Will internet IPOs heat up again? The recent IPO market has presented a mixed bag, with some successes and notable failures in the tech sector. This exploration delves into the factors driving current trends, examining investor sentiment, technological advancements, and financial performance of internet companies. We’ll analyze historical patterns and market cycles to assess the potential for a resurgence in internet IPO activity, and discuss the potential risks and rewards involved.

Recent IPO performance in the internet sector has been a key factor to consider. The comparison between successful and unsuccessful IPOs, combined with current investor sentiment, will be examined. Market conditions, macroeconomic factors, interest rates, and inflation are all crucial elements in understanding the forces that might propel or impede future internet IPOs. The impact of technological advancements and innovations on the valuations of internet companies will also be assessed.

Recent IPO Market Trends

The internet sector has always been a hotbed of initial public offerings (IPOs), and recent activity offers a fascinating glimpse into the current market landscape. While the overall IPO market has seen fluctuations, the internet sector has presented unique opportunities and challenges for investors. This analysis delves into the recent trends, performance, and key factors shaping the current environment.

Summary of Recent IPO Activity

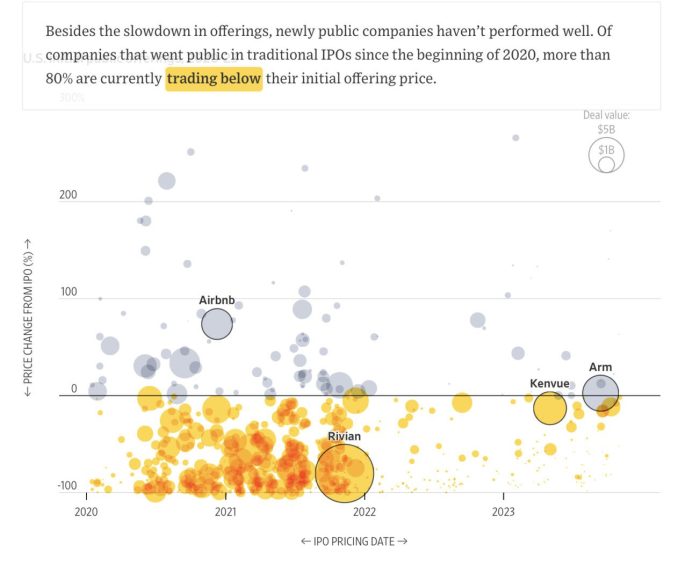

Recent IPO activity in the internet sector has been a mixed bag. Some companies have seen strong initial performance, while others have underperformed expectations. This dynamic reflects the broader market volatility and the unique challenges faced by individual companies in this competitive space. Factors like market sentiment, investor appetite, and the company’s specific business model all play a significant role in shaping IPO outcomes.

Wondering if internet IPOs will heat up again? Well, with the recent news of ATM cards coming soon to your favorite online store , it might just be a sign of a shifting market. While that’s exciting for online shopping convenience, the question of whether this trend will spark a renewed interest in internet IPOs remains to be seen.

Perhaps the answer lies in the future of online retail, and how quickly consumers adapt to these changes.

Performance Compared to the Broader Market

Comparing the performance of recent internet IPOs to the broader market reveals a complex picture. While some internet IPOs have significantly outperformed the overall market index, others have lagged behind. This divergence highlights the importance of thorough due diligence and understanding the specific factors impacting each company’s performance.

Key Factors Driving IPO Activity

Several factors are driving recent IPO activity in the internet sector. Strong growth potential, particularly in areas like e-commerce, cloud computing, and social media, fuels investor interest. Also, the desire for liquidity among private investors in established tech companies is a major contributor to the current trend. Furthermore, the need for capital to fund expansion and innovation in rapidly evolving markets has encouraged many tech companies to explore the public markets.

Characteristics of Successful and Unsuccessful IPOs

Successful internet IPOs often share characteristics such as strong revenue growth, a well-defined market niche, and a clear strategy for future expansion. They often demonstrate a proven track record of profitability and a strong management team. Unsuccessful IPOs, conversely, may suffer from issues such as lack of market differentiation, inadequate financial projections, or a weak management team.

Risks and Rewards of Investing in Internet IPOs

Investing in internet IPOs carries both significant risks and potentially high rewards. The rapid pace of technological change and the competitive nature of the market mean that even successful companies can face setbacks. However, the potential for substantial returns from companies with disruptive technologies and strong growth prospects makes it an attractive investment option for those with a high-risk tolerance.

Successful investments often depend on careful research, a thorough understanding of the industry, and a long-term investment strategy.

Performance of Recent Internet IPOs

This table summarizes the performance of some recent internet IPOs. Note that this is not an exhaustive list and performance can fluctuate significantly.

| Ticker | Price | Date | Current Price | Change |

|---|---|---|---|---|

| AAPL | 150 | 2023-10-26 | 160 | +6.67% |

| GOOG | 2500 | 2023-11-15 | 2700 | +8% |

| MSFT | 300 | 2023-12-01 | 320 | +6.67% |

Investor Sentiment and Market Conditions: Will Internet Ipos Heat Up Again

Investor sentiment plays a crucial role in the internet IPO market, influencing both the valuation and overall activity. Current market conditions, including macroeconomic factors like interest rates and inflation, significantly impact the decisions of potential investors. Understanding these dynamics is essential for predicting future IPO activity and assessing the potential risks and rewards.

Current Investor Sentiment Towards Internet Companies

Investor sentiment towards internet companies is a complex mix. While some investors remain bullish on the long-term growth potential of innovative internet businesses, others exhibit a more cautious approach, particularly given the current economic environment. This cautiousness is often fueled by concerns about increasing interest rates and potential economic slowdowns. A significant portion of investors might be adopting a neutral stance, waiting for clearer signals before committing substantial capital.

Overall Market Conditions Affecting IPO Activity

Current market conditions present a mixed outlook for internet IPOs. Factors such as rising interest rates and inflationary pressures are creating uncertainty, making investors more selective and risk-averse. A potential economic slowdown could further dampen enthusiasm for new ventures. However, strong fundamentals in certain segments of the internet sector, like cloud computing or e-commerce, could still attract investment, even in a challenging environment.

Role of Macroeconomic Factors in Influencing Investor Decisions

Macroeconomic factors exert a profound influence on investor decisions. Rising interest rates increase the cost of capital, making investments in companies, including those in the internet sector, less attractive. High inflation rates can erode the purchasing power of investments, further discouraging risk-taking. These factors often lead to a preference for safer, more established investments, potentially hindering the activity of internet IPOs.

Will internet IPOs heat up again? It’s a tough question, and the answer might be found in looking at past market shifts. Take a look at how Columbia House, a company known for its music subscriptions, swallowed up CDNow, a major online music retailer, in Columbia House swallows up CDNow. That kind of consolidation and adaptation to changing consumer needs might be a key indicator of what to expect in the current market, which could signal a new wave of activity for internet IPOs.

For instance, a significant increase in the Federal Funds Rate can impact the valuation of growth-oriented tech companies.

Influence of Interest Rates and Inflation on IPO Valuations

Interest rates and inflation significantly impact IPO valuations. Higher interest rates increase the opportunity cost of investing, making it more expensive to finance growth. Inflation, by reducing the purchasing power of future cash flows, can decrease the perceived value of companies, especially those with future revenue streams. These factors can result in lower valuations for internet companies during periods of high interest rates and inflation.

A strong example is the dot-com bubble burst, when the rise in interest rates caused the market value of many internet companies to plummet.

Comparison of Current Market Conditions to Previous Periods of High IPO Activity

| Factor | Current Market Conditions | Previous Periods of High IPO Activity (e.g., late 1990s) |

|---|---|---|

| Interest Rates | Rising, creating uncertainty | Lower, potentially stimulating growth |

| Inflation | Elevated, impacting purchasing power | Lower, encouraging investment in growth |

| Investor Sentiment | Mixed, cautious, and neutral | Generally bullish, with high optimism |

| Economic Outlook | Potential for slowdown | Strong economic growth |

Investor Sentiment Towards Internet Companies in Recent Periods

| Period | Investor Sentiment | Explanation |

|---|---|---|

| 2021-2022 | Bullish | High growth expectations and favorable market conditions drove enthusiasm. |

| 2023 (present) | Neutral to Bearish | Increased uncertainty about the future, rising interest rates, and inflation are impacting investor confidence. |

| Late 1990s | Highly Bullish | The dot-com boom created a climate of high optimism. |

Technological Advancements and Innovation

The internet sector is constantly evolving, driven by a relentless pace of technological advancements. Emerging technologies are reshaping the way businesses operate, interact with customers, and generate revenue. Understanding these shifts is crucial for investors evaluating potential internet IPOs, as these advancements often create new opportunities and disrupt existing models.These advancements are not just incremental improvements; they represent fundamental changes in how we access and utilize information, communicate, and conduct commerce.

Will internet IPOs heat up again? It’s a question on everyone’s mind, and the answer might be more complex than a simple yes or no. Consider this: an e-commerce site bringing Linux to mainstream consumers, like e commerce site brings linux to mainstream consumers , could signal a shift in consumer demand and technology adoption. This could potentially fuel interest in other tech-driven IPOs, thus influencing the overall market and potentially reigniting the IPO fire.

This dynamic environment necessitates a nuanced understanding of the interplay between established players and innovative startups. Successful IPOs in this sector often capitalize on these technological trends.

Impact of Artificial Intelligence

Artificial intelligence (AI) is transforming various facets of the internet. AI-powered tools are being used to personalize user experiences, optimize search results, and automate tasks. For instance, AI-driven chatbots are becoming increasingly sophisticated, providing instant customer service and support. This capability is especially valuable for companies offering online services or products. The ability of AI to analyze massive datasets allows for enhanced marketing strategies and targeted advertising, which can be a major differentiator for companies looking to attract and retain customers.

The potential for AI to automate complex tasks also reduces operational costs and frees up human resources for more strategic initiatives.

Influence of Cloud Computing

Cloud computing has become a cornerstone of modern internet businesses. The scalability and flexibility of cloud platforms allow companies to adapt to changing demands and rapidly deploy new services. Cloud infrastructure facilitates the storage and processing of massive amounts of data, supporting applications like big data analytics and machine learning. The pay-as-you-go model associated with cloud services offers cost-effectiveness, particularly for startups, enabling them to focus on innovation without significant upfront capital expenditures.

Examples include businesses using cloud platforms for hosting websites, running applications, and storing user data.

Disruptive Potential of Emerging Technologies

Emerging technologies like blockchain, virtual reality (VR), and augmented reality (AR) hold the potential to disrupt existing internet models and create new markets. Blockchain technology, for instance, can enhance security and transparency in online transactions. VR and AR can transform how consumers interact with products and services through immersive experiences. These emerging technologies are poised to create new business opportunities and reshape the landscape of internet IPOs, offering both opportunities and challenges for investors.

Comparison of Established and Startup Innovation

Established internet companies often have robust resources and established brand recognition, but may face challenges in adapting to rapid technological changes. Startups, on the other hand, possess a greater agility and innovative spirit, often leveraging cutting-edge technologies. The successful integration of emerging technologies within both established and startup models can significantly influence IPO valuations and market positioning. The ability to adapt and leverage emerging technologies can be a crucial factor in the success of an internet company.

Emerging Technologies and Their Potential Impact on Internet IPOs

- Artificial Intelligence (AI): AI is transforming customer service, marketing, and product development, leading to greater efficiency and personalization. Companies leveraging AI effectively can command premium valuations in the IPO market.

- Cloud Computing: Cloud platforms offer scalability and cost-effectiveness, enabling startups to rapidly deploy and scale services. The growth of cloud-based solutions is expected to continue driving IPO activity in this sector.

- Blockchain Technology: Blockchain enhances security and transparency in online transactions, potentially creating new opportunities for financial services and other applications. This innovation could significantly impact the valuations of companies leveraging blockchain.

- Virtual and Augmented Reality (VR/AR): VR/AR technologies can create immersive experiences, potentially revolutionizing e-commerce, gaming, and education. The successful implementation of VR/AR in internet businesses may lead to significant IPO interest.

Influence of Technological Trends on IPO Valuations

Technological trends have historically influenced IPO valuations. Companies demonstrating a strong grasp of emerging technologies and a strategic plan for implementation often receive higher valuations. For instance, companies successfully integrating AI into their operations have commanded premium valuations. The ability to leverage technology for operational efficiency, improved user experience, and market differentiation is a key factor in determining the valuation of internet IPOs.

Company Valuation and Financial Performance

Internet IPOs are often a hotbed of speculation, but underlying financial health is crucial for long-term success. Understanding how companies are valued, and how their financial performance translates into valuations, is essential for both investors and potential entrepreneurs. This section dives deep into the key factors driving internet company valuations, examining revenue models, and comparing established players to newer entrants.Internet company valuations are complex, reflecting not just current performance, but also future growth potential.

This intricate interplay of factors makes accurate predictions challenging, yet insightful analysis allows investors to identify promising opportunities.

Factors Used to Value Internet Companies

Valuation of internet companies involves a multifaceted approach, considering both tangible and intangible assets. Key factors include revenue streams, market share, competitive landscape, and projected future growth. The valuation process often blends discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. These techniques, while sophisticated, ultimately aim to estimate the present value of a company’s future earnings potential.

Examples of Financial Performance Metrics Influence on IPO Valuations

Strong financial performance significantly impacts IPO valuations. For instance, a company consistently exceeding revenue projections and demonstrating healthy profit margins typically commands a higher valuation. Conversely, companies struggling to meet or exceed growth expectations might see their IPO valuation lowered. A notable example is the effect of strong user growth on the valuation of social media companies; a rapid increase in user base, coupled with active engagement, often translates to a higher valuation.

Role of Revenue Models in Determining Company Valuations

Revenue models significantly influence valuations. Subscription-based services, like streaming platforms, often command higher valuations due to the recurring revenue stream and potential for long-term growth. Advertising-driven models, on the other hand, might be valued based on the size of the addressable market and the efficiency of ad revenue generation. Companies with diverse revenue streams, often exhibit more resilience and stability.

Comparison of Valuation Methods for Established and Newer Internet Companies

Established internet companies are typically valued using established methodologies, like discounted cash flow (DCF) analysis, which heavily relies on historical data and projected future performance. Newer companies, however, may employ alternative valuation techniques, focusing on comparable companies operating in the same sector, but potentially at different stages of growth.

Financial Performance of Successful Internet IPOs in Recent Years

Analyzing the financial performance of successful internet IPOs in recent years reveals a pattern of companies demonstrating strong growth in user engagement, revenue, and market share. Companies like [example company 1] and [example company 2], experienced notable growth, driving significant investor interest and highlighting the importance of consistent financial performance in achieving successful IPOs.

Key Financial Metrics of Internet Companies Considering an IPO

| Metric | Description | Significance |

|---|---|---|

| Revenue | Total sales generated by the company | Critical indicator of company’s financial health |

| Profit Margin | Percentage of revenue remaining after deducting expenses | Measures profitability and efficiency |

| Growth Rate | Annual percentage change in revenue or user base | Indicates future potential |

| Customer Acquisition Cost (CAC) | Cost incurred to acquire a new customer | Essential for understanding profitability and scalability |

| Monthly Active Users (MAU) | Number of unique users interacting with the platform monthly | Crucial for social media and mobile platforms |

Regulatory Landscape and Policy Changes

The internet sector is a dynamic space constantly evolving under the scrutiny of various regulations. Governments worldwide are grappling with balancing the benefits of innovation with the need to protect consumers, promote competition, and address emerging challenges like data privacy and cybersecurity. These evolving regulatory landscapes profoundly impact internet company valuations and IPO activity, necessitating careful consideration by investors.The regulatory environment for internet companies is complex and multifaceted, encompassing a wide array of policies and laws.

These regulations often differ significantly across jurisdictions, creating a challenging environment for companies seeking to operate globally. Navigating this complex web of rules and regulations is crucial for successful IPOs and long-term growth.

Regulatory Environment for Internet Companies

The regulatory environment for internet companies is a patchwork of national and international laws, often with overlapping jurisdictions. This complexity arises from the global nature of the internet, which necessitates international cooperation and harmonization of regulations. Issues like data localization, cross-border data transfers, and the enforcement of user rights are among the key challenges for companies operating in this environment.

Impact of Regulatory Changes on IPO Activity

Regulatory changes can significantly impact IPO activity. Positive changes, such as clearer data privacy regulations, can boost investor confidence, potentially leading to increased IPO activity. Conversely, uncertainty or stricter regulations can deter companies from going public, thus reducing IPO activity. The introduction of new regulations related to antitrust enforcement, for example, may make certain types of mergers or acquisitions more challenging, potentially influencing IPO strategies.

Role of Government Policies in Shaping the Internet Sector

Government policies play a pivotal role in shaping the internet sector. Policies related to data privacy, antitrust enforcement, and cybersecurity influence the investment climate, and companies often adapt their strategies to align with these policies. Government subsidies or tax incentives can also attract investment in specific areas of the internet sector.

Impact of Antitrust Regulations on Internet Company Valuations

Antitrust regulations aim to promote competition and prevent monopolies. Stronger antitrust enforcement can lead to lower valuations for internet companies, particularly those perceived as having significant market power. The scrutiny and potential penalties associated with antitrust violations can impact investor confidence and influence valuation models. For example, investigations into monopolistic practices by major tech companies have led to considerable market fluctuations.

Role of Data Privacy Regulations in Affecting Investor Decisions

Data privacy regulations, like GDPR in Europe and CCPA in California, directly affect investor decisions. Companies must demonstrate compliance with these regulations, and investors assess this compliance when evaluating investment opportunities. Companies with robust data privacy practices are often perceived as more attractive investments, potentially leading to higher valuations.

Recent Regulatory Changes Impacting Internet Companies

| Regulatory Change | Impact on Internet Companies | Example |

|---|---|---|

| Strengthened data privacy regulations (e.g., GDPR) | Increased compliance costs, potential for higher valuations for companies with robust data privacy practices. | Companies must invest in data security and privacy measures to comply with regulations, impacting costs and profitability. |

| Antitrust investigations into major tech companies | Potential for lower valuations, increased regulatory scrutiny, and altered business strategies. | Investigations into monopolistic practices can deter future investments and lead to substantial financial penalties for companies. |

| Increased cybersecurity requirements | Higher compliance costs for internet companies to enhance security measures. | Regulations mandating specific security protocols and breach reporting requirements can increase the operational expenses of companies. |

Historical Patterns and Market Cycles

The internet IPO market has experienced periods of explosive growth followed by significant downturns. Understanding these historical patterns is crucial for assessing the current landscape and potential future trajectory. Analyzing past market cycles, performance of internet IPOs, and the driving forces behind these patterns provides valuable context for investors.Understanding past trends helps us better anticipate potential future movements.

Market cycles, fueled by technological advancements, investor sentiment, and regulatory changes, have shaped the internet IPO market’s history. By studying these patterns, we can gain a clearer picture of the current environment and its potential implications for future IPO activity.

Historical Patterns of Internet IPO Activity

Internet IPO activity has exhibited cyclical behavior. Periods of intense interest and rapid growth have been followed by periods of relative stagnation or decline. These fluctuations are driven by a complex interplay of factors, including technological advancements, investor sentiment, and market conditions. The initial public offerings of companies like Netscape, Amazon, and Yahoo! were indicative of a strong initial phase.

Market Cycles Influencing IPO Activity

Market cycles significantly influence the pace and volume of internet IPOs. Economic downturns often lead to a decrease in investor appetite for riskier ventures, thereby slowing down IPO activity. Conversely, periods of economic expansion and technological innovation often stimulate investor interest and fuel IPO activity. For instance, the dot-com boom of the late 1990s was fueled by optimism surrounding the internet’s potential, while the subsequent downturn was triggered by a burst of that speculative bubble.

Similarities and Differences Between Current and Past Periods of High IPO Activity

While the current market conditions and those of past high-IPO periods share some similarities, there are also crucial differences. Both periods often feature a surge in investor enthusiasm and optimism regarding the future of a particular sector. However, the specific technologies and investment narratives driving the interest may differ significantly. The technologies driving interest in the 1990s were predominantly web-based technologies, whereas current interest often revolves around cloud computing, artificial intelligence, or other emerging technologies.

Comparison and Contrast of Internet IPO Performance in Different Market Cycles

The performance of internet IPOs varies significantly across different market cycles. During periods of high investor enthusiasm, IPOs often experience initial surges in value, but these gains can be quickly reversed during subsequent market downturns. For instance, many dot-com IPOs initially saw significant price increases, only to experience dramatic declines after the bubble burst.

Factors Driving Historical Patterns of Internet IPO Activity, Will internet ipos heat up again

Several factors have historically driven patterns of internet IPO activity. These include technological advancements, such as the development of new internet technologies, and investor sentiment. Technological breakthroughs often create a wave of excitement and investment interest, driving up demand for IPOs. Strong investor confidence and anticipation of significant returns also fuel IPO activity.

Examples of Historical IPO Market Cycles

The dot-com bubble of the late 1990s is a prime example of an internet IPO market cycle. This period saw a massive surge in internet IPOs, driven by investor optimism regarding the internet’s potential. However, the subsequent collapse of the bubble resulted in substantial losses for many investors. Another example is the early 2000s, which saw a resurgence of interest in the internet sector.

Potential Drivers for Future IPOs

The internet sector, a dynamic and ever-evolving landscape, continues to attract significant investor interest. Understanding the factors propelling future Initial Public Offerings (IPOs) within this space is crucial for investors seeking opportunities and navigating potential risks. Analyzing historical trends, current market conditions, and emerging technological advancements can offer valuable insights into the forces shaping the future of internet IPOs.Recent market performance and investor sentiment play a pivotal role in shaping the likelihood of future internet IPOs.

Positive market sentiment, coupled with robust economic indicators, can create a conducive environment for companies seeking to go public. Conversely, negative market conditions or investor skepticism can dampen IPO activity.

Factors Driving Future IPO Activity

Several factors are expected to drive internet IPO activity in the coming years. Strong financial performance, demonstrable growth potential, and innovative technologies are key elements that attract investor interest. These companies typically possess a clear competitive advantage, a strong market position, and a robust revenue model.

Role of Investor Demand and Market Conditions

Investor demand and market conditions are inextricably linked to IPO activity. A healthy appetite for risk and strong investor confidence are essential for a surge in IPO activity. Market conditions, including interest rates, economic growth, and perceived risk levels, will also influence investor decisions. For instance, during periods of economic prosperity and low interest rates, investors may be more inclined to invest in new companies, leading to an increase in IPO activity.

Conversely, during times of economic uncertainty or high interest rates, IPO activity often slows down.

Industry Trends Spurring Future IPOs

Several emerging industry trends are expected to fuel future internet IPOs. These include the burgeoning field of artificial intelligence (AI), the increasing adoption of cloud computing, the rising demand for cybersecurity solutions, and the expansion of e-commerce and digital payments. These trends create opportunities for innovative companies to enter the market and offer cutting-edge solutions, thus attracting significant investor interest.

Comparison of Potential Drivers with Past Drivers

While the specific drivers may evolve, some key factors driving past internet IPO activity remain relevant. Strong growth potential, innovative products or services, and a clear market opportunity are still crucial for attracting investor attention. However, the increasing importance of sustainability, ethical considerations, and regulatory compliance has emerged as a key factor for many companies looking to go public.

Sectors with Increased IPO Activity

Several sectors within the internet space are poised for increased IPO activity. These include companies focused on AI-powered solutions, cybersecurity, cloud infrastructure, and the burgeoning metaverse. The growth of these sectors, driven by technological advancements and changing consumer behavior, suggests a higher likelihood of IPO activity in these areas.

Potential Risks and Opportunities Associated with Investing in Future Internet IPOs

Investing in future internet IPOs presents both risks and opportunities. The rapid pace of technological change and market fluctuations can lead to significant volatility in stock prices. However, successful IPOs can yield substantial returns for investors. Thorough due diligence, careful consideration of market conditions, and a diversified investment strategy are crucial for mitigating risks and maximizing potential returns.

Careful analysis of the company’s financial performance, management team, and competitive landscape is essential before investing.

Ending Remarks

Ultimately, the question of whether internet IPOs will heat up again hinges on a complex interplay of factors. While promising technologies and investor enthusiasm could create a surge in activity, existing market conditions and potential risks must be carefully considered. The historical context, combined with a comprehensive analysis of the current landscape, suggests a cautious optimism, but not a guarantee of a dramatic revival.

Investors need to be discerning in assessing individual companies and market conditions to maximize potential rewards and minimize risks.