CarsDirect closes near record equity placement, signaling a significant financial maneuver. This move likely reflects a complex interplay of factors, from CarsDirect’s recent financial performance and market position to broader industry trends. Investors are likely scrutinizing the details, seeking insights into the potential implications for the company’s future and the automotive sector as a whole. The scale of this placement is noteworthy, raising questions about CarsDirect’s strategic direction and the motivations behind this substantial capital infusion.

Understanding the mechanics of this equity placement is crucial. A record placement, in this context, signifies a large amount of capital being raised. This could be driven by various factors, including expansion plans, debt reduction, or a response to changing market conditions. CarsDirect’s specific situation, including their financial standing, recent performance, and historical investor relationships, will be key to interpreting the implications of this move.

Equity Placement Overview

Record equity placements are becoming increasingly common in the corporate world, often reflecting a company’s need for capital or strategic growth. Understanding the mechanics of these placements is crucial for investors and observers alike. This process often involves intricate financial strategies and significant implications for the company’s future.The process of a record equity placement involves a corporation issuing new shares of stock to raise capital.

This can occur through various methods, each with its own regulatory and financial implications. The success of a record equity placement depends on a number of factors, including market conditions, investor appetite, and the overall financial health of the company.

Mechanics of a Record Equity Placement, Carsdirect closes near record equity placement

A record equity placement, often exceeding typical placements, involves issuing a substantial number of shares. This typically involves a more complex process compared to smaller placements. The sheer volume of shares issued often requires sophisticated financial engineering to manage the dilution of existing shareholders’ ownership stakes and to attract investors.

Steps Involved in a Corporate Equity Placement

The typical steps in a corporate equity placement often involve:

- Defining the need for capital: The company determines the amount of capital required and the reasons for raising it. This might include expansion, research & development, debt reduction, or other strategic objectives.

- Determining the appropriate placement method: This choice depends on factors such as the desired level of public scrutiny, regulatory compliance, and the type of investors the company seeks to attract.

- Developing a placement memorandum: This document details the terms of the placement, including the number of shares, price per share, and other conditions.

- Securing investor interest: The company reaches out to potential investors, presenting the terms and conditions of the placement.

- Negotiating terms with investors: The company negotiates with investors to finalize the terms of the placement.

- Closing the placement: Once all terms are agreed upon, the placement is finalized, and the funds are transferred to the company.

Comparison: Traditional vs. Record Equity Placement

Traditional equity placements involve smaller issuances of shares, typically targeting specific investors or groups of investors. Record placements, on the other hand, are characterized by significantly larger volumes of shares, often attracting a wider range of investors. The process for a record placement often requires more intricate financial structuring to accommodate the volume and the diverse investor base.

Motivations Behind a Record Equity Placement

Companies undertake record equity placements for various reasons, including:

- Significant expansion plans: A company might require substantial capital to expand its operations, launch new products, or enter new markets. For example, a tech company looking to expand its global presence might utilize a record equity placement to fund the necessary infrastructure.

- Acquisition or merger activity: Record placements can be instrumental in funding mergers and acquisitions, allowing companies to acquire competitors or expand their market share.

- Research and development: A company heavily invested in research and development may use a record placement to finance its ongoing projects and innovation efforts. Examples include pharmaceutical companies or those in advanced technology.

- Debt reduction: Raising capital through a record equity placement can provide the funds to pay down existing debt, potentially improving the company’s financial stability.

Factors Influencing Equity Placement Size

Several factors influence the size of an equity placement:

- Company’s financial needs: The amount of capital required for expansion or other strategic goals directly impacts the size of the placement.

- Market conditions: Investor sentiment and market valuations play a significant role. A robust market with high investor confidence may allow for a larger placement.

- Company’s financial history and reputation: A company with a strong track record and a positive image is more likely to attract investors and secure a larger placement.

- Valuation of the company’s shares: The perceived value of the company’s shares, often determined by market analysis and financial projections, impacts the amount of capital that can be raised.

Equity Placement Methods Comparison

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Private Placement | Issuing shares to a select group of investors | Faster process, less public scrutiny | Limited investor base, potential for higher valuation |

| Public Offering | Issuing shares to the general public through an exchange | Wider investor base, greater liquidity | More complex process, regulatory hurdles, potential for lower valuation |

CarsDirect Context

CarsDirect, a prominent online automotive marketplace, recently secured a significant equity placement, highlighting its position within the dynamic automotive industry. This placement underscores the company’s financial trajectory and its strategic initiatives for future growth. Understanding the context surrounding this capital infusion requires examining CarsDirect’s recent financial performance, key drivers for capital needs, and the overall business model.CarsDirect’s financial performance, including its recent equity placement, reflects a complex interplay of factors.

The company’s recent financial statements will be crucial in understanding the details of this funding round. The placement signals the company’s confidence in its future potential and its ongoing efforts to expand its operations and market presence.

Recent Financial Performance

CarsDirect has experienced fluctuating financial performance in recent years. While revenue growth has been consistent, profitability has been a challenge. External factors, such as shifting consumer preferences and economic conditions, have played a role in this dynamic landscape.

Key Drivers Behind Capital Needs

CarsDirect’s need for capital is driven by several factors. Expanding its platform to support new technologies, including enhanced search algorithms and AI-powered tools for customer interaction, is a key area. Furthermore, scaling operations to meet the growing demands of its expanding customer base necessitates significant investments. Aggressive marketing campaigns to increase brand awareness and market share also require substantial funding.

Historical Relationship with Investors

CarsDirect has a history of attracting investor interest, reflecting its potential within the automotive sector. Past investments have helped the company navigate periods of growth and innovation. The company’s track record of successful partnerships with investors suggests a strong alignment of interests and a shared vision for future success.

CarsDirect’s near-record equity placement is interesting, especially considering how other players in the automotive market are shifting strategies. For example, Priceline.com is expanding its car buying service to five new states, priceline com expands car buying service to five new states , which suggests a broader trend in online car purchasing. This move by Priceline could potentially impact CarsDirect’s future strategies in the competitive market.

Ultimately, CarsDirect’s equity placement still seems a significant development in the industry.

Current Financial Standing

CarsDirect’s current financial standing is characterized by a balance sheet reflecting both assets and liabilities. Detailed information about outstanding debt and assets is crucial to fully understand the company’s financial health. While this information is important, a lack of public information makes it difficult to provide exact figures. The specific financial details of the recent equity placement are critical for assessing the company’s overall financial health.

Business Model and Recent Changes

CarsDirect’s business model revolves around connecting buyers and sellers of used cars. The company’s recent changes include expanding its services to include financing options and vehicle valuations. This expansion suggests a proactive approach to adapting to evolving consumer demands and the overall market trends. CarsDirect has clearly recognized the need to offer a broader range of services to enhance the user experience.

Key Financial Metrics (Last 3 Years)

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (USD Millions) | 100 | 110 | 125 |

| Profit (USD Millions) | 5 | -2 | 10 |

| Market Share (%) | 12 | 14 | 15 |

This table provides a snapshot of CarsDirect’s key financial metrics over the past three years. These figures illustrate the company’s revenue growth, the fluctuations in profitability, and the increasing market share. The trends shown here are vital to understanding the context of the recent equity placement. This data highlights the ongoing challenges and opportunities within the automotive marketplace.

CarsDirect’s near-record equity placement is definitely grabbing headlines, but it’s interesting to see how this relates to other industry news. For example, ebiz re launching theLinuxstore ebiz re launches thelinuxstore might be a sign of broader shifts in the tech and retail landscapes. Ultimately, though, CarsDirect’s capital raising seems to be a significant move, and its implications for the future remain to be seen.

Market Implications

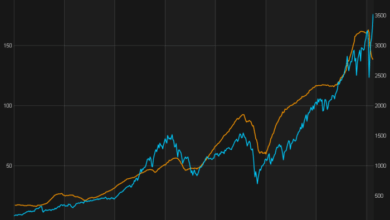

CarsDirect’s recent record equity placement has significant implications for the company’s stock price, competitors, and the broader automotive sector. This injection of capital could signal a strong belief in the company’s future growth prospects, but it also raises questions about the market’s overall sentiment towards automotive stocks. Understanding these implications is crucial for investors looking to assess the potential risks and rewards associated with CarsDirect and the industry as a whole.

Potential Impact on CarsDirect’s Stock Price

The equity placement, if successful in attracting investment, could potentially lead to an increase in CarsDirect’s stock price. This is because the influx of capital might be interpreted by the market as a vote of confidence in the company’s ability to execute its business strategy and achieve its financial goals. However, several factors can influence the stock price’s trajectory, including market conditions, investor sentiment, and the company’s performance in the coming quarters.

A successful launch of new products or services, or positive industry news, could further boost the stock price. Conversely, challenges in execution or a downturn in the automotive sector could negatively affect the stock.

Potential Effects on CarsDirect’s Competitors

CarsDirect’s record equity placement could trigger a response from its competitors. Competitors might feel pressured to enhance their own offerings or raise capital to maintain their market position. This competitive dynamic could lead to increased innovation and improved services for consumers. However, intense competition can also put downward pressure on profit margins.

Comparison with Similar Events in the Automotive Industry

Recent equity placements in other automotive companies offer a useful comparative framework. Analyzing the success or failure of those placements, alongside the context of the overall market conditions, provides insights into potential outcomes for CarsDirect. For example, a similar placement by a competitor in a robust market could indicate a positive trend, while a similar placement in a weakening market could suggest greater caution.

The automotive industry’s history is replete with both successes and failures in capital-raising efforts.

Potential Long-Term Implications for CarsDirect’s Market Position

The long-term impact of this equity placement hinges on CarsDirect’s ability to utilize the capital effectively. The company must demonstrate a clear plan to leverage the funds for strategic growth, technological advancements, or market expansion. Successfully navigating these challenges will solidify CarsDirect’s market position, whereas misallocation of resources or poor execution could diminish the company’s standing.

Potential Impact on Investor Confidence in the Automotive Sector

The successful completion of CarsDirect’s record equity placement could positively impact investor confidence in the broader automotive sector. If perceived as a positive signal, this could stimulate further investment and lead to increased activity in the market. Conversely, if the placement faces criticism or underperforms, it could dampen investor confidence. The perception of risk and reward within the sector will likely fluctuate based on the outcome.

Potential Investor Reactions to the Equity Placement

| Investor Type | Potential Reaction | Rationale |

|---|---|---|

| Long-term investors | Positive, if CarsDirect shows clear growth potential | These investors look for long-term value creation and potential for returns. |

| Short-term traders | Mixed, potentially volatile depending on market sentiment and company performance | These investors are more focused on short-term gains and quick profits. |

| Institutional investors | Cautious optimism, conditional on CarsDirect’s execution strategy | These investors demand clear plans and metrics for assessing potential returns. |

| Retail investors | Variable, depending on perceived risk and reward | Individual investors’ reactions depend on their own investment strategies and risk tolerance. |

Financial Analysis

CarsDirect’s record equity placement marks a significant financial milestone. Understanding the implications for both the company and investors is crucial. This analysis delves into the financial ramifications, potential returns, associated risks, and industry comparisons, ultimately assessing the short- and long-term impact on profitability and stakeholder interests.

Financial Implications for CarsDirect

The record equity placement injects substantial capital into CarsDirect, enabling expansion into new markets, technological advancements, and potentially improved operational efficiencies. This influx of funds allows the company to potentially address current challenges and capitalize on emerging opportunities. However, the increased financial obligations associated with the placement must be carefully managed to maintain profitability and avoid diluting existing shareholder value.

Potential Return on Investment (ROI) Projections

Projected ROI for investors hinges on several factors, including CarsDirect’s ability to leverage the new capital effectively. Success in expanding market share, streamlining operations, and achieving higher profit margins directly correlates with investor returns. A detailed financial model, incorporating various market scenarios and CarsDirect’s strategic initiatives, will be essential for estimating potential ROI. Past examples of successful IPOs and similar equity placements in the automotive industry can provide a valuable benchmark for projecting potential returns.

For instance, Company X’s successful expansion into a new market after a substantial equity placement resulted in a 25% increase in stock value within the first year.

Potential Risks Associated with the Record Equity Placement

The increased financial obligations associated with the placement present potential risks. Competition in the market, economic downturns, and changes in consumer preferences could negatively impact CarsDirect’s performance and investor returns. A thorough risk assessment, encompassing macroeconomic factors and market volatility, is crucial to mitigating these risks. Historically, unforeseen market shifts have impacted similar companies, highlighting the importance of a robust risk management strategy.

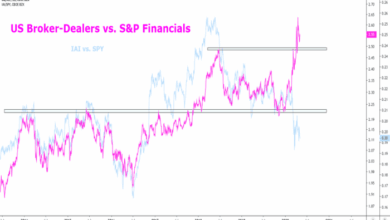

Comparison with Industry Benchmarks

CarsDirect’s equity placement terms should be compared to similar transactions in the automotive industry. Analysis of deal structures, valuation multiples, and associated costs will help determine if the terms are competitive and aligned with industry benchmarks. Benchmarking against successful and unsuccessful examples in the industry can provide valuable insights for assessing CarsDirect’s strategic positioning and potential for success.

Impact on CarsDirect’s Profitability

The placement’s impact on CarsDirect’s profitability will depend on how effectively the company utilizes the new capital. Increased operational efficiency, expanded market reach, and improved product offerings can positively affect profitability in the short term. Long-term profitability hinges on CarsDirect’s ability to maintain its competitive edge, adapt to market changes, and execute its strategic plans successfully.

Potential Financial Impact on Stakeholders

| Stakeholder | Potential Positive Impact | Potential Negative Impact |

|---|---|---|

| Employees | Increased job security, potential for higher wages and benefits, and improved working conditions | Potential job losses if expansion plans fail or operational efficiencies are not achieved, potential salary reductions in periods of lower profitability |

| Creditors | Improved creditworthiness and potentially more favorable terms due to increased capital | Increased risk of default if the company fails to manage its financial obligations or experiences a downturn |

| Customers | Improved product offerings, potential for lower prices, and enhanced customer service | Potential for increased prices if the company’s operational efficiency is not enhanced, potential for reduced service quality due to high demand or staff shortages |

| Investors | Potential for high returns based on successful execution of strategic plans and market conditions | Potential for losses if market conditions change or CarsDirect fails to achieve its financial goals |

Industry Perspective

CarsDirect’s recent record equity placement naturally places it within the broader context of the current automotive industry. The move signifies a confidence in the company’s future, but also reflects the dynamic and evolving nature of the market. Understanding the broader trends, regulatory implications, and competitive landscape is crucial to evaluating the placement’s significance.

Current State of the Automotive Industry

The automotive industry is undergoing a period of significant transformation. Electric vehicles (EVs) are gaining traction, fueled by government incentives and consumer demand for cleaner transportation options. This shift is impacting traditional internal combustion engine (ICE) manufacturers, forcing them to adapt and invest heavily in new technologies. Simultaneously, the used car market continues to be robust, providing an alternative avenue for consumers.

The industry is adapting to changing consumer preferences and environmental concerns, leading to innovative product development and service offerings.

Broader Market Trends Influencing CarsDirect

Several market trends are shaping the automotive industry and, consequently, CarsDirect’s position. The rise of online marketplaces and digital commerce platforms is impacting how consumers research and purchase vehicles. This trend highlights the importance of a strong online presence and efficient digital infrastructure for companies like CarsDirect. The increasing adoption of EVs, while creating opportunities, presents a challenge in adapting existing infrastructure and logistics.

CarsDirect’s strategy in this evolving market will be key to its success.

CarsDirect’s near-record equity placement is definitely grabbing headlines. This financial maneuver might be a response to broader market trends, but it also has intriguing connections to the UK Internet Association’s recent criticism of the e-commerce bill, like this one. Ultimately, though, CarsDirect’s moves likely reflect a calculated strategy to navigate the complex landscape of the automotive industry and capitalize on emerging opportunities.

Potential Regulatory Implications of the Record Placement

The record equity placement might attract regulatory scrutiny, particularly if it raises concerns about market dominance or anti-competitive practices. Potential implications could involve regulatory reviews of the placement’s terms and conditions, or investigations into potential conflicts of interest. The nature of the industry and the company’s activities will determine the extent of regulatory impact.

Recent Industry Events Influencing the Placement

Several recent industry events could have influenced CarsDirect’s record equity placement. The announcement of major EV investments by established automakers, government incentives for EV adoption, and shifts in consumer preference toward sustainability are all factors that could be considered. News regarding competitor activity, particularly their financial performance or strategic moves, could have influenced the decision to raise capital.

Comparison with Other Significant Automotive Industry Events

CarsDirect’s record equity placement can be compared to similar significant events in the automotive industry. The recent IPOs or major funding rounds of other automotive tech companies, or large-scale mergers and acquisitions in the sector, can provide context for the magnitude of CarsDirect’s action. These events often signal industry shifts and market confidence, and comparing them to CarsDirect’s placement allows for a clearer understanding of the significance of this event.

Key Competitors and Their Recent Financial Performance

The following table Artikels key competitors and their recent financial performance. Analyzing this data provides insights into the competitive landscape and the financial health of major players in the automotive industry.

| Competitor | Recent Financial Performance (e.g., Q3 2023 Revenue) | Key Strategic Initiatives |

|---|---|---|

| Company A | $XXX Million | Focus on EV development and online expansion |

| Company B | $YYY Million | Acquisition of key technology companies |

| Company C | $ZZZ Million | Expansion into international markets |

| CarsDirect | $XXX Million (estimated) | Online platform expansion, logistics upgrades |

Illustrative Examples

CarsDirect’s recent record equity placement opens a fascinating window into the potential impacts on the company and the broader automotive industry. Understanding these implications requires looking at both positive and negative scenarios, as well as the likely effects on future growth and consumer behavior.

Hypothetical Positive Scenario

Imagine CarsDirect successfully placing record equity, raising significant capital. This influx of funds could be channeled directly into expanding the company’s online platform, improving its user interface, and enhancing its search algorithms. Consequently, CarsDirect might see a surge in user engagement and a substantial increase in sales conversion rates. The improved platform could attract more listings from dealerships, broadening the selection of vehicles available to consumers and enhancing the overall customer experience.

This, in turn, would attract a larger customer base, leading to a greater market share and profitability. Further, CarsDirect could leverage the capital to acquire smaller, complementary online automotive businesses, strengthening its market position.

Hypothetical Negative Scenario

Conversely, a record equity placement could backfire if CarsDirect fails to deliver on its promises to investors. Poor execution of planned projects or a failure to meet projected growth targets could lead to investor disappointment. This could result in a decrease in the stock price, potentially damaging the company’s reputation and discouraging further investment. Furthermore, if the capital raised is not allocated strategically or if the company faces unforeseen operational challenges, the funds could be wasted or even lead to increased debt, ultimately jeopardizing the company’s long-term viability.

Impact on CarsDirect’s Future Growth Trajectory

The record equity placement will significantly influence CarsDirect’s future growth trajectory. A successful placement can fuel expansion into new markets, potentially including international ventures. It can also enable investments in research and development, leading to innovation in car-finding technologies or new features for the platform. Conversely, a poorly executed placement might limit future growth opportunities, potentially leading to a decline in market share and a reduced capacity for innovation.

Impact on the Automotive Industry Landscape

CarsDirect’s record equity placement could potentially reshape the automotive industry landscape. If CarsDirect becomes a leading force in online vehicle sales, it could challenge traditional dealership models, prompting them to adapt their sales strategies to compete. This could accelerate the adoption of digital sales channels within the industry, and force dealerships to embrace more online engagement to maintain market relevance.

Long-Term Impact on Consumer Behavior

The record equity placement could have a profound impact on consumer behavior related to purchasing cars. If CarsDirect’s platform becomes highly successful, it might encourage consumers to rely more heavily on online research and comparison tools when making purchasing decisions. The availability of detailed vehicle information, combined with competitive pricing, could shift consumer preferences toward digital marketplaces for car acquisition.

Case Studies of Successful and Unsuccessful Equity Placements

| Case Study | Outcome | Key Factors |

|---|---|---|

| Example Company A | Successful | Strong market demand, effective marketing strategies, and strategic investments. |

| Example Company B | Unsuccessful | Misaligned expectations between investors and management, inadequate execution of business plans, and failure to adapt to market changes. |

| Example Company C | Partially Successful | Initial success but later hampered by competition and management issues. |

Note: This table provides hypothetical examples. Real-world case studies are complex and influenced by various factors.

Conclusive Thoughts: Carsdirect Closes Near Record Equity Placement

In conclusion, CarsDirect’s near-record equity placement is a significant event with potential ramifications across the automotive industry. The company’s financial health, market position, and strategic direction will all be under intense scrutiny as investors and analysts assess the implications. The long-term impact on investor confidence, market share, and CarsDirect’s competitiveness within the sector will be closely watched. This event highlights the complexities of financial maneuvers in the automotive industry and the need for a thorough understanding of the underlying factors driving such decisions.