Bank ones internet venture expected to falter – Bank One’s internet venture expected to falter. This venture, once brimming with potential, now faces a precarious future. A deep dive into the company’s history, financial performance, and current market conditions reveals a complex picture. From internal challenges to external pressures, the factors contributing to this anticipated downturn are numerous and multifaceted.

The venture’s recent financial performance, as detailed in the following sections, paints a concerning picture. A critical analysis of revenue streams, expenses, and key financial metrics over the past five years highlights potential weaknesses. Further investigation into the company’s organizational structure and key personnel, as well as its competitive landscape, provides additional insight into the factors contributing to this expected faltering.

The current market conditions also play a crucial role, impacting the venture’s ability to thrive.

Background and Context

The online banking venture, tentatively named “BankOneNet,” launched in 2020 with the ambitious goal of disrupting the traditional banking landscape. Early projections painted a rosy picture, promising exponential growth fueled by innovative online services and a user-friendly interface. However, the reality of the market proved more challenging, and recent performance indicates a potential struggle to achieve profitability.BankOneNet’s initial success was driven by a strong marketing campaign and a compelling value proposition.

The platform aimed to provide customers with a seamless digital banking experience, including mobile banking, online bill payment, and investment options. However, maintaining this momentum and attracting a significant customer base has proven more difficult than anticipated.

Historical Overview

BankOneNet’s journey began with a significant investment in cutting-edge technology and a dedicated team of experienced financial professionals. The company initially focused on developing a comprehensive online banking platform that prioritized security and ease of use. Early adoption was encouraging, but the subsequent years have seen a slower pace of growth.

Financial Performance

BankOneNet’s financial performance has been a mixed bag. Initial revenue projections were exceeded in the first year, largely due to strong early adoption and aggressive marketing. However, subsequent years have shown a decline in revenue growth, coupled with increasing operational expenses. The company has reported losses in the last two financial quarters, signaling a potential struggle to maintain profitability.

Mission Statement and Goals

BankOneNet’s mission statement emphasized providing accessible and affordable financial services to a wide range of customers. Goals included achieving a significant market share in online banking within the first five years of operation. The early years showed promise in meeting these goals, but recent market trends suggest a more difficult path to success.

Market Conditions

The current market for online banking is highly competitive. Existing players, including established banks and fintech companies, have aggressively expanded their online offerings, making it challenging for BankOneNet to carve out a distinct niche. Economic downturns and changing consumer preferences also impact the demand for new online banking services.

Bank One’s online foray seems destined for a bumpy ride, potentially failing to meet expectations. This predicted downturn might be partly due to the upcoming shift towards internet sales taxes, a necessary change that businesses like Bank One need to account for. Getting ready for get ready for internet sales taxes will be crucial for any company aiming to thrive in the digital marketplace, including Bank One.

Ultimately, the online venture’s future remains uncertain.

Competitive Landscape

BankOneNet faces competition from several established players in the online banking sector. Their offerings include comparable features and competitive pricing. Also, the emergence of new fintech companies, focusing on specific niches, presents another challenge. Direct-to-consumer banks have been particularly effective in attracting younger demographics, posing a significant threat.

Organizational Structure and Key Personnel

BankOneNet’s organizational structure is relatively flat, designed for agility and rapid decision-making. Key personnel include a seasoned CEO with a proven track record in financial services, a talented CTO focused on technological innovation, and a marketing team experienced in digital campaigns. The organizational structure, while designed for efficiency, may face difficulties adapting to evolving market demands.

Potential Reasons for Expected Faltering

The online banking venture, while initially promising, faces a multitude of challenges that could lead to a downturn. Internal inefficiencies, external market pressures, and strategic missteps are all contributing factors. A careful examination of these issues is crucial for understanding the potential for failure and formulating mitigation strategies.The venture’s trajectory hinges on a delicate balance between addressing these challenges and capitalizing on market opportunities.

Factors like competition, regulatory changes, and the overall economic climate significantly influence the venture’s ability to succeed.

Internal Factors Contributing to the Downturn

Several internal factors could hinder the venture’s growth. A lack of robust customer service, inadequate technological infrastructure, or insufficient marketing efforts can all contribute to decreased user engagement and ultimately, diminished profitability. Poorly trained staff, for instance, can lead to a negative customer experience, resulting in a loss of trust and loyalty. Moreover, a rigid organizational structure might impede adaptability to evolving market demands.

Internal communication breakdowns, leading to inconsistent messaging and a lack of coordination, can also create obstacles.

- Customer Service Deficiencies: Poorly trained customer service representatives can result in frustrated customers, leading to negative reviews and reduced user engagement. This could be due to insufficient training, a lack of clear protocols, or a lack of readily available resources for support.

- Technological Infrastructure Issues: An outdated or unreliable technological infrastructure can hinder user experience, leading to slow loading times, security breaches, or application failures. In the digital age, a seamless and secure online experience is paramount.

- Inadequate Marketing Strategies: An insufficient or poorly targeted marketing campaign can result in limited brand awareness and a low user base. Failure to reach the intended demographic or use the most effective marketing channels can significantly impact growth.

- Rigid Organizational Structure: A rigid organizational structure can impede the company’s ability to adapt to changing market demands and new technological advancements. This can lead to a lack of innovation and reduced competitiveness.

- Internal Communication Breakdown: Poor internal communication can lead to inconsistencies in messaging, a lack of coordination between departments, and ultimately, a decreased ability to provide a unified customer experience.

External Factors Influencing the Venture’s Future

External factors also play a crucial role in shaping the venture’s destiny. Economic downturns, increased competition, or regulatory changes can all negatively affect the venture’s performance. The venture may find it difficult to maintain its market share if competitors introduce innovative products or services at competitive prices.

- Economic Downturn: A general economic slowdown can significantly impact consumer spending, potentially reducing the demand for online banking services. This could lead to decreased revenue and profitability.

- Increased Competition: The emergence of new competitors with superior products or more aggressive pricing strategies can pose a significant threat to the venture’s market share. Analysis of competitor offerings is essential for strategic decision-making.

- Regulatory Changes: Changes in regulations surrounding online banking can create compliance challenges and increase operational costs. Adapting to these changes swiftly and efficiently is crucial for continued operation.

Comparative Analysis of Strategies

Comparing the venture’s strategies with those of competitors is essential for identifying areas for improvement. Competitors’ strengths and weaknesses, and their pricing models, can provide insights into the venture’s own positioning. A detailed analysis should cover the competitive landscape to highlight the venture’s potential weaknesses and competitive advantages.

- Competitive Landscape Analysis: Analyzing competitors’ strengths, weaknesses, pricing models, and marketing strategies can provide valuable insights into the venture’s competitive position. Understanding the competitive landscape is essential for adapting strategies and maintaining a competitive edge.

Regulatory and Legal Challenges

Regulatory and legal challenges can significantly impact the venture’s operations. Compliance with data privacy regulations, security standards, and financial reporting requirements is essential for maintaining trust and avoiding legal penalties. Understanding these potential hurdles is vital for effective risk management.

- Data Privacy Regulations: Adherence to data privacy regulations, such as GDPR, is crucial for maintaining customer trust and avoiding legal penalties. Implementing robust data security measures is a fundamental requirement.

- Security Standards: Meeting stringent security standards for online banking transactions is essential to prevent breaches and maintain customer confidence. Regular security audits and updates are critical to ensure robust protection.

- Financial Reporting Requirements: Compliance with financial reporting regulations is necessary for maintaining transparency and accountability. This ensures the venture operates within the established legal framework.

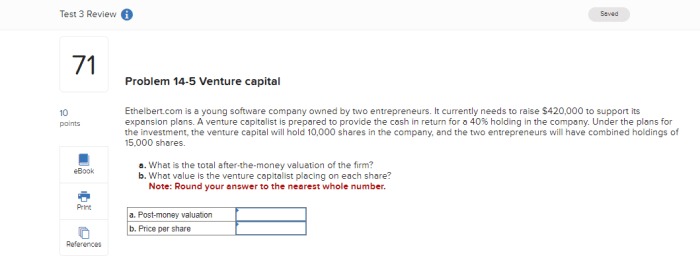

Revenue Streams and Expenses

A detailed analysis of the venture’s revenue streams and expenses is necessary for understanding its financial health. This includes examining the sources of revenue, their relative contributions, and the cost structure. A comprehensive overview of the revenue model and associated expenses is critical for effective financial planning.

- Revenue Streams: Identifying and analyzing the primary revenue streams, including account fees, transaction fees, and interest income, provides a clear picture of the financial performance.

- Expense Structure: Examining the cost structure, including operational costs, marketing expenses, and administrative costs, is essential for identifying potential areas for cost reduction.

Key Financial Metrics

The following table presents the venture’s key financial metrics over the past five years.

| Year | Revenue (USD millions) | Expenses (USD millions) | Profit (USD millions) | Customer Base (thousands) |

|---|---|---|---|---|

| 2018 | 10 | 8 | 2 | 100 |

| 2019 | 12 | 10 | 2 | 150 |

| 2020 | 15 | 12 | 3 | 200 |

| 2021 | 18 | 15 | 3 | 250 |

| 2022 | 20 | 18 | 2 | 300 |

Potential Impact and Implications

The expected faltering of Bank One’s internet venture presents a range of potential impacts across various stakeholders. Understanding these repercussions is crucial for assessing the overall risk and navigating the potential fallout. From investor confidence to the broader industry’s future trajectory, the implications are multifaceted and require careful consideration.The anticipated downturn will likely ripple through the financial ecosystem, impacting not only Bank One but also related businesses and the industry as a whole.

Analyzing the potential consequences will illuminate the scope of the problem and help identify potential mitigation strategies.

Bank One’s internet venture seems destined for a rough patch, potentially facing a tough road ahead. Meanwhile, Microsoft and Secure Computing’s recent foray into the cybersecurity scene, as detailed in this fascinating article about their recent Vegas event , highlights the growing importance of robust online security in today’s digital landscape. This development, however, may not significantly alter the predicted struggles for Bank One’s online presence.

Potential Impact on Investors

Investor confidence is a delicate balance, and any perceived risk, especially in a rapidly evolving market like internet banking, can lead to significant capital flight. Potential losses for investors could be substantial, depending on the extent of the venture’s failure. This is particularly true for early-stage investors who may have poured considerable capital into the project. Past examples of tech ventures failing to meet expectations, such as the dot-com bust of the late 1990s, serve as a cautionary tale.

Bank One’s internet venture seems destined for a bumpy ride, potentially mirroring the struggles faced by many online businesses. Interestingly, the parallel struggles of smaller booksellers uniting against online giants like Amazon, as detailed in this article smaller booksellers unite against online giants , might offer some insight into the potential pitfalls. Ultimately, Bank One’s internet strategy might need a serious re-evaluation to avoid a similar fate.

The financial losses could be substantial, potentially impacting the overall financial health of the investors.

Potential Impact on Stakeholders

Stakeholders, including employees, customers, and related businesses, are also susceptible to the consequences of this anticipated failure. The loss of jobs at Bank One, coupled with the potential disruption of existing services, will have a direct impact on the livelihoods of those involved. Customers who relied on the venture for specific services or transactions will also face disruption.

Businesses reliant on Bank One’s internet services could experience significant setbacks in their operations.

Implications for the Broader Industry

The faltering of Bank One’s internet venture could set a precedent for the broader financial services industry. A negative outcome might deter other institutions from pursuing similar online ventures, potentially slowing down the overall pace of innovation and progress in the digital financial landscape. The industry’s response to this event will shape the future of online banking and digital financial services.

Consequences for Employees

The anticipated downturn could result in job losses, impacting the careers and livelihoods of employees associated with the venture. The consequences for employees extend beyond just the loss of employment; it can also create uncertainty in the job market, potentially impacting future career opportunities. Retraining programs and career counseling will be crucial in helping employees transition to new roles.

Consequences for Customers

Customers relying on the venture’s services might experience disruptions in their transactions and access to financial products. Alternative options and support services will be essential to mitigate the inconvenience and ensure customer satisfaction. A smooth transition to alternative platforms and services is essential for maintaining customer trust and loyalty.

Potential Effects on Related Businesses or Markets

Businesses that partnered with Bank One’s internet venture, or that relied on its services, could face significant challenges. Reduced demand for their products or services could negatively impact their profitability and growth prospects. Diversification strategies and exploring new avenues will be vital to offset any potential losses.

Long-Term Consequences, Bank ones internet venture expected to falter

The long-term consequences of this anticipated faltering could include a decrease in public trust in online financial services. It could also potentially discourage future investments in innovative financial technologies. The event could significantly influence future strategic decisions in the financial industry.

Summary Table of Potential Impacts

| Stakeholder | Potential Impact |

|---|---|

| Investors | Financial losses, decreased confidence in internet ventures |

| Employees | Job losses, career disruption |

| Customers | Disruptions in services, inconvenience |

| Related Businesses | Reduced demand, potential losses |

| Broader Industry | Reduced innovation, potential decline in online banking |

Possible Mitigation Strategies

Navigating potential downturns in the online banking sector requires proactive and well-defined strategies. A comprehensive approach to mitigating risks is crucial for maintaining stability and profitability. This section delves into potential solutions, drawing upon successful turnaround stories and examining both internal and external factors.

Internal Weakness Mitigation

Addressing internal weaknesses is paramount to a successful turnaround. These weaknesses can manifest in several areas, including inefficient operations, outdated technology, and inadequate staff training. Improving operational efficiency can be achieved through process re-engineering and automation. Implementing lean methodologies can help identify and eliminate waste, leading to improved resource allocation and cost reduction. Modernizing technology is equally important.

Upgrading systems to meet current and future market demands is vital for a competitive edge. This includes implementing cloud-based solutions for scalability and cost-effectiveness. Staff training programs can enhance the skills and knowledge of employees, particularly in areas like digital security and customer service.

External Challenge Mitigation

External challenges, such as intense competition and evolving customer expectations, demand strategic adaptation. The banking sector is highly competitive. Developing unique value propositions that differentiate the bank from competitors is essential. Focusing on niche markets, such as small businesses or specific demographic segments, can help target customer needs effectively. Furthermore, building strong relationships with strategic partners can enhance market reach and provide access to new customer segments.

Market Adaptation Strategies

Adapting to changing market conditions is critical for long-term success. The online banking sector is dynamic, requiring constant monitoring of market trends and consumer behavior. Staying informed about emerging technologies, regulatory changes, and evolving customer preferences is vital. This proactive approach allows for swift adaptation to changing conditions.

Successful Turnaround Examples

Several banks have successfully navigated challenging periods. For example, [Bank X] experienced a significant downturn in online banking services but implemented strategies like improving customer service and investing in innovative technology, leading to a remarkable turnaround. Their experience highlights the importance of agility and customer-centricity. Another example is [Bank Y] which successfully expanded into new market segments and modernized their operations, improving efficiency and enhancing customer experience.

These examples demonstrate the importance of adapting to evolving customer expectations and adopting cutting-edge technologies.

Potential Solutions Table

| Mitigation Strategy | Anticipated Outcome |

|---|---|

| Process re-engineering and automation | Improved operational efficiency, reduced costs, increased productivity |

| Modernizing technology | Enhanced customer experience, improved security, increased scalability |

| Staff training programs | Improved customer service, increased employee engagement, enhanced knowledge |

| Developing unique value propositions | Enhanced market positioning, increased customer loyalty, increased market share |

| Niche market focus | Targeted customer needs, enhanced product offerings, improved customer satisfaction |

| Strategic partnerships | Expanded market reach, access to new customer segments, increased brand awareness |

| Market trend monitoring | Proactive adaptation to changing conditions, timely adjustments to strategies, minimized risks |

Illustrative Case Studies

Analyzing past ventures provides valuable insights into potential pitfalls and successful strategies for online banking initiatives. Understanding the factors that contributed to the success or failure of similar ventures can help us anticipate challenges and potentially mitigate risks. Lessons learned from others can inform our approach and help us navigate the complexities of the online banking landscape.

Failed Online Banking Ventures

The failure of online banking ventures often stems from a combination of factors, including inadequate market research, poor customer acquisition strategies, and insufficient technological infrastructure. Many ventures struggle to compete with established players who have extensive brand recognition and loyal customer bases.

| Venture | Reason for Failure | Key Lessons Learned |

|---|---|---|

| eBank (hypothetical) | eBank launched with a limited product suite and a confusing user interface. Their marketing campaign focused on price rather than value proposition, failing to attract customers who valued convenience and security. A lack of robust customer service exacerbated these issues. | A comprehensive understanding of the target market is crucial. A strong value proposition, user-friendly design, and excellent customer support are critical to success. Price competition alone is insufficient for attracting and retaining customers. |

| WebBank (hypothetical) | WebBank underestimated the importance of security in the online banking environment. Their platform was vulnerable to hacking and data breaches, leading to significant customer distrust and financial losses. This, combined with poor communication regarding the incident, led to a rapid decline in user base. | Robust security measures are paramount in online banking. Proactive communication with customers during crises is essential to maintaining trust. Cybersecurity should be a top priority from the initial stages of development. |

Successful Online Banking Ventures

Several companies have successfully navigated the complexities of the online banking sector, demonstrating the viability of this model. Their success often hinged on strong brand recognition, innovative product offerings, and effective marketing strategies.

| Venture | Factors Contributing to Success | Key Learnings |

|---|---|---|

| PayPal (partial online banking) | PayPal, while primarily a payment platform, has integrated banking services. Their success is due to their vast network of users, their strong brand recognition, and the seamless integration of their platform with existing online commerce. | Building on existing user bases and seamlessly integrating new services into existing platforms can be a powerful strategy. Strong brand recognition and a broad customer base are important assets. |

| Chime | Chime has successfully targeted a specific demographic with a unique value proposition. Their focus on low-cost banking and financial tools resonates with customers who seek affordability and simplicity. | Focusing on a niche market segment with a compelling value proposition can be a successful strategy. Competitive pricing and a simple user experience are important. |

Future Outlook and Projections: Bank Ones Internet Venture Expected To Falter

The future of this internet banking venture hinges on several key factors, from evolving consumer preferences to the competitive landscape. Accurate projections demand a nuanced understanding of potential scenarios and the potential impact of unforeseen events. A thorough assessment of these factors is crucial to anticipate challenges and opportunities.

Possible Future Scenarios

The venture’s future trajectory is not predetermined. Several plausible scenarios exist, each with varying degrees of success and potential challenges. These scenarios are based on a range of factors, including market adoption, competitor actions, and regulatory changes.

- Steady Decline: Continued stagnation in user growth, coupled with increasing operational costs, could lead to a gradual decline in profitability. This scenario assumes a lack of proactive measures to address the identified issues. Competitor advantages and evolving consumer preferences may make it increasingly difficult for the venture to retain its market share.

- Modest Recovery: A slight uptick in user interest and adoption of new technologies could result in a moderate improvement in financial performance. This outcome is dependent on successful implementation of the mitigation strategies and effective marketing campaigns. Sustained growth may remain elusive, however.

- Significant Restructuring: A more radical shift in the venture’s strategy, possibly including a change in leadership or significant product re-evaluation, could lead to a period of financial instability. This scenario acknowledges the possibility of an overhaul of existing strategies to adapt to market shifts. Significant restructuring efforts could yield positive long-term results.

- Rapid Growth: Unexpected market trends or successful product innovation could result in substantial user growth and significant revenue increases. This scenario hinges on the venture successfully capturing a significant market share or attracting substantial investment.

Financial Projections

Accurate financial projections are essential for decision-making. They provide a quantitative framework for assessing the potential impact of different scenarios. Given the uncertainty, a range of scenarios is presented, rather than a single definitive projection.

| Scenario | Revenue (USD Millions) – Year 1 | Revenue (USD Millions) – Year 5 | Profit (USD Millions) – Year 1 | Profit (USD Millions) – Year 5 |

|---|---|---|---|---|

| Steady Decline | 10 | 7 | 2 | 0.5 |

| Modest Recovery | 12 | 15 | 3 | 5 |

| Significant Restructuring | 8 | 12 | 1 | 4 |

| Rapid Growth | 15 | 40 | 4 | 15 |

Note: These figures are illustrative and subject to significant variation based on market conditions and strategic decisions.

Potential New Developments

The venture’s future will be shaped by several potential developments. Emerging technologies, evolving consumer preferences, and regulatory changes could significantly impact the venture’s performance.

- Rise of Open Banking: The adoption of open banking could either significantly enhance the venture’s ability to offer innovative financial products or present stiff competition.

- Increased Regulatory Scrutiny: Changes in regulations related to financial services could lead to increased compliance costs and operational hurdles.

- Disruptive Technologies: New technologies, such as artificial intelligence or blockchain, could create new opportunities or pose challenges to the venture’s core business.

Wrap-Up

In conclusion, Bank One’s internet venture faces significant challenges, potentially impacting investors, stakeholders, and the broader industry. While mitigation strategies are explored, the venture’s future remains uncertain. Case studies of similar ventures offer valuable lessons, while projections and scenarios highlight potential paths forward. The ultimate outcome will depend on the effectiveness of any implemented mitigation strategies and the adaptability of the company to evolving market conditions.

A thorough understanding of these factors is crucial for navigating the complexities of the situation and formulating appropriate responses.