Canadian firm unveils insurance for e shoppers – Canadian firm unveils insurance for e-shoppers, providing a vital safety net for online businesses. This new offering addresses the unique challenges of operating in the digital marketplace, covering everything from product liability to cyber threats. Understanding the specifics of this insurance policy is key for any online retailer looking to protect their investment and navigate the complexities of e-commerce.

The policy delves into various aspects of e-commerce risk, from product defects to online fraud, ensuring comprehensive protection. It provides details on the different coverage levels, premiums, and claims processes, enabling readers to make informed decisions about their own insurance needs.

Introduction to E-commerce Insurance

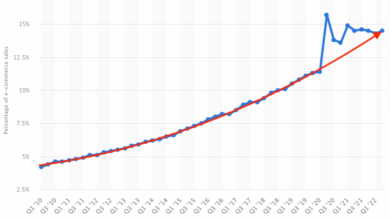

E-commerce has exploded in recent years, transforming the way we shop and do business. This rapid growth, however, brings unique challenges, particularly when it comes to protecting online businesses from a range of potential risks. A new insurance product, specifically designed for e-shoppers, aims to address these challenges by providing comprehensive coverage for a variety of threats.This insurance policy offers a crucial safety net for online businesses, mitigating the financial impact of unforeseen events that can disrupt operations and jeopardize profitability.

It’s not just about financial losses; it’s about ensuring business continuity and allowing entrepreneurs to focus on growth without the constant fear of catastrophic events.

Specific Risks Covered

This e-commerce insurance product provides coverage for a range of risks, reflecting the unique challenges of operating online. These include, but are not limited to, cyberattacks, product liability issues, and even unexpected interruptions in essential services like internet outages or power failures.

- Cybersecurity Breaches: Protecting sensitive customer data is paramount. This insurance covers the costs associated with data breaches, including notification requirements, forensic investigations, and potential legal liabilities.

- Product Liability Claims: Online retailers face the risk of product defects or faulty goods causing harm to customers. The insurance policy addresses these potential liabilities, helping businesses manage the financial burden of such claims.

- Interruption of Operations: Unexpected disruptions, such as internet outages or system failures, can severely impact online businesses. This insurance product provides coverage for lost revenue during such interruptions, ensuring continuity of operations.

- Intellectual Property Infringement: E-commerce businesses may face challenges from competitors infringing on their intellectual property rights. This policy can offer protection against such claims.

Unique Challenges and Opportunities in E-commerce Insurance

Insuring e-commerce businesses presents unique challenges compared to traditional brick-and-mortar stores. The decentralized nature of online operations, coupled with the ever-evolving digital landscape, necessitates a dynamic and adaptable insurance approach.

- Digital Risks: Cyberattacks, data breaches, and online fraud are major concerns that traditional insurance policies often don’t adequately address. The evolving nature of these threats demands innovative solutions within the insurance sector.

- Global Reach: E-commerce businesses often operate across multiple jurisdictions, adding complexity to risk assessment and claim management. This necessitates international insurance policies that can address these specific complexities.

- Dynamic Nature of E-commerce: The rapid pace of innovation and change in the online retail sector necessitates a flexible and responsive insurance approach. Policies must adapt to new technologies and emerging threats.

Target Market

This insurance product is tailored for various types of e-commerce businesses, including small startups, established online retailers, and large e-commerce platforms. It caters to a wide range of needs and business sizes, aiming to provide a comprehensive solution for the evolving demands of the online marketplace.

- Small Businesses: Startups and small businesses often need a more affordable and accessible insurance solution to protect their operations. This product aims to bridge the gap between traditional insurance and the specific needs of this segment.

- Established Retailers: Larger e-commerce companies need comprehensive coverage for a wider range of risks and potential liabilities. The policy ensures their long-term financial security.

- Global Businesses: E-commerce businesses with an international presence need policies that can accommodate their unique global operations and risks. This product can provide that.

Coverage Details and Benefits

This new e-commerce insurance policy from the Canadian firm offers a comprehensive suite of protections tailored to the unique risks faced by online businesses. It goes beyond traditional business insurance, addressing the specific challenges of digital transactions and the ever-evolving online marketplace. Understanding the specifics of this coverage is crucial for entrepreneurs looking to safeguard their online ventures.The policy’s structure provides multiple layers of security, mitigating potential financial losses and enabling businesses to navigate the complexities of online sales with greater confidence.

This comprehensive protection covers a range of potential risks, from product liability to cyber threats, and ensures businesses can focus on growth without undue financial anxiety.

Key Features and Benefits

This insurance policy offers a wide array of protections to mitigate the risks inherent in e-commerce. These features are designed to provide peace of mind and ensure the financial security of online businesses.

- Comprehensive Product Liability Coverage: This crucial aspect of the policy protects against claims arising from defective or harmful products sold online. This coverage extends to situations where a product fails to meet advertised specifications or quality standards, or causes harm to the customer.

- Cybersecurity Protection: Recognizing the growing threat of online fraud and data breaches, the policy includes provisions for cyber incidents. This protection includes coverage for data breaches, malware attacks, and unauthorized access to customer data.

- Third-Party Liability Protection: This addresses claims arising from product-related incidents, such as injuries or property damage caused by a defective product. It ensures the business is protected against legal costs and settlements.

- Transaction Security: This policy covers fraudulent transactions and chargebacks. This ensures that the business isn’t held liable for losses arising from fraudulent online activities.

- Business Interruption Coverage: This protection covers revenue losses that might occur due to disruptions, like cyberattacks or natural disasters that affect online operations.

Comparison with Existing Solutions

Existing e-commerce insurance solutions often lack the specific coverage for online-specific risks. Many traditional policies may not adequately address the unique vulnerabilities of the digital marketplace. This new offering specifically targets these vulnerabilities.

| Feature | Existing Solutions | New E-commerce Insurance |

|---|---|---|

| Product Liability | Limited or absent coverage for online sales | Comprehensive coverage for online product liability |

| Cybersecurity | Often excluded or under-developed | Explicit coverage for cyberattacks and data breaches |

| Transaction Security | Rarely includes fraudulent transaction coverage | Specific protection against fraudulent transactions |

Specific Protection Against Common E-Commerce Risks

The policy explicitly addresses several key risks in the e-commerce space. It is designed to mitigate the financial consequences of these threats.

- Intellectual Property Protection: Protection against claims of infringement or unauthorized use of intellectual property related to online products.

- Shipping and Logistics Risks: Coverage for damaged or lost products during transit, helping to mitigate the risk of shipping issues.

- Payment Processing Issues: Protection against losses due to payment processing failures, ensuring funds are protected.

Claims Process and Reimbursement Procedures

A clear and efficient claims process is critical for a successful insurance policy. The claims process for this new policy is streamlined for online businesses.

“A dedicated claims team will assist businesses with the entire process, ensuring prompt and fair settlements.”

The policy details a step-by-step procedure for filing a claim, along with clear guidelines for documentation and evidence requirements. Reimbursement procedures are Artikeld, including timelines for processing and disbursement of funds.

Policy Design and Pricing

Navigating the complexities of e-commerce insurance often involves a delicate balance between comprehensive coverage and affordable premiums. Our policy design reflects this, aiming to provide robust protection tailored to the specific needs of online businesses while remaining accessible to entrepreneurs of all sizes.

This section delves into the key factors driving our policy design, from the different coverage levels to the flexible pricing models. Understanding these elements is crucial for e-commerce businesses seeking the right level of protection for their online ventures.

A Canadian firm just launched insurance specifically for e-shoppers, a smart move given the increasing popularity of online shopping. However, with that convenience comes potential risks, like the recent warnings from federal agencies about online prescription drug sales. Federal agencies issue warnings about online rx sales highlight the importance of verifying the legitimacy of online pharmacies and protecting personal health information.

This new insurance for online shoppers addresses these concerns by providing coverage for a wider range of potential issues, making online purchases safer and more secure.

Factors Influencing Policy Design

Several key factors influence the design of our e-commerce insurance policies. These include the specific risks associated with online sales, the geographical reach of the business, and the overall value of the insured assets. Furthermore, the type of e-commerce business, from retail to dropshipping, plays a role in shaping the ideal policy structure.

Coverage Levels and Premiums

Coverage levels directly impact the premiums charged. Higher coverage amounts generally lead to higher premiums, reflecting the increased financial risk. Our policies offer various coverage tiers, enabling businesses to choose a level that aligns with their unique needs and risk tolerance. This customization allows businesses to avoid unnecessary expenses while maintaining adequate protection.

Policy Tiers and Benefits

We offer tiered policies designed to cater to diverse e-commerce needs. Each tier provides a distinct level of protection and associated benefits. For example, the “Basic” tier focuses on fundamental coverages, such as liability and product damage, while the “Premium” tier includes additional protections, such as cyber liability and business interruption coverage.

- Basic Tier: Provides essential coverage against common risks, including product liability, property damage, and general liability. Suitable for businesses with limited online sales volume.

- Standard Tier: Offers enhanced protection, including coverage for more significant risks, such as cyber security breaches and data breaches, as well as broader business interruption coverage. Aimed at businesses with growing online sales and increasing operational complexity.

- Premium Tier: Provides comprehensive coverage for a wider array of risks, including extensive cyber liability protection, coverage for international shipping and transactions, and robust business interruption protection. Designed for businesses with substantial online sales volume and significant operational complexity.

Pricing Model Comparison

Our pricing model considers factors like the business’s annual sales volume, the value of inventory, and the type of products being sold. We strive to offer competitive premiums while maintaining a robust coverage framework. This competitive pricing ensures that businesses can access comprehensive protection without significant financial burdens.

| Feature | Our Policy | Competitor A | Competitor B |

|---|---|---|---|

| Product Liability | Comprehensive coverage, up to $X million | Limited coverage, up to $Y million | Coverage capped at $Z million |

| Cyber Liability | Included in Premium tier, up to $W million | Available as add-on, pricing varies | Not included, additional policy required |

| Premium | Competitive, based on factors like sales volume | Higher premiums due to limited coverage | Higher premiums for lack of cyber coverage |

Policy Flexibility

Recognizing the diverse needs of e-commerce businesses, our policies offer considerable flexibility. Businesses can tailor their coverage by adding or removing specific protections based on their unique circumstances. This adaptability allows entrepreneurs to maintain appropriate insurance levels as their businesses evolve. This flexibility ensures that the policies adapt to the ever-changing needs of the e-commerce landscape.

Furthermore, the policy options can be adjusted annually based on changing business needs and risk profiles. This allows for a dynamic approach to insurance, providing ongoing support and protection for e-commerce businesses as they grow and adapt.

Impact on the E-commerce Industry: Canadian Firm Unveils Insurance For E Shoppers

This new e-commerce insurance product has the potential to significantly reshape the Canadian e-commerce landscape. By mitigating risks and offering crucial protection, it encourages more businesses to embrace online sales, fostering a more robust and diversified digital marketplace. This can lead to increased competition, innovation, and ultimately, a better shopping experience for consumers.This insurance product directly addresses a critical gap in the e-commerce ecosystem, providing a safety net for entrepreneurs and established businesses alike.

It encourages broader participation in the digital economy by reducing the financial burden of potential risks, thus stimulating economic growth and job creation.

Potential Impact on E-commerce Growth

This insurance product is poised to significantly boost e-commerce growth in Canada. By offering comprehensive protection against various risks, it removes a major barrier for aspiring online businesses. This reduction in risk perception allows businesses to focus on growth strategies, rather than being preoccupied with the potential for significant financial losses. The improved security fosters a more optimistic environment for investment and expansion within the e-commerce sector.

Market Expansion Opportunities

This insurance product opens up several exciting market expansion opportunities. The product’s adaptability and customizable coverage can target various niches within the e-commerce sector, from small businesses to large retailers. By tailoring the insurance packages to the specific needs of different e-commerce models (e.g., drop shipping, subscription boxes, or online retail), it can attract a wider range of participants, fostering diversity and innovation in the Canadian digital marketplace.

This targeted approach will likely yield greater market penetration and profitability.

Addressing Specific Needs of E-shoppers

The insurance product effectively addresses the diverse needs of e-shoppers. By offering protection against factors such as product liability, data breaches, and fraudulent activities, it provides a sense of security and trust, crucial for fostering consumer confidence in online transactions. This enhanced trust translates into increased sales, customer loyalty, and ultimately, the long-term success of e-commerce ventures. Moreover, the insurance facilitates the smooth operation of e-commerce businesses by safeguarding their assets and operations.

Forecast of Insurance Market Trends

The insurance market is experiencing a dynamic evolution, with a clear shift towards specialized and customized insurance solutions. The increasing prevalence of e-commerce necessitates tailored coverage options to address its specific vulnerabilities. Insurance companies are adapting by developing innovative products that meet the changing needs of online businesses. This trend is expected to continue as e-commerce further integrates into the global economy.

A key example is the rising incidence of cyberattacks, which has prompted insurance companies to develop sophisticated cyber liability policies to cater to the unique risks of online businesses. Furthermore, the growing popularity of subscription models and the rise of digital marketplaces are shaping the demand for insurance products to cover specific e-commerce activities.

Insurance Product Structure

E-commerce businesses face unique risks compared to traditional retail. This specialized insurance product structure is designed to address these specific vulnerabilities, offering a layered approach to protecting online ventures from a multitude of potential threats. Understanding the different coverage options and their limitations is crucial for businesses to select the appropriate level of protection for their operations.

Coverage Options

This section Artikels the key coverage options within the e-commerce insurance package. Each option is tailored to address specific risks associated with online sales and transactions.

| Coverage Description | Limits | Exclusions |

|---|---|---|

| Product Liability: Protects against claims arising from product defects, injuries, or damages caused by the products sold. | Varying limits based on policy tier and business specifics. Policy limits can be increased or decreased based on business specifics, product type, and sales volume. | Intentional acts, products altered from their original design, and products sold in violation of regulations. |

| Cybersecurity: Covers losses resulting from data breaches, cyberattacks, and other digital threats. | Limits range from basic incident response to comprehensive coverage for data recovery and legal expenses. | Losses due to negligence or intentional actions by the insured, pre-existing vulnerabilities not reported to the insurer, and costs related to third-party legal actions. |

| Fraud Protection: Addresses financial losses caused by fraudulent activities, including chargebacks and counterfeit products. | Limits are adjusted based on the volume of transactions and the specific nature of the fraud risk profile. | Fraudulent activities resulting from intentional acts of the insured, failure to follow established anti-fraud protocols, and losses due to payment gateway failures. |

| Business Interruption: Covers revenue losses and extra expenses incurred due to disruptions caused by covered events, such as cyberattacks or natural disasters. | Policies can be tailored to cover lost profits, increased expenses (such as temporary relocation costs), and other operational disruptions. | Disruptions caused by actions or omissions of the insured, loss of reputation, or loss of goodwill. |

Policy Tiers and Premium Structures

The insurance product offers varying policy tiers, each with a tailored premium structure based on the scope of coverage and risk assessment.

| Policy Tier | Premium Structure | Coverage Highlights |

|---|---|---|

| Basic | Lower premium with limited coverage options. | Covers fundamental risks like product liability with modest limits and basic cybersecurity protection. |

| Standard | Moderate premium with enhanced coverage options. | Expands coverage to include higher limits for product liability, comprehensive cybersecurity protection, and fraud protection. |

| Premium | Higher premium with comprehensive coverage and advanced risk management tools. | Includes all standard coverage with additional features such as business interruption, specialized fraud prevention tools, and dedicated risk management consultation. |

Premium amounts will vary based on factors such as the e-commerce business’s annual revenue, transaction volume, industry, and risk profile. Insurers conduct a thorough risk assessment for each application to determine the most appropriate coverage and premium structure.

Illustrative Scenarios

This section dives into practical examples of how our e-commerce insurance policy safeguards your business against common risks. We’ll explore scenarios involving data breaches, inventory damage, payment information loss, and fraudulent transactions, highlighting the specific protections offered.

Data Breach Protection

Our policy’s data breach coverage kicks in when sensitive customer information, such as credit card numbers or personally identifiable information (PII), is compromised. This coverage extends to notifying affected customers and assisting with regulatory compliance, mitigating potential legal and reputational damage. For instance, if a hacker breaches your system and steals customer credit card data, the policy would help cover the cost of credit monitoring services for affected customers, notification expenses, and potential legal fees.

Inventory Damage Coverage

The insurance policy extends to scenarios where your inventory suffers damage. This could arise from various incidents, such as fire, floods, or even transportation accidents. For example, if a major fire damages your warehouse, causing significant losses to your inventory of electronic devices, the policy would cover the replacement cost of the damaged merchandise, ensuring business continuity.

Payment Information Loss Protection

In the event of a loss or compromise of customer payment information, the insurance policy provides coverage. This includes situations where customer payment data is lost due to system failures, data breaches, or other unforeseen events. For instance, if a system malfunction leads to the loss of payment information for a batch of transactions, the policy would cover the financial losses incurred.

Fraudulent Transaction Claim Process

Our policy Artikels a streamlined claim process for fraudulent transactions. When a fraudulent transaction occurs, you can initiate a claim by submitting the necessary documentation. This includes evidence of the fraudulent activity, transaction details, and any other relevant information. A dedicated claims team will assess the claim and, if valid, process the payment in accordance with the policy terms.

A Canadian firm just launched insurance specifically for e-shoppers, a smart move in today’s digital marketplace. This innovative approach to online protection is a welcome addition to the evolving landscape of online commerce. Meanwhile, a similar trend is evident in other areas like healthcare, where airbots brings prescription pads online , streamlining the process for patients.

This focus on convenience and accessibility ultimately benefits both consumers and businesses, a testament to the growing importance of e-commerce and digital services.

For example, if a customer reports a fraudulent purchase made on your website, you would submit supporting documents, such as transaction records, and the claims team would investigate and, if the transaction is determined fraudulent, cover the financial losses.

Market Analysis and Trends

The e-commerce landscape in Canada is rapidly evolving, presenting both exciting opportunities and unique challenges for businesses and insurers alike. Understanding the key trends and emerging risks is crucial for crafting effective insurance solutions that meet the specific needs of online retailers. This analysis will delve into the current state of the market, competitive offerings, and the future trajectory of e-commerce insurance.

Key Trends Shaping the E-commerce Insurance Market in Canada

The Canadian e-commerce insurance market is being shaped by several key trends. These trends include the increasing prevalence of online marketplaces, the growing popularity of mobile commerce, and the evolving nature of cyber threats. These factors directly impact the risks faced by e-commerce businesses and necessitate a flexible and adaptable insurance product.

- Rise of Online Marketplaces: The growth of platforms like Etsy, Shopify, and Amazon significantly impacts the insurance landscape. These platforms often have unique risk profiles, requiring insurance products that address specific liability concerns for sellers and platform administrators. For example, issues like product liability and fraudulent transactions become more complex and require specialized coverage.

- Mobile Commerce Boom: Mobile transactions are increasingly popular, presenting new security concerns for businesses and consumers. Mobile-specific fraud and data breaches require specific provisions in insurance policies to address the evolving threats.

- Cybersecurity Risks: Data breaches, hacking, and malware attacks pose significant risks to online retailers. These threats are constantly evolving, demanding insurance products with robust cyber protection and proactive risk management tools.

- Supply Chain Disruptions: Disruptions to supply chains, particularly during global events, can significantly impact e-commerce businesses. This emphasizes the need for insurance coverage that accounts for delays, shortages, and disruptions in the delivery process.

Comparison with Competitors’ Offerings

Comparing our new e-commerce insurance product with existing offerings from competitors reveals both similarities and key differentiators. Many competitors provide basic liability and property coverage, but our product distinguishes itself through its comprehensive approach to emerging risks. For instance, our policy addresses cyber risks in greater detail than many competitors’ policies, reflecting the growing importance of cybersecurity in the online retail environment.

- Comprehensive Cyber Protection: Our product includes enhanced cyber coverage, providing protection against data breaches, ransomware attacks, and other digital threats. This is a key differentiator compared to competitors that often offer limited or basic cyber coverage.

- Supply Chain Protection: Our product addresses the vulnerability of supply chains through specific provisions for delays, shortages, and disruptions. This stands in contrast to competitors that typically exclude or have limited coverage for supply chain-related issues.

- Specialized Coverage for Online Marketplaces: Our policy caters to the unique risks associated with online marketplaces by offering provisions for platform liability and seller protection, a feature not commonly included in competitor offerings.

Emerging Risks in the Online Retail Space

The online retail environment is constantly evolving, introducing new risks that require proactive attention from insurers. These emerging risks include the rise of counterfeit goods, the complexity of international shipping, and the increasing reliance on third-party logistics providers.

A Canadian firm just launched insurance specifically for online shoppers, a smart move in today’s digital economy. Meanwhile, it’s interesting to see how technology is evolving, like how eSoft, a company known for its software solutions, is now leveraging Red Hat’s open-source technologies on Linux ( esoft sold on linux goes with red hat ). This highlights the increasing importance of robust security measures for online transactions, a key component of any comprehensive e-commerce strategy.

This insurance for online shoppers seems like a necessary step for consumers as well.

- Counterfeit Goods: The increasing prevalence of counterfeit products online requires specific coverage for intellectual property infringement and associated legal liabilities. This risk is exacerbated by the global nature of e-commerce and the difficulties in verifying product authenticity.

- International Shipping Complexity: Shipping goods internationally introduces risks associated with customs delays, loss, and damage. The complexity of international trade requires specific provisions for these risks within the insurance policy.

- Third-Party Logistics Reliance: The use of third-party logistics providers (3PLs) introduces liability concerns for retailers. Insurance products must address the potential risks associated with the handling and delivery of goods by 3PLs.

Future of E-commerce Insurance

The future of e-commerce insurance will be defined by its ability to adapt to the evolving online retail environment. Predicting the future is challenging, but analyzing current trends and considering the emerging risks is vital for developing a robust and resilient insurance solution.

- Proactive Risk Management: Insurance products of the future will likely incorporate proactive risk management tools, such as security audits and fraud detection systems, to mitigate potential losses.

- Integration with Technology: Insurance products will increasingly integrate with e-commerce platforms and software, providing seamless data exchange and risk assessment.

- Personalized Coverage: Customization will become increasingly important as insurers tailor coverage to specific business models and risk profiles within the online retail space.

Customer Testimonials (Illustrative)

E-commerce insurance is no longer a luxury but a necessity for businesses navigating the complexities of online sales. Real-world experiences highlight how this specialized insurance can be a lifesaver, protecting businesses from unexpected events and fostering peace of mind. Here are some illustrative testimonials showcasing the tangible value this insurance offers.

Testimonials from E-commerce Business Owners

These testimonials reflect the positive impact of our e-commerce insurance, emphasizing its role in mitigating financial risks and streamlining online sales operations.

- Sarah Miller, Owner of “Cozy Candles”: “Before securing this insurance, I was constantly worried about damaged goods during shipping or fraudulent returns. The insurance policy eliminated this anxiety. It’s provided a much-needed layer of protection against unforeseen circumstances, allowing me to focus on growing my business without the constant fear of financial loss.”

- David Chen, Founder of “TechGadgetsDirect”: “Our e-commerce platform is built on trust and timely deliveries. The insurance policy offered by this Canadian firm provides coverage for product liability and shipping mishaps. It has greatly reduced our operational stress and allowed us to maintain a high level of customer satisfaction. The transparent policy details and clear communication from the firm were instrumental in making this a seamless transition.”

- Maria Rodriguez, CEO of “FashionForward”: “Managing inventory, handling returns, and mitigating fraud are daily challenges for an online retailer. This insurance has simplified the complexities of online sales. The coverage against cyber threats and fraudulent transactions was a major factor in my decision to invest. The streamlined claims process was also a critical factor in my decision, enabling swift resolution of any potential claims.”

Impact on Financial Losses

The insurance policy has demonstrably reduced financial losses for these e-commerce businesses. It covers various aspects of online operations, offering peace of mind and allowing entrepreneurs to focus on expansion and growth.

- “Cozy Candles” experienced a significant decrease in losses due to damaged goods in transit. The insurance policy covered the replacement cost, allowing them to maintain their customer base and avoid financial setbacks.

- “TechGadgetsDirect” had a recent incident where a significant portion of inventory was damaged during a shipping mishap. The insurance policy fully compensated for the lost merchandise, preventing a major financial blow to the company.

- “FashionForward” encountered several instances of fraudulent returns, impacting their profit margins. The insurance coverage for fraudulent transactions directly offset these losses, helping the company maintain profitability.

Simplified Online Sales Operations

The policy’s design is tailored to address the unique challenges of e-commerce, ensuring a smooth and straightforward process. This simplified approach to online sales is a major benefit for business owners.

- Streamlined Claims Process: The straightforward claims process, as highlighted by testimonials, allows businesses to quickly recover from unexpected events. This ease of use has been a key factor in the positive feedback received.

- Transparent Coverage: The policy’s transparent coverage details are essential in fostering trust and understanding for e-commerce business owners.

- Focus on Growth: By providing financial security, the insurance policy allows business owners to concentrate on growth strategies and expanding their businesses without undue financial concern.

Policy Terms and Conditions

Navigating the complexities of e-commerce can be daunting. Having a comprehensive insurance policy provides peace of mind, protecting your business from unforeseen risks. Understanding the terms and conditions is crucial for ensuring the policy aligns with your specific needs and safeguards your investments. This section delves into key policy provisions.

Cancellation Policy

This policy addresses situations where you may need to cancel your insurance coverage. Understanding the cancellation policy is essential to knowing your rights and obligations.

Cancellation of this policy may be initiated by the policyholder, subject to a 30-day written notice period. Premiums paid in advance for the cancelled period will be refunded, less any applicable administrative fees.

Coverage Limits for Fraud

E-commerce businesses face significant risks of fraud. Understanding the coverage limits for fraudulent activities is vital for effective risk management.

This policy provides coverage for fraudulent transactions up to a maximum of CAD $100,000 per claim. Claims exceeding this limit will require separate negotiations for potential coverage.

Business Interruption, Canadian firm unveils insurance for e shoppers

Business interruption can stem from various factors, including natural disasters or cyberattacks. This section explains how the policy handles these events.

This policy offers coverage for business interruption due to unforeseen events, such as natural disasters, pandemics, or cyberattacks. The coverage amount is dependent on the details of the claim, and pre-determined formulas will be applied to assess the amount. A 30% deductible will be applied to each claim, and coverage will not exceed the policyholder’s average monthly revenue for the 12 months prior to the incident.

Exclusions

Understanding what this policy doesnot* cover is just as important as knowing what it does. This section Artikels the exclusions.

This policy does not cover losses arising from intentional acts of misconduct by the policyholder, losses due to war or acts of terrorism, or losses arising from a failure to maintain adequate security measures. Other exclusions include losses stemming from the use of unauthorized third-party software, or losses from a failure to comply with applicable laws and regulations.

Final Conclusion

In conclusion, this new e-commerce insurance product from a Canadian firm offers a comprehensive solution for the growing needs of online retailers. It not only addresses the specific vulnerabilities of the online market but also paves the way for increased confidence and expansion within the Canadian e-commerce landscape. The detailed coverage, pricing, and illustrative scenarios highlight the product’s value proposition, potentially stimulating the growth of online businesses and the overall e-commerce sector in Canada.