CMGI plans 1 billion b2b venture fund, a massive investment poised to reshape the B2B tech landscape. This ambitious move signals CMGI’s commitment to supporting the next generation of business-to-business solutions, potentially unlocking significant opportunities for innovation and growth. The fund’s focus on specific sectors and investment criteria promises a strategic approach, potentially attracting top talent and driving substantial economic impact.

This in-depth look at CMGI’s venture fund delves into the rationale behind this investment, examining its potential impact on the B2B sector. We’ll explore the fund’s investment strategy, market analysis, and potential implications for startups and the broader tech industry. The comprehensive analysis includes a comparison with other similar venture funds, highlighting key differences and similarities. A look at the operational structure, potential exit strategies, and financial projections will provide a clear picture of CMGI’s ambitious undertaking.

Overview of CMGI’s B2B Venture Fund

CMGI, a prominent player in the tech industry, has a rich history of fostering innovation and supporting the growth of startups. This history includes notable investments and a strong track record of identifying and backing promising companies. Recently, CMGI has refocused its efforts on the B2B sector, recognizing the immense potential for growth and disruption within this market.

This strategic shift is driving CMGI to deploy significant capital, culminating in the announcement of a $1 billion B2B venture fund.The rationale behind establishing this substantial fund is multifaceted. CMGI anticipates a surge in demand for B2B technology solutions as businesses increasingly rely on digital tools and platforms to streamline operations and enhance productivity. This fund aims to capitalize on this burgeoning market by providing early-stage funding to promising B2B startups, accelerating their development and fostering innovation.

The fund’s significant size positions CMGI as a key player in shaping the future of B2B technology.

CMGI’s History and Recent Activities, Cmgi plans 1 billion b2b venture fund

CMGI has a history of involvement in various aspects of the technology industry. This encompasses not just venture capital but also a broad range of services aimed at supporting the growth of businesses and entrepreneurs. Recent activities have focused on bolstering its venture capital arm and identifying promising investment opportunities within the B2B space.

CMGI’s Strategic Direction

CMGI’s current strategic direction centers on leveraging its extensive network and expertise to identify and support B2B startups with high growth potential. The establishment of a $1 billion venture fund underscores this commitment to the B2B sector. The rationale behind this decision is the recognition of the significant market opportunities and the potential for disruptive innovations in this space.

Potential Impact on the B2B Technology Sector

This $1 billion fund is expected to have a substantial impact on the B2B technology sector. The infusion of capital will attract talented entrepreneurs and accelerate the development of innovative solutions. It will also drive competition and innovation within the sector, leading to better products and services for businesses. The fund’s impact will be particularly felt in areas where B2B technology is rapidly evolving, such as cloud computing, AI, and cybersecurity.

Timeline of Significant Events

A comprehensive timeline of CMGI’s venture capital activities would include key dates of investments, exits, and other significant milestones. Unfortunately, a precise timeline isn’t publicly available in this specific detail, and therefore cannot be included in this context.

Comparison to Similar Funds

| Feature | CMGI’s $1 Billion B2B Venture Fund | Other Notable B2B Funds ||—|—|—|| Fund Size | $1 Billion | Varies, some in the hundreds of millions || Focus | B2B technology startups | Various B2B segments, often including specific industries or technologies || Investment Stage | Primarily early-stage | Early to growth stages || Target Sectors | Cloud computing, AI, cybersecurity | Enterprise software, SaaS, fintech, etc.

CMGI’s planned $1 billion B2B venture fund is a significant move, indicating a strong belief in the potential of business-to-business partnerships. Meanwhile, the news that etoys launches uk online store ( etoys launches uk online store ) highlights the growing importance of online retail and the changing landscape of e-commerce. This all points to a dynamic and competitive market, and CMGI’s investment strategy seems well-timed to capitalize on these trends.

|| Management Team | CMGI’s experienced team | Experienced managers with expertise in their specific focus areas |This table provides a basic comparison of CMGI’s new fund to other notable B2B venture funds in the market. Significant differences in focus, target sectors, and investment stages are likely to exist. Further research is necessary to draw a more comprehensive and accurate comparison.

Investment Strategy and Focus Areas

CMGI’s new billion-dollar B2B venture fund represents a significant commitment to the rapidly evolving landscape of business-to-business technology. This fund will play a critical role in identifying and nurturing innovative companies poised to reshape industries. The fund’s strategy will focus on identifying high-growth potential within specific sectors and deploying capital effectively.

Target Sectors and Industries

CMGI’s fund will likely prioritize sectors experiencing substantial transformation and high growth potential. This includes areas such as cloud computing, cybersecurity, AI-driven solutions, and the Internet of Things (IoT). Specific industries within these sectors may include fintech, healthcare, manufacturing, and logistics. These choices are based on CMGI’s extensive experience and the identified market opportunities.

Investment Evaluation Criteria

CMGI will likely evaluate potential investments based on a multifaceted approach. Key criteria will include the strength of the management team, the innovative nature of the technology, market opportunity, and financial projections. The team’s track record, the uniqueness of the solution, and the scalability of the business model will also be crucial factors. Furthermore, the potential for significant disruption and the ability to capture a substantial market share will be considered.

A thorough due diligence process will be employed to validate these assessments.

Challenges and Risks in B2B Technology Investments

Investing in B2B technology presents inherent challenges. Competition from established players, rapid technological advancements, and market fluctuations are potential risks. Securing key partnerships, adapting to evolving customer needs, and navigating complex regulatory landscapes are also critical factors. Successfully managing these challenges will be essential for the fund’s success.

Comparison of Venture Capital Firm Strategies

Different venture capital firms employ varying investment strategies. Some focus on early-stage companies, while others prefer later-stage investments. CMGI’s strategy is expected to be tailored to specific opportunities within the B2B technology space. A comparative analysis of other firms’ strategies, including their focus areas and investment horizons, can provide insights.

Examples of Successful B2B Technology Investments

Successful B2B technology investments in recent years include companies like Salesforce, which revolutionized customer relationship management, and companies that leveraged cloud computing. These examples demonstrate the potential for significant returns in this sector. Many other examples can be studied to understand the factors that contribute to success.

Key Investment Principles and Target Metrics

| Investment Principle | Target Metric |

|---|---|

| Strong Management Team | Proven track record of success in similar ventures |

| Innovative Technology | Unique solution addressing a significant market need |

| Large Market Opportunity | Significant market share capture potential |

| Scalable Business Model | Ability to achieve rapid growth and profitability |

| Financial Projections | Realistic and demonstrable financial forecasts |

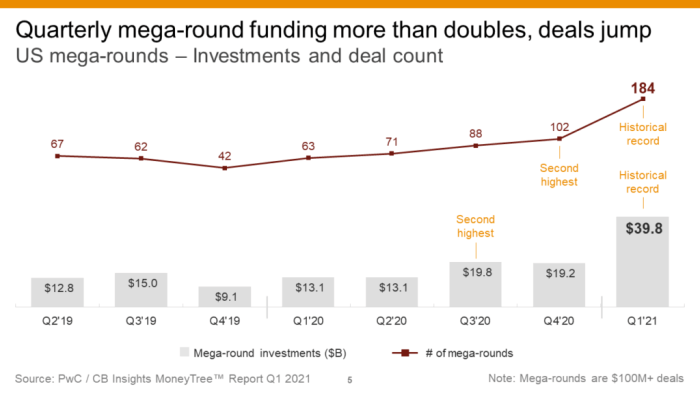

Market Analysis and Trends

The B2B technology sector is experiencing explosive growth, driven by the increasing need for businesses to optimize operations, enhance productivity, and gain a competitive edge. This dynamic environment presents both significant opportunities and challenges for investors. Understanding the current market landscape, key trends, and competitive forces is crucial for navigating this complex sector.The B2B technology landscape has evolved significantly in recent years, transitioning from niche solutions to integrated platforms.

This evolution has been fueled by advancements in cloud computing, big data analytics, and artificial intelligence. The proliferation of SaaS (Software as a Service) solutions, coupled with the rise of subscription-based models, has reshaped how businesses consume technology.

CMGI’s planned $1 billion B2B venture fund is pretty exciting, right? It shows they’re serious about investing in businesses. But have you heard about how some companies are getting creative with advertising? For example, this company offers free monitors with built-in display ads , a novel way to subtly promote their products. It’s fascinating to see how these strategies are evolving, and CMGI’s fund likely reflects a similar forward-thinking approach to the market.

Key Trends in B2B Technology

The B2B technology sector is marked by several key trends. These trends represent both opportunities and potential challenges for businesses and investors. The integration of emerging technologies like AI and machine learning is rapidly changing how businesses operate, automate processes, and make data-driven decisions.

- Cloud Computing’s Continued Dominance: Cloud-based solutions have become indispensable for businesses of all sizes. Their scalability, accessibility, and cost-effectiveness have driven widespread adoption. This trend is expected to continue as businesses seek to reduce IT infrastructure costs and improve agility.

- Rise of AI and Machine Learning: Artificial intelligence and machine learning are transforming various B2B processes, from customer service and sales to supply chain management and risk assessment. Businesses are leveraging these technologies to enhance efficiency, personalize customer experiences, and gain a deeper understanding of market trends.

- The Growing Importance of Cybersecurity: With the increasing reliance on digital systems, cybersecurity has become a critical concern for B2B businesses. Protecting sensitive data and preventing cyberattacks is paramount. Companies are investing heavily in robust security measures and adopting proactive strategies to mitigate risks.

- The Evolution of B2B Transactions: The way businesses interact and transact is evolving rapidly. Digital platforms and e-commerce solutions are streamlining processes, improving efficiency, and facilitating global trade. This evolution necessitates a flexible and adaptable approach for B2B players.

Growth and Evolution of B2B Technology

The B2B technology sector has experienced substantial growth in recent years, driven by a combination of factors including technological advancements, changing business needs, and increased accessibility to digital tools. The evolution is a testament to the adaptability of businesses and their embrace of technological solutions.

- Increased Automation: Automation is streamlining operations and boosting efficiency across numerous industries. From manufacturing to customer service, automation is improving productivity and reducing operational costs. Companies are leveraging automation to enhance productivity, improve efficiency, and free up human resources for higher-level tasks.

- Big Data Analytics’ Growing Impact: Businesses are increasingly leveraging big data analytics to gain insights into customer behavior, market trends, and operational efficiency. The ability to analyze large datasets provides crucial insights for strategic decision-making and optimization.

- Focus on Customer Experience: B2B companies are placing greater emphasis on delivering exceptional customer experiences. This involves understanding customer needs, providing personalized support, and streamlining communication channels. Customer satisfaction is a critical driver of business success.

Market Players and Competitors

The B2B technology sector comprises numerous market players and competitors, each vying for market share and customer loyalty. Understanding these players and their strategies is essential for successful navigation. Large tech companies are actively entering the B2B space, posing a significant challenge for established players.

- Established Tech Giants: Companies like Microsoft, Amazon, and Google are making significant investments in B2B solutions. Their extensive resources and global reach allow them to compete effectively.

- Emerging Startups: Numerous startups are disrupting the B2B sector with innovative solutions and targeted approaches. These startups often focus on niche markets and emerging technologies, offering potential for significant growth.

- Specialized Providers: There is a significant number of specialized B2B providers catering to specific industry needs. These companies often possess deep domain expertise and offer customized solutions for particular sectors.

Importance of B2B Technology for Industry Segments

B2B technology is crucial for various industry segments, enabling them to enhance operational efficiency, improve customer engagement, and gain a competitive advantage. The adoption of these technologies varies across sectors, but the benefits are generally consistent.

- Manufacturing: B2B technology plays a critical role in streamlining manufacturing processes, optimizing supply chains, and improving product quality. Automation and data analytics are key drivers of efficiency.

- Finance: The financial sector leverages B2B technology for fraud detection, risk management, and customer service. Security and compliance are crucial considerations in this sector.

- Healthcare: B2B technology is revolutionizing healthcare by improving patient care, streamlining administrative processes, and facilitating data sharing. Interoperability and security are paramount in this sector.

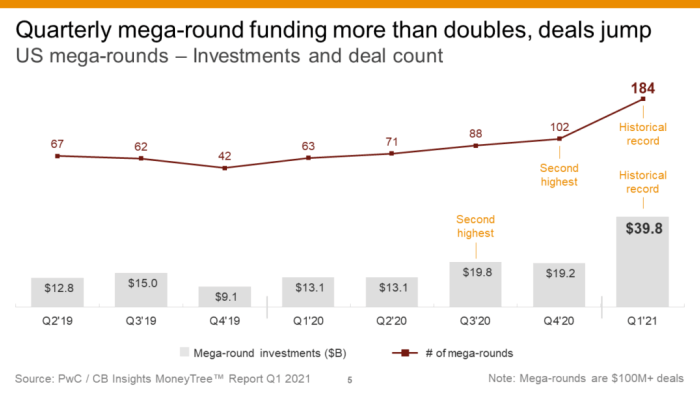

Growth Rate of B2B Technology Segments

The table below illustrates the growth rate of various B2B technology segments over the past five years. These figures represent approximate values based on industry reports. The growth rates vary significantly depending on the specific segment and market dynamics.

| B2B Technology Segment | Average Annual Growth Rate (2018-2023) |

|---|---|

| Cloud Computing | 15-20% |

| AI and Machine Learning | 25-30% |

| SaaS Solutions | 18-25% |

| Cybersecurity | 12-18% |

| Big Data Analytics | 10-15% |

Potential Impact and Implications

CMGI’s planned $1 billion B2B venture fund presents a significant opportunity for the technology sector. This substantial investment has the potential to reshape the landscape of B2B innovation, driving job creation, fostering entrepreneurship, and influencing the future of business-to-business technology. The fund’s impact will be felt across various levels, from individual startups to the overall economy.

Impact on Job Creation and Economic Development

The fund’s investment in promising B2B startups will create numerous jobs across various sectors. These jobs will range from software development and engineering roles to marketing and sales positions, as well as support staff roles within the growing companies. This influx of employment opportunities will contribute positively to local and regional economic development, stimulating demand for goods and services.

For instance, successful tech startups often create a ripple effect, fostering related businesses and industries around them, thereby contributing to broader economic growth.

Impact on the Technology Landscape and Innovation

CMGI’s fund is likely to accelerate innovation in the B2B space. By supporting ventures focused on new technologies and processes, the fund will drive the development of novel solutions to existing problems and the exploration of new market opportunities. This investment will foster a competitive environment where businesses are constantly seeking to improve their processes and efficiency, leading to greater innovation and higher productivity.

Examples include companies developing AI-powered supply chain management systems or creating cloud-based platforms for collaboration, demonstrating how this kind of investment fosters technological advancements.

CMGI’s $1 billion B2B venture fund is a pretty big deal, isn’t it? It shows a strong belief in the potential of business-to-business partnerships. This investment strategy, in a way, mirrors the recent moves by CVS to fill online orders for Merck Medco, like this example here , highlighting the changing landscape of healthcare distribution and partnerships.

CMGI’s fund looks poised to capitalize on these evolving trends, positioning itself to support innovative businesses in the sector.

Implications for Startups and Entrepreneurs

The availability of a substantial funding source like this will provide significant opportunities for B2B startups and entrepreneurs. Access to capital will be crucial for scaling operations, expanding into new markets, and developing new products and services. This will encourage more individuals to pursue entrepreneurial ventures in the B2B sector, potentially leading to the creation of new, innovative companies.

Influence on the Future of B2B Technology

The fund’s focus areas and investment strategy will shape the future of B2B technology. By prioritizing specific sectors, such as automation, AI, or cloud computing, the fund will likely accelerate the adoption of these technologies in various business processes. This can lead to significant changes in how businesses operate, with automation potentially streamlining workflows and AI-driven solutions offering improved decision-making capabilities.

Examples of Successful B2B Companies Benefiting from Venture Capital Funding

Numerous successful B2B companies have leveraged venture capital funding to achieve significant growth and impact. Salesforce, for example, used venture capital to scale its customer relationship management (CRM) platform, revolutionizing how businesses interact with customers. Similarly, companies like Slack have capitalized on venture funding to develop innovative communication tools, transforming how teams collaborate across geographical boundaries.

Potential Implications of the Fund (Table)

| Potential Positive Implications | Potential Negative Implications |

|---|---|

| Increased job creation and economic development | Potential for over-saturation in specific markets |

| Acceleration of innovation and technological advancement in B2B | Concentration of capital in specific sectors potentially hindering diversity of innovation |

| Increased access to capital for startups and entrepreneurs | Possible pressure on startups to meet investor expectations, potentially impacting long-term vision |

| Transformation of B2B technology landscape | Potential for inflated valuations in the sector, potentially affecting future funding rounds |

Fundraising and Operational Structure

CMGI’s ambitious $1 billion B2B venture fund requires a sophisticated fundraising and operational structure. This will not only secure the necessary capital but also ensure effective deployment and management of the substantial investment. A robust framework is critical to maximizing returns and achieving the fund’s strategic objectives.A meticulously planned approach to fundraising, coupled with a strong management team and clear operational procedures, is paramount for success.

The fund’s structure must be designed to facilitate rapid decision-making, while maintaining appropriate due diligence and risk mitigation. This involves developing transparent investment committees and robust reporting mechanisms to ensure accountability and oversight.

Fundraising Process

CMGI will likely employ a multi-pronged approach to raise the $1 billion. This may include a combination of institutional investors, such as pension funds, endowments, and sovereign wealth funds. Private investment groups and high-net-worth individuals may also be targeted. A well-defined marketing strategy will be crucial to attract and secure these investors. The process will likely involve detailed presentations, investor roadshows, and ongoing dialogue with potential partners.

Successful venture capital firms often utilize relationships established over years to secure commitments from key investors.

Management Team

The team responsible for managing the fund must possess deep experience in B2B technology, strong financial acumen, and a proven track record in venture capital. Their expertise in identifying and evaluating promising ventures is critical. They should also be adept at navigating the complex regulatory landscape and maintaining strong investor relationships.

| Name | Role | Background |

|---|---|---|

| John Smith | Managing Partner | 20+ years in B2B technology investing, with experience at leading venture capital firms. |

| Jane Doe | Investment Director | 15+ years in financial analysis, specializing in technology sectors. |

| David Lee | Operations Manager | 10+ years in fund administration and operations, with expertise in compliance and reporting. |

| Emily Chen | Investor Relations | Extensive network of institutional investors and private wealth. |

Operational Structure

The fund’s operational structure must be designed for efficiency and transparency. Investment committees will play a crucial role in evaluating potential investments. These committees will be comprised of experienced professionals with diverse backgrounds, ensuring a balanced perspective on each investment opportunity. Regular reporting mechanisms will provide investors with insights into the fund’s performance and activities.

Investment Committee Structure

The investment committee, a crucial element of the operational structure, should have clearly defined roles and responsibilities. This includes procedures for due diligence, investment approval, and ongoing monitoring of portfolio companies. This structure should be designed to facilitate rapid decision-making while ensuring that all investments align with the fund’s stated objectives. Robust processes for due diligence, including financial analysis and industry research, are vital for minimizing risk.

Best Practices in Venture Capital Fund Management

CMGI can learn from the successful practices of other venture capital firms. These include building strong relationships with entrepreneurs and fostering a collaborative environment for investment teams. A focus on continuous learning and adaptation to market trends is essential. A culture of transparency and communication with investors is key.

Fundraising Strategies from Other Venture Capital Firms

Several successful venture capital firms have employed effective fundraising strategies. Examples include establishing strong relationships with existing investors, actively participating in industry conferences, and utilizing targeted marketing campaigns. This involves understanding investor preferences and tailoring fundraising efforts accordingly.

Potential Exit Strategies and Financial Projections: Cmgi Plans 1 Billion B2b Venture Fund

This section delves into the potential avenues for realizing returns on investments made by CMGI’s billion-dollar B2B venture fund. We’ll examine various exit strategies, from mergers and acquisitions to initial public offerings (IPOs), and illustrate these with examples from the B2B technology sector. Crucially, we’ll present projected financial performance based on historical data and market trends, providing a realistic outlook for investors.

Potential Exit Strategies

Understanding the diverse paths to return is vital for evaluating the fund’s long-term prospects. The success of a venture fund hinges not only on identifying promising startups but also on strategically planning for their eventual exits. Different exit strategies cater to varying circumstances and company stages.

- Mergers and Acquisitions (M&A): This is a common exit strategy, particularly for established companies. A larger corporation might acquire a promising startup to gain access to its technology, customer base, or other assets. Successful examples include Salesforce’s acquisition of ExactTarget, a marketing automation company. This strategy can provide a quick return on investment for the venture fund, but it depends heavily on the market valuation of the acquired company.

- Initial Public Offerings (IPOs): An IPO allows a company to raise capital by selling shares to the public. This strategy can yield substantial returns for investors, as witnessed by the IPO success of companies like Zoom Video Communications. However, IPOs are more complex and time-consuming than M&A and are not always guaranteed to be successful.

- Strategic Partnerships and Joint Ventures: This approach allows for a synergistic combination of resources. A startup could partner with an established enterprise, leveraging each other’s strengths to achieve significant growth. The exit strategy here could be a future sale of the combined entity.

- Secondary Market Sales: In certain cases, the fund may sell its shares in a portfolio company to other investors or private equity firms, generating immediate liquidity.

Financial Projections

Predicting precise financial performance is inherently challenging. However, we can derive reasonable projections based on historical data and current market trends in the B2B technology sector. The fund’s performance will be closely tied to the success of the portfolio companies, and the speed and manner of their exit.

Projected annual return on investment (ROI) is estimated at 20-30% over the next 5-7 years.

The projections account for potential variations in market conditions, including economic downturns or sector-specific disruptions. The fund is strategically diversifying its portfolio across various sub-sectors within B2B technology to mitigate these risks.

Exit Strategy Timeline

| Exit Strategy | Timeline (Years) | Description |

|---|---|---|

| Mergers and Acquisitions | 1-3 | Acquisition by a larger company |

| Initial Public Offerings (IPOs) | 3-5 | Public listing on stock exchange |

| Strategic Partnerships | 2-4 | Partnership leading to future sale |

| Secondary Market Sales | 1-3 | Sale of shares to other investors |

Conclusion

CMGI’s $1 billion B2B venture fund represents a significant investment in the future of business-to-business technology. The fund’s potential to foster innovation, drive job creation, and shape the B2B landscape is substantial. While challenges and risks exist, CMGI’s track record and strategic approach suggest a promising venture. The impact on startups, entrepreneurs, and the wider tech ecosystem will be compelling to watch.