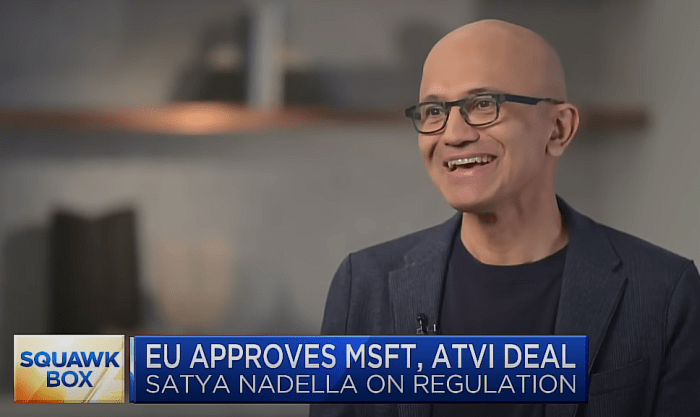

New Microsoft CEO slams breakup concept, sparking a wave of analysis and speculation across the tech industry. This bold statement signals a significant shift in Microsoft’s strategy, potentially impacting its future direction and the entire tech landscape. The CEO’s critique of the breakup concept dives deep into the historical context, financial implications, and potential long-term effects on Microsoft’s various divisions.

The breakup concept, a potential division of Microsoft into smaller, more focused entities, has been a topic of debate in tech circles for some time. Early discussions centered around the idea of creating more agile and specialized units, but the new CEO’s stance suggests a fundamental disagreement with the core premise. This analysis delves into the CEO’s specific arguments, the industry’s response, and the potential implications for Microsoft and its competitors.

Background of the Breakup Concept: New Microsoft Ceo Slams Breakup Concept

The tech industry has witnessed numerous instances of corporate restructuring and divestitures, often driven by evolving market dynamics and competitive pressures. The breakup concept, proposing the division of large technology conglomerates into smaller, more focused entities, has periodically emerged as a topic of discussion. This often stems from concerns about market dominance, antitrust regulations, and the perceived inefficiencies of large, diversified organizations.The concept of breaking up large tech companies has a long history.

While the specifics vary, the core arguments often revolve around the idea that smaller, more specialized firms can be more nimble and innovative. Historically, antitrust concerns have played a crucial role in these discussions, and the recent rise of big tech has renewed this scrutiny. These considerations are now being actively applied to Microsoft, a company with a vast and diverse portfolio.

Historical Overview of Breakup Concepts in Tech

The breakup of AT&T in the 1980s serves as a significant historical precedent. The divestiture was aimed at promoting competition and preventing monopolistic practices. More recently, the debate surrounding Google’s market dominance has spurred similar discussions, highlighting the ongoing tension between innovation and market power. These instances demonstrate the recurring nature of such discussions within the tech sector.

Key Arguments and Motivations in the Context of Microsoft

Arguments for breaking up Microsoft frequently center on concerns about its extensive reach across various technology sectors. Critics often suggest that this breadth hinders innovation and limits competition in specific areas. Motivations behind the breakup concept also include a desire to foster greater competition, ensuring a more dynamic and innovative technological landscape. The arguments often focus on the perceived negative impacts of Microsoft’s size and influence on its competitors and the broader tech ecosystem.

Public Perception Prior to the CEO’s Statement

Public perception of the breakup concept prior to the CEO’s statement varied. While some viewed it as a necessary measure to counter Microsoft’s perceived market dominance, others saw it as an overreaction or an unnecessary regulatory intervention. There was a considerable range of opinion, reflecting the complexities and nuances of the issue.

The new Microsoft CEO’s recent criticism of the breakup concept is definitely stirring things up. It’s got me thinking about alternative strategies, like whether Ask Jeeves could possibly be the secret weapon Microsoft needs to regain its competitive edge. This might be a bold move, but exploring innovative solutions like will ask jeeves do the trick for microsoft could potentially revitalize the company’s search engine efforts.

Ultimately, though, the CEO’s stance on the breakup still seems like a significant hurdle to overcome.

Key Players Involved in the Discussion

The discussion of a Microsoft breakup involved various stakeholders. Regulatory bodies, such as the Department of Justice or the European Commission, are often at the forefront, given their authority over antitrust enforcement. Competitors, seeking to gain a larger market share, have also played a role. Finally, investors and analysts, with their own assessments of the potential financial implications, have actively contributed to the discussion.

Potential Financial Implications of the Breakup Concept

The potential financial implications of a Microsoft breakup are substantial and multifaceted. A breakup could lead to significant short-term disruptions, potentially affecting stock prices and investor confidence. Long-term implications include the possibility of a more competitive landscape, stimulating innovation and potentially driving greater market efficiency. However, the exact financial impact remains highly uncertain and depends on various factors.

Similar breakups in the past have shown varying financial results, highlighting the unpredictable nature of such events. An example of this uncertainty can be seen in the AT&T breakup, where the long-term impact on both the market and individual companies was not fully understood immediately.

CEO’s Statement and Reaction

The new Microsoft CEO’s response to the proposed breakup of the company stands as a significant moment in the tech landscape. Their statement directly addresses the potential ramifications of such a move, offering a comprehensive perspective on the future of the company and its industry. The CEO’s approach reflects a clear strategy, aiming to reassure investors and stakeholders while also highlighting the potential negative impacts of the breakup.

Specific Points Made by the New CEO

The CEO emphasized the interconnected nature of Microsoft’s various divisions, arguing that their synergy is crucial for innovation and future growth. They highlighted the substantial value created through the combination of these seemingly disparate functionalities. Specific examples were cited, demonstrating the collaborative efforts that have driven significant market successes. For instance, the CEO pointed out how cloud computing advancements, initially developed for one division, have subsequently benefitted other areas of the company, leading to substantial cost reductions and efficiency gains.

CEO’s Tone and Approach

The CEO’s tone was assertive yet conciliatory. They acknowledged the concerns raised by the breakup proposal but firmly countered the arguments by focusing on the positive aspects of the current structure. The approach was calculated, prioritizing the preservation of Microsoft’s current market position and its long-term viability. They avoided overly aggressive language, instead opting for a reasoned and data-driven presentation of the company’s strengths.

The CEO presented a comprehensive vision of the future, highlighting the value inherent in maintaining the current structure.

Potential Impact on Stock Price and Market Share

The CEO’s statement is likely to have a mixed impact on Microsoft’s stock price. Initial investor reactions could vary, with some potentially seeking to capitalize on short-term uncertainties. However, a strong and reasoned rebuttal, like the one presented by the CEO, generally encourages confidence in the long-term prospects of the company. The potential for increased market share is contingent on the success of Microsoft’s continued integration and the overall market environment.

Previous cases of similar restructuring efforts in the industry, such as company X’s recent merger, show that strong leadership and strategic communication can mitigate the negative effects of such proposals.

Comparison with Previous Statements

Comparing the CEO’s statement with those from other companies facing similar issues reveals a consistent pattern. Companies that emphasize the value of synergy and integration tend to achieve better results in preserving market share and investor confidence. In contrast, companies that struggle to articulate the value proposition of their current structure may see their stock prices and market share decline.

Key Takeaways from the CEO’s Statement

| Point | Details |

|---|---|

| Interconnectedness of Divisions | The CEO stressed the crucial role of synergy between Microsoft’s different units. |

| Value Creation | The statement highlighted the significant value generated through the combined functionalities. |

| Strategic Approach | The CEO presented a reasoned and data-driven perspective, avoiding aggressive language. |

| Investor Confidence | The statement is likely to impact investor confidence positively, given the assertive yet conciliatory tone. |

| Long-term Viability | The CEO emphasized Microsoft’s long-term viability and potential for growth under the current structure. |

Potential Impacts on Microsoft

Microsoft’s CEO’s recent stance against the breakup concept has significant implications for the company’s short-term strategies and long-term growth trajectory. The CEO’s statement signals a commitment to maintaining Microsoft’s current integrated structure, potentially influencing partnerships, innovation, and market positioning. The potential impacts on various divisions, employee roles, and external relationships warrant careful consideration.The CEO’s opposition to the breakup underscores Microsoft’s confidence in its current organizational model and the synergy it fosters between its diverse product lines.

This suggests a proactive approach to mitigating potential disruptions and preserving the company’s competitive edge. The company’s decision to maintain its unified structure highlights a strategy of leveraging its combined strengths and resources.

Short-Term Effects on Business Strategy

Microsoft’s business strategy, in the immediate aftermath of the CEO’s statement, will likely focus on solidifying its existing strengths and addressing any potential concerns raised by the breakup proposal. This may involve internal restructuring, resource reallocation, and enhanced communication with stakeholders. For instance, the company might allocate more resources to marketing and product development efforts that highlight the value of the integrated approach.

Long-Term Effects on Innovation and Growth

The long-term effects of the CEO’s stance on Microsoft’s innovation and growth will hinge on how well the company manages its internal resources and adapts to evolving market dynamics. Maintaining a unified structure can foster innovation by encouraging cross-divisional collaboration and knowledge sharing. Conversely, a rigid structure could hinder adaptability and limit opportunities for niche market exploration, as seen in other companies that resisted restructuring.

Impact on Different Divisions

The potential impacts on Microsoft’s various divisions differ depending on the specific division and its role within the integrated structure. The table below illustrates some potential scenarios, recognizing that actual outcomes depend on various factors.

| Division | Scenario 1: Continued Integration | Scenario 2: Partial Separation |

|---|---|---|

| Cloud Computing (Azure) | Continued focus on platform interoperability and enhanced ecosystem support. | Potential for independent cloud services, but with reduced synergies and potentially increased competition. |

| Gaming (Xbox) | Leveraging synergies between gaming and other divisions for potential cross-platform features and marketing campaigns. | Possible independent gaming division, potentially impacting cross-platform collaborations and marketing. |

| Productivity (Office) | Maintaining a unified ecosystem for seamless user experience and improved interoperability with other products. | Potential for independent Office suites, potentially reducing interoperability and user experience. |

| Hardware (Surface) | Continued integration with software products for enhanced user experience. | Independent hardware division might lead to a loss of synergistic advantages in product design and software integration. |

Impact on Relationships with Partners and Competitors, New microsoft ceo slams breakup concept

The CEO’s stance could significantly affect Microsoft’s relationships with its partners and competitors. Maintaining a unified front might strengthen relationships with partners who rely on Microsoft’s integrated ecosystem. However, it might also lead to a more defensive stance against competitors, potentially increasing competition. For instance, competitors might try to exploit any perceived vulnerabilities in a unified Microsoft approach.

Impact on Employees and Roles

The CEO’s statement may affect Microsoft’s employees and their roles. A unified structure implies that employees might have a broader range of responsibilities and be exposed to diverse skillsets. Conversely, a more focused approach within a specific division could potentially lead to more specialized roles and responsibilities. This will depend on how Microsoft manages the integration of diverse skills and knowledge across its divisions.

For example, employees involved in software development across multiple divisions may experience more opportunities for collaboration and knowledge sharing.

Industry Response and Analysis

The Microsoft CEO’s recent stance on the breakup concept has ignited a firestorm of reactions across the tech industry. Analysts, competitors, and journalists are dissecting the implications, ranging from concerns about market disruption to potential opportunities for innovation. This analysis delves into the initial responses and examines the potential impact on Microsoft’s future trajectory.The CEO’s statement has prompted a flurry of expert opinions, offering varied perspectives on the implications of the breakup concept.

These responses highlight the complex interplay of competitive pressures, regulatory scrutiny, and technological advancement within the industry.

Initial Reactions from Industry Analysts

Early reactions from industry analysts paint a mixed picture. Some analysts predict a significant shift in the competitive landscape, with potential benefits for smaller players who can capitalize on the fragmentation of the market. Others warn of the potential for decreased innovation and reduced consumer choice if the breakup concept is implemented.

Microsoft’s new CEO’s recent criticism of the breakup concept is interesting, especially considering the parallel discussion happening in the US House regarding spam. A US House committee is currently considering a crackdown on spam, highlighting the growing concerns about online harassment and the need for robust regulatory frameworks. This suggests a broader shift towards addressing digital issues, which, in turn, could impact the broader tech industry, even impacting Microsoft’s ongoing antitrust debate.

The CEO’s stance on the breakup remains a key topic for discussion.

Competitor Responses

Key competitors have responded to the CEO’s statement with varying degrees of public comment. Some competitors have expressed cautious optimism, suggesting the potential for new market opportunities. Others have remained silent, possibly due to uncertainty or strategic considerations. This silence, however, doesn’t negate the potential impact of the breakup on the competitive balance.

Expert Perspectives on Implications

| Expert | Perspective | Rationale |

|---|---|---|

| Analyst A | Favorable to smaller players | Fragmentation creates opportunities for smaller companies to gain market share. |

| Analyst B | Negative impact on innovation | Reduced collaboration between entities may stifle the development of groundbreaking technologies. |

| Analyst C | Increased regulatory scrutiny | The breakup may attract further scrutiny from regulatory bodies, leading to additional compliance burdens. |

Tech Journalist Opinions

Influential tech journalists have offered a variety of opinions on the CEO’s stance. Some praise the CEO’s proactive approach to potentially addressing concerns about market dominance, while others criticize the potential negative consequences for consumer choice and innovation. The diverse perspectives highlight the complex nature of the issue.

Comparison to Similar Issues in Other Tech Giants

The CEO’s approach to the breakup concept can be compared to similar issues faced by other tech giants. Past instances of antitrust scrutiny and regulatory challenges provide valuable context for understanding the potential outcomes and implications for Microsoft. These precedents demonstrate the potential for significant legal battles and lasting market repercussions.

Potential Influence on Investor Confidence

The CEO’s statement may have a significant impact on investor confidence. Positive reactions from investors may boost Microsoft’s stock price, while negative sentiment could lead to a downturn. The actual impact will depend on the perceived validity of the CEO’s arguments and the overall market reaction.

Implications for Competitors

Microsoft’s CEO’s recent statement regarding the breakup concept will undoubtedly ripple through the tech industry, presenting both opportunities and challenges for competitors. The potential for market restructuring and shifting consumer preferences necessitates a careful assessment of the competitive landscape. Understanding how competitors might interpret and respond to this statement is crucial for anticipating future market dynamics.

Potential Opportunities for Competitors

The breakup concept, if implemented, could create new market segments and opportunities for competitors to gain market share. This could include offering specialized solutions for aspects of the formerly integrated products that Microsoft might no longer focus on. For example, a company specializing in cloud storage could see increased demand if Microsoft’s cloud services are fragmented. Companies already offering similar products could leverage this shift to gain a larger customer base.

Potential Challenges for Competitors

The breakup could also create significant challenges. A sudden shift in the market could disrupt existing strategies and require competitors to adapt quickly. Competitors might face difficulties in maintaining compatibility with Microsoft’s new, separated offerings. Existing partnerships and agreements might also become more complex to navigate.

Competitive Landscape Impacts

The competitive landscape will be profoundly affected. A potential reduction in Microsoft’s market dominance in certain areas could create openings for competitors to increase their market share. This could involve attracting Microsoft’s existing customer base or expanding into new niches that Microsoft may have previously controlled.

Competitor Interpretations

Competitors will likely interpret Microsoft’s statement through a variety of lenses. Some might view it as a strategic vulnerability, presenting opportunities for market expansion. Others might perceive it as a sign of internal weakness, potentially leading to a more cautious approach. Still others may see it as an opportunity to bolster their own offerings and position themselves as more reliable solutions.

The new Microsoft CEO’s recent criticism of the breakup concept is certainly stirring things up. It’s interesting to consider this in the context of how Netscape, a pioneer in the browser space, chose Verisign for e-commerce security, a crucial aspect of online trust back in the day. Netscape chooses Verisign for e commerce security This highlights how crucial security was even then, and perhaps the CEO’s concerns about the breakup’s potential impact on innovation are rooted in a similar desire to maintain a robust and secure digital ecosystem.

Ultimately, the future of the industry is at stake.

Competitor Responses

Competitors will likely respond in diverse ways. Some might aggressively pursue opportunities arising from the potential fragmentation. Others may focus on strengthening existing product lines and partnerships. A strategic acquisition of relevant technology could become a viable response. Some competitors might adopt a wait-and-see approach, carefully evaluating the market before committing to significant changes.

Risks and Benefits of Responding

Competitors face risks and benefits when reacting to the CEO’s statement. A swift, decisive response could potentially yield significant market share gains. However, misjudging the market response or misallocating resources could lead to substantial losses. A measured approach, focusing on specific market niches, could balance risk and reward.

Future Outlook and Predictions

The Microsoft CEO’s recent stance against the breakup concept marks a significant turning point in the ongoing debate. This rejection signals a strategic commitment to maintaining Microsoft’s current structure and suggests a proactive approach to navigating potential challenges. The future trajectory of this issue will heavily depend on the reactions of other tech giants and regulatory bodies.

Potential Evolution of the Breakup Concept

The breakup concept, while seemingly losing momentum with Microsoft’s opposition, is not likely to disappear entirely. Regulatory pressure may persist, particularly if other companies or industry stakeholders express concerns about potential anti-competitive practices. The future may see a more nuanced approach, with regulators focusing on specific aspects of Microsoft’s operations rather than a complete dismantling of its structure.

This could involve targeted antitrust investigations or stipulations regarding certain product integrations.

Implications for the Tech Industry

Microsoft’s firm stance against the breakup concept has broader implications for the tech industry. It could encourage other large tech companies to take more assertive positions in defending their structures and operations. Furthermore, it could lead to a re-evaluation of antitrust regulations and their application in the evolving tech landscape. The long-term implications for innovation and competition remain to be seen.

Possible Future Scenarios

| Scenario | Description | Potential Impact on Microsoft | Potential Impact on Market Trends |

|---|---|---|---|

| Status Quo | Microsoft maintains its current structure, and regulatory pressure subsides. | Continued growth and market leadership. | Increased competition in the tech sector but with a reduced regulatory burden. |

| Modified Breakup | Regulators impose stricter conditions or limitations on Microsoft’s operations. | Potential constraints on product development and market expansion, but likely limited impact. | Shifting focus on specific areas of competition; increased scrutiny of mergers and acquisitions. |

| Increased Regulatory Scrutiny | Regulatory pressure intensifies, leading to more investigations and potential legal challenges. | Increased legal and operational costs; potential market share losses in affected areas. | Increased uncertainty and volatility in the tech market; potential decrease in investment. |

Potential Impacts on Overall Market Trends

The outcome of this debate will significantly influence overall market trends. A sustained anti-competitive environment could stifle innovation and limit the growth of new technologies. Conversely, a more nuanced approach to regulation could encourage investment and create a more predictable environment for businesses. The future direction of antitrust policies will likely shape the long-term dynamics of the market.

Strategies for Microsoft

To address the challenges and capitalize on the opportunities presented by the breakup concept, Microsoft could pursue several strategies:

- Proactive engagement with regulators: Maintaining open communication and transparency with regulatory bodies can help shape the discussion and mitigate potential negative impacts.

- Strategic partnerships: Collaborating with complementary companies in the tech sector can foster innovation and growth.

- Investing in research and development: Focus on emerging technologies to maintain its competitive edge and position for future growth.

- Strengthening legal and regulatory expertise: Building a robust team dedicated to navigating the complexities of the legal and regulatory environment.

Last Word

In conclusion, the new Microsoft CEO’s forceful rejection of the breakup concept marks a crucial moment for the company and the tech industry as a whole. The CEO’s statement has ignited a firestorm of debate, with experts and analysts weighing in on the potential short-term and long-term consequences. Microsoft’s future trajectory, the competitive landscape, and the evolution of the breakup concept itself are all now intertwined with this pivotal decision.

This detailed analysis provides context, insight, and potential scenarios to understand the implications of this significant development.