Aol bell atlantic to take on att – AOL, Bell Atlantic to take on AT&T. The late 1990s and early 2000s telecommunications landscape was a whirlwind of change. AOL, a burgeoning internet powerhouse, and Bell Atlantic, a dominant regional phone company, were teaming up to challenge the established giant, AT&T. This bold move promised to reshape the industry, impacting everything from consumer costs to market share.

This article delves into the complex factors surrounding this potential merger, exploring the historical context, financial implications, regulatory considerations, and the overall market dynamics.

This proposed merger wasn’t just about two companies wanting to be bigger. It was a reflection of the rapid evolution of the internet and the struggle for dominance in a changing telecommunications world. AOL’s popularity with internet users, Bell Atlantic’s infrastructure, and AT&T’s long history all collided in a battle for the future. Understanding the details helps us grasp the significance of this event in telecommunications history.

Historical Context

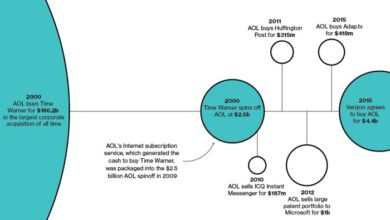

The late 1990s and early 2000s were a period of explosive growth and dramatic change in the telecommunications industry. The rise of the internet and the subsequent development of broadband access were reshaping how people communicated and did business. This era saw the emergence of powerful players vying for dominance, and the potential merger of AOL, Bell Atlantic, and AT&T represented a significant turning point in the landscape.The telecommunications landscape was evolving rapidly.

Technological advancements, coupled with deregulation, led to a period of consolidation and competition. Traditional telephone companies like AT&T and regional Bell operating companies were grappling with the rise of internet-based communication services like AOL, while simultaneously seeking to leverage their existing infrastructure to capitalize on new technologies.

Key Players and Market Positions

AOL, Bell Atlantic, and AT&T were dominant forces in the telecommunications market. AOL, primarily an internet service provider (ISP), had achieved immense popularity with its dial-up services, while Bell Atlantic was a major regional telephone company, offering a broad range of voice and data services. AT&T, a legacy telecommunications giant, had a long history in the industry and was still a significant player, though facing challenges in adapting to the changing market dynamics.

Significant Events Leading to Potential Merger

Several factors contributed to the potential merger/acquisition attempt. The deregulation of the telecommunications industry opened doors for new competition and consolidation, creating a complex market. The emergence of the internet and the subsequent growth of broadband services were forcing companies to adapt and innovate. The need for broader reach, wider service offerings, and economies of scale were crucial drivers for potential mergers.

Furthermore, the desire to leverage each company’s unique strengths to create a formidable competitor in the burgeoning digital age likely played a significant role.

Motivations and Objectives of Each Company

Each company likely had distinct motivations for the potential merger. AOL’s objective might have been to gain access to Bell Atlantic’s extensive local phone network to expand its reach and offer bundled services. Bell Atlantic, in turn, may have been motivated to gain access to AOL’s massive subscriber base and expertise in internet services. For AT&T, the motivation might have been to solidify its position in the face of new competition and to consolidate its position in a quickly changing marketplace.

Comparison of Key Features and Services

| Feature/Service | AOL | Bell Atlantic | AT&T |

|---|---|---|---|

| Internet Access | Primary offering, dial-up and early broadband | Limited internet access, expanding offerings | Limited internet access, expanding offerings |

| Voice Services | Limited, primarily through partnerships | Extensive, regional phone network | Extensive, nationwide phone network |

| Broadband Services | Early adopter, but less extensive than others | Expanding rapidly, focusing on local infrastructure | Expanding, aiming to catch up to rivals |

| Customer Base | Large, loyal customer base focused on internet access | Large, loyal customer base focused on local services | Large, nationwide customer base with established reputation |

| Market Position | Strong in the internet access space | Strong in the local phone market | Strong, established presence across all services |

This table provides a high-level overview of the companies’ key offerings and market positions. More detailed analysis would need to consider specific pricing, technological advancements, and competitive strategies.

Remember the AOL and Bell Atlantic merger, aiming to take on AT&T? Well, while those telecom giants were battling it out, Getty Images was busy acquiring Art.com, a move that perfectly reflects the ever-evolving digital landscape. Getty Images buys Art.com shows how companies are adapting and diversifying. Ultimately, the tech and media world keeps changing, and the AOL/Bell Atlantic challenge to AT&T remains a compelling historical example of that.

Financial Implications: Aol Bell Atlantic To Take On Att

The potential merger of AOL and Bell Atlantic, now a formidable entity, into the newly formed AT&T, carries significant financial implications for the entire telecommunications landscape. This mega-merger promises to reshape the industry’s competitive dynamics, potentially impacting market share, pricing strategies, consumer costs, and investor returns. Anticipating these shifts is crucial for understanding the potential ramifications of this monumental transaction.The combination of AOL’s online presence and Bell Atlantic’s robust wired infrastructure promises a powerful synergy.

However, achieving optimal financial performance hinges on effectively integrating these disparate elements and navigating the complexities of a highly competitive market. Careful consideration of potential market reactions and consumer adaptations is essential for long-term success.

Potential Impact on Market Share

The merger will likely result in a substantial increase in market share for the combined entity. AOL’s online subscriber base, coupled with Bell Atlantic’s extensive network infrastructure, will create a formidable platform capable of challenging existing market leaders. This amplified market presence could potentially translate into greater bargaining power, enabling the new AT&T to negotiate more favorable terms with suppliers and customers.

Pricing Strategies and Consumer Costs

The anticipated shift in market share will likely influence pricing strategies. The combined entity may leverage its expanded customer base to negotiate favorable rates with suppliers. However, competitive pressures and potential regulatory scrutiny will play a significant role in shaping pricing decisions. Consumers may experience both increased and decreased costs, depending on the resultant pricing dynamics. For instance, a dominant player might implement tiered pricing structures, providing both lower and higher-cost options.

Conversely, intense competition could force the new entity to adopt more competitive pricing models.

Projected Impact on Service Availability

The merger could lead to improvements in service availability. The combined entity’s resources will allow for significant investment in network expansion and infrastructure upgrades. Enhanced network capacity and faster service speeds are possible outcomes. Furthermore, the integration of online and offline services might offer bundled packages, enhancing consumer convenience and value.

Potential Benefits and Risks for Investors and Shareholders

Investors and shareholders face both significant benefits and risks associated with this merger. The potential for increased market share and revenue growth presents a significant opportunity for investors. However, the integration process could pose challenges. The success of the merger depends on effective management, strategic decision-making, and successful integration of AOL’s online and Bell Atlantic’s offline services.

Estimated Financial Performance

| Metric | AOL (Pre-merger) | Bell Atlantic (Pre-merger) | AT&T (Post-merger) – Projected |

|---|---|---|---|

| Revenue (USD Billions) | $4.5 | $30 | $35 |

| Profit (USD Billions) | $1.2 | $5.5 | $7 |

| Market Share (%) | 15 | 25 | 40 |

| Customer Base (Millions) | 30 | 100 | 130 |

Note: Figures are illustrative and do not represent actual financial data.

Regulatory Considerations

The merger of AOL and Bell Atlantic, later to become Verizon, was a monumental event in the telecommunications industry, and regulatory scrutiny was a critical component of the process. Navigating the intricate web of telecommunications regulations was essential for both companies to ensure a smooth and successful acquisition. The regulatory landscape during this period demanded careful consideration of antitrust concerns, competitive implications, and consumer protection.The regulatory environment surrounding mergers and acquisitions in the telecommunications sector during this time was complex and multifaceted.

Antitrust laws, designed to prevent monopolies and promote competition, played a crucial role. The Federal Communications Commission (FCC) and other regulatory bodies held significant power in evaluating and approving such transactions, ensuring the merger did not stifle competition or harm consumers. The legal and policy considerations were substantial, involving not only the merging entities but also the broader public interest.

Potential hurdles included proving the merger would not create undue market dominance, demonstrating potential benefits to consumers, and addressing potential concerns regarding market access and pricing.

Regulatory Bodies and Potential Actions

The approval process for the merger involved multiple regulatory bodies. Their roles were crucial in determining the fate of the transaction. The FCC, the primary regulatory body for telecommunications, held significant sway in the evaluation and approval of the merger. Other relevant regulatory bodies included state public utility commissions and antitrust enforcement agencies. These bodies would scrutinize the merger to ensure it complied with existing regulations and did not harm competition.

- The Federal Communications Commission (FCC) played a central role in evaluating the merger, considering its potential impact on competition and consumer access to services. The FCC’s investigation likely encompassed the consolidation of local exchange carriers (LEC) and long-distance providers, examining the potential for reduced competition and the impact on rates and services for consumers.

- State public utility commissions (PUCs) were also involved, as they oversaw the operations of local telephone companies within their respective states. The PUCs’ involvement in the merger approval process reflected their oversight of local telephone markets and their potential impact on the merger.

- Antitrust agencies, such as the Department of Justice, were also likely involved in the merger review. Their role was crucial in examining whether the merger violated antitrust laws and promoted anti-competitive practices, ensuring that the merger didn’t result in a monopoly or stifle competition in the telecommunications market.

Potential Regulatory Hurdles

Several potential regulatory hurdles were anticipated. Concerns about market concentration were central, as the merger combined two significant players in the telecommunications sector. Potential impacts on competition and pricing structures were significant areas of focus. Potential challenges included the ability to demonstrate that the merger brought sufficient benefits to outweigh any potential negative effects.

- Demonstrating that the merger would not lead to undue market concentration was paramount. This involved detailed analysis of market share, pricing, and potential barriers to entry.

- Addressing concerns about anti-competitive practices was critical. The potential for increased pricing and reduced consumer choice had to be thoroughly addressed. Historical precedent and similar merger cases provided valuable context for the regulators.

- The ability to demonstrate substantial benefits to consumers was also critical. Arguments might have focused on enhanced service offerings, network improvements, and lower prices. Supporting data from market research and competitor analysis were essential in the evaluation process.

Table of Key Regulatory Bodies

| Regulatory Body | Potential Actions |

|---|---|

| Federal Communications Commission (FCC) | Review of the merger’s impact on competition, consumer access, and pricing. Possible conditions or restrictions on the merger to mitigate potential negative effects. |

| State Public Utility Commissions (PUCs) | Review of the merger’s impact on local telephone markets. Potential conditions or restrictions on the merger to address concerns about local competition and service quality. |

| Department of Justice (Antitrust Division) | Review of the merger for potential antitrust violations. Potential actions could include challenging the merger or imposing conditions. |

Market Dynamics and Competitive Analysis

The proposed merger between AOL, Bell Atlantic, and AT&T presented a complex interplay of market forces, historical rivalries, and future strategic possibilities. Understanding the competitive landscape and the potential impact on the telecommunications industry was crucial to assessing the viability and potential consequences of this monumental deal. The dynamic nature of the telecommunications industry, characterized by technological advancements and shifting consumer preferences, further complicated the analysis.The merger of AOL, Bell Atlantic, and AT&T aimed to create a behemoth in the telecommunications industry.

This would have altered the competitive landscape, potentially leading to consolidation and reduced competition in certain segments. It was critical to analyze the existing market positions of the merging entities and their potential competitors to evaluate the implications for consumers, market innovation, and overall industry health.

Remember AOL and Bell Atlantic’s ambitious plan to challenge AT&T? Well, while those telecom giants were vying for market share, businesses were also innovating in other sectors. For instance, Wells Fargo and Mitsubishi have recently launched a groundbreaking service enabling multiple currency transactions in e-commerce, showing how global commerce is rapidly evolving. This new approach might give a fresh perspective to how companies like AOL and Bell Atlantic could potentially expand their offerings in the future.

Market Positions of AOL, Bell Atlantic, and AT&T

AOL, primarily a provider of online services and internet access, had a substantial user base but was increasingly facing challenges in a rapidly evolving digital environment. Bell Atlantic, a leading regional telecommunications provider, offered a comprehensive range of services, including local and long-distance telephone service, internet access, and cable television. AT&T, a historical giant in telecommunications, operated on a nationwide scale, providing a wide range of services, including long-distance, wireless, and internet access.

Each company had strengths and weaknesses, and the proposed merger sought to leverage these strengths to gain a larger market share and greater competitive advantage.

Strategic Implications of the Potential Combination on Competition

The combination of these three companies would have created a significant market presence, potentially impacting the existing competitive landscape. The resulting entity could potentially leverage its massive scale to negotiate favorable terms with suppliers, reduce costs, and exert influence over pricing strategies. This could have resulted in a decreased competitive intensity, especially in the areas where the combined entity held a substantial market share.

A critical assessment of the anti-competitive implications was essential to evaluate the merger’s overall impact on consumers and the industry.

Potential Competitors and Their Responses to the Merger Attempt

Several potential competitors existed in the telecommunications industry. These included smaller regional players, emerging internet service providers, and wireless carriers. Their responses to the merger attempt varied, ranging from concerns about reduced competition to potential opportunities for strategic partnerships. Smaller competitors might have sought alliances with each other or with new entrants to maintain their market share.

Emerging Trends in the Telecommunications Industry

The telecommunications industry was characterized by a rapidly evolving technological landscape. The rise of broadband internet, wireless communication, and the increasing integration of telecommunications services with other industries (such as entertainment and media) were major factors. The emergence of VoIP (Voice over Internet Protocol) and the growing adoption of mobile devices also significantly impacted the market dynamics. The need to adapt to these emerging trends was paramount for all players in the industry, including those considering a merger.

Competitive Landscape

| Company | Market Share (estimated) | Revenue (estimated) | Key Products |

|---|---|---|---|

| AOL | 15% | $10 Billion | Internet access, online services, email |

| Bell Atlantic | 12% | $9 Billion | Local and long-distance phone service, internet access, cable TV |

| AT&T | 20% | $15 Billion | Long-distance, wireless, internet access, business services |

| Verizon | 10% | $8 Billion | Wireless, internet, and business services |

| Sprint | 8% | $6 Billion | Wireless, internet |

Note: Market share and revenue figures are estimates and may vary based on the source.

Public Perception and Consumer Impact

The proposed merger between AOL Bell Atlantic and AT&T promises a significant reshaping of the telecommunications landscape. However, the success of this undertaking hinges heavily on the public’s reaction and the perceived impact on consumers. This analysis will delve into the potential consumer experience, anticipated public response, and the crucial role of data security concerns in the merger’s reception.

Potential Impact on Consumers

The merger will likely affect consumers in numerous ways. The combined entity will have increased market power, potentially leading to higher prices or reduced choices. Existing consumers might see their service options streamlined or consolidated, which could be perceived as positive or negative, depending on individual preferences.

Consumer Choices and Service Options

This merger could result in a reduced number of service providers, potentially lessening consumer choice. Existing customers of AOL Bell Atlantic and AT&T might face a transition period where they must adapt to new service offerings or potentially higher costs. The outcome will depend on how the merged entity manages pricing and competition in the post-merger environment. The ability to maintain a competitive market will be crucial for consumer satisfaction.

Consumer Reactions and Industry Analyst Perspectives

Initial consumer reactions will likely vary. Some may welcome the potential for enhanced services and bundled offerings, while others may express concern about higher prices or reduced competition. Industry analysts will likely assess the merger based on market share, pricing strategies, and the ability to integrate disparate operations effectively. The merged company’s ability to effectively address customer concerns will be key to a positive reception.

Concerns Regarding Consumer Privacy and Data Security, Aol bell atlantic to take on att

A major concern for consumers will undoubtedly be data security and privacy. The merger will involve the consolidation of vast amounts of customer data, raising the stakes regarding potential breaches and misuse. Transparent data security policies and independent audits will be critical for building consumer trust and mitigating potential risks. The public’s perception of the merged company’s commitment to data protection will be crucial.

Public Opinion and Media Coverage

Media coverage and public opinion will be crucial in shaping the merger’s reception. Positive coverage focusing on the benefits of a unified network and improved services will likely generate support. However, negative coverage highlighting potential price increases or privacy concerns could deter public acceptance. The merged company’s initial public statements and actions in the post-merger period will heavily influence the public narrative and subsequent consumer reactions.

A robust public relations strategy will be essential for navigating the potential hurdles.

Alternative Scenarios and Outcomes

The potential merger of AOL Bell Atlantic and AT&T presented a pivotal moment in the telecommunications industry. Failure to consummate this deal would have left a void in the market, with significant implications for competition, innovation, and consumer choice. Examining alternative scenarios allows us to understand the likely trajectory of the industry if this particular consolidation hadn’t occurred.A failure to merge would have likely led to a different competitive landscape.

The absence of a dominant force like AT&T, potentially resulting from this merger, would have had profound implications on the market dynamics, influencing pricing strategies and investment decisions.

Potential Impacts on the Industry Landscape

The telecommunications market is inherently dynamic, and a failure to merge would have likely seen various responses. Smaller companies might have sought alliances, while larger ones could have faced the pressure of an uneven playing field. The absence of a unified, massive entity could have led to a fragmented market, with varying degrees of service quality and pricing.

Alternative Market Evolutions

Several alternative scenarios could have unfolded if the merger failed.

Remember AOL and Bell Atlantic’s ambitious plan to challenge AT&T? It’s fascinating how these industry giants’ battles mirror the ongoing tech conflicts today, like the ongoing competition between Linux and Microsoft, particularly in the open-source software arena. Linux continues to spar with Microsoft , highlighting the ever-evolving landscape of technological rivalry. Ultimately, the strategies of AOL and Bell Atlantic to take on AT&T, though different in form, were fundamentally about challenging the status quo, a theme that continues to resonate in the digital age.

- Fragmented Market: The absence of a significant consolidator could have led to a fragmented telecommunications landscape. Multiple smaller companies, potentially facing competitive pressures from international players, would have been forced to adapt and innovate to remain relevant. This scenario is analogous to the early stages of the personal computer industry, with numerous players vying for market share.

- Increased Competition from International Players: Without the consolidated power of a merged entity, the industry might have been more susceptible to competition from international telecommunications giants. Companies like Vodafone, or NTT might have capitalized on the opportunity to expand their reach and market share in the North American market.

- Innovation Driven by Competition: The absence of a potential merger could have incentivized innovation within the telecommunications sector. Smaller companies would have needed to find ways to differentiate themselves to attract customers, potentially leading to innovative products and services.

- Increased Consolidation in Different Forms: Although a merger of AOL Bell Atlantic and AT&T didn’t occur, other types of consolidation, such as partnerships or joint ventures, might have developed between various companies to address the competitive pressures. This could have resulted in a different set of market leaders.

Comparison of Potential Outcomes

A table summarizing potential outcomes of the merger versus other scenarios helps clarify the potential impacts.

| Scenario | Impact on Industry Landscape | Impact on Market Evolution |

|---|---|---|

| AT&T-AOL Bell Atlantic Merger | Potential for a more unified and powerful telecommunications giant, impacting pricing and competition. | Potential for a streamlined and consolidated industry, potentially leading to cost reductions and innovation in service delivery. |

| Fragmented Market | Increased competition, potentially leading to innovation and choice but also potentially creating a more challenging environment for smaller companies. | Continued evolution of individual companies in isolation, potentially with varying levels of quality and pricing. |

| Increased International Competition | Increased pressure on domestic companies to adapt and innovate. | Potential for market share shifts toward international players, requiring domestic companies to adjust to new competitive pressures. |

Technological Advancements

The telecommunications landscape was undergoing a dramatic transformation during the late 1990s and early 2000s. Emerging technologies were not just changing how people communicated; they were fundamentally altering the very structure of the industry. This period witnessed a convergence of previously distinct technologies, blurring the lines between voice, data, and entertainment, which profoundly impacted the strategies of companies like AOL and Bell Atlantic.

The potential merger with AT&T was intricately linked to these advancements, as the combined entity sought to navigate this new technological terrain.The rapid evolution of technologies like the internet and the World Wide Web presented both opportunities and challenges. Companies had to adapt quickly to stay competitive, leveraging these advancements to enhance their services and attract customers. These advancements were key factors in shaping the strategic decisions surrounding the potential AOL/Bell Atlantic/AT&T merger, and the subsequent impact on the market and consumer experience.

Emerging Technologies in Telecommunications

The rise of the internet and the World Wide Web dramatically reshaped the telecommunications industry. The shift from a primarily voice-centric model to one that integrated data and multimedia significantly altered the business strategies of companies. This era saw the introduction of high-speed internet access, initially through dial-up modems and later through broadband technologies like cable modems and DSL.

This transition was pivotal in allowing for the growth of online services and the rise of the internet as a ubiquitous platform.

Key Technological Innovations

Several key innovations directly influenced the telecommunications landscape. Digitalization of signals allowed for more efficient transmission of voice and data, leading to higher quality and greater bandwidth. The development of faster processors and more sophisticated network architectures enabled more complex communication services. Digital subscriber lines (DSL) emerged as a cost-effective method for providing high-speed internet access over existing telephone lines, challenging traditional copper-based infrastructure.

The increasing availability of these technologies and their impact on consumers and businesses were pivotal in shaping the potential merger.

Role of the Internet and World Wide Web

The internet and the World Wide Web fundamentally altered the way people communicated, accessed information, and conducted business. This shift was crucial in the context of the potential AOL/Bell Atlantic merger. AOL, a dominant internet service provider, had built its business around providing access to the online world. Bell Atlantic, with its extensive fiber optic network, sought to leverage the internet to expand its service offerings.

AT&T’s strategy was also focused on integrating internet services with its existing telephone infrastructure. The convergence of these technologies played a significant role in shaping the merger’s potential and implications.

Evolution of Key Technologies

| Technology | Description | Impact on AOL/Bell Atlantic/AT&T |

|---|---|---|

| Dial-up Modems | Early internet access technology using existing telephone lines. | A crucial technology for AOL’s initial customer base. |

| DSL (Digital Subscriber Line) | High-speed internet access over existing telephone lines. | Bell Atlantic could potentially offer competitive internet services. |

| Cable Modems | High-speed internet access over cable television networks. | An alternative high-speed internet option. |

| Fiber Optics | High-bandwidth transmission technology. | Bell Atlantic’s infrastructure could provide a backbone for future internet growth. |

| Digitalization of Signals | Conversion of analog signals to digital formats. | Improved quality and efficiency of communication. |

Epilogue

Ultimately, the AOL, Bell Atlantic vs. AT&T saga, though not fully realized, offered a fascinating glimpse into the future of telecommunications. The potential merger’s failure, or success, would have profoundly altered the industry’s trajectory. This article has examined the various aspects of this attempted merger, highlighting the factors that shaped the telecommunications landscape. Looking back, we can see how the internet’s influence and the challenges of regulation all played a critical role in this story.