Bank One Gets It sets the stage for this enthralling narrative, offering readers a glimpse into a bank’s ability to truly understand and meet customer needs. From understanding customer experiences to streamlining internal processes, we’ll explore how a bank can achieve this “getting it” through innovative products, financial literacy programs, community engagement, and even subtle shifts in internal communication.

This journey promises to uncover the secrets behind exceptional customer service and the key components that drive customer loyalty.

This in-depth look examines the various facets of a bank achieving customer satisfaction and exceeding expectations. We’ll delve into the different interpretations of “Bank One Gets It,” exploring how this phrase manifests in diverse contexts, from customer service interactions to internal communications and marketing strategies. The discussion touches on the importance of efficient internal processes, tailored product offerings, and a commitment to community engagement.

Understanding the Phrase “Bank One Gets It”

The phrase “Bank One Gets It” suggests a positive interaction with a bank, implying understanding and responsiveness to a customer’s needs. It often implies a sense of satisfaction and trust. However, the precise meaning hinges heavily on context, as the sentiment can range from simple acknowledgment to a deeper level of empathetic understanding.The phrase’s significance lies in its ability to capture a feeling of connection and efficiency in a customer service interaction.

This feeling can be evoked through various actions, such as a bank representative addressing a complex financial problem, handling a sensitive situation with care, or proactively anticipating and fulfilling a customer’s needs.

Possible Meanings of “Bank One Gets It”

The phrase “Bank One Gets It” can encompass a range of interpretations. It might signify a simple understanding of a customer’s request, or it could indicate a more profound level of empathy and proactive problem-solving. The tone can shift from a basic acknowledgement to a more profound sense of partnership.

Interpretations Based on Context

The context surrounding the use of “Bank One Gets It” greatly influences its meaning. For instance, in a conversation about a loan application, it could indicate that the bank understands the applicant’s financial situation and is processing the application accordingly. In a dispute resolution scenario, it could mean the bank recognizes the validity of the customer’s complaint and is actively working towards a resolution.

Scenarios Where the Phrase Might Be Used

This phrase might be used in a variety of situations. A customer might say this after a complex loan application process is handled efficiently, highlighting the bank’s responsiveness to their unique circumstances. It could also be used in a scenario where a customer experiences a significant issue and the bank proactively finds a solution, demonstrating a high level of customer care.

Alternatively, a customer might use it to express satisfaction with a personalized service or a tailored financial plan.

Potential Implications in Different Settings

The use of “Bank One Gets It” can have significant implications in various settings. In a customer service environment, it reflects a positive customer experience, potentially leading to increased loyalty and positive word-of-mouth referrals. In a corporate setting, it could signal a shift towards a more customer-centric approach, fostering a stronger relationship with clients. From a bank’s perspective, the phrase highlights the value of providing exceptional service, leading to a stronger brand reputation.

Bank One gets it – they’re clearly ahead of the curve. Their innovative approach resonates with today’s digital landscape. This savvy thinking extends to their understanding of the changing book industry, as evidenced by Borders.com’s recent move to make books on demand borders com to make books on demand. This forward-thinking approach, in turn, highlights Bank One’s commitment to staying relevant and meeting customer needs in the evolving market.

Emotional Tone Associated with the Phrase

The emotional tone of “Bank One Gets It” varies based on the context. In a straightforward transaction, it might evoke a feeling of neutrality. However, in a challenging situation, like a loan rejection or a financial dispute, the phrase could convey a sense of relief and trust. The positive tone of the phrase, regardless of the context, often emphasizes the customer’s positive perception of the bank’s actions and efficiency.

Customer Experience and Satisfaction

Beyond just processing transactions, a bank’s true strength lies in its ability to connect with customers on a human level. “Bank One Gets It” suggests a deep understanding of the customer journey, moving beyond transactional convenience to create genuine satisfaction. This involves recognizing the emotional and practical needs that drive customer interactions. This understanding is paramount in today’s competitive banking landscape, where trust and a positive experience are increasingly valued over mere features.Customer experience is not just about the technology or the physical branch; it’s about how the entire interaction makes the customer feel.

A bank that truly “gets it” anticipates customer needs, offering solutions that address both their immediate concerns and long-term goals. This means more than simply having helpful staff; it involves anticipating challenges and providing proactive support.

Key Aspects of Customer Experience

A positive customer experience hinges on several key elements. These include responsiveness, empathy, and a proactive approach to problem-solving. Understanding individual customer needs is essential, recognizing that each interaction is unique and requires a tailored response.

Demonstrating Understanding of Customer Needs

Banks can demonstrate understanding by actively listening to customer feedback, both positive and negative. This involves implementing systems to collect and analyze this feedback. Furthermore, a bank must understand the diverse needs of its customer base, recognizing that not all customers have the same priorities or preferences. This might include tailoring products and services to different demographics or offering multiple channels for interaction.

A crucial element is adapting to evolving customer expectations, staying ahead of industry trends and technological advancements.

Exceptional Customer Service Experiences

Exceptional customer service experiences go beyond basic expectations. They involve going the extra mile to resolve issues, anticipate needs, and create a memorable experience. For instance, a bank might offer personalized financial planning sessions or provide proactive support when a customer is facing financial difficulties. An excellent example could be a bank that recognizes a customer’s need for a specific loan product and proactively reaches out with a tailored offer, anticipating the customer’s need before they even ask.

Comparing and Contrasting Approaches to Customer Service Excellence

Different banks employ varying approaches to customer service excellence. Some prioritize technological solutions, using online platforms and automated systems. Others emphasize human interaction, focusing on personalized service through dedicated staff. The most effective approach often combines both, leveraging technology to streamline processes while maintaining a personal touch in critical interactions. A successful model recognizes the value of both human connection and technological efficiency.

Customer Service Touchpoints and “Bank One Gets It”

| Customer Service Touchpoint | How “Bank One Gets It” Applies |

|---|---|

| Online Banking | Providing intuitive interfaces, clear instructions, and proactive alerts to help customers navigate online services smoothly. |

| Mobile App | Offering a user-friendly mobile banking app with personalized recommendations and secure transactions. |

| Branch Visits | Creating a welcoming and comfortable environment in branches, with knowledgeable staff who anticipate customer needs and offer tailored solutions. |

| Phone Support | Responding promptly to calls with empathetic and knowledgeable representatives, proactively offering assistance and resolving issues efficiently. |

| Email Support | Responding to emails within a reasonable timeframe, offering clear and concise solutions, and providing helpful resources. |

Internal Processes and Efficiency

A bank that truly “gets it” understands that efficient internal processes are crucial for delivering a positive customer experience. This isn’t just about speed; it’s about a seamless flow of operations, minimizing friction, and ensuring every interaction, from account opening to loan application, is handled with precision and care. This focus on internal efficiency translates directly into a more satisfying experience for customers.Internal processes are the invisible backbone of a bank’s operations.

Streamlined workflows, well-defined roles, and effective communication all contribute to a bank’s ability to anticipate and meet customer needs. This is more than just a checklist; it’s about cultivating a culture of understanding and responsiveness within the organization.

Efficient Internal Processes

Effective internal processes are the bedrock of a successful bank. They ensure tasks are completed quickly and accurately, minimizing delays and frustrations for customers. This contributes to the bank’s ability to quickly respond to customer inquiries and resolve issues efficiently. By streamlining operations, banks can create a more predictable and trustworthy experience for their clients. For example, a streamlined loan application process, with clear communication at each stage, reduces customer anxiety and increases the likelihood of approval.

Streamlined Operations and Customer Experience

Streamlined operations directly impact the customer experience. When internal processes are optimized, the bank can respond more quickly to customer requests, resolve issues promptly, and provide accurate information efficiently. This leads to a sense of reliability and trust, fostering customer loyalty. A customer who experiences a smooth and efficient transaction is more likely to return and recommend the bank to others.

Internal Process Flowchart

The following flowchart demonstrates a simplified loan application process within a bank. This visual representation illustrates how different departments interact and the steps involved in processing a loan application.

| Step | Department | Action |

|---|---|---|

| 1 | Customer Service | Initial application received and assigned to a loan officer. |

| 2 | Loan Officer | Verifies customer information, assesses creditworthiness, and requests supporting documents. |

| 3 | Underwriting | Reviews loan documents and performs risk assessment. |

| 4 | Legal | Reviews and approves loan documents according to legal requirements. |

| 5 | Loan Officer | Communicates approval or denial to the customer. |

| 6 | Customer Service | Handles follow-up questions and completes necessary paperwork. |

Effective Communication

Effective communication within a bank is paramount for efficient internal processes. Clear communication channels ensure that information flows smoothly between departments, allowing for faster decision-making and improved customer service. For instance, a streamlined communication protocol for loan approvals and denials minimizes delays and ensures customers are kept informed throughout the process.

Bank One Gets It, right? Their recent performance seems impressive, but what about the broader market? Ameritrade beats the street, as reported in this insightful piece ameritrade beats the street , which suggests that maybe the key to success lies in understanding market trends beyond just one institution. Ultimately, Bank One Gets It, but perhaps their success is less about isolated brilliance and more about a deeper understanding of the overall financial landscape.

Role of Technology in Internal Processes

Technology plays a critical role in improving internal processes and fostering a deeper understanding of customers. Digital platforms, such as online banking portals, allow customers to manage their accounts efficiently and access information promptly. Data analytics tools provide insights into customer behavior and preferences, enabling banks to tailor products and services more effectively.

Product and Service Offerings

A bank that truly “gets it” understands that its product offerings are the direct reflection of its customer understanding. It’s not just about the features; it’s about how those features solve real-world problems and improve lives. A bank that caters to its customer’s needs fosters loyalty and trust, which are crucial for long-term success.Effective product offerings go beyond basic services.

They anticipate evolving customer demands and provide innovative solutions. This proactive approach allows banks to not just meet current needs but to shape the future of financial services.

Reflecting Customer Needs in Product Design

Products and services should directly address the specific needs of target customer segments. This means understanding their financial goals, lifestyle choices, and technological preferences. For example, a bank targeting young professionals might offer mobile-first banking experiences and investment platforms tailored to their short-term and long-term financial goals. A bank catering to small business owners might provide tailored financial management tools, simplified loan applications, and easy access to business accounts.

Innovative Products and Services

Many banks are introducing innovative products and services to cater to specific customer demands. For example, some banks offer personalized budgeting tools integrated with their mobile apps. Others provide robo-advisors to simplify investment strategies for customers with limited financial expertise. These solutions make managing finances more accessible and efficient. Furthermore, digital-first banking platforms are becoming increasingly popular, allowing customers to manage their accounts from anywhere at any time.

Comparison of Bank Products

| Product Category | Traditional Bank Product | Innovative Bank Product | Customer Needs Addressed |

|---|---|---|---|

| Savings Accounts | Basic savings account with low interest rate | High-yield savings account with tiered interest rates based on savings amount and digital engagement | Encouraging savings and rewarding engagement with the bank |

| Loans | Traditional loan application process with lengthy paperwork | Online loan application with instant approval for qualified customers | Efficiency and accessibility for customers in obtaining financial assistance |

| Investment | Limited investment options | Robo-advisor with diversified investment portfolios tailored to risk tolerance | Ease of access to investment opportunities and diversification of investment portfolios |

Importance of Tailored Products and Services

Tailored products and services are essential for building customer loyalty and satisfaction. Customers appreciate solutions that cater specifically to their unique financial needs. This personalization enhances the customer experience and fosters a strong sense of connection with the bank. A one-size-fits-all approach is unlikely to resonate with the diverse needs of modern customers. Instead, banks must understand the nuanced financial landscapes of various customer segments to develop products that effectively meet their needs.

Benefits of a Bank That “Gets It” in Product Design

A bank that “gets it” in product design enjoys several advantages. Firstly, it experiences higher customer satisfaction and retention rates. Secondly, it builds a strong brand reputation for understanding and addressing customer needs. Thirdly, tailored products and services lead to increased profitability and efficiency. Finally, a bank that “gets it” can adapt to evolving market demands and stay ahead of the competition.

“A bank that truly understands its customers creates a loyal customer base and a thriving business.”

Financial Literacy and Education

Understanding your finances is crucial for making informed decisions and achieving your financial goals. Financial literacy empowers individuals to navigate the complexities of the financial world, from budgeting and saving to investing and debt management. A bank’s role extends beyond simply providing financial products; it includes fostering a deeper understanding of money management amongst its customers.Financial literacy is not just a skill; it’s a cornerstone of sound personal finance.

It helps customers make informed choices about their money, leading to better financial outcomes and increased satisfaction with their banking experience. A bank that actively promotes financial literacy strengthens its customer relationships and builds a reputation for responsible financial guidance.

Role of Financial Literacy in Customer Understanding

Financial literacy directly impacts customer understanding of banking products and services. Customers with a strong grasp of financial concepts are better equipped to assess the value of different accounts, loans, and investments. This understanding leads to more effective financial planning and better use of banking tools. They are more likely to make choices aligned with their financial goals and avoid unnecessary fees or poor financial decisions.

How Banks Can Promote Financial Education

Banks can proactively promote financial education through various channels. These channels can include workshops, seminars, online resources, and partnerships with community organizations. Effective financial education programs typically cover budgeting, saving, investing, debt management, and understanding credit reports. They often include practical exercises and interactive sessions to enhance engagement and comprehension.

Examples of Educational Resources Provided by Banks, Bank one gets it

Many banks offer online resources like educational articles, videos, and interactive tools. These resources often address specific financial topics such as budgeting, saving for retirement, or understanding different types of loans. Some banks partner with schools and community organizations to offer workshops and seminars on financial literacy. These events are often designed to meet the specific needs of different demographics and provide tailored financial advice.

Examples include workshops focused on student debt management or retirement planning for seniors.

Benefits of Financial Literacy Programs for Customers

Financial literacy programs provide numerous benefits for customers. These programs help customers make sound financial decisions, manage their money effectively, and achieve their financial goals. By reducing financial stress and improving financial outcomes, these programs improve customer satisfaction and foster long-term relationships with the bank. Improved financial knowledge can lead to reduced reliance on debt and better financial planning for the future.

Financial Education Programs

| Program Name | Target Audience | Key Topics Covered | Delivery Method |

|---|---|---|---|

| Budgeting Basics | Individuals and families | Creating a budget, tracking expenses, identifying areas for savings | Online modules, in-person workshops |

| Retirement Planning | Pre-retirement individuals | Understanding retirement accounts, estimating retirement needs, investing for retirement | Online calculators, seminars, personalized consultations |

| Debt Management | Individuals with debt | Understanding different types of debt, creating a debt repayment plan, managing credit utilization | Workshops, online resources, personalized consultations |

Community Engagement and Social Responsibility

A bank that truly “gets it” understands that its success is intertwined with the well-being of the communities it serves. This goes beyond simply providing financial services; it involves active participation in the social fabric, fostering economic growth, and contributing to a better future for all. This commitment is not just a public relations exercise but a fundamental aspect of a responsible and sustainable business model.Community engagement demonstrates a bank’s understanding of its role as a corporate citizen.

It showcases a proactive approach to social responsibility, reflecting a genuine concern for the needs and aspirations of the communities it touches. A bank that invests in community development, provides financial literacy programs, and supports local initiatives is actively demonstrating that it understands the unique challenges and opportunities within those communities.

Connection Between Community Engagement and a Bank’s Understanding

A bank’s commitment to community engagement is a direct reflection of its understanding of the diverse needs within its service area. By actively participating in local initiatives, a bank demonstrates a holistic view that goes beyond simply maximizing profits. A bank that “gets it” recognizes that financial health is not isolated from broader community well-being. Its involvement can range from sponsoring local sports teams to providing scholarships for students.

These actions showcase a bank’s commitment to long-term community growth and stability.

Social Responsibility Initiatives as Demonstrations of Understanding

Social responsibility initiatives are a critical component of a bank’s commitment to its community. These initiatives can encompass a wide range of activities, from supporting local charities to fostering financial literacy programs. By investing in programs that address critical community needs, banks are demonstrating their understanding of the importance of collaboration and collective progress. These programs often address issues such as education, job creation, and environmental sustainability.

They are not just about giving back; they are about recognizing the interconnectedness of community well-being and financial success.

Examples of Community-Focused Programs

A bank’s community engagement can manifest in various forms. Financial literacy programs, for instance, equip individuals with the skills to manage their finances effectively, fostering economic independence and empowerment. Supporting local small businesses through loans or mentorship programs is another way a bank can stimulate economic growth and create jobs. Environmental initiatives, such as sponsoring tree-planting projects or supporting renewable energy initiatives, reflect a bank’s understanding of sustainability and its long-term commitment to the community.

Importance of Ethical Practices in Banking

Ethical practices are fundamental to a bank’s community engagement and overall success. Maintaining transparency in transactions, avoiding predatory lending practices, and promoting fair and equitable treatment for all customers are critical aspects of ethical banking. Ethical conduct fosters trust and strengthens the relationship between the bank and the community it serves. This trust is essential for long-term sustainability and growth.

Bank’s Community Involvement Activities

| Activity | Description | Impact |

|---|---|---|

| Financial Literacy Workshops | Providing educational workshops on budgeting, saving, and investing | Empowering individuals with financial skills |

| Small Business Loans | Offering loans and mentorship programs to local businesses | Stimulating economic growth and job creation |

| Supporting Local Charities | Donating to and partnering with local charities | Addressing community needs and fostering social well-being |

| Environmental Initiatives | Supporting sustainable practices and environmental projects | Promoting environmental responsibility and sustainability |

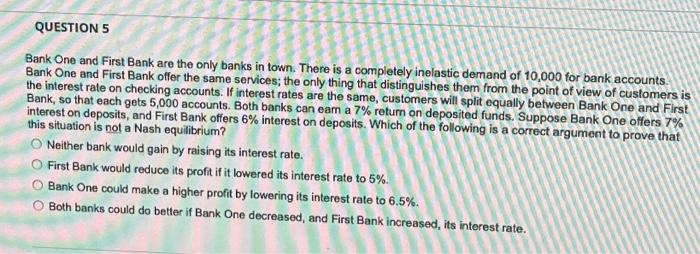

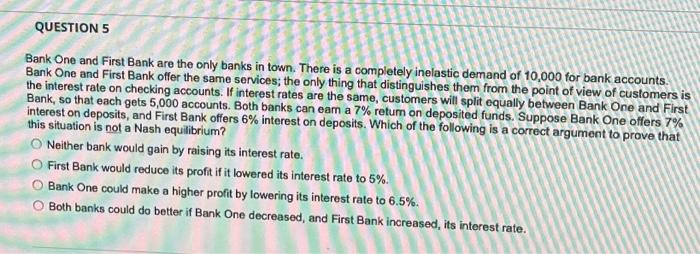

Analyzing the Phrase in Different Contexts: Bank One Gets It

The phrase “Bank One Gets It” implies a deep understanding of customer needs and a responsive approach to their banking requirements. This understanding can manifest in various ways, from efficient internal processes to tailored customer interactions. Analyzing how this phrase is used in different contexts reveals valuable insights into the bank’s overall approach to customer service and brand identity.

Interpretations in Business Meetings

In business meetings, “Bank One Gets It” could signal a positive evaluation of the bank’s ability to adapt to market trends, understand customer feedback, and effectively respond to challenges. It suggests a proactive and customer-centric approach, potentially highlighting specific successes in product development, service improvements, or strategic decision-making. For example, a presentation might cite a recent customer survey demonstrating a strong understanding of client needs.

Bank One gets it – they’re clearly on top of things. This is evident in their recent support for the burgeoning Latin American portal, latin american portal shifts into high gear , which is really accelerating. Their understanding of the market dynamics makes them stand out. Ultimately, Bank One’s forward-thinking approach is paying off.

Internal Communications

Internal communications using “Bank One Gets It” can foster a culture of customer focus. This phrase might appear in internal memos, newsletters, or team meetings. For instance, a memo might describe a new initiative to improve online banking based on recent customer feedback, demonstrating a direct response to customer needs.

Usage in Marketing Materials

The phrase “Bank One Gets It” in marketing materials can emphasize the bank’s empathy and responsiveness. This could be displayed through slogans, advertisements, or promotional materials. A TV commercial might depict a customer seamlessly navigating the bank’s website or mobile app, highlighting the bank’s understanding of their needs.

Customer Reviews

Positive customer reviews can use “Bank One Gets It” to describe the bank’s responsiveness and understanding of their individual situations. A customer might write a review that specifically mentions how a bank representative addressed their unique circumstances or provided a personalized solution to a complex problem. This implies a deep understanding and proactive engagement.

Social Media Applications

In social media, “Bank One Gets It” can be used to express appreciation for prompt service, innovative products, or community engagement. A customer might post a tweet praising the bank’s quick resolution of a problem or their recent donation to a local charity. This creates a sense of community and transparency.

Visual Representation of “Bank One Gets It”

Bank One Gets It – it’s more than just a catchy phrase. It’s a promise, a commitment, and a visual representation of a bank’s dedication to its customers. A powerful visual can solidify this concept, translating the intangible idea of understanding into a tangible and memorable experience. This section explores various ways to visually convey this concept, focusing on customer-centricity and the bank’s responsiveness.

Graphic Symbolizing “Bank One Gets It”

A graphic symbolizing “Bank One Gets It” should be a dynamic and engaging representation of understanding and empathy. Imagine a stylized, interconnected network of lines, like threads, radiating outward from a central point. This central point could be a stylized bank logo or a personified representation of the bank, conveying the bank’s core focus. Each thread should represent a different customer interaction, from online banking to branch visits.

Colors should evoke trust and reliability, perhaps a combination of a primary brand color and a calming secondary color, reflecting the bank’s commitment to customer care.

Infographic Illustrating the Concept

An infographic could visually demonstrate “Bank One Gets It” through a series of steps. The steps could depict a customer’s journey, starting with a problem or need and progressing through the resolution. Visual cues, like icons or progress bars, could indicate the bank’s responsiveness and understanding at each stage. Each step could be visually represented by a specific color, reflecting the specific aspect of the bank’s service or product that helped the customer.

Detailed Description of a Relevant Image

Imagine a collage of diverse customer scenarios, all with a common thread – a bank employee actively listening to and addressing a customer’s need. Each scenario should depict a different customer profile, showing diverse age groups, backgrounds, and needs. The focus should be on genuine connection, with the bank employee offering solutions tailored to the individual customer’s situation. The image should evoke a sense of warmth, trust, and a shared understanding between the bank and its customers.

The use of natural lighting and a clean, uncluttered background would emphasize the human connection and the bank’s dedication.

Illustrations for Different Interpretations

Different interpretations of “Bank One Gets It” can be illustrated through a series of illustrations. One illustration could showcase a customer seamlessly navigating a complex financial transaction online, with helpful prompts and intuitive design. Another could depict a branch manager patiently guiding a senior citizen through a banking procedure, emphasizing personalized service and clear communication. A third illustration could highlight a bank’s responsive customer service team resolving a technical issue for a customer, showcasing proactive problem-solving and rapid response.

These illustrations should be stylized and memorable, reflecting the bank’s brand identity.

Visual Representation of Customer Satisfaction and Bank “Getting It”

A visual representation of customer satisfaction and a bank “getting it” can be achieved through a graph depicting customer feedback over time. The graph should show a positive trend in customer satisfaction metrics, highlighting specific improvements. A key element would be highlighting the specific initiatives or service enhancements the bank implemented to drive this positive change. Visuals such as smiling customer faces or satisfied thumbs-up icons, interspersed throughout the graph, could emphasize the impact on the customer experience.

The visual should be clear, concise, and easily understandable, allowing for quick interpretation of the bank’s success in meeting customer needs.

Final Conclusion

Ultimately, “Bank One Gets It” signifies a bank deeply attuned to its customers. By understanding their needs and tailoring products and services accordingly, a bank can build stronger customer relationships and achieve lasting success. This goes beyond transactional banking; it’s about building trust and providing value in every interaction. The exploration of internal processes, financial literacy, and community engagement paints a comprehensive picture of a bank committed to excellence.