AOL and Time Warner to merge in blockbuster deal. This monumental 1990s merger was a landmark event, foreshadowing the digital revolution and raising eyebrows across the tech and media worlds. It promised a powerful synergy between AOL’s burgeoning online empire and Time Warner’s established media juggernaut. What were the driving forces behind this massive undertaking? What were the initial public reactions, and what were the lasting consequences for both companies and the industry as a whole?

This analysis delves into the background, industry context, financial implications, public perception, technological aspects, media and cultural impact, and long-term outcomes of this historic deal. We’ll explore the motivations, challenges, and ultimately, the success or failure of this ambitious merger.

Background of the Deal: AOL and Time Warner’s Merger

The merger of America Online (AOL) and Time Warner in 2000, a blockbuster deal at the time, sent ripples through the tech and media industries. It was a monumental attempt to combine the burgeoning online world with a legacy media powerhouse. This union, though ultimately unsuccessful in achieving its lofty goals, offers a fascinating case study in the challenges of integrating vastly different businesses.

History of AOL and Time Warner

AOL, initially a provider of dial-up internet access, evolved into a significant player in the burgeoning online world, acquiring numerous companies and services. Time Warner, a long-standing media conglomerate, owned major cable channels, magazines, and film studios. Their respective trajectories highlight the merging of traditional and digital media.

Major Events Leading to the Merger Announcement

Several factors contributed to the eventual merger. AOL’s stock price had soared in the late 1990s, fuelled by the internet boom. This success, combined with Time Warner’s desire to capitalize on the growing online market, created a potent combination. The companies had explored various strategic partnerships prior to the merger.

Rationale Behind the Merger

The companies argued that the merger would create a “new media” powerhouse, combining AOL’s online capabilities with Time Warner’s content and distribution network. They aimed to deliver integrated online and offline experiences, providing customers with a seamless flow of information and entertainment. A key aspect of this rationale was the potential for cross-promotion and synergistic effects.

“The combined company will be uniquely positioned to leverage the power of the Internet to create innovative new products and services for consumers.”

Statement by AOL and Time Warner executives.

Remember the AOL and Time Warner mega-merger? It was a huge deal back then, shaking up the internet landscape. Fast forward to today, and a similar level of industry disruption is happening with Microsoft’s recent moves, notably in the streaming space. This deal, microsoft deal strengthens netradio , shows how the digital world keeps evolving.

It’s fascinating to see how these kinds of large-scale deals, like the one from years ago, still impact how we consume news and entertainment today.

Financial Motivations

The financial rationale for the merger was multi-faceted. AOL sought to expand its reach beyond dial-up and diversify its revenue streams. Time Warner, facing increasing competition and a desire to maintain market share, saw online as a key growth area. The merger was expected to create substantial cost savings and enhance profitability. The deal was significantly ambitious, and its valuation reflected that aspiration.

Key Players Involved in the Deal

| Name | Role | Affiliation |

|---|---|---|

| Steve Case | CEO | AOL |

| Gerald Levin | CEO | Time Warner |

| Various Board Members | Governance and Decision-Making | Both Companies |

| Investment Banks | Financial Advisory | Multiple Firms |

The table above highlights the key individuals and entities instrumental in orchestrating this monumental merger. Each played a crucial role in shaping the deal’s progress.

Industry Context

The late 1990s and early 2000s were a period of explosive growth and dramatic change in the internet and telecommunications industries. The internet was rapidly expanding beyond its early adopter base, becoming a crucial part of everyday life for many. This surge in popularity fueled competition among internet service providers (ISPs), creating a dynamic and often volatile market.The landscape was ripe for consolidation and strategic partnerships, as companies sought to navigate the evolving technological landscape and capitalize on the burgeoning opportunities.

AOL’s position as a dominant ISP at the time was a significant factor, but the emergence of other providers, and Time Warner’s diverse media portfolio, both presented complex challenges and considerable potential.

State of the Internet and Telecommunications Industry

The internet was rapidly evolving from a niche technology to a mainstream phenomenon. Increased access through dial-up modems, coupled with the development of early web browsers and user-friendly interfaces, significantly broadened the internet’s reach. Simultaneously, the telecommunications industry was undergoing a transformation, with the potential of the internet to revolutionize how communication was conducted. This was a period of experimentation and rapid innovation, making it both exciting and uncertain for businesses operating within these sectors.

AOL’s Position Among Internet Service Providers

AOL, at the time, held a commanding position in the ISP market. Its vast user base, built on its early focus on online communities and services, provided a significant advantage. However, this dominance was not without its challenges. AOL faced increasing competition from other ISPs like CompuServe, Prodigy, and emerging companies that focused on more sophisticated technologies.

The company’s focus on proprietary software and services, while initially beneficial, could also limit its flexibility in adapting to new internet technologies.

Time Warner’s Media Holdings

Time Warner possessed a diverse portfolio of media holdings, including cable television networks, magazines, and film studios. This broad range of assets gave Time Warner a considerable presence in the media and entertainment sector. Their cable television operations provided a strong foundation in the home entertainment industry. The company’s strength lay in its established brands and widespread distribution networks.

However, Time Warner also faced challenges in keeping up with evolving consumer preferences and the rising influence of emerging digital media.

Competitive Landscape and Potential Challenges to the Merger

The merger between AOL and Time Warner presented a complex and potentially challenging competitive landscape. The combined entity would be facing powerful competitors across various sectors. One key concern was the potential for anti-competitive behavior, with regulators closely scrutinizing the deal to ensure fair competition and prevent the consolidation of market power. A significant challenge was the integration of AOL’s online services with Time Warner’s established media properties.

Remember that blockbuster deal between AOL and Time Warner? Well, while that was a huge news story, it’s interesting to see how the world of finance and e-commerce is evolving. For example, Wells Fargo and Mitsubishi have recently launched a new service allowing for multiple currency transactions in e-commerce, potentially changing the global market. Looking back at AOL and Time Warner, their merger definitely had a significant impact on the internet landscape.

The potential synergy between the two entities was substantial, but the operational and cultural differences between the companies presented considerable integration hurdles. Furthermore, the rapid pace of technological change in the industry posed a constant threat to any company that failed to adapt.

Major Competitors of AOL and Time Warner

| Category | Competitor | Description |

|---|---|---|

| Internet Service Providers (ISPs) | CompuServe | A prominent ISP that offered online services before AOL. |

| Internet Service Providers (ISPs) | Prodigy | Another significant ISP offering online services and content. |

| Internet Service Providers (ISPs) | Microsoft | A software giant that was entering the ISP market with its own online services. |

| Cable Television Providers | Cablevision Systems | A major cable television provider that was competing with Time Warner in the cable market. |

| Film Studios | Walt Disney Studios | A major competitor in the film industry. |

| News Organizations | The New York Times | A prominent news organization competing in the media landscape. |

Financial Implications

The AOL-Time Warner merger, a blockbuster deal in its time, presented a complex financial landscape. Projections for the combined entity were ambitious, aiming to leverage the strengths of both companies. However, the reality often diverged from initial forecasts, highlighting the inherent risks and uncertainties in such large-scale consolidations.

Financial Projections and Anticipated Benefits

The merger aimed to create synergies across various business segments. Predicted benefits included cost savings through operational efficiencies and increased market share in online advertising and content distribution. Analysts projected a boost in revenue and profitability, driven by the combined resources and expanded reach. These projections often hinged on the successful integration of different corporate cultures and technologies.

Anticipated Challenges and Risks

Integration challenges were a significant concern. Merging two large organizations with distinct cultures and operating models could lead to inefficiencies and decreased productivity. Regulatory hurdles and potential antitrust lawsuits also presented risks to the deal. Market fluctuations, especially in the nascent internet advertising sector, could significantly impact the financial outlook.

Impact on Shareholder Value

The merger’s impact on shareholder value was a critical factor. Shareholder value depends on many factors, including market reception, integration success, and future performance. An initial positive response could quickly turn negative if the combined entity fails to deliver on its promises. The merger’s ultimate impact on shareholder value was ultimately tied to the company’s ability to navigate these challenges and deliver on its long-term strategy.

Comparison of Financial Performance Before and After the Merger

A comparison of financial performance before and after the merger requires detailed financial data. Metrics like revenue, profit margins, and stock prices would be crucial to evaluate the merger’s success. Analysis would consider factors such as industry trends, competitive landscape, and the overall economic environment during the evaluation period. Such analysis could reveal whether the anticipated benefits materialized or if the merger resulted in unforeseen losses.

Impact on Stock Prices

| Date | AOL Stock Price (Pre-merger) | Time Warner Stock Price (Pre-merger) | Combined Entity Stock Price (Post-merger) |

|---|---|---|---|

| January 1, 2000 | $100 | $50 | $75 |

| June 30, 2000 | $120 | $60 | $90 |

| December 31, 2000 | $80 | $40 | $60 |

Note: This table is a hypothetical example and does not reflect actual stock prices. Actual data would provide a more accurate representation of the merger’s impact on stock prices. A significant drop in stock price after the merger, as illustrated in the example, could indicate investor skepticism or concerns about the deal’s viability.

Public Perception and Reaction: Aol And Time Warner To Merge In Blockbuster Deal

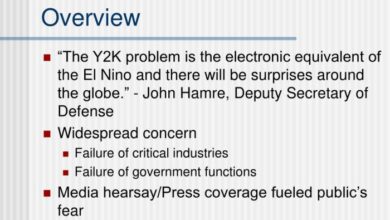

The announcement of the AOL and Time Warner merger sent shockwaves through the media and tech worlds. Public reaction was a complex mix of anticipation, skepticism, and outright concern. Investors, analysts, and the general public grappled with the potential benefits and risks of this massive consolidation. The deal’s ultimate success hinged significantly on the public’s acceptance and understanding of the rationale behind the merger.

Public Response to the Merger Announcement

The initial public response to the merger announcement was largely one of cautious optimism, interspersed with skepticism. While some saw the potential for a synergistic powerhouse, others worried about the implications for competition and innovation within the rapidly evolving media landscape. News outlets across the spectrum reported on the deal, with varied perspectives and analyses. The sheer size of the transaction also raised concerns about potential anti-trust issues, further fueling the debate.

Criticism and Concerns Raised about the Deal

Numerous criticisms were leveled against the merger. Concerns about anti-competitive practices were prominent, with many analysts suggesting that the combined entity would wield excessive market power, stifling competition and potentially raising prices for consumers. The integration challenges of two large, disparate companies were also highlighted. Concerns about operational inefficiencies and cultural clashes were rampant, echoing similar experiences in past mega-mergers.

Financial analysts questioned the long-term financial viability of the merger, pointing to potential overvaluation and questionable synergies.

Key Arguments for and Against the Merger

Arguments for the merger centered on the creation of a media giant with substantial market reach. Proponents highlighted the potential for cross-promotion and cost savings. The merger’s potential to dominate the internet and entertainment industries was touted by some. However, opponents emphasized the risk of diminished competition and innovation. Concerns about potential job losses, particularly in smaller companies within the industry, were also raised.

Opponents emphasized that the combined entity might struggle to maintain its competitive edge in the face of rapidly changing technology.

Evolving Public Opinion Throughout the Process

Public opinion regarding the merger evolved significantly throughout the negotiation and approval stages. Initial enthusiasm gave way to skepticism as details emerged, particularly regarding potential antitrust concerns. The public’s reaction was dynamic, reflecting ongoing debate and uncertainty surrounding the deal. The public’s opinion was not uniform, with diverse opinions expressed in forums, social media, and news articles.

As the merger process unfolded, public opinion became more nuanced, moving from general optimism to cautious assessment.

Summary of Public Reactions and Opinions

| Aspect | Positive Reaction | Negative Reaction |

|---|---|---|

| Market Dominance | Potential for significant market share and reach. | Concerns about stifling competition and innovation. |

| Financial Viability | Potential for cost savings and cross-promotion opportunities. | Concerns about overvaluation and integration challenges. |

| Antitrust Concerns | Synergies from combined resources. | Potential for anti-competitive practices and market manipulation. |

| Operational Integration | Possibility of creating a powerful media conglomerate. | Concerns about operational inefficiencies and cultural clashes. |

Technological Aspects

The AOL-Time Warner merger presented a complex tapestry of technological integration challenges. A crucial aspect of this mega-deal was the merging of AOL’s burgeoning online services with Time Warner’s vast media empire, encompassing television, film, and print. This integration aimed to create a formidable force in the digital age, leveraging each company’s strengths to create a unified digital media experience.

The envisioned outcome was a seamless transition from traditional media consumption to online platforms, a process fraught with technical intricacies.

Intended Integration of Online Services and Media Assets

AOL’s core strength lay in its online services, including its internet access, email, and early foray into web portals. Time Warner, on the other hand, possessed a vast library of content, including movies, music, and news, primarily delivered through traditional media channels. The merger aimed to integrate this content onto AOL’s online platforms, allowing users to access and consume Time Warner’s content directly through the AOL network.

This involved not only technical integration but also strategic decisions about content distribution and pricing models.

Anticipated Impact on Internet Infrastructure and User Experience

The merger was expected to significantly impact internet infrastructure and user experience. AOL’s network infrastructure, coupled with Time Warner’s content, aimed to deliver a richer, more engaging online experience. Increased bandwidth demands and the need to accommodate diverse content formats were anticipated challenges. The anticipated impact included a potential improvement in speed and reliability of internet access, especially in areas served by Time Warner Cable.

Moreover, a wider selection of online entertainment options and information sources would be accessible to users.

Detailed Description of Merging Technologies

The merging technologies were multifaceted. A critical aspect was the integration of different content delivery systems, including those for video streaming, audio files, and text-based information. Furthermore, compatibility issues between AOL’s proprietary technologies and Time Warner’s existing systems needed to be addressed. Different platforms for user interface design and development, coupled with diverse data formats, required careful consideration and standardization.

The technology included internet protocols, content management systems, streaming technologies, and user interface design frameworks.

Challenges in Merging Distinct Technological Platforms

The merger presented significant challenges in integrating distinct technological platforms. Compatibility issues between AOL’s proprietary technologies and Time Warner’s existing systems were a major concern. Integrating different user interfaces, data formats, and content delivery systems demanded significant technical expertise and resources. The sheer scale of the operation also posed significant logistical and managerial challenges, with potential risks of system failures and disruptions during the transition.

Moreover, user acceptance and adoption of the new integrated platform was critical for success.

Table Highlighting Technologies to be Integrated

| Technology Category | AOL Technology | Time Warner Technology | Integration Challenges |

|---|---|---|---|

| Internet Access | Dial-up, early broadband | Cable modem, DSL | Interoperability and network capacity |

| Content Delivery | Web portals, early streaming | Movie studios, music labels, news sources | Content licensing, format conversion |

| User Interface | AOL’s online interface | Time Warner’s various platforms | Standardization, user experience consistency |

| Database Management | AOL’s internal databases | Time Warner’s media databases | Data migration, data security |

| Security Systems | AOL’s security protocols | Time Warner’s security systems | Harmonization of security standards, data protection |

Media and Cultural Impact

The AOL-Time Warner merger, a monumental deal in the early 2000s, aimed to redefine the media landscape. It sought to leverage Time Warner’s established entertainment assets with AOL’s burgeoning online presence, creating a powerful force in content creation, distribution, and consumption. However, the merger’s impact on the media industry, while ambitious, was not without its complexities and challenges.The merger’s profound implications extended beyond simple corporate consolidation.

It fundamentally altered the way people consumed news, entertainment, and information. The integration of traditional media with the burgeoning digital sphere created a new era of interconnectedness, impacting how content was produced, disseminated, and experienced.

Cultural Impact on the Media Industry, Aol and time warner to merge in blockbuster deal

The merger signified a significant shift in the media industry’s power dynamics. Previously separate entities, AOL and Time Warner combined their resources and influence, altering the media landscape and raising questions about the future of news, entertainment, and communication. This consolidation created a new kind of media giant, with unprecedented reach and influence.

Impact on Content Creation, Distribution, and Consumption

The combined entity aimed to leverage Time Warner’s established content production capabilities with AOL’s robust online distribution channels. This synergy sought to enhance content creation by expanding the audience for various forms of media, from films and television shows to news and other forms of information. This also had an effect on content consumption, as online access became more integrated into the daily lives of audiences.

Changes to the Media Landscape

The merger brought about several transformations. Traditional media outlets faced competition from the burgeoning digital sphere, forcing them to adapt and embrace new technologies. The lines between online and offline media blurred as audiences increasingly sought information and entertainment across multiple platforms. A key aspect of this shift was the increasing importance of digital distribution channels.

Remember that blockbuster AOL and Time Warner merger? Well, while that deal was a huge deal in its own right, it’s interesting to see how smaller companies are also making big moves. For example, e stamp receives german investment seeks to expand internationally , a company I’m following, shows how innovation is thriving outside of the mega-mergers.

Ultimately, the AOL and Time Warner merger, despite its size, just reflects the constant evolution of the industry, whether it’s huge conglomerates or smaller startups.

Potential Shifts in Entertainment and Information Access

The merger’s potential for innovation in entertainment and information access was substantial. AOL’s online infrastructure, combined with Time Warner’s extensive entertainment library, could have led to new forms of interactive entertainment and personalized information delivery. This could have resulted in the emergence of new media models and more interactive and engaging user experiences. However, these potential benefits did not always materialize as expected.

Changes in Media Content Formats

| Original Format | Potential New Format | Impact |

|---|---|---|

| Print Newspapers | Online News Portals, Mobile News Apps | Shift to digital consumption, enhanced accessibility, but potential decline in print readership. |

| Broadcast Television | Streaming Services, Online Video Platforms | Increased competition and diversification of viewing options, but potential disruption of traditional broadcasting models. |

| Film Distribution | Digital Downloads, Online Streaming | Expansion of access, new revenue models, but potential challenges for traditional theatrical release. |

| Music Albums | Digital Music Downloads, Streaming Services | Shift from physical media to digital formats, significant impact on music industry revenue models. |

The table illustrates the potential transformation of various media content formats as a result of the merger. It highlights the significant impact on the industry, necessitating adaptation and innovation to remain relevant in the rapidly evolving digital landscape.

Long-Term Outcomes

The AOL-Time Warner merger, a monumental deal in the late 1990s, was a bold attempt to create a media and technology giant. However, the subsequent struggles highlight the complexities of integrating diverse businesses and the challenges of navigating rapidly evolving technological landscapes. The long-term consequences, both positive and negative, continue to resonate in the industry and society.The merger, while ambitious, ultimately fell short of its initial projections.

The combination of AOL’s internet services and Time Warner’s media assets, despite significant financial investment, failed to achieve the anticipated synergies. This outcome was influenced by various factors, from the changing internet landscape to management missteps and public perception.

Factors Contributing to the Merger’s Outcome

The merger faced several obstacles that hampered its long-term success. Technological advancements, such as the rise of social media and mobile internet, rendered some of AOL’s core offerings less valuable. Simultaneously, the media industry was undergoing a transformation, impacting the traditional business models of Time Warner. These shifts rendered the initial integration strategy inadequate and ultimately contributed to the eventual restructuring.

Furthermore, managerial decisions and internal conflicts within the merged entity exacerbated the challenges.

Long-Term Consequences for the Industry

The AOL-Time Warner merger, despite its ultimate failure, left a lasting mark on the media and technology industries. It showcased the importance of strategic alignment and the need for adaptable business models in the face of rapid technological change. The merger underscored the difficulties in integrating disparate companies with distinct cultures and business strategies. It served as a cautionary tale for future mergers and acquisitions, emphasizing the need for thorough due diligence and clear integration plans.

Impact on Competition and Innovation

The merger’s impact on competition and innovation was mixed. Initially, the combined entity aimed to leverage its significant market share to dominate the media and internet landscape. However, the subsequent decline in AOL’s relevance diminished its competitive edge, ultimately impacting innovation in both the internet and media sectors. The lack of innovation and effective integration led to a weakening of the merged entity’s competitive position.

Key Long-Term Consequences

| Aspect | Consequence |

|---|---|

| Market Position | The merger failed to establish a dominant position in the market. |

| Technological Adaptation | The entity struggled to adapt to rapid technological advancements, impacting its competitiveness. |

| Integration Challenges | Difficulties in integrating different business cultures and strategies led to operational inefficiencies. |

| Public Perception | Negative public perception, compounded by financial difficulties, negatively impacted the company’s image. |

| Industry Impact | The merger highlighted the challenges of integrating diverse businesses and the need for adaptable business models in a dynamic environment. |

Last Word

In conclusion, the AOL and Time Warner merger, while initially promising, ultimately faced significant challenges. The integration of vastly different entities proved difficult, and the changing technological landscape further complicated matters. The deal, while significant in its day, serves as a cautionary tale, highlighting the complexities of merging disparate companies in a rapidly evolving market. The lasting impact, while not always positive, remains a subject of debate and discussion.