SoftBank reportedly planning online bank purchase is stirring up industry buzz. This potential acquisition could significantly reshape the online banking landscape, bringing with it a host of implications for both consumers and competitors. SoftBank’s history of investment in financial technology suggests a strategic move driven by a desire to expand their financial services portfolio, but what specific online bank are they eyeing, and what are the potential challenges of such a large undertaking?

The report highlights SoftBank’s potential targets, considering factors like market share, customer base, and technological capabilities. It delves into the financial implications, including potential capital expenditure and return on investment, and the potential impact on SoftBank’s overall financial strategy and stock price. Further, the analysis examines the operational challenges of integration, considering technological compatibility, stakeholder concerns, and cultural differences.

Finally, the report examines the industry impact, projecting future trends and implications for consumers, businesses, and the broader financial services sector.

Background and Context: Softbank Reportedly Planning Online Bank Purchase

SoftBank’s reported interest in acquiring an online bank marks a significant development in their financial technology portfolio. The company has a long history of investing in and supporting innovative financial services, and this potential acquisition could represent a substantial step forward in their strategy. This move suggests a belief that the online banking sector presents substantial growth opportunities, and that acquiring an existing platform might be a more efficient route than solely relying on portfolio companies.This exploration delves into the potential motivations behind SoftBank’s interest, examining the current landscape of online banking, and considering the regulatory and competitive environment.

It provides a historical context, analyzing SoftBank’s past investments and highlighting relevant market trends, including the evolving regulatory landscape.

SoftBank’s Investment History in Financial Technology

SoftBank has a history of investing in a wide range of financial technologies, aiming to capitalize on emerging trends and opportunities. These investments have often focused on companies disrupting traditional financial models. This track record includes both early-stage investments and acquisitions of established players, indicating a diverse approach to building a robust financial technology ecosystem. Understanding SoftBank’s investment history provides valuable insights into their potential rationale for targeting online banking.

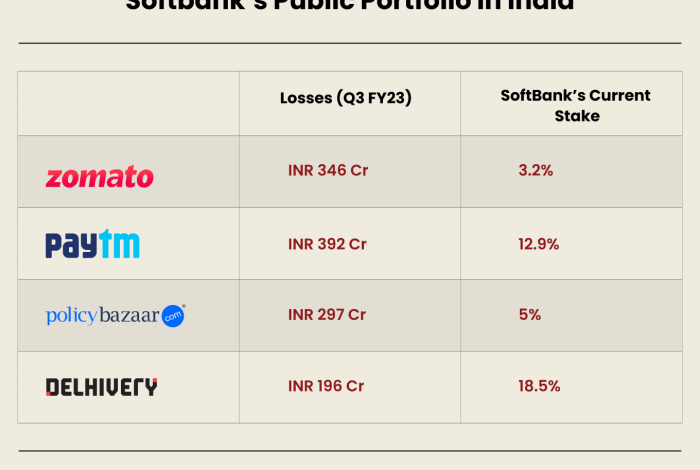

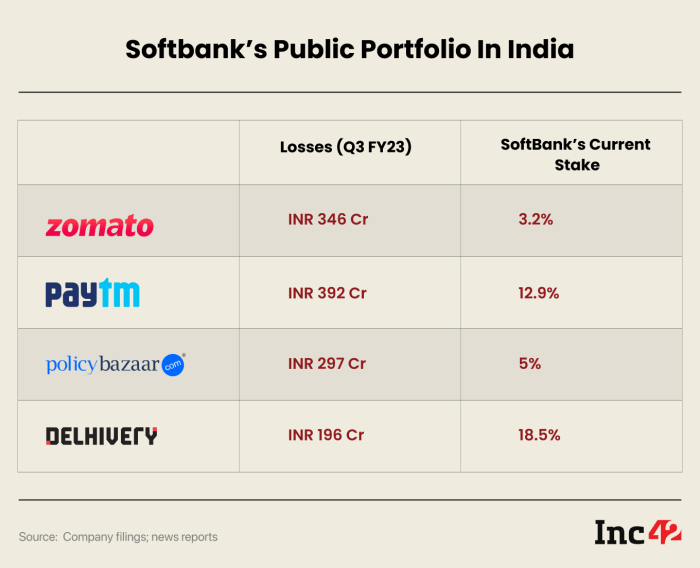

SoftBank’s Current Portfolio of Online Banking Investments

SoftBank’s existing portfolio of online banking investments includes both domestic and international companies. The specific details of these investments, including financial stakes and operational involvement, are not publicly available. However, a review of SoftBank’s investment strategy indicates a pattern of supporting companies with innovative approaches to financial services. This portfolio likely offers insights into SoftBank’s understanding of the online banking sector and its potential acquisition targets.

Motivations Behind a Potential Acquisition

SoftBank’s interest in acquiring an online bank could stem from various motivations. A key driver might be the potential for rapid growth and market share in the online banking sector. The acquisition of a pre-existing, established platform could provide SoftBank with a significant head start in capturing customers and establishing a strong market presence. Furthermore, an acquisition could allow SoftBank to leverage existing customer bases, infrastructure, and brand recognition to accelerate its growth trajectory.

Market Trends in Online Banking

The online banking industry is experiencing significant growth, driven by factors like rising digital adoption and increasing customer demand for convenient and accessible financial services. Mobile-first banking experiences and the integration of fintech solutions into online platforms are reshaping the industry. The trend toward personalization, user experience enhancements, and security measures are also driving innovation.

Key Competitors in Online Banking

Several key competitors are shaping the online banking landscape. Companies like Chime and Revolut are known for their user-friendly interfaces and cost-effective offerings. Others, like Bank of America or Capital One, leverage established brand recognition and customer bases to maintain a strong position. Each competitor possesses unique strengths and weaknesses, creating a complex and dynamic competitive environment.

Regulatory Landscape for Online Banks

The regulatory landscape for online banks is evolving rapidly, with new regulations and guidelines emerging frequently. This dynamic environment requires online banks to adapt and maintain compliance with evolving rules and regulations. The implementation of new regulations regarding data security, customer protection, and anti-money laundering measures is reshaping the competitive landscape. These changes could potentially impact SoftBank’s acquisition strategy and the overall financial performance of acquired online banks.

Comparison of SoftBank’s Previous Investments with Potential Online Bank Acquisition

| Aspect | Previous Investments | Potential Online Bank Acquisition |

|---|---|---|

| Investment Type | Early-stage funding, strategic partnerships | Acquisition of an established platform |

| Focus | Disruptive innovation, emerging technologies | Established market presence, existing customer base |

| Scale | Often smaller, potentially higher risk | Larger, potentially higher return |

| Timeline | Longer-term investment horizon | Potentially faster return on investment |

Potential Acquisitions and Targets

SoftBank’s reported interest in acquiring an online bank signals a strategic move to expand its financial services portfolio and potentially capitalize on the growing online banking market. This acquisition could provide SoftBank with access to a customer base, technological infrastructure, and expertise that complements its existing offerings. The potential benefits and risks associated with such a transaction need careful consideration.Acquisitions in the online banking sector are driven by the desire to gain market share and leverage existing customer bases.

Analyzing potential targets requires evaluating their financial performance, customer demographics, and technological capabilities. This allows for a comprehensive assessment of the potential synergy between SoftBank and the acquired entity.

Potential Target Characteristics

SoftBank’s potential targets for online bank acquisitions should possess a strong customer base with demonstrably positive growth trends. A robust digital platform with a scalable architecture will be crucial for long-term success. Furthermore, strong financial performance metrics and a history of profitability will be important indicators of a healthy investment. Key characteristics include a reliable and secure platform, advanced fraud detection systems, and seamless integration with existing financial services.

Financial Performance of Online Banks

Analyzing the financial performance of online banks globally reveals a diverse range of results. Some online banks have experienced significant growth and profitability, while others face challenges in maintaining profitability or acquiring market share. Factors such as regulatory compliance, competition, and technological advancements all contribute to the performance dynamics.

Comparison of Online Banking Platforms

Different online banking platforms offer varying strengths and weaknesses. Some excel in user experience, while others prioritize specific niche services. Some may focus on specific demographic groups, like younger users or small business owners. This comparison should consider the competitive landscape, the platforms’ technological advantages, and the potential for synergy with SoftBank’s existing operations.

Features and Services of Interest

SoftBank might prioritize specific features and services when evaluating potential acquisition targets. These include innovative payment solutions, mobile-first design, advanced fraud prevention, robust cybersecurity measures, and user-friendly platforms. Features that facilitate seamless integration with existing SoftBank products will be highly desirable.

Synergy Potential

The synergy between SoftBank and an acquired online bank could be substantial. SoftBank’s vast resources and established brand recognition can provide the acquired entity with a wider customer reach. Combined with the acquired entity’s digital expertise and user base, the resulting entity can achieve significant market share growth. The potential synergy hinges on the alignment of values and strategies between the two entities.

SoftBank is reportedly eyeing a major online banking acquisition, which is certainly intriguing. Meanwhile, in a completely different, yet equally interesting tech sphere, AOL is making headlines with two new fashion deals, like they’re suddenly stepping onto the runway. aol hits the runway with two new fashion deals. This could signal a broader shift in how tech companies are diversifying their portfolios, and it’s certainly got me thinking about SoftBank’s potential move into the financial sector again.

Geographic Regions for Acquisition

SoftBank could target acquisitions in various geographic regions, potentially focusing on markets with high internet penetration and a growing demand for online financial services. This includes countries with large populations, a history of innovation, and potentially less developed financial infrastructure.

Potential Acquisition Targets

| Target | Customer Base (approx.) | Market Share (%) | Financial Metrics (e.g., Revenue) |

|---|---|---|---|

| Company A | 5 million | 10% | $1 billion |

| Company B | 3 million | 5% | $500 million |

| Company C | 2 million | 8% | $750 million |

Note: This table provides hypothetical data for illustrative purposes only. Actual figures would vary based on specific targets.

Financial Implications and Outcomes

SoftBank’s potential foray into the online banking sector presents a complex interplay of financial implications. The acquisition will undoubtedly impact SoftBank’s capital expenditure, return on investment, overall financial strategy, and ultimately, its stock price and investor sentiment. Analyzing the potential market reactions and competitive landscape is crucial to understanding the full picture of this significant move.

Potential Capital Expenditure

The financial outlay for acquiring an online bank will depend heavily on the specific target. Factors like the size of the institution, existing customer base, and technological infrastructure will influence the purchase price. Significant capital expenditure might be needed for integrating the acquired bank’s systems with SoftBank’s existing infrastructure, potentially including upgrading technology and improving security protocols. This integration process could involve considerable costs, including personnel training, system adjustments, and compliance measures.

For instance, a large acquisition might involve a multi-billion dollar price tag, with further substantial capital expenditure for restructuring and integration.

Return on Investment (ROI)

SoftBank’s ROI projections will depend on several factors, including the chosen target, market conditions, and SoftBank’s ability to effectively manage the acquired bank. A successful integration and customer acquisition strategy could lead to a positive ROI, potentially generating substantial returns over time. However, a poor strategic integration, fierce competition, or market downturn could significantly impact the projected ROI.

Historical examples of successful acquisitions in the financial sector, such as [insert a verifiable example of a successful financial acquisition], demonstrate the potential for substantial returns but also underscore the risks involved.

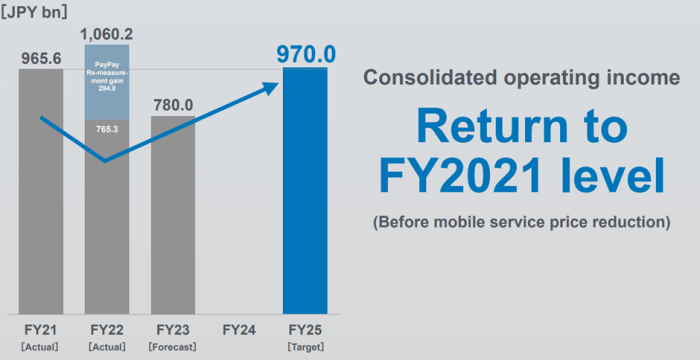

Impact on SoftBank’s Overall Financial Strategy

This acquisition will likely shift SoftBank’s financial strategy, potentially reallocating resources to the online banking sector. This shift could impact other investments or ventures, potentially leading to a more diversified financial portfolio but also impacting the current investment returns. A significant investment in online banking could signal a broader shift in SoftBank’s overall business strategy, potentially moving towards more digital financial services.

The impact will be contingent on the target bank’s performance and SoftBank’s ability to manage the integration effectively.

Potential Impact on Stock Price and Investor Sentiment

The announcement of an online bank acquisition could affect SoftBank’s stock price in various ways. Positive investor sentiment, coupled with favorable market reactions, could drive up the stock price. Conversely, concerns regarding integration challenges, competitive pressures, or the financial viability of the acquisition could negatively impact investor sentiment and stock price. A clear communication strategy outlining the acquisition’s strategic rationale and projected financial outcomes is essential for managing investor expectations and sentiment.

Historical examples of similar announcements in the financial sector can provide valuable insights into the market’s reaction.

Potential Market Reactions

Market reactions to the acquisition will likely be mixed, driven by various factors, including investor confidence in SoftBank’s ability to integrate and manage the acquired entity. The acquisition’s impact on competition will also be a significant factor influencing the market’s response. Potential competitive concerns could arise from established players in the online banking sector, potentially triggering regulatory scrutiny or retaliatory measures.

Potential Impact on Competition

The acquisition could significantly impact the competitive landscape of the online banking sector. A strong competitor could emerge, potentially disrupting the existing market dynamics. This disruption could lead to increased competition, potentially benefiting consumers with more options and competitive pricing. Conversely, the acquisition could consolidate power in the hands of a larger player, potentially leading to reduced competition and higher prices.

Possible Scenarios Regarding Financial Outcomes

Several scenarios regarding the financial outcomes of this acquisition are possible:

- Successful Integration and Market Penetration: This scenario involves a smooth integration of the acquired bank’s operations with SoftBank’s existing infrastructure, resulting in significant market share gains and improved financial performance. This could lead to substantial returns on investment.

- Integration Challenges and Market Resistance: This scenario entails difficulties in integrating the acquired bank’s operations, leading to reduced market share and potential losses. This scenario could negatively affect SoftBank’s stock price and investor sentiment.

- Competitive Pressure and Regulatory Scrutiny: This scenario involves intense competition and potential regulatory challenges, making it difficult for SoftBank to achieve significant market share gains. This could impact the overall financial outcomes and stock performance.

Projected Financial Performance Metrics

This table projects potential financial performance metrics for SoftBank post-acquisition. These are estimates based on various assumptions and should be considered as illustrative examples. Actual results may vary significantly.

SoftBank reportedly eyeing a purchase of an online bank, a move that feels reminiscent of a certain Texas tycoon. The recent news brings to mind Ross Perot, who famously entered the banking arena years ago. Ross Perot rides again , some might say, as a new era of digital banking is on the horizon. This purchase could significantly reshape the online banking landscape, creating a new competitive dynamic.

| Metric | Year 1 Post-Acquisition | Year 2 Post-Acquisition |

|---|---|---|

| Revenue (USD Billion) | 15 | 18 |

| Net Income (USD Billion) | 3 | 5 |

| Market Share (%) | 12 | 15 |

Operational Considerations and Challenges

SoftBank’s potential acquisition of an online bank presents exciting opportunities but also significant operational hurdles. Integrating a new entity’s systems and processes into SoftBank’s existing infrastructure requires careful planning and execution to avoid disruption and maintain service levels. The cultural fit, technological compatibility, and stakeholder concerns must be addressed proactively to ensure a smooth transition.Integrating a new online banking platform into SoftBank’s existing IT infrastructure is not a simple plug-and-play process.

SoftBank is reportedly eyeing a purchase of an online bank, which is certainly interesting. This potential acquisition seems to follow a similar strategy as the approach taken by other major players in the industry. It’s a big deal, especially when you consider the growing popularity of online banking options, and reminds me of the innovative approach taken by Bank One in the past.

Bank one gets it definitely points to a potential trend in the financial sector, and suggests that SoftBank’s move might be a calculated response to that. This could reshape the competitive landscape and potentially offer exciting new services for customers. The potential purchase by SoftBank remains a significant development in the digital banking space.

Significant efforts in system harmonization, data migration, and security protocols will be required. The challenges are multifaceted and demand a thorough understanding of both the acquiring and target organizations’ operations.

Potential Integration Issues with Different Technological Platforms

Different online banking platforms employ varying technologies, such as different programming languages, databases, and cloud services. This diversity can lead to incompatibility issues during the integration process. For example, a platform built on a proprietary language might require extensive code rewriting to fit SoftBank’s existing infrastructure, impacting timelines and costs. Thorough compatibility assessments are essential before proceeding with any acquisition.

Potential Conflicts or Concerns from Existing SoftBank Stakeholders

Existing SoftBank stakeholders, including employees, investors, and customers, may have concerns about the acquisition. Employees might worry about job security or changes in their roles and responsibilities. Investors may be concerned about the financial implications of the acquisition and its impact on SoftBank’s overall strategy. Customers might be concerned about changes to service offerings or account management processes.

Addressing these concerns through transparent communication and proactive engagement is crucial for maintaining stakeholder confidence.

Potential Cultural Differences and Their Impact on Integration

Cultural differences between SoftBank and the target online bank could significantly affect the integration process. These differences might manifest in operational procedures, decision-making styles, and communication approaches. For example, a culture prioritizing agility and innovation might clash with a more traditional, hierarchical approach. Building bridges through cultural awareness training and collaborative initiatives will be vital to fostering a harmonious working environment.

Framework for Mitigating Integration Risks

A robust framework is essential to mitigate the risks associated with integrating an online bank. This framework should include:

- A detailed due diligence process to assess the target online bank’s operations, technology, and culture.

- A phased integration plan with clear timelines and milestones.

- Dedicated project teams with representatives from both SoftBank and the acquired bank.

- Comprehensive communication strategies to keep all stakeholders informed throughout the process.

- A contingency plan to address unforeseen challenges.

Best Practices for Handling Potential Customer Concerns During Transition

Maintaining customer trust during a transition is paramount. Best practices include:

- Proactive communication with customers regarding the changes.

- Providing clear and concise information about the transition process and its implications.

- Offering comprehensive support channels to address customer queries and concerns.

- Maintaining consistent service levels during the transition period.

- Guaranteeing the security and confidentiality of customer data.

Operational Challenges and Proposed Solutions

| Operational Challenge | Proposed Solution |

|---|---|

| Incompatibility of technological platforms | Conduct thorough compatibility assessments and develop a migration plan for data and systems. |

| Concerns from existing SoftBank stakeholders | Establish open communication channels and address concerns proactively. |

| Cultural differences | Foster cross-cultural understanding through training and collaborative initiatives. |

| Customer concerns during transition | Implement transparent communication, support channels, and consistent service levels. |

| Data migration | Develop a robust data migration strategy, prioritizing data accuracy and security. |

Industry Impact and Future Trends

SoftBank’s potential foray into the online banking sector through acquisition signals a significant shift in the financial landscape. This move will likely reshape the competitive dynamics, influencing the future of online banking and impacting both consumers and businesses. The acquisition will undoubtedly trigger a wave of innovation and adjustments within the industry, necessitating a careful examination of potential long-term implications.This analysis delves into the potential ramifications of this acquisition, exploring its effects on the broader financial services industry, future developments in online banking, and the evolving needs of consumers and businesses.

Furthermore, it addresses the likely technological advancements and regulatory changes that could emerge as a consequence.

Potential Impact on the Broader Financial Services Industry, Softbank reportedly planning online bank purchase

The acquisition will undoubtedly reshape the competitive landscape, potentially leading to a consolidation of power among a select few players. This could result in increased scrutiny from regulatory bodies, as they evaluate the implications for market competition and consumer protection. Existing players in the online banking sector will likely face increased pressure to innovate and adapt to the changing market dynamics.

Future Developments in Online Banking

This acquisition is poised to accelerate the adoption of cutting-edge technologies in online banking. Expect a surge in the utilization of artificial intelligence (AI) for enhanced customer service, fraud detection, and personalized financial advice. Furthermore, advancements in blockchain technology could revolutionize transaction processing, enhancing security and efficiency.

Long-Term Implications for Consumers and Businesses

Consumers can anticipate a heightened level of convenience and personalization in their online banking experiences. Businesses, particularly small and medium-sized enterprises (SMEs), could benefit from access to more affordable and tailored financial products and services. However, the potential for increased data collection and usage by the acquirer needs to be carefully monitored and regulated.

Emerging Technologies in Online Banking

The acquisition is expected to accelerate the integration of innovative technologies into online banking services. Biometric authentication, augmented reality (AR) applications for financial literacy, and the use of chatbots for customer interaction are all likely to become more prevalent.

Innovation in the Online Banking Sector

The competitive pressure stemming from the acquisition is expected to spur innovation in the online banking sector. This includes the development of new financial products, improved user interfaces, and enhanced security measures. New and creative solutions will likely emerge to meet the evolving needs of customers.

Potential Regulatory Changes

The acquisition’s impact on the regulatory landscape is uncertain, but heightened scrutiny is a strong possibility. Antitrust regulations will be carefully reviewed, and potential adjustments to data privacy policies and consumer protection laws could be anticipated. These changes will be vital in maintaining a fair and transparent online banking ecosystem.

Potential Future Developments in Online Banking

| Technological Advancement | Potential Impact |

|---|---|

| Artificial Intelligence (AI) | Improved customer service, personalized financial advice, and enhanced fraud detection. |

| Blockchain Technology | Increased security and efficiency in transaction processing. |

| Biometric Authentication | Enhanced security and user experience. |

| Augmented Reality (AR) | Improved financial literacy and user engagement. |

| Internet of Things (IoT) | Integration of financial services into daily life through connected devices. |

| Cybersecurity Measures | Enhanced protection against cyber threats and data breaches. |

Wrap-Up

The potential acquisition of an online bank by SoftBank presents a complex interplay of opportunities and challenges. The success of this venture hinges on strategic target selection, careful integration planning, and navigating the regulatory environment. The acquisition will undoubtedly reshape the online banking industry, prompting both innovation and competition. While the long-term financial outcomes remain uncertain, the implications for the broader financial services sector are undeniable.