Asia4sale weighs in with public commercial auction, bringing a significant event to the Asian commercial real estate market. This auction promises to be a pivotal moment, shaping the landscape of investment and highlighting key trends in the region. The auction features a diverse range of commercial properties, from office spaces to warehouses, each offering unique opportunities for savvy investors.

Understanding the auction process, the assets on offer, and the broader market context is crucial for navigating this exciting opportunity.

This article delves into the specifics of the auction, including the properties being offered, the bidding procedures, and the potential impact on the market. We’ll explore the current state of the Asian commercial real estate market, examining recent trends and comparing this auction to previous similar events. Furthermore, we will analyze the potential opportunities and challenges that await investors.

Overview of “asia4sale weighs in with public commercial auction”

The public commercial auction by asia4sale signifies a significant event in the Asian commercial real estate market. This marks a shift towards transparent and competitive acquisition methods, potentially offering unique investment opportunities. The auction process aims to attract a wider range of bidders, driving up prices and increasing the overall value of the properties being offered.This auction presents a valuable opportunity for investors to acquire prime commercial assets at potentially attractive prices, while also offering a unique insight into the current market valuation trends in the region.

The process of a public auction provides a transparent mechanism for evaluating the worth of these assets and ultimately facilitates a fair distribution of investment opportunities.

Summary of the Auction Event

The auction, facilitated by asia4sale, involves the public offering of various commercial properties for sale. This encompasses a diverse range of assets, from retail spaces and office buildings to industrial facilities and land plots. The specific details of each property, including location, size, amenities, and potential rental income, are meticulously documented and presented to prospective buyers. This allows for informed decision-making and a fair assessment of the investment potential.

Significance in the Asian Commercial Real Estate Market

The auction’s significance lies in its potential to stimulate greater market liquidity and transparency. By offering commercial properties through a public auction, asia4sale is increasing competition among bidders and potentially driving up prices. This transparency, coupled with the potential for higher returns, attracts both domestic and international investors, injecting fresh capital into the market. This transparency fosters confidence and potentially enhances the overall health of the commercial real estate sector in Asia.

Key Participants and Their Roles

The auction process involves several key participants with distinct roles. These include the auction house (asia4sale), the sellers of the properties, prospective buyers, and possibly legal and financial advisors. Asia4sale acts as the facilitator, managing the bidding process and ensuring compliance with all regulations. Sellers benefit from the competitive bidding environment, potentially achieving higher sales prices than traditional transactions.

Asia4sale’s public commercial auction is definitely grabbing attention. It’s interesting to see how this plays out against the backdrop of the West Coast trying again with a new name, like in the recent news about west coast tries again with new name. Ultimately, Asia4sale’s auction is still a significant event, showcasing a potentially exciting marketplace for commercial deals.

Buyers gain access to a range of desirable commercial properties, often at potentially favorable pricing. Legal and financial advisors provide critical guidance to buyers, helping them navigate the complexities of the transaction.

Types of Commercial Properties Being Auctioned

The auction encompasses a variety of commercial properties, reflecting the diverse needs and investment opportunities within the Asian market. These include:

- Retail spaces:

- Office buildings:

- Industrial facilities:

- Land plots:

These are prime locations for businesses and offer high foot traffic. Examples include retail shops in busy shopping districts, attracting a large customer base.

These cater to businesses requiring substantial office space. Examples include modern office towers in major cities, offering prime locations for various industries.

These are crucial for businesses needing warehousing or manufacturing space. Examples include industrial estates in strategic locations, offering easy access to transportation and supplies.

These offer the potential for future development and are highly sought after for long-term investment. Examples include land parcels in urban areas with high growth potential, ideal for constructing commercial buildings or expanding existing businesses.

Auction Process and Methodology

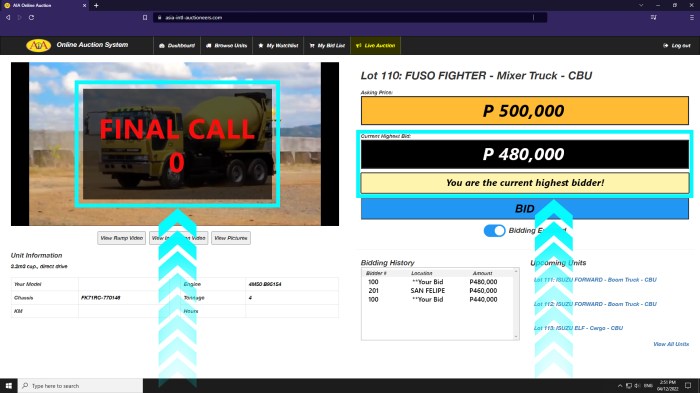

The Asia4Sale public commercial auction promises a transparent and efficient platform for buyers and sellers. A well-defined process, with clear bidding procedures and rules, is crucial for ensuring a fair and successful outcome for all parties involved. Understanding the auction methodology is key to navigating the process effectively.The auction will leverage a combination of modern technologies and established auction practices to streamline the process.

This approach aims to optimize efficiency, attract a wider range of participants, and ultimately maximize the value of the assets being offered.

Bidding Procedures and Rules

The auction will adhere to strict bidding procedures to maintain a level playing field for all participants. These rules ensure fairness, prevent manipulation, and protect the interests of both buyers and sellers. Detailed bidding rules will be available on the official Asia4Sale website, outlining the minimum bid increments, permissible bidding methods, and any restrictions on participation.

Auction Formats

Different auction formats have unique characteristics, each potentially impacting the final sale price and the overall experience. The Asia4Sale auction will likely employ a combination of formats, strategically chosen to maximize the potential of each asset.

Asia4sale’s public commercial auction is definitely grabbing attention, but it’s interesting to see how other sectors are evolving. For example, the recent acquisition of MightyMail by xoom.com, detailed in this article ( xoom com gobbles up mightymail ), shows a significant shift in the online marketing space. Still, Asia4sale’s auction remains a major development in the commercial real estate sector.

- Sealed-bid auctions are advantageous for complex or highly specialized items, allowing bidders to submit confidential bids without affecting competitors’ strategies. This format provides a sense of security and privacy to bidders. The Asia4Sale platform is likely to use a combination of this format for assets that require detailed evaluation.

- Open outcry auctions are known for their dynamic nature and potential for aggressive bidding, often resulting in higher sale prices. This format is suitable for items with readily apparent value and for generating excitement amongst bidders. The Asia4Sale platform might employ this format for assets that are more straightforward and quickly appraised.

Stages of the Auction Process

The auction process typically involves several key stages, each designed to streamline the process and ensure a smooth transaction.

| Stage | Description |

|---|---|

| Registration | Potential buyers and sellers register on the Asia4Sale platform, providing necessary information and adhering to the platform’s terms and conditions. |

| Asset Presentation | Detailed information about the assets, including specifications, condition reports, and supporting documentation, will be made available to potential bidders. |

| Bidding Period | The bidding period will be clearly defined, allowing bidders ample time to review the information and submit their bids according to the specified format and rules. |

| Bidding Closure | The auction concludes at a predetermined time, and the highest bid is declared the winning bid. |

| Confirmation and Settlement | The successful buyer and seller will finalize the transaction through the platform, following the pre-established legal and financial protocols. |

Assets and Properties Offered

Asia4Sale’s public commercial auction presents a diverse portfolio of prime commercial properties across various Asian markets. These offerings represent a unique opportunity for investors and businesses seeking strategic locations, high-growth potential, and strong returns. From bustling city centers to developing areas, the properties showcase a range of uses and potential, making them attractive investments for a variety of stakeholders.

Commercial Property Listings

The auction features a curated selection of commercial properties, each with distinct characteristics and market value estimates. This careful selection aims to provide a spectrum of opportunities, from established retail spaces to potential office developments.

- Property A: Located in the heart of [City Name], this three-story commercial building offers 5,000 square meters of space. Amenities include high-speed internet access, ample parking, and a prominent street presence. The property’s current market value estimate is USD 10 million, based on comparable sales in the area and recent market trends. Potential buyers include large corporations seeking prominent retail space or investors looking for strong rental income.

- Property B: Situated in a rapidly developing area of [City Name], this 2-story industrial warehouse boasts 8,000 square meters of space. The property features a loading dock, ample storage space, and proximity to major transportation hubs. Market value estimates range from USD 12-15 million, factoring in the area’s growth potential and the property’s exceptional features. Investors looking for warehouse space for manufacturing or logistics operations are potential buyers.

Businesses with established supply chains or expansion plans would find this property appealing.

- Property C: A prime retail space in the [City Name] central business district, spanning 1,500 square meters, is a high-traffic location. The space includes ready-to-use fixtures, signage, and excellent visibility. The estimated market value is USD 6 million. Potential buyers include established retail brands looking to expand their presence in a bustling city center, and individuals seeking substantial rental returns from high-demand retail space.

- Property D: A multi-tenant office building in [City Name] offering 10,000 square meters of office space. The property has modern amenities, including conference rooms, and high-speed internet access. The estimated market value is USD 15 million. Potential investors include real estate funds, institutional investors, and businesses seeking to lease out office space.

Market Value Estimates and Potential Buyers

The market value estimates for the properties are based on a thorough analysis of comparable sales, market trends, and local economic indicators. These assessments aim to provide a realistic and informed evaluation for prospective buyers.

| Property | Features | Estimated Value (USD) | Potential Buyers |

|---|---|---|---|

| Property A | Three-story building, 5,000 sq m, prime location | 10,000,000 | Corporations, Retail Investors |

| Property B | 2-story industrial warehouse, 8,000 sq m, proximity to transport | 12,000,000 – 15,000,000 | Logistics Companies, Manufacturers |

| Property C | Prime retail space, 1,500 sq m, high-traffic location | 6,000,000 | Retail Brands, Rental Investors |

| Property D | Multi-tenant office building, 10,000 sq m, modern amenities | 15,000,000 | Real Estate Funds, Institutional Investors |

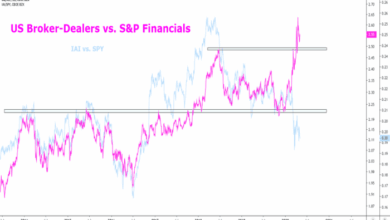

Market Context and Trends: Asia4sale Weighs In With Public Commercial Auction

Asia’s commercial real estate market is a dynamic landscape, shaped by a complex interplay of macroeconomic factors, evolving investor preferences, and localized regulatory changes. This auction, “asia4sale,” takes place within this backdrop, reflecting the current state of play and highlighting key trends. Understanding these nuances is crucial for both potential buyers and sellers navigating this ever-shifting market.The “asia4sale” commercial auction is not an isolated event.

It’s a snapshot of the broader Asian commercial real estate market, and its outcome will be influenced by the prevailing market trends and the overall investment climate. Analyzing the auction’s performance against past events in the region will offer valuable insights into current market sentiment and future prospects.

Asia4sale’s public commercial auction is definitely grabbing attention, but it’s interesting to see how this relates to the current UK e-commerce scene, particularly the icat e commerce uk invasion. This recent surge in online retail activity from icat, a rapidly growing player in the UK market, icat e commerce uk invasion is shaking things up. Ultimately, Asia4sale’s auction likely reflects broader shifts in global trade and the ever-evolving landscape of online retail.

Current State of the Asian Commercial Real Estate Market

The Asian commercial real estate market is characterized by diverse regional dynamics. Some markets exhibit robust growth, driven by robust economic performance and increasing urbanization. Others face headwinds due to geopolitical tensions, regulatory changes, or slower economic expansion. The overall trend suggests a market that is segmented, with pockets of strong performance coexisting with areas of uncertainty.

Relevant Market Trends Influencing the Auction

Several key trends are impacting the “asia4sale” auction. These include shifts in investor preferences, particularly the growing interest in sustainable and resilient properties. Furthermore, the increasing importance of technology in commercial spaces and the impact of remote work are altering demand patterns. The rise of e-commerce is also reshaping the needs of businesses and affecting the demand for certain types of commercial properties.

Comparison with Previous Similar Events

Analyzing the outcomes of previous auctions in Asia can offer insights into the current market. A comparison of transaction volumes, pricing trends, and bidding patterns across similar events in the region provides context for understanding the “asia4sale” auction’s potential results. Key metrics like average price per square foot and the success rate of the auctions in different market segments should be considered.

By understanding the trends from past auctions, we can predict and analyze the outcomes of similar events.

Investment Climate in Asia

The overall investment climate in Asia is complex and multifaceted. While some countries experience high investor confidence and capital inflows, others face challenges related to geopolitical instability, economic downturns, or regulatory uncertainty. Understanding these nuanced factors is essential to assess the potential risks and rewards of investments in the Asian commercial real estate market. Government policies, economic growth forecasts, and the global economic environment are all influencing the current investment climate.

Key Market Trends Over the Past Five Years, Asia4sale weighs in with public commercial auction

| Year | Trend | Impact on Auction | Example |

|---|---|---|---|

| 2018 | Rise of e-commerce | Increased demand for logistics and warehouse space | Demand for fulfillment centers and last-mile delivery facilities increased. |

| 2019 | Growing interest in sustainable properties | Higher premiums for environmentally friendly buildings | Green building certifications became a key factor for attracting investors. |

| 2020 | Impact of the pandemic | Shift in office demand, rise in remote work | Demand for office space in central business districts decreased. |

| 2021 | Global capital inflows | Increased competition and higher valuations | Significant capital inflows into Asian markets fueled the rise in prices. |

| 2022 | Geopolitical uncertainties | Cautious investor sentiment, market volatility | Uncertainty regarding global supply chains and rising interest rates impacted investment decisions. |

Potential Impact and Implications

The Asia4Sale public commercial auction promises a significant ripple effect across the market. This event isn’t just about selling assets; it’s about reshaping market dynamics, influencing future investments, and potentially triggering substantial shifts in related industries. Understanding the potential ramifications is crucial for anyone considering participation or simply keeping an eye on the Asian commercial real estate sector.

Market Sentiment and Future Transactions

The auction’s outcome will undoubtedly shape market sentiment. Successful bids and aggressive pricing strategies can signal a surge in investor confidence, encouraging more transactions in the future. Conversely, a lackluster response could dampen enthusiasm and lead to cautiousness in the market. This sentiment often influences borrowing rates, investment strategies, and overall market volume. For instance, successful auctions of high-profile properties in prime locations have historically boosted investor confidence, leading to increased activity in similar sectors.

Effects on Related Industries

The auction’s impact extends beyond the immediate participants. The financing industry, particularly in commercial lending, will be significantly affected. Successful auctions could signify improved loan demand and potentially lead to lower interest rates for borrowers. Construction industries may also experience a ripple effect. New development projects could emerge based on the auction’s outcomes and the market’s subsequent response, impacting labor demands and construction activity.

Furthermore, the potential for land re-zoning or redevelopment following auction sales could alter the landscape of certain urban areas.

Investment Opportunities

The auction presents several potential investment opportunities. Properties acquired through the auction could provide significant returns through rental income, redevelopment, or resale. The auction may uncover undervalued assets or properties poised for appreciation in the future. Successful investors often scrutinize the local market conditions, development plans, and potential for long-term growth when evaluating such opportunities. Identifying properties with high occupancy rates, strong lease agreements, and strategic locations is key to potential profit.

Long-Term Implications

The long-term implications of the auction outcome are substantial. Successful auctions could reshape the commercial real estate landscape in the region. They may also establish new benchmarks for pricing and valuation, influencing future transactions and setting precedents for similar events. The auction could reveal market trends, providing valuable insights for future investments. For example, the auction outcome could confirm or disprove prevailing market theories and forecasts.

Potential Investment Opportunities Table

| Asset Category | Potential Opportunity | Investment Strategy | Estimated Return (Illustrative) |

|---|---|---|---|

| Prime Retail Space | High occupancy rates, strong lease agreements, and strategic location. | Strategic leasehold improvements and management. | 15-20% annual return (based on comparable properties). |

| Industrial Warehouse | Increasing demand for warehousing in growing e-commerce sector. | Lease the space to businesses in the warehousing sector. | 10-15% annual return (based on lease agreements and market trends). |

| Underutilized Commercial Building | Potential for redevelopment or re-zoning. | Collaborate with architects and developers for a feasibility study. | 20-30% return (depending on the redevelopment project and market value increase). |

Visual Representation

Asia4Sale’s public commercial auction needs a compelling visual identity to attract potential buyers and showcase the diverse assets on offer. The visuals must clearly communicate the auction’s scope, process, and the value proposition for participants. Strong visuals will create an engaging experience and build trust in the auction platform.

Ideal Auction Site and Surroundings

The visual representation of the auction site should evoke a sense of opportunity and professionalism. Imagine a vibrant cityscape, perhaps with a prominent landmark in the background, highlighting the location’s strategic position. The site itself could be depicted as a modern, well-maintained area, suggesting that the properties offered are in good condition. The image should include details like clear signage for the auction event, highlighting the auction venue’s accessibility and visibility.

This creates a sense of legitimacy and excitement.

Auction Process Flow Graphic

This graphic should visually guide prospective bidders through the key stages of the auction process. A clear, step-by-step flowchart would be ideal. Each stage should be illustrated with simple icons or symbols, making it easy to understand the progression from initial registration to bidding, to final sale. The flow should highlight key deadlines and milestones, encouraging engagement and ensuring bidders understand the process.

Example of Commercial Property

The image showcasing the type of commercial property being auctioned should be high-quality and realistic. For example, a modern office building with a contemporary design, or a well-maintained warehouse with ample space and loading docks, would be appropriate. The image should clearly demonstrate the property’s size, features, and potential, while adhering to professional real estate photography standards. Key details such as the building’s exterior, parking areas, and proximity to public transportation should be clearly depicted.

Asian Commercial Real Estate Market Trends Infographic

The infographic should visually represent the trends in the Asian commercial real estate market. A combination of charts, graphs, and icons can illustrate key market factors. For instance, a line graph could track the growth of rental rates in key cities over time. Pie charts might show the distribution of property types in the market, highlighting the demand for specific assets.

Symbols or icons can represent important developments, such as new infrastructure projects or changes in government policies. The infographic should be designed in a visually appealing way, using contrasting colors and clear labels to ensure readability and comprehension. Examples could include the impact of e-commerce on warehouse demand, or the growth of co-working spaces in urban centers.

Wrap-Up

In conclusion, Asia4sale’s public commercial auction presents a unique window into the dynamic Asian commercial real estate market. The diverse range of properties, transparent auction process, and significant market context provide compelling reasons for investors to engage. The potential for significant returns and the influence on future transactions underscore the importance of understanding the intricacies of this auction.

Whether you’re an experienced investor or a newcomer to the scene, this auction warrants careful consideration.