Cybercash and concentric target small biz e commerce – Cybercash and concentric target small biz e-commerce sets the stage for a fascinating look at how small businesses can thrive in the digital marketplace. This approach allows businesses to pinpoint their ideal customer base and leverage cybercash for secure and efficient transactions. We’ll explore the unique challenges and opportunities, delve into security best practices, and examine the integration process with various e-commerce platforms.

Understanding cybercash’s role in modern e-commerce is key to successful small business operations. From understanding different cybercash systems to integrating them with existing platforms, this guide will equip you with practical knowledge to navigate the digital landscape.

Introduction to Cybercash and Small Business E-commerce

Cybercash is rapidly transforming the way small businesses operate in the digital marketplace. This innovative payment system offers a streamlined and secure alternative to traditional methods, enabling small enterprises to reach a wider customer base and manage transactions more efficiently. Understanding cybercash and its applications for small business e-commerce is crucial for navigating the complexities of modern trade.Cybercash, in essence, is a digital form of currency used for online transactions.

It facilitates secure and efficient financial exchanges, reducing the reliance on physical cash and traditional banking systems. Small businesses, especially those operating online, benefit significantly from the speed and convenience cybercash provides, while also mitigating risks associated with traditional payment methods. However, navigating the nuances of different cybercash systems and understanding the specific challenges and opportunities they present is key to leveraging its full potential.

Cybercash and its Role in Modern E-commerce

Cybercash plays a pivotal role in modern e-commerce by providing a secure and convenient way to process transactions. Its decentralized nature allows for faster processing times and lower transaction fees compared to traditional payment methods. This can significantly impact the bottom line of small businesses, particularly those operating with limited capital.

Challenges and Opportunities for Small Businesses

Small businesses face unique challenges when adopting cybercash. Security concerns and a lack of familiarity with the technology can be hurdles. However, the opportunities are equally significant. Cybercash can open up new markets and customer bases, allowing small businesses to expand their reach beyond their local area. Increased efficiency in managing transactions can free up valuable time for business owners to focus on growth and development.

Types of Cybercash Systems and Suitability

Various cybercash systems exist, each tailored to different needs. Some focus on peer-to-peer transactions, while others are integrated into established e-commerce platforms. A detailed understanding of these systems and their functionalities is crucial. For example, decentralized systems like cryptocurrencies can offer greater flexibility but may require more technical expertise to implement. Systems integrated with existing payment gateways might offer a smoother transition for businesses already using those platforms.

- Decentralized Systems: These systems operate independently of central authorities, like banks, offering potential benefits in terms of transaction speed and reduced fees. However, they also come with challenges related to security and regulatory compliance. Examples include Bitcoin and other cryptocurrencies.

- Centralized Systems: These systems rely on a central authority for processing transactions. This often involves established payment gateways that already handle significant transaction volumes. They typically offer a more secure and regulated environment.

Benefits of Cybercash for Small Business E-commerce

Cybercash offers numerous advantages for small businesses operating online. Its ability to streamline transactions and provide increased security is a key benefit. Faster transaction processing means less time spent waiting for funds to clear, allowing businesses to respond quickly to customer needs and manage inventory efficiently. Cybercash systems often provide detailed transaction data, offering valuable insights into customer behavior and sales trends.

- Efficiency: Reduced processing times, lower fees, and automated transaction management can significantly improve the efficiency of small business operations.

- Security: Cybercash systems typically utilize encryption and other security measures to protect sensitive financial information, minimizing the risk of fraud and data breaches.

Enhanced security measures reduce the likelihood of financial losses.

- Accessibility: Cybercash often facilitates cross-border transactions, enabling small businesses to expand their market reach and connect with customers globally.

Security and Risk Management in Cybercash Transactions: Cybercash And Concentric Target Small Biz E Commerce

Cybercash transactions, while offering convenience for small businesses, introduce unique security challenges. Understanding these risks and implementing robust security measures is crucial for protecting sensitive financial data and maintaining customer trust. This article delves into the specific security concerns associated with cybercash for small businesses and Artikels practical strategies for mitigating risks.

Security Risks Associated with Cybercash

Cybercash transactions, while convenient, expose small businesses to a variety of security risks. These risks range from simple human errors to sophisticated cyberattacks. Phishing scams, malware infections, and compromised payment gateways are all potential threats. Understanding the specific vulnerabilities can help businesses take proactive steps to protect themselves.

Common Security Vulnerabilities and Potential Attacks

Small businesses often lack the resources of larger corporations, making them particularly vulnerable to cyberattacks. Common vulnerabilities include weak passwords, outdated software, and insufficient security awareness training. Attackers may exploit these vulnerabilities to steal sensitive financial data, disrupt operations, or damage reputation. Examples include phishing emails designed to trick employees into revealing login credentials, or malware disguised as legitimate software to gain access to networks.

Best Practices for Securing Cybercash Transactions

Implementing robust security measures is crucial for mitigating risks. These measures include strong password policies, regular software updates, and employee training programs. Implementing two-factor authentication (2FA) can significantly enhance security by requiring an additional verification step beyond a password.

Strategies for Mitigating Fraud and Protecting Sensitive Financial Data

Implementing comprehensive fraud detection systems and regularly monitoring transactions for suspicious activity are vital. Businesses should also establish clear policies regarding data handling and access. Data encryption protects sensitive information during transmission and storage. Regular security audits can identify vulnerabilities and improve overall security posture. Robust fraud detection systems, capable of identifying anomalies and unusual transaction patterns, can prevent fraudulent activities.

Security Protocols for Cybercash Transactions

Implementing a multi-layered approach to security is crucial. A table outlining various security protocols can aid in understanding the diverse measures businesses can take:

| Security Protocol | Description | Effectiveness |

|---|---|---|

| Strong Password Policies | Enforcing complex passwords, regular password changes, and password managers. | High – Reduces the risk of unauthorized access. |

| Two-Factor Authentication (2FA) | Adding an extra layer of security by requiring a second verification method, such as a code sent to a mobile device. | High – Significantly increases security. |

| Regular Software Updates | Ensuring that all software, including operating systems and security applications, is up-to-date. | High – Patches vulnerabilities and addresses known security flaws. |

| Data Encryption | Converting data into an unreadable format during transmission and storage. | High – Protects sensitive data from unauthorized access. |

| Firewall Protection | Creating a barrier between internal networks and external threats. | Medium – Provides a first line of defense. |

| Security Awareness Training | Educating employees about common security threats, such as phishing scams, and how to identify them. | High – Empowers employees to act as the first line of defense. |

Concentric Target Approach for Small Business E-commerce

The concentric target approach in e-commerce isn’t just another buzzword; it’s a strategic framework that can significantly boost sales and brand recognition for small businesses, particularly when leveraging cybercash transactions. This approach focuses on building a strong foundation with a core customer segment and then progressively expanding to related groups. This allows for optimized resource allocation and maximizes return on investment.

It’s especially effective when used in conjunction with cybercash, offering enhanced security and accessibility.This strategy involves starting with a well-defined core customer segment and meticulously understanding their needs and preferences. Once this initial group is effectively served, the business can then identify and target similar segments with overlapping characteristics. This concentric expansion is key to growth without losing focus on the core customer base.

Defining the Concentric Target Approach

The concentric target approach in e-commerce involves focusing on a primary customer segment, thoroughly understanding their needs, and then expanding to similar customer groups. It’s a gradual, well-structured expansion that leverages knowledge gained from the initial segment to efficiently target related customer profiles. This method differs from a scattergun approach, which tries to appeal to too many diverse groups at once, often leading to diluted marketing efforts.

Tailoring the Concentric Target Approach for Small Businesses Using Cybercash

Small businesses can adapt the concentric target approach to maximize the benefits of cybercash. This involves targeting segments with a high propensity for digital transactions, a key advantage of cybercash. For instance, a small business selling handmade crafts could initially focus on digitally savvy millennials and Gen Z. Once this segment is effectively reached, they could expand to environmentally conscious customers and craft enthusiasts.

Cybercash and its concentric targeting of small business e-commerce is a fascinating area. It’s all about reaching the right niche with the right digital payment solutions, and Barnes Noble’s recent exclusive deal with go2net, as detailed here , highlights how crucial these partnerships can be. This kind of strategic move ultimately benefits the small business owner, and it’s a powerful indicator of the evolving landscape of cybercash solutions for this segment.

Cybercash, by streamlining transactions and reducing reliance on physical cash, can make the entire process smoother and more appealing for these customer groups.

Advantages of a Concentric Target Strategy for Small Businesses Using Cybercash

A concentric target strategy offers several advantages for small businesses leveraging cybercash:

- Improved Resource Allocation: Resources are directed at customer segments with demonstrable interest and potential, reducing wasted effort on less receptive groups.

- Enhanced Customer Understanding: The strategy emphasizes in-depth knowledge of the core customer segment, which informs future expansions and improves products/services.

- Increased Brand Loyalty: By focusing on specific segments, the business can better tailor its offerings and build stronger relationships with loyal customers, which is vital in the long term.

- Reduced Marketing Costs: Targeted marketing campaigns are more effective than broad strokes, leading to higher conversion rates and lower overall marketing expenses.

Comparing and Contrasting with Other Strategies

A concentric target approach contrasts sharply with a “shotgun” approach that attempts to appeal to everyone. Instead of spreading resources thinly, this strategy concentrates efforts on specific, well-defined groups. Other strategies, such as demographic targeting, often lack the in-depth understanding of customer needs that a concentric approach provides. A concentric strategy also avoids the pitfalls of over-segmentation, which can be counterproductive and confusing for customers.

Identifying and Targeting Customer Segments

Identifying the right customer segments for a small business using cybercash and a concentric approach is crucial. Consider demographics, interests, and online behavior. For example, a small business selling organic pet food might initially target pet owners who actively use social media for pet-related information. Later, they could expand to environmentally conscious pet owners and dog-specific groups.

Customer Segment Comparison for Cybercash Transactions

| Customer Segment | Characteristics | Cybercash Transaction Potential | Marketing Strategies |

|---|---|---|---|

| Tech-Savvy Millennials | High digital literacy, familiar with online transactions | High | Targeted social media campaigns, online promotions |

| Eco-Conscious Consumers | Prioritize sustainability, ethical products | Medium | Highlight eco-friendly aspects of the business, partnership with eco-conscious organizations |

| Small Business Owners | Need secure and efficient payment options | High | Highlight security features, offer competitive rates |

| Budget-Conscious Customers | Value cost-effective products | Medium | Highlight value propositions, discounts, and promotions |

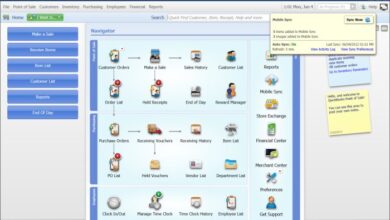

Cybercash Integration with Small Business E-commerce Platforms

Integrating Cybercash with small business e-commerce platforms is crucial for streamlining transactions and enhancing security. This integration offers a robust payment solution, often improving the user experience for both customers and business owners. Cybercash’s adaptability to various e-commerce platforms ensures a smooth transition for small businesses seeking secure and efficient payment processing.Popular e-commerce platforms like Shopify, WooCommerce, and Squarespace provide APIs (Application Programming Interfaces) that facilitate the integration of payment gateways like Cybercash.

Cybercash and focusing on small business e-commerce is a hot topic, especially with concentric targeting. Thinking about how Netscape chose VeriSign for e-commerce security gives a great insight into the security challenges of the time. Netscape chooses Verisign for e-commerce security highlights the importance of strong encryption and trust in online transactions, which directly impacts how cybercash systems are designed for small businesses today.

Ultimately, this all comes back to the core concept of making e-commerce safer and more accessible for small businesses.

These APIs allow for the seamless transfer of data between the e-commerce platform and the Cybercash system, enabling real-time processing of transactions. This approach minimizes the need for manual intervention and reduces errors, thus contributing to a more efficient workflow.

Cybercash and focusing on small businesses in e-commerce is a hot topic, and the recent move by Bluefly, partnering with excite in their e-commerce deal with excite , highlights the growing need for innovative payment solutions. This kind of strategic alliance suggests a broader trend toward bolstering digital commerce infrastructure, which ultimately benefits the small business community, and makes cybercash an even more important element of the future of small business e-commerce.

Methods of Cybercash Integration

Cybercash integration with e-commerce platforms typically involves utilizing the platform’s API. This API allows for communication between the platform’s payment processing system and the Cybercash system. The integration process typically involves several steps, including setting up a Cybercash merchant account, obtaining API keys and credentials, and configuring the e-commerce platform to interact with the Cybercash system. Proper configuration is crucial for accurate and secure transactions.

Successful Integration Examples

Numerous small businesses have successfully integrated Cybercash into their e-commerce platforms. One example involves a local artisan who sells handcrafted jewelry on Shopify. By integrating Cybercash, they simplified the payment process, leading to increased sales and improved customer satisfaction. Similarly, a small bookstore using WooCommerce saw a significant reduction in transaction errors and an increase in customer trust after integrating Cybercash.

These real-world examples showcase the positive impact of Cybercash integration on small business operations.

Technical Considerations for Seamless Integration

Technical considerations for seamless Cybercash integration include the security of API keys and credentials, the handling of potential errors, and the ability to support multiple currencies and payment methods. Data encryption is critical to maintain the security of customer information during the transaction process. Cybercash’s robust security measures ensure that sensitive data remains protected throughout the integration.

Popular E-commerce Platforms Compatible with Cybercash

- Shopify: Shopify’s extensive app store offers a wide variety of payment gateways, including those compatible with Cybercash. This allows for seamless integration of Cybercash payment options into existing Shopify storefronts.

- WooCommerce: WooCommerce, a popular plugin for WordPress, also allows for integration with various payment gateways. The process typically involves installing a compatible plugin and configuring the necessary settings. This enables Cybercash payment options within the WooCommerce platform.

- Squarespace: Squarespace, known for its user-friendly interface, offers a range of payment processing options. Cybercash integration often requires specific configuration settings within the Squarespace platform. The process may involve using a third-party app or contacting Squarespace support for guidance.

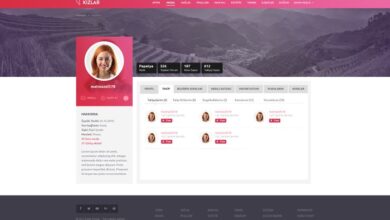

Customer Experience and User Interface Design

A seamless and positive customer experience is crucial for small businesses leveraging cybercash transactions in e-commerce. A well-designed user interface (UI) directly impacts how customers perceive and interact with the platform, ultimately influencing their satisfaction and loyalty. A strong UI design fosters trust, encourages repeat purchases, and differentiates the small business from competitors. This section explores the importance of a positive customer experience and how UI design plays a critical role in enhancing it.

Importance of a Positive Customer Experience

A positive customer experience is paramount for small businesses using cybercash. Happy customers are more likely to return, recommend the business to others, and contribute to a strong brand reputation. A positive experience builds trust, reduces customer acquisition costs, and increases lifetime value. Satisfied customers are also more tolerant of minor issues, showcasing the long-term value of a well-executed customer experience strategy.

Role of User Interface (UI) Design

UI design directly impacts the customer’s perception and interaction with the cybercash transaction process. A user-friendly interface makes the entire transaction process intuitive, minimizing friction and frustration. Clear visual cues, logical navigation, and easily accessible information create a positive experience, fostering trust and encouraging repeat use. Effective UI design can transform a complex process into a simple and enjoyable one, particularly crucial for small businesses aiming for growth and sustainability.

Design Principles for Enhanced User Engagement and Satisfaction

Several design principles are critical for creating a compelling user experience with cybercash. Simplicity and clarity are key—the interface should be easy to understand and navigate. Consistency in design elements across the platform ensures a familiar and predictable user journey. Intuitive navigation and clear calls to action guide customers through the transaction process. Visual appeal and aesthetic design enhance engagement and satisfaction.

A visually appealing and well-organized interface fosters a positive emotional connection with the platform.

Accessibility for Users with Diverse Needs

Ensuring accessibility for users with diverse needs is not just ethically sound; it’s also a smart business practice. Accessibility features, such as keyboard navigation, alternative text for images, and support for screen readers, make the cybercash platform usable by a wider range of customers. This inclusivity expands the market reach and fosters a positive perception of the business as a whole.

It demonstrates a commitment to ethical practices and improves the overall customer experience for everyone.

UI Design Elements for a Cybercash Platform

This table Artikels essential UI design elements for a cybercash platform focused on small business e-commerce. These elements are crucial for a user-friendly experience, building trust, and ensuring seamless transactions.

| UI Element | Description | Importance |

|---|---|---|

| Clear and concise information | Transaction details, payment options, and security information are presented in a clear and understandable format. | Reduces confusion and improves user understanding. |

| Secure payment gateways | Integration with secure payment gateways ensures protection of customer data. | Fosters trust and confidence in the platform. |

| Intuitive navigation | Easy-to-use menus and buttons, clear labeling, and visual cues guide users through the process. | Reduces friction and improves user satisfaction. |

| Responsive design | The platform adapts to different screen sizes and devices (desktop, mobile, tablet). | Ensures consistent experience across all devices. |

| Progress indicators | Visually communicate the progress of a transaction. | Provides reassurance and transparency. |

| Error handling | Clear and informative error messages help users resolve issues. | Reduces frustration and improves troubleshooting. |

| Help and support | Accessibility to FAQs, contact information, or chat support for user assistance. | Provides immediate support for users with questions or issues. |

Legal and Regulatory Compliance for Cybercash

Navigating the digital landscape of financial transactions requires a strong understanding of the legal and regulatory frameworks governing cybercash. This is particularly crucial for small businesses embracing e-commerce solutions, as they must ensure their operations comply with established rules and regulations. Failure to do so can lead to significant penalties and reputational damage. This section delves into the complexities of legal compliance in the cybercash arena, emphasizing the requirements for small businesses and the crucial role of government regulations.

Legal Frameworks Governing Cybercash Transactions

The legal frameworks surrounding cybercash transactions are multifaceted, encompassing national and international regulations. These frameworks address areas such as consumer protection, data security, and anti-money laundering (AML). Different jurisdictions have unique laws, leading to a complex regulatory environment for businesses operating in multiple markets. For instance, the European Union’s General Data Protection Regulation (GDPR) has significantly impacted how businesses handle customer data.

Understanding the specific laws of the regions where a business operates is vital for compliance.

Compliance Requirements for Small Businesses Using Cybercash

Small businesses employing cybercash for e-commerce transactions must adhere to stringent compliance requirements. These requirements often overlap with existing regulations for traditional financial transactions, but with added considerations for digital platforms. A critical aspect is the safeguarding of customer data. Businesses must implement robust security measures to protect sensitive information like credit card numbers and personal details.

Furthermore, compliance with KYC (Know Your Customer) and AML regulations is essential. Failure to adhere to these requirements can lead to substantial financial penalties.

Key Legal Considerations for Cybercash and E-commerce

Several key legal considerations arise in the context of cybercash and e-commerce. These include consumer protection laws, which dictate the rights and responsibilities of both businesses and customers. Contract law governs the terms and conditions of transactions, ensuring clarity and transparency. Intellectual property rights are also pertinent, particularly when businesses use software, branding, or trademarks related to cybercash platforms.

Addressing these considerations proactively is crucial for minimizing legal risks.

Role of Government Regulations in Shaping the Cybercash Market

Government regulations play a pivotal role in shaping the cybercash market. These regulations establish standards for security, consumer protection, and data privacy. For example, regulations concerning financial institutions and their online operations dictate the security measures cybercash providers must employ. These regulations directly impact the features and functionality of cybercash platforms, driving innovation while ensuring safety. Government oversight also helps maintain a level playing field for businesses operating in the cybercash sector.

Examples of Relevant Legal Cases Related to Cybercash and E-commerce

Numerous legal cases highlight the complexities of cybercash and e-commerce regulations. Cases concerning data breaches, fraud, and consumer disputes often arise in this context. These cases frequently involve disputes over transaction validity, data security breaches, and misrepresentation of services. Understanding how these cases have been resolved helps businesses anticipate potential legal challenges and implement proactive measures to mitigate risk.

Examples include cases involving platform providers accused of inadequate security measures, leading to data breaches and financial losses for customers. Another example might concern a business misrepresenting the security of its cybercash system, leading to a consumer protection lawsuit.

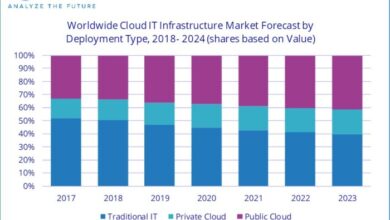

Future Trends and Emerging Technologies in Cybercash and E-commerce

The landscape of cybercash and e-commerce is constantly evolving, driven by innovations in technology. Understanding these emerging trends is crucial for small businesses to adapt and thrive in this dynamic environment. From the rise of blockchain to the potential of artificial intelligence, the future promises exciting possibilities and challenges. This exploration delves into the emerging technologies shaping the cybercash market and their implications for small businesses.The integration of emerging technologies like blockchain and AI offers unprecedented opportunities for small businesses to streamline operations, enhance security, and improve customer experiences.

However, navigating these complexities requires a strategic approach to ensure successful adoption and mitigate potential risks.

Emerging Technologies Impacting Cybercash and E-commerce

The digital economy is being reshaped by innovative technologies. These advancements directly impact the cybercash and e-commerce sectors, introducing new possibilities for small businesses. Key emerging technologies include blockchain, AI, and enhanced security protocols.

- Blockchain technology is transforming how transactions are processed and verified. Its decentralized nature offers increased security and transparency. Cryptocurrencies, while still relatively niche, offer an alternative payment method. Examples of businesses exploring blockchain integration include supply chain management for enhanced tracking and reduced fraud.

- Artificial intelligence (AI) is revolutionizing customer service, personalization, and fraud detection. AI-powered chatbots can provide instant support, while sophisticated algorithms can identify fraudulent transactions more accurately. Examples include AI-driven recommendation systems that improve customer experience and personalized marketing campaigns that boost sales.

- Enhanced security protocols are becoming increasingly important as cyber threats evolve. Biometric authentication, multi-factor authentication, and advanced encryption techniques are critical to safeguarding sensitive financial data. Businesses using these technologies can build trust with customers and reduce the risk of data breaches.

Future Trends Shaping the Cybercash Market for Small Businesses, Cybercash and concentric target small biz e commerce

The cybercash market is evolving rapidly, and small businesses must adapt to stay competitive. The future of cybercash for small businesses hinges on the successful integration of these technologies.

- Decentralized payment systems are gaining traction. These systems offer greater control and security for users.

- AI-powered fraud detection is becoming a standard feature for e-commerce platforms. This technology significantly reduces financial losses for businesses.

- Increased emphasis on user experience will be paramount. Intuitive interfaces and seamless transactions are essential to attract and retain customers.

Role of Blockchain Technology in Cybercash and E-commerce

Blockchain technology, with its inherent security and transparency, has the potential to revolutionize cybercash and e-commerce. Its decentralized nature reduces reliance on intermediaries and improves trust between buyers and sellers.

Blockchain’s immutability and transparency can enhance the security of transactions, making it more difficult for fraudulent activities to occur.

The use of blockchain in tracking and verifying products, from origin to final consumer, further strengthens supply chain security and reduces counterfeiting.

Potential Impact of Artificial Intelligence on Cybercash Transactions for Small Businesses

AI can significantly improve cybercash transactions for small businesses. AI algorithms can analyze vast amounts of data to identify patterns and anomalies, helping to detect and prevent fraud more effectively. Personalized recommendations and targeted advertising can also increase sales.

AI can analyze customer behavior to provide personalized recommendations and targeted advertising, increasing sales and customer satisfaction.

Small businesses can leverage AI tools to automate customer service, provide 24/7 support, and personalize the customer experience.

Potential Impact of Future Technologies on Small Business E-commerce

The table below Artikels the potential impact of future technologies on small business e-commerce.

| Technology | Potential Impact on Small Business E-commerce |

|---|---|

| Blockchain | Enhanced security, transparency, reduced fraud, streamlined supply chain management |

| AI | Improved customer experience, personalized recommendations, automated customer service, fraud detection |

| Enhanced Security Protocols | Increased customer trust, reduced risk of data breaches, improved transaction security |

Case Studies of Successful Small Businesses Utilizing Cybercash

Small businesses are increasingly embracing digital payment solutions like Cybercash to streamline their e-commerce operations and expand their reach. These case studies delve into the real-world experiences of successful small businesses that have integrated Cybercash, highlighting their strategies, challenges, and ultimately, their remarkable achievements. By examining these successful implementations, we can glean valuable insights for other small businesses considering adopting Cybercash.

Strategies for Successful Cybercash Integration

Small businesses often face unique challenges when adopting new technologies. Successful implementations of Cybercash involve a strategic approach that considers the specific needs and goals of each business. A crucial aspect is understanding the target customer base and tailoring the Cybercash integration to enhance their experience. This might involve optimizing the user interface for intuitive navigation and seamless transactions.

Another key strategy is prioritizing security and data protection to build customer trust. By implementing robust security measures, businesses can mitigate risks and ensure that sensitive financial information is handled with the utmost care.

Challenges Faced by Small Businesses

While the benefits of Cybercash are significant, small businesses may encounter several challenges during the implementation process. One common hurdle is the initial setup and configuration of the Cybercash platform. Understanding the intricacies of the integration process, including API connections and technical requirements, is vital for smooth operation. Another challenge involves training employees on the new system.

Effective onboarding and ongoing support are crucial to ensuring employees can utilize Cybercash efficiently and confidently. Time constraints and limited technical resources can also pose obstacles for small businesses, especially those with limited IT support.

Outcomes and Benefits Achieved

The benefits of successfully integrating Cybercash extend beyond increased sales. Small businesses often experience a notable boost in customer satisfaction and convenience. This can lead to repeat business and positive word-of-mouth referrals. Improved efficiency in transaction processing can translate into reduced operational costs and increased profitability. The ability to reach a wider customer base through e-commerce platforms can contribute to expansion and growth.

Increased customer trust, facilitated by robust security features, fosters long-term relationships and promotes business longevity.

Factors Contributing to Success

Several key factors contribute to the success of small businesses in their Cybercash implementation. A clear understanding of business objectives and how Cybercash aligns with those objectives is crucial. Adequate planning and preparation, including thorough research and consultation, can significantly mitigate potential problems. A strong understanding of Cybercash’s features and functionalities, and how they can best serve the business’s needs, is vital.

A dedicated team with technical expertise to oversee the integration and provide support can ensure the smooth transition. Continuous monitoring and optimization of the Cybercash integration can lead to further improvements in efficiency and customer satisfaction.

Summary Table of Key Takeaways

| Case Study | Strategies | Challenges | Outcomes | Success Factors |

|---|---|---|---|---|

| Example Business A | Focused on mobile-first approach, optimized UX | Initial technical setup complexities | Increased mobile sales by 30%, improved customer retention | Strong leadership support, dedicated tech team |

| Example Business B | Implemented comprehensive security measures | Employee training requirements | Reduced fraud by 20%, improved customer trust | Prioritization of security and data protection |

| Example Business C | Targeted marketing campaigns, clear customer onboarding | Limited initial resources | Improved customer acquisition by 15%, increased conversion rate | Strong marketing strategy, effective customer service |

Closure

In conclusion, cybercash, when combined with a concentric target strategy, offers significant advantages for small businesses looking to excel in e-commerce. By focusing on security, user experience, and integration with existing platforms, small businesses can streamline operations and boost profitability. The future of e-commerce is bright for those who understand and embrace these tools.