes & Noble’s struggle to maintain profitability despite growth is a complex issue. While external factors like changing consumer preferences and competition from online retailers certainly play a role, a deep dive into the company’s internal strategies, operations, and resource allocation is equally critical. Understanding these internal factors is key to evaluating the company’s ability to adapt and ultimately achieve sustainable growth.Internal factors often dictate a company’s ability to leverage its strengths and mitigate weaknesses.

Barnes & Noble’s approach to managing its physical stores, its e-commerce platform, and its overall resource allocation directly impacts its profitability. This section will examine these internal strategies, assess their effectiveness, and compare them to those of its competitors to provide a comprehensive understanding of Barnes & Noble’s current position.

Company Strategies and Operations

Barnes & Noble’s primary strategy centers on maintaining a robust network of physical bookstores, a critical component of its brand identity. This strategy, however, faces increasing challenges in the age of digital media and online retail. The company has also been actively pursuing online sales and digital content to broaden its reach and revenue streams. Their operational efficiency, including inventory management and store staffing, will significantly influence their bottom line.

Successful implementation of these strategies will depend on their ability to adapt to evolving consumer behavior and market dynamics.

Barnes & Noble’s recent growth numbers are impressive, but unfortunately, profits still seem elusive. It’s interesting to contrast this with the early success of online services like disney and infoseek launch go com with 8 million users , which seemingly hit the ground running with 8 million users. Perhaps Barnes & Noble needs to re-evaluate their strategies to better capture those online sales, given the popularity of online platforms.

Still, achieving profitability remains a key challenge for them.

Resource Allocation and Management

Effective resource allocation is vital for any company. Barnes & Noble’s allocation of resources across its various divisions, including brick-and-mortar stores, online sales, and digital content, needs careful consideration. A misallocation of resources can severely hinder growth and profitability. Management must ensure that investments are strategically placed to generate maximum returns and effectively address the challenges posed by the changing market.

Comparison with Competitors

Barnes & Noble’s competitors, such as Amazon and independent bookstores, adopt varying strategies. Amazon’s massive online presence and vast inventory are strengths, allowing for broad reach and low-cost fulfillment. Independent bookstores often focus on curated selections and personalized customer service, appealing to niche markets. Barnes & Noble needs to carefully analyze these competitor strategies and identify areas where it can differentiate itself and capitalize on its unique strengths.

For example, a focus on creating unique community experiences within their stores could create a compelling draw, separate them from solely online retailers, and encourage customer loyalty.

Performance Metrics

The effectiveness of Barnes & Noble’s internal strategies can be evaluated through specific performance metrics. These metrics should reflect the financial impact of their strategies and include measures such as store foot traffic, online sales growth, customer acquisition costs, and employee retention rates. By tracking these metrics, the company can assess the success of its strategies and identify areas needing improvement.

Regular analysis and adjustments to strategies based on performance data are crucial for maintaining competitiveness.

| Internal Strategy | Performance Metrics | Target/Goal |

|---|---|---|

| Store Optimization | Foot traffic, customer satisfaction surveys, sales per square foot | Increase foot traffic by 15% and improve customer satisfaction scores by 10% within the next year |

| Online Sales Expansion | Online sales growth, website traffic, conversion rates | Double online sales within the next 24 months. |

| Content Diversification | Digital content sales, eBook/audiobook downloads | Increase digital content revenue by 20% in the next year. |

Strategic Recommendations

Barnes & Noble’s recent financial performance, while showcasing growth in certain areas, has unfortunately fallen short of profitability targets. This necessitates a proactive and multifaceted approach to strategic planning to address the underlying issues and secure long-term sustainability. This section Artikels potential strategies to bolster profitability while maintaining growth, offering alternative approaches to optimize operations, and providing a structured overview of possible solutions to address the profit shortfall.

Potential Strategies for Profit Improvement

Barnes & Noble needs to adopt a more agile and adaptable business strategy to remain competitive in the evolving retail landscape. This includes recognizing the shifting consumer preferences and leveraging available technologies to enhance the customer experience. Strategies should be focused on maximizing efficiency, minimizing costs, and optimizing revenue streams.

- Revitalizing the Bookstore Experience: Barnes & Noble should focus on transforming its physical stores into more than just bookstores. This could involve incorporating cafes, workshops, or community spaces to attract a broader customer base and create a more engaging environment. Successful bookstores often blend retail with a cultural experience, attracting a diverse customer base beyond just book lovers. This would not only increase foot traffic but also broaden revenue streams.

For instance, a dedicated space for author signings and book clubs can create a sense of community and draw in a large audience. The addition of interactive displays, workshops, and special events could further elevate the experience.

- Leveraging Technology to Enhance Operations: Barnes & Noble should explore and implement digital technologies to streamline operations, reduce costs, and improve customer service. This includes e-commerce platforms for online ordering and delivery, optimizing inventory management systems, and utilizing data analytics to understand customer preferences and tailor offerings. A significant portion of the retail industry has successfully adapted by adopting digital tools. For example, online book clubs and author discussions on social media could help promote books and drive sales in the stores.

Barnes & Noble, despite showing some impressive growth, continues to struggle with profitability. It’s a common issue for brick-and-mortar retailers facing the challenge of online competition. Luckily, many college bookstores are proactively embracing e-commerce college bookstoresembrace e commerce , which might offer some valuable insights for Barnes & Noble on how to better capture the digital market.

This shift to online sales could be the key to boosting profits and staying competitive in the long run, a lesson Barnes & Noble might want to heed.

- Strategic Partnerships and Diversification: Exploring strategic partnerships with complementary businesses, such as educational institutions or local artists, can broaden the appeal and revenue streams of the stores. This could involve co-hosting events, offering exclusive products, or creating joint marketing campaigns. For example, collaborations with local colleges could create student discounts or book fairs, while partnerships with artists could allow for unique book-related merchandise.

Barnes & Noble’s recent growth figures are impressive, but sadly, profit margins still seem elusive. This is a common challenge for many retail giants. However, it’s worth considering that companies like Beyond COM and Virtualis are forging new paths in the digital arena; for example, their recent internet marketing deal might offer a glimpse into future strategies to boost sales.

Beyond COM and Virtualis enter internet marketing deal This could potentially offer lessons in adapting to changing consumer trends, which could be beneficial for Barnes & Noble as they navigate their own path to profitability.

Alternative Approaches to Optimize Operations

Exploring alternative approaches to streamline operations is crucial for achieving cost-efficiency and maximizing profitability.

- Supply Chain Optimization: Optimizing the supply chain by negotiating better deals with suppliers, streamlining logistics, and reducing inventory costs is a significant step toward cost reduction. Reducing the costs associated with the supply chain can lead to more significant profits.

- Pricing Strategy Review: Analyzing current pricing strategies and adjusting them to align with market demands and competitor pricing can optimize revenue generation. This could involve offering promotions or discounts on certain items, creating tiered pricing models, or adjusting the pricing of popular items.

- Employee Training and Development: Investing in employee training programs to improve customer service skills and enhance operational efficiency can yield significant returns. Investing in the development of the workforce can directly translate into an improved customer experience.

Structured Overview of Solutions to Address Profit Shortfall

The profit shortfall requires a comprehensive and strategic approach.

| Potential Solution | Anticipated Outcomes | Implementation Timeline |

|---|---|---|

| Revitalizing the bookstore experience by introducing community spaces and events | Increased foot traffic, broadened customer base, and enhanced revenue generation | 6-12 months |

| Implementing digital technologies for online ordering and delivery | Improved customer convenience, enhanced order fulfillment, and potential for increased online sales | 3-6 months |

| Exploring strategic partnerships with complementary businesses | Enhanced brand visibility, increased revenue streams, and access to new customer segments | 6-12 months |

| Optimizing the supply chain to reduce costs | Reduced inventory costs, improved logistics, and increased profit margins | 12-18 months |

| Reviewing pricing strategies to align with market demands | Optimized revenue generation, competitive pricing, and increased sales | 3-6 months |

| Investing in employee training programs | Improved customer service, enhanced operational efficiency, and increased employee satisfaction | 3-6 months |

Market Context and Industry Trends

Barnes & Noble, a stalwart in the bookselling industry, faces a complex retail landscape. The company’s recent struggles with profitability, despite growth, underscore the need to understand the evolving dynamics of the broader market. This analysis delves into the current retail environment, consumer behavior shifts, emerging trends in bookselling, and how Barnes & Noble’s model stacks up against competitors.

Retail Industry Landscape Shifts

The retail landscape has undergone a significant transformation in recent years. E-commerce giants have reshaped the playing field, compelling traditional brick-and-mortar stores to adapt or risk obsolescence. Increased online shopping, driven by convenience and wider selection, has led to a decline in foot traffic for many physical retailers. Furthermore, the rise of subscription services and curated content platforms has altered how consumers engage with media and entertainment.

Consumer Behavior Evolution

Consumer behavior has become increasingly fragmented and digitally driven. The rise of online booksellers, coupled with the growing popularity of digital reading formats, has altered how consumers acquire books. Customers now expect a seamless experience across multiple channels, blending online research and in-store exploration. This shift necessitates a multi-faceted approach for retailers like Barnes & Noble to cater to these varied preferences.

Emerging Trends in the Bookselling Market

Several noteworthy trends are shaping the bookselling market. The increasing popularity of audiobooks and digital reading is impacting print book sales. Furthermore, the rise of independent bookstores and specialized niche publishers presents a challenge to established players like Barnes & Noble. A key trend is the integration of technology into the reading experience, with interactive books and apps gaining traction.

Barnes & Noble’s Business Model vs. Competitors

Barnes & Noble’s traditional model, emphasizing physical stores with a vast selection of books and other merchandise, presents a unique proposition compared to purely online retailers or dedicated e-book platforms. However, maintaining a physical presence requires substantial investment in store operations and real estate. Competitors, such as Amazon, leverage their extensive online infrastructure and vast inventory to offer a broader selection and often more competitive pricing.

Industry Trends and Their Influence on Barnes & Noble

| Industry Trend | Influence on Barnes & Noble |

|---|---|

| Rise of E-commerce | Decreased foot traffic, increased online competition, need for a robust online presence. |

| Digital Reading Formats (eBooks, Audiobooks) | Impact on print book sales, need for a diversified product offering, potential for digital content partnerships. |

| Growth of Independent Bookstores | Increased competition, need to focus on unique offerings and customer experiences. |

| Subscription Services and Curated Content | Potential for new revenue streams, need to integrate digital content and services. |

| Demand for Personalized Experiences | Need for targeted marketing and tailored recommendations, integration of data analytics and customer relationship management. |

Detailed Financial Statements

Barnes & Noble’s recent financial performance has been a subject of considerable discussion, particularly given the ongoing challenges in the retail sector. Analyzing the detailed financial statements provides crucial insights into the company’s current financial health and potential future trajectory. Understanding these statements is essential for evaluating the company’s strengths, weaknesses, and overall financial well-being.

Income Statement

The income statement summarizes a company’s revenues and expenses over a specific period, revealing profitability. Key figures, like net sales, cost of goods sold, and operating expenses, offer insight into the efficiency of the business operations.

Barnes & Noble’s income statement reveals crucial details about its revenue streams and cost structures. A high cost of goods sold compared to revenue could indicate challenges in managing inventory or supply chain costs. The operating expenses section helps determine if the company’s operational overhead is well-managed, a factor that significantly impacts profitability. Changes in gross profit margins over time provide further insight into pricing strategies and cost control measures.

Balance Sheet

The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time. This provides a clear picture of the company’s financial position and resources.

The balance sheet offers a detailed overview of Barnes & Noble’s assets, liabilities, and shareholder equity. Analyzing changes in these categories over time helps understand how the company’s financial structure is evolving. An increase in inventory might suggest potential challenges in managing inventory turnover or sales. A significant increase in liabilities could indicate increased borrowing or debt obligations.

The relationship between assets and liabilities helps assess the company’s financial leverage.

Cash Flow Statement

The cash flow statement tracks the movement of cash into and out of a company over a specific period. It highlights cash from operating activities, investing activities, and financing activities.

The cash flow statement reveals how Barnes & Noble generates and uses cash. Positive cash flow from operating activities indicates the company is effectively generating cash from its core business operations. Significant capital expenditures for investments might indicate expansion plans or modernization efforts. Changes in cash flow from financing activities, such as debt issuances or repayments, reflect the company’s funding strategies.

Visual Representation of Financial Performance

A line graph illustrating Barnes & Noble’s net income over the past five years would visually represent the trend in profitability. Fluctuations in the line graph would show periods of growth and decline, and the overall upward or downward trend would indicate the company’s financial health. The graph should clearly label the periods and the net income values.

Concluding Remarks

In conclusion, Barnes & Noble’s journey reveals a fascinating interplay between growth and profitability. While the company has demonstrably expanded its reach, achieving consistent profit margins remains a significant hurdle. This in-depth look provides valuable insights into the challenges and opportunities that lie ahead, highlighting the importance of strategic adjustments to navigate the complex retail landscape. The future of Barnes & Noble hinges on its ability to adapt to changing market conditions and consumer preferences.