China com reportedly mulling hong kong sell off – China com reportedly mulling Hong Kong sell-off, sparking a wave of concern and speculation about the future of this vital financial hub. This potential sale raises complex questions about the future of Hong Kong’s autonomy, its economic stability, and its place in the global community. Will this move reshape the geopolitical landscape and impact international relations? The implications are far-reaching, affecting everything from financial markets to social structures.

This potential sale by China has prompted diverse reactions, from international organizations to financial institutions. Analyzing the historical context of previous policy changes impacting Hong Kong’s autonomy, alongside the political and economic implications, is crucial. Understanding the potential motivations behind this consideration, along with diverse viewpoints from stakeholders, helps paint a clearer picture of the situation.

Background on the Rumored Sale: China Com Reportedly Mulling Hong Kong Sell Off

The recent whispers of China potentially selling Hong Kong have ignited a firestorm of speculation and concern. While the reports remain unconfirmed, the mere possibility raises critical questions about China’s future relationship with the territory and its implications for global geopolitics. The historical context, policy shifts, and potential motivations behind such a move demand careful consideration.This potential sale, if realized, would represent a dramatic departure from the established norms of governance and international relations.

The implications for Hong Kong’s future, its economic stability, and its citizens’ freedoms are profound. Understanding the potential motivations and the diverse viewpoints surrounding this possibility is crucial to forming a nuanced perspective.

Historical Context for Potential Sales

The history of Hong Kong’s relationship with China is complex and marked by periods of both cooperation and conflict. Hong Kong’s handover to China in 1997, under the “One Country, Two Systems” principle, was intended to maintain Hong Kong’s distinct political and economic structures for 50 years. However, recent developments, including the national security law imposed in 2020, have cast doubt on the long-term viability of this framework.

This shift in policy, among other measures, has led to concerns about Hong Kong’s autonomy and freedoms.

Significant Policy Changes Affecting Hong Kong’s Autonomy

China’s implementation of the national security law in Hong Kong in 2020 significantly altered the political landscape. This legislation, intended to curb perceived threats to national security, has been criticized by international organizations and human rights groups for suppressing dissent and restricting freedoms of speech and assembly. Subsequent actions, including the disqualification of pro-democracy politicians and the erosion of the judiciary’s independence, have further fueled anxieties about the future of Hong Kong’s autonomy.

Political and Economic Implications for Hong Kong

A potential sale of Hong Kong would have profound implications for the territory’s future. Economically, Hong Kong’s status as a major financial hub could be jeopardized, potentially leading to capital flight and a decline in investment. Politically, the transfer of sovereignty would raise questions about the rights and freedoms of Hong Kong citizens, potentially creating a refugee crisis and disrupting the established social order.

The implications for Hong Kong’s legal system and its independent judiciary are equally concerning.

Motivations Behind a Potential Sale

China’s motivations for considering such a sale remain speculative. Possible drivers could include a desire to consolidate control over the territory, address perceived security risks, or potentially to streamline administrative processes and integrate Hong Kong more closely into the mainland economy. The motivations may also be linked to internal political considerations within China.

Diverse Viewpoints on the Potential Sale

The potential sale of Hong Kong has sparked a range of responses from various stakeholders. International organizations, such as the United Nations and human rights groups, have expressed deep concern about the potential impact on human rights and democratic freedoms in Hong Kong. Financial institutions and investors are watching the situation closely, with some expressing worries about the potential economic disruption.

Pro-Beijing voices within Hong Kong and China might view the sale as a necessary step toward greater integration and stability.

Economic Impact Analysis

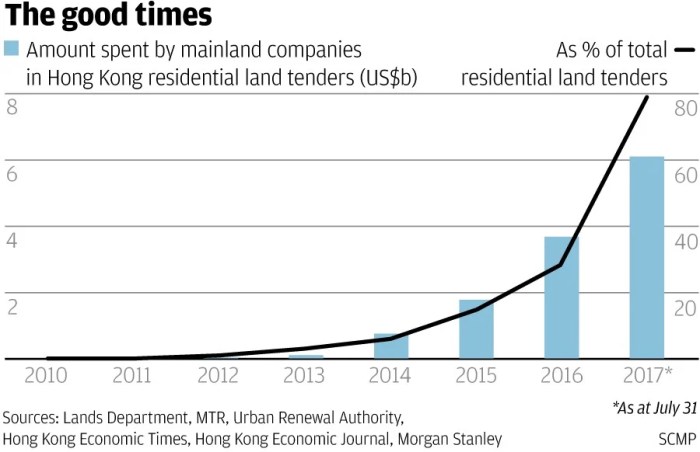

The potential sale of Hong Kong by China presents a complex web of economic uncertainties. The implications for Hong Kong’s economy, international businesses, and global financial markets are profound and multifaceted. Understanding these interconnected effects is crucial to assessing the potential ramifications of such a dramatic shift.

Potential Economic Outcomes Comparison

Analyzing the potential economic outcomes of a sale versus maintaining the status quo requires careful consideration of various factors. A comprehensive comparison highlights the stark differences in likely trajectories.

China Com reportedly considering selling off its Hong Kong holdings, which is quite a significant development. This potential sale naturally raises questions about the future of the region’s economic landscape. Meanwhile, it’s interesting to see how companies like Dell UUnet are adapting to the evolving market, as evidenced by their partnership to bring e-commerce to the chemical industry, dell uunet partner to bring e commerce to chemical industry.

Ultimately, the implications of China Com’s potential move on Hong Kong’s future remain to be seen.

| Feature | Sale Scenario | Status Quo |

|---|---|---|

| GDP Growth | Significant short-term uncertainty, potentially followed by either a rapid recovery or prolonged stagnation depending on the terms of the sale and subsequent integration. Factors like infrastructure investment and policy changes will determine the exact path. | Stable, though potentially slower growth compared to previous periods, driven by ongoing domestic reforms and evolving global trade patterns. |

| Investment Flows | Initial investment may decline as uncertainty prevails, followed by a potential influx if the sale fosters a clearer investment environment and a more favorable regulatory framework. | Steady investment flows, though potentially impacted by global economic conditions and regional political developments. |

| Employment Rates | Potential job losses in certain sectors during the transition period. New employment opportunities could emerge in sectors aligned with the new ownership structure, but this is highly uncertain. | Stable employment rates, with fluctuations linked to global economic conditions and local industry trends. |

| Currency Fluctuations | Significant volatility in the Hong Kong dollar, potentially influenced by the currency of the acquiring entity and market sentiment towards the transaction. | Relatively stable exchange rate, influenced by global market trends and China’s monetary policies. |

Scenarios for Hong Kong’s Economic Future

The sale of Hong Kong would inevitably shape the future trajectory of the region’s economy. Different scenarios based on various sale conditions and the subsequent integration process are possible.

- Scenario 1: Rapid Integration. If the sale involves a smooth and rapid integration with China’s economic structures, there could be a swift restoration of confidence, potentially leading to rapid economic recovery. This outcome hinges on the preservation of existing infrastructure, economic policies, and investor confidence.

- Scenario 2: Protracted Transition. Significant uncertainties surrounding the transition period could lead to a prolonged period of economic instability. Investor hesitancy, regulatory hurdles, and lack of transparency could cause considerable disruption.

- Scenario 3: Fragmentation. A less-than-ideal sale or integration could lead to a fragmentation of Hong Kong’s economy, with sectors and industries diverging. This scenario is less likely, assuming the Chinese government seeks a unified and cohesive integration.

Consequences for International Businesses

International businesses operating in Hong Kong face significant implications from a potential sale.

- Uncertainty and Risk. The sale introduces a high degree of uncertainty regarding regulatory frameworks, legal systems, and overall business environment. This could discourage investment and hinder operations.

- Shift in Market Dynamics. The sale may reshape Hong Kong’s position as a financial hub. The nature of the sale and the subsequent economic policies will determine the extent of this shift. Existing competitive advantages could be eroded or potentially enhanced.

- Potential for Relocation. International businesses may consider relocating operations if the new ownership structure or the subsequent economic environment presents increased risks or challenges.

Effects on Financial Markets Worldwide

The sale of Hong Kong could reverberate through global financial markets.

- Volatility and Uncertainty. The transaction could create significant market volatility, impacting investor confidence and driving fluctuations in global asset prices. The nature of the sale and the resulting economic policies would be key determinants.

- Shift in Global Trade Patterns. The sale could affect global trade routes and investment patterns as Hong Kong’s role as a trading and financial center shifts. This is dependent on how the new structure is integrated into the global economic landscape.

- Regional and International Relations. The transaction could have implications for regional and international relations, influencing trade agreements and economic alliances. This depends on the specifics of the sale and subsequent integration.

Political Ramifications

The potential sale of Hong Kong by China raises profound questions about the future of Hong Kong’s political system and its relationship with the mainland. This move would undoubtedly reshape the delicate balance of power and influence in the region, triggering significant reactions both domestically and internationally. The implications for Hong Kong’s autonomy, its democratic aspirations, and China’s standing on the global stage are substantial and far-reaching.The sale, if it proceeds, would represent a dramatic shift in Hong Kong’s political landscape, altering the very fabric of its governance and potentially leading to a significant erosion of its autonomy.

The current political structure, heavily influenced by China, could undergo a radical transformation under a new owner, potentially affecting the legal framework, political processes, and fundamental rights of Hong Kong citizens.

Chinacom reportedly considering selling off its Hong Kong assets, which is quite a move. Meanwhile, the recent news of Drugstore.com and Yahoo! merging is certainly interesting, highlighting the shifting landscape in e-commerce. This is all the more intriguing given the potential impact on the future of online retail, mirroring the potential restructuring of Chinacom’s Hong Kong presence. Perhaps the acquisition of online retail companies could be a part of Chinacom’s strategy in navigating this uncertain period.

drugstore com and yahoo make it official This potential Hong Kong sale is certainly a pivotal moment for Chinacom, and investors are keeping a close eye.

Consequences for Hong Kong’s Political System

The sale of Hong Kong would inevitably lead to changes in the territory’s political system. The current framework, designed to balance Chinese sovereignty with a degree of autonomy, would likely be dismantled or significantly altered. This could include modifications to the Basic Law, the constitutional document governing Hong Kong, leading to a redefinition of Hong Kong’s relationship with China.

The existing political structures, including the legislative council and the executive branch, would be affected, potentially leading to significant restructuring.

Comparison of Political Landscapes

Before a potential sale, Hong Kong enjoyed a degree of autonomy under the “one country, two systems” framework, albeit increasingly curtailed in recent years. The city maintained a distinct legal system and some freedoms, albeit under Beijing’s influence. After a sale, the political landscape would be transformed, likely aligning more closely with the political system of the new owner.

Examples of political systems under similar circumstances, such as colonial territories transitioning to independence, or mergers between political entities, demonstrate that changes in ownership can lead to profound political shifts.

International Community Reactions

The international community’s response to a sale of Hong Kong would likely be highly critical, given the concerns surrounding human rights, democratic freedoms, and the rule of law in the territory. Organizations like the United Nations and international human rights bodies would likely condemn such a move, potentially imposing sanctions or other forms of pressure on the involved parties.

Previous instances of similar actions in international relations, including concerns over territorial disputes or human rights abuses, offer valuable insights into potential reactions and the implications for global stability.

Impact on China’s International Relations

Such a move would significantly damage China’s international relations. Many countries would view it as a violation of international agreements and a further erosion of democratic values, leading to diplomatic isolation and economic sanctions. The precedent set by this action would also likely affect China’s ability to negotiate international agreements and cooperate with other nations on various issues.

Examples of nations facing international condemnation for similar actions in the past, including actions against other nations, illustrate the potential damage to a country’s reputation and standing.

Geopolitical Implications, China com reportedly mulling hong kong sell off

The geopolitical implications of Hong Kong’s sale would be profound. The region would likely become a focal point of international tension, potentially leading to heightened instability in the Asia-Pacific region. The sale would also significantly alter the balance of power in the region, influencing strategic partnerships and alliances. The potential for a domino effect in other regions cannot be discounted, drawing parallels with other geopolitical events that have had far-reaching consequences.

Societal Considerations

The potential sale of Hong Kong by China raises profound concerns about the social fabric of the city. This shift in governance could irrevocably alter Hong Kong’s unique identity and its citizens’ way of life, potentially leading to significant social unrest. The long-term implications for human rights and freedoms, and the psychological impact on residents, demand careful consideration.

Potential Impacts on Hong Kong’s Social Fabric

The transfer of Hong Kong’s administration to a unified Chinese system would inevitably lead to changes in the city’s social dynamics. The existing social structures, deeply rooted in a blend of Chinese and Western influences, could be significantly altered. A fundamental shift in values and cultural norms is a realistic possibility, potentially eroding the existing societal equilibrium.

Changes in Lifestyle, Culture, and Identity

Hong Kong’s unique blend of cultures and lifestyles, reflecting its historical development as a British colony, is a significant aspect of its identity. The introduction of mainland Chinese norms and values could lead to a homogenization of cultural expression. Changes in language use, traditions, and even fashion choices could lead to the gradual erosion of the city’s distinct identity.

Hong Kong’s iconic, vibrant street food scene, a testament to its diverse culinary heritage, may be subject to shifts. Similarly, the city’s distinctive architecture, a reflection of its historical and cultural influences, could also face adjustments.

Potential Challenges to Human Rights and Freedoms

The current autonomy enjoyed by Hong Kong citizens could be significantly diminished under a complete integration with mainland China. Concerns about freedom of speech, assembly, and the press are particularly pressing. The experience of other regions in China where similar freedoms are limited provides a cautionary tale. Examples from the suppression of dissent in Tibet or Xinjiang serve as stark reminders of the potential ramifications.

China Com reportedly considering selling off its Hong Kong holdings, which is quite a significant development. Meanwhile, the explosive growth of the internet and groundbreaking innovations are clearly taking center stage at the explosive internet growth and innovations focus of conference. This certainly raises questions about the future direction of China Com and its potential strategic shifts, given the Hong Kong sale rumors.

Psychological Impact on Hong Kong Citizens

The uncertainty surrounding the future of Hong Kong could have a profound psychological impact on its citizens. Loss of control, fear of the unknown, and anxieties about personal safety are potential consequences. The loss of the perceived security and freedoms they once enjoyed could lead to significant mental health issues. The historical precedent of cultural assimilation and suppression of dissenting voices in other contexts may serve as a troubling illustration of the potential psychological toll.

The experience of Uyghur Muslims in Xinjiang, forced into cultural assimilation, could be a troubling parallel.

Social Unrest That Could Possibly Emerge

The potential for social unrest in Hong Kong is significant. If citizens feel their rights and freedoms are under threat, protests and demonstrations are a likely outcome. Historical examples, such as the 2019 Hong Kong protests, demonstrate the potential for widespread and sustained social unrest when fundamental rights are perceived to be compromised. The social and political upheaval in other parts of the world in similar circumstances should serve as a clear warning.

Legal and Regulatory Aspects

A sale of Hong Kong, a highly complex territory with a unique legal and regulatory framework, would undoubtedly face significant legal challenges. Navigating the intricacies of international law, Chinese law, and Hong Kong’s existing legal structure is crucial to understanding the potential ramifications. The sale’s impact on existing contracts, property rights, and the rule of law will be significant, and a careful examination of these issues is vital.

Potential Legal Challenges

The potential sale of Hong Kong presents a myriad of complex legal hurdles. These range from the intricate legal framework of Hong Kong itself to the international treaties and agreements that might be affected. Understanding these challenges is essential to assessing the potential ramifications of such a significant event.

Legal Framework Governing Hong Kong

Hong Kong’s legal system is a unique blend of common law and a separate, but interconnected, legal framework with China. The Basic Law, a foundational document, Artikels the principles of Hong Kong’s autonomy, while China retains ultimate jurisdiction. This delicate balance forms the basis for Hong Kong’s legal structure and could be impacted by a potential sale.

International Treaties and Agreements

Several international treaties and agreements might be affected by a sale of Hong Kong. These agreements, such as those concerning investment protection and human rights, could face significant scrutiny if the terms of the sale compromise their underlying principles. Specific treaties and their potential impacts should be evaluated on a case-by-case basis.

Comparison of Legal Systems

The legal systems of China and Hong Kong, while interconnected, differ significantly. China’s legal system is primarily based on civil law, whereas Hong Kong’s system is largely based on common law. This difference in legal tradition can create challenges in harmonizing the two systems if a sale occurs. Understanding these distinctions is essential to anticipate potential conflicts and their resolutions.

Potential Legal Disputes

| Issue | Potential Dispute |

|---|---|

| Property Rights | A sale could lead to disputes over property ownership, particularly for assets held by individuals or entities in Hong Kong. Existing property rights and title might be challenged or reinterpreted under a new legal framework. |

| Contracts | Existing contracts and agreements within Hong Kong could be impacted by the change in sovereignty. Enforceability and interpretation of contracts might vary significantly under a new legal regime. |

| Intellectual Property | Intellectual property rights within Hong Kong could face challenges. The transfer of ownership and enforcement of these rights under the new system require careful consideration and legal framework. |

| Investment Protection | International investment agreements could be jeopardized if the sale of Hong Kong results in a loss of investor protections. The long-term stability of investment within the region would be significantly impacted. |

Alternative Perspectives

The rumored sale of Hong Kong by China presents a complex web of potential outcomes, each with its own set of benefits and drawbacks. Beyond the immediate economic and political ramifications, alternative solutions offer a pathway to potentially mitigate the escalating tensions and safeguard Hong Kong’s unique identity and future. Examining these alternatives is crucial for understanding the full spectrum of possible responses to this unprecedented situation.Addressing the concerns surrounding Hong Kong’s future requires a multifaceted approach that considers the needs of all stakeholders, including the citizens of Hong Kong, the Chinese government, and the international community.

This necessitates exploring alternative solutions that foster dialogue, cooperation, and a shared understanding of the issues at hand.

Potential Diplomatic Solutions

Finding a mutually agreeable solution requires active engagement from various parties. International mediation could play a crucial role in facilitating dialogue and finding common ground. Past examples of international mediation in similar situations highlight the importance of neutral facilitators who can encourage compromise and foster trust. This could involve various actors, including the United Nations or other international organizations with a proven track record of mediating disputes.

The role of international organizations like the UN Security Council or the International Court of Justice in providing a framework for negotiations should also be considered. Mediation efforts should aim to achieve a balance between Chinese sovereignty concerns and Hong Kong’s autonomy.

Alternative Governance Models

Beyond a complete sale, alternative governance models deserve consideration. A significant shift in the current administrative framework could potentially address the concerns of both the Chinese government and the Hong Kong populace. This could involve a renewed emphasis on democratic principles within a redefined administrative structure, possibly incorporating elements of federalism or devolved powers. Examining the successes and failures of similar models in other regions can provide valuable insights and frameworks for developing tailored solutions.

For example, the Canadian model of federalism or the Swiss system of direct democracy offer potential elements for comparison and adaptation. Implementing a robust system of checks and balances to safeguard against abuses of power would be essential.

Economic Diversification and Development

Strengthening Hong Kong’s economic independence and resilience is another crucial aspect of any alternative approach. Diversifying its economy beyond its current reliance on finance and trade can make it more resilient to global economic fluctuations and political pressures. Developing new industries, such as technology, innovation, or sustainable development, can create job opportunities and enhance its overall economic strength.

Examples from other regions undergoing similar economic transitions offer valuable learning opportunities. Hong Kong could explore partnerships with other economies to develop shared initiatives in key sectors.

International Pressure and Support

The international community’s response to this situation will be critical. Maintaining consistent and coordinated pressure on China to uphold Hong Kong’s autonomy and freedoms can be a powerful tool. This pressure could involve sanctions, diplomatic measures, or other forms of economic or political leverage. A review of past international responses to similar situations, like the responses to the annexation of Crimea or the repression in Xinjiang, will be crucial to understanding the possible impacts and effectiveness of various approaches.

International support for Hong Kong’s citizens in advocating for their rights and freedoms is also a vital aspect of this alternative approach.

Illustrative Case Studies

Rumored discussions about a potential Hong Kong sale raise critical questions about the precedent-setting nature of such a transaction. Analyzing similar historical situations offers valuable insights into the potential consequences of such a significant shift in territory and governance. Examining past cases allows us to draw lessons learned and apply them to the current situation in Hong Kong.Understanding the complex interplay of economic, political, and social factors in past territorial shifts provides a framework for evaluating the potential impacts of a Hong Kong sale.

This examination of case studies aims to illustrate the multifaceted challenges and opportunities associated with such decisions.

Historical Parallels

Territorial changes and shifts in governance are not unprecedented. Throughout history, various nations have faced similar situations, often with complex and long-lasting effects. The study of these historical precedents illuminates potential trajectories and pitfalls.

- The transfer of sovereignty over Hong Kong from the United Kingdom to China in 1997 serves as a relevant comparison. While not an outright sale, the handover involved a significant shift in power and governance. The “One Country, Two Systems” principle was established to preserve Hong Kong’s unique identity, a critical factor in the current situation. However, the subsequent evolution of Hong Kong’s autonomy has raised concerns about the long-term viability of this principle.

This precedent highlights the need for careful consideration of the implications of such transitions.

- The division of Germany after World War II is another notable example. The division of a nation into different administrative entities, and the associated economic and political implications, provides insight into the potential disruptions that can arise from large-scale territorial shifts. The reunification of Germany, although decades later, serves as a counter-example demonstrating that such divisions are not necessarily permanent. The differing experiences of East and West Germany offer a case study of the challenges of political and economic integration.

- The sale of assets in troubled economies, while not involving entire territories, provides context for understanding the economic implications of a potential Hong Kong sale. In these cases, the impact on the local economy, employment, and investment confidence is significant. The precedent of asset sales during economic distress provides a framework for evaluating the potential economic consequences for Hong Kong.

Lessons Learned

Examining these precedents reveals key lessons that can inform the analysis of a potential Hong Kong sale.

| Case Study | Key Lessons Learned |

|---|---|

| Hong Kong handover | Maintaining a unique identity and autonomy after a transfer of sovereignty can be challenging. The long-term stability of special administrative regions is contingent on political will and economic viability. |

| Post-WWII Germany | Significant territorial changes can have lasting impacts on national and regional economies. The political and economic integration of formerly separated territories can be a complex and time-consuming process. |

| Asset sales in troubled economies | Sales of key assets can significantly impact local economies. Confidence and investment are affected by such events. The implications of asset sales on the future prosperity of the affected region should be considered. |

Impact on the Current Situation

The lessons learned from these case studies provide context for understanding the potential implications of a Hong Kong sale. The potential for lasting economic and social disruption underscores the importance of careful consideration and comprehensive planning. The need for robust safeguards to protect the interests of Hong Kong’s residents and businesses is crucial. The historical precedents offer a range of potential outcomes, highlighting the importance of proactive measures to mitigate negative impacts and maximize positive outcomes.

Last Point

The potential sale of Hong Kong, as reported by China com, presents a multifaceted challenge with profound implications. Examining the economic, political, and societal consequences, as well as legal and regulatory aspects, highlights the complexity of this issue. Alternative perspectives and illustrative case studies further enrich the discussion. Ultimately, this potential move could significantly alter the global landscape, demanding careful consideration and a nuanced understanding of all sides of the issue.