AOL and banks sign new online agreement, marking a significant step in the digital financial landscape. This innovative partnership promises to reshape online banking experiences, offering both exciting possibilities and potential challenges. The agreement details intricate terms and conditions, impacting everything from consumer access to the competitive landscape of online financial services. We’ll explore the key provisions, background, and implications for consumers, businesses, and the future of online banking.

This new agreement between AOL and banks touches upon several key areas. From the agreement’s fundamental terms to the broader implications for the financial industry, we’ll dissect the potential benefits and drawbacks for both parties involved. The analysis includes a comprehensive look at the agreement’s impact on consumers, examining both potential opportunities and risks.

Overview of the Agreement

A new online agreement between AOL and various banks marks a significant step in the digital financial landscape. This agreement streamlines online banking services and potentially expands access to financial products for AOL’s user base. The specifics of the agreement aim to improve user experience and potentially drive revenue for both parties.This agreement Artikels the terms under which AOL will integrate banking services into its platform, providing users with a one-stop shop for their online financial needs.

It encompasses various aspects, from the technical integration of banking tools to the handling of user data and financial transactions. Key considerations involve security, user privacy, and the overall user experience.

Key Terms and Conditions

The agreement details the specific terms and conditions governing the integration of banking services within the AOL platform. These terms ensure a secure and transparent environment for users engaging in online financial transactions. The contract addresses the responsibilities of each party and Artikels the parameters of the agreement.

- Data Security: The agreement explicitly addresses data security protocols to protect user information. Robust encryption and secure storage methods are crucial elements of the agreement. Examples include 256-bit encryption for sensitive data transfer and regular security audits to maintain compliance with industry standards. This will directly affect both parties as user trust is paramount to the success of the partnership.

- Transaction Processing: The agreement establishes clear procedures for processing online transactions. This includes defining the responsibilities for handling user funds, processing fees, and dispute resolution. The agreement also lays out the expected response times for transaction processing and the means of communication for both parties should delays occur.

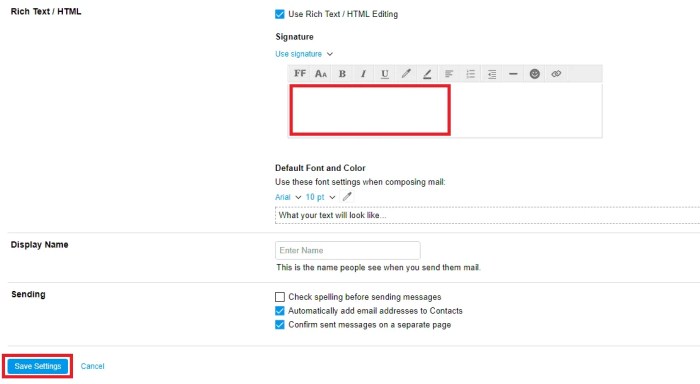

- User Experience: The agreement aims to enhance the user experience by integrating banking services seamlessly into the AOL platform. This includes intuitive navigation, simplified transaction flows, and user-friendly interfaces. This will affect both AOL and the banks, as a positive user experience is critical for attracting and retaining customers.

Potential Benefits and Drawbacks

The agreement presents several opportunities and challenges for both AOL and the banks involved.

- AOL Benefits: AOL gains access to a wider range of financial products and services, which can enhance its platform’s value proposition to users. Increased user engagement and potentially higher user retention are potential outcomes. A more comprehensive platform, including financial services, can differentiate AOL from its competitors.

- AOL Drawbacks: Integrating banking services can introduce new complexities and risks. Maintaining security protocols and compliance with financial regulations are essential concerns. The added responsibility for handling financial transactions will require careful management and monitoring.

- Bank Benefits: Banks gain access to a wider customer base through AOL’s user network. Increased brand visibility and potential for new customer acquisition are major benefits. Reaching a larger audience, especially younger demographics, is possible with AOL’s platform.

- Bank Drawbacks: The banks need to invest in integrating their systems with AOL’s platform. They must also manage the increased volume of transactions and potential security risks associated with a new channel. The cost of integration and maintenance must be weighed against the potential benefits.

Key Provisions of the Agreement

| Party | Description | Impact on AOL | Impact on Banks |

|---|---|---|---|

| AOL | Responsible for providing a secure platform for online banking services | Increased user engagement, potential for new revenue streams | Access to a larger customer base, increased brand visibility |

| Banks | Provide financial services and handle transactions | Integration of financial tools and services | Increased customer acquisition, expanded market reach |

| Both | Compliance with financial regulations and data security protocols | Maintain user trust, secure user data | Meet compliance standards, protect user data |

Background and Context: Aol And Banks Sign New Online Agreement

The digital financial landscape is rapidly evolving, with online banking and digital services becoming increasingly crucial for both consumers and financial institutions. This agreement between AOL and various banks signifies a strategic move within this dynamic environment, reflecting the ongoing transformation of how people interact with their finances.The current financial landscape is characterized by a high demand for convenient and secure online banking solutions.

Consumers are seeking seamless access to their accounts, 24/7 availability, and personalized financial management tools. This has led to a surge in the adoption of mobile banking and other digital financial services, placing significant pressure on traditional institutions to adapt.

Current Financial Landscape for Online Banking

The online banking sector is experiencing significant growth, driven by factors such as increasing smartphone penetration, rising internet usage, and the desire for greater financial convenience. This evolution has led to a competitive marketplace, where institutions are vying for market share through innovative features and user-friendly interfaces. New entrants are also challenging established players, further fueling the need for robust digital strategies.

Recent Trends and Developments in Online Banking

Several trends are shaping the online banking sector. The rise of open banking, allowing consumers to share financial data with third-party providers, is gaining momentum. Biometric authentication and AI-powered fraud detection are becoming more prevalent, enhancing security and streamlining the customer experience. Moreover, the integration of fintech solutions into banking platforms is becoming increasingly common, expanding the range of services offered to customers.

AOL’s Market Position Compared to Competitors

AOL’s current market position in the digital realm is being reassessed. The company has a history in internet services but faces competition from established tech giants like Google and Meta in the digital space. AOL’s strengths and weaknesses in the online banking sector need to be evaluated in relation to competitors. Success in this new venture hinges on building a strong brand identity and offering unique value propositions to consumers.

Significance of Online Banking Partnerships

Strategic partnerships between online platforms and banks are essential for both parties. Banks gain access to a wider customer base and a new distribution channel, reaching consumers through a platform with existing user engagement. For AOL, these partnerships represent an opportunity to expand its offerings and establish a more robust financial services presence.

AOL’s History in Online Financial Services

A thorough examination of AOL’s previous involvement in online financial services is necessary. This includes investigating past partnerships, product launches, and market responses. This historical analysis is critical to understanding AOL’s current approach and the potential success of this new agreement.

So, AOL and the banks have inked a new online agreement. This sort of thing is pretty common, but it’s interesting to consider how this impacts smaller businesses, especially when you look at the recent trend of smaller booksellers uniting against online giants like Amazon. Smaller booksellers unite against online giants are pushing back against the overwhelming market share held by these massive online retailers.

Ultimately, this new AOL and bank deal will likely have a similar effect on the online landscape, creating a dynamic playing field for smaller businesses and changing how we interact with the digital world.

Types of Banks Involved in the Agreement

| Type of Bank | Description |

|---|---|

| Regional Banks | Banks with a limited geographic footprint, often focusing on a specific region or state. |

| National Banks | Banks with a nationwide presence, serving customers across the country. |

| International Banks | Banks operating in multiple countries, offering global banking services. |

This table provides a basic overview of the types of banks participating in the agreement. Further details on individual bank involvement would require specific information from the agreement itself.

So, AOL and the banks are partnering on a new online agreement. This new initiative is interesting, especially considering how tech companies are always adapting to new threats. For example, similar to the proactive approach of IBM and Symantec teaming up to battle the Melissa virus, IBM and Symantec’s joint efforts to counter the Melissa virus are a good example of how collaboration can lead to innovative security solutions.

Ultimately, this new AOL and bank agreement seems like a smart move to strengthen online security for their users.

Implications for Consumers

This new online agreement between AOL and banks presents a mixed bag for consumers. While promising enhanced convenience and potentially lower fees, it also raises concerns about data security and the overall user experience. Understanding these implications is crucial for consumers to make informed decisions about their online banking habits.This section delves into the potential impact of this agreement on consumers, exploring potential benefits, drawbacks, and security considerations.

We will examine how this collaboration might reshape the online banking landscape and how consumers can navigate this evolving digital environment.

Potential Impact on Access to Online Banking Services

This agreement could lead to a more streamlined and potentially cheaper online banking experience for consumers. By leveraging AOL’s infrastructure and user base, banks might be able to reach a wider customer base and offer services at more competitive rates. This could result in greater accessibility for individuals who might not have been able to access online banking services previously.

For instance, smaller banks may gain the ability to offer online banking services more effectively due to AOL’s support.

Examples of Consumer Benefits and Drawbacks

Consumers could benefit from a more user-friendly interface, wider service offerings, and potentially lower fees. AOL’s vast network of users could lead to a broader reach for financial institutions, potentially driving down costs and increasing convenience. For example, a user could access their bank’s services via a simplified, intuitive AOL interface. However, there might be drawbacks. If AOL’s user base has a high concentration of specific demographic groups, it could lead to a narrower range of services and limited support for certain user needs.

Security Concerns Related to the Agreement

The agreement necessitates a heightened focus on security measures. Integrating banking systems with a platform like AOL necessitates robust security protocols to protect sensitive financial data. Data breaches could have severe consequences for consumers, leading to financial losses and identity theft. A strong emphasis on encryption, multi-factor authentication, and regular security audits is paramount. This agreement could lead to increased risk if security measures are not diligently implemented.

Potential Impact on the Overall Online Banking Experience

The integration of AOL and banking services could significantly alter the online banking experience. Consumers may experience a more personalized interface, potentially tailored to their specific financial needs and preferences. This integration could also lead to more sophisticated features, such as real-time financial updates or seamless integration with other financial tools. The integration of AOL’s platform could also affect customer service experiences.

Potential Benefits and Drawbacks for Consumers

| Potential Benefits | Potential Drawbacks |

|---|---|

| Wider access to online banking services, potentially at lower costs. | Security concerns related to the integration of a new platform. |

| Improved user experience and interface through integration with AOL. | Potential for a narrower range of services if AOL’s user base is not diverse. |

| Increased accessibility for individuals who may not have previously used online banking services. | Potential for data breaches if security measures are not adequately implemented. |

| More sophisticated financial tools and features. | Changes in customer service and support if the integration disrupts existing support systems. |

Competitive Analysis

This new online agreement between AOL and several banks marks a significant move in the online financial services landscape. Understanding how this partnership stacks up against existing models and the potential for new competitors is crucial to assessing its long-term impact. A thorough competitive analysis reveals the strengths and weaknesses of this venture, offering valuable insights for investors, consumers, and industry observers alike.The online financial services sector is highly competitive, with established players vying for market share and innovative startups disrupting the status quo.

This agreement’s success hinges on its ability to carve out a unique position within this dynamic environment, considering not only the existing competitors but also emerging technologies and evolving consumer preferences.

Comparison with Similar Partnerships

Existing partnerships in online financial services, like other internet portals collaborating with banks, often focus on streamlining account access and transaction management. These partnerships typically aim to provide a convenient one-stop shop for online banking needs. The AOL-bank agreement likely shares this goal, aiming to leverage AOL’s user base and the bank’s financial expertise to enhance the online banking experience.

However, the specifics of this deal, such as the level of integration and exclusive features offered, will be critical in determining its unique selling proposition compared to existing models.

Competitive Advantages and Disadvantages

AOL’s advantage lies in its established online presence and large user base, which can potentially drive significant traffic to the participating banks’ online platforms. Conversely, banks bring their financial expertise and existing customer base, bolstering the credibility of the online service. A potential disadvantage for both parties could be the need to adapt to the evolving needs of consumers and potentially face challenges in managing the increased volume of transactions.

Also, the level of trust and security offered by the platforms will be a crucial aspect in determining consumer acceptance.

Potential Competitors and Strategies

Several companies, including established financial technology firms and newer fintech startups, actively compete in the online banking space. These competitors often focus on developing innovative digital solutions, tailored mobile applications, and personalized financial management tools to attract and retain customers. Some key players are known to emphasize seamless integration with other digital services. The competitive strategies of these entities could include partnerships, aggressive marketing campaigns, and product differentiation to gain a larger market share.

The specific strategies of potential competitors will be key in understanding the landscape of the financial sector.

Market Share Implications

The market share implications of this agreement depend significantly on factors like user adoption, consumer feedback, and the overall effectiveness of the partnership. If the collaboration successfully meets customer needs and expectations, it could lead to a shift in market share for both AOL and the participating banks. Successful implementation of this agreement could attract new customers and potentially increase the revenue streams for both entities, leading to a better overall financial outcome for both.

Comparative Analysis of AOL and Competitors, Aol and banks sign new online agreement

| Feature | AOL | Competitor 1 (e.g., Google Finance) | Competitor 2 (e.g., a major fintech startup) |

|---|---|---|---|

| Online Presence | Established, large user base | Strong online presence, extensive user base | Emerging, focusing on targeted user acquisition |

| Financial Expertise | Limited | Limited | Strong financial expertise |

| Transaction Volume | Dependent on user engagement and partnership scale | Dependent on user engagement and partnership scale | Dependent on user engagement and partnership scale |

| Customer Acquisition | Leveraging existing user base | Utilizing advertising and partnerships | Aggressive marketing, product differentiation |

Future Considerations

This new online agreement between AOL and the banks marks a significant step in the evolution of online financial services. The potential for future developments is substantial, promising both innovation and growth, but also presenting challenges and risks. Understanding these potential trajectories is crucial for navigating the landscape and maximizing opportunities.

Potential for Innovation and Growth

The combination of AOL’s vast online user base and the banks’ financial expertise creates a powerful synergy for innovation. Imagine personalized financial advice integrated seamlessly into the user experience, or AI-powered tools for budgeting and investment planning, directly accessible through AOL platforms. This partnership could lead to a new generation of user-friendly financial tools and services, potentially democratizing access to sophisticated financial products.

The potential for growth in this sector is substantial, as the online financial services market continues to expand rapidly.

Potential Challenges and Risks

Despite the promising opportunities, potential challenges exist. Data security and privacy concerns are paramount. Robust security measures and transparent data handling practices are essential to maintain user trust. Furthermore, the need to adapt to evolving regulatory environments and consumer expectations is critical. Competition from established and emerging fintech companies will be fierce, requiring the partnership to adapt and innovate to maintain a competitive edge.

So, AOL and the banks have inked a new online agreement, which is interesting. This development seems to mirror the broader trend towards digital financial services. It’s all about streamlining online transactions, and in a similar vein, Wells Fargo and Mitsubishi have just launched a new service enabling multiple-currency e-commerce transactions. This innovative service highlights the evolving landscape of international trade and online commerce.

Ultimately, these new agreements signal a shift towards a more interconnected and efficient digital financial future for everyone, including those using the AOL banking services.

A key risk is the potential for technological obsolescence, requiring continuous investment in research and development to stay ahead of the curve.

Possible Scenarios for the Future of this Partnership

Several scenarios are possible for the future of this partnership. One scenario envisions a significant expansion of online financial services offerings, with a strong focus on user experience and accessibility. Another potential scenario involves a shift towards more sophisticated financial products and services, catering to a wider range of investor needs. A third scenario highlights the potential for this partnership to serve as a model for future collaborations between online platforms and financial institutions, potentially leading to widespread industry adoption of similar models.

Timeline of Potential Future Developments

| Milestone | Timeline | Impact |

|---|---|---|

| Launch of personalized financial advice tools integrated into AOL platforms. | Within 12-18 months | Improved user experience, increased engagement, potential for significant revenue generation through targeted financial products. |

| Development of AI-powered budgeting and investment planning tools. | Within 24-36 months | Increased user adoption of financial planning tools, improved financial literacy, potential for a new market segment. |

| Expansion of financial product offerings to include more sophisticated options, such as fractional ownership in real estate investments. | Within 36-48 months | Attracting a wider range of investors, catering to more diverse needs, potential for greater market share. |

| Implementation of robust data security and privacy measures compliant with all relevant regulations. | Ongoing | Maintaining user trust and confidence in the platform, avoiding potential regulatory fines or legal challenges. |

Illustrative Case Studies

Unveiling the tapestry of online financial partnerships requires examining real-world examples. These case studies provide invaluable insights into the successes and failures of such collaborations, showcasing the impact on both consumers and businesses, and ultimately, the market trends they’ve shaped. By understanding the nuances of past partnerships, we can better anticipate the potential outcomes of this new agreement between AOL and the banks.Examining similar partnerships within the online financial services industry allows us to dissect the key elements that contribute to success or failure.

Factors such as consumer adoption, market competition, and the overall financial health of the participating entities all play crucial roles. The following case studies highlight specific instances, demonstrating the wide-ranging effects of such collaborations.

Examples of Successful Partnerships

Successful online financial partnerships often foster a symbiotic relationship, where both parties benefit from enhanced brand recognition and expanded market reach. Increased consumer engagement and heightened user experience are common outcomes.

- PayPal and eBay: This landmark partnership revolutionized online commerce by providing a secure and convenient payment platform for eBay’s vast user base. The partnership not only facilitated seamless transactions but also significantly increased the trust and confidence in online shopping, leading to exponential growth in online sales. The integrated payment system fostered a seamless user experience, contributing significantly to eBay’s success and PayPal’s rapid rise.

- Apple Pay and various Retailers: Apple Pay’s success hinges on its seamless integration with existing Apple products and services. Its partnerships with numerous retailers facilitated the widespread adoption of mobile payments, showcasing the power of a unified user experience. This, in turn, influenced other payment platforms to adopt similar user-friendly approaches.

Examples of Partnerships Facing Challenges

While some partnerships thrive, others face challenges due to various factors, including misalignment of strategic goals, inadequate marketing efforts, or unforeseen regulatory hurdles.

- Some online banking platforms and third-party lending platforms: Certain partnerships between online banking platforms and third-party lending platforms have encountered difficulties due to concerns about user data security and transparency. The lack of clear communication about data usage and privacy practices often deterred consumer trust, hindering the success of these partnerships.

Impact on Consumers and Businesses

The impact of these partnerships on consumers is multi-faceted, ranging from increased convenience and access to financial services to the potential for fraud and security breaches. Businesses benefit from expanded customer bases and increased revenue streams.

| Partnership | Consumer Impact | Business Impact | Market Trend Influence |

|---|---|---|---|

| PayPal and eBay | Increased trust and confidence in online shopping, convenience in transactions. | Exponential growth in online sales for eBay, increased user base and revenue for PayPal. | Facilitated the widespread adoption of online payments, influencing other payment platforms. |

| Apple Pay and Retailers | Enhanced convenience and speed in mobile payments. | Increased sales for retailers, streamlined payment processing. | Influenced other payment platforms to adopt similar user-friendly approaches. |

Detailed Case Study: PayPal and eBay

Aspect Description Analysis Success Factors Partnership Structure PayPal provided a secure payment platform for eBay users. Strategic alignment between a payment platform and an online marketplace. Clear value proposition for both parties, shared vision of expanding online commerce. Consumer Impact Increased trust and confidence in online shopping, streamlined transactions. Enhanced online shopping experience, fostering wider adoption of online transactions. Improved user experience, reduced transaction friction. Business Impact eBay experienced exponential growth in online sales. PayPal gained a significant user base, expanded market share in online payments. Strong marketing campaigns, strategic partnerships. Market Trend Influence Facilitated the widespread adoption of online payments. Set a precedent for successful online financial partnerships. Demonstrated the potential for significant growth in online commerce.

Final Thoughts

The AOL and banks new online agreement represents a significant development in the evolving online financial services sector. The agreement’s potential to reshape the online banking experience is substantial, with both promising opportunities and potential challenges. By understanding the details, background, and implications for all stakeholders, we can better assess the agreement’s impact and future prospects. Further research and analysis are essential to fully grasp the long-term implications of this new partnership.