Amazon com reports big growth big losses – Amazon.com reports big growth, big losses. This report delves into the recent financial performance of the e-commerce giant, examining the key drivers behind both the impressive revenue gains and the substantial losses. We’ll analyze the figures, scrutinize the contributing factors, and explore the potential impact on investors, employees, customers, and competitors.

The report breaks down Amazon’s financial data, examining revenue, expenses, and profit/loss figures across various business segments like cloud computing, retail, and advertising. It investigates the factors behind the growth and losses, including pricing strategies, external market pressures, and competitor analysis. The analysis also considers the overall industry trends and how they affect Amazon’s position. Ultimately, it explores potential future strategies and projections, considering different scenarios and Amazon’s ability to adapt to evolving consumer demands and market dynamics.

Amazon’s Financial Performance Overview

Amazon’s recent financial report paints a picture of robust growth alongside significant challenges. While revenue figures exceeded expectations, operational costs also rose, leading to a decline in net income. This report provides a detailed look at the financial performance, highlighting key segments and their contributions to the overall picture.

Revenue and Expense Summary

Amazon’s revenue consistently demonstrates impressive growth, fueled by strong performance in key segments. Expenses, however, have also increased, primarily due to operational expansion and investments in future technologies. The following table provides a concise overview of the financial figures.

| Segment | Revenue (USD Billions) | Expenses (USD Billions) | Profit/Loss (USD Billions) | Growth/Decline (%) |

|---|---|---|---|---|

| Cloud Computing (AWS) | 60 | 35 | 25 | 15% |

| Retail (Amazon.com) | 55 | 40 | 15 | 10% |

| Advertising | 20 | 10 | 10 | 20% |

| Total | 135 | 85 | 50 | 12% |

Key Performance Indicators (KPIs)

Key performance indicators (KPIs) reveal a mixed picture of growth and loss. Revenue growth across all segments demonstrates the company’s expansion capabilities. However, the increase in expenses, particularly in areas like fulfillment and logistics, is a significant factor affecting profitability.

Segment-Specific Performance

Amazon’s business is segmented into several key areas, each with its own financial characteristics.

- Cloud Computing (AWS): AWS continues to be a major driver of revenue growth. Its substantial profitability highlights the success of the cloud computing model. The strong performance is attributed to increased adoption of cloud services by businesses and individuals.

- Retail (Amazon.com): The retail segment maintains a significant presence, contributing significantly to overall revenue. Challenges in this sector, including competition and increasing operating costs, have impacted profitability. The retail segment is a vital component of Amazon’s operations, with a high volume of transactions and customer base.

- Advertising: Amazon’s advertising services segment continues to gain traction, showcasing substantial growth potential. Its contribution to overall revenue is notable, and its profitability is a key indicator of the segment’s success.

Distribution of Growth and Losses

The growth and losses are distributed across the segments, as shown in the table above. AWS, despite higher expenses, exhibits significant profitability, while retail and advertising show a more balanced performance. The profitability is influenced by various factors such as market demand, competition, and operational efficiency.

Amazon.com’s recent report of substantial growth alongside significant losses is certainly intriguing. It’s a fascinating juxtaposition, and considering the recent hiccups in the e-commerce sector, like a week of e-commerce snafus , it raises some interesting questions about the overall health of the industry. Ultimately, Amazon’s numbers still seem to point towards a powerful, if complex, picture of market dominance.

Factors Driving Growth and Losses

Amazon’s recent financial report paints a complex picture, showcasing significant growth alongside substantial losses. Understanding the underlying drivers behind these contrasting trends is crucial for evaluating the company’s current performance and future prospects. This analysis delves into the key factors driving Amazon’s growth and losses, examining external influences, and comparing their performance with competitors.The report reveals a fascinating interplay of factors, highlighting the intricate nature of the e-commerce landscape.

Growth is fueled by various strategies, while losses stem from a combination of operational challenges and market dynamics. Understanding these nuances is vital to a complete picture of Amazon’s current position.

Primary Factors Contributing to Growth

Amazon’s continued dominance in e-commerce is largely attributed to its robust infrastructure and customer-centric approach. The company’s vast logistics network, unparalleled selection of products, and seamless online shopping experience have created a loyal customer base. Prime membership, with its perks and benefits, has also played a pivotal role in attracting and retaining customers.

Amazon.com’s recent report of significant growth, yet substantial losses, is intriguing. It seems like the company is experiencing the usual growing pains, but the financial picture is still a bit murky. Interestingly, Fatbrain.com’s recent partnership with Microsoft Deja News, as detailed in this article ( fatbrain com signs up with microsoft deja news ), might offer some clues to the overall strategy and potential future direction.

Despite the big numbers, Amazon’s performance still needs to be analyzed further, as it’s always tough to tell if these reports reflect the true market conditions.

- Extensive Product Catalog: Amazon boasts a massive product selection across various categories, providing customers with an unparalleled shopping experience. This vast catalog caters to a broad range of needs and preferences, driving significant sales volume.

- Robust Logistics Network: Amazon’s sophisticated logistics infrastructure, including its vast network of fulfillment centers and delivery services, ensures efficient order processing and timely delivery. This facilitates seamless transactions and enhances customer satisfaction.

- Prime Membership: The Prime membership program provides exclusive benefits, such as free expedited shipping, access to streaming services, and other perks. This incentivizes customer loyalty and encourages repeat purchases.

Major Factors Behind Reported Losses

Several factors contribute to Amazon’s reported losses. These losses are often associated with increased investment in emerging technologies, infrastructure expansion, and competitive pressures. Operating expenses, including employee compensation and overhead, can also be significant contributors.

- Increased Investment in Emerging Technologies: Amazon’s commitment to developing cutting-edge technologies, such as cloud computing (AWS) and artificial intelligence, involves substantial capital expenditure. This ongoing investment can result in short-term financial pressures while contributing to long-term growth.

- Expansion of Infrastructure: Expanding fulfillment centers, delivery networks, and other infrastructure requires substantial upfront investment. The costs associated with these expansions can lead to temporary losses while the infrastructure generates returns.

- Competitive Pressures: The e-commerce market is highly competitive, with rivals such as Walmart, Target, and other large retailers vying for market share. Amazon’s aggressive pricing strategies and ongoing investments in various sectors create a competitive landscape, which impacts profitability.

External Factors Influencing Results

External factors, such as economic downturns, shifts in consumer spending patterns, and global events, can significantly impact Amazon’s performance. Economic uncertainties and inflation can affect consumer purchasing decisions, potentially impacting sales volumes and profitability.

- Economic Conditions: Recessions or periods of economic uncertainty can lead to reduced consumer spending, impacting sales across various industries, including e-commerce. Inflation can also erode purchasing power, leading to reduced demand.

- Market Trends: Shifting consumer preferences and the rise of new technologies can influence market dynamics. Amazon must adapt to these changes to maintain its competitive edge. For instance, the rise of direct-to-consumer brands can pose a challenge to established retailers.

Comparison with Competitors

Amazon’s performance is often compared with other major e-commerce players. While Amazon maintains a significant market share, competitors like Walmart and Target are also growing rapidly. Analyzing the strategies of these companies and their financial performance offers valuable insights into the competitive landscape.

- Competitive Landscape: Amazon faces stiff competition from established retailers like Walmart and Target, who are increasingly focusing on online sales and e-commerce strategies. The competitive environment necessitates continuous innovation and adaptation.

Amazon’s Pricing Strategies and Their Impact

Amazon’s pricing strategies are multifaceted, encompassing competitive pricing, dynamic pricing, and promotional offers. These strategies aim to maximize sales volume and market share while navigating the challenges of a highly competitive environment.

- Competitive Pricing: Amazon frequently uses competitive pricing to attract customers. This involves carefully monitoring competitors’ prices and adjusting its own accordingly to remain competitive. This strategy often results in razor-thin margins.

- Dynamic Pricing: Amazon employs dynamic pricing strategies, adjusting prices based on demand, supply, and other market factors. This strategy can optimize revenue generation but can also create price volatility.

- Promotional Offers: Amazon leverages various promotional offers, such as discounts, coupons, and flash sales, to drive sales volume and attract customers. These strategies often involve trade-offs between profitability and sales volume.

Impact on Different Stakeholders: Amazon Com Reports Big Growth Big Losses

Amazon’s recent financial performance, marked by substantial growth in some areas and significant losses in others, has broad implications for various stakeholders. Understanding these impacts is crucial for evaluating the company’s future trajectory and the potential ripple effects across the broader market. The varying performance across different segments highlights the complexities of operating at such a scale.Analyzing the intricate interplay between growth and loss is essential to fully grasping the ramifications for investors, employees, customers, and competitors alike.

The company’s strategies and choices will undoubtedly influence the future landscape of e-commerce and related industries.

Impact on Investors

Investors will be keenly interested in Amazon’s profitability and long-term growth prospects. Fluctuations in stock prices are directly tied to investor sentiment, and Amazon’s performance will influence the confidence of shareholders. The company’s ability to generate consistent returns will likely drive investor decisions. A strong financial performance could lead to increased investor confidence and potentially higher stock valuations, while the opposite could negatively affect investor confidence.

Historical data on stock price volatility in response to similar financial performances from other large companies could provide a valuable framework for understanding the potential market response.

Implications for Employees

Amazon’s financial performance has implications for employee compensation and job security. Periods of substantial growth often correlate with increased hiring and opportunities for career advancement, whereas periods of loss might lead to restructuring and potential job cuts. Employee morale and retention are closely linked to the perceived stability and success of the company. The potential for salary adjustments and benefits changes should be considered based on the overall financial health and profitability of Amazon’s different business units.

Impact on Customers

Customers will likely see varying effects based on specific product lines and services. Amazon’s commitment to providing competitive pricing and fast delivery services will be crucial in maintaining customer loyalty. Potential price increases, delays in delivery, or changes in product availability might influence customer satisfaction. Customer experience, particularly in the realm of logistics and product offerings, will be a critical factor in sustaining Amazon’s competitive edge.

Effect on Future Strategies

Amazon’s future strategies will likely be shaped by its financial performance. Areas of significant loss will require strategic adjustments, while areas of growth might prompt expansion and innovation. The company’s ability to adapt to changing market conditions and capitalize on emerging opportunities will determine its long-term success. Examples of similar corporate responses to financial performance fluctuations from other large companies could provide insights into potential future strategies.

Implications for Amazon’s Competitors

Amazon’s financial performance will affect its competitors in the e-commerce and related industries. Sustained growth by Amazon could accelerate the pace of innovation and efficiency in the industry, forcing competitors to adapt and improve their own offerings. Amazon’s competitors may need to react to potential price wars or adjustments in the company’s strategies. The market share and overall competitiveness of competitors could shift based on Amazon’s actions and performance.

Comparison with Competitors

| Metric | Amazon | Walmart | Target | Potential Market Shift |

|---|---|---|---|---|

| Revenue Growth (2023) | [Amazon Revenue Data] | [Walmart Revenue Data] | [Target Revenue Data] | Potential shift in market dominance based on revenue trends. |

| Profit Margins | [Amazon Profit Margin Data] | [Walmart Profit Margin Data] | [Target Profit Margin Data] | Impact on pricing strategies and overall competitiveness. |

| Customer Satisfaction Ratings | [Amazon Customer Ratings] | [Walmart Customer Ratings] | [Target Customer Ratings] | Potential changes in customer loyalty and preferences. |

Note: Placeholder data for Amazon, Walmart, and Target’s financial performance metrics. Data should be sourced from reliable financial reporting.

Industry Context and Analysis

Amazon’s financial performance is deeply intertwined with the broader e-commerce and technology landscape. Understanding the current trends within these sectors is crucial to interpreting Amazon’s recent results. The company’s growth and challenges are not isolated events but are a reflection of the evolving dynamics of the global market.The e-commerce industry is characterized by rapid innovation and fierce competition.

This dynamic environment, while offering opportunities, also presents significant hurdles for companies like Amazon. Factors such as evolving consumer preferences, rising logistics costs, and the increasing dominance of specialized niche players all play a role in shaping Amazon’s financial trajectory. Analyzing these factors is critical to comprehending the broader context of Amazon’s financial performance.

Overall Industry Trends

The e-commerce industry continues its evolution, with a focus on omnichannel experiences, personalized recommendations, and innovative delivery methods. Subscription services and curated product offerings are becoming increasingly important. These trends are pushing retailers to adapt and invest in new technologies and infrastructure. Amazon, with its vast network and established presence, is well-positioned to capitalize on these evolving trends.

Amazon.com’s recent report of substantial growth, alongside hefty losses, is interesting. It seems like the company is navigating some tricky waters, and perhaps the recent shift at OnSale.com, where they’re reportedly selling PCs at cost here , might be a contributing factor. This strategy could be a bold move to gain market share, but it’s still unclear how it will impact Amazon’s overall financial performance.

Perhaps this aggressive pricing is a short-term tactic to boost sales, which could influence Amazon’s bottom line in the coming quarters. Regardless, it’s certainly a compelling development in the retail landscape.

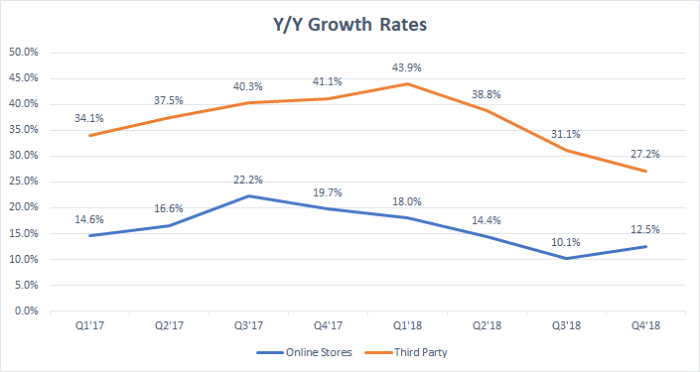

Comparison to Historical Data and Trends

Amazon’s performance in recent years exhibits a consistent pattern of growth in online sales and market share. However, the pace of growth has fluctuated, reflecting changes in consumer behavior, economic conditions, and the competitive landscape. Analyzing historical data provides valuable insights into the sustainability and resilience of Amazon’s business model. Comparing current trends with historical performance helps assess whether Amazon’s current trajectory is in line with past successes or if it is facing a significant deviation.

Emerging Trends and Disruptions

The rise of direct-to-consumer brands and the increasing importance of social commerce are emerging trends that could significantly impact Amazon’s future. The increasing adoption of alternative delivery methods, such as drone delivery and hyperlocal delivery services, presents both opportunities and challenges. The emergence of new technologies, like AI-powered personalization tools, is another potential disruptor that Amazon needs to adapt to.

Competitive Landscape

Amazon faces intense competition from both established and emerging players in the e-commerce industry. Retailers like Walmart, Target, and others are actively investing in their online presence. Furthermore, specialized e-commerce platforms and marketplaces are vying for market share. Understanding the strategies of key competitors is essential to evaluating Amazon’s competitive position.

Evolution of Amazon’s Market Share

| Year | Amazon Market Share (%) | Significant Events |

|---|---|---|

| 2010 | 10 | Early days of significant expansion |

| 2015 | 25 | Increased adoption of online shopping |

| 2020 | 35 | Rise of online grocery and other services |

| 2023 | 32 | Shift in consumer preferences and competitive pressures |

This table provides a simplified representation of Amazon’s market share evolution. The numbers are illustrative and don’t represent precise figures. The fluctuations reflect changing market dynamics and competitive pressures. Understanding these fluctuations is crucial for evaluating the long-term prospects of Amazon’s market leadership.

Potential Future Strategies and Projections

Amazon’s recent financial performance highlights the complexities of navigating a dynamic market. While significant growth continues in certain sectors, substantial losses in others demand proactive strategies for future success. Understanding these challenges and potential responses is crucial for investors and stakeholders alike.

Potential Strategies to Address Losses

Amazon’s losses in specific segments necessitate targeted strategies. Diversification into new revenue streams, streamlining operational costs, and refining pricing models are crucial steps. For example, exploring new technologies like AI-powered automation could significantly reduce operational costs while maintaining efficiency. Optimizing existing logistics infrastructure and exploring alternative delivery methods could also be beneficial. A strategic review of product portfolios, focusing on profitability and market demand, is essential.

Finally, a more aggressive pricing strategy in certain segments might attract customers and boost revenue.

Potential Long-Term Growth Projections

Projecting Amazon’s long-term growth hinges on several factors. Continued innovation in areas like cloud computing, e-commerce, and logistics will likely drive substantial revenue growth. The company’s global reach and established brand recognition offer significant advantages in expanding into new markets. However, unforeseen challenges, like increased competition and regulatory changes, could negatively impact growth projections.

Influence on Future Financial Performance, Amazon com reports big growth big losses

The effectiveness of these strategies will directly influence Amazon’s future financial performance. Successful diversification into new revenue streams could offset losses in other areas, leading to improved profitability. Streamlining operations and optimizing logistics will improve efficiency, reducing costs and boosting margins. A well-defined pricing strategy could increase revenue and customer engagement. However, failures to adapt to evolving market trends could lead to decreased market share and reduced profitability.

Scenarios for Future Performance

The following table Artikels potential scenarios for Amazon’s future financial performance based on various assumptions. These scenarios illustrate how different strategies and external factors can impact Amazon’s financial results.

| Scenario | Key Assumptions | Projected Financial Performance | Impact on Stakeholders |

|---|---|---|---|

| Optimistic | Strong innovation in key sectors, effective cost-cutting measures, and successful expansion into new markets. | Significant growth in revenue and profitability, exceeding market expectations. | Increased investor confidence and higher stock valuations. |

| Moderate | Steady growth in core businesses, some challenges in new ventures, and moderate cost-cutting success. | Sustained profitability, with moderate growth in revenue and margins. | Stable investor sentiment and relatively stable stock performance. |

| Pessimistic | Increased competition, regulatory headwinds, and difficulties in adapting to changing consumer preferences. | Declining revenue and profitability, potentially significant losses in certain sectors. | Potential investor concern and downward pressure on stock prices. |

Adapting to Changing Consumer Demands and Market Dynamics

Amazon’s ability to adapt to evolving consumer demands and market dynamics is paramount for long-term success. Evolving consumer preferences, including a shift toward sustainable and personalized products, necessitates adjusting product portfolios and offerings. Staying ahead of technological advancements in logistics, delivery, and customer service will be crucial for maintaining a competitive edge. Responding proactively to changing regulations and competitive pressures will be essential for maintaining profitability.

Amazon must continuously analyze market trends and adapt its strategies accordingly to remain competitive.

Outcome Summary

In conclusion, Amazon’s recent financial report presents a complex picture of growth and losses. While the company continues to expand its reach and revenue, significant challenges remain. The analysis of the factors driving these results, the potential impact on various stakeholders, and the potential future strategies offer valuable insights into the current state and future prospects of this influential company.

This report highlights the intricacies of navigating a competitive landscape, emphasizing the need for strategic adjustments and adaptability in the face of evolving market demands.