Internet companies band together to battle fraud, creating a powerful front against the rising tide of online scams and phishing attempts. This collaborative effort promises to dramatically impact the fight against fraud, combining individual strategies with shared resources and data to achieve greater effectiveness.

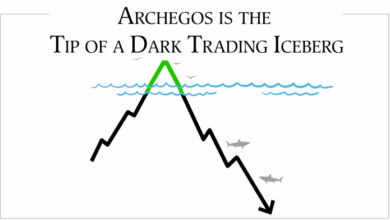

The increasing sophistication of fraudsters necessitates a collective response from internet companies. From sophisticated phishing campaigns to malware infestations, the damage to both finances and reputation is significant. Previous, isolated efforts have had varying success, highlighting the need for a coordinated approach to this evolving threat.

Introduction to the Issue

The digital landscape is increasingly vulnerable to sophisticated fraud schemes. Internet companies, from e-commerce platforms to social media giants, are constantly under attack from a multitude of fraudulent activities. These attacks range from simple phishing attempts to complex malware deployments, causing significant financial and reputational damage. The sheer volume and sophistication of these attacks demand a coordinated and proactive approach to prevention and response.The rise of online services has coincided with a corresponding increase in the tactics used by fraudsters.

Phishing, social engineering, malware deployment, and account takeovers are just a few of the methods used to steal sensitive information and financial assets. These methods often target users with compelling yet deceptive messages, exploiting human psychology to gain access to accounts and systems.

Types of Internet Fraud

Fraudulent activities targeting internet companies encompass a wide spectrum of malicious intent. Phishing attacks, which trick users into revealing personal information, are a common tactic. Scams, ranging from fake investment opportunities to fake support services, also exploit vulnerabilities in online systems. Malware, including viruses and ransomware, infiltrates systems to steal data, disrupt operations, or extort money.

Internet companies are stepping up their efforts to combat online fraud, recognizing the critical need for robust security measures. However, the ongoing debate about internet taxation, as highlighted in the recent Ernst Young report on ernst young internet taxation can wait , seems to be putting a hold on any significant progress. Ultimately, these companies need to focus on the real-world threat of fraud and find effective solutions to protect consumers and maintain trust in the digital space.

Financial and Reputational Damage

The impact of fraud on internet companies can be devastating. Financial losses stemming from fraudulent transactions, data breaches, and compromised accounts can severely impact profitability and sustainability. Furthermore, reputational damage from these incidents can lead to a loss of customer trust and brand loyalty, impacting future revenue and market share. Cases of large-scale data breaches, like those involving credit card information, have resulted in significant financial penalties and reputational damage for companies.

Internet companies are increasingly joining forces to combat online fraud, a critical issue for the booming sector. This collaborative effort is crucial, especially as Asian e-commerce is poised for significant growth, with Asian e-commerce set to go in a big way. Stronger security measures will be essential for maintaining trust and fostering further expansion in this lucrative market.

This collective approach will hopefully ensure a safer online shopping experience for everyone.

Past Attempts at Combating Fraud

Several attempts have been made to combat fraud targeting internet companies. Some initiatives, like enhanced security protocols and improved user authentication systems, have shown positive results in reducing fraud incidents. However, these efforts are often reactive, responding to existing threats rather than proactively anticipating new and evolving tactics. Some efforts have focused on educating users about fraud schemes, though this approach alone is often insufficient.

Less successful attempts have relied on reactive measures, leading to inadequate prevention strategies.

Examples of Fraudulent Activities

| Type of Fraud | Affected Industry | Approximate Financial Impact (USD) |

|---|---|---|

| Phishing | Online Banking | Millions |

| Malware | E-commerce | Hundreds of thousands |

| Account Takeover | Social Media | Tens of thousands |

| Fake Investment Scams | Financial Services | Millions to Billions |

Note: Financial impacts are estimates and may vary significantly depending on the specific incident.

Collaborative Strategies

Combating online fraud requires a multifaceted approach, moving beyond individual company efforts to a collective strategy. Internet companies currently employ a variety of techniques to detect and prevent fraudulent activities, but the limitations of these individual strategies highlight the need for collaboration. A unified front, sharing resources and data, can dramatically improve fraud detection and prevention, leading to a safer online environment for everyone.Individual companies employ a range of methods to combat fraud, each with inherent advantages and disadvantages.

Internet companies are increasingly uniting against fraud, recognizing the need for a unified front. This collaborative effort is crucial, particularly in the face of increasingly sophisticated scams. The rise of sophisticated fraud tactics requires a comprehensive approach, like the innovative network solutions being developed, for example, the network solutions death star that are proving successful in detecting and preventing malicious activity.

Ultimately, these combined efforts by internet companies are key to creating a safer online environment for everyone.

Individual Fraud Prevention Methods

Various individual strategies are used by internet companies to combat fraudulent activities. These range from advanced algorithms to stringent verification processes. Each approach has its own strengths and weaknesses. Some companies focus on sophisticated machine learning models to identify anomalies in user behavior, while others prioritize stringent account verification processes and multi-factor authentication. However, these methods can be resource-intensive and may not be equally effective across all platforms or user bases.

- Behavioral Analysis: Sophisticated algorithms analyze user behavior patterns to identify unusual activity that could indicate fraudulent intent. This approach, however, can be computationally expensive and may flag legitimate actions as suspicious, leading to false positives.

- Account Verification: Stringent account verification processes, including identity checks and multi-factor authentication, aim to minimize the risk of unauthorized access. This approach can be effective, but it can be cumbersome for legitimate users and may not deter sophisticated fraudsters.

- Transaction Monitoring: Real-time monitoring of transactions can help detect suspicious activity. This can be particularly effective in high-value transactions, but may not be as effective in identifying more subtle fraudulent schemes.

Benefits of Collaboration

Collaboration among internet companies offers significant advantages in the fight against fraud. By pooling resources and sharing data, companies can create a more comprehensive and effective fraud detection system. This approach allows for the identification of patterns and trends that might be missed by individual companies. Sharing data and resources can lead to a more rapid response to emerging fraud threats.

Examples of Successful Collaborations

Successful collaborations in other industries demonstrate the effectiveness of shared resources in combating fraud. Cybersecurity alliances, for example, have proven successful in identifying and responding to evolving cyber threats. These alliances share threat intelligence, develop joint security protocols, and coordinate responses to major attacks. The benefits are clear: a more unified and robust approach to combating the ever-evolving threat landscape.

Data Sharing and Resource Pooling

Sharing data and resources across internet companies can significantly improve fraud detection and prevention. A centralized database of known fraud patterns and tactics can enable faster identification and response. This collaborative approach allows for the development of more sophisticated algorithms and models, increasing the effectiveness of fraud detection systems.

Comparison of Individual vs. Collaborative Strategies

| Feature | Individual Strategy | Collaborative Strategy |

|---|---|---|

| Effectiveness | Variable, dependent on the specific method and its implementation. | Potentially higher, leveraging combined data and expertise. |

| Cost | Can be high for implementing sophisticated systems. | Potentially lower through shared costs and resources. |

| Speed | Dependent on the company’s internal processes and infrastructure. | Potentially faster due to the combined effort and wider access to information. |

Data Sharing and Information Exchange

Pooling resources and knowledge is crucial for effective fraud detection in the digital age. Sharing data across internet companies provides a more comprehensive view of fraudulent activities, enabling faster identification and response. This collective approach allows for the development of more sophisticated detection algorithms and predictive models, ultimately leading to a stronger defense against fraud.Sharing data isn’t just about identifying patterns; it’s about proactive measures.

By collaborating on information exchange, companies can preemptively address potential vulnerabilities and prevent fraud before it occurs. A coordinated response creates a powerful shield against malicious actors operating across multiple platforms.

Importance of Data Sharing

Data sharing is essential for enhancing fraud detection capabilities. A centralized repository of information across various platforms allows for the identification of patterns and anomalies that individual companies might miss. This holistic view enables the creation of more robust algorithms for identifying and predicting fraudulent behavior. For example, a retailer might not recognize a specific fraudulent transaction pattern on its own, but when combined with data from other e-commerce platforms, the pattern becomes strikingly evident.

Challenges of Data Sharing

Data sharing, while beneficial, presents significant challenges. Privacy concerns are paramount. The sensitive nature of user data necessitates robust security measures to protect individual information. Data breaches and misuse of confidential information can have severe repercussions, impacting both companies and users.Security risks are another critical concern. Data exchanged between companies must be protected from unauthorized access and manipulation.

Ensuring the integrity and confidentiality of shared information is paramount. The security protocols must be rigorous and regularly audited to maintain a high level of protection.

Secure Information Exchange Methods

Establishing secure channels for data exchange is critical. These methods should employ encryption to protect sensitive information during transmission and storage. Secure protocols, such as Transport Layer Security (TLS), are vital for establishing encrypted connections. Federated learning techniques, where models are trained on decentralized data without transferring the raw data, offer a promising approach to preserving privacy while enabling joint analysis.

Moreover, anonymization techniques can be employed to mask sensitive identifying information, while still allowing for valuable insights to be drawn.

Examples of Successful Data-Sharing Initiatives

Several successful data-sharing initiatives have emerged within the internet industry. For instance, credit card companies often share transaction data to identify and prevent fraudulent charges. Similarly, online payment platforms collaborate to flag suspicious activity, reducing the likelihood of successful fraud attempts. The collaboration between various financial institutions demonstrates the effectiveness of shared data in combating fraud.

Data Exchange Protocols

| Protocol | Security Features | Privacy Considerations | Suitability |

|---|---|---|---|

| Secure Sockets Layer (SSL) | Encryption, authentication | Basic privacy protection | Suitable for basic data exchange |

| Transport Layer Security (TLS) | Strong encryption, authentication, integrity checks | Robust privacy protection | Ideal for sensitive data exchange |

| Zero-Knowledge Proofs | Verifiable computations without revealing data | High privacy protection | Suitable for data-sharing scenarios where privacy is paramount |

| Homomorphic Encryption | Encrypted data can be processed without decryption | High privacy protection | Suitable for complex data analysis while maintaining privacy |

Data exchange protocols need to be carefully chosen based on the sensitivity of the data being shared.

Standardized Protocols and Procedures

The fight against online fraud demands a unified front. Without standardized protocols, reporting and response to fraudulent activities remain fragmented and inefficient. This lack of consistency hampers collaboration and ultimately, hinders the effectiveness of anti-fraud efforts. Standardized procedures are crucial for a cohesive and rapid response.Consistent processes are vital for efficient coordination. When different companies use the same reporting methods and follow the same steps to investigate and resolve fraudulent activities, the process becomes smoother and more effective.

This shared understanding streamlines information flow, allowing for quicker identification and mitigation of fraudulent schemes.

Importance of Standardized Reporting Protocols

Standardized protocols for reporting fraudulent activities are essential for effective collaboration. Clear, consistent reporting methods ensure that all parties receive the same information, minimizing confusion and facilitating faster investigation and resolution. This leads to a more unified response and, ultimately, a greater likelihood of success in combating fraud. A standardized approach minimizes discrepancies in interpretation, allowing for a more objective assessment of each reported incident.

Consistent Processes for Improved Efficiency and Coordination

Consistent processes are crucial for improving efficiency and coordination. When different companies use the same reporting methods, investigation protocols, and response mechanisms, the process becomes more streamlined and efficient. This reduces redundancies, minimizes delays, and enables a more rapid response to fraudulent activities. This unified approach allows companies to leverage each other’s expertise and resources, ultimately improving the effectiveness of anti-fraud efforts.

Obstacles to Implementing Standardized Procedures

Several obstacles hinder the implementation of standardized fraud reporting and response procedures. These include differing technological infrastructure, varying levels of internal expertise, and concerns over data security and privacy. Cultural differences in how companies handle complaints and the lack of trust between organizations can also present significant hurdles. Furthermore, existing internal procedures and workflows may need to be adapted to align with new standards, leading to resistance to change.

Examples of Existing Standards in Related Industries

The financial services industry has established standards for reporting and responding to fraud. The Payment Card Industry Data Security Standard (PCI DSS) provides a framework for secure handling of payment card information, and the use of standardized transaction monitoring systems is also common. These examples demonstrate the value of standardized protocols in enhancing security and efficiency.

Role of Industry Associations in Developing and Enforcing Protocols

Industry associations play a crucial role in developing and enforcing standardized protocols. They can facilitate discussions and collaborations between companies, establish best practices, and create guidelines for reporting and responding to fraud. Associations can also provide training and resources to help companies implement standardized procedures, thereby contributing to a more unified approach to combating fraud. The development of these protocols involves experts in fraud detection and prevention, fostering a collective effort to protect businesses and consumers.

Table: Examples of Fraud, Reporting, and Response Protocols

| Type of Fraud | Suggested Reporting Procedure | Corresponding Response Protocol |

|---|---|---|

| Phishing | Submit a detailed report via a designated online portal, including screenshots of the phishing email or website, user account information, and any financial losses. | Immediately block the suspicious emails and websites. Inform affected users about the incident and provide security awareness training. Investigate the source of the phishing campaign. |

| Unauthorized Account Access | Submit a report to the designated security team within 24 hours, providing details about the compromised account, suspicious activity, and any financial losses. | Immediately freeze the affected accounts. Change passwords, and implement multi-factor authentication. Monitor for further suspicious activity. |

| Payment Card Fraud | Submit a detailed report to the payment processor, including transaction details, cardholder information, and evidence of fraud. | Immediately dispute the fraudulent transactions with the payment processor. Issue a new payment card to the affected user and provide security awareness training. |

Enhanced Security Measures

Protecting online platforms from fraud requires a proactive and multifaceted approach. Simply relying on reactive measures is insufficient in today’s sophisticated digital landscape. Internet companies must implement robust security protocols and continuously adapt to emerging threats. This includes integrating advanced technologies, sharing intelligence, and fostering a culture of vigilance.A multi-layered security strategy is crucial for mitigating fraud risks effectively.

No single solution can guarantee complete protection; rather, a combination of approaches is necessary to create a formidable defense against fraudulent activities. This involves not only technical safeguards but also robust policies and procedures.

Implementation of Enhanced Security Measures Across Internet Companies

Internet companies must implement a comprehensive security strategy encompassing various layers, from network infrastructure to user authentication. This proactive approach necessitates regular security audits, penetration testing, and the development of incident response plans. These measures will help identify and address vulnerabilities before fraudsters exploit them. Continuous monitoring and evaluation of security measures are also vital for maintaining effectiveness in the face of evolving threats.

Need for a Multi-Layered Approach to Security, Internet companies band together to battle fraud

A multi-layered security approach is essential for effective fraud prevention. This strategy involves implementing a combination of technical, procedural, and organizational safeguards. Technical measures include encryption, firewalls, and intrusion detection systems. Procedural measures encompass strong passwords, two-factor authentication, and regular security awareness training for employees. Organizational measures focus on establishing clear fraud prevention policies and procedures, as well as internal controls to prevent collusion or negligence.

These measures, when combined, create a more resilient and secure platform.

Integration of Advanced Technologies for Fraud Prevention

Advanced technologies are essential for detecting and preventing fraudulent activities. This includes machine learning algorithms capable of identifying patterns and anomalies in user behavior. Sophisticated data analytics tools can pinpoint suspicious transactions and alert security teams in real-time. Integrating these technologies allows for more proactive and intelligent fraud prevention, enabling faster response times and minimizing financial losses.

Comparison and Contrast of Advanced Security Techniques

Various advanced security techniques are available for fraud prevention, each with its strengths and weaknesses. Biometric authentication, for example, leverages unique physical characteristics for identification, increasing security against account takeovers. Behavioral biometrics analyzes user patterns to identify anomalies in login times and locations, which can flag suspicious activity. While both methods are effective, their implementation and maintenance costs vary.

The choice of technique depends on the specific needs and resources of the internet company.

Role of Artificial Intelligence and Machine Learning in Fraud Detection

Artificial intelligence (AI) and machine learning (ML) play a critical role in fraud detection. AI algorithms can analyze vast datasets of transactions, identifying subtle patterns and anomalies that might be missed by human analysts. ML models can be trained to recognize fraudulent behavior based on historical data, improving detection accuracy over time. These technologies enable real-time fraud detection, significantly reducing the impact of fraudulent activities.

Different Security Measures, Effectiveness, and Associated Costs

| Security Measure | Effectiveness | Associated Costs |

|---|---|---|

| Two-Factor Authentication | High | Moderate |

| Advanced Data Analytics | High | High |

| Biometric Authentication | Very High | High |

| Machine Learning Models | Very High | High |

| Regular Security Audits | Moderate | Moderate |

Note: Effectiveness ratings are subjective and can vary based on implementation and maintenance. Cost estimations are general and can differ based on specific solutions and deployment scales.

Impact and Future Outlook

The burgeoning collaboration among internet companies to combat fraud represents a significant step forward in online security. This unified approach promises to reshape the fraud landscape, potentially leading to a dramatic reduction in illicit activities and a substantial improvement in the overall online experience for consumers. The long-term implications are profound, with the potential to redefine how businesses operate and how consumers interact with the digital world.The combined efforts of these companies, leveraging their collective resources and expertise, can significantly reduce the prevalence of various fraudulent activities.

This collaborative approach fosters a more robust and secure digital ecosystem, making it increasingly difficult for fraudsters to operate effectively. Furthermore, the potential for a substantial reduction in fraud incidents translates directly into tangible economic benefits for all involved parties.

Potential Impact on the Fraud Landscape

The unified approach to fraud prevention, with shared intelligence and standardized protocols, will create a more challenging environment for fraudsters. This collaborative effort, pooling resources and expertise, can potentially disrupt established fraud networks and deter future attempts. The increased vigilance and proactive measures will make it more difficult for fraudsters to exploit vulnerabilities in individual systems.

Long-Term Implications of Collaboration

This collaborative approach has the potential to reshape the entire online ecosystem. By sharing information and best practices, companies can anticipate and mitigate emerging fraud threats. This collaborative approach can help establish industry-wide standards for fraud prevention, potentially influencing future regulations and policies. This will ultimately foster a more secure and trustworthy online environment for businesses and consumers alike.

Potential for Significant Fraud Reduction

The combined resources and intelligence of these companies, through information sharing and advanced security measures, will create a much stronger barrier against fraud. This unified approach, including the development and implementation of standardized protocols, will help identify and mitigate fraudulent activities in real-time, potentially reducing fraud incidents by a significant percentage. Real-world examples of successful collaborative efforts in other sectors demonstrate the effectiveness of such partnerships.

Projected Economic Benefits

The reduction in fraud incidents directly translates into significant economic benefits for all stakeholders. Reduced losses due to fraudulent activities will positively impact the profitability of participating companies. Furthermore, this collaboration will likely reduce the costs associated with fraud investigations and recovery. This cost reduction is a tangible benefit for both individual businesses and the broader economy.

Impact on Customer Trust and Satisfaction

A more secure online environment, achieved through this collaborative effort, will directly enhance customer trust and satisfaction. Customers will experience a more reliable and trustworthy digital experience, fostering greater confidence in online transactions. This improved customer experience, built on a foundation of security and reliability, can potentially drive customer loyalty and positive brand perception.

Fraud Reduction Scenarios

| Collaborative Effort | Potential Fraud Reduction (%) | Description |

|---|---|---|

| Information Sharing (real-time) | 25-35 | Immediate identification and blocking of suspicious transactions. |

| Standardized Protocols | 10-20 | Minimizing variations in security protocols across platforms. |

| Enhanced Security Measures (across platforms) | 15-25 | Unified, stronger security posture across all participating companies. |

| Comprehensive Data Analysis | 5-10 | Identifying emerging fraud patterns and proactively implementing mitigation strategies. |

| Joint Threat Intelligence | 10-15 | Predictive modeling and proactive prevention of sophisticated attacks. |

Conclusion: Internet Companies Band Together To Battle Fraud

The potential for a significant reduction in fraud incidents, coupled with enhanced security measures and standardized protocols, is a testament to the power of collaboration. This collective approach to fraud prevention promises to safeguard consumers, bolster the integrity of the online ecosystem, and potentially yield significant economic benefits for all involved. The future of online security depends on this united front.