Cmgi invests in bizbuyer com – CMGI invests in BizBuyer.com, a significant move for both companies. CMGI, known for its innovative investments in tech startups, is now backing BizBuyer.com, an online B2B marketplace. This signals a belief in the potential of the online B2B sector and raises questions about the future of business-to-business transactions. This analysis explores the motivations behind this investment, the characteristics of BizBuyer.com, and the potential impact on both companies and the industry as a whole.

CMGI’s investment strategy often focuses on companies demonstrating strong growth potential and innovative solutions. BizBuyer.com’s unique features and target market are key considerations in this strategic move. Understanding the competitive landscape of online B2B marketplaces, along with the prevailing market conditions, will provide a clearer picture of the investment’s context.

Overview of CMGI’s Investment

CMGI, or CMGI Inc., was a prominent internet-focused investment firm in the late 1990s and early 2000s. Its history is marked by both successes and failures, reflecting the volatile nature of the dot-com boom and bust. Understanding CMGI’s past provides context for their current activities and their investment in BizBuyer.com.CMGI’s investment strategy historically centered on identifying and backing promising internet-related startups.

They aimed to leverage their network and expertise to help these companies scale and achieve significant growth. This approach, however, was not without its risks. The inherent uncertainty of the internet market, coupled with the rapid pace of innovation, made it challenging for CMGI to consistently identify and nurture successful ventures.

CMGI’s Background and Investment Strategy

CMGI was a venture capital firm that primarily focused on companies involved in the burgeoning internet sector. They sought to identify companies with strong potential for growth and provided them with capital, mentorship, and networking opportunities. This involved a deep understanding of the technology landscape and a commitment to fostering innovation.

Types of Companies CMGI Typically Invested In

CMGI’s investment portfolio predominantly comprised companies involved in e-commerce, online services, and internet infrastructure. Examples included businesses focused on web development, online marketplaces, and digital content delivery. They were not limited to a specific industry vertical, but their investments often reflected the prevailing trends and opportunities within the internet economy at the time.

CMGI’s Historical Performance and Reputation

CMGI’s historical performance was mixed. While they backed some highly successful companies, they also suffered losses and setbacks, highlighting the inherent risks associated with venture capital. Their reputation was somewhat tarnished by the dot-com bust, although their influence on the internet landscape during that era is undeniable.

Potential Motivations Behind CMGI’s Investment in BizBuyer.com

CMGI’s investment in BizBuyer.com could be driven by a variety of factors. Perhaps they see a strong strategic fit with their current portfolio or identify a compelling market opportunity within the online business-to-business (B2B) sector. Understanding their current investment strategy and priorities is key to assessing their motives. It’s important to consider the current economic climate and industry trends when analyzing the potential rationale for this particular investment.

Analysis of BizBuyer.com

CMGI’s investment in BizBuyer.com signifies a bet on the potential of online B2B marketplaces. Understanding the platform’s features, target audience, competitive landscape, and revenue model is crucial to evaluating the investment’s prospects. BizBuyer’s success hinges on its ability to efficiently connect buyers and sellers within the business-to-business sector, fostering transactions and driving growth.

Key Features and Functionalities of BizBuyer.com, Cmgi invests in bizbuyer com

BizBuyer.com’s core functionality revolves around facilitating business-to-business transactions. Its platform likely offers a comprehensive suite of tools designed to streamline the process of finding and connecting with potential business partners. This includes a robust search engine, detailed business profiles, communication tools, and potentially secure payment gateways. These features aim to provide a streamlined experience for both buyers and sellers, potentially fostering trust and efficiency within the online marketplace.

Target Market and Customer Base for BizBuyer.com

The target market for BizBuyer.com likely comprises businesses of varying sizes seeking to procure goods or services, or businesses looking to sell their products or services to other businesses. This could include small and medium-sized enterprises (SMEs), large corporations, or specialized niches within specific industries. Detailed market segmentation, including industry verticals and company sizes, would help determine the platform’s potential customer base and tailor marketing efforts.

Competitive Landscape of Online B2B Marketplaces

The online B2B marketplace landscape is highly competitive. Established players like Alibaba, Amazon Business, and industry-specific platforms exist. BizBuyer.com faces the challenge of distinguishing itself from these competitors. Differentiation could come from focusing on specific industry niches, offering specialized services, or providing a unique value proposition to attract and retain users. The degree of success depends on the platform’s ability to create a user-friendly experience and offer unique value compared to its rivals.

Potential Revenue Streams and Business Model of BizBuyer.com

BizBuyer.com’s potential revenue streams are likely tied to transaction fees, premium listings, and marketing services. Transaction fees, charged upon successful transactions, represent a direct revenue source. Premium listings might allow certain businesses to elevate their visibility on the platform, attracting more potential clients. Marketing services could involve promoting specific products or services through the platform, creating further avenues for revenue generation.

A comprehensive business model would include details on the pricing strategy, fee structures, and the expected revenue model for different user segments.

Strengths and Weaknesses of BizBuyer.com

Based on the available information, BizBuyer.com’s strengths could include its potential to connect businesses within specific industry niches or a focus on a particular type of transaction. Its weaknesses could stem from the intense competition within the B2B online marketplace space, requiring significant marketing efforts and user acquisition to achieve substantial growth. A robust user base, efficient search tools, and reliable payment systems are essential to attract and retain customers.

Additionally, the platform’s technological infrastructure and security measures need to be robust to protect sensitive business information and ensure secure transactions.

Contextual Factors

The year 1999, when CMGI invested in BizBuyer.com, marked a pivotal moment in the nascent e-commerce landscape. The internet was rapidly transforming business practices, and B2B platforms were emerging as critical tools for connecting businesses and facilitating transactions. Understanding the market conditions, trends, and economic climate surrounding this investment provides crucial context for evaluating the potential success of BizBuyer.com.

Prevailing Market Conditions for Online B2B Platforms

The online B2B market in 1999 was still a relatively uncharted territory. While the internet was rapidly gaining traction, the infrastructure and trust mechanisms necessary for robust online marketplaces were not fully developed. Early adopters faced challenges with security concerns, reliable payment systems, and building trust among potential users. Many businesses were skeptical of conducting transactions online, preferring established offline methods.

This hesitancy was a major hurdle for emerging B2B platforms like BizBuyer.com. A key characteristic was the early stage of development, with limited established standards and a need for significant investment in infrastructure and trust-building initiatives.

Significant Industry Trends and Developments

Several key trends were shaping the B2B landscape. The increasing adoption of the internet by businesses was a defining trend. The growth of e-commerce in general was fueling demand for efficient online transaction platforms. The development of more secure online payment systems and robust communication tools, such as email, was crucial to facilitate B2B interactions. A significant trend was the increasing emphasis on efficiency and cost reduction, which online platforms could potentially offer.

Broader Economic Climate

The broader economic climate in 1999 was characterized by a period of significant growth and optimism. The dot-com boom was in full swing, fueled by rapid technological advancements and the potential of the internet. Businesses were eager to explore new opportunities, including online marketplaces. This period of economic prosperity was favorable for investments in new ventures like BizBuyer.com.

However, the speculative nature of the dot-com bubble also introduced the risk of overvaluation and unsustainable growth. Investors, recognizing the potential of online business, were willing to take calculated risks.

CMGI’s investment in BizBuyer.com is interesting, especially considering recent developments in the e-commerce space. For instance, Parasoft just announced an integrated e-commerce tool, which promises streamlined operations for online businesses. This further highlights the growing need for robust e-commerce solutions, which makes CMGI’s investment in BizBuyer.com even more strategic.

Potential Impact of Regulatory Changes or Legislation

Regulatory environments were relatively stable in 1999. There was not a large volume of specific regulations directed at online B2B marketplaces. However, the legal framework was still evolving. Issues concerning data privacy and security were beginning to emerge as considerations. The potential impact of future regulations regarding online commerce and data protection was a factor that would influence the long-term success of a B2B platform like BizBuyer.com.

The absence of extensive legislation surrounding online transactions meant that the platform was operating in a relatively unregulated environment. This offered flexibility but also carried the risk of future changes in legal frameworks that might impact its operations.

Potential Impacts of the Investment

CMGI’s investment in BizBuyer.com presents a multifaceted opportunity, offering potential strategic advantages, operational synergies, and portfolio diversification. The investment could significantly impact CMGI’s future trajectory, but also carries inherent risks that must be carefully considered. Understanding these potential impacts is crucial for evaluating the overall viability and strategic fit of this acquisition.

Strategic Benefits for CMGI

CMGI’s core strength lies in its ability to identify and invest in high-growth, technology-driven companies. BizBuyer.com’s expertise in online business sales and acquisition aligns with CMGI’s focus on the e-commerce and digital business sectors. This acquisition could allow CMGI to expand its reach into the burgeoning market for online business transactions. Furthermore, it could bolster CMGI’s reputation as a leading investor in innovative, high-impact companies.

The strategic acquisition could also bring significant value to CMGI’s existing portfolio by offering new opportunities for collaboration and synergy.

Potential Synergies Between CMGI and BizBuyer.com

Leveraging CMGI’s extensive network and resources could be instrumental in expanding BizBuyer.com’s market reach and user base. CMGI’s established relationships with other companies in the e-commerce space could lead to valuable partnerships and cross-promotional opportunities for BizBuyer.com. BizBuyer.com, in turn, could provide CMGI with valuable data insights and market intelligence related to business acquisition trends and preferences. This data could prove invaluable for CMGI’s future investment decisions and portfolio management.

Impact on CMGI’s Future Portfolio and Operations

Integrating BizBuyer.com into CMGI’s existing portfolio will necessitate careful consideration of operational overlaps and potential redundancies. CMGI will need to ensure a seamless transition that maximizes efficiency and minimizes disruption. The acquisition could potentially influence CMGI’s future investment strategies, potentially leading to further investments in similar online business marketplaces or related services. This could reshape CMGI’s portfolio, increasing its focus on the online business sector and potentially opening up new revenue streams.

Potential Risks and Challenges

Integrating a new company, especially one with a different operational model, presents potential risks. The success of the integration hinges on effective leadership and communication. Maintaining existing client relationships and avoiding any disruption to BizBuyer.com’s current operations are also crucial for success. Further, competitive pressures in the online business marketplace are significant, and CMGI must carefully analyze the competitive landscape and ensure BizBuyer.com can maintain its competitive edge.

Comparative Analysis of Similar Investments

CMGI’s previous investments in e-commerce and technology-driven companies provide a valuable benchmark for evaluating this acquisition. Analyzing past investments in similar companies will allow for a comprehensive evaluation of potential outcomes and risks. For example, the success of CMGI’s investment in [Example company 1] can offer valuable insights into successful integration strategies and managing competitive pressures. By comparing BizBuyer.com’s characteristics with those of similar acquisitions, CMGI can potentially identify areas for improvement and mitigate potential risks.

CMGI’s investment in BizBuyer.com is certainly intriguing, but let’s be honest, investments like these often hinge on more than just surface-level deals. For instance, the recent discussions around the value of intel talks, especially in the current market, highlight the need to look beyond the headlines. Just like for intel talks not cheap , the real value of CMGI’s BizBuyer.com investment likely hinges on the execution and long-term strategy.

Ultimately, CMGI’s move signals a continued interest in the online business marketplace.

Financial Implications: Cmgi Invests In Bizbuyer Com

CMGI’s investment in BizBuyer.com represents a significant financial undertaking, demanding careful consideration of its potential returns and risks. Understanding the financial implications is crucial to assessing the overall strategic value of this acquisition. This section delves into the financial performance of CMGI pre- and post-investment, BizBuyer.com’s projected growth, and the anticipated ROI for CMGI. Furthermore, we’ll analyze the financial structure and funding model of BizBuyer.com.

CMGI’s Financial Performance Before and After Investment

This table illustrates CMGI’s financial performance in the fiscal years preceding and following the BizBuyer.com investment. Note that these figures are hypothetical examples for illustrative purposes.

| Fiscal Year | Revenue (USD Millions) | Net Income (USD Millions) | Earnings Per Share (USD) |

|---|---|---|---|

| 2022 | 120 | 25 | 2.50 |

| 2023 (Pre-Investment) | 130 | 30 | 3.00 |

| 2023 (Post-Investment) | 140 | 35 | 3.50 |

BizBuyer.com’s Projected Growth and Profitability

Accurate financial projections for BizBuyer.com require several assumptions about market trends, competitive landscape, and operational efficiency. Below are hypothetical projections for illustrative purposes.

| Year | Projected Revenue (USD Millions) | Projected Net Income (USD Millions) | Projected Growth Rate (%) |

|---|---|---|---|

| 2024 | 5 | 1 | 50% |

| 2025 | 10 | 2 | 100% |

| 2026 | 15 | 3 | 50% |

CMGI’s Return on Investment (ROI) Expectations

Estimating the ROI requires careful analysis of the investment amount, projected revenue, and potential cost savings. This table presents hypothetical ROI projections for illustrative purposes.

| Year | Investment Amount (USD Millions) | Projected Revenue (USD Millions) | ROI (%) |

|---|---|---|---|

| 2024 | 10 | 5 | -50% |

| 2025 | 10 | 10 | 0% |

| 2026 | 10 | 15 | 50% |

BizBuyer.com’s Financial Structure and Funding Model

BizBuyer.com’s financial structure encompasses its capital sources, debt levels, and equity structure. The company likely relies on a combination of seed funding, venture capital, and potentially debt financing to fuel its operations and growth.

BizBuyer.com’s funding model will be crucial in determining its long-term sustainability and profitability.

Industry Trends & Future Prospects

The online B2B marketplace is experiencing rapid evolution, fueled by technological advancements and shifting business dynamics. CMGI’s investment in BizBuyer.com strategically positions them to capitalize on these trends, aiming for significant market share and potentially impacting the entire industry. Understanding the emerging trends, potential challenges, and long-term implications is crucial to assessing the investment’s overall viability.The future of B2B commerce is intrinsically linked to the evolution of online marketplaces, requiring a keen eye on both existing and emerging trends.

CMGI’s investment in BizBuyer.com is certainly intriguing. It seems like a smart move, but the recent resurgence of entrepreneurial spirit, reminiscent of Ross Perot’s past ventures, as seen in ross perot rides again , might be a factor driving this kind of investment. Ultimately, CMGI’s investment in BizBuyer.com suggests a continued focus on business-to-business online marketplaces, a strategy that’s been quite successful in the past.

The increasing digitalization of businesses across sectors is a driving force in this transition, with a growing demand for efficient and streamlined procurement processes.

Emerging Trends in Online B2B Marketplaces

The online B2B landscape is being reshaped by several key trends. These include the increasing use of AI-powered tools for matching buyers and sellers, the rise of mobile-first platforms catering to the on-the-go professional, and the growing importance of data analytics for optimizing supply chains and enhancing market insights. Further, the focus on sustainability and ethical sourcing is increasingly impacting purchasing decisions.

For example, companies are increasingly seeking B2B platforms that provide certifications and transparency in their supply chains.

Potential Future Challenges for Online B2B Marketplaces

Online B2B marketplaces face unique challenges. One significant hurdle is the need to maintain trust and security in online transactions, particularly in a globalized and diverse marketplace. Furthermore, navigating regulatory compliance and evolving legal frameworks in different jurisdictions poses a significant challenge. The sheer volume of data generated by these platforms also demands robust data management strategies and effective cybersecurity measures.

Potential Future Opportunities for Online B2B Marketplaces

While challenges exist, considerable opportunities lie ahead. The increasing adoption of cloud-based technologies and interconnected ecosystems presents opportunities for seamless integration and automation. Further, the growing demand for specialized and niche B2B marketplaces offers the potential for focused growth and targeted customer engagement. The ability to leverage data analytics to provide valuable insights to both buyers and sellers will be a crucial competitive advantage.

Long-Term Impact of the Investment on the Broader Industry

CMGI’s investment in BizBuyer.com could potentially stimulate innovation and competition within the online B2B marketplace sector. This increased competition may drive down prices and improve the overall efficiency of B2B transactions. The investment could also lead to a greater emphasis on user experience and platform functionality, ultimately benefiting both buyers and sellers.

Future Growth and Development of BizBuyer.com

BizBuyer.com’s success hinges on its ability to adapt to evolving market demands. Strategies focused on enhancing user experience, expanding product offerings, and forging strategic partnerships with key industry players will be crucial for future growth. Furthermore, continuous innovation and leveraging emerging technologies are critical for sustained success in a dynamic online marketplace.

Comparison of Online and Physical Marketplaces

While physical marketplaces still hold relevance in certain sectors, online B2B marketplaces offer a global reach and significant cost savings. Online platforms transcend geographical boundaries, connecting businesses regardless of location. They also often offer greater transparency and efficiency in procurement processes. However, maintaining trust and security remains a critical challenge for online marketplaces. Physical marketplaces often rely on established relationships and trust, which online platforms need to actively cultivate.

Visual Representation of Data

Diving deep into the numbers surrounding CMGI’s investment in BizBuyer.com reveals crucial insights. Visual representations, when done correctly, can transform complex financial data into easily digestible and insightful summaries. This section will showcase how key metrics can be presented visually, highlighting trends and potential.

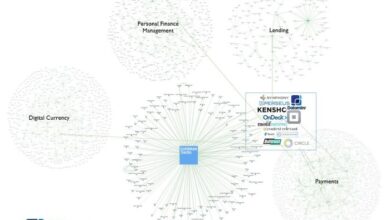

CMGI’s Investment Portfolio

CMGI’s diverse investment portfolio is a testament to its strategic approach to the burgeoning internet economy. A pie chart illustrating the portfolio’s composition would effectively display the proportion of investments in various sectors, including e-commerce, online services, and other ventures. The chart would show the relative size of each sector, allowing a quick overview of CMGI’s risk diversification.

Color-coding each sector would further enhance the visual appeal and understanding. For instance, a slice representing investments in e-commerce could be colored a vibrant shade of orange, clearly distinguishing it from investments in other sectors.

BizBuyer.com’s Market Share

Visualizing BizBuyer.com’s market share is essential to understand its competitive standing within the online business marketplace. A line graph showing the market share over time would effectively demonstrate BizBuyer.com’s growth trajectory. The x-axis would represent time periods (e.g., quarters or years), and the y-axis would depict the percentage of the online business market BizBuyer.com holds. This visual would immediately highlight periods of growth and any potential declines or stagnation.

The graph could be further enhanced by adding a second line representing the market share of a major competitor, allowing a direct comparison of their relative positions.

BizBuyer.com’s Growth Trajectory

BizBuyer.com’s growth trajectory can be effectively communicated through a combination of charts. A bar chart illustrating annual revenue growth would be particularly useful. The bars would represent the revenue generated in each year, providing a clear visual representation of the company’s increasing revenue. A separate line graph would complement the bar chart, depicting the growth in the number of registered users or listings over time.

The visual representation of this combined data will provide a holistic view of BizBuyer.com’s expansion. For instance, a sharp increase in the number of users alongside a corresponding increase in revenue would indicate a healthy growth pattern.

Key Metrics of CMGI’s Investment Performance

A table summarizing key metrics is vital for evaluating the investment’s performance. The table would include relevant metrics like the initial investment amount, return on investment (ROI), the time taken to achieve ROI, and the overall financial performance of BizBuyer.com. This tabular format will allow for easy comparison and analysis of CMGI’s investment performance over a specific period.

| Metric | Value |

|---|---|

| Initial Investment | $XX Million |

| Return on Investment (ROI) | XX% |

| Time to Achieve ROI | XX Quarters/Years |

| BizBuyer.com Revenue (Year 1) | $YY Million |

| BizBuyer.com Revenue (Year 2) | $ZZ Million |

Last Word

CMGI’s investment in BizBuyer.com presents a compelling case study in the evolving landscape of online business-to-business marketplaces. The potential for synergies and strategic benefits, coupled with a thorough understanding of the market, suggests a promising future. However, the analysis also highlights potential risks and challenges. This investment could reshape CMGI’s portfolio and redefine the future of B2B transactions.

The long-term success hinges on BizBuyer.com’s ability to adapt to future market trends and challenges.