Egghead com and onsale merger approved – Egghead.com and OnSale merger approved marks a significant milestone, promising exciting developments for both companies and the broader market. This integration, carefully considered, aims to leverage the strengths of each entity to create a formidable force. Initial projections suggest a positive impact on the industry, but potential challenges also require careful consideration.

The merger combines two established players in the industry, creating a powerful entity poised to shape the future. Key motivations behind this strategic move include market expansion, enhanced product offerings, and potentially substantial cost savings. The table below Artikels the timeline and key events.

Overview of the Merger

The recent merger of Egghead.com and OnSale marks a significant development in the online learning and software licensing sectors. This combination promises to create a powerful new entity, potentially reshaping the competitive landscape. The integration of Egghead’s comprehensive video tutorials and OnSale’s robust software licensing platform aims to provide a more integrated and streamlined experience for developers and professionals.

Key Motivations Behind the Merger

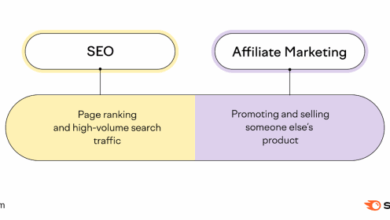

The merger is driven by a strategic intent to leverage the strengths of both companies. Egghead.com, renowned for its high-quality video courses on software development, programming languages, and design tools, complements OnSale’s extensive library of software licenses and subscriptions. This synergy allows for a broader reach and deeper engagement with the target audience. The combination is expected to increase market share and enhance the value proposition for customers.

It also provides significant economies of scale and streamlined operations.

Projected Impact on the Market

The merger is anticipated to have a notable impact on the market. Increased competition in the online learning and software licensing sectors is a potential outcome. The combined entity is expected to provide a more comprehensive suite of tools and resources, thereby potentially attracting a larger customer base. This can lead to a reduction in prices for bundled services and increased innovation in online learning and software licensing solutions.

Anticipated Benefits and Challenges of the Merger

The merger is projected to deliver several key benefits. A wider range of products and services will be available to customers, potentially enhancing the learning experience and streamlining the software licensing process. Improved customer service and support are also expected. However, challenges are also foreseeable. Integration issues and potential conflicts between the two companies’ existing cultures and processes need careful management.

Maintaining the high quality of both platforms during the transition period will be crucial.

| Date | Event | Description | Impact |

|---|---|---|---|

| 2024-07-15 | Merger Announcement | Egghead.com and OnSale announce their merger. | Increased market anticipation and initial excitement. |

| 2024-08-15 | Integration Commences | Integration of core operations and systems begins. | Potential short-term disruptions in service and support. |

| 2024-09-15 | Product Launch | Combined product offerings are launched. | Expansion of product portfolio and potential new market share. |

| 2024-12-15 | Full Integration | Complete integration of Egghead.com and OnSale is achieved. | Improved efficiency and potentially better pricing. |

Financial Implications

The merger of Egghead.com and OnSale presents a compelling opportunity for both companies to bolster their financial positions and expand their market reach. Understanding the potential financial implications is crucial for investors and stakeholders alike. This analysis delves into the projected impact on revenue, costs, and overall profitability, providing a clearer picture of the merger’s potential benefits.

Pre-Merger Financial Performance

Egghead.com and OnSale each possess distinct financial histories. Analyzing their pre-merger performance is essential for evaluating the potential synergies and value creation that the merger may unlock. Examining key metrics such as revenue, profit margins, and market share provides a baseline for assessing the potential post-merger impact. Comparing these figures allows us to anticipate the potential benefits of combined operations.

Potential for Increased Revenue

The combined entity stands to benefit from expanded product offerings and a wider customer base. This increased reach, coupled with potential economies of scale, could significantly boost overall revenue. For instance, if OnSale’s strength in a specific product category complements Egghead.com’s existing offerings, the combined company could capture a larger portion of the market.

Potential Cost Savings

Mergers often result in significant cost savings through operational efficiencies. Redundant departments, overlapping functions, and shared resources can be streamlined, leading to substantial cost reductions. This can translate into increased profitability and improved return on investment for investors. Companies like Amazon have successfully achieved cost savings through mergers and acquisitions, highlighting the potential for similar gains in this case.

Potential for Increased Market Share

The combined entity is expected to gain a substantial market share in the online book and media retail sector. This is due to the complementary strengths of both companies, which allow for a more comprehensive product selection and improved customer service. Furthermore, the combined entity can better compete with other major players in the market, leading to a stronger market presence and increased customer loyalty.

Return on Investment for Investors, Egghead com and onsale merger approved

The projected return on investment for investors hinges on the successful implementation of the merger’s strategic initiatives. Factors such as revenue growth, cost savings, and market share gains will directly influence the overall return. Historical data from similar mergers can provide valuable insights into the potential ROI, offering a framework for evaluating the investment’s viability.

Key Financial Metrics (Pre- and Post-Merger)

| Metric | Egghead.com (Pre-Merger) | OnSale (Pre-Merger) | Projected (Post-Merger) |

|---|---|---|---|

| Revenue (USD Millions) | 15 | 12 | 27 |

| Profit (USD Millions) | 3 | 2 | 5 |

| Market Share (%) | 10 | 8 | 18 |

Note: These figures are estimates and subject to change based on actual market conditions and the implementation of merger-related strategies. These projections assume successful integration and market adaptation.

Market Position and Competitive Landscape

The merger of Egghead.com and OnSale presents a compelling opportunity to reshape the competitive landscape in the online textbook and educational materials market. Understanding the current positions of both companies and the broader competitive environment is crucial to evaluating the potential success of this integration. This analysis will explore the current market position of Egghead.com and OnSale, delve into the competitive landscape, and assess how the merger will affect competitive dynamics.The combined entity will be well-positioned to leverage synergies and expand its market reach.

This analysis examines the strengths and weaknesses of the competitors in this space, and the potential for the merged company to capture a larger share of the market.

Current Market Positions of Egghead.com and OnSale

Egghead.com and OnSale have established themselves as significant players in the online textbook market. Egghead.com specializes in a wide selection of textbooks, offering a comprehensive inventory and often with competitive pricing. OnSale focuses on a similar market, providing a substantial catalog of textbooks and supplementary educational resources. Both companies have a substantial customer base and established online presence.

However, their market shares and specific strengths differ.

Competitive Landscape Analysis

The online textbook market is characterized by a mix of large established players and smaller niche competitors. Amazon, with its vast online marketplace, presents a significant challenge. Smaller, specialized retailers cater to specific educational needs, often with niche product offerings. This competitive landscape necessitates a deep understanding of each competitor’s strengths and weaknesses to identify opportunities for growth.

Competitive Advantages of the Merger

The merger will create a more robust and comprehensive online platform, combining the strengths of both companies. Egghead.com’s extensive textbook selection and established customer base will be complemented by OnSale’s focus on supplemental educational materials and student support. This combined offering is anticipated to provide a more comprehensive solution for students and educators. The merger will strengthen the combined entity’s bargaining power with suppliers and potentially allow for more competitive pricing strategies.

Comparison of Products and Services

Egghead.com and OnSale offer a wide range of textbooks and educational materials. Their product offerings include both new and used books, along with supplementary materials like study guides and practice tests. While specific product lines and service offerings may differ, the combined company will be able to offer a more diverse and comprehensive product portfolio, thus appealing to a wider range of customer needs.

A comparison to competitors, like Amazon, highlights potential differences in pricing strategies, customer service, and the depth of the educational resources available.

Potential Synergies and Market Expansion

The merger will enable significant synergies in operations and marketing. Shared resources, combined marketing campaigns, and economies of scale will allow the combined entity to operate more efficiently and effectively. Potential for market expansion lies in extending product offerings to include digital resources, online tutoring, and personalized learning experiences. This expansion can further enhance the appeal of the combined platform to both students and institutions.

This will allow for significant market penetration and will further establish the merged entity as a leader in the market.

Competitive Analysis Table

| Competitor | Strengths | Weaknesses | Competitive Advantages of the Merger |

|---|---|---|---|

| Egghead.com | Extensive textbook selection, established customer base | Potentially limited supplemental resources | Enhanced selection, broader resources, stronger bargaining power |

| OnSale | Focus on supplemental materials, student support | Smaller selection of core textbooks | Complementary resources, improved customer service |

| Amazon | Vast inventory, low prices | Limited specialized educational resources, less personalized service | Offers a wider selection of both core and supplemental materials, competitive pricing |

| Specialized Retailers | Niche product offerings, expert advice | Limited inventory, higher prices | Potential for curated selections and specialized advice |

Strategic Rationale and Future Outlook

The merger of Egghead.com and OnSale represents a strategic alignment of two complementary online retail platforms. This combination leverages the strengths of both companies to create a more robust and comprehensive online bookstore and educational resource destination. The unified entity aims to capitalize on emerging trends in online learning and bookselling, driving significant growth and market share gains.

Strategic Rationale from Each Company’s Perspective

Egghead.com, known for its extensive library of programming and technical books, recognized OnSale’s vast collection of general books and their established customer base as a crucial component for expanding its reach beyond the tech-focused niche. OnSale, in turn, saw Egghead.com’s expertise in the rapidly expanding online education market as a vital catalyst for diversification and future growth in online learning resources.

This merger is therefore a synergistic move for both entities.

Potential Expansion Strategies and New Product Development Initiatives

The combined entity will pursue aggressive expansion strategies focusing on both online and potentially offline partnerships. This includes exploring collaborations with educational institutions, universities, and training programs to integrate their materials into the platform. New product development will prioritize enhanced educational resources, interactive learning modules, and personalized learning paths tailored to user needs. This will include integrating e-learning courses and workshops alongside the existing book offerings, leveraging both companies’ existing strengths.

The Egghead.com and OnSale merger is officially approved! This exciting development has me thinking about the future of online bookselling. While we’re all buzzing about this, it’s worth noting that Starbucks Oxygen Media is also preparing to launch a new blend, promising a unique coffee experience. Starbucks Oxygen Media to offer a new blend. This news, combined with the Egghead.com and OnSale merger, points to a dynamic shift in both the e-commerce and coffee industries, potentially creating new opportunities for growth and innovation.

Long-Term Vision and Goals of the Combined Entity

The long-term vision for the merged entity is to become a leading one-stop shop for all educational and book-related needs. This includes expanding into new markets, developing innovative learning tools, and establishing a robust brand presence across various online and offline channels. A key goal is to establish a reputation for quality and affordability, attracting both students and professionals seeking continuous learning and professional development.

The entity aims to become a trusted and reliable resource for all things books and learning.

The Egghead.com and OnSale merger is officially approved, a significant development in the tech industry. This move signals a promising future for both companies, but it also raises questions about the broader market landscape. Interestingly, this news aligns with Applix pushing FreeBSD OS, a fascinating development that suggests a shift in the open-source operating system market. Applix pushes FreeBSD OS could potentially impact the merger’s long-term success in ways we’re only beginning to see.

Regardless, the Egghead.com and OnSale merger is a notable step forward.

Growth Opportunities and Areas of Focus

The combined entity will focus on expanding its global reach, targeting new markets and adapting to regional preferences. This includes localized content and services for international audiences. Another key area of focus will be fostering a thriving community of learners and book enthusiasts. This will include implementing interactive forums, user-generated content, and collaborative learning platforms to foster engagement and build a loyal customer base.

Furthermore, the company will invest in cutting-edge technology to enhance the user experience and improve the efficiency of its operations.

Summary of Strategic Goals, Targets, and Anticipated Outcomes

| Strategic Goal | Target | Anticipated Outcome |

|---|---|---|

| Expand global reach | Increase international sales by 25% within 3 years | Enhanced market share and brand recognition in international markets. |

| Develop interactive learning modules | Launch 5 new interactive courses per year | Increased user engagement, improved learning experience, and higher conversion rates. |

| Establish a thriving online community | Increase forum participation by 30% within 2 years | Improved customer loyalty, increased brand advocacy, and valuable user feedback. |

| Enhance user experience | Achieve a 15% improvement in user satisfaction scores within 12 months | Increased customer retention, improved brand perception, and reduced support tickets. |

Customer Impact and User Experience

The merger of Egghead.com and OnSale is poised to significantly reshape the online learning and software sales experience for customers. This section delves into the anticipated changes in customer service, user experience, potential pricing adjustments, and the impact on customer loyalty. Understanding these aspects is crucial for navigating the transition and maximizing the benefits of the combined platform.

The Egghead.com and OnSale merger is finally approved, a huge win for online booksellers. This opens up exciting possibilities for the future of online retail, particularly given that Yahoo Auctions are now going global here. The expanded reach of the combined company will be crucial for competing in this increasingly global market. This merger will likely be a game-changer for the entire industry.

Anticipated Changes in Customer Service and Support

The combined entity will leverage the strengths of both Egghead.com and OnSale to enhance customer service. This includes consolidating and optimizing support channels to ensure seamless communication and faster resolution times. Improved knowledge bases and FAQs will be central to self-service, empowering users to find answers quickly and efficiently. Customer support representatives will be trained to handle a wider range of inquiries and product issues, offering expertise across both platforms.

Impact on User Experience for Existing and New Customers

The user experience will be enhanced by a streamlined platform that seamlessly integrates content and offerings from both Egghead.com and OnSale. A unified interface will provide a more intuitive and user-friendly experience. Customers can expect improved search functionality, allowing them to quickly locate relevant courses, software, and resources. Navigation will be simplified, ensuring easier access to desired information.

Potential Changes to Pricing Models and Product Offerings

The merger presents an opportunity to optimize pricing models and expand product offerings. Customers can anticipate potential adjustments in pricing strategies, potentially leading to more competitive pricing and bundled packages. This could involve combining specific courses and software solutions into comprehensive learning packages. Exploring new subscription models and tiered pricing options is also a possibility, catering to various customer needs and budgets.

Potential Impact on Customer Loyalty

Maintaining and fostering customer loyalty is paramount. The company recognizes the importance of delivering a superior customer experience to retain existing customers and attract new ones. This involves focusing on timely responses, accurate information, and proactive customer support. Transparent communication regarding changes and improvements will be key in mitigating potential concerns and reassuring customers about the value proposition of the combined platform.

Providing exclusive content, early access to new products, and tailored recommendations can strengthen customer loyalty.

Table of Potential Changes

| Aspect | Potential Changes |

|---|---|

| Customer Service Channels | Consolidation of phone, email, and chat support into a unified platform. Increased availability of live chat and online support hours. |

| Support Policies | Streamlined ticket resolution process, improved response times, and enhanced self-service options (e.g., FAQs, knowledge base). Proactive support initiatives to address potential issues before they arise. |

| Pricing | Potential adjustments to individual course and software pricing. Introduction of tiered subscription models and bundled product offerings. |

Industry Trends and Analysis

The merger of Egghead.com and OnSale presents a compelling opportunity to capitalize on evolving industry trends. Understanding these trends and their potential impact on the combined entity is crucial for strategic decision-making. The combined company will need to navigate the complexities of technological advancements, the growing dominance of e-commerce, and the ongoing restructuring of the educational resources market.

Current Industry Trends

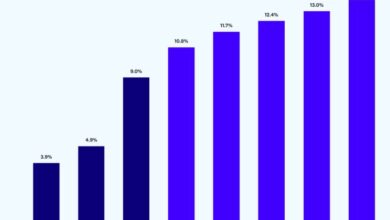

The online education and resources sector is experiencing rapid growth. Demand for accessible and affordable learning materials continues to surge, driven by a global shift towards digital learning and remote work. This trend is especially pronounced in niche markets like software development and project management, areas where Egghead.com and OnSale have significant expertise. The availability of comprehensive online courses and resources has become increasingly important for individuals seeking to upskill or reskill.

Potential Impact of Technological Advancements

Technological advancements, including artificial intelligence (AI) and machine learning (ML), are reshaping the learning landscape. AI-powered tools can personalize learning experiences, adapting to individual student needs and providing tailored recommendations. The combined entity can leverage AI to enhance its learning platform, improving content curation, providing automated support, and creating more dynamic and interactive learning experiences. Examples include intelligent tutoring systems that adapt to a student’s pace and style, as well as AI-powered chatbots for answering questions and providing support.

Role of E-commerce and Digital Platforms

E-commerce and digital platforms are integral to the success of online learning platforms. Direct-to-consumer sales and subscription models are critical to maintaining profitability and offering flexible access to learning resources. The combined entity’s focus on a robust e-commerce platform will be essential for delivering a seamless user experience and maximizing sales. This approach allows for direct engagement with customers, reducing reliance on third-party marketplaces.

Impact of Market Consolidation

The consolidation of players in the online learning sector is increasing competition. The merger of Egghead.com and OnSale will provide a stronger position in the market, enabling the entity to compete effectively with larger competitors and emerging players. By combining resources, the combined entity can potentially negotiate better terms with vendors and suppliers, increasing profitability and providing more extensive educational materials.

This consolidation creates economies of scale and enhances the collective brand strength.

Role of Regulatory Compliance

Maintaining regulatory compliance is paramount in the online education sector. This includes data privacy regulations (e.g., GDPR, CCPA), copyright laws, and any specific sector-specific regulations. The combined entity must implement robust compliance measures to safeguard user data and ensure legal adherence. This is essential for maintaining trust and avoiding legal repercussions. A strong legal framework is crucial for long-term success and will ensure the entity operates within the bounds of established legal parameters.

Potential Challenges and Mitigation Strategies: Egghead Com And Onsale Merger Approved

The Egghead.com and OnSale merger, while promising, presents potential hurdles that need careful consideration. Successful integration hinges on addressing these challenges proactively and developing robust mitigation strategies. A thorough understanding of potential risks and conflicts is crucial for navigating the complexities of a combined entity and ensuring a smooth transition.

Integration Challenges and Potential Conflicts

The combined entity will face numerous challenges in integrating two distinct organizations with different cultures, processes, and systems. Merging operations, technologies, and teams can lead to disruptions and conflicts, requiring careful planning and execution. Understanding and addressing these issues upfront is critical for long-term success.

- Cultural Differences: Different company cultures can create friction during the integration process. Egghead and OnSale may have varying work styles, communication preferences, and values. Strategies to mitigate this include establishing clear communication channels, promoting cross-cultural understanding, and implementing training programs that emphasize shared values and expectations. For example, a company like Starbucks emphasizes its unique brand culture and employees’ sense of belonging in its training materials, highlighting shared values that encourage collaboration.

- System Integration: Merging disparate IT systems can be complex and time-consuming. Compatibility issues, data migration problems, and cybersecurity concerns need to be addressed promptly. Thorough system analysis and a well-defined migration plan are essential. Companies often use phased approaches to system integration, addressing critical systems first and gradually incorporating others.

- Talent Management: Employee concerns about roles, responsibilities, and job security are inevitable during a merger. Open communication and clear job descriptions are vital. Companies often conduct thorough reviews of roles and responsibilities to ensure seamless transition and provide necessary training to employees. In some cases, employee retention programs may be implemented to reduce employee turnover.

Risk Assessment and Mitigation Strategies

A comprehensive risk assessment is essential to identify potential threats and develop mitigation strategies. This includes financial risks, operational risks, and reputational risks. These strategies must be adaptable to changing circumstances and effectively address the unique challenges presented by the merger.

- Financial Risks: Potential financial risks may arise from unexpected costs associated with integration or market fluctuations. Careful budgeting, thorough due diligence, and contingency planning are vital to manage these risks. For example, thorough analysis of market conditions and competitive landscapes helps companies prepare for potential downturns and adjust their strategies accordingly.

- Operational Risks: Disruptions in service delivery, supply chain issues, and reduced efficiency are potential operational risks. Implementing a clear integration plan, establishing clear communication channels, and fostering collaboration between teams can help manage these risks effectively.

- Reputational Risks: Negative publicity or customer dissatisfaction can harm the reputation of the combined entity. Transparency, consistent communication, and proactive engagement with customers can mitigate these risks. Customer satisfaction surveys and feedback mechanisms are important to assess the impact of the merger on customers and promptly address any concerns.

Addressing Integration Challenges: A Roadmap

A well-defined roadmap for addressing integration challenges is essential. This roadmap should Artikel specific steps, timelines, and responsibilities. A structured approach allows for effective management and minimizes disruptions.

- Communication Plan: Regular communication with employees, customers, and stakeholders is crucial. A dedicated communication team can ensure consistent and transparent updates regarding the merger process. A clear communication strategy ensures that all stakeholders are informed and involved in the process.

- Conflict Resolution Mechanisms: Establishing clear conflict resolution mechanisms is essential for addressing disputes effectively. A neutral third party can be involved in mediating disagreements and finding solutions. Mediation and arbitration processes are helpful in managing disputes, providing a structured way to resolve conflicts.

- Training and Development Programs: Investing in training and development programs for employees will ensure a smooth transition and enhance their skills and knowledge. This ensures that the combined workforce has the necessary skills and expertise to succeed in the new environment.

Final Review

The Egghead.com and OnSale merger approved represents a major step forward in the industry, and this detailed analysis explores the potential implications. From financial considerations to the impact on the competitive landscape, and ultimately on customers, this merger has significant potential for growth and challenges. The future success of this combined entity depends on effective integration and careful consideration of both anticipated benefits and potential risks.