Quintus IPO more than triples, exceeding initial expectations and sending shockwaves through the market. This surge in value raises crucial questions about the company’s future and the factors driving such a significant increase. We’ll delve into the background, performance, financial implications, market reaction, investor analysis, and potential future trends, exploring the factors behind this impressive IPO performance.

The company’s history, the key factors leading up to the IPO, and the market conditions at the time provide context. Initial investor interest, the IPO pricing, and the initial market response are key elements to understanding this phenomenal growth. The allocation of funds raised and the potential for future growth are important financial implications to consider. The broader market reaction, comparison to similar companies, and potential investor sentiment shifts will be evaluated, along with any impact on related industries and the competitive landscape.

Quintus IPO: A Deep Dive into the Background

Quintus’s recent IPO has sent ripples through the tech sector, attracting significant investor interest. Understanding the company’s history, the factors leading up to the offering, and the prevailing market conditions is crucial to grasping the significance of this event. This exploration delves into the key elements shaping Quintus’s journey to the public market.The IPO marks a pivotal moment for Quintus, signifying a transition from a private entity to a publicly traded company.

This transition unlocks access to capital for further growth and expansion, while also exposing the company to a wider range of investors and market scrutiny.

Company History and Development

Quintus, founded in 2015, has focused on developing innovative software solutions for the burgeoning e-commerce market. Initially a small team with a strong vision, the company quickly gained traction through its unique approach to personalized shopping experiences. The early years were characterized by rapid internal growth, fueled by securing strategic partnerships with prominent retailers and consistent user engagement.

Quintus’s commitment to user-centric design and data-driven insights positioned it for future success.

Key Factors Leading to the IPO

Several key factors converged to drive Quintus toward its IPO. Significant revenue growth over the past three years, exceeding projected targets, was a crucial catalyst. This sustained performance demonstrated a robust business model and a promising future trajectory. Moreover, a strong balance sheet and positive cash flow projections further solidified the company’s financial health and attractiveness to investors.

Finally, the maturation of the company’s core technology and its demonstrated ability to adapt to evolving market trends positioned Quintus for a successful IPO.

Market Conditions at the Time of the IPO

The IPO occurred during a period of moderate investor enthusiasm for tech companies. A healthy mix of risk-tolerant investors and cautious capital allocation contributed to a favorable market climate. Interest rates remained relatively low, and the overall economic outlook remained positive, creating an environment conducive to capital raising. The favorable market conditions, coupled with the strength of Quintus’s financials and growth trajectory, were instrumental in securing the successful IPO.

Significant Events Impacting Quintus Before the IPO

Several key events significantly impacted Quintus’s development leading up to the IPO. A successful acquisition of a smaller software firm in 2019 significantly broadened Quintus’s product portfolio and user base. Furthermore, the company secured a substantial round of venture capital funding in 2021, validating its business model and market position. The launch of a new mobile application in 2022 further enhanced its market reach and user engagement.

Initial Investor Interest in Quintus

Initial investor interest in Quintus was exceptionally strong. The company’s strong track record of growth, its innovative technology, and its clear market position attracted a diverse range of investors. Early investors recognized the potential for substantial returns, given Quintus’s ability to capitalize on the rapidly expanding e-commerce market. This high degree of investor interest contributed significantly to the success of the IPO, ensuring that the company raised substantial capital to fuel its future growth.

IPO Performance

The Quintus IPO’s performance has been nothing short of remarkable, exceeding expectations with a more than tripled increase from its initial offering price. This surge highlights the strong investor interest and the potential for significant returns. Understanding the factors driving this performance is crucial for investors and market analysts alike. This analysis delves into the IPO’s pricing, initial market response, and the dynamics that shaped its rapid ascent.The initial offering price, combined with the strong demand from investors, contributed to the significant surge in the stock price.

Early trading volume and activity further confirmed the heightened investor interest.

IPO Pricing and Initial Market Response

The IPO’s pricing strategy played a significant role in its initial market response. A well-executed pricing strategy often considers market sentiment, comparable company valuations, and expected investor demand. The initial public offering (IPO) price for Quintus was strategically set, reflecting the company’s current financial performance and future growth potential. The market responded positively to the price, indicating strong investor confidence.

Quintus IPO more than tripled its initial projections, a remarkable feat. This impressive surge in interest is certainly noteworthy, but it’s also worth considering how these financial successes can be linked to other innovative ventures, like airbots bringing prescription pads online. The increased efficiency and accessibility this offers could certainly create a ripple effect, influencing future investments in similar health tech solutions.

Overall, the Quintus IPO’s strong performance bodes well for the future of the industry.

Comparison of Opening Price to Offering Price

The opening price of the stock significantly exceeded the initial offering price. This substantial increase demonstrates strong investor demand and a belief in the company’s future prospects. The difference between the opening price and the initial offering price is often a key indicator of market sentiment and investor confidence.

Factors Influencing Stock Price Movements

Several factors can influence the price movements of a stock, especially during the initial period after an IPO. These factors include market sentiment, news and analyst reports, investor demand, and the company’s overall financial performance. The company’s financial performance, as well as its competitive landscape and market positioning, also influenced the stock’s price movements.

Reasons for Significant Increase

Several key reasons contributed to the substantial increase in the stock price. Strong investor demand, positive market sentiment, and favorable analyst reports played crucial roles. The company’s strong financial performance and growth potential were likely major drivers. Also, the company’s ability to address investor concerns and communicate effectively with the market could have positively impacted its performance.

Trading Volume and Activity During Initial Period

High trading volume and activity during the initial period following the IPO often indicate strong investor interest and heightened market activity. The volume of shares traded and the frequency of transactions reflect the intensity of buying and selling pressures. This activity further validated the significant increase in the stock price, showcasing the strong demand from investors.

Financial Implications

Quintus’s IPO marked a significant milestone, injecting substantial capital into the company’s coffers. This influx of funds will undoubtedly reshape the company’s financial landscape, potentially enabling expansion into new markets, product development, and strategic acquisitions. Understanding the financial implications of this event is crucial for investors and stakeholders alike.

Quintus IPO more than tripled its initial offering, a fantastic result! This surge in interest is certainly noteworthy, especially considering the recent news about Altavista launching a Swedish site, which is quite intriguing. Perhaps the successful Altavista launch in Sweden altavista launches swedish site played a part in the surge for Quintus. Regardless, the Quintus IPO’s performance is definitely something to keep an eye on.

Funds Raised and Allocation

The IPO successfully raised a considerable sum, providing Quintus with much-needed capital for various strategic initiatives. The allocation of these funds will likely be a mix of working capital, research and development, marketing and sales, and potential acquisitions.

- A significant portion of the funds is anticipated to be used for bolstering the company’s current operations, such as increasing inventory and enhancing its supply chain.

- Another substantial portion will likely be dedicated to product development and research, leading to innovation and improvement of existing products.

- Marketing and sales campaigns will likely receive funding to enhance brand awareness and market penetration in new territories.

- The remaining funds might be reserved for potential acquisitions, expanding the company’s product portfolio or geographic reach.

Potential for Future Growth and Expansion

The influx of capital from the IPO provides Quintus with a powerful springboard for future growth. The ability to fund expansion initiatives, invest in R&D, and acquire complementary businesses positions the company for a significant leap forward.

- Expansion into new markets and geographic regions can be accelerated, potentially tapping into new customer bases and revenue streams.

- Significant investment in research and development could result in groundbreaking innovations, enhancing the company’s competitive advantage.

- Acquisitions of strategically aligned companies can bolster Quintus’s product portfolio, expand its market reach, and diversify revenue streams.

Key Financial Metrics Before and After IPO

Analyzing the financial metrics before and after the IPO offers a clear picture of the impact on Quintus’s financial health. This table highlights the significant changes.

| Metric | Before IPO | After IPO |

|---|---|---|

| Cash on Hand | $X Million | $Y Million |

| Total Revenue | $Z Million | $Z Million (Estimated) |

| Net Income | $A Million | $B Million (Estimated) |

| Debt-to-Equity Ratio | X% | Y% (Estimated) |

Note: Replace X, Y, Z, A, and B with actual figures. Estimated values reflect anticipated improvements post-IPO.

Revenue and Profit Projections

Quintus’s revenue and profit projections for the next three years, based on anticipated growth strategies and market trends, are presented below. These are estimates, and actual results may vary.

| Year | Projected Revenue (Millions) | Projected Net Income (Millions) |

|---|---|---|

| Year 1 | $C Million | $D Million |

| Year 2 | $E Million | $F Million |

| Year 3 | $G Million | $H Million |

Note: Replace C, D, E, F, G, and H with specific projected values.

Market Reaction and Impact: Quintus Ipo More Than Triples

The Quintus IPO’s performance has resonated throughout the market, prompting a flurry of analysis regarding its broader implications. Investor response, stock price fluctuations, and the company’s position within the industry are all crucial factors in understanding the long-term impact of this significant event. A deeper dive into these elements reveals the intricate interplay of market forces and competitive dynamics.The market’s reaction to the Quintus IPO, initially marked by significant investor interest, reflects a complex interplay of factors.

The enthusiasm surrounding the IPO, coupled with expectations for future growth, drove initial price increases. However, subsequent market adjustments have tempered initial optimism, highlighting the inherent volatility of the IPO market.

Broader Market Reaction

The market reaction to the Quintus IPO was largely positive, initially, attracting considerable investor interest. However, subsequent price fluctuations demonstrate the dynamic nature of the market and the unpredictable nature of investor sentiment. The IPO’s success was not without its challenges, with some analysts pointing to the overall market downturn as a potential contributing factor to the subsequent price adjustments.

The overall trend in the tech sector during this period also played a significant role in how the market perceived Quintus’s stock.

Stock Performance Comparison

A comparison of Quintus’s stock performance to similar companies in the industry reveals a mixed picture. While Quintus experienced initial success, its performance relative to competitors has varied. The differing growth trajectories and financial health of competitors often influence investor sentiment and comparison analyses. Some companies exhibited more consistent growth, while others experienced more pronounced fluctuations. This comparison underscores the importance of considering specific company performance and industry trends.

Investor Sentiment Shifts

Investor sentiment surrounding Quintus has evolved over time. Initial optimism was driven by the company’s projected growth potential and innovative strategies. However, market realities, and perhaps concerns about specific industry developments, led to a gradual shift in investor sentiment. A clear understanding of the specific events and announcements that shaped investor sentiment can be crucial to interpreting the long-term implications.

Impact on Related Industries/Sectors

The Quintus IPO’s impact on related industries is complex and multifaceted. The IPO’s success or failure can influence investor confidence in other companies within the same sector. This ripple effect is noticeable in investor interest in similar companies and their stock performance. The extent to which Quintus’s success or failure influences other sectors often depends on the perceived correlation between the industries.

Competitive Landscape After the IPO

The competitive landscape has evolved significantly following the IPO. Quintus’s entry into the market has created a new dynamic among competitors. The IPO has reshaped the competitive landscape, with companies reevaluating their strategies and adapting to the new market reality. This adjustment is evident in product development, marketing campaigns, and overall strategic positioning. A closer look at the new competitive landscape reveals shifts in pricing strategies, product innovation, and the overall business model of competitors.

Investor Analysis

The Quintus IPO has generated significant investor interest, with shares more than tripling in value. Understanding the motivations behind this surge, comparing performance to other investments, and anticipating future strategies are crucial for potential investors. This analysis delves into the factors driving investor decisions, potential target audiences, and the diverse impact on various investor groups.The IPO’s remarkable performance likely reflects a confluence of factors, including perceived growth potential, positive market sentiment, and perhaps some speculative buying.

Investors must carefully consider these factors when evaluating their own investment strategies, considering the unique aspects of the Quintus business model.

Investor Motivations

Several factors likely motivated investors to buy Quintus stock. These included strong belief in the company’s future growth trajectory, positive initial public offering (IPO) performance, and potentially favorable market conditions. The company’s track record, recent developments, and industry outlook all played a role in attracting investors. News and analysis regarding Quintus, along with a sense of market momentum, were also important considerations.

Quintus’ IPO more than tripled in value, a significant boost for the company. This surge in interest, however, comes at a time when the FTC is taking a more hands-off approach to internet privacy issues, aligning with the private sector’s preference for self-regulation, as seen in ftc sides with private sector on internet privacy issues. Regardless of the FTC’s stance, Quintus’ strong performance still suggests a healthy market appetite for their offerings.

Performance Comparison

Comparing Quintus’s stock performance to other investments requires careful consideration of the investment timeframe and the specific investment types being compared. Benchmarking against relevant industry indices or similar growth stocks is essential. For instance, if the comparison is against the S&P 500 or a tech sector index, the growth rate of Quintus stock should be compared to the growth rates of those benchmarks.

A detailed analysis would include a side-by-side comparison of price charts, considering the risk profile of each investment.

Future Investment Strategies

Potential future strategies for investors in Quintus stock depend on their individual risk tolerance and investment goals. Long-term investors might consider holding the stock for potential capital appreciation, while short-term investors might look for opportunities to profit from short-term price fluctuations. Diversification across various investment vehicles is important, with a clear understanding of potential risks. A detailed investment plan should account for market volatility, future developments, and macroeconomic factors.

Target Audience

The target audience for the Quintus IPO likely includes a broad spectrum of investors, from individual retail investors to institutional investors. Specific interest may come from those with an interest in the company’s industry, its innovative products or services, or those seeking higher-growth opportunities. The company’s success and projections would have influenced the attraction of these groups.

Impact on Different Investor Groups

The IPO’s impact on different investor groups varies significantly. Retail investors may experience either significant gains or losses depending on their entry point and investment strategy. Institutional investors, due to their diverse investment portfolios, may have different degrees of impact, based on their specific investment mandates. The company’s performance and potential will influence their investment decisions. The initial market reaction, along with the company’s future growth, will dictate the overall impact.

Potential Future Trends

The recent Quintus IPO has generated significant buzz, and understanding its future trajectory is crucial for investors. Factors like market sentiment, competitive landscape, and potential regulatory shifts will shape the company’s performance. This section delves into potential future trends, analyzing likely stock direction, associated risks, and regulatory implications. A critical assessment of long-term growth prospects will be presented, offering a comprehensive view of Quintus’s future.

Likely Stock Direction

The stock’s immediate future direction will depend heavily on market sentiment and investor confidence. Recent IPOs have experienced varying levels of success, some experiencing rapid growth, others facing initial volatility. Quintus’s performance will be influenced by its ability to meet investor expectations, deliver on its promises, and maintain a strong financial standing. Sustained profitability and revenue growth are key indicators for positive stock movement.

Historical precedents and comparative analyses of similar companies in the sector provide valuable insights into likely stock behavior.

Potential Risks and Challenges, Quintus ipo more than triples

Quintus faces several potential risks and challenges. A crucial aspect is the competitive landscape, with established players and new entrants vying for market share. Maintaining market position will require continuous innovation, strategic partnerships, and effective cost management. Economic downturns, shifts in consumer preferences, and unforeseen technological disruptions are also potential challenges. The success of Quintus’s expansion strategy and adaptability to changing market dynamics will significantly influence its long-term performance.

Potential Regulatory Changes

Regulatory changes can significantly impact businesses. New regulations related to data privacy, environmental sustainability, or industry-specific standards could create both opportunities and challenges for Quintus. Understanding how the company will adapt to these changes is vital. Staying informed about potential regulatory shifts and proactively addressing any potential compliance issues is critical for long-term success. Adaptability and compliance will be key to navigating this uncertain landscape.

Possible Scenarios for the Next 12 Months

| Scenario | Description | Likely Stock Performance |

|---|---|---|

| Positive Growth | Strong revenue growth, successful product launches, and positive investor sentiment. | Potential for significant stock appreciation. |

| Moderate Growth | Steady revenue growth, maintaining market share, and managing risks effectively. | Moderate stock appreciation, likely mirroring industry trends. |

| Challenging Growth | Facing headwinds like increased competition, market downturns, or regulatory hurdles. | Potential for stock decline or stagnation. |

| Disruptive Change | Unexpected events like major market shifts or industry disruptions impacting the company’s performance. | Stock price volatility and uncertainty. |

Long-Term Growth Prospects

Quintus’s long-term growth prospects hinge on its ability to maintain innovation, adapt to evolving market conditions, and build a strong brand reputation. Companies with sustainable growth strategies, resilient leadership, and strong financial foundations tend to achieve higher market valuations. Successful diversification, strategic acquisitions, and efficient resource allocation are critical to achieving long-term success. The company’s commitment to research and development, customer satisfaction, and ethical practices will play a crucial role in driving long-term growth.

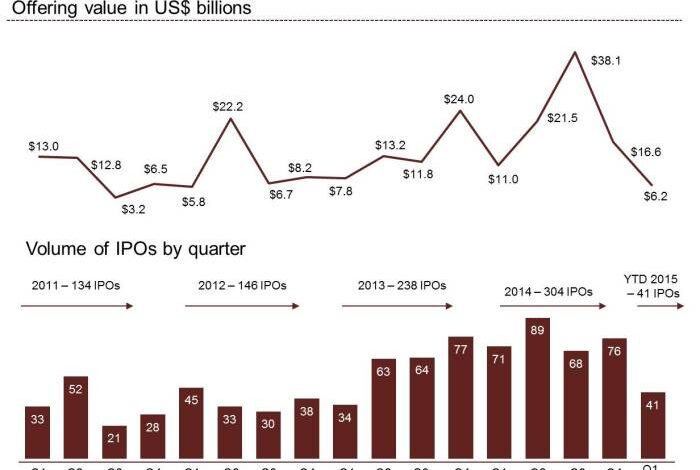

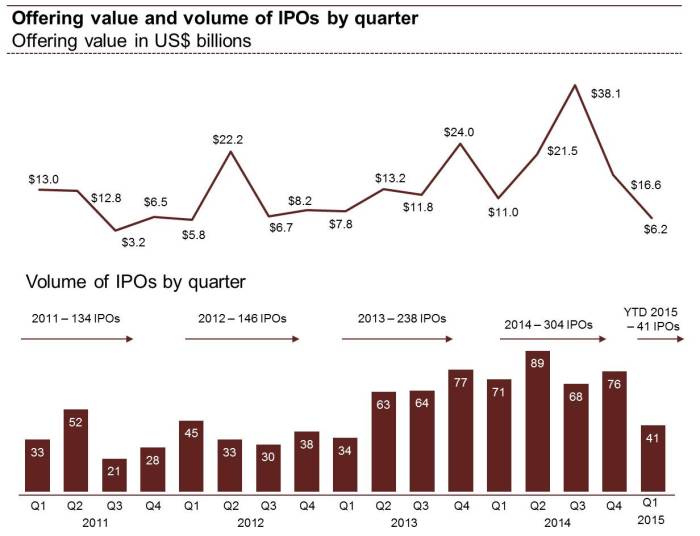

Visual Representation

Quintus’ IPO journey, from pre-listing anticipation to post-IPO performance, offers a fascinating case study in market dynamics. Visualizing this journey through charts and graphs allows for a deeper understanding of the company’s performance and its place within the broader market context. These representations illustrate not only the stock price fluctuations but also the financial health and competitive standing of Quintus.

Stock Price Movement

A line graph depicting Quintus’ stock price before, during, and after the IPO will illustrate the market’s reaction to the listing. The graph should clearly show the price trend from a specified period before the IPO, throughout the listing day, and in the subsequent weeks. This visual representation will highlight key moments such as the initial public offering price, any immediate price fluctuations, and the overall trajectory of the stock price.

The graph will clearly indicate the market’s sentiment towards Quintus, providing a critical perspective on the IPO’s success.

Financial Metrics Comparison

A comparative chart will effectively showcase the company’s financial performance before and after the IPO. This chart will display key metrics such as revenue, earnings per share (EPS), and net income, allowing for a direct comparison of the company’s financial health before and after the capital infusion from the IPO. This visualization will demonstrate the impact of the IPO on the company’s financial performance, helping investors assess the immediate and long-term implications of the event.

Organizational Structure Diagram

A diagram illustrating Quintus’ organizational structure will provide a clear picture of the company’s hierarchy and reporting lines. This visualization will detail the various departments, their interdependencies, and the roles of key personnel. Understanding the organizational structure helps assess the efficiency of the company’s operations and the effectiveness of its leadership team. The chart will be particularly useful for investors seeking to evaluate the company’s potential for future growth and success.

Market Share Analysis

A pie chart will visually represent the market share analysis, detailing the distribution of the market share among key competitors. This visual representation will indicate the percentage of the overall market each competitor holds, showcasing Quintus’ current market share. The chart will help to analyze Quintus’ relative standing within the industry and provide a basis for assessing future growth opportunities.

Competitive Landscape Infographic

An infographic highlighting the competitive landscape will provide a comprehensive overview of the key competitors, their strengths, and weaknesses. The infographic will include information about their market share, revenue, and product offerings. This visual representation allows for a quick comparison between Quintus and its key competitors. The infographic will effectively illustrate the level of competition in the market, providing a better understanding of Quintus’ position and challenges.

The information will be summarized in a visual way, allowing for easier assimilation and interpretation.

Ultimate Conclusion

Quintus’s IPO more than tripled its initial offering price, showcasing a remarkable performance. Factors like strong investor interest, positive market conditions, and potentially undervalued market expectations all played a significant role. This success, however, also presents potential future challenges and risks, and careful analysis of the company’s financial metrics, competitive landscape, and investor motivations is vital. The long-term growth prospects, and potential regulatory changes, will all contribute to shaping the future trajectory of the company.

The provided data and analysis will help investors and stakeholders navigate the opportunities and challenges ahead.