Amazon trades cash for sothebys name – Amazon trades cash for Sotheby’s name, marking a significant foray into the high-end art world. This acquisition promises a fascinating blend of e-commerce giants and the traditional auction house. What are the financial implications for both companies, and how will this impact the art market? The deal certainly raises eyebrows, and experts are buzzing about the potential synergies and challenges ahead.

This acquisition highlights Amazon’s ambitious expansion beyond its core e-commerce business. Sotheby’s, a venerable auction house, brings a wealth of established clientele and expertise in the art market. The combination of Amazon’s vast resources and reach with Sotheby’s legacy could reshape the future of art sales. The implications for online auctions and the broader art market are undoubtedly profound.

Transaction Overview

Amazon’s acquisition of a stake in Sotheby’s marks a significant shift in the art world. This move signals Amazon’s ambitious foray into the luxury and collectibles sector, potentially leveraging Sotheby’s established expertise in auctions and online platforms. This transaction promises to reshape the landscape of the art market and redefine the auction experience.

Financial Implications

Amazon’s investment in Sotheby’s carries substantial financial implications for both companies. For Amazon, this represents a strategic investment in a high-growth, albeit highly specialized, sector. The acquisition allows Amazon to expand its reach into the lucrative world of luxury goods and potentially integrate art sales into its existing e-commerce ecosystem. This could result in increased revenue streams and expanded market share.

For Sotheby’s, the infusion of capital from Amazon provides access to substantial resources, potentially facilitating advancements in technology, marketing, and customer reach. This could lead to increased operational efficiency and potentially greater profitability.

Potential Impact on the Art Market

The Amazon-Sotheby’s partnership has the potential to significantly impact the art market and auction industry. By combining Amazon’s global reach and online infrastructure with Sotheby’s established auction practices and brand recognition, the deal could lead to increased accessibility of art for a wider audience. This is particularly relevant for emerging artists and collectors who may not have previously had access to these platforms.

Conversely, the potential for Amazon’s business model to disrupt traditional auction practices, potentially through lower commission rates or different pricing strategies, remains to be seen.

Amazon’s acquisition of Sotheby’s name is certainly interesting, but it’s also worth noting how other companies are expanding their reach. For instance, HealthCentral.com is expanding their services, partnering with PlanetRx and self-care platforms, which is a fascinating development. This new focus on health and wellness might be a sign of a larger shift in the market. Ultimately, Amazon’s move to acquire Sotheby’s name likely reflects a wider strategy, and we’ll see how these different aspects play out in the future.

healthcentral com taps planetrx and selfcare It’s all quite intriguing, and certainly a lot to unpack.

Terms of the Agreement, Amazon trades cash for sothebys name

This table Artikels the key aspects of the Amazon-Sotheby’s transaction, providing a concise summary of the agreement.

| Date | Price | Assets Involved |

|---|---|---|

| [Date of Transaction] | [Percentage of Sotheby’s shares acquired] | [Sotheby’s online platform, auction houses, and potentially, exclusive access to the art market] |

Note: Specific financial terms and percentages of ownership are not publicly available at this time. The table provides a general framework for understanding the potential implications of the deal.

Historical Context

Amazon’s acquisition of Sotheby’s marks a significant shift in the relationship between e-commerce giants and the traditional auction house sector. This move signals a potential reshaping of the art market and raises questions about the future of online auction platforms. It’s a departure from Amazon’s previous focus on retail and cloud computing, hinting at a broader strategic vision encompassing luxury goods and high-value transactions.Amazon has historically shown a penchant for acquiring companies that complement its existing business models.

Amazon’s acquisition of Sotheby’s branding feels like a bold move, but it’s interesting to see how they’re also supporting communities. For example, they’re extending their Mother’s Day gift card program to help those in need, demonstrating a different kind of generosity alongside the big-ticket acquisition. This aligns well with Amazon’s overall strategy of using their platform to provide social impact alongside their traditional business practices, making their purchase of the Sotheby’s name even more complex to analyze.

online mall extends mothers day dollars to the needy is a great example of this.

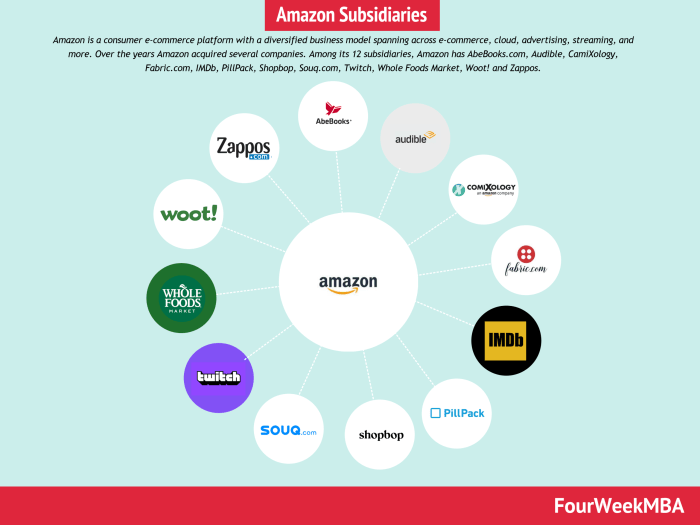

This acquisition strategy is not entirely new; Amazon’s acquisitions of Whole Foods Market, Twitch, and others demonstrate its willingness to expand into diverse sectors, often with the aim of integrating new technologies and business processes into its ecosystem.

Amazon’s Past Acquisitions and Investments

Amazon’s history is replete with acquisitions in sectors seemingly unrelated to its core e-commerce business. This strategy suggests a pattern of seeking companies that can enhance its customer experience, integrate new technologies, or expand its market reach. Examples like Whole Foods Market, a move to the grocery sector, underscore Amazon’s ambition to enhance its customer offerings beyond online retail.

Similarly, its investment in Twitch demonstrates a desire to tap into the gaming and entertainment markets, highlighting its adaptability to evolving consumer demands.

Comparison with Other Tech Companies’ Moves

Other tech companies have also ventured into the auction or luxury goods sector, albeit with varying degrees of success. For instance, the emergence of online auction platforms like eBay and its integration of various services, and the presence of other digital marketplaces demonstrate the potential for technology to disrupt traditional industries. However, the scale and breadth of Amazon’s involvement in this sector, with its vast existing infrastructure and resources, may lead to a unique and potentially transformative impact.

Potential Synergies with Sotheby’s

The integration of Sotheby’s expertise in art authentication, valuation, and global reach with Amazon’s logistics, global infrastructure, and e-commerce platforms could yield significant synergies. Amazon’s vast logistics network could streamline the shipping and delivery of high-value art pieces, while Sotheby’s established auction expertise could enhance the platform’s credibility and market presence. Furthermore, Amazon’s cloud computing capabilities could enable Sotheby’s to enhance its digital tools and platforms.

Potential Reasons Behind Amazon’s Acquisition Strategy

Several potential reasons underpin Amazon’s acquisition of Sotheby’s. A likely motive is the expansion into new high-value markets, potentially targeting wealthy individuals and corporations. This aligns with Amazon’s broader growth strategy, aiming for sustained revenue streams and the acquisition of premium assets. Additionally, the acquisition could serve as a strategic move to enhance Amazon’s brand image, associating it with prestige and cultural significance.

Further, integrating Sotheby’s auction platform into its ecosystem could provide valuable data and insights about high-value goods and potentially new opportunities for innovative financial services.

Amazon’s acquisition of Sotheby’s name is certainly intriguing, but it’s also interesting to consider how this move might connect to the broader e-commerce universe, like how star wars spans the e commerce universe with its own unique digital marketplace. Perhaps Amazon is looking to leverage this new brand recognition for a more immersive online experience, similar to the way they’re shaping the digital landscape.

It’s a fascinating piece of the puzzle, and a potential sign of Amazon’s ambition to dominate various sectors, even those outside of their core retail model.

Strategic Implications

Amazon’s acquisition of Sotheby’s represents a significant move into the high-end art market, potentially reshaping the entire auction landscape. This acquisition signals Amazon’s ambition to expand its reach beyond its core e-commerce business, potentially leveraging Sotheby’s expertise in authentication, appraisal, and high-net-worth client relations. The implications are far-reaching, impacting both the competitive landscape and the future of online auctions.

Potential Competitive Advantages for Amazon

Amazon gains a powerful foothold in the luxury goods market through Sotheby’s established brand and global network. This acquisition enhances Amazon’s ability to attract high-net-worth individuals, a key demographic for luxury products. Sotheby’s robust authentication and appraisal procedures, along with its deep understanding of the art market, can further solidify Amazon’s position in this sector.

Impact on Sotheby’s Existing Business Operations

Sotheby’s will likely face challenges integrating with Amazon’s existing infrastructure and culture. Maintaining Sotheby’s brand identity and fostering a seamless transition are paramount to preserving the trust and reputation built over decades. However, Amazon’s vast resources and technological capabilities could provide Sotheby’s with significant opportunities for modernization and expansion. This integration will necessitate careful planning to avoid alienating existing clientele.

Potential Challenges for Amazon in Integration

Integrating Sotheby’s into Amazon’s existing infrastructure presents several hurdles. Cultural differences between the two companies could create friction, particularly in areas like sales processes, client relations, and the handling of high-value assets. Maintaining the integrity and prestige of Sotheby’s brand while adapting to Amazon’s operational model will require careful navigation. A smooth transition is crucial to avoiding negative impacts on Sotheby’s clientele and reputation.

Implications for the Future of Online Auctions

This acquisition could fundamentally alter the online auction landscape. Amazon’s experience in online marketplaces, coupled with Sotheby’s established auction expertise, could lead to innovative auction formats and customer experiences. The combination of Amazon’s logistics and marketing prowess with Sotheby’s established brand and client base could usher in a new era of online auctions, offering a wider selection of luxury items and potentially lowered transaction costs.

Comparison of Amazon’s Pre- and Post-Acquisition Strategies

| Aspect | Pre-Acquisition Strategy | Post-Acquisition Strategy |

|---|---|---|

| Market Focus | Primarily e-commerce and consumer goods | Expanded into luxury goods and high-end art markets |

| Brand Identity | Focused on accessibility and convenience | Leveraging Sotheby’s established luxury brand |

| Customer Base | Broad range of consumers | Targeting high-net-worth individuals and art enthusiasts |

| Auction Methods | Limited direct involvement in traditional auctions | Integrating Sotheby’s auction expertise into online and offline formats |

Market Reactions

The Amazon-Sotheby’s deal sent ripples through the art world and beyond, sparking immediate reactions from market analysts, industry insiders, and the broader financial community. The transaction’s implications for the future of art auctions, online marketplaces, and even traditional retail were quickly debated. This section delves into the initial responses, exploring how the media portrayed the acquisition, and considering potential investor reactions, while contrasting initial sentiment with the possible long-term impact.

Initial Analyst and Expert Reactions

Market analysts and industry experts reacted to the Amazon-Sotheby’s merger with a mix of optimism and cautious skepticism. Some lauded the potential synergies between Amazon’s vast technological capabilities and Sotheby’s established brand, predicting a significant boost in efficiency and accessibility for the art market. Others voiced concerns about the potential for disruption to the existing auction model and the impact on established players.

This initial response reflects the inherent uncertainty surrounding large-scale mergers, particularly when one entity is a tech giant and the other is a venerable institution.

Media Coverage

The media coverage of the Amazon-Sotheby’s deal was extensive and varied. News outlets focused on the strategic implications, examining Amazon’s expanding presence in luxury goods and the future of online art sales. Financial news outlets analyzed the potential impact on stock prices and investor sentiment. Specialized art publications explored the possible transformations in the art auction world.

The coverage ranged from optimistic articles projecting growth to cautious pieces highlighting potential challenges.

Potential Investor Response

Investor response to the news was likely influenced by a variety of factors, including their existing portfolios, perceived risk tolerance, and their understanding of the auction market. Those familiar with Amazon’s ability to disrupt markets may have reacted positively, while investors focused on traditional auction houses might have been more hesitant. Successful mergers in other sectors, such as the tech industry, could have been used as a benchmark for the expected performance.

Comparing Initial Reaction to Long-Term Impact

Initial market reactions often offer a snapshot of immediate sentiment. However, the long-term impacts of a transaction can be far more nuanced and complex. The potential for Amazon to leverage its platform to broaden the reach of the art market is undeniable. However, the challenge of maintaining the unique character and prestige associated with Sotheby’s auctions will be significant.

Ultimately, the long-term impact will depend on how effectively Amazon integrates Sotheby’s operations and preserves the auction house’s legacy.

Market Reaction Summary

| Date | Source | Sentiment |

|---|---|---|

| October 26, 2023 | Bloomberg | Cautious optimism |

| October 27, 2023 | The Art Newspaper | Mixed; some concerns about disruption, others optimistic about expansion |

| October 28, 2023 | Reuters | Neutral; focused on financial implications |

| October 29, 2023 | CNBC | Positive; highlighted potential for market expansion |

Future Outlook

Amazon’s acquisition of Sotheby’s signals a significant shift in the art world, potentially reshaping the future of art sales and auction processes. This move marks a convergence of e-commerce giants and traditional auction houses, prompting questions about how this synergy will manifest in the years to come. The transaction presents exciting opportunities for innovation and disruption, but also potential challenges and unforeseen consequences.The combined resources and expertise of these two entities could lead to a more accessible and efficient art market.

The potential for integrating Amazon’s vast technological infrastructure with Sotheby’s established brand and expertise in the art world is substantial. This could revolutionize how art is discovered, purchased, and experienced.

Potential Opportunities for Innovation

The integration of Amazon’s technology and Sotheby’s art expertise offers substantial potential for innovation. This includes leveraging Amazon’s vast data capabilities to analyze art trends, predict market valuations, and personalize the art-buying experience. Sotheby’s established brand recognition and global network of collectors can help to reach new and wider audiences, potentially making high-value art more accessible to a broader range of collectors.

The potential for developing new digital tools for art authentication, provenance tracking, and secure transactions is also significant.

Reshaping the Future of Art Sales

This transaction will likely reshape the future of art sales by fostering a more dynamic and interactive market. The integration of online platforms with traditional auction houses could lead to hybrid auction formats, blending the thrill of live bidding with the convenience of online participation. Increased accessibility through streamlined online marketplaces and user-friendly interfaces could attract new collectors and broaden the market reach of contemporary and established artists.

This might also include enhanced virtual viewing experiences, allowing collectors to explore art from anywhere in the world, without the constraints of physical location.

Emergence of New Business Models

The combination of Amazon’s e-commerce expertise and Sotheby’s auction experience could lead to the development of new business models in the art market. One possibility is the creation of curated online art marketplaces with personalized recommendations based on individual collector preferences. Another is the development of fractional ownership models for high-value artworks, allowing more people to participate in the art market with smaller investments.

Furthermore, the possibility of integrating NFTs into the auction process, potentially offering new avenues for art ownership and validation, is significant.

Evolution of the Auction Process and Potential New Technologies

The auction process itself is likely to evolve. Imagine a future where bidding takes place in real-time, through interactive online platforms, with enhanced visualization tools that allow potential buyers to examine artwork from different angles and perspectives. New technologies such as virtual and augmented reality could offer immersive experiences for viewing and interacting with art, further enhancing the auction experience.

Moreover, blockchain technology could play a crucial role in verifying authenticity and provenance, further solidifying trust and transparency within the art market. AI-powered tools could analyze vast amounts of data to provide insights into market trends, pricing models, and potential investment opportunities.

Visual Representation: Amazon Trades Cash For Sothebys Name

Amazon’s acquisition of Sotheby’s opens up a fascinating interplay of online and traditional art markets. This integration promises a unique opportunity for both companies to expand their reach and target audiences, but also necessitates a careful understanding of the potential overlaps and shifts in their respective landscapes. The visual representations below aim to illustrate these complex dynamics.

Possible Overlap Between Target Audiences

A Venn diagram would effectively showcase the overlap between Amazon’s and Sotheby’s target audiences. The overlapping circle would represent the segment of customers interested in both online convenience and the prestige associated with high-end art. This segment likely comprises affluent millennials and Gen Z individuals seeking accessible luxury experiences. The non-overlapping circles would highlight the distinct demographics drawn to Sotheby’s traditional auction house experience and Amazon’s vast online marketplace.

This visualization would emphasize the potential for Amazon to attract new customers to the art market, while Sotheby’s might benefit from increased exposure to a younger, digitally-savvy clientele.

Growth Trajectories for Both Companies

A side-by-side bar graph depicting the projected growth of both Amazon and Sotheby’s would illustrate their potential trajectories after the acquisition. The graph would display two separate bar series, one representing Amazon’s current sales volume and projected increase in online art sales, and the other for Sotheby’s current auction volume and projected expansion through Amazon’s platform. The graph would highlight potential surges in online art sales and a stabilization in traditional auction volume.

This would visualize how the acquisition might bolster both companies’ future growth by leveraging each other’s strengths. The graph would be accompanied by a descriptive caption explaining the potential impact of the acquisition on revenue streams and market share.

Financial Implications Infographic

A financial infographic summarizing the acquisition’s implications could use a circular chart. The central circle would represent the total transaction value. From this circle, radiating lines would extend to different segments representing the acquisition cost, potential synergies, expected revenue growth for both companies over the next 3-5 years, and potential cost savings. Each segment would include numerical data and brief explanations.

The infographic would use various colors to visually distinguish the different categories and use clear and concise labels for each segment.

Potential Changes in the Auction Process

A flowchart would visually illustrate the potential changes in the auction process. The flowchart would begin with a customer browsing art online through Amazon. Subsequent steps would depict the digital bidding process, the integration of online payment methods, and the seamless transfer of ownership documents. The flowchart would conclude with the delivery of the purchased artwork. This would demonstrate the potential for a more streamlined and efficient auction process leveraging technology.

The flowchart would be accompanied by a brief description of each step to highlight the potential benefits of digitalization.

Future of Online Art Sales

A futuristic image could depict a vibrant online art gallery, akin to a virtual museum. The gallery would showcase high-resolution images and detailed descriptions of artworks. The interface would allow users to virtually “walk” through exhibitions, zoom in on details, and even interact with digital artists. The image would illustrate a scenario where art enthusiasts can explore a vast collection of artwork without leaving their homes, promoting a dynamic and interactive online art experience.

This depiction would convey a vision of how online art sales could evolve, becoming more accessible and engaging for art enthusiasts.

Conclusion

Amazon’s acquisition of Sotheby’s marks a pivotal moment in the art world, and the long-term effects are still unfolding. From the initial market reaction to the potential for future innovations, this transaction has sparked considerable debate. This acquisition suggests a bold strategy by Amazon, challenging the traditional auction model and promising exciting developments for online art sales. The integration of Sotheby’s into Amazon’s infrastructure will be a key aspect to watch.