e stamp targets small business with intuit alliance sets the stage for a compelling discussion about how this innovative solution can transform administrative tasks for small businesses. This partnership promises significant improvements in efficiency, cost-effectiveness, and security for entrepreneurs. The current small business landscape often presents challenges in streamlining administrative processes, and e-stamps are poised to address these concerns.

Intuit’s expertise in financial tools and software further enhances the potential for this alliance to create a powerful solution for small businesses.

This article explores the mechanics of e-stamps, examines the strategic partnership with Intuit, and analyzes the target audience and market potential. It also dives into the advantages, challenges, and future projections of this technology for small businesses. A key element of the discussion will be comparing traditional stamp methods with the e-stamp system, highlighting the differences in speed, cost, and security.

Introduction to e-Stamp and Small Business Impact

E-stamps are digital versions of traditional postage stamps, offering a convenient and increasingly essential tool for small businesses. They streamline the process of affixing postage, reducing administrative burdens and potentially boosting efficiency. This shift towards digital solutions reflects a broader trend of digital transformation in various sectors, with small businesses particularly feeling the pressure to adapt to evolving technologies and customer expectations.The small business landscape is characterized by dynamism and resilience.

These entities often operate with limited resources and are constantly seeking ways to optimize their operations. From local boutiques to online retailers, the diversity of small businesses demands adaptable solutions that address their unique challenges. Effective administrative tools are crucial for maintaining profitability and growth.

Understanding E-Stamps

E-stamps are digital representations of postage stamps that are electronically validated and linked to the specific delivery requirements. They provide a secure and verifiable method of paying postage, eliminating the need for physical stamps. The process typically involves generating an e-stamp through an online platform, which then becomes linked to the shipping label, ensuring accurate postage payment and delivery confirmation.

Challenges Faced by Small Businesses

Small businesses frequently face significant administrative hurdles. Managing paperwork, tracking inventory, and handling logistics can be overwhelming, consuming valuable time and resources. These tasks often require significant staff time, potentially impacting productivity and profitability. Common issues include inefficient workflows, inaccurate data entry, and a lack of streamlined communication systems.

Benefits of E-Stamps for Small Businesses

E-stamps offer numerous benefits for small businesses. They streamline the postage process, saving time and resources. This efficiency translates to potential cost savings, especially for businesses with high shipping volumes. The digital nature of e-stamps also fosters greater accuracy, reducing the risk of errors associated with manual stamp application. Furthermore, e-stamps often provide detailed tracking information, enhancing transparency and customer satisfaction.

The e-stamp initiative, targeting small businesses with the Intuit alliance, is a smart move. It’s interesting to see how this aligns with other financial industry developments, like MSN MoneyCentral’s recent partnerships with major players in the financial world, like MSN MoneyCentral inks deals with financial heavyweights. This suggests a broader trend of digital tools and platforms becoming increasingly important for small businesses, ultimately bolstering the e-stamp initiative’s potential.

Comparing Traditional and E-Stamp Methods

| Feature | Traditional Stamps | E-Stamps |

|---|---|---|

| Speed | Requires time for stamp acquisition and application, potentially delaying shipping. | Faster process due to digital validation and automated integration with shipping systems. |

| Cost | Potentially higher costs due to stamp purchase, handling, and potential errors in application. | Often more cost-effective, especially for high-volume shippers, due to reduced administrative overhead and automated calculations. |

| Security | Vulnerable to loss, theft, or damage. Verification can be cumbersome. | Enhanced security features, including digital signatures and encryption, provide secure transactions and prevent counterfeiting. |

The table above provides a concise comparison of traditional stamp methods and e-stamp methods. As you can see, e-stamps offer significant advantages in terms of speed, cost, and security, making them a valuable tool for small businesses seeking operational efficiency.

Intuit Alliance

The Intuit Alliance for e-stamp solutions represents a significant step forward in simplifying tax compliance for small businesses. This partnership leverages Intuit’s vast experience in financial management software and their established user base to make e-stamping more accessible and user-friendly. Intuit’s integration of e-stamp functionality promises streamlined workflows, reducing administrative burdens for small business owners.Intuit’s involvement goes beyond simply adding a feature to their existing products.

They bring a wealth of knowledge and expertise in user interface design, data security, and robust financial systems. This translates into a more polished, secure, and reliable e-stamp solution for small business clients. Their proven track record of creating intuitive and user-friendly software directly benefits the e-stamp experience.

Significance of Intuit’s Involvement

Intuit’s extensive user base of small business owners provides immediate access to a large market. This substantial existing user base translates into a pre-built customer base for e-stamp services, minimizing the need for significant initial marketing efforts. Intuit’s expertise in financial management software, particularly in areas like tax preparation and accounting, directly enhances the e-stamp platform’s value proposition. This integration assures a seamless user experience for small businesses already familiar with Intuit’s products.

E-stamp’s recent alliance with Intuit is a smart move, targeting small businesses. It’s interesting to see how this plays out in the wider market, given the recent news about how the Audio Book Club has been aggressively acquiring competitors, like audio book club swallows competitor audiobooks direct. Ultimately, this kind of strategic partnership positions e-stamp well for growth and market share in the small business sector.

Their existing platform provides a reliable framework for integrating e-stamp technology.

Strengths and Expertise

Intuit brings substantial strengths to the e-stamp partnership, including:

- Extensive user base of small businesses familiar with Intuit’s products and services.

- Proven expertise in financial management software, including tax preparation and accounting.

- Robust data security measures, critical for handling sensitive financial information.

- Established user interface design, ensuring a user-friendly e-stamp experience.

- Experience in handling large volumes of transactions, guaranteeing stability and reliability of the platform.

These strengths contribute significantly to the success of the e-stamp offering.

Comparison with Existing Intuit Products

Intuit’s existing suite of products, such as QuickBooks, offer comprehensive financial management tools. The e-stamp offering, when integrated with Intuit’s products, becomes a seamless extension of existing functionalities. The seamless integration minimizes the learning curve for users familiar with Intuit’s software, allowing them to leverage their existing knowledge and familiarity with the platform.

Market Reach and Influence

The partnership’s market reach is substantial. Intuit’s existing customer base of small businesses, combined with the potential for integration with other Intuit products, creates a vast potential user base. This reach allows for wider dissemination of e-stamp services and increased market penetration. Intuit’s brand recognition and trust with small businesses further bolster the market reach and influence of the partnership.

Successful integration into QuickBooks or other Intuit products will significantly amplify market reach.

Key Benefits for Small Businesses, E stamp targets small business with intuit alliance

The Intuit alliance brings numerous benefits for small businesses:

| Benefit | Description |

|---|---|

| Streamlined Workflow | Integrating e-stamp functionality directly into existing Intuit products reduces administrative burdens, saving time and effort for small businesses. |

| Improved Efficiency | Automating e-stamp processes within the familiar Intuit interface reduces manual tasks, improving efficiency and accuracy. |

| Enhanced Security | Leveraging Intuit’s robust security measures ensures the secure handling of sensitive financial information, mitigating potential risks. |

| Simplified Compliance | The integrated e-stamp solution simplifies tax compliance processes, reducing the potential for errors and ensuring timely filing. |

| Cost Savings | Streamlining e-stamp processes potentially lowers operational costs associated with compliance and administration. |

These benefits directly translate to cost savings, reduced administrative burden, and increased efficiency for small businesses.

E-Stamp Target Audience and Market Segmentation: E Stamp Targets Small Business With Intuit Alliance

E-stamps offer a compelling opportunity for small businesses to streamline their operations and reduce administrative burdens. Understanding the specific types of businesses most receptive to this technology is crucial for successful implementation and marketing strategies. Targeting the right segments will maximize the return on investment for both the e-stamp providers and the businesses adopting them.This analysis delves into the target audience for e-stamps, examining factors that influence adoption, pricing strategies, and demographics to identify the ideal market segments.

By segmenting the market, e-stamp providers can tailor their offerings and marketing campaigns to resonate with specific business needs and preferences.

Types of Small Businesses Likely to Adopt E-stamps

Small businesses that handle a significant volume of mailings, such as those in the shipping, logistics, and retail industries, are likely early adopters of e-stamps. This is because automation can drastically reduce the time spent on manual postage processes, freeing up employees for more important tasks. Businesses with a strong online presence and reliance on digital communication also benefit from the seamless integration e-stamps offer.

For example, e-commerce businesses and online marketplaces frequently handle large volumes of packages, making e-stamps an ideal solution to streamline their shipping processes.

Factors Influencing E-Stamp Adoption Rate

Several factors influence the decision of a small business to adopt e-stamps. Cost savings, ease of use, and compatibility with existing systems are primary considerations. Businesses that experience high postage costs or are burdened by time-consuming manual postage processes are more likely to be attracted to the efficiency of e-stamps. Furthermore, businesses that value automation and digital workflows are more receptive to this technology.

A business that already relies on digital platforms for communication and transactions is likely to embrace the e-stamp system, as it aligns with their current operations.

Pricing Strategies and Payment Models

Pricing strategies for e-stamps should be tailored to the different needs and sizes of businesses. Small businesses may benefit from tiered pricing models, offering discounts for higher volume users. Subscription-based models, offering a monthly or annual fee for access, are also viable options, particularly for businesses with consistent mailing needs. Another strategy is to offer a free trial period to encourage businesses to test the system before committing to a subscription.

Target Audience Demographics and Psychographics

The target audience for e-stamps spans a range of demographics and psychographics. Businesses with a focus on efficiency, cost-effectiveness, and digital workflows are highly receptive to this technology. Businesses that have established online operations, such as e-commerce stores, or those in the shipping and logistics sector, are likely to have a higher adoption rate. The psychographic profile also includes businesses that prioritize automation, are tech-savvy, and are interested in adopting new technologies to improve their operations.

Potential E-Stamp Adoption Rate Categorization

| Category | Description | Potential Adoption Rate |

|---|---|---|

| High Potential | Businesses with high mailing volumes, strong online presence, and a focus on automation. | High (e.g., e-commerce stores, online marketplaces, shipping companies) |

| Medium Potential | Businesses with moderate mailing volumes, some online presence, and interest in improving efficiency. | Medium (e.g., small retail stores, service providers) |

| Low Potential | Businesses with low mailing volumes, minimal online presence, and less focus on automation. | Low (e.g., local service businesses with infrequent mailings) |

Benefits and Advantages for Small Businesses

Embracing digital solutions is no longer a luxury but a necessity for small businesses navigating today’s competitive landscape. E-stamps, in particular, offer a compelling suite of advantages that can significantly impact profitability and efficiency. They represent a smart transition from traditional methods, delivering substantial returns in terms of cost savings, streamlined workflows, and improved security.E-stamps are not just a technological upgrade; they are a strategic investment that empowers small businesses to operate more effectively and profitably.

They unlock a new level of control and transparency, offering a clear path to enhanced administrative processes, reduced costs, and ultimately, increased profitability.

The e-stamp initiative, targeting small businesses with an alliance to Intuit, is a smart move. However, it’s interesting to consider this alongside the current state of online brokerage, where assets are soaring to a staggering 3 trillion despite, as discussed in this article online brokerage assets soaring to 3 trillion despite poor service , persistent service issues.

Ultimately, e-stamp’s focus on simplifying processes for small businesses through Intuit’s platform could prove to be a crucial step in improving their financial management.

Cost Savings Associated with E-Stamps

E-stamps dramatically reduce the costs associated with traditional postage methods. The elimination of printing, handling, and postage costs results in significant savings. For instance, a small business sending 1000 letters per month could save hundreds of dollars annually by switching to e-stamps. The elimination of printing and postage costs directly translates into a substantial reduction in operational expenses.

These savings can be reinvested into other core business functions or used to boost profit margins.

Streamlining Administrative Workflows with E-Stamps

E-stamps automate the process of generating and applying postage, streamlining administrative workflows. This automation reduces manual errors and frees up valuable time for business owners to focus on core responsibilities. By eliminating the need for manual postage sorting and application, e-stamps significantly improve efficiency. This leads to a reduction in administrative overhead, which can directly impact the bottom line of a small business.

Improved Accuracy and Security Features of E-Stamps

E-stamps offer enhanced accuracy compared to traditional methods. Digital records eliminate the risk of human error in postage application. Furthermore, e-stamps integrate robust security features, preventing fraud and ensuring the authenticity of postage. This heightened level of security contributes to a reduction in potential losses. The digital nature of e-stamps also enables detailed tracking of postage, offering greater transparency and accountability.

Time Savings and Increased Efficiency for Small Business Owners

E-stamps significantly reduce the time spent on administrative tasks related to postage. The automation of postage application frees up valuable time for business owners to focus on revenue-generating activities. This time savings can be substantial, especially for businesses with high volumes of mailings. The elimination of manual processes also allows for a more efficient use of resources and staff time, allowing them to focus on more productive aspects of the business.

Top 5 Benefits of Adopting E-Stamps for Small Businesses

- Reduced Operational Costs: E-stamps eliminate the expenses associated with printing, handling, and purchasing postage, leading to substantial cost savings. This reduction in operational expenses directly impacts the bottom line and frees up resources for other crucial business functions.

- Improved Administrative Efficiency: Automation of the postage process streamlines administrative workflows. The elimination of manual tasks reduces errors and frees up valuable time for business owners to concentrate on core business functions.

- Enhanced Accuracy and Security: Digital records and robust security features minimize the risk of errors and fraud associated with traditional postage methods. The accuracy and security provided by e-stamps are essential for maintaining trust and reliability with customers.

- Increased Time Savings: The automation of postage application frees up valuable time for business owners, allowing them to focus on more strategic and revenue-generating tasks. This translates to increased efficiency and productivity.

- Enhanced Customer Experience: By ensuring timely and accurate delivery, e-stamps contribute to a positive customer experience. This is especially important for businesses relying on mail communications to maintain strong customer relationships.

Challenges and Considerations

Embarking on digital transformation, especially for small businesses, often presents unique hurdles. E-stamp implementation, while offering significant advantages, requires careful consideration of potential roadblocks. Understanding these challenges proactively allows small businesses to develop robust strategies for successful adoption.Small businesses, often with limited resources and technical expertise, may face difficulties adapting to new technologies. A clear understanding of the technical and security aspects is crucial for seamless integration and long-term success.

This section will explore the potential barriers, technical requirements, security concerns, and data protection considerations associated with e-stamp adoption.

Potential Barriers to E-Stamp Adoption

Small businesses may encounter several obstacles when adopting e-stamp systems. These include a lack of familiarity with digital platforms, limited technical resources, and concerns about the cost of implementation and ongoing maintenance. The complexity of integrating e-stamp systems into existing workflows also presents a significant hurdle. Businesses without dedicated IT staff may struggle to manage the technical aspects of implementation and maintenance.

Technical Requirements and Infrastructure

Implementing e-stamp solutions necessitates a robust digital infrastructure. This includes reliable internet connectivity, compatible software, and adequate storage capacity. The specific technical requirements vary based on the chosen e-stamp platform and the business’s existing systems. Businesses should carefully assess their current infrastructure to ensure compatibility and scalability.

Security Concerns and Solutions

Security is paramount in any digital transaction. Potential security concerns include unauthorized access, data breaches, and system vulnerabilities. Robust security measures, such as multi-factor authentication, encryption protocols, and regular security audits, are essential. Businesses should implement these security measures to protect sensitive data and maintain user confidence. Examples include implementing strong passwords, using encryption for data transmission, and employing intrusion detection systems.

Data Breaches and Data Protection

The potential for data breaches is a serious concern for businesses using e-stamp systems. The security of sensitive data, including financial and personal information, must be prioritized. Businesses should implement comprehensive data protection strategies, including data encryption, access controls, and regular security awareness training for employees. Complying with relevant data protection regulations, like GDPR or CCPA, is critical.

Challenges and Solutions for E-Stamp Adoption

| Challenge | Suggested Solution |

|---|---|

| Lack of technical expertise | Partnering with a reputable e-stamp provider for guidance and support. Utilizing online resources, tutorials, and training programs. |

| High implementation costs | Researching and selecting cost-effective e-stamp solutions that align with business needs. Exploring cloud-based options to reduce infrastructure costs. |

| Integration challenges with existing systems | Thoroughly evaluating e-stamp solutions for compatibility with current systems. Working closely with the e-stamp provider to address any integration issues. |

| Security concerns | Implementing robust security protocols, including multi-factor authentication, encryption, and regular security audits. Training employees on best security practices. |

| Data breaches | Implementing data encryption and access controls. Regularly backing up data and testing disaster recovery plans. Complying with relevant data protection regulations. |

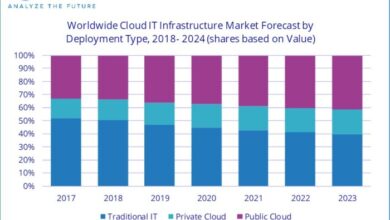

Future Trends and Projections

E-stamps are poised for significant growth in the small business sector, driven by a combination of factors. These factors include the increasing need for digital efficiency, the rising cost of traditional stamp services, and the growing adoption of cloud-based business solutions. This projected expansion is not just theoretical; it’s already evident in the current market trends.The future of e-stamps in the small business arena hinges on technological advancements.

This dynamic environment will not only enhance efficiency but also potentially transform the very nature of how businesses manage their document-related administrative tasks.

Anticipated Growth Trajectory

The adoption of e-stamps is expected to accelerate in the coming years, particularly among small businesses. This anticipated surge is fueled by the increasing recognition of e-stamps as a cost-effective and time-saving solution compared to traditional methods. Small businesses often operate with limited resources, making efficiency and cost reduction critical. E-stamps directly address these concerns. Further, as more small businesses transition to online platforms and digital document management systems, the demand for seamless digital integration for stamps will grow.

Impact of Technological Advancements

Technological advancements are set to significantly impact e-stamp solutions. Improvements in security protocols will bolster trust and reliability, making e-stamps more appealing to businesses. Furthermore, advancements in blockchain technology could revolutionize the verification and tracking of e-stamps, enhancing transparency and accountability. Real-world examples of how blockchain is impacting other sectors provide a glimpse into its potential.

Future Developments and Innovations

Future developments in e-stamp technology will likely focus on greater user-friendliness and integration. This includes simplified user interfaces, intuitive workflows, and automated functionalities. For example, the integration of AI-powered features could streamline the stamp application process, potentially automating tasks such as document recognition and validation.

Integration with Business Tools

E-stamps have the potential to seamlessly integrate with various business tools and applications. Imagine a scenario where e-stamps are directly integrated into accounting software, automatically applying the correct stamp based on the transaction details. Such integration would eliminate manual steps and streamline administrative processes.

Projected Advancements Timeline

| Year | Advancements | Impact on Small Businesses ||—|—|—|| 2024-2025 | Enhanced security protocols, improved user interfaces, increased API integrations | Reduced fraud risks, improved user experience, greater flexibility in integration with existing systems || 2026-2027 | Integration with popular accounting and CRM software | Automated stamp application, streamlined administrative processes, significant time savings || 2028-2029 | AI-powered automation, blockchain-based verification | Further automation of tasks, enhanced transparency and traceability, reduced administrative overhead || 2030+ | Predictive analytics, personalized stamp solutions | Anticipatory document management, optimized workflow design, tailored solutions for individual business needs |

Closing Notes

In conclusion, e-stamps, especially with Intuit’s involvement, hold significant promise for streamlining administrative tasks and reducing costs for small businesses. The benefits, such as improved efficiency, enhanced security, and potential cost savings, are compelling. However, careful consideration of potential challenges and a thorough understanding of the target audience are crucial for successful implementation. The future of e-stamps looks bright, particularly with anticipated integrations and technological advancements, making it an interesting area to watch for small business owners.