Wit Capital expands into Europe, marking a significant step in its global strategy. This exploration delves into the historical context, market entry strategies, and potential financial implications of this ambitious venture. We’ll examine the competitive landscape, potential challenges, and the overall impact on Wit Capital’s existing operations and the European market.

The report provides a comprehensive overview, including financial projections, operational adjustments, and a detailed comparison of Wit Capital’s offerings with key competitors. It also discusses the potential return on investment, regulatory compliance considerations, and the economic climate across different European regions.

Background and Context: Wit Capital Expands Into Europe

Wit Capital’s expansion into Europe represents a significant strategic move, building on a history of successful investments in the burgeoning technology sector. This foray into the European market signifies a calculated risk, reflecting a confident assessment of opportunities and a commitment to global growth. The decision likely stems from a deep understanding of the evolving European tech landscape and the potential for substantial returns.The European tech sector presents a complex and dynamic environment.

Wit Capital’s decision to enter this market likely reflects an analysis of the region’s innovative ecosystem, coupled with the identification of specific niches or underserved segments where Wit Capital can leverage its expertise. Their targeted approach suggests a meticulous assessment of market dynamics, competitive advantages, and potential challenges.

Historical Overview of Wit Capital’s Expansion Strategy

Wit Capital’s expansion strategy has consistently prioritized identifying high-growth potential sectors and leveraging their deep understanding of technology. Early successes in the North American market have likely fueled confidence in their investment model and informed their decision to explore international opportunities. The European expansion, therefore, is a natural evolution of their established strategy.

Key Motivations for Entering the European Market

Several key factors likely drove Wit Capital’s decision to enter the European market. These include a burgeoning European tech scene, characterized by rapid innovation and significant funding opportunities. Further, the potential to tap into a skilled talent pool and access cutting-edge research and development initiatives in specific sectors within Europe was a crucial consideration. The presence of large and rapidly growing consumer markets in Europe also contributed to the attractiveness of the region.

Wit Capital’s expansion into Europe is exciting, mirroring a broader trend. Barnes & Noble, for instance, is clearly seeing the audio book market’s growth, as detailed in their recent shift, barnesandnoble com follows audio trend. This suggests a smart move by Wit Capital, recognizing the potential for similar shifts in the European market and likely adapting their strategies accordingly.

Competitive Landscape in Europe

The European tech sector is highly competitive, with established players and emerging startups vying for market share. Major competitors in Wit Capital’s target sector include well-known venture capital firms and private equity firms with extensive experience in Europe. The competitive landscape presents both opportunities and challenges, requiring Wit Capital to demonstrate a unique value proposition and differentiate themselves.

The presence of established European firms requires Wit Capital to clearly articulate their comparative advantage.

Potential Challenges in Europe

Wit Capital’s expansion into Europe is not without its potential challenges. Navigating different regulatory environments and legal frameworks will be crucial. Cultural nuances and variations in business practices will require careful adaptation and understanding. Language barriers and potential logistical complexities also pose challenges, especially when considering the diverse range of countries in Europe. These potential challenges are common to any international expansion, and the successful management of them will be crucial to Wit Capital’s success.

Comparison of Wit Capital’s Offerings with Competitors

| Feature | Wit Capital | Competitor A | Competitor B |

|---|---|---|---|

| Investment Strategy | Focus on early-stage technology companies with disruptive innovation | Emphasis on established companies with proven track records | Hybrid approach, supporting both early-stage and later-stage firms |

| Portfolio Companies | Examples: [Insert examples of companies Wit Capital has invested in] | Examples: [Insert examples of companies Competitor A has invested in] | Examples: [Insert examples of companies Competitor B has invested in] |

| Geographic Focus | Global, with a focus on emerging markets and advanced technologies | Primary focus on Europe and North America | Global reach, with significant presence in Asia |

| Investment Amount | Typically [Insert investment amount range for Wit Capital] | Typically [Insert investment amount range for Competitor A] | Typically [Insert investment amount range for Competitor B] |

| Exit Strategy | Focus on mergers, acquisitions, and IPOs | Strong emphasis on acquisitions and strategic partnerships | Emphasis on secondary market transactions and corporate development |

This table illustrates a comparison of key offerings between Wit Capital and its competitors. The specific examples in the table should be replaced with relevant information. The table highlights the need for Wit Capital to clearly define its competitive advantages in the European market.

Market Entry Strategies

Wit Capital’s expansion into Europe hinges on carefully chosen market entry strategies. These strategies must balance the need for rapid growth with the complexities of navigating a diverse and competitive European landscape. The selection process considers factors like market size, regulatory environments, and cultural nuances. This section details the strategies Wit Capital has adopted and their expected impact.

Chosen Market Entry Strategies

Wit Capital is pursuing a multi-pronged approach to its European expansion. This approach involves a combination of organic growth and strategic partnerships, tailored to specific market conditions.

- Direct Investment: Wit Capital plans to directly invest in promising European startups, leveraging its existing network and expertise. This strategy allows for greater control over investments and fosters a deeper understanding of the market dynamics. Direct investment facilitates collaboration with founding teams and ensures a closer alignment with Wit Capital’s investment philosophy. This is suitable for markets where Wit Capital can identify clear opportunities for high-growth companies, with existing infrastructure to support its investment operations.

- Joint Ventures: In certain regions, Wit Capital will form joint ventures with established European investment firms. This strategy capitalizes on local knowledge and facilitates market entry into regions where direct investment is challenging. Joint ventures allow Wit Capital to tap into existing networks and distribution channels, reducing the need for extensive infrastructure development in the early stages.

- Acquisition Strategy: Wit Capital will also explore the possibility of acquiring existing European venture capital firms. This strategy aims to rapidly scale its presence and gain immediate access to established portfolios and expertise within specific European markets. Acquisition of a well-established firm provides a ready-made network and established operational structure, minimizing start-up costs and accelerating market penetration.

Advantages and Disadvantages of Each Strategy

Each market entry strategy presents a unique set of advantages and disadvantages.

- Direct Investment: Advantages include greater control, deeper market understanding, and potential for higher returns. Disadvantages include a higher initial investment cost, longer time to market, and the need for building a dedicated European team.

- Joint Ventures: Advantages include reduced risk, quicker market entry, and access to local expertise. Disadvantages include potential conflicts of interest, dilution of control, and shared returns.

- Acquisition Strategy: Advantages include rapid market penetration, access to existing portfolios, and a ready-made infrastructure. Disadvantages include potential integration challenges, higher transaction costs, and possible cultural clashes within teams.

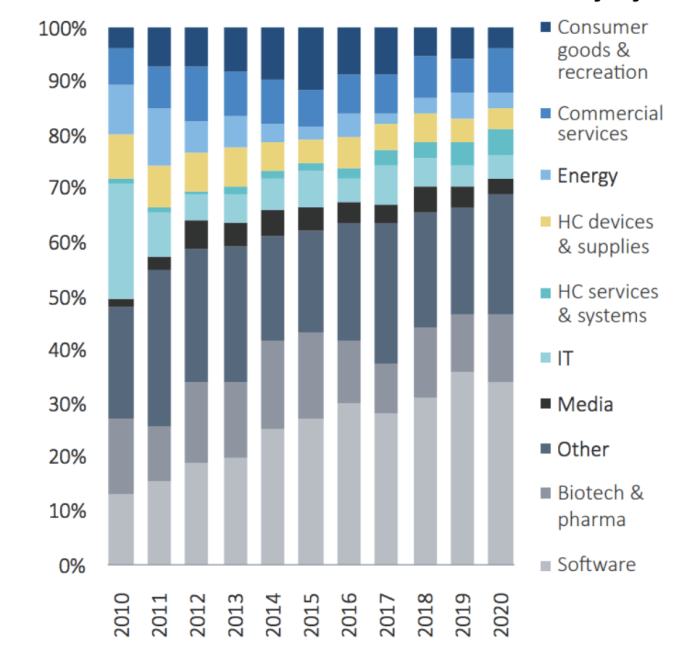

Target Customer Segments

Wit Capital’s target customer segments in Europe encompass a range of startups across various industries, focusing on high-growth potential. Specific sectors like fintech, AI, and sustainable technologies are priorities.

- Fintech Startups: These startups offer innovative solutions in financial services, including payments, lending, and investment platforms. Wit Capital’s expertise in financial technology aligns well with this segment.

- AI-Driven Businesses: Wit Capital seeks startups leveraging artificial intelligence for various applications, including automation, data analysis, and personalized experiences. This sector is expected to see rapid growth in Europe.

- Sustainable Tech Innovators: Wit Capital is particularly interested in companies focused on sustainable technologies, including renewable energy, circular economy solutions, and environmentally conscious products.

Marketing and Sales Approach

Wit Capital’s marketing and sales approach in Europe will emphasize networking and partnerships with key players in the European startup ecosystem.

- Networking Events: Wit Capital will actively participate in industry events, conferences, and accelerator programs to build relationships with potential startups.

- Targeted Outreach: The team will conduct focused outreach to startups matching Wit Capital’s investment criteria.

- Online Presence: A dedicated European website and active social media presence will be crucial for showcasing Wit Capital’s expertise and investment opportunities.

Potential Partnerships and Collaborations

Wit Capital’s European expansion will benefit from strategic partnerships and collaborations.

| Potential Partner Type | Potential Partner Examples | Rationale |

|---|---|---|

| Industry Associations | European Fintech Association, AI Alliance | Access to industry expertise and potential investment opportunities. |

| Incubators/Accelerators | Techstars Europe, Station F | Access to promising startups and support networks. |

| Venture Capital Firms | Early-stage funds in specific sectors | Access to established networks and complementary investment strategies. |

Financial and Operational Implications

Wit Capital’s foray into the European market presents a complex interplay of financial projections, operational adjustments, and regulatory hurdles. Navigating these challenges effectively will be crucial for success. Understanding the diverse economic landscapes across Europe is paramount, as a one-size-fits-all approach will likely prove inadequate.The financial implications are significant. Successful expansion requires careful budgeting, realistic revenue projections, and a clear understanding of the potential return on investment (ROI).

This necessitates not just projecting growth but also factoring in potential risks and adapting strategies accordingly.

Financial Projections for European Expansion

Wit Capital’s financial projections for Europe will hinge on a careful assessment of the market potential in various regions. Factors like average deal sizes, transaction frequency, and market penetration rates will be critical inputs. For instance, a high concentration of startups in a particular region might translate into higher deal volume, leading to more optimistic revenue projections. Conversely, a less developed startup ecosystem might necessitate a more cautious approach.

Operational Adjustments for Wit Capital in Europe

Successful expansion demands adjustments to Wit Capital’s operational structure. These include establishing local offices, hiring multilingual staff with relevant expertise in European financial regulations, and potentially adapting its investment strategies to align with the unique characteristics of each target market. For example, the UK market might require a more established presence, while a newer market in Eastern Europe might benefit from a more agile, flexible approach.

Potential Impact of Regulatory Compliance in Europe

European regulatory frameworks are highly complex. Compliance with local laws and regulations concerning financial services, data privacy (GDPR), and anti-money laundering (AML) will be critical. These compliance measures could lead to higher operational costs, but non-compliance carries even greater risks. For instance, fines for non-compliance with GDPR could be substantial, impacting profitability.

Comparison of Economic Climates in European Regions

The economic climate varies significantly across European regions. Countries like Germany and the UK have well-established economies and robust startup ecosystems, potentially offering higher returns on investment. Emerging markets in Eastern Europe, while presenting lower immediate returns, may offer substantial growth potential in the long term. It’s essential to understand the specific economic conditions of each target region to tailor investment strategies effectively.

Potential Return on Investment (ROI) for Wit Capital’s European Ventures

Wit Capital’s ROI will depend on several factors, including market penetration, deal size, and operational efficiency. The ROI will likely vary across different European regions. Successful precedents in similar ventures, combined with thorough market research, can provide valuable insights. For example, successful venture capital firms in similar markets can offer valuable benchmarks.

Costs Associated with Wit Capital’s European Expansion

| Category | Description | Estimated Cost (USD) |

|---|---|---|

| Establishment of Local Offices | Setting up offices in key European markets. | $500,000 – $2,000,000 |

| Hiring Staff | Recruiting multilingual professionals. | $250,000 – $1,000,000+ |

| Regulatory Compliance | Legal and compliance costs. | $100,000 – $500,000 per year |

| Marketing and Promotion | Building brand awareness in European markets. | $100,000 – $500,000 per year |

| Travel and Expenses | Business travel and related costs. | $50,000 – $200,000 per year |

This table provides a general overview. Actual costs may vary based on specific market conditions and Wit Capital’s chosen expansion strategy.

Potential Impact and Outcomes

Wit Capital’s foray into the European market promises exciting opportunities, but also presents complex challenges. Understanding the potential ripple effects on existing operations and the broader industry is crucial for strategic planning. This section delves into the potential impacts, both positive and negative, on Wit Capital’s operations, the industry landscape, job creation, and the European market itself.

Wit Capital’s expansion into Europe is certainly exciting, but it’s interesting to see how other players in the open-source space are also making moves. For instance, VA Linux is making a bold play to potentially become the next Red Hat, a significant player in the Linux distribution market. VA Linux launches bid to become next red hat.

This could reshape the landscape considerably, which, in turn, might impact Wit Capital’s future strategies in the European market. Overall, the European tech scene is looking quite dynamic right now.

Potential Impact on Wit Capital’s Existing Business

Wit Capital’s existing operations in other regions will likely be affected by the expansion into Europe. Increased resources and personnel dedicated to the European market could temporarily divert attention and resources from other regions. However, successful European expansion could potentially lead to a wider network effect, increasing brand recognition and attracting more capital for investments globally. Successfully replicating successful models in Europe could also lead to improved strategies and methodologies, which could be implemented across all Wit Capital’s regional operations.

Potential Impact on the Industry Sector

Wit Capital’s entry into the European market could significantly impact the competitive landscape. The introduction of new investment strategies and technologies could spur innovation and efficiency improvements across the entire venture capital sector. It could also attract new talent and investors to the industry, boosting overall market activity and attracting further investments.

Potential Impact on Job Creation in Europe

Wit Capital’s European expansion, if successful, could contribute to job creation. The establishment of new offices, hiring of personnel for investment analysis, marketing, and administrative roles, as well as potential collaborations with European companies and startups, could create numerous employment opportunities across various sectors. Successful investments by Wit Capital could also foster the growth of associated companies, creating further jobs in related industries.

Examples of Influence on the European Market

Wit Capital’s entry could influence the European market in several ways. Successful investments in European startups could foster the growth of innovative technologies and businesses, potentially leading to a rise in European entrepreneurship and a stronger European tech sector. The adoption of Wit Capital’s investment strategies by other European venture capital firms could lead to a more streamlined and efficient investment process.

This could lead to increased funding for innovative projects and a rise in successful startups.

Wit Capital’s expansion into Europe is exciting, but it’s also worth considering the broader implications. Simultaneously, the US government is phasing in new internet child privacy measures, u s govt phasing in new internet child privacy measures , which could significantly impact how companies like Wit Capital operate in the digital space. Ultimately, this European expansion signals a proactive approach to global market opportunities for Wit Capital.

Challenges Related to Cultural Differences

Navigating cultural differences in Europe is crucial for success. Europe comprises diverse cultures, each with unique business practices, legal frameworks, and communication styles. Difficulties in understanding and adapting to these differences could hinder successful partnerships and investments. Effective communication strategies, cultural sensitivity training, and building strong relationships with local stakeholders are essential for overcoming these challenges. Furthermore, understanding the nuanced regulatory environment in different European countries is critical.

Possible Scenarios and Outcomes for Wit Capital’s European Expansion

| Scenario | Outcome | Impact on Existing Business | Impact on Industry | Impact on Job Creation |

|---|---|---|---|---|

| Successful Market Entry | Increased market share, brand recognition, and profitability. | Potential strain on resources, but overall growth. | Increased competition, innovation, and investment. | Significant job creation in Europe and potentially globally. |

| Slow Market Entry | Gradual increase in market presence, with a slower rate of return. | Minimal strain on resources. | Moderate impact on industry. | Limited job creation. |

| Unsuccessful Market Entry | Significant financial losses, and potentially reputational damage. | Negative impact on resources and possibly global reputation. | Limited or no impact on the industry. | Limited or no job creation. |

Strategic Considerations and Opportunities

Wit Capital’s expansion into Europe presents a fascinating array of strategic opportunities and challenges. Navigating the diverse regulatory landscapes, cultural nuances, and competitive dynamics across the continent requires a meticulously crafted strategy. This section delves into the long-term goals, potential market openings, inherent risks, and the potential for synergy between European and non-European operations.The key to success lies in understanding the unique characteristics of each European market and tailoring strategies accordingly.

This involves adapting investment approaches, understanding local regulatory requirements, and building a team that reflects the multicultural fabric of the continent.

Long-Term Strategic Goals for Wit Capital in Europe

Wit Capital’s long-term vision in Europe is to establish a robust presence, fostering strong partnerships, and becoming a leading investment firm in select sectors. This entails identifying high-growth potential businesses, providing tailored financial solutions, and contributing to the overall economic development of the region. The primary goal is to build a sustainable and profitable business unit in Europe that complements the existing global portfolio.

Potential Opportunities in the European Market

Europe offers a diverse range of investment opportunities across various sectors. The potential for growth in sectors like sustainable energy, fintech, and advanced manufacturing presents lucrative avenues for Wit Capital. Stronger regional partnerships and access to established European venture capital networks will be crucial for capitalizing on these opportunities. A detailed understanding of local regulations and investor preferences is essential for achieving success in these markets.

Potential Risks and Mitigation Strategies for Wit Capital

Expanding into a new market always comes with risks. Difficulties in navigating the intricate regulatory frameworks of different European countries, managing diverse teams across multiple cultures, and competing against established players are potential hurdles. Mitigation strategies include building strong local networks, engaging with regulatory authorities early on, establishing a clear communication strategy, and fostering a culture of cross-cultural understanding within the team.

Potential for Synergy Between Wit Capital’s European and Non-European Operations, Wit capital expands into europe

The European expansion presents an excellent opportunity to leverage synergies between Wit Capital’s existing global network and its emerging European operations. Sharing best practices, transferring expertise, and pooling resources can significantly boost efficiency and effectiveness. By fostering collaboration between European and non-European teams, Wit Capital can gain a competitive edge. This includes knowledge transfer, sharing of market intelligence, and the creation of joint investment funds.

Innovative Approaches to Managing Diverse Teams in Europe

Managing a diverse team in Europe requires an innovative approach. Recognizing and respecting the varied cultural backgrounds and perspectives of team members is crucial. Investing in cross-cultural training, promoting open communication channels, and creating a psychologically safe environment are vital for building a high-performing team. This necessitates a clear understanding of the cultural nuances of each European country.

Potential Opportunities in Different European Countries

| Country | Potential Opportunity Sector | Key Considerations |

|---|---|---|

| Germany | Advanced Manufacturing, Sustainable Energy | Strong regulatory framework, established market, high-quality workforce |

| France | Fintech, Luxury Goods | Strong entrepreneurial ecosystem, focus on innovation, robust legal system |

| United Kingdom | Life Sciences, Fintech, AI | Well-developed financial sector, strong research and development capabilities, experienced talent pool |

| Spain | Renewable Energy, Tourism | Growing tourism sector, strong potential for investment in renewable energy, skilled workforce |

| Italy | Fashion, Food & Beverage, Tourism | Established fashion and food industries, tourism potential, skilled workforce |

This table highlights the potential opportunities across several European countries. Each country presents unique opportunities, requiring a tailored approach to investment strategies. Understanding the specific characteristics of each market is essential for success.

Illustrative Case Studies

Navigating the complexities of European expansion requires a nuanced understanding of both successful and unsuccessful strategies. Analyzing comparable companies’ journeys, both triumphant and challenging, provides valuable insights for Wit Capital’s own European venture. This section delves into specific case studies, highlighting key factors that contributed to success or failure, ultimately offering lessons for Wit Capital’s approach.

Successful European Expansion: The Netflix Model

Netflix’s European expansion exemplifies a strategic approach focused on adaptation and localized content. They didn’t attempt a one-size-fits-all approach. Instead, they recognized the importance of tailoring their offerings to specific regional preferences. This included localizing content libraries, creating unique marketing campaigns for different countries, and adapting their pricing strategies. Their success demonstrates the critical role of understanding and responding to local market nuances.

Failed European Expansion: The Nokia Mobile Case

Nokia’s decline in the smartphone market, despite its initial success in Europe, serves as a cautionary tale. Nokia’s failure wasn’t due to a lack of product innovation in Europe, but rather a failure to adapt to the rapidly evolving technological landscape. They failed to recognize the disruptive potential of emerging players and failed to fully embrace the mobile internet revolution.

This illustrates the crucial importance of constant innovation and adaptation in the face of dynamic market changes.

Wit Capital’s Distinctive Strategy

Wit Capital’s strategy distinguishes itself from competitors by emphasizing a data-driven, technology-focused approach. Unlike many competitors relying on traditional investment methods, Wit Capital leverages sophisticated algorithms and advanced analytics to identify and assess investment opportunities. This unique approach aims to yield higher returns and reduced risk, potentially providing a competitive advantage in the European market.

Expanding into France: Challenges and Opportunities

Expanding into France presents a complex set of challenges and opportunities. France’s strong regulatory environment, a highly developed financial sector, and a culturally nuanced consumer base demand a precise approach. Opportunities lie in tapping into France’s substantial venture capital market and leveraging the country’s entrepreneurial spirit. However, navigating French bureaucracy and establishing trust within the French business community are significant challenges.

Cultural Sensitivity: The Case of IKEA

IKEA’s success in Europe is largely attributed to its adeptness in navigating cultural differences. They recognize and respect regional preferences, tailoring product designs and marketing strategies to resonate with different European tastes and lifestyles. This inclusive approach allows them to build a global brand while still retaining local appeal. IKEA’s ability to adapt to cultural nuances across various markets has been a cornerstone of their international success.

Comparative Analysis Table

| Company | Expansion Strategy | Success/Failure Factors | Key Lessons for Wit Capital |

|---|---|---|---|

| Netflix | Adaptation to local preferences, localized content, targeted marketing | Success due to tailored approach, understanding of local markets | Adapt investment strategies to local needs, use localized marketing. |

| Nokia | Failure to adapt to technological changes, lack of innovation in mobile internet era | Failure due to inability to innovate and adapt to disruption. | Continuously innovate and adapt to evolving market trends. |

| Wit Capital | Data-driven, technology-focused investment strategy | Leverages technology to enhance investment decision-making | Maintain a competitive edge through technological advancements. |

| IKEA | Cultural sensitivity, tailored products and marketing | Success in adapting to various cultures and maintaining local appeal | Develop a deep understanding of cultural nuances and adjust strategies accordingly. |

Last Recap

Wit Capital’s expansion into Europe presents both significant opportunities and potential hurdles. The success of this venture hinges on effectively navigating the complexities of the European market, including cultural nuances, regulatory environments, and competition. This report offers a nuanced perspective on the potential impacts, enabling informed decision-making for both Wit Capital and stakeholders. Ultimately, the outcome will depend on Wit Capital’s ability to adapt and capitalize on the opportunities presented.