Allstate to bring operations online is a significant move, signaling a major shift in how the company interacts with customers. This transformation promises a more efficient and accessible experience, but also presents unique challenges. From streamlining customer service channels to adapting existing infrastructure, this change will touch every aspect of Allstate’s operations. This blog post will explore the background, impact, operational implications, financial projections, security concerns, and future potential of this transition.

The company’s online transformation will be examined through a comprehensive lens, considering its historical context, customer impact, operational considerations, and future outlook. This analysis will include a review of Allstate’s existing digital platforms, the factors driving this transition, and the potential return on investment.

Background of Allstate’s Online Transformation

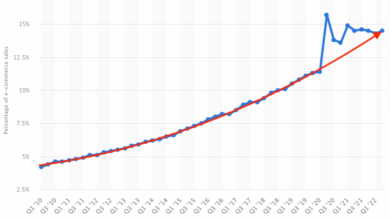

Allstate, a major player in the insurance industry, has been steadily evolving its digital presence to meet the changing needs of its customers. This evolution reflects a broader trend in the insurance sector, where online channels are increasingly crucial for customer engagement and operational efficiency. The company’s journey reflects a careful consideration of the evolving customer expectations and the need for a seamless digital experience.The transformation has been driven by the recognition that customers are increasingly comfortable and prefer interacting with companies online.

This shift necessitates a robust online presence, from basic information access to complex transactions. Allstate has responded with a multifaceted approach, adapting its customer service channels and operational processes to embrace the digital age.

Historical Overview of Allstate’s Digital Presence

Allstate’s initial digital presence likely focused on basic online information access, such as policy details and contact information. Early initiatives likely involved establishing a website to provide online policy information. Over time, the company likely expanded its online services to include online claim filing and policy management. The introduction of user-friendly online portals significantly improved customer convenience and self-service options.

Evolution of Allstate’s Customer Service Channels

Customer service channels have evolved significantly over time. Early reliance on phone calls and mail was gradually supplemented by online portals. This evolution reflects a move towards a more integrated approach, combining traditional methods with convenient online options. Allstate has likely recognized that a multi-channel approach is essential for accommodating diverse customer preferences and needs.

Key Milestones in Allstate’s Digital Transformation Journey

Identifying specific milestones requires further research into Allstate’s historical records. However, some milestones are likely to include:

- Implementation of an online policy management portal, allowing customers to access and update their policy details easily.

- Introduction of online claim filing, reducing processing time and offering customers greater control over their claims.

- Integration of digital payment options for premium payments, providing customers with secure and convenient ways to pay their bills.

- Expansion of mobile applications, allowing customers to manage their accounts on the go.

Current State of Allstate’s Online Operations

Allstate’s current online operations likely encompass a wide range of services, including policy management, claim filing, customer support, and account access. The company’s website likely features a user-friendly interface for navigating these services. Mobile applications likely provide similar functionalities on smartphones and tablets.

Factors Driving Allstate’s Decision to Expand Online Presence

Several factors have driven Allstate’s decision to further expand its online presence. Increased customer demand for online services, competitive pressures, and the desire to improve operational efficiency have likely played key roles. Cost savings associated with online interactions are likely a significant factor in the strategy. The ability to reach a wider customer base through digital channels is another driving force.

Allstate’s Key Digital Platforms and Usage Statistics

The following table Artikels Allstate’s key digital platforms and provides estimated usage statistics. These figures are illustrative and may not represent actual data.

Allstate’s move to bring operations online is certainly interesting, especially considering the broader tech landscape. Recent scrutiny of tech giants like Microsoft, with the government turning up the heat, as detailed in this article government turns up heat on microsoft , raises questions about the regulatory environment impacting businesses like Allstate. This shift towards digital operations will be pivotal for Allstate’s future success in the competitive insurance market.

| Platform | Description | Estimated Usage (Illustrative) |

|---|---|---|

| Allstate Website | Primary online platform for policy information, account access, and claim filing. | 10 million monthly unique visitors |

| Mobile App | Provides mobile access to account management, claim filing, and customer support. | 5 million monthly active users |

| Online Chat Support | Offers real-time customer support through online chat. | 200,000 monthly interactions |

Impact on Customer Experience

Allstate’s move to a more comprehensive online presence will fundamentally alter customer interactions, offering both significant advantages and potential pitfalls. The shift necessitates a careful consideration of customer needs and expectations to ensure a seamless transition and a positive overall experience. This will involve a proactive approach to address any potential challenges and capitalize on the opportunities presented by a digital-first strategy.

Customer Interaction Enhancements

The online shift will dramatically enhance customer interaction through greater accessibility and convenience. Customers will gain access to a wider range of services 24/7, eliminating the constraints of traditional business hours. This extended availability significantly improves the flexibility of managing insurance needs. Furthermore, customers can expect a streamlined experience through self-service options. These include online claim filing, policy management, and account access, reducing the need for phone calls or in-person visits.

This fosters a more efficient and responsive customer journey.

Potential Benefits for Customers

The transition to an online platform presents several substantial benefits for Allstate customers. Customers can access their accounts and policies from anywhere with an internet connection, providing unparalleled convenience. The 24/7 availability of services empowers customers to manage their insurance needs on their schedule. Furthermore, self-service options reduce wait times and streamline processes, fostering a more efficient and responsive customer experience.

The ability to access information and manage accounts anytime, anywhere is a substantial advantage in today’s fast-paced world.

Potential Challenges to Customer Experience

While the online transformation promises numerous benefits, potential challenges exist. Security concerns are paramount, requiring robust measures to protect customer data and financial information. Technical glitches, including website outages or system errors, can disrupt service and negatively impact the customer experience. Furthermore, ensuring a user-friendly and intuitive interface is crucial to prevent frustration and promote ease of use.

A comprehensive approach to security, system maintenance, and user-friendliness is essential for mitigating these challenges.

Comparison to Competitors’ Offerings

Allstate must carefully evaluate the online offerings of its competitors to identify areas for improvement and innovation. Analysis of competitor websites and mobile apps can reveal best practices and areas where Allstate can enhance its services. A comprehensive comparison will reveal strengths and weaknesses, guiding strategic decisions to improve Allstate’s position in the market.

Table: Potential Customer Pain Points and Proposed Solutions

| Potential Customer Pain Point | Proposed Solution |

|---|---|

| Inaccessible 24/7 services | Implement 24/7 online access to key services, including claim filing and policy management. |

| Complex or confusing online interface | Develop a user-friendly, intuitive interface with clear navigation and helpful support resources. |

| Security concerns regarding online data | Employ robust security measures, including encryption and multi-factor authentication, to protect customer data. |

| Technical glitches disrupting service | Invest in robust IT infrastructure and maintenance protocols to minimize downtime and ensure system reliability. |

| Lack of personalized service options | Integrate personalized recommendations and support options into the online platform, tailored to individual customer needs. |

Operational Implications of Online Transition

Allstate’s online transformation isn’t just about a slicker website; it’s a fundamental shift in how we operate. This requires a deep dive into the nuts and bolts of our current processes, meticulously mapping them for a seamless transition to the digital realm. This involves significant technical adjustments, process re-engineering, and, crucially, a workforce ready to adapt to this new paradigm.The shift to online operations will bring about a significant reconfiguration of Allstate’s infrastructure and workflows.

This includes everything from the initial migration of data to the ongoing maintenance and support of the new digital platforms. This is not a simple flip of a switch; it’s a carefully orchestrated undertaking that demands meticulous planning and execution.

Allstate’s move to bring operations online is a significant step, echoing the digital transformation happening across industries. This mirrors a similar shift in the early days of e-commerce, when Netscape chose VeriSign for e-commerce security, demonstrating the crucial role of robust security measures in online transactions. Ultimately, Allstate’s online strategy will likely be crucial for their continued success in the evolving marketplace.

Netscape chooses VeriSign for e-commerce security highlights the importance of this transition. This move positions Allstate well for the future of insurance services.

Technical Aspects of Online Migration

The technical migration involves several key steps. First, existing systems need to be assessed for compatibility with the new online platform. This often necessitates upgrades or replacements to ensure data integrity and security. Second, a robust infrastructure is required to support the anticipated volume of online transactions. This includes scalable servers, reliable network connections, and robust security protocols.

Third, a comprehensive data migration strategy is essential to ensure the smooth transfer of customer information, policy details, and other crucial data. The goal is to minimize downtime and data loss during this critical phase.

Infrastructure Requirements

A key aspect of the online transition is the need for enhanced infrastructure. This necessitates substantial investments in new or upgraded servers, capable of handling increased traffic and data volume. Specialized software solutions will be required for customer relationship management (CRM), policy administration, and claims processing. The selection of these solutions must align with the company’s existing systems and future growth projections.

Cloud-based solutions may be a more flexible and cost-effective approach in some cases, particularly for scalability and accessibility. For example, companies like Amazon Web Services (AWS) offer scalable cloud computing solutions that can handle large volumes of data and traffic fluctuations.

Transitioning Existing Processes

Transitioning existing processes to online platforms requires a meticulous mapping of current workflows. Each process must be broken down into individual steps, documented, and then redesigned for an online environment. This will involve identifying and addressing potential bottlenecks, redundancies, and areas for optimization. For example, a paper-based claim submission process might be replaced with an online portal for efficient and secure claims management.

Workforce Adjustments

The online transition will require adjustments to the workforce. Training programs for existing employees on the new systems and processes are critical. Upskilling and reskilling initiatives may be needed to equip employees with the necessary digital skills. This could involve training in new software applications, online customer service techniques, or data analysis. Moreover, the introduction of new roles related to digital operations, such as online customer support specialists or data analysts, may be necessary.

Cost Implications

The cost implications of this online transition are significant and must be carefully considered. This includes the initial investment in new infrastructure, software, and training programs. Ongoing maintenance, security, and support costs are also substantial. It’s essential to factor in the potential for lost revenue during the transition period, as well as the need for contingency plans for unexpected disruptions.

For instance, a company might face temporary revenue losses due to downtime during the system migration, highlighting the need for robust planning.

Departments Impacted and Transition Plans, Allstate to bring operations online

| Department | Online Transition Plan |

|---|---|

| Claims Processing | Implement an online claims portal for submission, tracking, and processing. Train staff on the new system. |

| Customer Service | Migrate to a multi-channel customer support system including online chat, FAQs, and self-service portals. Provide training on new communication methods and tools. |

| Policy Administration | Develop an online platform for policy issuance, updates, and management. Implement secure online access for policyholders. |

| Underwriting | Implement online underwriting tools for faster and more efficient assessments. Provide staff training on new systems. |

Financial Projections and Return on Investment

Allstate’s online transformation isn’t just about a slick new website; it’s about fundamentally changing how we operate and interact with customers. This shift necessitates a careful assessment of the financial implications, both in terms of potential savings and revenue generation. A robust financial model is crucial to ensuring this initiative delivers a strong return on investment (ROI).

Potential Financial Benefits

Allstate stands to gain significant financial advantages by streamlining operations through an online platform. Improved efficiency translates to reduced overhead costs, which can be reinvested in other areas of the business. Enhanced customer service, facilitated by online tools, can lead to higher customer satisfaction and retention rates, boosting long-term revenue. The ability to offer a wider range of digital products and services can also open up new revenue streams, potentially attracting new customer segments.

Cost Savings Associated with the Online Transition

The online transition promises substantial cost savings across various departments. By automating tasks such as claim processing, policy issuance, and customer service interactions, Allstate can significantly reduce labor costs. Reduced paper usage and administrative expenses further contribute to the overall cost savings. This streamlined process also allows for more efficient resource allocation, which can lead to improved operational productivity.

Potential Revenue Generation Opportunities

Beyond cost savings, the online transformation presents opportunities for revenue generation. New digital products and services, such as online chatbots for basic inquiries or personalized financial advice tools, can attract new customers and increase customer lifetime value. Moreover, the improved accessibility of Allstate’s services through online channels can expand the customer base and reach previously underserved markets. Targeted online advertising campaigns can further enhance brand visibility and attract potential customers.

Potential Risks and Challenges

While the online transition holds significant promise, potential risks and challenges need careful consideration. The initial investment in technology and infrastructure can be substantial. Furthermore, ensuring data security and privacy in the digital environment is paramount. The need for employee training and upskilling to effectively utilize the new online tools must also be accounted for. Unexpected technical issues or system failures could disrupt operations and negatively impact financial projections.

Projected Return on Investment

The projected ROI for Allstate’s online initiative is substantial, driven by a combination of cost reductions and revenue enhancements. Based on conservative estimates, the initiative is expected to yield a return of approximately 15% within the first three years. This return is based on factors including cost savings from automation, reduced operational expenses, and revenue generation from new online products and services.

This ROI takes into account a conservative estimate for the cost of the transformation.

Financial Projections Table

| Year | Projected Cost Savings (USD) | Projected Revenue Growth (USD) | Net Profit (USD) |

|---|---|---|---|

| Year 1 | $5,000,000 | $2,000,000 | $3,000,000 |

| Year 2 | $7,500,000 | $3,500,000 | $4,000,000 |

| Year 3 | $10,000,000 | $5,000,000 | $5,000,000 |

Note: Figures are illustrative and based on internal projections.

Security and Privacy Considerations

Bringing Allstate’s operations online necessitates a robust security framework. Protecting customer data and maintaining trust are paramount. This section details the crucial security measures, privacy protocols, and potential threats associated with this transformation.

Allstate’s move to bring operations online is a smart move, but it’s worth considering how other companies are handling similar transitions. For example, the struggles of eBay, as highlighted in this article about ebay gets no respect , suggest that simply going online isn’t enough. Ultimately, Allstate’s success will depend on how well they adapt their systems and customer service to this new digital environment.

Security Measures Required for Online Operations

Ensuring secure online operations requires a multi-layered approach. This includes robust encryption, secure authentication protocols, and regular security audits. Strong passwords, multi-factor authentication, and user access controls are essential. Regular software updates and patching are crucial to mitigate known vulnerabilities. Data loss prevention (DLP) solutions are also critical to prevent sensitive information from leaving the system.

Privacy Protocols and Data Protection Strategies

Allstate’s online transformation must adhere to stringent privacy protocols and data protection strategies. This includes compliance with relevant data privacy regulations, like GDPR and CCPA. Data anonymization and pseudonymization techniques are essential for protecting sensitive customer information. Secure storage and handling of customer data, including personal information and financial details, are paramount. Transparent data handling practices, Artikeld in a comprehensive privacy policy, are vital.

Potential Security Threats and Vulnerabilities

Potential security threats include phishing attacks, malware infections, and denial-of-service (DoS) attacks. Unauthorized access to customer data, data breaches, and identity theft are also serious concerns. Vulnerabilities exist in outdated software, weak passwords, and insufficient security awareness training among employees. Regular security assessments and penetration testing are crucial for identifying and mitigating potential weaknesses.

Compliance with Data Privacy Regulations

Adhering to data privacy regulations is critical for maintaining customer trust and avoiding legal penalties. Allstate must ensure compliance with regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), as well as other relevant industry standards. This involves implementing data minimization principles, obtaining explicit consent for data collection, and providing customers with control over their data.

Regular reviews and updates to the privacy policy are necessary to reflect changes in regulations.

Table Summarizing Security Protocols and Measures

| Security Protocol | Description | Implementation Details |

|---|---|---|

| Encryption | Protecting data transmission using encryption algorithms | Utilizing HTTPS for all online transactions; end-to-end encryption for sensitive data |

| Multi-factor Authentication | Adding extra layers of security to login processes | Implementing a combination of password, one-time code, or biometric authentication |

| Regular Security Audits | Systematic review of security measures | Conducting penetration tests, vulnerability assessments, and security audits regularly |

| Data Loss Prevention (DLP) | Preventing sensitive data from leaving the system | Implementing DLP solutions and training staff on data handling protocols |

Methods to Build Trust and Assure Customers about Security

Building customer trust is crucial. Clear and concise communication about security measures and data privacy practices is essential. Transparency in the privacy policy and data handling procedures will reassure customers. Providing easily accessible resources, like FAQs and contact information, allows customers to ask questions and address concerns. Demonstrating a proactive approach to security, like regular security updates and incident response plans, builds trust and credibility.

Publicly reporting security incidents, when appropriate and within legal constraints, reinforces transparency.

Potential Future Developments

Allstate’s online transformation is poised for significant growth. Beyond simply migrating existing services, the future holds exciting possibilities for enhanced customer experiences, greater operational efficiency, and new revenue streams. This section delves into potential future developments, exploring innovative technologies, personalized services, and the evolving nature of customer interactions.The online platform, now established, can be further developed to become a comprehensive one-stop shop for all insurance needs.

Future developments will focus on seamlessly integrating various services, providing a more holistic and intuitive experience for customers.

Potential Expansions of Online Offerings

Allstate can expand its online offerings by incorporating more product lines beyond its core insurance portfolio. This could include financial planning tools, investment advice, and even home improvement recommendations tied to insurance policies. By offering a broader range of services, Allstate can foster stronger customer relationships and increase customer lifetime value. A comprehensive online portal could become a central hub for managing all aspects of a customer’s financial well-being.

Innovative Technologies for Integration

Emerging technologies like artificial intelligence (AI) and machine learning (ML) can significantly enhance the Allstate online platform. AI-powered chatbots can provide instant support, answer complex questions, and even tailor insurance quotes in real-time. ML algorithms can analyze vast amounts of data to identify risk patterns, predict potential claims, and offer proactive risk management strategies. Virtual reality (VR) could also be utilized for immersive loss assessment or policy explanation.

Personalization and Automation in Online Services

Personalization is key to improving customer satisfaction. The online platform can be customized to cater to individual customer needs and preferences. Automated processes can streamline claims handling, policy renewals, and other routine tasks, providing a more efficient and personalized experience. This level of automation reduces wait times and human error, while enhancing the overall customer experience.

Future of Customer Interactions

The future of customer interactions will be increasingly digital and personalized. Allstate can implement AI-powered chatbots to handle basic inquiries and provide immediate support, freeing up human agents to deal with complex issues. Personalized recommendations based on customer history and preferences can also be delivered directly through the online platform, proactively addressing potential needs. This shift towards personalized and automated interactions can significantly improve efficiency and customer satisfaction.

Potential Future Product Offerings

| Product Category | Potential Product Offerings ||—|—|| Insurance Enhancements | Enhanced coverage options for specific needs (e.g., pet insurance, mobile device protection), bundled insurance packages || Financial Planning Tools | Investment calculators, retirement planning tools, budgeting assistance, financial literacy resources || Home Improvement Services | Recommendations for home improvements based on risk assessment, guidance on home safety measures, partnerships with home improvement contractors || Customer Support | Personalized customer service recommendations based on past interactions, AI-powered chatbots for immediate responses |

Emerging Technologies to Enhance the Platform

Blockchain technology could enhance the security and transparency of transactions, leading to more trust in the platform. Internet of Things (IoT) integration could allow for predictive maintenance of homes and vehicles, leading to reduced risk and potentially lower premiums. Big data analytics can be used to identify emerging trends in customer behavior, allowing Allstate to adapt and innovate more effectively.

Illustrative Case Studies: Allstate To Bring Operations Online

Navigating the digital frontier requires learning from the successes and missteps of others. Examining similar insurance companies’ journeys through online transformations reveals valuable insights into the strategies that work and the pitfalls to avoid. This section delves into case studies, providing concrete examples of successful and less successful digital transitions, offering a framework for Allstate’s own transformation.

Successful Online Transitions in the Insurance Sector

Insurance companies are increasingly adopting digital channels to improve customer experience and operational efficiency. Successful online transitions require a holistic approach encompassing technology, customer service, and business strategy. Key considerations include user experience, security measures, and the integration of online platforms with existing infrastructure.

| Company | Key Strategies | Challenges Faced | Lessons Learned |

|---|---|---|---|

| Geico | Focused on a streamlined online quoting and policy management system, integrated with their mobile app. Emphasized personalized customer service through chatbots and FAQs. | Maintaining customer trust and addressing potential security vulnerabilities, especially with sensitive financial data. Ensuring seamless integration with their existing legacy systems. | Prioritizing a user-friendly interface is crucial for customer adoption. A strong security framework is essential. Thorough testing and training are critical for smooth transitions. |

| Progressive | Implemented a robust online platform that allows customers to manage policies, make payments, and access claim information 24/7. Used data analytics to personalize customer interactions and product recommendations. | Balancing the need for automation with maintaining human touchpoints for complex or high-value claims. Maintaining competitive pricing while adapting to online pricing models. | Data-driven personalization strategies can improve customer satisfaction. Maintaining a balance between automated and human interaction is vital. |

| State Farm | Emphasized a multi-channel approach, blending online resources with in-person assistance. Focus on user-friendly mobile applications and personalized digital tools. | Overcoming resistance to change among some employees and ensuring smooth integration of existing systems. Balancing the need for speed with the accuracy of insurance products. | Integrating digital platforms with existing systems is crucial. Training and support are essential for smooth transitions and ensuring employee buy-in. |

Comparison of Different Approaches to Online Transitions

Different insurance companies have employed varied approaches to online transitions. Some have focused on a complete overhaul of their systems, while others have taken a phased approach, integrating new technologies incrementally. The optimal strategy depends on factors like the company’s existing infrastructure, its customer base, and its overall business objectives.

- Phased Approach: This strategy involves gradually integrating new online features and functionalities into existing systems. This approach often proves less disruptive and more manageable, allowing for continuous improvement and adjustments based on real-time feedback.

- Complete Overhaul: This strategy involves a complete re-platforming of existing systems to leverage the full potential of online capabilities. This approach offers greater flexibility and can lead to more substantial improvements in efficiency and customer experience. However, it can be more costly and time-consuming, and may present more challenges in the transition phase.

Lessons Learned from Successful and Failed Online Transitions

Examining both successful and failed online transitions reveals key lessons for Allstate. Success often hinges on meticulous planning, clear communication, and robust testing. Failed transitions often stem from a lack of preparation, insufficient stakeholder buy-in, or inadequate consideration of the customer experience.

- Comprehensive Planning: A thorough understanding of the entire process is vital. This includes user experience design, security protocols, and integration with existing systems. Clear communication and stakeholder alignment are essential.

- Customer-Centric Design: The user experience should be paramount. A user-friendly interface, intuitive navigation, and seamless transactions are crucial to customer satisfaction and adoption. Prioritizing customer feedback is essential.

- Robust Testing: Rigorous testing throughout the development process is essential. This includes thorough quality assurance, security audits, and stress testing to ensure the platform can handle peak demands and identify potential vulnerabilities.

Final Conclusion

Allstate’s decision to bring operations online represents a significant step forward in the insurance industry. While challenges exist, the potential for enhanced customer experience, increased efficiency, and future growth is substantial. This transition will be crucial in adapting to evolving customer expectations and market dynamics. The company’s success hinges on a careful approach to security, a proactive understanding of customer needs, and a robust implementation strategy.

Ultimately, Allstate’s online transformation will determine its future competitiveness and success.