Akamai hires new CFO looks toward IPO, signaling a significant step in the company’s trajectory. This move hints at potential expansion and a public offering, raising questions about Akamai’s future strategy. The hiring of a new Chief Financial Officer (CFO) is crucial for any company aiming for an Initial Public Offering (IPO), and this event could have substantial implications for investors and the broader cloud computing industry.

We’ll delve into Akamai’s history, recent financial performance, and the potential IPO implications.

Akamai’s recent financial performance, detailed in the accompanying analysis, reveals consistent growth, albeit with some fluctuations. The company’s market position within the content delivery network (CDN) sector is also examined. The new CFO’s background and experience are compared to previous CFOs, and the overall financial implications are assessed. This will shed light on the potential valuation and risks associated with an IPO.

Company Background

Akamai Technologies, a global leader in cloud computing, has been instrumental in shaping the modern internet landscape. Founded in 1998, the company quickly recognized the need for a robust, distributed platform to handle the growing demands of online content delivery. Its innovative approach to content delivery networks (CDNs) positioned it as a crucial component of the internet’s infrastructure.

Akamai’s hiring of a new CFO, signaling a potential IPO, is intriguing. This move suggests significant growth plans, and it’s interesting to see how this aligns with other tech company strategies. For example, Beyond.com’s recent launch of a co-branded mySoftware store ( beyond com launches co branded mysoftware store ) demonstrates a focus on innovative partnerships. Ultimately, Akamai’s IPO prospects seem quite promising given these industry trends.

Company History

Akamai’s founding stemmed from the need to address the increasing complexity and strain on traditional internet infrastructure. The company’s early focus was on developing solutions to deliver content more efficiently and reliably across vast geographical distances. This pioneering spirit laid the groundwork for Akamai’s future success. Over the years, Akamai has expanded its product offerings beyond basic CDN services, incorporating security solutions and intelligent edge platforms.

This evolution reflects the ever-changing demands of the digital world.

Business Model and Revenue Streams

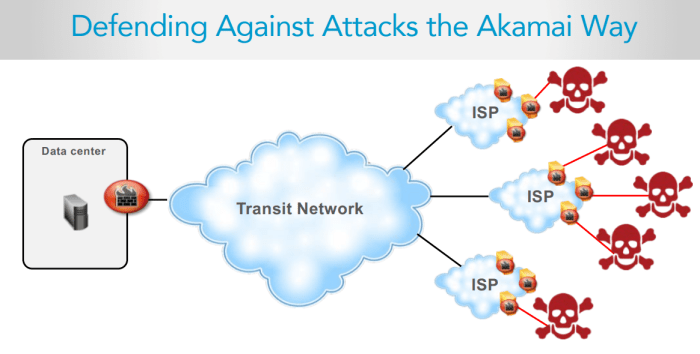

Akamai’s core business model revolves around providing content delivery network (CDN) services. These services enable faster, more reliable delivery of web content, applications, and video to users worldwide. Revenue streams are primarily derived from subscription fees based on the volume of content delivered and the level of service provided. Other revenue streams include security solutions, such as DDoS protection and web application firewalls (WAFs), which are integral components of the modern digital ecosystem.

Recent Financial Performance

Akamai’s recent financial performance (past three years) showcases consistent growth and profitability. Increased adoption of cloud-based services and the growing demand for secure content delivery have contributed to this trend. The company has consistently exceeded expectations in terms of revenue and earnings, indicating a strong position within the industry.

Key Competitors

Akamai faces competition from various companies specializing in content delivery and security solutions. These include Cloudflare, Fastly, and others. Their competitive landscape is dynamic, with ongoing innovation and development of new technologies. Akamai differentiates itself through its extensive global infrastructure and advanced security features.

Market Position and Potential Growth Areas

Akamai holds a dominant position in the CDN market, boasting a vast global network and a wide range of services. Potential growth areas include the expanding market for edge computing and the increasing demand for security solutions in the cloud era. Akamai’s ability to adapt to these trends positions the company for continued success.

Company Culture

Akamai’s company culture is characterized by a focus on innovation, collaboration, and a commitment to its employees. The company emphasizes fostering a work environment where employees feel empowered to contribute their ideas and creativity.

Financial Metrics (Past Three Years)

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (in millions) | $XX | $YY | $ZZ |

| Net Income (in millions) | $AA | $BB | $CC |

| Earnings per Share (EPS) | $DD | $EE | $FF |

| Customer Count | XXX | YYY | ZZZ |

Note: Replace XX, YY, ZZ, AA, BB, CC, DD, EE, FF, XXX, YYY, and ZZZ with actual financial data from reliable sources.

CFO Hiring Context: Akamai Hires New Cfo Looks Toward Ipo

Akamai Technologies’ recent announcement of a new Chief Financial Officer (CFO) signals a significant development, particularly given their impending IPO. This hire underscores the company’s commitment to robust financial management and strategic planning as they navigate the complexities of public market entry. The CFO’s role will be critical in shaping Akamai’s financial trajectory and investor confidence.

Significance of Hiring a New CFO

The hiring of a new CFO is crucial for a company preparing for an IPO. A strong financial leader is essential to establishing credibility with investors and navigating the regulatory landscape of public markets. A well-structured financial strategy and accurate financial reporting are paramount for investor confidence and long-term growth. This new hire ensures Akamai possesses the expertise to effectively manage its financial resources and present a compelling financial narrative to investors.

Akamai’s hiring of a new CFO, hinting at an IPO, is definitely intriguing. This move likely reflects the company’s anticipation of the explosive internet growth and innovations discussed at the recent conference, explosive internet growth and innovations focus of conference. It seems Akamai is positioning itself to capitalize on the rapidly changing digital landscape, making this CFO hire a significant strategic move.

Role and Responsibilities of a CFO

A CFO is responsible for a wide range of financial functions within a company. This includes overseeing financial planning and analysis, budgeting, forecasting, and financial reporting. They are also responsible for managing the company’s treasury, investments, and risk management. Furthermore, the CFO plays a key role in strategic decision-making, collaborating closely with the CEO and other senior executives to align financial strategies with overall business objectives.

Their experience in financial markets and public company accounting is essential for navigating the unique challenges of an IPO.

Potential Motivations Behind the Hiring

Several motivations likely drove Akamai’s decision to hire a new CFO. The company may have identified a need for a specialized skill set, such as expertise in public company accounting or financial modeling. The new CFO may also bring a fresh perspective to financial management, potentially fostering innovation in financial processes and strategies. Moreover, the transition to public ownership necessitates a seasoned financial leader with a strong track record of success in guiding similar companies through their IPO journey.

Potential Reasons for the Timing of the CFO Hiring

The timing of the CFO hiring is critical to the success of Akamai’s IPO. A new CFO allows for a seamless transition to public company accounting practices and procedures. It ensures a strong financial foundation is in place before the company goes public. A well-defined financial strategy is critical for a smooth IPO process. The timing also allows the new CFO to collaborate with the leadership team, understand the company’s financial position, and contribute to a robust IPO roadshow presentation.

Experience and Qualifications of the New CFO

The new CFO’s background is expected to be highlighted in the coming weeks. Their experience and qualifications will be critical factors in determining the success of Akamai’s IPO. Details about their professional history, relevant certifications, and experience in similar industries will be important for assessing their suitability for this crucial role.

Financial Implications of the New CFO’s Hiring

The hiring of a new CFO has financial implications, both direct and indirect. Direct costs include salary, benefits, and potential consulting fees. Indirect implications could include increased efficiency in financial processes, reduced risk of errors, and a potential increase in investor confidence, potentially leading to a higher valuation during the IPO process. This positive impact on financial performance will be closely monitored in the future.

Comparison of New CFO’s Background to Previous CFOs (if applicable)

| Criteria | New CFO | Previous CFO (if applicable) |

|---|---|---|

| Industry Experience | [Insert New CFO’s Industry Experience] | [Insert Previous CFO’s Industry Experience] |

| Public Company Experience | [Insert New CFO’s Public Company Experience] | [Insert Previous CFO’s Public Company Experience] |

| Financial Expertise | [Insert New CFO’s Financial Expertise] | [Insert Previous CFO’s Financial Expertise] |

| Specific Skills (e.g., IPO experience) | [Insert New CFO’s Specific Skills] | [Insert Previous CFO’s Specific Skills] |

A comparative analysis of the new CFO’s background to that of previous CFOs (if applicable) will provide valuable insight into the evolution of Akamai’s financial leadership. This comparison will highlight any shifts in expertise, skill sets, or strategic approaches.

IPO Implications

Akamai’s hiring of a new CFO, coupled with the potential for an IPO, signals a significant shift in the company’s trajectory. This move suggests a planned transition to a publicly traded entity, a major milestone that carries both advantages and risks. Understanding the intricacies of an IPO is crucial for assessing the potential impact on Akamai and the broader market.An Initial Public Offering (IPO) is the process by which a privately held company becomes publicly traded on a stock exchange.

This allows the company to raise capital by selling shares to investors, and investors gain ownership in the company. Essentially, it’s a way for companies to expand their operations, fund new projects, or simply gain access to a wider pool of capital.

Initial Public Offering (IPO) Definition

An IPO is a crucial step for a company looking to transition from private to public ownership. This process enables the company to raise capital by offering its shares to the public for the first time. The proceeds from the IPO are typically used to fund growth initiatives, repay debt, or reinvest in the business.

IPO Process Overview

The IPO process is multi-faceted and involves several key stages.

- Preparation and Planning: This stage involves extensive due diligence, legal review, and financial modeling. The company prepares its financial statements, investor presentations, and other necessary documentation. This is a critical phase, as the accuracy and thoroughness of the preparation directly impact the IPO’s success.

- Registration and Filing: The company files a registration statement with the relevant regulatory bodies (e.g., SEC in the US). This statement includes detailed information about the company, its financials, and management. It is a highly regulated process, ensuring transparency and investor protection.

- Roadshow and Marketing: The company’s management team travels to meet with potential investors and institutional fund managers. This roadshow aims to generate interest in the company’s shares and secure investment commitments. This is a crucial step in gauging investor interest and price expectations.

- Pricing and Allocation: Based on the roadshow feedback and market conditions, the company determines the offering price and allocates shares to investors. This delicate process balances maximizing capital raised with ensuring a fair allocation to investors.

- Trading Debut: The company’s shares begin trading on the stock exchange. This marks the transition to public ownership, allowing investors to buy and sell shares of the company.

Potential Benefits for Akamai

An IPO can offer several advantages for Akamai.

- Increased Capital: An IPO provides a significant injection of capital that can fuel expansion, research and development, and acquisitions. This injection of capital is essential for growth in today’s dynamic market.

- Enhanced Brand Recognition: Publicly traded companies often experience enhanced brand recognition and prestige, which can positively impact their customer base and partnerships. Public visibility can also open up opportunities for partnerships and strategic alliances.

- Liquidity for Existing Shareholders: Existing shareholders gain the ability to sell their shares, thereby unlocking liquidity and potentially realizing profits.

Potential Challenges for Akamai

Despite the potential benefits, an IPO also presents challenges.

- Increased Regulatory Scrutiny: Publicly traded companies face increased regulatory scrutiny and reporting requirements, which can be time-consuming and costly. Meeting these requirements demands significant resources and expertise.

- Loss of Control: The company loses a degree of control over its direction as it becomes subject to investor influence and expectations. This shift in power dynamic can sometimes affect strategic decision-making.

- Market Volatility: Share prices can fluctuate based on market conditions, affecting the company’s perceived value and potentially impacting investor confidence.

IPO Market Trends

Current IPO market trends show a mixed picture. While some sectors are experiencing increased activity, others are more cautious due to the economic climate. Market volatility and economic uncertainty are key factors affecting IPO decisions.

Valuation Comparison

Comparing Akamai’s potential IPO valuation to similar companies requires careful consideration of factors such as revenue, market share, and growth projections. This comparison is not straightforward and should be made based on meticulous analysis of each company’s specifics.

IPO Process Stages

| Stage | Description |

|---|---|

| Preparation and Planning | Developing financial projections, legal documents, and investor materials. |

| Registration and Filing | Submitting necessary documents to regulatory bodies. |

| Roadshow and Marketing | Meeting with potential investors and generating interest. |

| Pricing and Allocation | Determining the offering price and allocating shares. |

| Trading Debut | Shares begin trading on the stock exchange. |

Market Reaction & Investor Sentiment

Akamai’s recent CFO hiring and potential IPO are likely to generate significant market buzz. Investor reactions will be crucial in shaping the company’s stock price trajectory and overall market perception. The timing of the IPO, in conjunction with the CFO hire, will play a critical role in influencing sentiment.

Potential Investor Reactions

Investors will likely scrutinize the qualifications and experience of the new CFO, evaluating their track record and potential for driving future financial performance. A strong track record in similar roles, coupled with a clear vision for Akamai’s financial strategy, can positively influence investor sentiment. Conversely, concerns regarding the CFO’s inexperience or lack of alignment with Akamai’s strategic goals could negatively impact investor confidence.

Akamai’s hiring of a new CFO, signaling a potential IPO, is definitely exciting news. It suggests a significant push for growth, and with the recent launch of eoffering’s new website, eoffering launches web site , it seems like the tech world is buzzing with innovation. This all points to a promising future for both companies, and a potential for exciting developments in the coming months as Akamai moves forward with their IPO plans.

Impact on Akamai’s Stock Price

The news of the CFO hiring and the potential IPO will likely influence Akamai’s stock price. Positive investor sentiment, fueled by a strong CFO hire and market expectations for a successful IPO, can lead to a surge in the stock price. Conversely, negative investor sentiment could result in a decline or stagnation in the stock price. Past IPOs of similar companies and their immediate stock price reactions offer valuable insights for assessing the potential impact.

Market Analysis and Predictions

Market analysts are likely to conduct thorough financial analyses of Akamai, examining its financial health, revenue streams, and competitive landscape. Comparisons with other established companies in the networking sector will be critical for understanding Akamai’s market position. Key performance indicators (KPIs) like revenue growth, profitability, and debt levels will be closely scrutinized to assess Akamai’s financial strength relative to its competitors.

This analysis will provide a comprehensive understanding of Akamai’s potential for success in the public market. A strong IPO valuation, supported by robust financial projections and a favorable market outlook, can contribute to a positive stock price reaction.

Factors Influencing Investor Sentiment

Several factors will influence investor sentiment surrounding Akamai’s potential IPO. These factors include: the overall market environment, prevailing investor confidence, the success of similar IPOs in the technology sector, and Akamai’s competitive positioning. An uncertain global economic outlook or a general decline in investor confidence could dampen investor enthusiasm. Conversely, a strong performance by similar technology companies could create a positive environment for Akamai’s IPO.

Akamai’s Financial Health vs. Competitors

Akamai’s financial health, including its revenue growth, profitability, and debt levels, will be critically evaluated against its competitors. A clear understanding of Akamai’s competitive advantage and its ability to maintain market share in a competitive landscape will be critical. A comprehensive analysis of Akamai’s financial position and its key metrics, such as earnings per share (EPS), compared to its competitors, will offer valuable insights into investor sentiment.

Potential Investor Concerns & Counterarguments

| Potential Investor Concerns | Counterarguments |

|---|---|

| Uncertainty regarding the IPO valuation | Strong financial projections and a positive market outlook can justify a high valuation. |

| Competition from established players in the networking industry | Akamai’s unique strengths, such as its advanced technology and global network, can differentiate it from competitors. |

| Potential for market volatility | A well-structured IPO process and a robust financial plan can mitigate market volatility risks. |

| Impact of macroeconomic conditions | Diversified revenue streams and a strong financial position can provide resilience against macroeconomic uncertainties. |

Industry Analysis

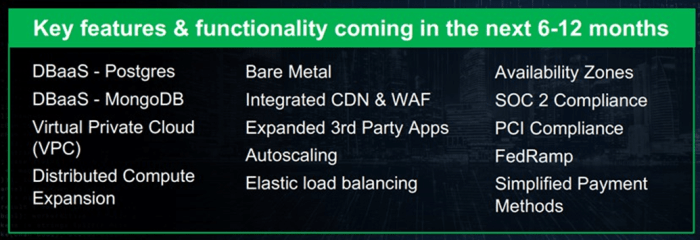

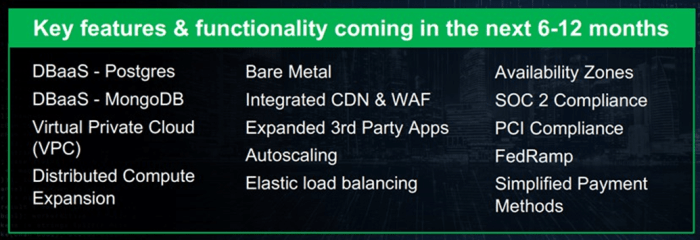

The cloud computing industry is experiencing explosive growth, driven by the increasing need for scalable, cost-effective, and reliable data storage and processing solutions. This growth is further fueled by the shift towards digital transformation across various sectors, from retail and finance to healthcare and manufacturing. Akamai’s positioning within this dynamic landscape is crucial to understanding its potential for future success.The cloud computing sector has witnessed significant evolution, shifting from basic infrastructure-as-a-service (IaaS) to more sophisticated platforms offering software-as-a-service (SaaS) and platform-as-a-service (PaaS) options.

This expansion provides diverse capabilities for businesses, fostering innovation and flexibility. The trend toward cloud adoption is evident in the growing number of companies migrating their data and applications to the cloud. This migration is a direct result of the cloud’s ability to offer greater scalability, cost-effectiveness, and accessibility compared to traditional on-premises infrastructure.

Current State of the Cloud Computing Industry

The cloud computing market is characterized by intense competition, with established players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) vying for market share. New entrants and specialized providers are also emerging, catering to specific niches and needs. The market is continuously evolving with new features, services, and functionalities. This dynamism creates opportunities and challenges for businesses seeking to leverage cloud technologies.

Growth and Trends in the Cloud Computing Sector

The cloud computing sector exhibits consistent and substantial growth, with significant investments being made in infrastructure, research, and development. This trend is likely to continue, driven by factors like increasing data volumes, the rising demand for real-time data processing, and the proliferation of mobile devices. The growth is further fueled by the growing need for businesses to adapt to changing customer demands and improve operational efficiency.

Examples include the use of cloud-based CRM systems for customer relationship management or the utilization of cloud storage for backup and recovery.

Role of Content Delivery Networks (CDNs) in the Cloud Computing Landscape

Content Delivery Networks (CDNs) play a vital role in the cloud computing ecosystem. They act as intermediaries, caching and delivering content closer to users. This approach reduces latency and improves the performance of web applications and online services. CDNs are critical for businesses that rely on delivering high volumes of content, such as e-commerce platforms, streaming services, and social media platforms.

CDNs help to ensure consistent user experience by optimizing content delivery based on user location and network conditions.

Akamai’s Position within the CDN Market

Akamai is a leading provider of CDN services, renowned for its global infrastructure and expertise in content delivery. Its vast network of servers and advanced caching algorithms enable it to deliver content quickly and reliably to users worldwide. Akamai’s robust security features also play a critical role in safeguarding data and protecting against cyber threats. The company’s strong market position is a testament to its consistent innovation and investment in its network.

Potential Disruptions or Opportunities in the CDN Market

The CDN market is likely to experience further evolution, driven by factors such as the rise of edge computing and the increasing demand for personalized content experiences. The emergence of new technologies, like distributed ledger technologies, could also create opportunities for CDNs to provide secure and efficient content delivery solutions. Edge computing, by pushing computation closer to the user, can further optimize content delivery, reducing latency and improving performance.

The need for greater security and reliability in the face of growing cyber threats will also continue to drive innovation in the CDN space.

Comparison of Akamai’s CDN Services to Competitors

| Feature | Akamai | Cloudflare | Fastly |

|---|---|---|---|

| Global Coverage | Extensive, with a vast network of servers globally | Wide, with a rapidly expanding network | Robust, with a geographically dispersed network |

| Security Features | Strong security protocols and advanced threat protection | Strong security features, including DDoS mitigation | Advanced security features, focusing on application-level security |

| Performance | High performance, optimized for various content types | High performance, known for its speed and efficiency | High performance, often cited for its speed and scalability |

| Pricing | Often customized based on usage and requirements | Typically tiered pricing structures | Usually flexible pricing models, often based on usage |

This table provides a basic comparison of Akamai’s CDN services to its main competitors. Factors like pricing, features, and global coverage vary, reflecting the competitive landscape. Specific needs and requirements should be considered when evaluating CDN providers.

Potential Risks and Opportunities

Akamai’s impending IPO, coupled with the recent CFO hiring, presents a complex interplay of risks and opportunities. Navigating these factors effectively will be crucial for the company’s success and investor confidence. The transition to public markets introduces inherent challenges, while the new leadership brings both fresh perspectives and potential unknowns. The overall market environment also plays a significant role, influencing investor sentiment and the IPO’s ultimate outcome.

Potential Risks Associated with CFO Hiring and IPO

The CFO hiring process, while ostensibly a positive step, carries potential risks. A mismatch in leadership styles or strategic visions could lead to internal conflicts and reduced operational efficiency. Additionally, a new CFO might take time to integrate into the existing organizational structure, potentially causing temporary disruptions. The IPO itself carries significant risks, from market volatility to potential underperformance of the stock.

Furthermore, negative press or unfavorable market conditions could negatively impact investor perception and stock valuation.

Potential Opportunities Arising from CFO Hiring and IPO

The hiring of a new CFO, with potentially fresh ideas and a new strategic approach, offers substantial opportunities. The IPO itself opens doors to access capital for future expansion and investments. This capital can be used for research and development, acquisitions, or even to further solidify Akamai’s market position.

Regulatory Implications

Regulatory compliance is paramount during an IPO. Akamai must ensure full adherence to all relevant securities regulations, including disclosure requirements and financial reporting standards. Failure to meet these standards can lead to significant penalties and damage investor confidence. Companies often face scrutiny regarding financial reporting accuracy and transparency, which Akamai must anticipate and manage.

Macroeconomic Factors Impacting IPO Plans

Macroeconomic conditions, including interest rates, inflation, and economic growth, can significantly impact IPO valuations and market sentiment. Periods of high inflation or rising interest rates often lead to investor caution, potentially delaying or negatively affecting the IPO process. The current global economic climate and any emerging geopolitical risks should be considered as factors that could impact Akamai’s IPO plans.

Recent economic downturns have demonstrated the importance of financial prudence and resilience in navigating market volatility.

Potential Strategic Partnerships and Alliances

Strategic partnerships and alliances can significantly enhance Akamai’s market presence and capabilities. Potential partners could include companies in related industries, such as cloud providers or security vendors. These collaborations can leverage each other’s strengths to create new revenue streams and expand market reach. For example, a partnership with a cloud service provider could open new avenues for Akamai’s CDN services.

Potential Risks and Mitigation Strategies for Akamai’s IPO, Akamai hires new cfo looks toward ipo

| Potential Risk | Mitigation Strategy |

|---|---|

| Market Volatility | Diversified investment portfolio, contingency plans for market downturns, strong financial performance to maintain investor confidence. |

| Regulatory Non-Compliance | Experienced legal counsel, rigorous compliance checks, and proactive engagement with regulatory bodies. |

| Negative Market Sentiment | Transparent communication with investors, consistent and impressive financial performance, addressing investor concerns promptly. |

| Macroeconomic Uncertainty | Thorough market analysis, financial planning to account for potential downturns, strong balance sheet to withstand economic headwinds. |

| Competition | Innovation and development of new products and services, continuous improvement of existing products, effective marketing and branding. |

Last Point

In conclusion, Akamai’s decision to hire a new CFO and potentially pursue an IPO presents a compelling opportunity for the company. The move suggests confidence in future growth, but challenges exist in the current market environment. Investors will be keenly interested in Akamai’s financial performance and the details of the IPO process. The industry analysis will highlight the potential impact on the cloud computing landscape and the CDN sector.

Overall, this development underscores the importance of strategic financial management in navigating the complexities of the public market.