Wal mart targets amazon etoys for holiday rush – Walmart targets Amazon’s Etoys for holiday rush, a bold move in the fiercely competitive toy market. This strategy highlights Walmart’s ambition to challenge Amazon’s dominance in online toy sales during the crucial holiday season. Walmart’s approach involves a multi-faceted strategy, analyzing Amazon’s strengths and weaknesses, and developing unique strategies to attract customers. Will this be a successful counter-offensive, or will Amazon maintain its stronghold?

This analysis delves into Walmart’s holiday strategy, exploring its past successes and current online presence. We’ll compare Walmart’s and Amazon’s online shopping features, from delivery options to customer service. We’ll also examine Amazon’s toy strategy, focusing on pricing, promotions, and inventory management. Further, we’ll investigate the competitive landscape, analyzing other players in the market and the factors influencing consumer choices during the holidays.

The impact on stock prices, supply chains, and consumer spending will be considered, along with potential consumer reactions to Walmart’s targeting. Finally, we’ll look at emerging trends and marketing strategies that both companies might employ.

Walmart’s Holiday Strategy

Walmart, a cornerstone of the retail landscape, has long held a prominent position in the holiday shopping rush. Its strategy has evolved over time, adapting to changing consumer preferences and competitive pressures. The company’s approach to the holiday season, including its brick-and-mortar presence and e-commerce initiatives, is crucial for its continued success.Walmart’s historical holiday sales strategies have centered on aggressive pricing, extensive product selection, and strategic promotions.

Early adopters of “everyday low pricing” strategies, Walmart has consistently offered competitive prices on a wide array of goods, attracting price-conscious consumers. Early-bird promotions and Black Friday sales have been key components, driving significant sales volume. Walmart’s performance has varied throughout the years, often dependent on factors such as economic conditions, competitor activity, and the effectiveness of its marketing campaigns.

Historical Overview of Walmart’s Holiday Sales

Walmart’s approach to holiday shopping has been characterized by its focus on broad product availability. From electronics and apparel to toys and groceries, the company offers a comprehensive selection to cater to diverse consumer needs. The retailer’s strategy has often involved deep discounting, particularly around key shopping holidays like Thanksgiving and Christmas. This approach has proven effective in attracting price-sensitive customers.

While exact sales figures fluctuate year to year, Walmart’s historical data indicates consistent strong holiday sales, demonstrating the effectiveness of its strategy.

Walmart’s Current Online Presence

Walmart’s online presence has grown significantly, aiming to compete effectively with Amazon. The company has invested heavily in its e-commerce platform, aiming to provide a seamless online shopping experience. Strengths include a wide selection of products, competitive pricing, and convenient delivery options, often including same-day or next-day delivery. A key strength is its vast network of stores that can serve as fulfillment centers, enabling quick and efficient order processing.

However, Walmart’s online presence still faces challenges compared to Amazon’s more established and feature-rich platform.

Walmart’s targeting of Amazon’s eToys for the holiday rush is a fascinating strategy, mirroring the broader shift in media. Just like Walmart is vying for a piece of the online toy market, major radio broadcasters are also looking to diversify their revenue streams by focusing on internet-based advertising and services, as discussed in this insightful article about major radio broadcasters go after internet revenues.

This competitive landscape ultimately benefits consumers, as companies are pushed to innovate and provide better options. Walmart’s efforts to combat Amazon in the toy market, therefore, seem perfectly aligned with the current media trends.

Strengths and Weaknesses Compared to Amazon

Walmart’s online shopping platform, while improving, still lags behind Amazon’s robust and extensive features. Walmart’s strength lies in its extensive brick-and-mortar presence, which serves as a significant advantage for order fulfillment and customer service. However, Amazon’s vast selection, comprehensive customer service options, and highly developed logistics network are significant competitive advantages. The ongoing competition between Walmart and Amazon continues to shape the landscape of online retail.

Potential Strategies to Counter Amazon’s Influence

Walmart can consider several strategies to counter Amazon’s influence during the holiday season. Expanding its Prime-like membership program with exclusive benefits, such as faster delivery options and discounts, could be a valuable approach. Improving its online search capabilities, making it easier to locate products, is another crucial element. Investing in more sophisticated customer service solutions, allowing for quicker resolution of customer issues, could also significantly enhance the shopping experience.

Leveraging its vast network of stores for in-store pickup and returns is also a viable option.

Comparison of Online Shopping Features

| Feature | Walmart | Amazon |

|---|---|---|

| Delivery Options | Same-day, next-day, standard; store pickup | Prime Now, various delivery speeds, Prime membership |

| Payment Methods | Credit cards, debit cards, digital wallets | Wide array of payment methods, including Amazon Pay |

| Customer Service | Phone, online chat, in-store support | Extensive online support channels, including FAQs, chatbots |

| Product Selection | Broad but may not be as deep as Amazon | Vast and comprehensive |

This table highlights key differences in online shopping features between Walmart and Amazon. The comparison underscores the need for Walmart to focus on specific areas to enhance its online offerings. Walmart’s success during the holiday season will hinge on its ability to effectively address the aforementioned points.

Amazon’s Etoys Strategy

Amazon’s foray into the toy market has been a significant driver of holiday sales, and their strategies for the toy sector are intricate and multifaceted. Their offerings extend far beyond simple retail; they encompass a robust ecosystem of online shopping, customer reviews, and third-party seller participation. This allows Amazon to constantly adapt and adjust their approach, often outpacing traditional toy retailers in the holiday rush.Amazon’s dominance in e-commerce has undoubtedly influenced its toy strategy, leveraging its vast network to cater to a broad range of customer preferences and demands.

This includes a strong emphasis on data-driven decision making, using customer purchase history, reviews, and search trends to personalize recommendations and product selections. Understanding the competitive landscape is also crucial; Amazon’s strategies are consistently evaluated against the actions of competitors like Walmart and Target.

Amazon’s Etoys Offerings and Market Share

Amazon’s toy offerings are extensive, covering everything from classic board games and dolls to the latest electronic gadgets and action figures. They feature a wide array of brands, both established and emerging, providing customers with a vast selection. Amazon’s market share in the toy industry has been consistently high, but precise figures are not always readily available, and often fluctuate based on the specific reporting period and category breakdown.

Market research reports often highlight Amazon’s substantial influence, though precise numbers are not always publicly available.

Amazon’s Holiday Strategies for the Toy Sector

Amazon’s holiday toy strategies revolve around three key pillars: pricing, promotions, and inventory management. They employ dynamic pricing strategies, often adjusting prices based on demand, competitor offerings, and product popularity. Promotional campaigns are frequently tailored to specific holidays, creating exclusive deals and discounts, and leverage the potential of limited-time offers to drive sales. Effective inventory management is crucial during the holiday season.

Amazon anticipates demand fluctuations and optimizes their inventory levels to avoid stockouts while minimizing excess inventory costs.

Amazon’s Strengths and Weaknesses in the Toy Market

Amazon’s primary strength in the toy market lies in its vast customer base and logistical infrastructure. This allows for quick delivery options and extensive product selection, often exceeding the capabilities of traditional brick-and-mortar stores. The platform’s reliance on third-party sellers offers a diverse range of products and allows for more responsive inventory management. Weaknesses include potential challenges in managing the quality control of third-party products, which can affect consumer trust.

Amazon’s dependence on external logistics providers, sometimes resulting in shipping delays, is another possible drawback. However, this is a challenge shared by many large online retailers.

Potential Strategies for Maintaining Market Position

To maintain its position in the toy market, Amazon can continue to refine its product curation, focusing on emerging trends and providing a wider range of niche products. Further investments in quality control measures for third-party products could improve consumer trust. Expanding fulfillment options, potentially including more local warehouses or partnerships with regional retailers, could reduce shipping times and improve customer satisfaction, especially during peak holiday seasons.

Amazon’s Recent Toy Sales Trends

| Category | Best-Selling Items | Seasonal Popularity |

|---|---|---|

| Action Figures | Popular movie and game tie-ins | High demand during movie release months |

| Dolls | Fashion dolls, collectible dolls | Strong demand around holidays and birthdays |

| Board Games | Strategy games, family-friendly options | Increased sales during fall and winter months |

| Educational Toys | STEM toys, learning games | Strong demand for back-to-school and holiday gifts |

Note: This table provides a general overview. Specific best-selling items and seasonal trends can vary significantly depending on the year and the specific product category.

Competitive Landscape

The holiday toy market is a fiercely contested arena, with established giants like Walmart and Amazon vying for market share alongside a constellation of smaller competitors. Understanding the strategies of these players, as well as the factors shaping consumer choices, is crucial for navigating this complex landscape. The holiday season, with its intense demand, puts a spotlight on the strengths and weaknesses of each competitor.Beyond the dominant players, a rich ecosystem of retailers and brands contributes to the overall market dynamics.

This includes specialty toy stores, online marketplaces catering to niche interests, and traditional brick-and-mortar retailers. This diversity offers consumers a wide array of options, but also makes it challenging for any single retailer to capture the entire market share.

Key Competitors Beyond Walmart and Amazon

Several companies play significant roles in the holiday toy market beyond Walmart and Amazon. These include Target, which consistently competes with Walmart on price and availability; smaller, independent toy stores that often focus on unique and curated selections; and online retailers specializing in specific toy categories like educational toys or collectibles. These competitors bring unique selling propositions to the table, often catering to specific niches within the broader toy market.

Comparison of Strategies

Walmart and Amazon’s strategies in the toy market differ in emphasis. Walmart traditionally focuses on broad product offerings and competitive pricing, aiming for mass appeal. Amazon, with its vast online platform, prioritizes convenience and a wide selection, including specialized products and often competitive prices. Other competitors, like Target, blend elements of both approaches, offering a wider range of toys than smaller stores but often at a higher price point than Walmart.

Factors Influencing Consumer Choices

Several factors influence consumer choices during the holiday season. Price, of course, is a major consideration, but so is brand recognition, perceived quality, and the novelty or educational value of the toy. Parents often prioritize safety and appropriateness for their children’s age group, influencing their decisions. Availability and convenience of purchasing, particularly during the holiday rush, also plays a significant role.

Social media trends and recommendations from friends and family also sway purchasing decisions.

Evolving Consumer Preferences

Consumer preferences in the toy market are constantly evolving. Increased demand for sustainable and eco-friendly toys reflects a growing awareness of environmental issues. The rising popularity of educational toys and STEM-focused play reflects a desire for toys that foster learning and critical thinking skills. Furthermore, personalization and customization are increasingly important to parents seeking unique experiences for their children.

These shifts are impacting toy manufacturers and retailers, driving innovation and adjustments to their strategies.

Strengths and Weaknesses of Major Players

| Company | Strengths | Weaknesses |

|---|---|---|

| Walmart | Extensive product selection, competitive pricing, strong physical presence, large supply chain | Potentially lower perceived quality in some product lines, may struggle with online customer service compared to Amazon. |

| Amazon | Vast online selection, convenience, efficient logistics, extensive customer reviews and ratings | High shipping costs can impact affordability, potential reliance on third-party sellers may affect product quality consistency. |

| Target | Strong brand image, well-designed retail stores, a mix of high and mid-range product selection, excellent in-store customer service | Limited online presence compared to Amazon, potential higher pricing compared to Walmart. |

| Specialty Toy Stores | Curated selection, expert advice, personalized service, unique and niche offerings | Limited product availability, potentially higher prices, less broad reach. |

The Impact of the Holiday Rush

The holiday rush is a critical period for retailers like Walmart and Amazon. Sales volume explodes, putting immense pressure on supply chains, logistics, and pricing strategies. This period also significantly influences consumer spending patterns and market share dynamics, making it a crucial period for both companies to strategize effectively. The outcome of this period can set the tone for the entire upcoming year.

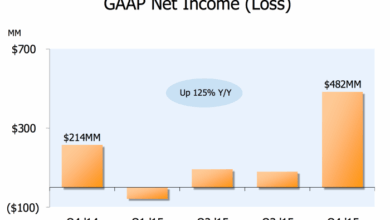

Expected Impact on Stock Prices and Market Share

The holiday rush directly affects stock prices by reflecting consumer response and operational efficiency. Strong sales translate to higher profits, often boosting stock prices. Conversely, supply chain disruptions or poor consumer reception can negatively impact stock valuation. Amazon, with its established online presence and extensive logistics network, often shows resilience. However, Walmart’s performance during this period can be a significant indicator of its ability to compete effectively with Amazon’s e-commerce dominance.

Market share fluctuations are also closely tied to consumer preference shifts and retail strategies implemented during the holiday season. For example, a successful campaign can result in a substantial increase in market share.

Potential Supply Chain and Logistics Disruptions

The sheer volume of orders during the holiday rush can lead to significant supply chain bottlenecks. Challenges in transportation, warehousing, and fulfillment centers can cause delays in delivery times. Increased demand often outpaces the available capacity, resulting in shortages of certain products or delays in shipment. Real-world examples include the 2021 holiday season, where many retailers faced delays due to increased demand and supply chain disruptions, affecting both online and in-store operations.

Walmart’s targeting of Amazon’s eToys for the holiday rush is interesting, especially given the ongoing tech industry landscape. It’s a classic case of retail rivalry, but are you sick of the are you sick of the microsoft antitrust case ? Perhaps the focus on e-commerce is a response to the evolving market and a way to compete effectively during the holidays.

Regardless, it’s a compelling strategy to watch in the retail world.

Companies need to anticipate these issues and have contingency plans in place to mitigate disruptions.

Impact on Consumer Spending Habits

The holiday rush significantly influences consumer spending habits. Promotional offers, limited-time deals, and attractive gift-giving options can incentivize consumers to purchase more than usual. The rush can also impact consumers’ overall spending outlook and budget allocation. For instance, consumers might prioritize specific items, potentially shifting their spending towards technology, home goods, or apparel, based on specific campaigns or promotions.

This influence often extends beyond the holiday season, impacting overall consumer spending patterns for the following year.

Potential Consumer Reactions to Walmart’s Targeting of Amazon’s Etoys

Consumer reaction to Walmart’s targeting of Amazon’s eToys offerings will depend on the specific strategies employed. If Walmart offers competitive pricing, a wider selection of toys, or unique customer experiences, consumers may be attracted to their offerings. Conversely, negative perceptions of Walmart’s strategy, such as perceived poor quality or poor customer service, may drive consumers towards Amazon’s established reputation and offerings.

Consumer loyalty and past experiences with each brand will heavily influence purchasing decisions during the holiday rush.

Potential Risks and Rewards for Walmart During the Holiday Rush

| Potential Risks | Potential Rewards |

|---|---|

| Supply chain disruptions leading to stock-outs and delays | Increased market share through competitive pricing and wider product selection |

| Negative consumer perception of Walmart’s strategy regarding Amazon’s eToys offerings | Improved brand image by offering a more comprehensive selection of toys and gifts |

| Competition from other retailers | Attracting new customers with strategic marketing campaigns |

| Higher operational costs due to increased demand | Strong sales growth and profitability, enhancing stock price |

Emerging Trends: Wal Mart Targets Amazon Etoys For Holiday Rush

The holiday shopping season is a dynamic landscape, constantly evolving with new trends and technologies. Understanding these shifts is crucial for retailers like Walmart and Amazon to adapt and capitalize on opportunities. This year, we’re seeing a blend of familiar favorites and innovative approaches, all vying for consumer attention.

Personalized Shopping Experiences

Personalized shopping experiences are no longer a niche offering but a fundamental aspect of the online retail experience. By leveraging data analysis and machine learning, retailers can tailor product recommendations, promotions, and even the overall shopping interface to individual customer preferences. This results in a more engaging and relevant shopping journey, ultimately driving higher conversion rates. For example, Amazon’s personalized recommendations engine has become a hallmark of their platform, consistently presenting products that align with user browsing history and purchase patterns.

Walmart’s aggressive targeting of Amazon’s eToys division for the holiday rush is certainly interesting. It seems like a direct challenge to Amazon’s dominance, but perhaps this is part of a broader strategy to counter competitors in the space. This might be especially true considering e commerce times’ recent deal with internet wire, e commerce times enters deal with internet wire , which could potentially offer Walmart a significant edge in the race for holiday sales.

Ultimately, Walmart’s efforts to snag Amazon’s eToys customers will be a key factor in determining the overall success of the holiday season for both companies.

The Role of Technology in Shaping Experiences

Technology plays a pivotal role in shaping consumer experiences during the holiday season. Augmented reality (AR) is becoming increasingly important, allowing customers to virtually try on clothes or visualize furniture in their homes before purchasing. Artificial intelligence (AI) is being used for tasks such as fraud detection, chatbots for customer service, and even predicting demand fluctuations. These advancements improve the overall shopping experience, from initial browsing to final checkout.

Imagine trying on a pair of shoes in your living room before purchasing them online, or instantly resolving a query through an AI-powered chatbot.

Social Media’s Influence on Consumer Decisions

Social media platforms are integral to the holiday shopping process. Influencer marketing is a significant driver of consumer decisions, as individuals trust recommendations from personalities they follow. User-generated content, reviews, and social commerce features directly influence purchase decisions. The accessibility of social media makes it a powerful tool for brands to engage with potential customers and build trust.

Holiday campaigns often leverage these platforms to showcase products, promotions, and customer testimonials. A well-executed social media strategy can significantly boost sales during the holiday season.

Evolving Technology and its Implications on Retail

| Technology | Description | Implications on Retail ||—|—|—|| Augmented Reality (AR) | Allows customers to virtually try on products, visualize products in their homes, or experience products in a new way. | Enhanced customer engagement, increased purchase confidence, reduced returns. || Artificial Intelligence (AI) | Leverages data analysis and machine learning for personalized recommendations, fraud detection, customer service, and demand forecasting.

| Improved customer experience, increased efficiency, and optimized inventory management. || Machine Learning (ML) | Enables algorithms to learn from data, identify patterns, and predict future outcomes. | Personalized recommendations, targeted marketing campaigns, dynamic pricing strategies, improved inventory management. || Social Media | Provides platforms for connecting with customers, building brand awareness, and facilitating sales. | Increased brand visibility, direct engagement with consumers, promotion of user-generated content.

|

Marketing Strategies

Walmart and Amazon are locked in a fierce battle for holiday toy sales, and marketing plays a crucial role in this competition. Effective marketing strategies can significantly influence consumer choices and ultimately impact sales figures. This section will delve into Walmart’s past performance, contrast their approach with Amazon’s, and explore potential strategies Walmart could employ to attract Amazon’s toy customers.Walmart’s historical marketing campaigns have often emphasized value and affordability, appealing to budget-conscious shoppers.

They have frequently used seasonal promotions and limited-time offers to drive urgency and generate excitement. However, their success has also been dependent on factors like product selection and supply chain efficiency.

Effectiveness of Walmart’s Past Holiday Toy Marketing

Walmart has traditionally focused on offering a wide variety of toys at competitive prices. Their past campaigns have often revolved around holiday-themed promotions, emphasizing deals and discounts. Success has varied, often correlated with the availability of popular items and the timing of promotions. Sometimes, a strong early season marketing push, followed by consistent, targeted offers, proved highly effective.

Conversely, periods of limited stock or a lack of desirable toys could negatively impact perceived value and effectiveness.

Walmart’s Marketing Strategies vs. Amazon’s, Wal mart targets amazon etoys for holiday rush

Walmart’s marketing strategies typically lean towards broader, more traditional approaches like television commercials, print advertisements, and in-store promotions. They heavily leverage their physical presence to create an immersive shopping experience. In contrast, Amazon’s marketing tends to be more data-driven and focused on online channels, leveraging targeted advertising, personalized recommendations, and social media engagement. They prioritize ease of online ordering and seamless delivery options, offering a distinct customer journey.

Strategies for Walmart to Target Amazon’s Etoys Customers

To effectively compete with Amazon, Walmart needs to adapt its strategy. Attracting Amazon’s Etoys customers requires focusing on aspects where Amazon might have weaker points. These customers are likely comfortable with online shopping but value personalized recommendations and convenience. Walmart could enhance its online presence by creating a user-friendly website with personalized product suggestions, exclusive online deals, and faster delivery options.

Partnerships with influencers could be valuable for generating excitement and reaching target demographics.

Comparative Analysis of Walmart and Amazon’s Holiday Toy Marketing

A comparative analysis reveals that Walmart’s traditional marketing channels can still be effective but need to be supplemented with online capabilities. Amazon’s strengths lie in its comprehensive online ecosystem, personalized recommendations, and seamless delivery. Walmart can leverage its extensive physical network to complement online offerings, building a more integrated and appealing customer experience. This hybrid approach is crucial for maintaining competitiveness.

Marketing Channels for Walmart During the Holiday Rush

Walmart can leverage various marketing channels to maximize holiday toy sales. A comprehensive approach is necessary to reach a wide audience.

| Marketing Channel | Description | Potential Strategies |

|---|---|---|

| Television Commercials | Traditional broadcast advertising | Highlighting exclusive deals, new releases, or popular toy lines. |

| Print Advertising | Newspaper and magazine ads | Targeting specific demographics with localized ads or holiday-themed inserts. |

| Radio Ads | Local and national radio advertising | Using catchy jingles and short, compelling messages. |

| Social Media Marketing | Leveraging platforms like Facebook, Instagram, and TikTok | Creating engaging content, running contests, and targeted ads. |

| Email Marketing | Direct marketing via email | Promoting exclusive offers and holiday-themed content. |

| In-Store Promotions | In-store displays and demonstrations | Highlighting bestsellers and creating an engaging shopping experience. |

| Website and App Promotions | Targeted online offers and personalized product recommendations | Leveraging online tools for product discovery and purchase. |

Outcome Summary

Walmart’s aggressive targeting of Amazon’s Etoys during the holiday rush signifies a significant shift in the online retail landscape. The competition between these two giants is intense, with both companies employing diverse strategies to capture the holiday shopping market. The outcome will depend on consumer preferences, supply chain efficiency, and the effectiveness of each company’s marketing campaigns. This analysis provides a comprehensive overview of the forces at play, offering insights into the potential impact on the toy market and beyond.

The holiday rush is upon us, and the outcome remains to be seen.