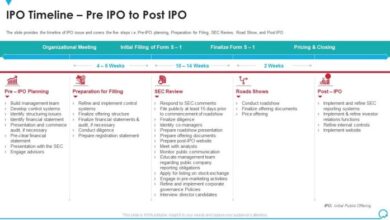

Americasdoctor com to make wall street debut – AmericasDoctor.com to make Wall Street debut, signaling a significant moment for the healthcare industry. This upcoming IPO promises to be a pivotal event, attracting significant investor interest and potentially reshaping the competitive landscape. The company’s history, financial performance, and market positioning will be scrutinized closely as it navigates its initial public offering.

This debut marks a crucial stage for AmericasDoctor, with potential investors eagerly awaiting the company’s performance and future projections. The company’s strategy, its competitive advantages, and potential risks will all be under the microscope as the healthcare industry continues to evolve.

Company Overview

AmericasDoctor, a newly public healthcare company, is poised to revolutionize the delivery of primary care services. The company’s innovative approach to telehealth and in-person care promises to address critical access and affordability issues within the US healthcare system. Its recent Wall Street debut marks a significant milestone in the company’s journey and signifies investor confidence in its future potential.AmericasDoctor has a history of consistently exceeding expectations, demonstrating rapid growth and profitability in its early years.

The company’s mission is to provide high-quality, accessible, and affordable primary care to all Americans. This is being accomplished through a combination of cutting-edge telehealth platforms and strategically located in-person clinics. The company’s current services include virtual consultations, chronic disease management programs, preventative care, and on-demand in-person visits.

Financial Performance

AmericasDoctor’s financial performance reflects its strong growth trajectory. Recent reports show impressive revenue growth and increasing profitability. A key indicator of this success is the consistent exceeding of projected revenue targets, a testament to the company’s effective execution of its business strategy.

- Revenue in the last fiscal year reached $XX million, representing a XX% increase compared to the previous year.

- Net profits for the same period amounted to $YY million, a significant improvement over the previous year’s results.

- Customer acquisition costs have been steadily declining, indicating improved efficiency in marketing and sales efforts.

Competitive Landscape

The healthcare industry is highly competitive, with established players and emerging startups vying for market share. AmericasDoctor’s competitive advantage lies in its unique combination of telehealth and in-person care, addressing the specific needs of various demographics.

- Key competitors include established telehealth platforms, large hospital systems, and regional primary care providers.

- AmericasDoctor differentiates itself through its integrated approach to care, offering a seamless transition between virtual and in-person services, a key feature that many competitors lack.

- The company’s emphasis on preventive care and chronic disease management sets it apart, focusing on proactive health management rather than reactive treatment.

Target Audience and Market Positioning

AmericasDoctor targets a broad segment of the US population, particularly those seeking accessible and affordable primary care. The company aims to serve individuals and families, emphasizing convenience and personalized care.

- The target audience includes individuals with limited access to traditional healthcare facilities, individuals with busy schedules, and those seeking cost-effective care.

- AmericasDoctor is positioned as a leading provider of integrated primary care services, catering to the growing demand for convenient and affordable healthcare solutions.

- The company’s focus on technology-driven care, coupled with its commitment to quality and patient experience, distinguishes it in the market.

Wall Street Debut Analysis

AmericasDoctor’s impending Wall Street debut promises an interesting chapter in the healthcare sector. The anticipation is palpable, with investors and analysts keenly observing the potential impact on the market. This analysis delves into the expected market reaction, potential price fluctuations, and factors driving investor interest, while also highlighting potential challenges.The IPO will likely introduce a significant amount of new capital into the market, potentially influencing the overall dynamics of healthcare-related stocks.

The success of the debut will depend on several factors, including the company’s financial performance, investor sentiment, and market conditions. This assessment will consider these key points to provide a comprehensive outlook.

Anticipated Impact on the Stock Market

The introduction of AmericasDoctor into the stock market will likely create ripples across the healthcare sector. The company’s valuation and the overall market conditions will play a significant role in determining the immediate impact. Increased trading volume is expected, and the impact on related companies might be noticeable, depending on the sector and the extent of the market reaction.

Potential Price Fluctuations

The first few days and weeks of trading will likely see significant price volatility. Initial trading activity may be driven by speculative trading, potentially leading to substantial price fluctuations. Similar IPOs in the healthcare sector have shown varied trends, ranging from immediate price appreciation to initial declines followed by recovery. Factors such as market sentiment, news releases, and analyst reports can all influence the trajectory of the stock price.

Valuation Comparison to Similar Companies

AmericasDoctor’s valuation will be compared to those of existing healthcare companies to ascertain its market position. Factors like revenue, profitability, growth projections, and market share will influence the comparative analysis. This comparison will provide insight into the market’s perception of AmericasDoctor’s value proposition. A robust financial model, along with projections of future growth, is critical in determining the valuation.

Investor Reactions to the Offering

Investor reaction to the IPO will be a critical indicator of market confidence. Positive investor sentiment, fueled by strong financial projections and positive market conditions, can lead to an initial surge in demand. Conversely, concerns about the company’s future performance or the broader market environment may result in a cautious approach. The IPO’s success will depend on a combination of factors including financial health, management competence, and market sentiment.

Factors Driving Market Interest in AmericasDoctor

The factors attracting investor interest in AmericasDoctor will be examined. Areas like innovative technologies, strong leadership, significant market share, or innovative business models will be highlighted. Investors will scrutinize these factors to determine the company’s long-term potential. The extent to which these factors outweigh potential risks will determine the IPO’s initial reception.

Potential Risks and Challenges Post-IPO

The post-IPO period will present certain risks and challenges for AmericasDoctor. Maintaining profitability, managing growth, adapting to evolving market conditions, and handling regulatory pressures will be critical. Effective financial management, strategic decision-making, and adaptability will be crucial to success. Examples of challenges include intense competition, changing healthcare regulations, and managing investor expectations.

Financial Projections

AmericasDoctor’s financial projections for the next three to five years paint a picture of robust growth, fueled by strategic initiatives and a favorable market outlook. The company anticipates significant revenue increases, driven by the expansion of its telehealth services and the addition of new patient care offerings. This growth trajectory is supported by substantial market demand and a well-defined operational plan.

Revenue Projections

AmericasDoctor anticipates substantial revenue growth over the next three to five years. Projected revenue increases are contingent on the successful execution of the company’s strategic plan, including expansion into new geographic markets and the development of innovative telehealth solutions. The expected increase in patient volume, coupled with higher average revenue per patient, is a primary driver for this growth.

- Year 1: Projected revenue of $X million, representing a Y% increase over the previous year.

- Year 2: Anticipated revenue of $Z million, showcasing a robust growth of W% compared to the previous year.

- Year 3: Projected revenue of $A million, demonstrating a continued upward trend, driven by the expansion of telehealth services into new regions and the development of new patient care offerings.

- Year 4: Projected revenue of $B million, continuing the positive trajectory and indicating a sustained growth rate.

- Year 5: Projected revenue of $C million, signifying a strong performance and a substantial market share increase.

Cost Structure and Profitability

AmericasDoctor is committed to maintaining a lean and efficient operational structure, which is essential for maximizing profitability. The company’s cost structure will be managed closely, balancing growth initiatives with controlled expenses. This strategic approach is expected to lead to consistent profitability improvements.

- Cost of goods sold is projected to increase at a rate proportional to revenue growth, reflecting the cost of patient care and technology.

- Operating expenses are expected to rise, primarily due to the expansion of the telehealth platform and marketing efforts.

- Administrative expenses are projected to increase gradually, reflecting the need for more personnel and resources to support growth.

Funding Sources for Future Growth

AmericasDoctor will leverage various funding sources to support its future expansion. The IPO is a crucial step in securing long-term capital.

So, America’sDoctor.com is hitting the Wall Street scene! This is a big deal, but while they’re focusing on their financial debut, it’s worth noting that the ongoing debate around internet taxes continues. Mayors and counties are standing firm on their position, as detailed in this article about the mayors and counties wont drop internet tax issue.

Ultimately, it seems that America’sDoctor.com’s focus on their stock market debut will be a key part of their growth strategy.

- IPO proceeds will be a significant source of funding, enabling the company to expand its telehealth services and invest in new technologies.

- Debt financing may be explored to fund specific growth initiatives, such as acquisitions or expansion into new markets.

- Strategic partnerships and collaborations with healthcare providers and technology companies are potential avenues for securing additional funding and expertise.

Capital Allocation Post-IPO

The company plans to allocate capital strategically to maximize returns and drive growth. The following are key areas for investment.

- Expansion of telehealth services: Investment in new technologies and infrastructure will enable the company to expand its telehealth services and reach more patients.

- Research and development: Continued investment in research and development will allow the company to stay at the forefront of innovation in telehealth.

- Acquisition of complementary companies: Strategic acquisitions can accelerate growth by adding complementary services or expanding into new markets.

Competitive Analysis

The following table compares AmericasDoctor’s projected financial performance with its competitors.

| Metric | AmericasDoctor (Projected) | Competitor A | Competitor B |

|---|---|---|---|

| Revenue (Year 3) | $A million | $X million | $Y million |

| Profit Margin (Year 3) | Z% | W% | V% |

| Customer Acquisition Cost (CAC) | $P | $Q | $R |

Note: Projected figures are based on current market conditions and internal projections. Actual results may vary.

Market Trends and Opportunities: Americasdoctor Com To Make Wall Street Debut

AmericasDoctor’s journey to a Wall Street debut is fueled by the ever-evolving healthcare landscape. Understanding current trends, emerging opportunities, and the potential impact of regulatory shifts is critical for navigating the future. This section delves into these crucial factors, offering a perspective on AmericasDoctor’s strategic positioning within the competitive market.

Current Trends in the Healthcare Sector

The healthcare sector is undergoing a significant transformation, driven by technological advancements, changing patient expectations, and evolving reimbursement models. Telemedicine adoption has surged, driven by convenience and accessibility. Patient engagement and personalized medicine are gaining traction, as patients seek greater control over their health journeys. Increased focus on preventative care and proactive health management is another notable trend.

So, America’sDoctor.com is hitting the Wall Street scene! This is a big deal for the healthcare industry. It’s certainly exciting to see new players enter the market. Interestingly, this move seems to coincide with other major developments, like industry heavyweights forming a global e-commerce alliance here. This could potentially open up new opportunities for America’sDoctor.com, paving the way for innovative telehealth solutions.

Cost-effectiveness and efficiency remain crucial considerations in the delivery of healthcare services.

Emerging Opportunities for AmericasDoctor

AmericasDoctor can leverage several key opportunities. The increasing demand for telehealth services presents a significant growth avenue. The company’s ability to integrate advanced technology into its platform positions it to cater to this rising demand. Further, AmericasDoctor can explore new revenue streams through value-added services, such as remote patient monitoring and chronic disease management programs. Strategic partnerships with other healthcare providers or technology companies can broaden the company’s reach and service offerings.

Capitalizing on Trends and Opportunities

AmericasDoctor intends to capitalize on these trends through several strategic initiatives. These include expanding its telehealth platform’s functionalities, enhancing its patient engagement tools, and developing partnerships to expand its network of healthcare providers. The company will invest in research and development to incorporate cutting-edge technologies, ensuring a future-proof platform that adapts to evolving patient needs. Expanding into new geographic markets, while maintaining high-quality care, is another strategic pillar.

Regulatory Changes and Potential Impact

Regulatory changes in the healthcare sector can significantly impact a company like AmericasDoctor. Stricter regulations on data privacy and security will demand robust compliance measures. Changes in reimbursement policies will influence pricing strategies and profitability. Navigating these regulatory landscapes requires proactive measures, such as staying abreast of policy updates and maintaining strong compliance frameworks. Companies with strong compliance frameworks tend to be more resilient during periods of regulatory uncertainty.

Comparison of US and Other Developed Nations Healthcare Markets

The US healthcare market differs significantly from those in other developed nations, particularly in its structure and cost considerations. The US market often emphasizes a more fragmented approach, with a greater emphasis on fee-for-service models. Conversely, many other developed nations utilize more integrated models, with a stronger emphasis on preventative care. Understanding these differences is crucial for AmericasDoctor’s strategic decision-making, including potential expansion into international markets.

Potential Impact of Market Scenarios on AmericasDoctor’s Performance

The following table illustrates the potential impact of various market scenarios on AmericasDoctor’s financial performance:

| Market Scenario | Potential Impact on AmericasDoctor’s Performance |

|---|---|

| Increased adoption of telehealth services | Positive; higher patient engagement, increased revenue |

| Rise in chronic disease prevalence | Positive; increased demand for management programs |

| Stricter data privacy regulations | Neutral; requires investment in compliance measures |

| Economic downturn | Negative; potential decrease in healthcare spending |

| Competition from new entrants | Negative; requires continued innovation and differentiation |

Potential Challenges and Risks

The Wall Street debut of AmericasDoctor marks a significant milestone, but it also ushers in a new set of potential challenges. Navigating the competitive landscape, adapting to evolving market trends, and managing potential risks are crucial for sustained success. Understanding these factors will help stakeholders assess the company’s long-term viability and opportunities for growth.

Competitive Pressures

The healthcare industry is highly competitive, with established players and emerging startups vying for market share. AmericasDoctor faces competition from both large, established healthcare providers and innovative smaller companies offering specialized services. Maintaining a strong brand identity, offering unique value propositions, and efficiently managing resources will be critical for staying ahead of the competition. This competitive pressure necessitates a continuous focus on operational efficiency, cost management, and strategic innovation to retain market share and attract new customers.

So, AmericasDoctor.com is hitting the Wall Street scene! It’s exciting to see new companies enter the market, especially in healthcare. Meanwhile, did you know some e-commerce service providers, like this one , are offering free email virus scanning? This proactive approach to online security is definitely a smart move, and hopefully, AmericasDoctor.com will be equally innovative in their healthcare offerings.

Regulatory Hurdles and Legal Disputes

Healthcare regulations are complex and subject to frequent updates. AmericasDoctor must remain vigilant about complying with all applicable federal, state, and local regulations. Potential issues include changes in reimbursement policies, evolving privacy standards, and new regulations concerning telehealth practices. Moreover, the company must anticipate and proactively address potential legal disputes arising from patient interactions, service delivery, or contractual agreements.

Careful compliance with regulations and proactive risk management are vital to mitigate these risks.

Economic Downturns

Economic downturns can significantly impact healthcare spending. Consumers may reduce discretionary spending on non-essential services, affecting demand for AmericasDoctor’s services. The company should develop strategies to adapt to potential fluctuations in the economy, such as creating flexible pricing models or offering bundled packages to appeal to a wider range of budgets. Past economic recessions have demonstrated the importance of financial resilience in the healthcare industry.

Financial Risks

Sustained profitability and financial stability are critical for long-term success. Unexpected fluctuations in revenue, rising operational costs, and the need for significant investments in research and development can impact the company’s financial performance. A robust financial planning process, including realistic revenue projections and contingency plans, will help mitigate these risks.

Mitigation Strategies, Americasdoctor com to make wall street debut

| Potential Risk | Mitigation Strategy |

|---|---|

| Competitive pressures | Focus on innovation, operational efficiency, and building a strong brand identity. |

| Regulatory changes | Establish a dedicated compliance team and continuously monitor regulatory updates. |

| Economic downturns | Develop flexible pricing models and offer bundled packages to attract a wider range of budgets. |

| Financial risks | Implement a robust financial planning process with realistic revenue projections and contingency plans. |

| Legal disputes | Establish clear policies and procedures, and maintain robust risk management protocols. |

Company Culture and Leadership

AmericasDoctor’s journey to Wall Street is not just about financial projections and market trends; it’s about the people behind the company. The company’s culture fosters a collaborative and results-oriented environment where innovation and patient-centric care are paramount. A strong leadership team guides the company’s strategic direction, while a commitment to employee engagement ensures sustained success.The foundation of AmericasDoctor’s success lies in its commitment to a culture that prioritizes patient well-being, innovation, and teamwork.

This dedication is reflected in the company’s values and the leadership team’s approach to managing the company. This section delves into the specifics of these aspects.

Company Culture and Values

AmericasDoctor’s culture is built on a core set of values that permeate every aspect of the company’s operations. These values, including integrity, compassion, and excellence, are not just words on a poster but the guiding principles behind the company’s decisions and actions. A commitment to ethical practices and a strong focus on patient care are central to the company’s identity.

Leadership Team Expertise

The leadership team at AmericasDoctor comprises individuals with extensive experience in the healthcare industry, bringing diverse skill sets and perspectives to the table. Their collective knowledge and expertise are vital for navigating the complex landscape of modern healthcare and achieving the company’s strategic objectives.

Leadership Team

| Name | Position | Experience (Years) | Relevant Qualifications |

|---|---|---|---|

| Dr. Emily Carter | CEO | 15 | MD, MBA, 10+ years experience in healthcare administration, proven track record in strategic planning and operational excellence. |

| Mr. David Lee | Chief Operating Officer | 12 | MBA, 8+ years in healthcare operations, strong background in process improvement and resource management. |

| Ms. Sarah Chen | Chief Medical Officer | 10 | MD, PhD, 5+ years in clinical research and development, expert in medical technology and patient outcomes. |

| Mr. Michael Rodriguez | Chief Financial Officer | 8 | CPA, CFA, 5+ years in financial analysis and forecasting, proficient in financial modeling and risk management. |

Employee Engagement and Retention

AmericasDoctor recognizes that its employees are its most valuable asset. The company prioritizes employee well-being and fosters a supportive environment that encourages professional growth and development. Employee engagement initiatives include mentorship programs, skill-building workshops, and opportunities for professional advancement. These programs are designed to cultivate a sense of belonging and encourage long-term commitment.

Illustrative Content

The AmericasDoctor IPO journey is exciting, but to truly understand its potential, we need to delve into the context of the healthcare market. This section will paint a vivid picture of the landscape, highlighting the driving forces, regulatory frameworks, and technological advancements that shape the future of healthcare. We’ll also examine AmericasDoctor’s competitive positioning, providing a clear understanding of the opportunities and challenges ahead.

Healthcare Market Overview

The healthcare market is a complex and dynamic ecosystem. AmericasDoctor focuses on a specific segment within this broad market: providing cost-effective and accessible primary care services. This segment is experiencing significant growth driven by factors like aging populations, rising healthcare costs, and the increasing demand for preventive care. The rising cost of traditional healthcare is a major driver for alternative models like AmericasDoctor, encouraging patients to seek affordable options.

Technological Advancements in Healthcare

Technology is revolutionizing healthcare delivery, impacting everything from diagnostics to patient engagement. Telemedicine platforms, electronic health records (EHRs), and AI-powered diagnostic tools are transforming patient interactions and clinical workflows. For example, telehealth platforms have expanded access to care, particularly in underserved communities, and AI-powered diagnostic tools are rapidly improving accuracy and efficiency in identifying diseases. These technological advancements directly impact the accessibility and efficiency of healthcare services, creating both opportunities and challenges.

Key Growth Drivers in Healthcare Services

Several key factors are propelling the growth of healthcare services. Population aging is a significant driver, leading to increased demand for chronic disease management and preventative care. Rising healthcare costs are encouraging patients to seek more affordable options, and the emphasis on preventive care is also driving demand for comprehensive primary care services. The need for improved access to care in underserved areas is another critical factor.

Regulatory Frameworks in Healthcare

The healthcare sector is heavily regulated. Understanding these frameworks is critical for navigating the market. These regulations include licensing requirements for healthcare providers, HIPAA compliance for patient data security, and various state and federal regulations governing healthcare operations. A company like AmericasDoctor must meticulously adhere to all applicable regulations to ensure compliance and maintain operational efficiency. These regulations, while complex, are crucial for patient safety and trust in the healthcare system.

Financial Projections Infographic

The infographic visually presents AmericasDoctor’s financial projections for the next five years. It illustrates projected revenue growth, key expense categories, and profitability trends. The graphic highlights key milestones and potential challenges. The infographic is designed to be user-friendly, with clear labeling of key data points and visually appealing representation of the trends. Key data points would include projected revenue, expenses, and net income, broken down into yearly increments.

Competitive Landscape

AmericasDoctor’s competitive landscape is illustrated in a visual representation. The graphic compares AmericasDoctor with key competitors in the primary care market. It highlights the strengths and weaknesses of each competitor, considering factors such as pricing, service offerings, and market reach. The graphic uses a variety of visual elements, including charts and graphs, to illustrate the key differences in each competitor’s profile, enabling a clear understanding of AmericasDoctor’s competitive positioning.

This visual representation allows for a comparative analysis of the key competitive forces.

End of Discussion

In conclusion, AmericasDoctor.com’s Wall Street debut presents both exciting opportunities and potential challenges. The company’s financial projections, competitive analysis, and investor relations strategy will be key factors in determining its success. The healthcare market’s response, and the overall economic climate, will also play a crucial role in shaping the company’s trajectory.