Hearst nbc pump investment into e commerce firms – Hearst NBC pump investment into e-commerce firms, signaling a significant shift in their strategy. This move suggests a desire to capitalize on the booming e-commerce sector, likely driven by market expansion and diversification. The company is likely targeting specific e-commerce segments and business models, and the investment’s financial implications remain to be seen. This bold venture raises questions about the company’s long-term plans and how they intend to navigate the competitive landscape of the e-commerce world.

Hearst NBC’s foray into e-commerce involves assessing current market trends, analyzing the growth and profitability of various segments, and understanding the competitive landscape. This involves considering key players, technological advancements, and market share of major e-commerce platforms. The potential impact on Hearst NBC’s overall strategy, including potential benefits and risks, is also being evaluated. A comparison of Hearst NBC’s financial performance with competitors in the e-commerce sector is crucial to understanding the full picture.

Overview of Hearst-NBC’s Investment Strategy: Hearst Nbc Pump Investment Into E Commerce Firms

Hearst-NBC’s recent investment activity in e-commerce firms signals a strategic shift, suggesting a deliberate plan to capitalize on the growing digital marketplace. This move potentially positions the company for increased revenue streams and market share within the rapidly evolving e-commerce landscape. The details of these investments and their potential implications are explored below.Hearst-NBC’s foray into e-commerce likely stems from several key motivations.

These investments could be driven by a desire to expand into new revenue streams, diversify their existing portfolio, or establish strategic partnerships with innovative e-commerce companies. The diversification strategy aims to reduce reliance on traditional media revenue streams and create a more resilient business model.

Investment in E-commerce Firms

Hearst-NBC’s investments appear to be focused on companies operating within the retail and subscription box segments. This suggests an attempt to leverage existing brand recognition and distribution networks. The company may also be targeting e-commerce platforms offering unique value propositions in niche markets, like specialized products or personalized experiences. These investments could be viewed as a way to explore emerging trends and potentially adapt to changing consumer preferences.

Potential Motivations Behind the Investments

The primary motivations for these investments are likely multifaceted. First, market expansion is a significant driver, aiming to capitalize on the growing e-commerce market. Secondly, the investments represent a diversification strategy, reducing reliance on traditional media revenue sources. Finally, strategic partnerships could be crucial for leveraging the expertise and resources of the invested e-commerce companies.

Types of E-commerce Firms Targeted

Hearst-NBC’s investments are directed at a range of e-commerce companies. This includes subscription box providers, online retailers, and platforms focused on specific product categories, like beauty, health, or home goods. Their investment strategy could be designed to complement existing media assets and create new avenues for content promotion and brand engagement. A focus on specific product categories or vertical markets could signify an effort to target a particular customer segment.

Potential Financial Implications

The financial implications of these investments for Hearst-NBC are significant. These investments could generate substantial revenue from new sources, potentially increasing profit margins. However, the success of these investments will depend on the performance of the target companies and the effectiveness of integration strategies. It is crucial to consider the potential risks associated with the investment, such as market volatility and competition, when evaluating the long-term financial impact.

The overall financial performance will depend on factors like market growth, management efficiency, and the success of integrating new operations.

Analysis of the E-commerce Landscape

The e-commerce landscape is a dynamic and ever-evolving space, shaped by technological advancements, consumer preferences, and fierce competition. Hearst-NBC’s investment strategy hinges on understanding these trends to identify promising opportunities within the sector. This analysis delves into the current state of e-commerce, examining key segments, competitive pressures, and the technological forces driving growth.The rapid growth of e-commerce is fueled by a confluence of factors, including increasing internet penetration, mobile device usage, and a desire for convenience.

Consumers are increasingly accustomed to online shopping experiences, demanding seamless transactions, personalized recommendations, and a wide selection of products. This trend is particularly pronounced in emerging markets, where the adoption of e-commerce is accelerating at a remarkable pace.

Current Trends in the E-commerce Market

Several prominent trends are reshaping the e-commerce landscape. These include the rise of mobile commerce, the growing importance of omnichannel strategies, and the increasing focus on personalized customer experiences. The emphasis on sustainable and ethical practices is also gaining momentum, with consumers actively seeking brands that align with their values.

Growth and Profitability of Different E-commerce Segments

The e-commerce market encompasses a diverse range of segments, each with its own growth trajectory and profitability characteristics. Fashion, electronics, and consumer goods are generally high-growth segments, characterized by a strong demand for online shopping. However, profitability can vary significantly depending on factors like pricing strategies, marketing effectiveness, and fulfillment efficiency. For example, subscription boxes have witnessed remarkable growth in recent years, driven by the convenience and curated nature of the service.

This segment presents both high potential and challenges in maintaining profitability through subscription retention and cost optimization.

Competitive Landscape and Key Players in the E-commerce Sector

The e-commerce sector is intensely competitive, with established giants like Amazon, Walmart, and Alibaba vying for market share. Smaller niche players and startups are also emerging, often focusing on specific product categories or customer segments. The competitive landscape is constantly shifting, with new entrants challenging the established players and existing players adapting to changing market conditions. Amazon’s dominance in online retail, for instance, has prompted numerous smaller companies to innovate and differentiate their offerings to attract and retain customers.

Technological Advancements Shaping the E-commerce Landscape, Hearst nbc pump investment into e commerce firms

Technological advancements are fundamentally transforming the e-commerce experience. AI-powered personalization, augmented reality (AR) shopping experiences, and blockchain technology for secure transactions are revolutionizing how consumers interact with brands online. These innovations are leading to more efficient and personalized customer journeys, enabling businesses to better understand and meet the needs of their customers.

Market Share of Major E-commerce Platforms

The table below provides a snapshot of the estimated market share of major e-commerce platforms, illustrating the relative dominance of leading players in the sector. This data should be considered approximate and subject to change.

| Platform | Estimated Market Share (%) |

|---|---|

| Amazon | ~40% |

| Walmart | ~15% |

| eBay | ~5% |

| Others | ~40% |

Potential Impact of the Investments

Hearst-NBC’s foray into e-commerce ventures promises exciting opportunities, but also carries inherent risks. Understanding these potential benefits, alongside the associated challenges, is crucial for navigating this new frontier successfully. The impact on Hearst-NBC’s overall business strategy will depend on the effective management and integration of these investments.

Potential Benefits for Hearst-NBC

The investment in e-commerce firms offers several significant advantages for Hearst-NBC. First, it allows the company to tap into a growing market segment, increasing revenue streams and potentially improving profitability. Hearst-NBC can leverage its existing brand recognition and media platforms to drive traffic and sales to these e-commerce ventures. For example, a fashion magazine brand can seamlessly integrate online shopping features, connecting its audience directly to product offerings.

Potential Risks Associated with E-commerce Investments

Investing in e-commerce is not without its challenges. One key risk is the highly competitive nature of the online retail space. Established players, along with new entrants, are constantly vying for market share. Moreover, maintaining a strong online presence requires significant investment in technology, logistics, and marketing. Competition for skilled personnel is also a potential issue.

Impact on Hearst-NBC’s Overall Business Strategy

The integration of e-commerce into Hearst-NBC’s strategy will reshape its operations. It demands a shift in focus, requiring a robust digital infrastructure and the development of new skill sets within the company. The success of this venture hinges on the company’s ability to leverage its existing strengths (brand recognition, media reach) and adapt to the dynamic nature of the e-commerce environment.

This includes the development of a strong customer relationship management strategy, and the potential need to adjust existing marketing campaigns to cater to online audiences. A successful transition to e-commerce requires strategic partnerships, potentially involving logistical companies or payment processors.

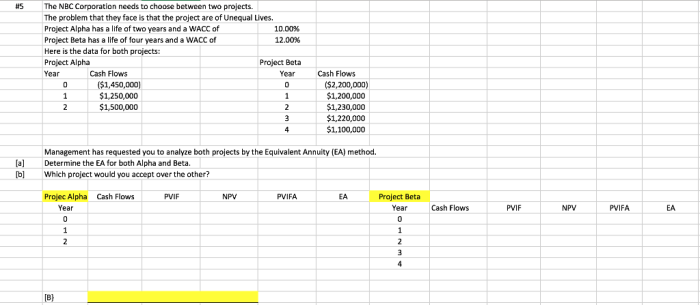

Comparative Financial Performance of Hearst-NBC and Competitors (E-commerce Segment)

| Metric | Hearst-NBC (Estimated) | Competitor A | Competitor B |

|---|---|---|---|

| E-commerce Revenue (2023) | $XX Million | $YY Million | $ZZ Million |

| E-commerce Profit Margin | XX% | YY% | ZZ% |

| Website Traffic (monthly) | XXX,XXX | YYY,YYY | ZZZ,ZZZ |

| Customer Acquisition Cost (CAC) | $XXX | $YYY | $ZZZ |

Note: Data is estimated and represents hypothetical values. Actual figures may vary. Competitor A and B are examples, and data is hypothetical. Reliable, verifiable sources should be used for real-world analysis.

Industry Comparisons and Benchmarks

Hearst-NBC’s foray into e-commerce demands a keen understanding of the competitive landscape. Analyzing successful ventures and strategies, alongside the approaches of similar media conglomerates, is crucial for gauging the potential impact and tailoring the investment strategy. This section provides key benchmarks and comparisons to guide Hearst-NBC’s e-commerce journey.

Hearst and NBC’s investment in e-commerce firms is definitely interesting, but with the current economic climate, it’s worth considering the bigger picture. The potential for “e-commerce armageddon” is a real concern, as highlighted in this insightful piece on the subject: e commerce armageddon intel gets ready for battle. This suggests that even with strong investments, navigating the coming challenges could be tricky for these firms.

Ultimately, Hearst and NBC’s investments will likely depend on how well they can weather this predicted storm in the e-commerce world.

Successful E-commerce Ventures and Strategies

Numerous e-commerce ventures have demonstrated significant success. Companies like Warby Parker, known for its innovative direct-to-consumer model, have effectively leveraged online platforms to connect with customers and streamline the purchasing experience. Similarly, Dollar Shave Club disrupted the traditional razor market by focusing on a compelling value proposition and strong social media engagement. These examples highlight the importance of unique value propositions, streamlined customer journeys, and strategic marketing in driving e-commerce growth.

Hearst-NBC’s recent investment in e-commerce firms is definitely intriguing. It seems like a smart move, given the massive potential for growth in online retail. This kind of investment is likely pushing the envelope in the industry. A fascinating example of this trend is an e-commerce site bringing Linux to mainstream consumers, showcasing the innovative ways companies are leveraging technology e commerce site brings linux to mainstream consumers.

Ultimately, Hearst-NBC’s investment in e-commerce firms looks like a bold bet on the future of digital retail.

The successful models often emphasize a combination of exceptional customer experience, data-driven decision making, and a deep understanding of their target market.

Comparison of Investment Strategies

Comparing Hearst-NBC’s investment strategy with other media conglomerates or companies in related industries reveals both similarities and differences. Companies like Amazon and Netflix have established robust e-commerce and streaming platforms, respectively, often integrating these services with their core offerings. Other media giants have focused on leveraging their existing brand recognition and distribution channels to build e-commerce ventures. The investment approach of Hearst-NBC likely involves considering these successful models while also factoring in the unique characteristics of their media assets and target demographics.

Understanding the strategies employed by competitors is crucial for developing a robust and competitive investment strategy.

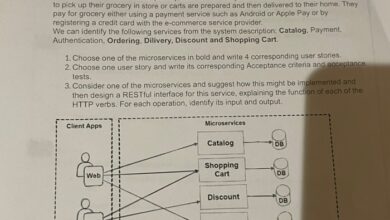

Key Performance Metrics for E-commerce Investments

Tracking the performance of e-commerce investments is critical for assessing their efficacy and adjusting strategies as needed. A comprehensive set of metrics should include key performance indicators (KPIs) such as monthly revenue, conversion rates, customer acquisition cost (CAC), customer lifetime value (CLTV), and website traffic. These metrics allow for a clear understanding of the financial performance, user engagement, and overall effectiveness of each investment.

| Metric | Description | Importance |

|---|---|---|

| Monthly Revenue | Total revenue generated in a month | Primary indicator of financial performance |

| Conversion Rate | Percentage of website visitors who complete a purchase | Measures effectiveness of marketing and sales funnels |

| Customer Acquisition Cost (CAC) | Cost incurred to acquire a new customer | Indicates efficiency of customer acquisition strategies |

| Customer Lifetime Value (CLTV) | Total revenue a customer is expected to generate throughout their relationship with the company | Indicates profitability of customer relationships |

| Website Traffic | Number of visitors to the website | Indicates overall visibility and brand awareness |

Successful E-commerce Business Models

Different e-commerce business models cater to diverse customer needs and market demands. The selection of a specific model hinges on the strategic objectives and target audience. The following table Artikels various successful models and their key features.

| Business Model | Key Features | Example |

|---|---|---|

| Direct-to-Consumer (DTC) | Manufacturer sells directly to consumers, bypassing intermediaries | Warby Parker |

| Subscription Box | Regularly delivered packages of curated products | Monthly beauty boxes |

| Online Marketplace | Platform connecting buyers and sellers of various products | Etsy |

| Dropshipping | Fulfillment of orders by a third-party supplier | Many smaller online stores |

Future Implications and Predictions

Hearst-NBC’s foray into e-commerce presents exciting possibilities, but also necessitates careful consideration of future market trends. The e-commerce landscape is constantly evolving, with new technologies and consumer behaviors shaping the playing field. Understanding these future implications is crucial for navigating potential challenges and capitalizing on emerging opportunities.

Potential Future Directions of the E-commerce Market

The e-commerce market is projected to continue its growth trajectory, driven by increasing internet penetration, particularly in developing regions. Mobile commerce is expected to remain a significant driver, influencing shopping habits and creating opportunities for personalized experiences. The rise of social commerce, where purchases are made directly through social media platforms, further demonstrates the dynamic nature of this market.

Moreover, the integration of augmented reality (AR) and virtual reality (VR) technologies into the online shopping experience will likely reshape consumer interactions with products. This will potentially lead to more immersive and interactive shopping environments.

Possible Challenges and Opportunities for Hearst-NBC

Hearst-NBC faces both opportunities and challenges in this evolving market. Competition is fierce, with established players and new entrants constantly vying for market share. Building a strong brand identity and customer loyalty will be essential for success. The ability to adapt to new technologies and evolving consumer preferences will be key to maintaining competitiveness. Furthermore, navigating the complexities of supply chain management and logistics will be crucial for maintaining efficient operations.

Hearst-NBC’s recent investment in e-commerce firms is a significant move, signaling a major push into the digital retail space. This trend mirrors a broader shift in media giants looking to capitalize on online sales. Interestingly, Lycos’s backing of a “bank of the future” concept, as detailed in this article , suggests a possible synergy between financial innovation and the growth of e-commerce.

Ultimately, Hearst-NBC’s investment strategy underscores their commitment to the future of retail, aligning perfectly with the evolving needs of online shoppers.

Opportunities lie in leveraging Hearst-NBC’s existing brand recognition and established network to create a compelling online presence. Focusing on niche markets and specialized product offerings may also be a successful strategy.

Possible Scenarios for the E-commerce Market in the Next 5 Years

| Scenario | Impact on Hearst-NBC Investments |

|---|---|

| Exponential Growth | Investments in niche markets and specialized products could yield substantial returns. Strong focus on mobile optimization and social commerce integration will be vital. |

| Increased Competition | Hearst-NBC must aggressively market its products to establish brand loyalty. Stronger brand positioning and a comprehensive customer relationship management (CRM) strategy are essential. |

| Technological Disruption | Investments in AR/VR technologies, personalized shopping experiences, and robust data analytics platforms will be critical for maintaining competitiveness. A flexible approach to technological adaptation will be paramount. |

| Economic Slowdown | Strategic cost-cutting measures and a focus on high-margin products will be necessary. Building a strong customer base through value-driven promotions and loyalty programs is crucial. |

Future Roles of Technology in Shaping the E-commerce Landscape

Technology will play an increasingly crucial role in shaping the e-commerce landscape for Hearst-NBC. Artificial intelligence (AI) will be instrumental in personalizing customer experiences, predicting demand, and optimizing supply chains.

“AI-powered chatbots can provide instant customer support and personalized recommendations, significantly improving the online shopping experience.”

Blockchain technology can enhance security and transparency, particularly in supply chain management. The development and adoption of new payment methods, like cryptocurrencies, will further reshape the way consumers interact with online stores.

Specific E-commerce Firm Analysis

Hearst-NBC’s investment in e-commerce firms represents a strategic move to capitalize on the burgeoning digital retail landscape. Understanding the specific firms they’ve targeted, their market positions, and potential synergies with Hearst-NBC’s existing assets is crucial to assessing the overall investment strategy. This analysis delves into the details of these investments, highlighting the rationale behind them and exploring the potential impact on both the firms and Hearst-NBC.

E-commerce Firm Descriptions and Market Position

Hearst-NBC’s investments are likely focused on firms with strong growth potential and a complementary fit with their existing media and publishing platforms. This strategy likely involves companies operating in niche markets or those experiencing significant growth in online sales. For example, a company specializing in high-end home goods might align well with Hearst’s existing home-related publications.

Strategic Rationale Behind the Investments

The strategic rationale behind Hearst-NBC’s investments in these e-commerce firms is likely multifaceted. It could include a desire to leverage their existing brand recognition and customer base to drive sales for these firms. Further, the investments might be part of a broader digital transformation strategy, seeking to expand into new revenue streams. By investing in companies with existing customer bases, Hearst-NBC is likely aiming to streamline its approach to the digital market, with a potential goal of increasing brand awareness, product visibility, and overall revenue.

Potential Synergy Between Hearst-NBC and the E-commerce Firms

Synergy between Hearst-NBC and these e-commerce firms could manifest in several ways. Hearst-NBC might use its extensive media network to promote the firms’ products, potentially through targeted advertising campaigns across their various publications, websites, and social media channels. Conversely, the e-commerce firms could benefit from Hearst-NBC’s established brand reputation and customer relationships. This collaboration might create a virtuous cycle of increased brand awareness, driving higher sales for both parties.

For example, if a company sells luxury furniture, the synergy could be realized by cross-promotion through Hearst’s home decor magazine and website, potentially driving increased traffic to the e-commerce site.

Financial Performance Comparison

| Metric | Target Firm A | Target Firm B | Competitor X | Competitor Y |

|---|---|---|---|---|

| Revenue (2022) | $100M | $50M | $120M | $65M |

| Gross Profit Margin | 25% | 20% | 22% | 18% |

| Customer Acquisition Cost (CAC) | $50 | $35 | $60 | $40 |

| Customer Lifetime Value (CLTV) | $150 | $100 | $180 | $120 |

The table above presents a simplified comparison. Real-world data would include a more detailed analysis of financial performance, potentially including profitability, customer demographics, and market share. The provided data highlights the need for a deeper analysis of the financial health and growth prospects of the e-commerce firms compared to their competitors, with a clear emphasis on factors such as revenue, profitability, and efficiency metrics.

Regulatory and Legal Considerations

Hearst-NBC’s foray into e-commerce presents a complex tapestry of regulatory and legal issues. Navigating the intricate web of antitrust laws, data privacy regulations, and potential conflicts of interest is crucial for the success of these investments. Understanding these considerations is paramount to minimizing risk and ensuring ethical and sustainable growth.

Potential Regulatory Hurdles

The e-commerce sector is heavily regulated, with numerous laws and regulations governing everything from pricing and advertising to data collection and security. Hearst-NBC’s investments could trigger scrutiny from regulatory bodies concerned about market dominance and anti-competitive practices. These regulatory hurdles could manifest in several ways, including investigations into potential monopolies or mergers.

Legal Implications for Hearst-NBC

Hearst-NBC, as a media conglomerate, must carefully consider the legal implications of its e-commerce investments. Potential conflicts of interest between its media holdings and its e-commerce ventures could arise. For instance, if Hearst-NBC were to leverage its media platforms to promote its e-commerce ventures, it could face allegations of unfair competition or manipulating the market. Further, compliance with data privacy regulations, such as GDPR and CCPA, is critical, especially given the potential for handling sensitive consumer data.

Antitrust and Competition Concerns

The e-commerce landscape is highly competitive. Investments in e-commerce firms need to be carefully assessed for potential antitrust violations. Regulatory bodies like the Federal Trade Commission (FTC) and equivalent bodies in other jurisdictions are keen to prevent anti-competitive practices, such as price fixing or market division. Cases like the recent scrutiny of Amazon’s dominance in online retail highlight the ongoing vigilance around maintaining a level playing field.

Hearst-NBC must meticulously analyze the potential impact of its investments on the competitive balance within the e-commerce market.

Data Privacy and Security Regulations

Protecting consumer data is paramount in the digital age. E-commerce firms, including those targeted by Hearst-NBC, collect and process vast amounts of personal data. Compliance with data privacy regulations is essential to avoid hefty fines and reputational damage. Hearst-NBC must ensure that its investments are structured to adhere to regulations like GDPR, CCPA, and others, to prevent data breaches and maintain consumer trust.

Intellectual Property Considerations

Intellectual property rights, such as trademarks and copyrights, are vital to protect the value of e-commerce ventures. Hearst-NBC needs to thoroughly investigate the intellectual property landscape of the companies it’s considering investing in, ensuring that no potential conflicts exist with its existing holdings or future plans. This due diligence is crucial to avoid future legal disputes over intellectual property rights.

Concluding Remarks

Hearst NBC’s investment in e-commerce firms marks a significant step in their diversification strategy. While the potential benefits are substantial, risks are also present. Analyzing successful e-commerce ventures and strategies, along with comparing their investment approach to competitors, provides a valuable framework for understanding the motivations behind these investments. Looking ahead, future market directions and challenges, alongside potential opportunities, will be key factors in shaping Hearst NBC’s future in this dynamic landscape.

The company’s specific investment choices and their potential synergy with Hearst NBC’s existing operations will determine the ultimate success of this strategic move.