Consumers yet to pocket digital wallets represent a significant untapped market. This exploration delves into the reasons behind their reluctance, examining demographics, digital literacy, and security concerns. We’ll analyze the current digital wallet landscape, comparing available options and highlighting their strengths and weaknesses. Understanding the barriers to adoption is crucial to devising effective strategies for increasing usage, and we’ll explore potential solutions and future trends.

Understanding the motivations and pain points of these consumers is vital to crafting targeted strategies that encourage adoption. This deep dive into the digital wallet world will uncover actionable insights, empowering businesses and individuals to connect with this market segment more effectively.

Understanding the Target Audience

Digital wallets are rapidly gaining popularity, but a significant portion of the population remains hesitant to adopt them. Understanding the characteristics and motivations of these consumers is crucial for businesses aiming to bridge the gap and effectively market digital wallet solutions. This analysis delves into the demographics, psychographics, pain points, and motivations behind the reluctance to use digital wallets.

Demographics and Psychographics of Non-Adopters

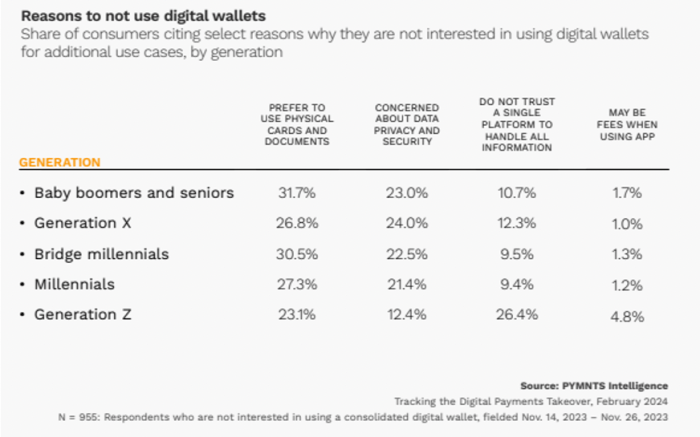

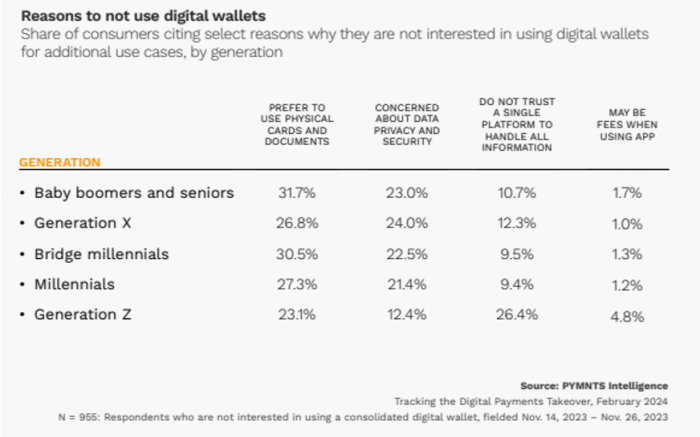

This group is diverse, encompassing various age groups, income levels, and geographic locations. However, some common threads exist. Older generations, those less tech-savvy, and individuals with limited access to reliable internet connectivity are frequently underrepresented in digital wallet adoption. Further, consumers who are primarily cash-oriented and lack confidence in online security measures tend to avoid digital wallets.

Consumer Segments

Several distinct consumer segments fall within the category of non-adopters. One group consists of older adults who are comfortable with traditional methods of payment and may be resistant to learning new technologies. Another segment includes low-income individuals who may not have access to the necessary devices or reliable internet access to use digital wallets effectively. Further, some consumers who live in areas with limited digital infrastructure may find digital wallet services less accessible.

While many consumers are still hesitant to embrace digital wallets, Travelocity’s sales are booming, likely due to increased convenience and streamlined online transactions. This suggests that Travelocity’s sales soar high despite the large portion of consumers who haven’t yet adopted digital payment methods. Perhaps a more intuitive user experience could persuade more people to ditch their physical wallets and embrace the digital age.

Pain Points and Barriers to Adoption

Several pain points hinder the adoption of digital wallets. Concerns regarding security and data privacy are significant deterrents for many consumers. A lack of trust in the security of online transactions, fears of identity theft, and worries about potential hacking incidents often prevent individuals from embracing digital wallets. Furthermore, the complexity of setting up and using digital wallets can be intimidating, especially for those with limited digital literacy.

Difficulties in understanding the terms and conditions, and the absence of clear and concise instructions, are common barriers. In addition, a lack of trust in the technology provider and concerns about the lack of physical receipts are prevalent among some non-adopters.

Digital Literacy Levels, Consumers yet to pocket digital wallets

Digital literacy varies significantly within this group. Some consumers may have limited familiarity with smartphones or the internet, hindering their ability to navigate digital wallet platforms. Others may be more tech-savvy but lack experience with mobile payment systems. These differences in digital literacy levels underscore the importance of providing clear, concise, and user-friendly digital wallet interfaces.

Motivations for Not Using Digital Wallets

There are various reasons why consumers might avoid digital wallets. Some individuals prioritize the physical feel and tangibility of cash. Others may be wary of losing access to their funds due to technical glitches or account issues. Furthermore, some individuals may be concerned about potential fees associated with digital transactions. Lastly, the lack of physical receipt or documentation associated with digital transactions can be a deterrent for certain individuals.

Comparison of Digital Wallet Adopters and Non-Adopters

| Characteristic | Digital Wallet Adopters | Non-Digital Wallet Adopters |

|---|---|---|

| Age | Generally younger, comfortable with technology | Generally older, may be less comfortable with technology |

| Digital Literacy | High digital literacy, familiar with mobile devices and online transactions | Variable digital literacy, potentially lower familiarity with technology |

| Payment Preferences | Prefer digital payments for convenience and speed | Prefer cash or traditional methods for perceived security and tangibility |

| Security Concerns | Less concerned about security, trust established with technology providers | High concern about security and data privacy |

| Financial Literacy | Often have a higher level of financial literacy | May have lower levels of financial literacy |

| Accessibility | Often have access to reliable internet connectivity and devices | May have limited access to reliable internet connectivity and devices |

Analysis of Current Digital Wallet Landscape: Consumers Yet To Pocket Digital Wallets

The digital wallet landscape is rapidly evolving, offering consumers a diverse array of options for managing their finances. From simple mobile payment apps to sophisticated platforms integrating various financial services, the choices are vast and can be overwhelming for those unfamiliar with the space. This analysis will delve into the different types of digital wallets, their features, and the leading players in the market.

It will also examine the security measures implemented and user experiences, equipping you with the knowledge to make an informed decision.Understanding the various digital wallets available is crucial for navigating this complex market. This analysis provides a comprehensive overview, from basic payment apps to advanced financial management tools, empowering you to choose a solution that best suits your needs.

Types of Digital Wallets

Digital wallets can be broadly categorized into several types, each with its unique strengths and weaknesses. This categorization allows for a more nuanced understanding of the available options. These include mobile payment apps, integrated banking apps, and specialized payment platforms.

- Mobile Payment Apps:

- Integrated Banking Apps:

- Specialized Payment Platforms:

These apps are designed primarily for quick and easy mobile payments. They often integrate with credit or debit cards, allowing users to make purchases and send money directly from their smartphones. Examples include Apple Pay, Google Pay, and Samsung Pay. Their primary function is facilitating transactions, with limited financial management capabilities beyond basic payment.

Many banks offer integrated banking apps that act as a digital wallet, often encompassing features such as bill payments, fund transfers, and account management. These apps usually integrate directly with the user’s bank accounts, providing a streamlined experience for managing financial transactions within the bank’s ecosystem. They can include savings, investments, and loans, enhancing financial management.

These platforms focus on specific payment functionalities, such as peer-to-peer (P2P) transfers or international money transfers. They often cater to niche needs, like facilitating international payments or streamlining transactions for businesses. These platforms may lack the comprehensive financial management features of integrated banking apps.

Features and Functionalities

Different digital wallets offer varying features and functionalities. Comparing these attributes helps in understanding their strengths and weaknesses. Some wallets are robust, encompassing financial management tools, while others are more focused on specific functionalities, like mobile payments.

- Payment Processing:

- Financial Management Tools:

- Security Measures:

The ability to process payments via different methods (credit/debit cards, bank accounts) is a fundamental feature. Some wallets may support contactless payments, QR codes, or other advanced methods. This is a key aspect to consider when choosing a wallet.

Some wallets extend beyond basic payment processing to offer tools for budgeting, tracking spending, and managing investments. These tools enhance financial literacy and planning, providing more comprehensive financial management.

While many consumers are still hesitant to embrace digital wallets, the shift towards connected devices like those discussed in GE’s recent foray into modem media, ge plugs into modem media , might actually be a catalyst for wider adoption. The seamless integration of technology into everyday life, as seen in this new development, could eventually lead to a greater comfort level with digital transactions, pushing more consumers to finally embrace digital wallets.

Security is paramount when dealing with financial transactions. Different wallets employ various security measures to protect user data, including encryption, two-factor authentication, and fraud detection. Understanding the security protocols implemented is essential for choosing a reliable platform.

Leading Players in the Market

Several companies dominate the digital wallet market, each with its own strengths and user base. Analyzing these players helps to understand the market dynamics.

- Apple Pay, Google Pay, and Samsung Pay:

- Integrated Banking Apps:

These are leading mobile payment platforms, widely adopted and integrated into various devices and ecosystems. Their success is rooted in their ubiquity and user-friendly interface.

Many major banks and financial institutions offer robust digital wallets through their integrated banking apps, catering to their existing customer base and providing a seamless experience. Their strengths lie in their integration with existing accounts and offerings.

Security Measures

Digital wallets employ various security measures to protect user data and transactions. These measures are essential for safeguarding sensitive information.

- Encryption:

- Two-Factor Authentication:

- Fraud Detection:

Encrypting data during transmission and storage is a fundamental security measure to prevent unauthorized access.

Implementing two-factor authentication adds an extra layer of security, requiring users to verify their identity through multiple factors.

Advanced fraud detection systems analyze transactions for anomalies, preventing fraudulent activities and protecting users from potential financial losses.

Ease of Use and User Experience

User experience plays a crucial role in the adoption and success of digital wallets. A simple and intuitive interface encourages user engagement and loyalty.

- Intuitive Interface:

- Mobile Accessibility:

Digital wallets with intuitive interfaces are easier to use, enhancing the user experience and encouraging adoption. Simplicity and ease of navigation are key factors.

The ability to access and use the wallet through a mobile device is crucial, especially in today’s mobile-centric world. This facilitates accessibility and portability.

Pros and Cons of Different Platforms

The following table summarizes the pros and cons of different digital wallet platforms, helping in the decision-making process.

| Platform | Pros | Cons |

|---|---|---|

| Apple Pay | Seamless integration with Apple ecosystem, widespread acceptance | Limited financial management features, reliance on Apple devices |

| Google Pay | Wide acceptance, integration with Android ecosystem, broader payment options | Potentially less user-friendly interface compared to Apple Pay, dependence on Android ecosystem |

| Integrated Banking Apps | Enhanced financial management tools, often tied to existing accounts | Limited acceptance outside of the bank’s network, potentially less intuitive for new users |

Barriers to Digital Wallet Adoption

Embracing digital wallets promises a seamless and convenient future for financial transactions. However, several obstacles hinder widespread adoption. Understanding these barriers is crucial for fostering innovation and user trust in digital payment systems. This exploration delves into the key challenges that prevent consumers from readily adopting digital wallets.

Technological Barriers

Many consumers lack the necessary technology to fully benefit from digital wallets. This includes insufficient internet access, outdated smartphones, or lack of compatible devices. Furthermore, varying levels of digital literacy significantly impact the ease of use and adoption.

- Limited Internet Access: In regions with poor internet infrastructure or unreliable connectivity, the practicality of using digital wallets is severely hampered. Transactions might fail due to network interruptions or slow speeds, leading to frustration and a negative experience. For example, rural communities often face challenges with consistently high-speed internet, which hinders their ability to access and utilize digital payment platforms.

- Outdated Smartphones: Older smartphones might not have the processing power or operating system compatibility to run digital wallet applications efficiently. This can lead to glitches, freezing, or security vulnerabilities, deterring users from adopting digital wallets.

- Lack of Compatible Devices: Not all devices are compatible with digital wallets. For instance, older tablets or specific types of smartwatches may not offer the necessary functionalities or security features for smooth operation.

- Digital Literacy Issues: Varying levels of digital literacy play a significant role. Users unfamiliar with digital payment systems may find it difficult to navigate the interface or understand the security protocols, thus impacting their adoption.

Cost-Related Issues

The cost associated with using digital wallets, including transaction fees, service charges, or lack of availability of necessary infrastructure, can prevent some users from adopting them.

- Transaction Fees: Some digital wallet services charge transaction fees for certain types of transactions, potentially increasing the overall cost for consumers compared to traditional payment methods.

- Service Charges: Monthly or annual service charges can deter consumers, particularly those who might not use the digital wallet frequently enough to justify the expense.

- Lack of Infrastructure: The absence of necessary infrastructure in some regions, such as the availability of POS terminals that support digital wallets, can pose a barrier to adoption. This is particularly problematic for businesses in developing regions or small towns.

Security Concerns

Security risks and concerns are among the primary factors deterring consumers from adopting digital wallets. Concerns about data breaches, fraud, and unauthorized access significantly impact user trust.

- Data Breaches: Concerns about potential data breaches in digital payment systems can lead consumers to distrust the security of their personal information. The fear of having their financial data compromised can be a major obstacle.

- Fraud and Unauthorized Access: The risk of fraud or unauthorized access to digital wallets can be a significant deterrent. Concerns about scams, phishing attacks, or account hijacking can create hesitation.

- Lack of Transparency: The complexity of digital payment systems and the lack of transparency in security protocols can instill a sense of insecurity among consumers. Limited knowledge of how the system protects their data can deter them from adopting the technology.

Lack of Trust in Digital Payment Systems

Consumers’ lack of trust in the security and reliability of digital payment systems can impede their adoption. Lack of clear communication about security protocols and privacy policies can also be a significant barrier.

- Lack of Transparency: A lack of clarity regarding security protocols and privacy policies contributes to a lack of trust in digital payment systems.

- Limited Experience: Limited personal experience with digital wallets or insufficient knowledge of the system’s workings can create hesitation. Users without personal stories of successful digital transactions might be reluctant to adopt them.

Educational Campaigns

Educational campaigns can play a vital role in addressing consumer concerns regarding digital wallet security.

- Focus on Transparency: Educational campaigns should emphasize the transparency of security protocols and privacy policies. Clear explanations of how data is protected and used can build trust.

- Highlighting Success Stories: Sharing positive experiences and success stories from real users can help alleviate concerns and demonstrate the practicality of digital wallets.

- Addressing Common Concerns: Educational campaigns should directly address common security concerns, such as data breaches and fraud. Provide clear and simple explanations about how digital wallets protect user information.

Potential Solutions

| Barrier | Potential Solution |

|---|---|

| Limited Internet Access | Improving internet infrastructure in underserved areas, offering offline access options (like QR code scanning), or partnering with mobile network providers to improve connectivity |

| Outdated Smartphones | Promoting smartphone upgrades, providing affordable devices, or developing wallet apps optimized for older devices |

| Cost-Related Issues | Implementing fee waivers or discounts for first-time users, partnering with banks to offer bundled services, or establishing transparent pricing structures |

| Security Concerns | Investing in robust security measures, enhancing user authentication methods, and providing clear and concise security guidelines. |

| Lack of Trust | Building strong brand reputation, collaborating with trusted institutions, and highlighting security certifications. |

Strategies for Increasing Digital Wallet Adoption

Digital wallets have the potential to revolutionize the way we interact with money, but widespread adoption is still lagging. Addressing consumer concerns and enhancing the user experience are key to unlocking this potential. This section details strategies to overcome hesitation, improve user experience, educate consumers, and tailor approaches for diverse groups.The current digital wallet landscape presents a blend of promising innovations and lingering obstacles.

Success hinges on understanding and effectively addressing these obstacles.

Overcoming Consumer Hesitation Related to Security

Consumer security concerns remain a significant barrier to digital wallet adoption. Building trust requires transparent security protocols and demonstrable protection against fraud. Clear and concise explanations of security measures, including encryption, multi-factor authentication, and fraud detection systems, are crucial. Transparency in data handling practices, including how personal information is collected, stored, and protected, reassures users.

Plenty of consumers are still hesitant to embrace digital wallets, a trend that might seem surprising in this digital age. Perhaps the fear of security breaches, or a lack of familiarity with the technology plays a role. However, the parallels between the potential pitfalls of widespread digital wallet adoption and the question of “will success spoil Linux?” are intriguing.

If widespread adoption leads to the same vulnerabilities that could plague Linux with increased reliance on external services, then maybe the hesitation of consumers to pocket digital wallets isn’t so surprising after all. Ultimately, the future of digital wallets will depend on addressing consumer concerns and creating a truly secure and user-friendly experience. will success spoil linux

Enhancing the User Experience for Digital Wallets

A seamless and intuitive user experience is vital for digital wallet adoption. User-friendly interfaces, simplified onboarding processes, and readily available support are essential. A well-designed app should offer intuitive navigation, clear instructions, and quick access to frequently used features. Mobile-first design, optimized for different screen sizes and operating systems, is paramount.

Educating Consumers About the Benefits of Digital Wallets

Consumers often lack a clear understanding of the advantages digital wallets offer. Effective education emphasizes the convenience, cost savings, and security benefits. Highlighting features like contactless payments, loyalty program integration, and budgeting tools showcases the practical value. Promoting the convenience of avoiding physical cash and the potential for reward programs further motivates adoption.

Innovative Ways to Encourage Digital Wallet Adoption Among Different Consumer Groups

Different consumer groups have unique needs and preferences. Tailored marketing campaigns are necessary to reach and resonate with diverse segments. For example, offering tailored rewards and promotions for students, families, or frequent travelers can be effective. Focusing on the specific needs of these groups, such as simplified budgeting tools or international payment options, is crucial.

Comparing and Contrasting Different Marketing Strategies

Various marketing strategies can promote digital wallet adoption. Social media campaigns, targeted advertising, and partnerships with retailers are common approaches. Influencer marketing, especially from trusted figures within specific demographics, can be highly effective. Analyzing which marketing approaches resonate most with different consumer groups is vital for optimizing campaigns.

Marketing Channels and Their Effectiveness

| Marketing Channel | Effectiveness | Description |

|---|---|---|

| Social Media Marketing | High | Leveraging platforms like Instagram, TikTok, and Facebook to engage with potential users through visually appealing content, interactive polls, and user-generated campaigns. |

| Search Engine Optimization () | Medium | Optimizing online presence to rank higher in search engine results for relevant s, increasing visibility and organic traffic. |

| Paid Advertising (PPC) | High | Using targeted ads on search engines and social media platforms to reach specific demographics and interests. |

| Partnerships with Retailers | High | Collaborating with businesses to offer exclusive discounts or incentives for using the digital wallet. |

Improving Integration of Digital Wallets into Existing Payment Systems

Seamless integration with existing payment systems is crucial for digital wallet adoption. Facilitating seamless transitions between physical and digital payment methods will encourage widespread use. Support for various payment networks and standardized interfaces are critical to achieving this.

Future Trends and Projections

The digital wallet landscape is constantly evolving, driven by technological advancements and shifting consumer preferences. Understanding the trajectory of these changes is crucial for businesses and individuals alike to navigate the future of payments. This section explores potential future developments, innovative features, and the impact of emerging technologies on the digital wallet ecosystem.The future of digital wallets hinges on the ability to offer seamless, secure, and convenient experiences.

This involves not only the technical aspects of the wallets themselves but also the evolving needs and expectations of users. From integrating with other financial tools to incorporating new security protocols, the next few years promise exciting developments in this space.

Potential Future Developments in Digital Wallets

Digital wallets are likely to become more integrated into our daily lives. Expect deeper integration with other apps and services, such as loyalty programs, entertainment platforms, and even utility payments. This seamless integration will significantly increase user convenience and engagement. The ability to pay for goods and services through simple mobile phone gestures or even eye-tracking technology is no longer confined to the realm of science fiction.

Innovative Digital Wallet Features

The evolution of digital wallets will bring innovative features to enhance user experience and functionality. Imagine a digital wallet that automatically tracks spending habits, provides personalized financial advice, and even proactively notifies users of potential fraud or overspending. Furthermore, features like embedded insurance or access to micro-loans within the wallet itself are plausible future developments. These advancements will address the growing need for personalized financial management and support.

Impact of Emerging Technologies on Digital Wallets

Emerging technologies like blockchain, artificial intelligence (AI), and biometric authentication will fundamentally alter digital wallets. Blockchain technology can enhance security and transparency in transactions. AI can personalize user experiences and provide tailored financial advice. Biometric authentication will make transactions more secure and convenient. These technologies are already starting to impact various sectors, and digital wallets are poised to be significantly influenced by their growth.

Impact of Changing Consumer Preferences

Consumer preferences are constantly evolving, driving demand for features like greater personalization, seamless integration with existing platforms, and enhanced security. Users are increasingly seeking convenience and efficiency in their financial transactions, and digital wallets that cater to these preferences will thrive. The rise of mobile-first consumers underscores the need for user-friendly interfaces and intuitive design in digital wallets.

Impact of Government Regulations

Government regulations will play a significant role in shaping the digital wallet market. Regulations around data privacy, security, and anti-money laundering (AML) will likely become more stringent. These regulations will impact the way digital wallets operate, ensuring consumer protection and financial stability. Compliance with these regulations will be a key factor for digital wallet providers in the future.

Potential Scenarios for Digital Wallet Adoption

| Scenario | Description | Likelihood |

|---|---|---|

| High Adoption | Rapid and widespread adoption of digital wallets across various demographics. Increased reliance on mobile payments for everyday transactions. | Medium-High |

| Moderate Adoption | Digital wallets gain significant traction, but physical payment methods remain prevalent in certain sectors or demographics. | Medium |

| Slow Adoption | Limited adoption of digital wallets, with physical payment methods remaining dominant. Concerns about security and privacy may hinder widespread adoption. | Low |

Impact of Cryptocurrency on Digital Wallets

Cryptocurrencies are rapidly changing the landscape of digital finance. Digital wallets are evolving to incorporate cryptocurrencies, enabling users to store, manage, and transact cryptocurrencies seamlessly. The integration of cryptocurrencies into digital wallets is opening up new possibilities for financial transactions, but security and regulatory frameworks must keep pace with the rapid evolution of cryptocurrencies. The growing interest in decentralized finance (DeFi) is also influencing the development of digital wallets that support decentralized transactions.

“The integration of cryptocurrency into digital wallets is likely to reshape the financial landscape, enabling a more diverse range of transactions and financial services.”

Concluding Remarks

In conclusion, the journey towards universal digital wallet adoption is multifaceted. Addressing the specific needs and concerns of consumers who haven’t yet embraced this technology is crucial for the future of digital payments. By understanding the reasons behind reluctance and implementing targeted strategies, the digital wallet market can overcome barriers and expand its reach. The future holds exciting possibilities, with innovation promising to further streamline and enhance the user experience.