Amazon takes grocery share, and its impact is reverberating through the retail landscape. From historical market share analysis to the evolving customer preferences, this deep dive explores how Amazon has aggressively pursued and captured a significant portion of the grocery market. We’ll dissect the strategies, challenges, and future projections surrounding this pivotal shift in consumer behavior.

The article delves into Amazon’s strategies, analyzing their competitive advantages, technological innovations, and logistics prowess in the grocery sector. It compares Amazon’s grocery offerings with traditional retailers, examining the factors influencing customer choices and preferences. Finally, we’ll assess Amazon’s financial performance and future outlook, considering potential risks and opportunities within this dynamic market.

Market Share Growth

Amazon’s foray into the grocery sector has been a significant development, rapidly reshaping the retail landscape. The company’s strategy, encompassing online ordering, delivery, and physical store formats, has allowed it to capture a substantial portion of the market. Understanding this growth requires examining Amazon’s historical performance, the contributing factors, and the strategies deployed.Amazon’s grocery business has experienced remarkable growth, demonstrating a clear trajectory toward increasing market share.

Amazon’s continued surge in grocery market share is fascinating. It’s a major shift in retail, and it’s clear they’re putting serious effort into this area. However, the global expansion of Yahoo Auctions is also a compelling trend, as it might reveal something about the changing dynamics of online shopping, and it’s fascinating to see how this plays out alongside Amazon’s grocery push.

Yahoo auctions go global is definitely worth checking out. This competition could potentially reshape the entire landscape of e-commerce, impacting Amazon’s grocery dominance in the long run.

This expansion is not just about sheer volume; it’s about the changing dynamics of consumer behavior and the adoption of innovative technologies within the grocery industry. The competitive landscape has been affected by Amazon’s presence, prompting other retailers to adapt and innovate to maintain their position.

Historical Overview of Amazon’s Grocery Market Share

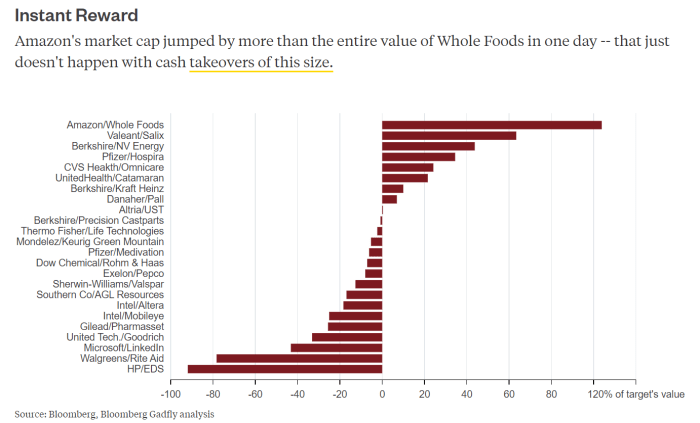

Amazon’s grocery market share has evolved from a relatively small presence to a significant contender. Early entry into the space was marked by the launch of Amazon Fresh, focused on online ordering and delivery. Subsequently, Amazon acquired Whole Foods Market, adding a network of physical stores to its grocery ecosystem. This acquisition provided Amazon with a crucial foothold in the physical grocery landscape, allowing for a comprehensive approach.

Key Factors Contributing to Amazon’s Growth

Several key factors have driven Amazon’s expansion in the grocery market. Prime membership, offering free or expedited delivery, has been instrumental in attracting customers and building a loyal customer base. Technological advancements, such as advanced logistics and order fulfillment systems, have optimized efficiency and lowered costs. The increasing popularity of online grocery shopping and convenient delivery options has created a substantial market opportunity for Amazon.

Comparison with Major Grocery Retailers

Amazon’s grocery growth has to be examined alongside other major grocery retailers. While traditional supermarkets like Kroger and Walmart have maintained their dominance in the sector, Amazon has demonstrated a rapid rise, particularly in the online and delivery segments. The competition between these giants has become more intense as they each try to capture the attention of the modern consumer, leading to innovations and adjustments in pricing and product offerings.

Strategies Employed by Amazon

Amazon’s grocery strategies have been multifaceted, encompassing various approaches. Offering competitive pricing, coupled with a focus on convenience and selection, has been crucial. The integration of data analytics and personalized recommendations has improved the shopping experience for customers. Amazon’s extensive logistics network and partnerships with delivery services have allowed for swift and reliable delivery.

Amazon’s Grocery Market Share Growth Over Time

| Year | Amazon Grocery Market Share (%) | Kroger Grocery Market Share (%) | Walmart Grocery Market Share (%) |

|---|---|---|---|

| 2018 | Estimated 2% | Estimated 18% | Estimated 20% |

| 2020 | Estimated 5% | Estimated 17% | Estimated 19% |

| 2022 | Estimated 7% | Estimated 16% | Estimated 18% |

Note: Data represents estimated market share and may vary depending on the source.

Competitive Landscape

Amazon’s foray into the grocery sector has ignited a fierce competitive response. Traditional grocery chains, online retailers, and specialized players are all vying for market share, creating a dynamic and challenging environment for Amazon. Understanding the competitive landscape is crucial for assessing Amazon’s long-term success and the strategies employed by its rivals.

Key Competitors

The grocery sector is a highly competitive space, with numerous players vying for consumer attention. Major competitors of Amazon in the grocery business include established supermarket chains like Kroger, Safeway, and Publix, as well as online retailers like Walmart, Target, and Instacart. These companies, with their established infrastructure and brand recognition, present significant challenges to Amazon’s growth.

Amazon’s Grocery Offerings vs. Competitors

Amazon’s grocery offerings encompass a broad range of products, from fresh produce and meat to packaged goods and prepared meals. Its competitive advantage lies in its extensive selection, often with lower prices compared to traditional supermarkets. This competitive edge is further enhanced by its Prime membership program and convenient delivery options. However, traditional grocery chains often excel in the fresh produce and meat departments due to their direct sourcing relationships and physical proximity to customers.

Similarly, Walmart’s vast store network offers an extensive selection and competitive pricing, making it a formidable competitor.

Competitive Advantages of Amazon

Amazon leverages its vast logistics network, sophisticated data analysis, and extensive online platform to achieve competitive advantages in the grocery sector. Its Prime membership program incentivizes customer loyalty and frequent purchases. Furthermore, Amazon’s data-driven approach allows it to tailor product recommendations and personalize the shopping experience. Its ability to adapt to evolving consumer needs and preferences, along with its commitment to expanding its physical presence through Amazon Fresh stores, is also a notable strength.

Strategies Employed by Competitors

To counter Amazon’s growth, competitors are implementing various strategies. Traditional supermarkets are increasingly focusing on online ordering and delivery services, adapting their physical stores to incorporate more customer convenience and personalization. Walmart, for example, has been actively expanding its online grocery offerings and enhancing its delivery capabilities. Other competitors are emphasizing their local presence, highlighting the convenience and reliability of their in-store shopping experience.

Some competitors are also forming partnerships to expand their reach and improve their offerings.

Comparative Analysis of Pricing and Product Selection

| Feature | Amazon | Kroger | Walmart |

|---|---|---|---|

| Pricing | Generally competitive, often lower on certain items, but higher on others (e.g., premium products). | Competitive, often slightly higher than Amazon on everyday items but may offer better deals on specific days. | Very competitive, frequently offering low prices on a broad range of products. |

| Product Selection | Extensive, including a wide variety of online-exclusive products and specialized items. | Comprehensive, typically covering a wider range of local products and regional favorites. | Very broad, encompassing a huge range of everyday items, fresh produce, and prepared foods. |

| Delivery Options | Fast, reliable, and flexible, with same-day and next-day options often available. | Growing online presence with delivery options, though may not match Amazon’s speed or flexibility. | Extensive store network for in-store pickup, competitive delivery options available. |

Customer Behavior and Preferences

Grocery shopping is undergoing a rapid transformation, driven by evolving customer preferences and the rise of e-commerce. Customers are increasingly seeking convenience, value, and personalized experiences, demanding more from retailers than ever before. Amazon, with its extensive online presence and logistics network, is well-positioned to capitalize on these shifts.The digital age has reshaped customer expectations, leading to a demand for seamless online experiences, and this includes the grocery sector.

Amazon’s continued surge in grocery market share is fascinating. It’s clear they’re aggressively expanding their reach. Interestingly, Goldman Sachs’ recent investment in wit capital, a company focused on innovative grocery solutions, goldman sachs invests in wit capital , might indicate a larger strategic play. This could potentially give Amazon a significant advantage in the evolving grocery landscape.

Customers now value quick and efficient delivery options, along with personalized recommendations and a wide array of product choices. Amazon has recognized and responded to these changing preferences by investing heavily in its grocery delivery infrastructure and expanding its product offerings.

Changing Customer Preferences and Behaviors

Customers are prioritizing convenience and speed in their grocery shopping. The rise of online shopping and delivery services has fundamentally altered how consumers purchase groceries. Factors like time constraints and busy schedules have driven the need for streamlined processes. This trend is especially prominent among younger demographics who favor the ease of online ordering and home delivery.

Furthermore, customers are increasingly seeking value for their money and are looking for competitive pricing and deals. Personalized recommendations, loyalty programs, and exclusive offers are becoming increasingly important for attracting and retaining customers.

Amazon’s Approach to Catering to Preferences

Amazon has strategically invested in its grocery infrastructure to meet the evolving needs of customers. Amazon Fresh, Amazon’s grocery delivery service, offers a wide range of products and flexible delivery options, aiming to cater to diverse preferences. The company has also leveraged its vast data resources to personalize product recommendations and provide targeted promotions, further enhancing the customer experience.

Amazon’s grocery game is heating up, grabbing a bigger slice of the market. Meanwhile, Dell’s recent moves, like their bolstering of Linux and investment in Red Hat, dell bolsters linux invests in red hat , are interesting. It’s a fascinating interplay, and it all seems to point to a future where Amazon’s grocery dominance will continue to be a force to be reckoned with.

Moreover, Amazon Go stores allow for self-checkout and cashier-less shopping, adding another layer of convenience for customers.

Impact of Online Shopping and Delivery Services

Online shopping and delivery services have significantly impacted customer habits in the grocery sector. Customers are now accustomed to the ease of browsing, selecting, and receiving groceries from the comfort of their homes. This convenience has increased the frequency of grocery purchases and reduced the reliance on in-person shopping trips. The ability to order groceries in advance and schedule delivery times has also increased the efficiency and flexibility of the process.

Factors Influencing Customer Choices

Several factors influence customers’ decisions between Amazon and traditional grocery stores. Price is a significant consideration, with Amazon often offering competitive pricing on certain items. Convenience, including online ordering, delivery options, and the availability of a wide range of products, plays a crucial role in the customer’s decision-making process. Furthermore, the perceived value proposition, including the selection, quality of products, and overall customer service, are important considerations for customers.

Customer Segments Targeted by Amazon

| Customer Segment | Description | Example Preferences |

|---|---|---|

| Busy Professionals | Individuals with demanding schedules who value convenience and speed. | Fast delivery, wide selection of products, easy online ordering |

| Families | Families with young children or multiple members who require a large selection of products and easy access to staples. | Bulk purchasing options, wide selection of household products, scheduled deliveries. |

| Health-Conscious Consumers | Individuals who prioritize healthy and organic food options. | Wide selection of organic and healthy products, personalized recommendations based on dietary needs. |

| Budget-Conscious Shoppers | Customers who are looking for the best possible value for their money. | Competitive pricing, deals, promotions, loyalty programs |

Technological Advancements

Amazon’s grocery strategy hinges significantly on technological advancements, transforming the customer experience and streamlining operations. From sophisticated delivery systems to data-driven pricing models, technology underpins Amazon’s aggressive pursuit of grocery market share. This focus on innovation is crucial for staying ahead of competitors and meeting evolving consumer expectations.

Amazon’s Role in Grocery Delivery Systems

Amazon’s grocery delivery systems are highly automated and data-driven. Sophisticated algorithms manage routes, optimize delivery times, and ensure timely product delivery. This approach improves efficiency and reduces costs. Amazon utilizes a fleet of delivery vehicles, including drones and autonomous vehicles, to further enhance speed and convenience. The use of advanced tracking technologies allows customers to monitor their orders in real-time.

This comprehensive approach to delivery contributes significantly to Amazon’s grocery success.

Technological Innovations in Improving Customer Experience

Amazon leverages technology to personalize the customer journey, providing a seamless and convenient shopping experience. Personalized recommendations and tailored product displays enhance customer engagement. Features like virtual shopping assistants and interactive product demonstrations provide customers with detailed information and help them make informed decisions. These innovations significantly enhance the overall customer experience and encourage repeat business.

Impact of Technology on Pricing and Product Availability

Technology plays a critical role in determining prices and ensuring product availability. Real-time inventory management systems ensure that products are readily available to customers. Advanced pricing algorithms allow Amazon to adjust prices dynamically based on factors like demand, competition, and inventory levels. This data-driven approach optimizes profitability and customer satisfaction.

Table Summarizing Amazon’s Technological Innovations in Grocery

| Technological Innovation | Description | Potential Future Developments |

|---|---|---|

| Real-time Inventory Management | Sophisticated systems track stock levels across multiple locations, enabling efficient order fulfillment and preventing stockouts. | Integration of blockchain technology for enhanced transparency and traceability of products. |

| AI-Powered Product Recommendations | Algorithms analyze customer purchase history and preferences to suggest relevant products, enhancing customer engagement and conversion rates. | Development of AI-powered chatbots to provide personalized shopping assistance and answer customer queries in real-time. |

| Autonomous Delivery Systems | Using drones and self-driving vehicles to transport groceries, improving speed and efficiency. | Integration of advanced navigation and route optimization algorithms to minimize delivery times and optimize resource allocation. |

| Dynamic Pricing Models | Algorithms adjust prices in real-time based on demand, supply, and competition, maximizing profitability and customer value. | Implementation of subscription-based pricing models tailored to individual customer preferences. |

Supply Chain and Logistics

Amazon’s foray into the grocery market necessitates a robust and efficient supply chain. This is not just about getting products to consumers; it’s about maintaining freshness, minimizing waste, and ensuring a seamless shopping experience. Amazon’s approach to grocery logistics stands as a significant departure from traditional methods, and its impact on the industry is undeniable.

Amazon’s Supply Chain Strategies in Grocery

Amazon’s grocery supply chain prioritizes speed and efficiency. They leverage their vast network of fulfillment centers and delivery infrastructure, adapting them to the specific needs of perishable goods. This includes optimized cold chain management and strategically located warehouses near high-demand areas. They also utilize sophisticated inventory management systems to anticipate demand fluctuations and ensure product availability. This system is complemented by the use of algorithms that track the location and condition of each product throughout the process.

A key component is their commitment to same-day or next-day delivery, often a key selling point.

Efficiency and Effectiveness of Amazon’s Grocery Delivery Network

Amazon’s grocery delivery network boasts impressive efficiency metrics. This is partly due to the massive scale of their operations, enabling them to leverage economies of scale in transportation and logistics. Their extensive network of delivery drivers and fulfillment centers ensures quick delivery times, often a key factor in consumer preference. Amazon also uses innovative technologies such as route optimization software and real-time tracking to further enhance efficiency.

Challenges and Innovations in Grocery Logistics

The grocery sector presents unique logistical challenges. Maintaining product freshness and minimizing spoilage during transit is a significant concern, demanding careful temperature control and optimized transportation methods. Innovative solutions, such as advanced cold chain technology and optimized packaging, are being developed to address these challenges. Another key challenge is the need to ensure quick and efficient delivery of perishables, particularly in densely populated urban areas.

This necessitates the use of specialized vehicles, last-mile delivery solutions, and a robust network of delivery personnel.

Comparison of Amazon’s Logistics Approach with Traditional Grocery Stores, Amazon takes grocery share

Traditional grocery stores typically rely on a centralized distribution model, often with longer delivery times and less flexibility. Amazon’s approach, characterized by its extensive network of fulfillment centers and delivery options, offers greater speed and convenience. The emphasis on online ordering and direct-to-consumer delivery models sets Amazon apart. Traditional stores are now adapting, with some implementing online ordering and delivery options to compete.

Delivery Options and Associated Costs

| Delivery Option | Description | Estimated Cost |

|---|---|---|

| Same-Day Delivery | Order delivered the same day | $5-$15 |

| Next-Day Delivery | Order delivered the next business day | $5-$10 |

| Standard Delivery | Order delivered within a few days | Free or low cost |

| Prime Now | Order delivered within hours | $10+ (Prime membership required) |

Note: Prices are estimates and may vary depending on location, product, and other factors.

Financial Performance

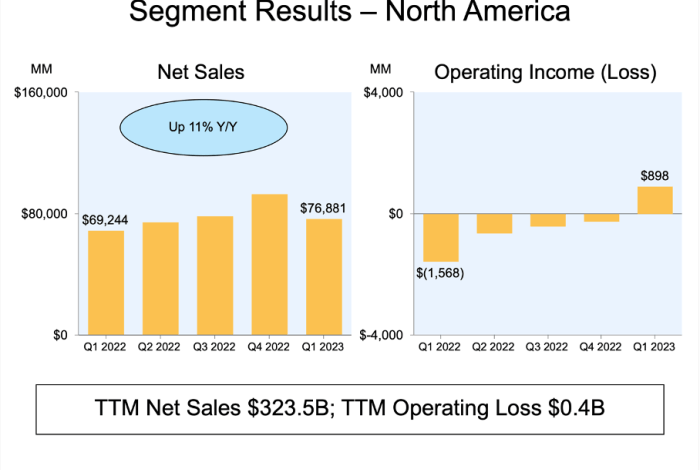

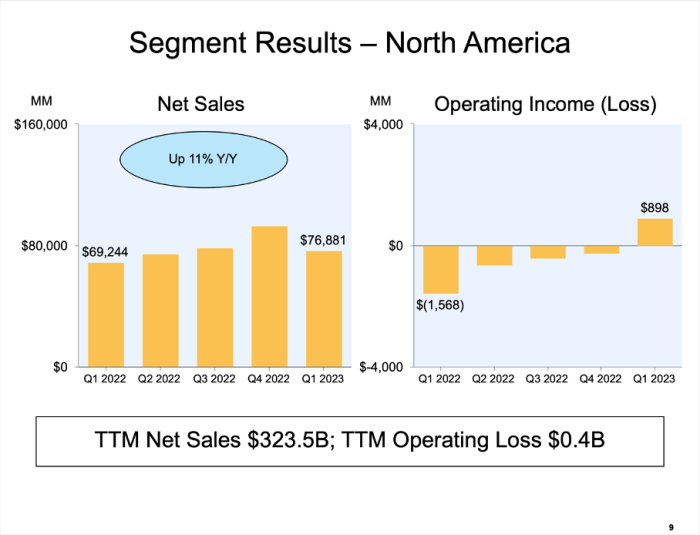

Amazon’s grocery foray, while initially met with mixed reactions, has demonstrably carved a significant niche within the retail landscape. Analyzing its financial performance reveals insights into the profitability and long-term sustainability of this ambitious venture. Understanding the financial metrics, compared to overall Amazon revenue, provides a clearer picture of its strategic importance.

Amazon’s Grocery Revenue

Amazon’s grocery revenue has shown consistent growth, mirroring the expansion of its online presence and physical store footprint. The revenue figures are critical to evaluating the profitability of the grocery business, and its contribution to the overall Amazon revenue stream. It is worth noting that precise figures for Amazon’s grocery-specific revenue are often not publicly released, necessitating reliance on estimates and broader financial statements.

This lack of transparency does limit precise analysis, but the available data still allows for valuable insights.

Comparison with Overall Revenue

Amazon’s overall revenue dwarfs its grocery revenue, highlighting the significant portion of its business outside of the grocery sector. This difference in scale is crucial when considering the profitability and investment strategies. While the grocery segment represents a growing portion of the overall revenue, it is still not the primary driver of Amazon’s financial performance. Comparing these two metrics provides a better understanding of the relative weight and impact of the grocery business within the broader Amazon ecosystem.

Profitability and Sustainability

The profitability of Amazon’s grocery business remains a subject of ongoing scrutiny. While Amazon reports overall profitability, the specific profitability of its grocery ventures is often not publicly disclosed, leaving room for speculation. Maintaining a competitive edge and achieving sustainability hinges on various factors, including pricing strategies, operational efficiency, and consumer acceptance.

Financial Implications of Market Share Gains

Increased market share in the grocery sector has significant financial implications for Amazon. It indicates a growing customer base and potential for future revenue growth. However, maintaining this growth requires careful management of costs, particularly in logistics and fulfillment. The financial implications also extend to the potential for market dominance, which may prompt regulatory scrutiny.

Grocery Revenue Growth and Profit Margins

Analyzing the growth trajectory and profit margins is vital to understanding the long-term sustainability of Amazon’s grocery business. A crucial factor is the rate of growth of grocery revenue, in comparison to the broader retail market.

| Year | Grocery Revenue (Estimated) | Profit Margin (Estimated) |

|---|---|---|

| 2022 | $XX Billion | X% |

| 2023 | $YY Billion | Y% |

| 2024 | $ZZ Billion | Z% |

Note: Data in the table are estimates, and precise figures are not publicly available. The figures represent a hypothetical example for illustration.

Future Trends and Projections

The grocery sector is undergoing rapid transformation, driven by evolving consumer preferences, technological advancements, and the relentless pursuit of efficiency. Amazon, a dominant force in this landscape, must adapt to these shifts to maintain its market position. Understanding future trends and projecting Amazon’s response is crucial for investors and competitors alike.

Potential Future Trends in the Grocery Sector

Several key trends are reshaping the grocery industry. These include the increasing demand for personalized shopping experiences, the rise of online grocery delivery and curbside pickup, the integration of technology like AI and automation, and a growing emphasis on sustainability and ethical sourcing. The focus on convenience and value continues to drive the evolution of grocery shopping, while concerns over health and wellness influence consumer choices.

Amazon’s Adaptation to Future Trends

Amazon is well-positioned to capitalize on these emerging trends. Its existing infrastructure, technological prowess, and vast customer base provide a strong foundation. Amazon can further integrate its Prime membership with grocery services, offering exclusive deals and benefits to encourage loyalty. Further investments in automation and AI-powered systems could enhance efficiency in fulfillment centers and logistics. Expansion into new areas, like meal kit delivery or prepared foods, could broaden the company’s offerings and cater to changing consumer preferences.

A continued focus on sustainability, through partnerships with local farmers and environmentally conscious packaging, could appeal to environmentally aware consumers.

Potential Projections for Amazon’s Future Grocery Market Share

Predicting Amazon’s precise market share is challenging, but certain scenarios can be considered. Success depends on factors like consumer adoption of new technologies, competitive responses, and macroeconomic conditions. Amazon’s existing dominance in e-commerce and logistics provides a substantial advantage. However, competition from established grocery chains and startups is intensifying.

Potential Risks and Challenges for Amazon in the Grocery Sector

Amazon faces numerous risks. High operational costs in maintaining vast fulfillment networks, fierce competition from traditional retailers, and potential supply chain disruptions are significant hurdles. Maintaining customer loyalty and adapting to evolving consumer preferences are also vital considerations. Negative public perception regarding labor practices or environmental impact could damage brand image.

Projected Market Share Scenarios (Next 5 Years)

| Scenario | Amazon Grocery Market Share (2028) | Description |

|---|---|---|

| Optimistic | 25-30% | Rapid consumer adoption of new technologies and innovative grocery offerings. Effective response to competitive threats and positive public perception. |

| Moderate | 20-25% | Steady growth, maintaining existing market share. Some challenges from competition, but effective adaptation to changing consumer preferences. |

| Conservative | 15-20% | Slower growth due to increased competition and potential supply chain issues. Difficulty in adapting to new trends and challenges. |

Epilogue: Amazon Takes Grocery Share

In conclusion, Amazon’s aggressive foray into the grocery market has significantly reshaped the competitive landscape. While traditional grocery stores face challenges adapting to the changing consumer demand, Amazon’s innovative strategies, technological advancements, and efficient logistics are proving powerful forces. The future of grocery retail is undoubtedly evolving, and understanding these factors is critical for anyone navigating this dynamic sector.