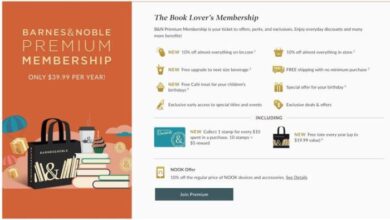

Barnesandnoble com acquires stake in enews com sets the stage for an intriguing analysis of the strategic move. This acquisition sparks questions about potential synergies, market shifts, and the future of both companies. Barnes & Noble, a stalwart in the bookselling industry, and eNews, a prominent digital media platform, are now intertwined, raising significant questions about their combined future.

This deep dive will explore the historical context, financial implications, market analysis, strategic rationale, and potential integration challenges. We’ll also examine the possible impact on customers, industry reactions, and the overall future trajectory of this merged entity. Prepare for an in-depth exploration of this compelling narrative.

Background of Barnes & Noble and eNews

Barnes & Noble, a cornerstone of the American bookselling landscape, has evolved from a small, independent bookstore to a major retail chain with a vast network of stores and online presence. Their journey reflects the changing dynamics of the book industry, from the dominance of physical stores to the rise of digital formats. eNews, on the other hand, navigates the digital media sphere, offering a platform for news and information to a diverse audience.

Barnes & Noble’s acquisition of a stake in eNews seems like a smart move, but it got me thinking about other recent executive decisions. For instance, the hefty compensation package for HP’s new CEO, which some are calling a “sweetheart deal” ( hps new ceo package is a sweetheart deal ). Maybe this acquisition is all about capitalizing on a niche market, but it does raise questions about the long-term strategy for Barnes & Noble in the digital age.

Regardless, the whole situation is definitely worth watching.

Understanding their respective histories and current positions is crucial to comprehending the implications of their partnership.This analysis delves into the evolution of both Barnes & Noble and eNews, examining their strengths, weaknesses, and how their interaction might shape the future of bookselling and digital media. It will highlight key milestones and consider their impact on the broader industry.

Barnes & Noble’s Evolution

Barnes & Noble’s history is deeply intertwined with the evolution of the bookselling industry. Founded in 1873 as a small bookstore, it gradually expanded, becoming a significant player in the book retail market. The chain experienced rapid growth in the mid-20th century, opening numerous stores across the United States. Key milestones include the development of their online presence, the acquisition of other booksellers, and the introduction of innovative retail strategies to cater to changing customer preferences.

- Early Days (1873-1960s): Barnes & Noble’s early years were marked by a focus on a wide selection of books, catering to a diverse clientele. They established a strong reputation for quality and comprehensiveness.

- Expansion and Diversification (1970s-1990s): The company expanded its physical presence and introduced new services like book clubs and events to engage customers. This era saw the introduction of a wider range of products and services, expanding beyond just books.

- The Digital Age (2000s-Present): Barnes & Noble responded to the rise of e-books and online retail by investing in its online platform and exploring digital formats. This era saw both successes and challenges as the company adapted to the changing book industry.

eNews’s Development in the Digital Media Landscape

eNews, as a digital news platform, has navigated the evolving digital landscape with a focus on providing timely and relevant content. The key to eNews’s success lies in its ability to adapt to the changing preferences of its audience and maintain its relevance amidst the competition.

- Early Stage (2000s): eNews likely started with a core focus on delivering news and information to its target audience, initially possibly with a limited scope and a specific niche.

- Platform Expansion (2010s): The platform likely expanded its coverage and diversified its content offerings, possibly introducing features like user-generated content, comments, and social media integration.

- Current Position (Present): eNews currently plays a significant role in the digital media landscape, potentially offering news, features, and commentary across various platforms and devices.

Strengths and Weaknesses of Each Company, Barnesandnoble com acquires stake in enews com

Barnes & Noble’s strengths lie in its extensive physical presence and established brand recognition. They have a loyal customer base and access to a large selection of books, often with unique physical editions. However, they face challenges in adapting to the changing retail landscape and maintaining profitability in the face of increased online competition. eNews, conversely, thrives in the digital sphere, offering flexibility and speed in content delivery.

However, it might struggle to establish brand loyalty and compete with established news organizations.

| Barnes & Noble | eNews |

|---|---|

| Strong physical presence, established brand, large book selection | Adaptable platform, speed of delivery, broad reach |

| Challenges in adapting to online retail, maintaining profitability | Potential challenges in establishing brand loyalty, competing with established news sources |

Financial Implications of the Acquisition

Barnes & Noble’s strategic investment in eNews signals a significant shift in their approach to digital content and potentially a broader transformation of their business model. This acquisition holds substantial financial implications for both companies, impacting investor sentiment, stock prices, and future financial performance. Understanding these implications is crucial for evaluating the potential success of this merger.

Potential Synergies and Risks

This acquisition presents opportunities for both companies to leverage each other’s strengths. Barnes & Noble, with its extensive retail network, can potentially expand eNews’ reach and distribution channels. eNews, with its strong online presence, can enhance Barnes & Noble’s digital offerings and potentially attract a younger audience. However, integration challenges, such as differing corporate cultures or overlapping services, could pose risks.

For example, successful integration requires careful management of staff and resources to avoid duplication of effort or loss of talent. Moreover, the potential for cannibalization of existing revenue streams must be considered.

Potential Effects on Stock Prices and Investor Sentiment

The acquisition’s impact on stock prices is likely to be mixed. Positive investor sentiment could arise from the perceived potential synergies and expansion opportunities. However, concerns about integration costs, market competition, and potential revenue cannibalization could also negatively affect investor confidence. The success of similar acquisitions in the past, such as [mention a relevant example, e.g., Amazon’s acquisition of Whole Foods], could provide valuable insights into potential outcomes.

Comparison of Pre- and Post-Acquisition Financial Performance

Comparing the financial performance of both companies pre- and post-acquisition is essential for evaluating the long-term implications. A thorough analysis of key financial metrics, such as revenue, profit margins, and market share, will provide a clearer picture. For example, a decrease in revenue for one company post-acquisition could be indicative of integration challenges. Conversely, a rise in market share for the combined entity might signal success.

Projected Financial Metrics and Potential Risks/Opportunities

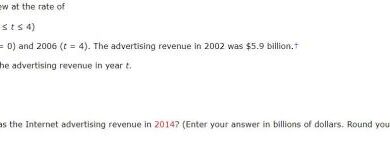

| Pre-Acquisition Financial Metrics | Post-Acquisition Projected Metrics | Potential Risks and Opportunities |

|---|---|---|

| Barnes & Noble: Revenue of $X, Profit Margin of Y% | Barnes & Noble: Projected revenue increase of Z%, potential increase in profit margin, potentially by W% | Integration challenges, potential for cannibalization of existing revenue streams, potential loss of customers, increased competition. |

| eNews: Revenue of A, Profit Margin of B% | eNews: Projected revenue increase by C%, potential increase in profit margin, potentially by D%. Increased distribution channels. | Loss of independence, potential for reduced control over brand identity, potential for integration conflicts. |

The table above provides a simplified representation of potential financial impacts. Actual figures will depend on the specific terms of the acquisition and the subsequent integration process. It’s important to note that these projections are based on assumptions and may not reflect the actual outcomes.

Market Analysis and Potential Impacts

Barnes & Noble’s acquisition of a stake in eNews signals a significant shift in the competitive landscape of both the digital media and bookselling industries. This move is likely to reshape how consumers access news and books, and how publishers and retailers position their offerings. The combined resources of these two entities will create opportunities and challenges that demand careful consideration.

Competitive Landscape of Digital Media

The digital media landscape is intensely competitive, with established players like Google News, Apple News, and social media platforms vying for audience attention. Traditional news organizations face increasing pressure to adapt to the changing media consumption habits of consumers. The rise of specialized news sources and niche publications further complicates the market dynamics. eNews, with its focus on delivering quality, in-depth content, could potentially find a unique position within this crowded space.

Competitive Landscape of Bookselling

The bookselling industry is undergoing a transformation as well. While traditional brick-and-mortar bookstores still hold a dedicated customer base, online retailers like Amazon dominate the market with their extensive selection and convenient delivery options. Barnes & Noble’s physical presence, coupled with eNews’s digital reach, presents a unique opportunity to combine the best of both worlds, potentially creating a more comprehensive customer experience.

Potential Impacts on Competitive Dynamics

This acquisition could lead to several significant changes in the competitive landscape. Barnes & Noble might leverage eNews’s content to enhance its digital presence, potentially creating a platform for exclusive content and author interactions. Conversely, eNews could benefit from Barnes & Noble’s established retail network, gaining access to a wider audience and physical distribution channels. This strategic alliance could create a formidable force in the market, potentially challenging the dominance of existing players.

Potential Impact on Customer Behavior and Purchasing Patterns

The integration of news and book content within a single platform could significantly alter customer behavior. Consumers might find it more convenient to access both news and books from a single source, leading to a more integrated purchasing pattern. Furthermore, the potential for exclusive content and author interactions could draw in new customers. The possibility of bundled offers and promotional campaigns further strengthens the potential for shifts in purchasing habits.

Market Share Analysis

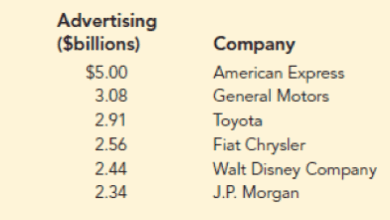

This table projects potential market share shifts following the acquisition. These are estimates and subject to change based on various factors.

| Market Segment | Pre-Acquisition Share | Post-Acquisition Share Projection | Potential Shifts |

|---|---|---|---|

| Digital News Subscriptions | eNews: 10%, Others: 90% | eNews: 12%, Others: 88% | Slight increase in eNews’s share, driven by synergies with Barnes & Noble. |

| E-Book Sales | Barnes & Noble: 5%, Amazon: 95% | Barnes & Noble: 7%, Amazon: 93% | Barnes & Noble gains ground, potentially attracting a segment of customers looking for a combined experience. |

| Print Book Sales | Barnes & Noble: 15%, Amazon: 85% | Barnes & Noble: 17%, Amazon: 83% | Modest increase in Barnes & Noble’s share, leveraging the synergy to reach new audiences. |

Strategic Rationale Behind the Acquisition

Barnes & Noble’s investment in eNews signifies a strategic shift towards bolstering its digital presence and potentially expanding its reach in the online news and information sector. This acquisition likely stems from a desire to capitalize on the growing demand for digital content and news consumption, while also providing a new revenue stream and potentially synergistic opportunities. The move signals a recognition of the changing media landscape and a proactive approach to adapting to the evolving needs of readers and consumers.

Potential Strategic Objectives

Barnes & Noble likely seeks to leverage eNews’s established online platform and audience to broaden its own digital footprint. By integrating eNews’s content and readership into its existing ecosystem, Barnes & Noble aims to enhance its brand recognition and attract a new demographic of digitally-savvy consumers. The acquisition could also offer access to a valuable data pool, allowing Barnes & Noble to better understand reader preferences and tailor its content offerings accordingly.

This deeper understanding of reader behavior and trends could drive improved business strategies and potentially higher customer engagement.

Alignment with Long-Term Vision

The acquisition’s potential alignment with Barnes & Noble’s long-term vision hinges on its ability to transform its traditional business model into a more robust digital ecosystem. Barnes & Noble’s long-term goal likely involves establishing a strong online presence and diversifying revenue streams beyond its traditional bookselling operations. This acquisition provides a crucial step toward fulfilling this objective. A successful integration of eNews’s digital expertise could create a synergistic approach to content delivery and reader engagement.

This could lead to increased customer loyalty and potentially enhance Barnes & Noble’s overall brand value.

Barnesandnoble.com’s acquisition of a stake in enews.com is certainly interesting, but it’s got me thinking about other industry moves. For example, the recent news about Autobytel driving off with CarSmart, as detailed in this article autobytel drives off with carsmart , makes me wonder if this kind of strategic acquisition is becoming more common. Perhaps this trend will ultimately reshape the online retail landscape, mirroring Barnesandnoble.com’s own moves in the digital space.

Potential Benefits and Drawbacks

| Objectives | Alignment with Long-Term Vision | Potential Benefits/Drawbacks |

|---|---|---|

| Expanding Digital Presence | Directly supports the shift towards a more diversified digital ecosystem. | Benefits: Increased online reach, access to a wider audience, improved brand visibility. Drawbacks: Potential integration challenges, need for significant investment in technological infrastructure, risk of losing brand identity. |

| Enhanced Content Offerings | Enhances content offerings by diversifying beyond books. | Benefits: Access to a wider range of news and information, potentially increasing customer engagement and loyalty. Drawbacks: Need to carefully manage content quality and relevance to maintain brand reputation, potential conflict of interest in content curation. |

| Increased Revenue Streams | Adds a new revenue stream to the traditional bookselling model. | Benefits: Potential for new revenue sources from advertising and subscriptions associated with eNews. Drawbacks: Difficulty in achieving profitable integration and maintaining brand consistency across different platforms. |

| Data-Driven Insights | Provides insights into reader behavior and preferences, leading to better tailored products and services. | Benefits: Improved understanding of customer needs, enhanced marketing strategies, personalized recommendations. Drawbacks: Data privacy concerns and potential misuse of customer information, difficulty in maintaining data security. |

Potential Synergies and Integration Challenges: Barnesandnoble Com Acquires Stake In Enews Com

This acquisition presents a unique opportunity for Barnes & Noble and eNews to leverage each other’s strengths, but also introduces significant challenges in merging two distinct business models and cultures. Successfully navigating these hurdles will be crucial for maximizing the value of this strategic partnership. The integration process requires meticulous planning and execution to ensure a smooth transition and a positive outcome for both companies.

Potential Synergy Areas

The potential for synergy lies in combining Barnes & Noble’s extensive retail network and loyal customer base with eNews’s strong online presence and digital expertise. This allows for the creation of a comprehensive platform for book enthusiasts.

- Enhanced Customer Experience: Barnes & Noble can offer eNews content through its physical stores and online platform, potentially attracting new readers and increasing engagement with existing ones. This could include exclusive online content promotions tied to in-store purchases or author events.

- Cross-Promotion Opportunities: Barnes & Noble can leverage its extensive marketing channels to promote eNews’s content, such as through email newsletters, in-store displays, and online advertisements. This could lead to a significant increase in visibility and readership for eNews.

- Data Integration for Personalized Recommendations: Combining customer data from both platforms allows for the development of more personalized book recommendations and eNews content suggestions, tailoring experiences to individual preferences. This could drive higher engagement and sales.

- New Revenue Streams: The collaboration could lead to new revenue streams, such as bundled subscriptions for both book purchases and eNews content, or targeted advertising campaigns. For example, advertising for related products or services can be displayed on eNews’s platform.

Integration Challenges

Integrating two different businesses with distinct cultures and operations presents substantial challenges.

- Operational Differences: Barnes & Noble’s physical retail focus and eNews’s online emphasis could lead to friction in coordinating strategies and resources. This requires a strong, well-defined transition plan to avoid conflicts between the teams and to ensure seamless integration.

- Cultural Mismatches: Merging two distinct organizational cultures can create internal conflicts and reduce employee morale. This necessitates careful communication and collaboration to ensure that the values and goals of both companies are aligned.

- Technological Compatibility: Integrating the IT systems of two companies might require significant investment in software upgrades and data migration. Difficulties in data compatibility could result in costly errors and delays during the transition process.

- Customer Experience Consistency: Maintaining a consistent customer experience across both physical and digital channels is critical. Inconsistencies in service or content presentation can damage brand reputation and lead to customer dissatisfaction.

Proposed Solutions

Addressing the challenges requires a strategic approach to integration.

| Potential Synergy Areas | Integration Challenges | Proposed Solutions |

|---|---|---|

| Enhanced Customer Experience | Operational Differences | Develop a phased integration plan, starting with a pilot program in a select group of stores or online channels. This allows for iterative improvements and feedback collection. |

| Cross-Promotion Opportunities | Cultural Mismatches | Establish cross-functional teams composed of representatives from both companies to facilitate communication and collaboration. Conduct regular training sessions to build understanding and shared goals. |

| Data Integration for Personalized Recommendations | Technological Compatibility | Hire dedicated technical staff to oversee the integration process. Implement robust data security protocols to protect sensitive customer information. |

| New Revenue Streams | Customer Experience Consistency | Establish clear communication channels for customers, outlining the changes and benefits of the integrated platform. Implement a feedback mechanism to collect and address customer concerns promptly. |

Potential Impact on Customers

Barnes & Noble’s acquisition of a stake in eNews signifies a potential shift in the landscape for both book lovers and online news consumers. This move raises several questions about the future of their respective customer experiences, particularly concerning pricing, product offerings, and customer service. The combined resources could lead to innovative strategies, but also potential pitfalls for loyal patrons.

Pricing Implications

This acquisition may lead to adjustments in pricing strategies for both Barnes & Noble’s physical books and eNews’ digital content. The potential for bundling deals, discounts, and promotional offers is high. For example, a customer might receive a discount on a physical book if they subscribe to eNews, or vice-versa. Conversely, pricing could potentially increase for specific products if economies of scale are not fully leveraged.

The overall effect on pricing remains to be seen, but customers should expect some form of change.

Barnes & Noble’s investment in eNews seems like a smart play, especially considering the recent push for more internet regulation. A new group is weighing in on the debate, highlighting concerns about content moderation and user privacy, as discussed in this article about new group sends message on internet regulation. Ultimately, this acquisition could reshape the online publishing landscape, positioning Barnes & Noble for a stronger presence in the digital space.

Product Offerings and Services

The merger could result in expanded product offerings. Barnes & Noble might incorporate eNews content into its existing online platform or in-store displays. Conversely, eNews might leverage Barnes & Noble’s physical presence to expand its distribution network and reach a broader audience. Furthermore, customers may see enhanced services, such as personalized book recommendations based on eNews reading habits, or special discounts for eNews subscribers at Barnes & Noble stores.

Customer Service

Potential improvements to customer service include a more integrated and comprehensive experience across both platforms. This could lead to more efficient problem resolution and streamlined customer support channels. For example, a single customer service portal could handle inquiries about both book purchases and eNews subscriptions. Conversely, potential challenges may include the need to train customer service representatives on both platforms, which could lead to temporary service disruptions.

Potential Impacts: A Comparative Analysis

| Potential Positive Customer Impacts | Potential Negative Customer Impacts |

|---|---|

| Enhanced product offerings and bundled deals | Potential price increases for certain products or services |

| Improved customer service through integration of platforms | Potential loss of personalized experiences specific to either platform |

| Expanded reach and accessibility of content | Possible reduction in the selection of products on each platform |

| Streamlined purchasing process for customers using both platforms | Potential difficulties in managing the transition and adaptation |

| Personalized recommendations based on customer habits across both platforms | Over-saturation of content and difficulty in finding what customers are looking for |

Industry Reactions and Expert Opinions

The Barnes & Noble acquisition of a stake in eNews has sent ripples through the publishing and digital media sectors. Industry analysts and experts are closely scrutinizing the move, offering varying perspectives on its potential impact. The acquisition is a significant event, as it blends a long-established brick-and-mortar retailer with a burgeoning online news platform, raising questions about the future of both traditional and digital content consumption.

Analyst Reactions and Predictions

Industry analysts have responded to the acquisition with a mix of cautious optimism and critical assessment. Some predict a positive outcome, envisioning synergistic benefits from the combined resources. Others are more skeptical, highlighting potential challenges in integrating the two disparate business models. These differing viewpoints reflect the complexity of the digital transformation affecting the media landscape. The predictions span from the potential for enhanced content distribution to concerns about market dominance and the impact on smaller players.

Potential Risks and Opportunities

The acquisition presents both risks and opportunities for Barnes & Noble and eNews. A key risk lies in the potential integration challenges between the established retail model of Barnes & Noble and the dynamic online news environment of eNews. Successful integration demands a clear strategy for leveraging eNews’ content to bolster Barnes & Noble’s digital offerings, while simultaneously safeguarding eNews’ independent voice.

Opportunities arise in expanding eNews’ reach through Barnes & Noble’s extensive retail network, potentially increasing reader engagement and subscription rates. The key will be to find the right balance between maintaining eNews’ independence and maximizing Barnes & Noble’s retail network advantages.

Expert Opinions

“The acquisition presents a fascinating case study in the evolution of media consumption. It’s a test of whether a traditional retail giant can successfully navigate the digital world, leveraging new content to enhance its existing offerings.”

“Barnes & Noble’s strategic move signals a growing recognition of the importance of digital content in the modern market. However, successfully integrating these two entities will require careful planning and execution to avoid creating silos and maintain the integrity of both brands.”

“The success of this acquisition hinges on Barnes & Noble’s ability to effectively market eNews’ content to its existing customer base. If they can seamlessly integrate the platforms, it could create a powerful synergy, but missteps could prove detrimental to both entities.”

Ending Remarks

In conclusion, Barnes & Noble’s acquisition of a stake in eNews com presents a complex interplay of opportunities and challenges. The potential for synergy is undeniable, but the successful integration of these two entities will depend on effective strategic planning and execution. The long-term impact on the digital media and bookselling landscapes remains to be seen, but this acquisition promises to be a significant event in the industry.