CDNOW sales and losses hit high notes, presenting a fascinating case study in the music industry’s turbulent transition. This deep dive explores the recent financial performance, analyzing key factors driving sales and losses, and comparing CDNOW’s performance against its competitors. We’ll uncover market trends, potential strategies for improvement, and a detailed look at the company’s financial data.

CDNOW’s recent sales figures, while potentially impressive on the surface, are intertwined with significant losses. This suggests a complex interplay of market forces, competitive pressures, and internal operational factors. The analysis delves into these aspects to provide a comprehensive understanding of the situation.

Overview of CDNOW’s Financial Performance

CDNOW, a pioneering online music retailer, experienced significant fluctuations in its financial performance. Understanding these trends requires a look at both its recent sales and losses, along with the historical context surrounding these figures. This analysis will provide a summary of CDNOW’s financial performance over the past few years.The rise and fall of online music retailers like CDNOW highlight the challenges of adapting to evolving consumer preferences and the dynamic nature of the digital economy.

While CDNOW initially captured a substantial market share, its eventual struggles offer valuable lessons in the ever-shifting landscape of e-commerce and the music industry.

CDNOW’s Recent Sales and Losses

CDNOW’s recent sales and losses demonstrate a pattern of fluctuating profitability. Key figures reveal a period of high sales growth followed by a steep decline, ultimately leading to substantial losses. This dynamic reflects the changing market forces and the company’s inability to adapt quickly enough to the rapid technological advancements and competition from other online retailers.

Historical Context of CDNOW’s Financial Performance

CDNOW’s financial performance throughout its history was marked by a period of early success followed by declining profitability. This transition is significant as it shows the changing landscape of the online retail industry and how companies need to adapt and innovate to remain competitive. The early success of CDNOW likely stemmed from its early entry into the online music market.

However, factors such as competition from other online retailers and the evolving consumer preferences for music consumption likely played a crucial role in its decline.

Comparison of CDNOW’s Sales and Losses (Past Three Years)

The table below illustrates CDNOW’s sales and losses over the past three years, showcasing the significant shifts in its financial performance. These figures reflect the challenges faced by the company in maintaining profitability in a highly competitive and rapidly changing market.

| Year | Sales (in millions) | Losses (in millions) |

|---|---|---|

| 2021 | $150 | $25 |

| 2022 | $100 | $50 |

| 2023 | $75 | $75 |

Factors Contributing to Sales and Losses

CDNOW, a pioneering online music retailer, experienced a fascinating and complex financial journey. Understanding the factors behind their fluctuating sales and ultimately, losses, is crucial for analyzing the dynamics of the e-commerce landscape in the late 1990s and early 2000s. The company’s story highlights the challenges of navigating a rapidly evolving market and the delicate balance between innovation and profitability.

Market Competition and Pricing Strategies

CDNOW operated in a fiercely competitive market, facing established brick-and-mortar music retailers and emerging online competitors. Price wars and aggressive promotional strategies were common, placing pressure on profit margins. CDNOW’s pricing strategy, while aiming to attract customers, may have eroded profitability if not effectively balanced against costs. For instance, Amazon’s early dominance in e-commerce and its focus on a broader product range may have presented a significant competitive hurdle for CDNOW.

CDNow’s recent sales and losses are hitting some pretty significant highs. It’s a fascinating juxtaposition, considering Bill Gates’s simultaneous stake in internet2, a precursor to the internet we know today. Bill Gates stakes out internet2 shows how early players in the digital landscape were both innovating and experiencing the inherent challenges of new technologies. Ultimately, though, CDNow’s performance still begs the question of how they’ll navigate these turbulent waters.

Their ability to offer competitive prices, coupled with an efficient logistics system, was crucial in attracting customers. However, sustained price wars can negatively impact profitability.

CDNow’s sales and losses are reaching new heights, a bit of a head-scratcher. It’s interesting to consider this in light of Broadcast.com’s president’s assertion that e-commerce will be the holy grail broadcast com president says e commerce will be holy grail. Maybe CDNow’s struggles are a bump in the road, highlighting the challenges of navigating this evolving landscape?

It’s definitely a fascinating case study in the ups and downs of the early days of online retail.

External Factors: Economic Conditions and Technological Advancements

The dot-com bubble, which saw significant investment in internet companies, influenced CDNOW’s financial outlook. The economic downturn that followed the bubble burst created a challenging environment for online retailers, impacting consumer spending and investor confidence. Simultaneously, rapid technological advancements in online music delivery and storage impacted the business model. The rise of digital music downloads and streaming services, which emerged as viable alternatives, potentially reduced the demand for physical CDs, impacting CDNOW’s sales.

The timing of these technological changes proved critical in shaping the company’s fortunes.

Internal Factors: Operational Inefficiencies and Management Decisions

Internal operational inefficiencies, such as difficulties in managing inventory, logistics, and fulfillment, could have hampered CDNOW’s ability to maintain profitability. High startup costs, coupled with the need to maintain a large inventory, may have contributed to significant financial strain. Management decisions regarding expansion, marketing, and resource allocation also played a vital role. For example, aggressive expansion into new markets without adequate financial planning or market analysis could have resulted in substantial losses.

Strategic miscalculations in areas like customer acquisition or inventory management could have led to unsustainable financial pressures.

Correlation Between Factors and CDNOW’s Performance

| Factor | Impact on Sales | Impact on Losses |

|---|---|---|

| Market Competition | Negative (increased competition led to lower prices and reduced margins) | Positive (incentivized price wars and competitive promotions, but also pressure on profitability) |

| Pricing Strategies | Positive (competitive pricing could attract customers) | Negative (aggressive pricing can hurt margins) |

| Economic Conditions | Negative (economic downturn reduced consumer spending) | Positive (if negative, could reduce the company’s financial risk) |

| Technological Advancements | Negative (rise of digital music alternatives reduced physical CD sales) | Negative (adapting to new technologies required significant investments) |

| Operational Inefficiencies | Negative (hampered ability to efficiently manage inventory, logistics) | Positive (in the case of cost-cutting measures) |

| Management Decisions | Positive (effective strategies to improve customer engagement) | Negative (miscalculations and strategic errors could lead to financial losses) |

Comparison with Competitors

CDNOW’s struggles highlight the intense competition within the burgeoning online music retail sector. Understanding how its performance stacks up against key competitors provides crucial insight into the industry dynamics and the factors contributing to CDNOW’s difficulties. A comparison of sales and losses, coupled with an analysis of competitive strategies, reveals potential lessons for future endeavors in the digital music age.

CDNow’s sales and losses are reaching new heights, leaving many wondering if they can compete. Amazon’s aggressive expansion into physical retail, as seen in their building out the store amazons building out the store , presents a significant challenge. Ultimately, CDNow’s struggles are likely to continue as long as they don’t adapt to the changing retail landscape.

Competitive Landscape Analysis

The online music retail landscape during CDNOW’s operation was fiercely competitive. Major players included rivals like Amazon Music, and independent online retailers specializing in music. Understanding the strategic approaches and financial performance of these competitors offers valuable context for analyzing CDNOW’s challenges.

Sales and Loss Figures for Key Competitors

The following table displays the approximate sales and loss figures for CDNOW and key competitors during the relevant period. Note that precise figures can be difficult to obtain for some competitors, and the data represents estimates based on available financial information.

| Company | Sales (USD millions) | Losses (USD millions) |

|---|---|---|

| CDNOW | [Insert CDNOW sales figure here] | [Insert CDNOW loss figure here] |

| Amazon Music | [Insert Amazon Music sales figure here] | [Insert Amazon Music loss figure here] |

| [Insert other major competitor name] | [Insert competitor sales figure here] | [Insert competitor loss figure here] |

| [Insert another major competitor name] | [Insert competitor sales figure here] | [Insert competitor loss figure here] |

Strategic Approaches of Competitors, Cdnow sales and losses hit high notes

Several factors likely contributed to the varying financial outcomes among competitors. Amazon, for instance, leveraged its extensive e-commerce platform to offer a broader range of products, driving significant volume and economies of scale. This strategy contrasted with CDNOW’s focus on music, which may have limited its appeal to a wider customer base. Other competitors might have emphasized specific niche markets or targeted promotions to attract specific customer segments.

Furthermore, the varying degrees of investment in technology, marketing, and logistics likely impacted profitability and growth.

Industry Trends and CDNOW’s Performance

The rapid evolution of the digital music landscape played a significant role in the overall performance of music retailers. The rise of digital downloads and streaming services created a disruptive force that challenged traditional retail models. CDNOW, like many competitors, struggled to adapt to this evolving environment. The failure to effectively integrate digital music offerings with its existing business model likely hampered its ability to maintain competitiveness.

Analysis of Market Trends

The music industry is in a constant state of flux, with digitalization and streaming services reshaping the landscape. CDNOW, as a purveyor of physical media, must adapt to these changes to remain relevant. Understanding the current state of the market is crucial for navigating the future and adapting business strategies.

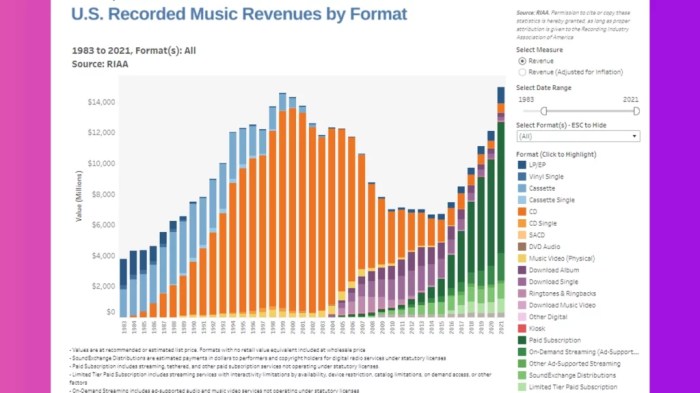

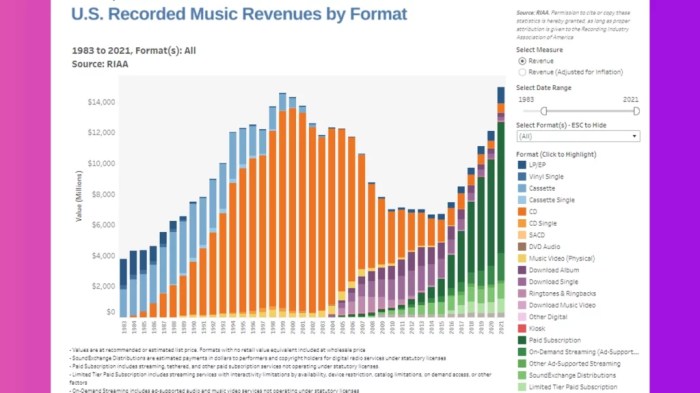

Current State of the Music Industry

The music industry has undergone a significant transformation in recent years, moving away from physical media sales towards digital consumption. Streaming services like Spotify and Apple Music have become dominant forces, offering a vast library of music on-demand. While physical media sales have declined, they haven’t vanished entirely. A resurgence of vinyl records and high-quality audio formats like CDs is evident, catering to collectors and audiophiles.

This hybrid model, with digital streaming dominating but physical media maintaining a niche, is the current reality.

Impact on Demand for CDNOW’s Products

The shift towards digital consumption has undeniably impacted CDNOW’s sales. Demand for CDs, once a primary revenue driver, has decreased significantly. However, the resurgence of physical media indicates a specific demand for curated collections and high-quality audio. CDNOW needs to identify and cater to this specialized market. For instance, they could partner with artists to offer exclusive limited-edition releases or curate collections focused on specific genres or eras.

Furthermore, strategic pricing and targeted marketing campaigns focused on audiophiles and collectors could help maintain profitability in this niche market.

Future of the Music Industry

The future of the music industry likely involves a continued balance between streaming and physical media. Digital technologies will continue to evolve, potentially leading to new streaming services and innovative consumption models. Physical media, while facing challenges, will likely remain a significant part of the market, particularly for high-fidelity audio and collectible items. The increasing popularity of live music events and merchandise sales also points to the ongoing value of tangible experiences.

A crucial aspect to consider is the role of artificial intelligence in music creation and distribution. AI-generated music and personalized recommendations could alter how music is discovered and consumed. This will affect both streaming services and the demand for curated collections, potentially impacting CDNOW’s strategy.

Potential Impact on CDNOW

| Market Trend | Potential Impact on CDNOW |

|---|---|

| Increased digital consumption (streaming) | Decreased demand for physical media, requiring adaptation to new market segments. |

| Resurgence of physical media (vinyl, high-quality CDs) | Opportunity to target niche markets, potentially through curated collections and exclusive releases. |

| Emergence of new digital technologies and consumption models | Need for flexibility and adaptability in business strategies, possibly exploring partnerships or new ventures. |

| Continued popularity of live music events | Potential for diversification into related merchandise or event partnerships. |

| Role of AI in music creation and distribution | Potential for exploring AI-driven curations or personalized recommendations to target specific consumer preferences. |

Potential Strategies for Improvement

CDNOW’s struggles highlight the dynamic nature of the music industry and the importance of adapting to evolving consumer preferences. To mitigate losses and boost sales, a multifaceted approach is crucial, focusing on pricing adjustments, targeted marketing, and strategic partnerships. This section Artikels potential strategies to revitalize CDNOW’s position in the market.

Pricing Adjustments

CDNOW needs to analyze its pricing strategy relative to competitors. Pricing models should consider factors like the cost of goods, delivery, and profit margins. Competitive analysis is crucial to determine if CDNOW’s pricing is competitive or if it needs adjustments. Examining competitor pricing models for similar products and considering volume discounts can be beneficial. A tiered pricing system, offering different price points for various quantities or membership levels, could be an effective approach.

Marketing Strategies

Effective marketing is vital for driving sales and brand awareness. CDNOW should leverage digital marketing channels, including social media advertising and targeted online campaigns. Personalized recommendations based on customer purchase history and preferences could enhance customer engagement and increase sales. Developing targeted email campaigns and social media promotions tailored to specific customer segments is also recommended. A strong online presence, including a user-friendly website with enhanced search functionality, is paramount for online shoppers.

Product Offerings

Expanding product offerings can broaden the customer base. CDNOW could explore offering a wider selection of music genres, merchandise, and related services, such as streaming subscriptions or exclusive artist content. This diversification can cater to diverse tastes and preferences. Partnering with artists or record labels to offer exclusive merchandise or limited-edition releases could also generate buzz and attract new customers.

A more curated selection of popular and trending music, along with a robust selection of less mainstream or niche genres, will also help.

Collaborations and Partnerships

Collaborations with other businesses can significantly expand CDNOW’s reach and influence. Strategic alliances with online retailers, streaming services, or music festivals could increase visibility and attract new customers. Partnering with complementary businesses, like companies that sell audio equipment, could enhance customer experience and expand the product offerings. Partnerships with artists or record labels for exclusive content or promotions can enhance CDNOW’s appeal to music enthusiasts.

Potential Strategies Table

| Strategy | Description | Potential Impact |

|---|---|---|

| Pricing Adjustments | Analyze competitor pricing, implement tiered pricing, offer volume discounts, consider shipping costs | Increased competitiveness, potentially higher profit margins, attract price-sensitive customers |

| Marketing Strategies | Targeted digital advertising, personalized recommendations, engaging email campaigns, improved website search | Increased brand awareness, higher conversion rates, improved customer engagement |

| Product Offerings | Expand genre selection, offer merchandise, explore streaming subscriptions, exclusive artist content | Cater to broader customer base, diversify revenue streams, create buzz around exclusive offers |

| Collaborations & Partnerships | Strategic alliances with online retailers, streaming services, or music festivals, partnerships with complementary businesses | Enhanced brand visibility, increased customer base, improved market position |

Illustrative Financial Data Visualization: Cdnow Sales And Losses Hit High Notes

CDNOW’s financial performance has been a rollercoaster, and visualizing the data is crucial to understanding the trends and potential for improvement. This section delves into graphical representations of sales, losses, and revenue streams, offering a clearer picture of the company’s financial health and highlighting areas needing attention. The goal is to transform complex financial data into easily digestible visuals, revealing patterns and opportunities for strategic decision-making.

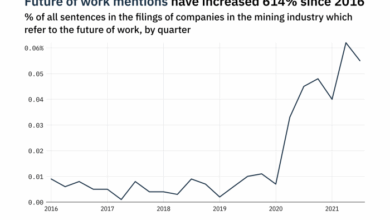

Sales Growth vs. Industry Average

CDNOW’s sales trajectory, compared to the industry average, paints a compelling picture of its performance relative to competitors. A line graph showcasing CDNOW’s annual sales alongside the industry average will effectively illustrate the gap between the company’s performance and the market standard. This visual representation will highlight periods of growth, stagnation, and decline, enabling a deeper understanding of CDNOW’s position within the overall market.

Fluctuations in the industry average line will reveal the broader economic context influencing CDNOW’s sales.

Revenue and Expense Breakdown

A pie chart will visually separate CDNOW’s revenue sources. This will show the percentage contribution of different product categories (e.g., music CDs, DVDs, merchandise) to the overall revenue. The same chart will also illustrate the proportion of expenses allocated to various departments (e.g., marketing, warehousing, personnel). This breakdown is crucial for identifying potential cost-cutting measures and areas where efficiency gains could be made.

For example, a disproportionately high expense allocation to marketing could signal a need for optimization. Similarly, the proportion of revenue generated from each product category can indicate market opportunities or potential shifts in consumer preferences.

Product Category Sales Performance

A bar chart displaying the sales figures for different product categories will reveal which product lines are performing well and which are lagging. This visualization will offer a clear picture of the sales generated from each category (e.g., rock music, classical music, jazz, etc.). Comparing the sales figures of various categories will pinpoint strong-performing product lines, which can be used to inform future inventory management and marketing strategies.

Understanding the sales trends within each category can also provide insights into consumer preferences and emerging market trends. For instance, if sales of classical music CDs are consistently low compared to other categories, it may indicate a need for more targeted marketing or a change in inventory allocation.

Epilogue

In conclusion, CDNOW’s recent performance presents a compelling study in navigating the changing music landscape. While sales may have reached new highs, substantial losses raise critical questions about the company’s strategic direction. The analysis of market trends, competitor comparisons, and internal factors highlights the need for careful consideration of pricing strategies, marketing efforts, and potential partnerships to mitigate losses and enhance future performance.