Cybercash finds some for itself. This exploration delves into the fascinating journey of digital currencies, examining their evolution, challenges, and eventual successes in carving out a space for themselves within the financial landscape. We’ll uncover the diverse types of cybercash systems, trace their historical development, and analyze the factors contributing to their adoption in specific markets. From pioneering milestones to the strategies employed for independent growth, this deep dive will illuminate the story of cybercash’s rise.

The journey of cybercash, from its early conceptualization to its present-day applications, reveals a complex interplay of technological innovation, societal impact, and market forces. Understanding these intricacies is crucial for grasping the potential of cybercash in shaping the future of finance.

Defining Cybercash

Cybercash, a digital form of money, represents a fascinating intersection of finance and technology. It’s not simply an electronic version of physical currency; it’s a complex system with distinct characteristics and potential applications. This exploration delves into the different types of cybercash, its historical evolution, the underlying technology, and a comparative analysis of various protocols.Cybercash transcends the limitations of traditional banking systems, offering potential benefits like reduced transaction costs and increased accessibility.

However, it also presents challenges related to security, regulatory frameworks, and widespread adoption. Understanding its intricacies is crucial for appreciating its role in the future of finance.

Types of Cybercash Systems

Different types of cybercash systems cater to various needs and applications. Some systems are designed for micropayments, while others aim for large-scale transactions. The choice of system depends on factors like transaction volume, security requirements, and regulatory environment.

- Micropayment Systems: These systems are specifically designed for handling small-value transactions, such as online content access or digital goods. Examples include systems used for online gaming or downloading digital music. These systems often prioritize speed and efficiency over security measures, as the small value of individual transactions makes the security risks relatively manageable.

- General-Purpose Systems: These systems aim to facilitate a wider range of transactions, encompassing both small and large values. They often adopt robust security protocols to protect against fraud and malicious activity. This broader applicability necessitates a more comprehensive security infrastructure and compliance with regulations.

Historical Overview of Cybercash

The concept of digital money has existed for decades, but the term “cybercash” gained prominence in the 1990s. Early attempts at creating digital currencies faced challenges in adoption and security, but they laid the groundwork for future developments.The emergence of the internet and advancements in cryptography played a critical role in enabling the creation of more secure and reliable cybercash systems.

The early 1990s saw the rise of pioneering cybercash systems, which, despite their eventual limitations, contributed significantly to the development of digital payment methods.

Technological Underpinnings of Cybercash

The technological foundation of cybercash systems is built on several key components. These include cryptography for secure transactions, digital signatures for authentication, and protocols for managing transactions and balances.

Cryptographic algorithms, like RSA and ECC, are essential for securing transactions and preventing fraud. Digital signatures provide authentication and ensure the integrity of transactions. Secure protocols, like SSL/TLS, safeguard data during transmission.

These underlying technologies enable the secure and efficient exchange of digital value.

Comparison of Cybercash Protocols

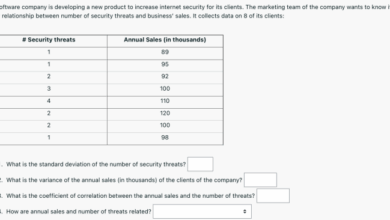

A comparative analysis of different cybercash protocols reveals varying approaches to security, scalability, and transaction speed. This table summarizes some of the key differences.

| Protocol | Security | Scalability | Transaction Speed | Use Cases |

|---|---|---|---|---|

| DigiCash | Strong | Limited | Moderate | Early online transactions |

| eCash | Strong | Moderate | High | Early online transactions, micropayments |

| Bitcoin | Strong (decentralized) | High | Variable | Decentralized digital currency |

This table provides a simplified overview; the complexities of each protocol are multifaceted. Each protocol has strengths and weaknesses that make it suitable for specific use cases.

Cybercash Discovery

Cybercash, the digital equivalent of physical cash, has a fascinating history marked by both innovative breakthroughs and significant hurdles. From early conceptualizations to the present day, its development has been shaped by technological advancements, economic realities, and societal shifts. This exploration delves into the key milestones, challenges, and societal impact of this evolving digital currency.Early attempts to create cybercash reflected the nascent stages of computer networking and cryptography.

These early experiments often laid the groundwork for future innovations but faced limitations inherent in the technology of the time.

Key Milestones in Cybercash Development

The evolution of cybercash is a complex tapestry woven from various threads of technological advancement. Early conceptualizations were often theoretical, with practical implementations emerging gradually. This section details the key stages in the journey of cybercash.

- Early 1980s: Prototypes and theoretical models began to emerge, exploring the potential of digital currencies. Researchers envisioned systems for secure digital transactions, but the technology to support them was still in its infancy.

- Late 1980s to early 1990s: Development of cryptographic techniques, essential for securing digital transactions, gained momentum. This period saw the conceptualization of digital signatures and encryption protocols, laying the foundation for secure digital payment systems.

- Mid-1990s: The emergence of the internet and the increasing availability of personal computers created a fertile ground for cybercash. This period saw the development of several early cybercash systems, each with its own strengths and weaknesses. Some of these systems attempted to build upon the theoretical frameworks from earlier years, aiming for practical implementation.

- Late 1990s to early 2000s: Several notable cybercash ventures were launched, introducing innovative approaches to digital payment. These projects often struggled with scaling issues, user adoption challenges, and regulatory uncertainty. This era saw a mix of successes and failures, highlighting the complexities of bringing cybercash into mainstream use.

- 2000s and beyond: The rise of e-commerce and mobile payments further fueled the evolution of cybercash. While a single, universally adopted cybercash system hasn’t materialized, the foundations for future development have been significantly strengthened. This period has seen cybercash incorporated into various payment ecosystems, showing its growing role in the digital economy.

Challenges Faced by Early Cybercash Ventures

The journey of cybercash was not without its obstacles. Several challenges hindered the widespread adoption of these early digital payment systems.

- Security Concerns: Ensuring the security of transactions and preventing fraud was a critical concern. Early systems often lacked robust security protocols, making them vulnerable to hacking and other cyber threats.

- Scalability Issues: Many early cybercash systems struggled to handle a large volume of transactions efficiently. This scalability problem often limited their potential reach and hindered their widespread adoption.

- User Adoption: Educating users about the new technology and persuading them to adopt a new payment system was a major challenge. The lack of widespread familiarity with cybercash hindered its acceptance.

- Regulatory Uncertainty: The regulatory environment surrounding cybercash was often unclear and inconsistent. This lack of regulatory clarity created uncertainty for businesses and users, hindering the growth of the market.

Societal Impact of Cybercash Emergence

The emergence of cybercash has had a profound impact on society, affecting various aspects of daily life and economic activities.

Cybercash is finally seeing some positive traction, which is great news. Meanwhile, the tech world is buzzing about Turbolinux beginning its US market debut, a significant development for the Linux community. Turbolinux begins u s market debut is likely to impact various sectors, potentially creating new opportunities for cybercash in the long run. This suggests a promising future for both developments, ultimately benefitting the overall digital landscape.

- Enhanced Efficiency: Cybercash has streamlined financial transactions, allowing for faster and more efficient payments, compared to traditional methods.

- Increased Accessibility: Digital payment systems have made financial services more accessible to people in remote areas or those with limited access to traditional banking.

- Economic Growth: The ability to conduct transactions quickly and securely has spurred economic growth, especially in e-commerce and online services.

Timeline of Key Cybercash Events

| Year | Event |

|---|---|

| 1983 | Early concepts of digital money emerge. |

| 1990 | Development of cryptographic techniques accelerates. |

| 1995 | Internet boom; several cybercash ventures launch. |

| 2000 | Challenges in scalability and user adoption become evident. |

| 2010 | Cybercash integrates into e-commerce and mobile payment systems. |

Cybercash’s Self-Discovery

Cybercash, a revolutionary form of digital currency, is not static. Its evolution and adoption within various markets are driven by its inherent ability to adapt and find its own niche. This self-discovery process is not a passive one, but rather a dynamic interaction between the currency’s inherent properties and the needs of specific communities. It’s a fascinating exploration of how technology can organically respond to real-world challenges.Cybercash’s self-discovery involves several key mechanisms, including market analysis, community engagement, and strategic partnerships.

This exploration hinges on identifying areas where its unique features, such as its decentralized nature or its speed of transaction, provide a clear advantage over existing solutions. This active adaptation, often unseen by the casual observer, is a crucial element of cybercash’s ongoing development.

Examples of Cybercash’s Market Penetration

Cybercash has demonstrated a remarkable ability to identify and capitalize on specific market needs. For instance, in the realm of micro-transactions, its low transaction fees and speed have proven highly attractive to freelance artists and independent creators. In developing nations, its accessibility, often without requiring traditional banking systems, has empowered individuals previously excluded from financial systems. Furthermore, in online gaming communities, cybercash has facilitated seamless in-game commerce and rewards systems.

Methods of Self-Discovery

Cybercash employs several methods to identify promising market segments. These include market research, which examines transaction patterns and user behavior within various online platforms. This information helps cybercash refine its features and tailor its user experience to specific needs. It also leverages feedback loops, collecting data on user experiences to improve the platform and its integration with existing services.

Strategic partnerships are another crucial aspect, allowing cybercash to gain access to new user bases and expand its reach in specific industries.

Factors Influencing Cybercash Adoption

Several factors influence the adoption of cybercash in different communities. Ease of use and user-friendliness are critical, as is the security of the platform. The reputation of cybercash within a given community is also vital, built on positive user experiences and testimonials. Accessibility, both in terms of technical requirements and affordability, plays a significant role in wider adoption.

Finally, the integration with existing systems, such as online payment gateways or loyalty programs, can be a key driver for wider acceptance.

Cybercash’s Growth Strategies

Cybercash’s independent growth strategy centers around its core strengths and adapts to specific market needs. Its strategies include targeted marketing campaigns to highlight its benefits in specific niches. It also invests heavily in community engagement, building relationships with key influencers and stakeholders. Furthermore, cybercash’s development is iterative, continually improving its features and user interface based on feedback from users.

This iterative approach ensures that cybercash remains relevant and useful in evolving markets.

Cybercash’s Advantages and Disadvantages

Cybercash, a digital currency, presents a compelling alternative to traditional financial systems. Understanding its potential benefits and drawbacks is crucial for evaluating its overall impact and potential for widespread adoption. This section delves into the advantages and disadvantages of cybercash, considering both its practical applications and the inherent risks.Cybercash, in its various forms, offers a dynamic array of advantages and disadvantages for users.

Its flexibility, speed, and potential for global reach can be powerful tools, but its vulnerabilities to fraud and the lack of regulatory frameworks also pose considerable challenges.

Benefits for Users

Cybercash offers numerous advantages for users, primarily centered around enhanced convenience and efficiency. The seamless, instant transactions possible through cybercash networks eliminate the delays associated with traditional banking systems. This rapid transfer of funds is particularly beneficial in cross-border transactions, where traditional methods often involve significant processing times. Additionally, cybercash can reduce the costs associated with financial transactions, eliminating the need for physical currency handling and potentially reducing fees charged by intermediaries.

Drawbacks of Cybercash

While cybercash presents significant advantages, it is not without its drawbacks. Security concerns are paramount, as cybercash transactions are susceptible to hacking and fraud. The decentralized nature of some cybercash systems can make it challenging to recover funds in case of theft or loss. Furthermore, the volatility of certain cryptocurrencies can create significant financial risk for users.

Potential for Misuse

The anonymity inherent in some cybercash systems can potentially facilitate illicit activities. The lack of transparency and regulatory oversight can be exploited by criminals to engage in money laundering, terrorist financing, or other illegal activities. It’s essential to develop robust mechanisms for monitoring and regulating cybercash transactions to mitigate these risks.

Cybercash Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Enhanced convenience and speed of transactions, particularly in cross-border transactions. | Vulnerability to hacking and fraud, potential for theft or loss of funds. |

| Reduced transaction costs and fees compared to traditional methods. | Volatility of cryptocurrency values can lead to significant financial risks. |

| Potential for global reach and access to financial services for unbanked populations. | Anonymity can facilitate illicit activities like money laundering and terrorist financing. |

| Reduced reliance on intermediaries and traditional financial institutions. | Lack of regulatory oversight and clear legal frameworks in some jurisdictions. |

| Potential for innovative financial applications and services, such as micropayments and peer-to-peer lending. | Difficulty in recovering lost or stolen funds due to the decentralized nature of some systems. |

Cybercash and the Future

Cybercash, with its potential to revolutionize financial transactions, is poised to shape the future of digital economies. Its decentralized nature and diverse applications are driving innovation and changing how we interact with money. The journey of cybercash is far from over, and its evolution will be crucial in shaping the future of finance.Cybercash is not merely a replacement for traditional currency; it represents a fundamental shift in how value is exchanged and tracked.

This shift necessitates a careful examination of its future trends, impact on the digital economy, potential disruptions, and the implications for existing financial systems.

Future Trends of Cybercash

Cybercash’s future trends are driven by advancements in blockchain technology, the growing demand for privacy and security, and the increasing need for seamless cross-border transactions. The emergence of new applications, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), is accelerating this evolution.

Role of Cybercash in a Digital Economy

Cybercash plays a crucial role in a digital economy by enabling faster, cheaper, and more secure transactions. It fosters innovation and reduces reliance on intermediaries, potentially creating new avenues for financial inclusion and entrepreneurship. Its ability to transcend geographical boundaries enables businesses and individuals to operate globally with ease. For example, cross-border payments using cybercash can significantly reduce transaction fees and processing times, benefiting businesses involved in international trade.

Cybercash is finding some success, and it’s interesting to see how this ties into the wider tech landscape. For example, with IDT setting the table for a new restaurant directory, idt sets table for restaurant directory , it highlights the potential for innovative digital platforms to streamline various aspects of daily life, potentially impacting how we use cybercash even more.

This certainly points to a future where cybercash plays a larger role in everyday transactions.

Potential Disruptions and Innovations in Cybercash

Cybercash is poised to disrupt traditional financial systems through several innovative applications. Decentralized exchanges (DEXs), built on blockchain technology, allow for peer-to-peer trading without intermediaries. This model can reduce transaction fees and increase transparency. Additionally, the development of stablecoins, cryptocurrencies pegged to fiat currencies, offers a way to bridge the gap between traditional and digital currencies. The integration of cybercash with emerging technologies like AI and machine learning promises to further enhance its functionality.

Implications of Cybercash on Financial Systems, Cybercash finds some for itself

Cybercash’s impact on financial systems is multi-faceted. It challenges the dominance of traditional banks and payment processors, potentially forcing them to adapt or face obsolescence. The increased transparency and security offered by blockchain technology could lead to a more trustworthy and efficient financial system. However, regulatory hurdles and security concerns remain significant challenges that need careful consideration.

The future evolution of cybercash will require careful regulatory frameworks to ensure its stability and safety, while fostering innovation and adoption.

Cybercash is finding some footing, and that’s great to see. The rise of e-commerce, especially in campus settings like those highlighted in e commerce shining in campus spotlights , is definitely a contributing factor. More students are turning to online shopping, creating a market that cybercash can tap into and benefit from. This trend is boosting cybercash’s potential for growth and success.

Illustrative Examples of Cybercash

Cybercash, while a promising concept, needs tangible examples to truly grasp its potential. This section explores hypothetical and real-world scenarios, highlighting the practical applications and challenges of this digital currency. From fictional systems to successful implementations, we’ll examine the diverse landscape of cybercash.Understanding the various forms cybercash can take is crucial. The examples below showcase the breadth of possibilities, from a completely decentralized system to one integrated with existing financial infrastructures.

This diversity is key to evaluating cybercash’s viability and future potential.

Hypothetical Cybercash System: “CryptoCoin”

CryptoCoin is a hypothetical, peer-to-peer cybercash system. Transactions are recorded on a distributed ledger, ensuring transparency and security. Users need a digital wallet to store and manage CryptoCoin. The system employs encryption to secure transactions and utilizes a consensus mechanism (similar to Bitcoin’s proof-of-work) to validate and add new transactions to the ledger. CryptoCoin’s unique feature is its integration with social media platforms.

Users can earn CryptoCoin by participating in online discussions, sharing content, or completing tasks, fostering a dynamic economy within these platforms. This fosters a symbiotic relationship between social interaction and financial gain.

Real-World Example: Mobile Wallets

Mobile wallets, like Apple Pay and Google Pay, are real-world examples of cybercash-like functionalities. Users can store digital money and make payments using their smartphones. These systems often rely on secure payment networks, similar to the infrastructure cybercash could utilize. The integration with existing credit card systems and the ease of use for everyday transactions demonstrate a practical application of digital payment methods.

While not entirely cybercash, mobile wallets show the potential of digital currencies for common transactions.

Case Study: The Rise of Bitcoin

Bitcoin, although not a perfect example of cybercash (due to its speculative nature and volatility), serves as a case study in the potential for decentralized digital currencies. Its success lies in its decentralized nature, secured by cryptography. Bitcoin has inspired many other cryptocurrencies, illustrating the potential for a new financial paradigm. The growth and adoption of Bitcoin, despite its challenges, demonstrate the appeal of alternative payment systems.

“Cybercash is evolving from a theoretical concept to a tangible reality, driven by the need for secure, efficient, and accessible financial solutions in the digital age.”

Evolution of Cybercash

The evolution of cybercash is marked by a shift from theoretical models to practical applications. Early models focused on security and privacy. Modern implementations emphasize usability and integration with existing financial systems. The integration with existing infrastructure, including banking systems and payment gateways, is critical to broad adoption. Successful cybercash solutions must address user concerns about security and ease of use.

This ensures that the transition to cybercash is seamless and widely accepted.

Last Word: Cybercash Finds Some For Itself

In conclusion, cybercash’s journey, marked by both innovative leaps and hurdles, demonstrates the power of adaptation and resilience in the digital economy. From the initial challenges to the evolving strategies, cybercash’s story underscores the enduring human drive to create and utilize new financial systems. Its future potential, shaped by ongoing innovation and user adoption, promises to be significant in reshaping the global financial landscape.

We’ve only just scratched the surface of this fascinating story, and the future holds even more intriguing developments.