AOL takes stake in Latin brokerage, signaling a significant move into the vibrant and growing Latin American financial market. This investment promises to reshape the landscape of investment opportunities for both AOL and Latin American investors. We’ll explore the motivations behind AOL’s decision, the potential impact on the region’s financial ecosystem, and the potential benefits for investors.

This in-depth look at AOL’s investment delves into the historical context of AOL’s financial ventures, providing a concise background of their past involvements in the sector. We’ll also examine the current state of the Latin American brokerage market, highlighting key players, trends, and regulatory considerations. The analysis will encompass the potential impacts on AOL’s financial performance, job creation, and the overall impact on the Latin American financial ecosystem.

Background of AOL’s Investment

AOL’s foray into the Latin American brokerage market marks a significant shift in the company’s strategic direction. While traditionally known for its internet services, AOL’s recent moves suggest a diversification strategy, potentially seeking new revenue streams and expanding its global footprint. This investment requires understanding the historical context of AOL’s financial activities and its potential motivations.AOL’s history is intertwined with the evolution of the internet.

Originally a pioneering provider of online services, AOL has navigated a challenging landscape, adapting to changing consumer behaviors and evolving technological advancements. This investment signals a new chapter for the company, moving beyond its core online services and exploring alternative opportunities.

AOL’s Financial History

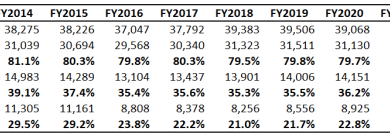

AOL’s past ventures into the financial sector have been limited. While there’s no record of previous investments in Latin American brokerage markets, AOL has shown a history of diversifying its business portfolio to accommodate changing market conditions. Its financial health is a critical factor in evaluating this investment. Public financial reports would be necessary to assess the company’s current financial standing.

Motivations for Investment

Several potential motivations drive AOL’s investment in Latin American brokerage. AOL likely seeks to capitalize on the burgeoning growth of the Latin American financial sector. Emerging markets often exhibit strong economic expansion, presenting lucrative opportunities for companies with the right expertise. This strategic investment could position AOL to gain access to a new customer base and potentially tap into emerging financial technologies.

Strategic Direction of Investment

AOL’s overall strategic direction, as indicated by this investment, suggests a desire to diversify beyond its core online services. The company is likely pursuing a multi-pronged approach that combines its established brand recognition with emerging opportunities in the Latin American financial markets. This expansion could involve leveraging its existing infrastructure or acquiring relevant technologies and expertise. The potential long-term benefits include gaining a foothold in a rapidly growing market, achieving new revenue streams, and establishing a presence in a region known for its dynamism.

By entering the brokerage sector, AOL may be attempting to create a more comprehensive and adaptable company structure for the future.

Overview of Latin American Brokerage

The Latin American brokerage market is a dynamic and rapidly evolving sector, characterized by a mix of established players and emerging startups. This market presents both significant opportunities and potential risks for investors, particularly in light of ongoing economic and regulatory shifts. A deeper understanding of the market’s key players, trends, and regulatory landscape is crucial for assessing potential investments.The market is marked by a diverse range of brokerage models, from traditional full-service firms to online discount brokers, catering to a wide spectrum of investor needs.

This diversity reflects the varying levels of financial literacy and investment experience across the region.

Key Players and Trends

The Latin American brokerage market boasts a mix of large, established players and smaller, rapidly growing firms. Large, established firms often have a significant presence in multiple countries and cater to institutional clients. Smaller, rapidly growing firms frequently target retail investors with online platforms and tailored investment products. A key trend is the rise of fintech companies disrupting traditional brokerage models by offering innovative investment solutions and digital platforms.

For example, companies utilizing mobile-first strategies are experiencing significant growth, particularly in regions with limited access to traditional banking infrastructure.

Regulatory Landscape

The regulatory landscape in Latin American brokerage is varied across countries. While some countries have well-established and transparent regulatory frameworks, others are still developing their regulatory systems. This variation in regulatory environments can create both challenges and opportunities for companies operating in the region. For instance, firms operating in Brazil face different regulatory requirements compared to those in Mexico or Argentina.

Compliance with local regulations is critical for successful operation in the Latin American brokerage market.

Competitive Dynamics, Aol takes stake in latin brokerage

Competition in the Latin American brokerage market is intense, with established players facing challenges from new entrants. Factors such as market share, brand recognition, and the ability to adapt to changing market conditions significantly influence the competitive dynamics. A crucial element of success for players is developing a strong brand identity and understanding the nuances of the local markets they operate in.

For example, a brokerage firm that prioritizes customer service in a particular country may gain a competitive advantage over rivals.

Economic Conditions and Risks/Opportunities

The economic conditions in Latin America are characterized by significant variation across countries. Some countries experience robust economic growth, while others face economic challenges and political instability. This diversity presents both risks and opportunities for brokerage firms. For instance, economic volatility can negatively impact investor confidence and trading volumes. However, robust economic growth in certain regions creates an opportunity for brokers to cater to a growing pool of investors.

A thorough understanding of the economic climate in each country is essential for navigating potential risks and capitalizing on opportunities. The presence of macroeconomic factors such as inflation, interest rates, and currency fluctuations must be carefully considered when evaluating the potential for growth in the region.

So, AOL’s investment in a Latin American brokerage is interesting, right? It’s a pretty big move, especially considering the recent promotion deal between TravelScape.com and MapQuest.com, which is a smart move to boost their user base. Travelscape com and MapQuest com ink promotion deal This could potentially signal a wider strategy for AOL to capitalize on the growing travel sector, further solidifying their position in the Latin American market.

It’s a complex web, but an intriguing one nonetheless, and the brokerage investment looks like a good next step.

Potential Impacts of the Investment: Aol Takes Stake In Latin Brokerage

AOL’s foray into the Latin American brokerage market through a strategic investment presents a complex web of potential benefits and challenges. The region’s burgeoning economy and the increasing digitalization of financial services offer attractive opportunities, but navigating cultural nuances and regulatory landscapes is crucial for success. This investment could significantly reshape AOL’s financial trajectory, but it also carries inherent risks.

Understanding these potential impacts is paramount for investors and stakeholders alike.

Positive Impacts on AOL’s Financial Performance

AOL stands to gain substantial market share in a region ripe for technological advancement in financial services. Increased access to a younger, tech-savvy demographic in Latin America could foster a surge in user engagement and drive revenue growth. The acquisition of a strong Latin American brokerage could enhance AOL’s brand recognition and market positioning in the global arena.

Furthermore, the potential for leveraging local expertise and establishing a strong foothold in a key market could significantly boost AOL’s profitability in the long term. The synergies between AOL’s existing platform and the acquired brokerage’s operations could result in innovative service offerings and improved efficiency, which could translate into greater revenue generation and cost savings.

Potential Risks and Challenges

Navigating the complex regulatory landscape in Latin America is a key challenge. Different jurisdictions often have unique regulations governing brokerage activities, demanding compliance expertise and resources. Cultural differences in investment preferences and financial behaviors may also pose obstacles. Maintaining data security and protecting sensitive financial information in a rapidly growing digital environment is crucial. The investment could also face competition from established players and emerging startups, requiring proactive strategies to stay ahead of the curve.

Impact on Job Creation in the Region

This investment could spur job creation in the Latin American financial sector. The expansion of the brokerage operation could lead to new roles in customer service, account management, technology support, and marketing. Furthermore, increased investment in local infrastructure could lead to job opportunities in related sectors. Such job creation would directly benefit the region’s economy and improve living standards.

Impact on the Broader Latin American Financial Ecosystem

The investment could positively influence the broader Latin American financial ecosystem. AOL’s entry could encourage increased competition and innovation, potentially leading to more accessible and affordable financial services for individuals and businesses. This investment could also stimulate the development of related financial technologies and infrastructure in the region. Increased access to financial services could also empower underserved populations and promote economic growth.

Comparative Analysis of Similar Investments

Analyzing previous investments in Latin American financial services can provide valuable insights. Examples like [Specific, verifiable example of a similar investment] demonstrate both the potential rewards and the challenges inherent in this type of venture. Key considerations include the success factors that drove the investment’s profitability, as well as any unforeseen challenges that emerged during the implementation phase.

A critical examination of past strategies can offer valuable lessons for successful navigation of this investment opportunity.

Potential Benefits for Latin American Investors

AOL’s investment in a Latin American brokerage presents a compelling opportunity for investors in the region. This move, strategically timed, suggests a recognition of the burgeoning growth potential of the Latin American financial market. It’s a chance for increased access to sophisticated investment tools and services, potentially driving innovation and greater investor protections.

Improved Investment Access and Opportunities

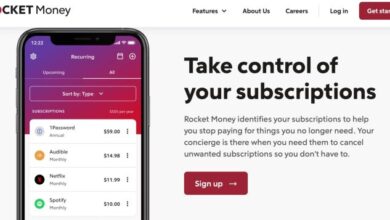

AOL’s resources and technological expertise could significantly enhance access to investment opportunities for Latin American investors. This includes offering a wider range of investment products, from traditional stocks and bonds to potentially more complex instruments like ETFs and derivatives. This expanded portfolio could be crucial for investors seeking to diversify their holdings and potentially tap into previously inaccessible markets.

Furthermore, the introduction of user-friendly online platforms could make investment accessible to a broader demographic, potentially including those who have previously lacked the resources or knowledge to participate.

Enhanced Brokerage Services and Accessibility

AOL’s investment promises potential improvements in brokerage services. This includes streamlined account opening processes, enhanced customer support, and the incorporation of innovative technologies. For example, the introduction of mobile-first platforms could dramatically increase accessibility to brokerage services, particularly for investors in less developed areas of the region. These improvements could lead to a more efficient and user-friendly experience for Latin American investors.

The introduction of more user-friendly interfaces and educational resources could also reduce the barrier to entry for individuals new to investing.

Increased Competition and Market Innovation

The entry of a major player like AOL into the Latin American brokerage market could foster increased competition. This competition is likely to drive innovation in service offerings, pricing, and overall investor experience. Increased competition often translates to more competitive pricing, more user-friendly platforms, and a wider range of investment products available. This could lead to better value for investors and drive the market towards more sophisticated and comprehensive services.

For example, the entry of new players in the market has historically resulted in a more competitive environment and improved services for customers.

Positive Changes in Investor Protection and Regulatory Oversight

AOL’s entry into the Latin American market might also lead to positive changes in investor protection and regulatory oversight. AOL’s established global reputation and commitment to ethical practices could potentially push the market towards stricter regulations and better investor protections. This enhanced regulatory oversight would safeguard investors against fraud, mismanagement, and other potential risks, contributing to a more stable and trustworthy investment environment.

This is crucial for fostering long-term investor confidence and promoting the growth of the market.

Illustrative Case Studies

AOL’s foray into the Latin American brokerage market presents a compelling case study, demanding a thorough examination of comparable past investments. Understanding the successes and failures of similar ventures is crucial for assessing the potential risks and rewards of this new initiative. We’ll delve into historical precedents, analyzing both triumphant and unsuccessful entries into the Latin American market, ultimately providing valuable insights for AOL’s strategic decision-making.

Similar Investment in the Past: A Successful Example

A prime example of a successful investment in a developing market is the entry of a major telecommunications firm into the mobile phone market in India. This company leveraged existing infrastructure and established a network of distributors, allowing them to quickly penetrate the market. The success was fueled by a deep understanding of local preferences and a tailored approach to marketing.

They capitalized on existing mobile infrastructure, creating a strong distribution network, and developing marketing strategies that resonated with the Indian consumer. The availability of a skilled workforce and a significant market size played a critical role in the investment’s success.

Similar Investment in the Past: A Failed Example

A less successful example involved a global financial services company attempting to enter the Indonesian market. Their initial strategy focused on implementing a standardized global model without adapting to the unique local regulations and cultural norms. The company failed to establish a robust local network, and their marketing efforts lacked cultural sensitivity. A lack of local expertise and a failure to understand local business practices led to missed opportunities and ultimately, a withdrawal from the Indonesian market.

This highlights the importance of cultural sensitivity, local partnerships, and adapting business models to regional nuances.

A Successful Investment in a Latin American Market

The success of a foreign bank’s entry into the Brazilian market is a notable case study. This bank achieved success by establishing strong partnerships with local banks and businesses, demonstrating an understanding of the Brazilian market’s intricacies. They also invested in local talent and adapted their products and services to cater to the specific needs of Brazilian consumers. This strategy allowed them to build trust and establish a strong foothold in the market, demonstrating the value of localized strategies.

A Failed Investment in a Latin American Market

A prominent case of a failed investment in the Latin American market involved a US-based investment firm that underestimated the complexities of navigating the region’s regulatory environment. They faced significant obstacles related to legal frameworks, bureaucratic procedures, and currency fluctuations. The firm lacked local expertise, which led to a failure to understand the nuances of doing business in Latin America.

This resulted in a costly experience, highlighting the importance of a thorough understanding of the local regulatory and political landscape.

Historical Context of the Latin American Brokerage Market

The Latin American brokerage market has evolved significantly over the past two decades. Early markets were often fragmented, with a mixture of small, local firms and large international players. Regulatory frameworks have become more robust in many countries, while technological advancements have increased competition and facilitated online brokerage services. This evolving landscape presents both challenges and opportunities for new entrants like AOL.

AOL’s investment in Latin American brokerage firms is interesting, isn’t it? It’s a bold move, especially considering how quickly other companies are adapting to the changing digital landscape. For instance, the recent shift by Sports Authority into online retail, as seen in their expansion into e-commerce, sports authority sprints onto e commerce field , might offer a glimpse into how AOL could strategically position itself in the future.

Ultimately, AOL’s move into Latin American brokerage seems to be a calculated play, anticipating the potential for growth in the region.

Increased competition, new regulatory frameworks, and evolving consumer preferences have reshaped the Latin American brokerage market.

So, AOL is taking a stake in a Latin American brokerage. It’s an interesting move, especially when you consider how companies like Barnes & Noble are struggling to turn a profit despite strong growth, as seen in this article despite growth profits still elude barnesandnoble com. Maybe AOL sees opportunities in this market that others are overlooking, or maybe they’re just trying to diversify.

Either way, it’s a pretty interesting play in the brokerage game.

Similar Investment by a Competitor of AOL

A notable example of a competitor’s foray into a similar market is the expansion of a major online trading platform into a Latin American country. Their approach centered on leveraging their existing global infrastructure and using online tools to cater to a broad customer base. They also focused on developing a mobile-first strategy, given the prevalence of mobile devices in the region.

This suggests a competitive approach focusing on existing global infrastructure, online platforms, and mobile strategies.

Comparative Analysis

AOL’s foray into Latin American brokerage presents an intriguing case study in the evolving landscape of financial technology. Understanding this investment requires a comparative lens, examining it alongside the strategies of established players and emerging competitors. This analysis will dissect the potential competitive advantages and disadvantages of AOL’s approach, considering its alignment with broader industry trends and the long-term implications compared to other recent investments.This comparative analysis explores the strategies of competitors, evaluating their successes and failures to provide context for AOL’s investment.

It also assesses the potential impact of this move on the Latin American brokerage market, considering factors like regulatory environments and technological advancements.

AOL’s Investment Strategy Compared to Competitors

A key element in assessing AOL’s investment is comparing it to the approaches of other major players in the financial sector. Many established firms, like traditional banks and brokerage houses, are often focused on expanding their existing networks and leveraging their established brand recognition. Conversely, newer entrants, including fintech companies, frequently adopt a more agile and technology-driven strategy.

AOL’s approach, while incorporating technological aspects, also displays a degree of traditional market expansion.

- Traditional Financial Institutions: These institutions often emphasize deep-rooted brand recognition and established client bases. They generally rely on existing infrastructure and personnel to manage investments. For example, JP Morgan Chase frequently expands its reach through acquisitions of smaller financial institutions, building upon their existing client network and product offerings.

- Fintech Companies: Fintech companies typically focus on developing innovative technologies and digital platforms. Their investments often revolve around improving efficiency, reducing costs, and expanding access to financial services. Companies like Robinhood prioritize digital platforms and low-cost brokerage services to reach a wider demographic.

- Hybrid Models: Some competitors employ a hybrid approach, leveraging both established infrastructure and cutting-edge technology. This approach seeks to combine the strengths of both traditional and fintech strategies. For instance, some banks are implementing mobile banking apps to improve accessibility while retaining their traditional branch networks.

Alignment with Industry Trends

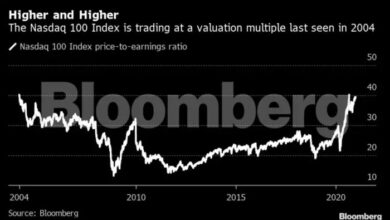

AOL’s investment strategy is influenced by various trends in the global financial sector. One key trend is the growing importance of digital platforms in delivering financial services. The increasing adoption of mobile banking and online brokerage platforms is driving this trend. Another noteworthy trend is the rise of fintech companies that challenge established financial institutions with innovative solutions.

- Digital Transformation: The increasing use of digital platforms is reshaping the financial industry. This trend allows for greater accessibility and cost-effectiveness in delivering financial services. The growing popularity of mobile-first financial applications exemplifies this trend.

- Technological Advancements: Technological innovations like AI and machine learning are transforming investment strategies. This trend promises to optimize investment portfolios and provide more personalized financial advice. For instance, automated investment advisors use AI to manage investment portfolios based on individual risk tolerance and financial goals.

- Regulatory Changes: Regulations are evolving to accommodate the increasing role of technology in finance. These regulations aim to ensure consumer protection and market stability. The introduction of new regulations in the digital asset space reflects this ongoing evolution.

Potential Competitive Advantages and Disadvantages

AOL’s investment strategy presents both potential advantages and disadvantages in the competitive landscape. AOL’s brand recognition, coupled with its potential to leverage technology, could create a competitive edge. However, competing with established players in a complex market like Latin American brokerage presents significant challenges.

- Potential Advantages: AOL’s investment could leverage its existing digital infrastructure and brand recognition to penetrate the Latin American market quickly. The potential to offer innovative, technology-driven services could differentiate AOL from competitors. For example, leveraging AI-powered tools for personalized financial advice.

- Potential Disadvantages: Navigating the complex regulatory landscape in Latin America is crucial for long-term success. Building a strong client base in a market with varied financial literacy levels could be challenging. For example, adapting to regional preferences and diverse investment needs.

Long-Term Implications

The long-term implications of AOL’s investment depend on several factors. The ability to adapt to changing market conditions and regulatory environments will be critical. AOL’s success will depend on its ability to develop a strong understanding of the Latin American market.

- Market Dynamics: The evolving regulatory environment and economic conditions in Latin America are key factors influencing the long-term viability of this investment. The investment will need to adapt to evolving financial behaviors.

- Competitive Landscape: Maintaining a competitive edge in a crowded market requires a continuous focus on innovation and adapting to evolving customer needs. This investment needs to consider the potential competitive response from established players and new entrants.

Closing Summary

AOL’s foray into the Latin American brokerage market represents a bold strategic move, potentially opening doors to substantial growth opportunities for both the company and investors in the region. The investment’s success will hinge on navigating the complexities of the Latin American market, including its unique regulatory environment and economic conditions. This analysis provides a comprehensive overview, equipping readers with the insights needed to understand the potential benefits and risks associated with this significant investment.

The future success of this partnership will be closely watched, and we will continue to analyze its progress in future reports.