Ameritrade joins with Sprint PCS to make wireless trading a reality, opening up a whole new world of investment opportunities for mobile users. Imagine accessing your brokerage account and executing trades from anywhere with a smartphone or tablet. This innovative partnership promises to revolutionize how investors interact with the market, making financial decisions more convenient and accessible than ever before.

The partnership brings together Ameritrade’s expertise in financial services with Sprint PCS’s wireless infrastructure, creating a powerful synergy.

This collaboration has the potential to significantly expand the reach of financial markets. By removing geographical barriers and simplifying the trading process, Ameritrade and Sprint PCS aim to attract a wider range of investors, particularly younger generations and those in remote areas. The anticipated benefits for both companies are substantial, but challenges also exist, such as security concerns and the need for a seamless user experience.

This article will delve into the details of this innovative partnership, exploring the functionalities, market impacts, customer experience, and the technological infrastructure behind this groundbreaking development.

Overview of the Partnership

Ameritrade’s recent alliance with Sprint PCS marks a significant step towards revolutionizing the way investors interact with the financial markets. This innovative partnership aims to bring seamless, mobile trading experiences to a wider audience, potentially transforming the landscape of online brokerage services. The core concept is to leverage Sprint PCS’s robust wireless network to offer Ameritrade’s comprehensive investment tools and resources directly on mobile devices.This strategic collaboration is driven by the desire to improve accessibility and convenience for investors.

Both companies recognize the increasing importance of mobile technology in daily life, and this partnership is a direct response to that trend. By combining Ameritrade’s expertise in financial markets with Sprint PCS’s mobile infrastructure, they anticipate delivering a superior user experience and attracting a new generation of investors. The projected benefits include enhanced market accessibility, improved trading speed, and a more user-friendly platform for investors.

Key Motivations Behind the Partnership

Ameritrade and Sprint PCS are driven by several key motivations. The primary motivation is to expand market reach and tap into a wider pool of potential investors. Mobile technology is rapidly becoming the primary mode of access for many, and this partnership recognizes that trend. The synergy between Ameritrade’s investment knowledge and Sprint PCS’s technological prowess is designed to enhance customer experience and facilitate a more comprehensive approach to investment management.

Anticipated Benefits for Ameritrade

The alliance with Sprint PCS is expected to deliver numerous benefits for Ameritrade. The anticipated increase in user base and engagement with the platform will likely boost revenue and market share. Enhanced user experience and streamlined trading processes will improve customer satisfaction and loyalty. The partnership will likely result in increased brand visibility and recognition, particularly among younger demographics.

Anticipated Benefits for Sprint PCS

The partnership offers Sprint PCS a unique opportunity to establish itself as a key player in the financial technology sector. By associating its name with a trusted brand like Ameritrade, Sprint PCS can enhance its brand image and appeal to a broader demographic. The partnership will likely attract a new customer base interested in financial services. The integration of financial tools into the mobile experience will potentially increase customer engagement and loyalty, leading to improved long-term customer retention.

Ameritrade teaming up with Sprint PCS to enable wireless trading is a big deal. It opens up a whole new world of possibilities for investors on the go. But, as we increasingly rely on these technologies, we need to be mindful of our privacy, and consider the implications. This is why I’ve been exploring the topic of digital privacy, particularly the ongoing debate about data security and user rights, and recommend checking out one more chance on privacy for a more in-depth look.

Ultimately, while wireless trading becomes more accessible, safeguarding our personal information remains paramount.

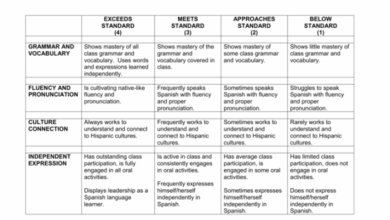

Comparison of Trading Platforms

The following table compares Ameritrade’s existing trading platforms with potential new features enabled by the partnership with Sprint PCS.

| Feature | Existing Platform | Potential New Features (Sprint PCS) |

|---|---|---|

| Platform Access | Desktop, web-based | Mobile-first, optimized for various devices (smartphones, tablets) |

| Order Execution | Standard order types | Real-time market updates, enhanced order tracking via mobile |

| Research Tools | Limited mobile access to research | Enhanced mobile research tools, real-time market data on the go |

| Account Management | Desktop and web-based | Mobile-first account management, portfolio monitoring |

| Customer Support | Phone, email, chat | Potential for integrated mobile customer support channels |

Existing Ameritrade users will have seamless access to their existing account details and trading history through their preferred mobile devices, and will likely experience faster and more convenient trading. The partnership will introduce new investment features and tools designed for mobile-first investors.

Wireless Trading Functionality

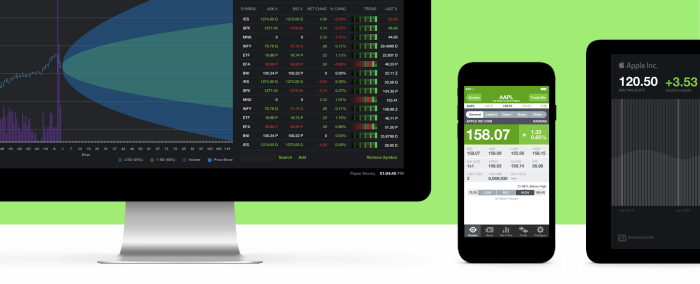

The future of investing is here, and it’s mobile. Imagine effortlessly checking market trends, placing trades, and managing your portfolio from anywhere with a strong wireless signal. This partnership between Ameritrade and Sprint PCS is paving the way for this exciting reality, offering a seamless and secure wireless trading experience.This new capability transcends the limitations of traditional trading, empowering investors with unprecedented flexibility and accessibility.

It’s about bringing the power of financial markets directly into your palm.

Envisioned Wireless Trading Experience

The envisioned wireless trading experience will be intuitive and user-friendly, designed for seamless navigation on various mobile devices. Real-time market data will be readily available, allowing investors to react quickly to opportunities and make informed decisions. The platform will be designed with a clean, modern aesthetic, and incorporate interactive charts and graphs to visualize market trends. This mobile-first approach will significantly enhance accessibility for investors.

Scenarios of Wireless Trading

A wide array of scenarios demonstrate the utility of wireless trading. A trader could monitor stock prices while commuting, react to breaking news, or execute trades during a business meeting. Investors could track their portfolio performance in real-time, adjusting their holdings as needed. Additionally, individuals could initiate trades based on market analysis, all from the convenience of their smartphone.

This flexibility is key to transforming how individuals interact with financial markets.

Technical Aspects of Mobile Trading

Enabling trading through mobile devices requires robust technology. The platform must support real-time data feeds, ensuring accurate and up-to-date market information. Secure communication channels are crucial to protect sensitive financial data. The application will be optimized for various mobile operating systems (iOS and Android) to ensure compatibility and a positive user experience. A high-performance mobile infrastructure is essential for seamless transactions.

Security Measures for Wireless Trading Platform

Robust security measures are paramount for a wireless trading platform. Advanced encryption protocols will safeguard user data and transactions. Multi-factor authentication will add another layer of security, demanding multiple verification steps to confirm user identity. Regular security audits and vulnerability assessments are critical for ongoing protection. These measures ensure the integrity of the platform and protect sensitive investor data.

Step-by-Step Guide for Initiating a Trade

This guide Artikels the steps for initiating a trade using a mobile device:

- Open the Ameritrade mobile app.

- Log in using your registered credentials.

- Navigate to the “Trade” section of the app.

- Select the desired security to buy or sell.

- Enter the quantity of shares you wish to trade.

- Confirm the trade details and review the order.

- Authorize the trade via your chosen authentication method.

Supported Mobile Devices

The new trading platform will support a variety of mobile devices, ensuring a wide range of users can access the platform.

| Mobile Operating System | Supported Devices |

|---|---|

| iOS | iPhone 12, iPhone 13, iPhone 14, iPad Pro (2020) |

| Android | Google Pixel 7, Samsung Galaxy S23, OnePlus 11 |

Market Impact and Opportunities

The partnership between Ameritrade and Sprint PCS to bring wireless trading to the forefront marks a significant shift in how investors engage with the market. This innovative approach has the potential to democratize access to financial instruments and dramatically reshape the trading landscape. It opens doors for a new generation of investors who may not have had access to traditional brokerage services.This fusion of financial technology and mobile communication promises to disrupt existing models and redefine the customer experience.

The implications for the broader financial market, competitive landscape, and investor behavior are far-reaching and warrant careful consideration. The integration of real-time market data with mobile devices can lead to unprecedented levels of accessibility and responsiveness, transforming how investors make decisions.

Potential Impacts on the Broader Financial Market

This partnership has the potential to significantly expand market participation, potentially leading to increased trading volume and liquidity. Lower barriers to entry could lead to more diverse investment portfolios, potentially creating more vibrant and robust markets. Furthermore, real-time access to market data on mobile devices could increase the frequency of transactions, leading to more active trading behavior and a more dynamic market.

Competitive Landscape Influence

The emergence of wireless trading services presents a significant challenge to traditional brokerage firms. The ability to offer a more accessible and user-friendly platform through mobile devices will undoubtedly attract new customers. Existing players will need to adapt their services to maintain competitiveness. This could involve implementing similar mobile-first strategies, enhancing their existing platforms, or developing entirely new mobile-focused solutions.

Ultimately, the competitive landscape will likely become more dynamic and innovative as firms seek to capture the potential of this new market segment.

New Customer Segments, Ameritrade joins with sprint pcs to make wireless trading a reality

This partnership is poised to attract several new customer segments. These include:

- Millennials and Gen Z investors:

- Investors with limited access to traditional brokerage services:

- Retail investors seeking real-time market access:

- Investors who prioritize mobile convenience:

These demographics are often more comfortable with technology and mobile devices, making wireless trading particularly appealing.

Geographical limitations or financial constraints may make it difficult for these investors to access traditional brokerage services. Wireless trading can overcome these hurdles.

The ability to access real-time market data and execute trades instantly is attractive to those looking for maximum flexibility and responsiveness.

The ease of accessing investment information and executing trades from anywhere with a mobile device is a key advantage for this segment.

Challenges in Reaching and Engaging New Customer Segments

While the potential customer base is vast, several challenges exist in effectively reaching and engaging these new customer segments.

- Building trust and educating new investors:

- Addressing potential security concerns:

- Providing comprehensive educational resources:

Wireless trading may be unfamiliar to many potential investors, requiring substantial educational efforts to build trust and confidence. This includes demonstrating the security and reliability of the platform.

Securing sensitive financial information on mobile devices requires robust security measures and clear communication with investors about data protection protocols.

Investors need access to clear and concise information about the products and services offered, as well as tools to navigate the complexities of the market.

Implications for Existing Trading Platforms and Brokerage Services

The rise of wireless trading will force existing trading platforms and brokerage services to adapt to the changing market.

- Adaptation and innovation:

- Maintaining competitiveness:

- Differentiation strategies:

Existing players will need to innovate to maintain their market share, potentially integrating mobile-first features into their existing platforms or creating entirely new mobile-focused solutions.

Failure to adapt could lead to a loss of market share to competitors that are more agile and responsive to the demands of the mobile-first generation.

Successful firms will need to develop clear differentiation strategies to highlight the unique value proposition of their services.

Changes in Investor Behaviors

The introduction of wireless trading will likely alter investor behaviors in several ways.

Ameritrade’s partnership with Sprint PCS to bring wireless trading to life is pretty cool. It’s definitely a step forward in making financial markets more accessible. Meanwhile, CBS Sportsline’s new e-commerce reseller program is another interesting development, showcasing the evolving landscape of online commerce. Ultimately, Ameritrade’s wireless trading initiative looks like it will offer a fresh approach to investing on the go.

- Increased trading frequency:

- Greater portfolio diversification:

- Enhanced market responsiveness:

The convenience of mobile trading will likely encourage more frequent transactions and a more active approach to investing.

The ease of access may lead to more frequent and more dispersed investments, potentially promoting greater portfolio diversification.

Real-time access to market data and quick trade execution could result in more responsive and potentially more emotional trading decisions.

Customer Experience and User Interface: Ameritrade Joins With Sprint Pcs To Make Wireless Trading A Reality

The new wireless trading platform from Ameritrade and Sprint PCS aims to revolutionize how investors interact with the market. This seamless integration of mobile technology and financial instruments will empower investors to make informed decisions, execute trades efficiently, and ultimately, achieve their financial goals. The intuitive design and robust functionality are critical to the success of this partnership.

User Interface Design

The user interface (UI) design of the new platform prioritizes simplicity and clarity. A clean, modern aesthetic, complemented by intuitive navigation, ensures a smooth and user-friendly experience for all users, regardless of their technical expertise. The platform will utilize a responsive design, adapting seamlessly to various screen sizes, from smartphones to tablets. Key elements, such as charts, market data, and order placement tools, will be strategically positioned for easy access.

Color palettes and typography will be carefully chosen to enhance readability and visual appeal.

User Experience (UX) Considerations for Mobile Trading

Mobile trading requires a unique UX approach, emphasizing speed, reliability, and security. The platform will be designed with security as a top priority. Biometric authentication, two-factor authentication, and secure encryption will safeguard sensitive information. Real-time market updates and customizable dashboards will allow users to stay informed and monitor their portfolios efficiently. Intuitive controls for managing trades, including quick access to order history and portfolio details, will be paramount.

Ameritrade’s partnership with Sprint PCS to bring wireless trading to the masses is a game-changer. It’s exciting to see how this could affect the market, especially given recent news about how Value America stocks are holding their own despite the current market downturn. Checking out stock watch value america defies market offers some insight into this fascinating trend.

Ultimately, this innovative approach from Ameritrade promises a more accessible and potentially lucrative future for individual investors.

Investment Product Accessibility

The platform will provide access to a diverse range of investment products, catering to various investor needs and risk tolerances.

| Investment Product Type | Description |

|---|---|

| Stocks | Individual company shares, offering potential for capital appreciation. |

| Bonds | Debt securities issued by corporations or governments, providing fixed income. |

| Exchange-Traded Funds (ETFs) | Basket of securities that track specific market indices or sectors, providing diversified exposure. |

| Mutual Funds | Pools of money invested in a diversified portfolio of securities, managed by professional fund managers. |

| Options | Contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. |

Research and Selection Workflow

A streamlined workflow for researching and selecting investment products is essential. The platform will feature advanced search functionalities, enabling users to quickly filter investments based on criteria like sector, market capitalization, or performance metrics. Detailed information, including company profiles, financial statements, and market analysis, will be readily available. Interactive charts and graphs will help visualize market trends and provide insights into investment opportunities.

Users can create personalized watchlists to monitor specific stocks or ETFs. This personalized tracking feature allows users to keep abreast of market movements affecting their interests.

Design Principles

- Intuitive Navigation: The platform should be designed with intuitive navigation in mind, ensuring easy access to all features.

- Accessibility: The platform should be accessible to users with diverse needs and abilities.

- Security: Robust security measures, such as encryption and multi-factor authentication, should be incorporated to protect user data.

- Performance: The platform should be designed for optimal performance, ensuring fast loading times and smooth functionality.

- Responsiveness: The platform should be responsive to various screen sizes, adapting to different devices and providing a consistent experience.

Technological Infrastructure

This new wireless trading platform hinges on a robust and secure technological infrastructure. The system needs to handle a high volume of transactions, execute orders swiftly, and ensure the safety of sensitive financial data. A well-designed architecture will be critical to the platform’s success and user confidence.

Core Technologies for Wireless Trading

The foundation of this wireless trading platform requires several key technologies. Secure communication protocols are paramount to prevent unauthorized access and data breaches. Real-time data feeds from various market sources are essential for accurate pricing and execution. A robust back-end system must handle the processing of orders, managing accounts, and ensuring compliance with regulatory requirements. The platform must also seamlessly integrate with existing Ameritrade and Sprint PCS systems.

Secure Communication Protocols

Ensuring secure communication is critical for preventing unauthorized access and data breaches. Advanced encryption protocols, such as TLS/SSL, are necessary to protect sensitive financial data during transmission. Multi-factor authentication, requiring multiple forms of verification, further enhances security. These measures are crucial for maintaining user trust and compliance with industry standards.

Real-time Data Feeds

Reliable real-time data feeds are essential for providing up-to-the-second market information. High-frequency trading often relies on millisecond-level accuracy, and the platform needs to adapt to this. Partnerships with reputable financial data providers are key for consistent and reliable information streams. A well-designed caching system can further optimize performance by storing frequently accessed data.

Back-end System Architecture

The back-end system must handle the high volume of transactions, manage user accounts, and ensure regulatory compliance. A scalable, fault-tolerant architecture is essential to handle fluctuating trading activity and potential disruptions. Microservices architecture can enhance flexibility and maintainability, allowing for easier updates and additions. Load balancing across multiple servers is also crucial to prevent overload and maintain responsiveness.

Data Transmission Protocols

Different data transmission protocols suit various needs and environments. The selection depends on factors like speed, reliability, and cost.

| Protocol | Description | Suitability |

|---|---|---|

| TCP (Transmission Control Protocol) | Reliable, connection-oriented protocol with error checking and guaranteed delivery. | Ideal for critical data transmission where reliability is paramount. |

| UDP (User Datagram Protocol) | Faster, connectionless protocol without error checking. | Suitable for situations where speed is prioritized over absolute reliability, like streaming market data. |

| MQTT (Message Queuing Telemetry Transport) | Lightweight, publish-subscribe protocol ideal for machine-to-machine communication. | Useful for communication between different parts of the platform or with external systems. |

Payment Processing Methods

The platform must support various payment processing methods for user convenience. Integration with major payment processors is essential to handle credit card, debit card, and potentially other methods like wire transfers. Security is paramount, and compliance with PCI DSS (Payment Card Industry Data Security Standard) is mandatory.

Scalability Considerations

The platform must be designed to handle growth in user base and transaction volume. Cloud-based infrastructure can provide the necessary scalability and flexibility. Using containerization technologies like Docker can streamline deployment and resource management, facilitating scaling to meet demand. The system must also be adaptable to future technological advancements. Examples like Amazon Web Services (AWS) provide the scalability needed to handle significant transaction volumes.

Potential Risks and Mitigation Strategies

The exciting prospect of wireless trading brings forth a new set of challenges. While the potential for increased accessibility and efficiency is significant, inherent risks must be carefully considered and mitigated. This section delves into the potential pitfalls of this innovative approach, along with strategies to minimize their impact.

Security Risks Associated with Wireless Trading

Wireless trading introduces new vulnerabilities to cyberattacks. Unauthorized access to trading accounts, data breaches, and malicious code injection are serious threats. Criminals might exploit vulnerabilities in the wireless network or the trading platform itself to steal sensitive information, potentially leading to substantial financial losses for individuals and institutions. Implementing robust security measures, such as multi-factor authentication, encryption protocols, and regular security audits, is crucial to safeguard against these threats.

Network Connectivity and Outages

Reliable network connectivity is paramount for seamless trading. Interruptions or outages can lead to missed market opportunities, delays in transactions, and significant financial losses. Factors such as network congestion, natural disasters, or intentional disruptions can jeopardize the entire trading process. Strategies to mitigate these risks include diversifying network providers, implementing redundancy systems, and establishing robust disaster recovery plans.

For example, a trading platform could utilize multiple network providers, ensuring a backup connection in case of an outage with one provider.

Operational Issues

Operational challenges can stem from the complex integration of wireless technology into existing trading systems. Issues such as compatibility problems between the new wireless platform and legacy systems, delays in transaction processing, and unexpected errors in data transmission could hinder the smooth operation of the trading process. Thorough testing, comprehensive integration plans, and continuous monitoring of the new system are critical to identifying and resolving these issues proactively.

Risk Assessment Plan

A structured risk assessment plan is essential to proactively identify and address potential threats. This plan should incorporate a phased approach, covering various stages of development, implementation, and operation.

- Risk Identification: A comprehensive inventory of potential risks, considering both technical and operational aspects, must be compiled. This includes identifying vulnerabilities in the wireless network, the trading platform, and the integration of both. Examples include unauthorized access, network outages, and compatibility issues.

- Risk Analysis: Each identified risk must be assessed for its likelihood and potential impact. Quantitative analysis, utilizing historical data and expert opinions, should help determine the severity of potential risks. A scoring system can help prioritize risks based on probability and impact.

- Risk Mitigation: Strategies for mitigating identified risks should be developed and implemented. This involves choosing appropriate security measures, establishing redundancy protocols, and developing contingency plans to address various operational challenges. Examples include deploying multi-factor authentication, implementing redundant network connections, and creating backup systems.

- Monitoring and Review: The risk assessment plan should include a continuous monitoring process. Regular reviews and updates are crucial to adapting to changing market conditions and technological advancements. Real-time monitoring of system performance and user feedback can provide critical insights for proactive risk mitigation.

Last Word

In conclusion, Ameritrade’s partnership with Sprint PCS represents a significant step towards democratizing access to financial markets. By enabling wireless trading, the companies aim to connect investors with the global marketplace, regardless of their location or device. The implications for the broader financial landscape are profound, and the potential for new customer segments and market growth is enormous.

While challenges remain, the innovative approach promises a future where investment decisions are more fluid and responsive, shaping a new era of accessible financial services.