Venture capital goes mainstream, signaling a significant shift in the investment landscape. Traditional investors, previously hesitant to delve into the world of startups, are now increasingly drawn to the potential rewards. This influx of capital promises to reshape the entire ecosystem, affecting everything from the startups themselves to the strategies employed by venture capital firms.

This evolution stems from a confluence of factors, including macroeconomic trends, technological advancements, and a changing risk tolerance among mainstream investors. The resulting impact on the venture capital ecosystem will be substantial, impacting the availability of capital for startups and the competitive dynamics of the industry.

Defining Mainstream Venture Capital

Venture capital, once a niche activity, is rapidly becoming a mainstream investment strategy. This shift signifies a profound change in how capital is allocated to early-stage companies and a broader understanding of the potential for high-growth businesses. The characteristics of mainstream venture capital differ significantly from its earlier iterations, marking a transition from specialized funds to a more widely accessible and understood investment category.This evolution is driven by factors such as increased investor sophistication, the proliferation of accessible information, and the demonstrable success of venture-backed companies in various sectors.

The definition of “mainstream” in this context implies a broader appeal, greater accessibility, and more readily understood investment principles compared to the more esoteric practices of earlier times.

Characteristics of Mainstream Venture Capital

The rise of mainstream venture capital is not just about increased investment volume; it’s about a fundamental shift in how these investments are perceived and managed. This shift manifests in several key characteristics.

| Characteristic | Description | Example |

|---|---|---|

| Broader Investor Base | Mainstream venture capital attracts a wider range of investors, moving beyond traditional venture capitalists to include institutional investors, high-net-worth individuals, and even retail investors through accessible investment vehicles. | Exchange-traded funds (ETFs) focused on venture capital or venture capital-specific mutual funds allow broader participation in the sector. |

| Increased Transparency and Standardization | Investment processes and reporting standards are becoming more standardized, making it easier for investors to evaluate and compare opportunities. This includes greater transparency in fund strategies, performance metrics, and due diligence procedures. | Publicly available data and performance benchmarks for venture capital funds allow investors to assess risk and potential returns. |

| Emphasis on Measurable Metrics | Mainstream venture capital focuses on quantifiable metrics and demonstrable growth potential, shifting away from purely qualitative assessments. Valuation models and exit strategies are more clearly defined and emphasized. | Venture capital funds employing rigorous financial modeling and clearly defined exit strategies for investments. |

| Focus on Replicable Success Models | Proven business models and successful investment strategies are being replicated across different sectors, fostering a sense of predictable returns and lowering perceived risk. | Increased investment in sectors like SaaS (Software as a Service), e-commerce, and fintech, driven by the demonstrated success of companies in these spaces. |

| Accessibility through Technology | Digital platforms and technologies are facilitating greater accessibility to venture capital opportunities for both investors and entrepreneurs. | Online investment platforms and crowdfunding campaigns enabling broader access to venture capital funding. |

Examples of Mainstream Venture Capital

Several examples illustrate the evolving nature of venture capital. The rise of specific sectors, such as fintech and e-commerce, has seen an influx of mainstream investment.

Criteria for Identifying Mainstream Venture Capital

A venture capital activity or investment is considered mainstream when it meets specific criteria. These include a wider investor base, greater transparency, reliance on measurable metrics, replicable success models, and facilitated accessibility through technology. This shift towards standardization and quantifiable results marks a crucial difference from earlier, more specialized forms of venture capital.

Venture capital is definitely going mainstream, with more and more everyday investors jumping on the bandwagon. This increased accessibility, however, raises questions about whether the wild internet stock market frenzy is over. Perhaps the shift reflects a broader change in how we view risk and investment, moving beyond the initial internet bubble and into a more calculated approach.

If you’re curious about whether the internet stock party is truly over, check out this insightful article: is the internet stock party over. Regardless, the growing interest in venture capital suggests a sustained period of innovation and investment in the future of technology.

Drivers of Mainstream Adoption: Venture Capital Goes Mainstream

The once-exclusive world of venture capital is rapidly becoming more accessible to a broader range of investors. This influx of traditional players, from pension funds to insurance companies, is reshaping the landscape, bringing with it new capital, perspectives, and potentially, new strategies. Understanding the forces driving this mainstream adoption is crucial to grasping the future of innovation and capital allocation.Traditional investors are increasingly drawn to venture capital due to a confluence of factors, including attractive potential returns, diversification benefits, and the evolving macroeconomic environment.

The allure of high growth potential, combined with the relative stability of a diversified portfolio, makes venture capital an increasingly attractive option for long-term capital allocation.

Key Factors Driving Increased Participation

The widening participation of traditional investors stems from several key drivers. These include the pursuit of higher returns in a low-interest rate environment, a desire for diversification beyond traditional asset classes, and a recognition of venture capital’s role in fostering economic growth. The combination of these factors creates a powerful incentive for institutions to allocate a portion of their portfolios to venture capital.

- Higher Returns in a Low-Interest Rate Environment: With interest rates remaining relatively low, traditional investors are actively seeking alternative investment avenues that offer higher potential returns. Venture capital, with its track record of generating substantial returns, presents an attractive alternative to more traditional investments.

- Diversification Benefits: Venture capital often provides diversification benefits that complement traditional portfolios. Its uncorrelated returns can help mitigate overall portfolio risk and enhance long-term performance. This diversification is crucial for managing risk in an increasingly volatile investment environment.

- Recognition of Venture Capital’s Role in Economic Growth: A growing understanding of venture capital’s critical role in fostering innovation and economic growth is influencing institutional investors. Many institutions are now incorporating ESG (environmental, social, and governance) factors into their investment decisions, and venture capital can play a significant role in supporting companies addressing societal challenges.

Macroeconomic Trends and Mainstream Venture Capital

Macroeconomic trends play a significant role in encouraging mainstream venture capital. Lower interest rates, increasing inflation, and evolving geopolitical dynamics create an environment where alternative investments, including venture capital, become more appealing.

- Lower Interest Rates: Low-interest rates often drive investors to seek higher returns in alternative investment strategies, including venture capital. This is a crucial factor in motivating traditional investors.

- Increasing Inflation: Rising inflation can erode the real value of fixed-income investments, prompting investors to seek assets with the potential for higher inflation protection. Venture capital investments can potentially offer a hedge against inflation.

- Evolving Geopolitical Dynamics: Global political and economic uncertainties can lead to heightened interest in diversified portfolios, and venture capital can provide exposure to emerging markets and technologies.

Technological Advancements and Innovation

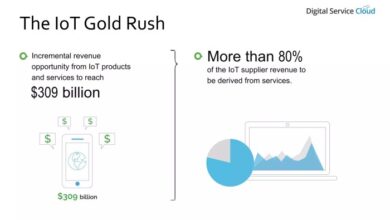

Technological advancements are fundamentally reshaping the venture capital landscape. These innovations are enabling more efficient fundraising, investment analysis, and portfolio management.

- Increased Efficiency in Fundraising and Investment Analysis: Digital platforms and advanced data analytics are significantly streamlining the fundraising process and facilitating more informed investment decisions. This increased efficiency makes venture capital more accessible to a wider range of investors.

- Technological Advancements Driving New Opportunities: Technological advancements are creating new opportunities and sectors for investment, making venture capital more relevant to a diverse range of institutions. Examples include fintech, biotech, and AI.

Motivations of Traditional Investors vs. Earlier Venture Capital Participants

While the motivations of traditional investors and earlier venture capital participants share some common ground, differences exist.

- Emphasis on Diversification and Long-Term Growth: Traditional investors are typically more focused on portfolio diversification and long-term growth, whereas earlier venture capital participants often prioritized individual deal opportunities and high-growth potential.

- Emphasis on Risk Tolerance: The risk tolerance of traditional investors has evolved over time, becoming more accepting of higher-risk, higher-return investments in certain circumstances. This shift is driven by the need for diversification and potentially higher returns in a low-interest-rate environment.

Shift in Risk Tolerance Among Mainstream Investors

The risk tolerance of mainstream investors has shifted significantly. This shift is driven by a combination of factors, including the need for diversification, attractive potential returns, and the availability of new tools for risk management.

Venture capital is definitely going mainstream, and that’s exciting to see. It signals a shift in how businesses are funded, and with the holiday shopping season booming, as reported by Visa ( visa reports holiday online shopping was a hit ), it seems more people are embracing this new investment landscape. This increased accessibility to capital could really propel innovation across various sectors.

- Evolution of Risk Tolerance: Traditional investors are increasingly comfortable with venture capital investments due to improved risk management tools and the demonstrated potential for substantial returns. This increased comfort level is reflected in a growing allocation of capital to venture capital funds.

Impact on the Venture Capital Ecosystem

Mainstream venture capital is no longer a niche activity. Its increasing prevalence fundamentally reshapes the landscape, creating both opportunities and challenges for everyone involved. From startups seeking funding to seasoned investors, the implications are far-reaching. This shift brings about a new set of dynamics and demands careful consideration of how the ecosystem adapts.The influx of mainstream capital alters the very fabric of venture capital.

It brings with it new expectations, different investment strategies, and a broader range of stakeholders. This increased competition and changing investment patterns demand adaptability and a clear understanding of the evolving norms. The traditional hierarchy of venture capital firms is being challenged, and new entrants are disrupting the established order.

Effects on Capital Availability for Startups

The availability of capital for startups is likely to increase significantly. Mainstream investment brings a larger pool of capital into the market, making it easier for promising ventures to secure funding. However, this increased competition also implies a potential for increased scrutiny and higher expectations from investors. This competition could lead to a need for startups to demonstrate a higher degree of preparedness and scalability in their business plans.

Changes in the Competitive Landscape for Venture Capital Firms

The competitive landscape for venture capital firms undergoes a transformation. Traditional venture capital firms face increased competition from institutional investors, private equity firms, and even corporations themselves. This necessitates a re-evaluation of investment strategies and a greater emphasis on differentiation. Firms that can adapt to the changing dynamics, identify promising niches, and develop specialized expertise will likely thrive.

Impact on the Talent Pool

The increasing demand for venture capital expertise and the broadening range of investment opportunities create a demand for a broader range of talent. This translates into a need for a diverse range of skills, from financial modeling and deal structuring to industry expertise and strategic partnerships. Furthermore, the need for highly skilled professionals across various sectors will be a strong driver of talent acquisition and retention.

Impact on the Types of Startups Being Funded

Mainstream venture capital often funds startups that exhibit a higher degree of market validation, established traction, and demonstrable potential for substantial growth. These factors suggest a shift in the types of startups being funded, potentially leading to a decline in funding for ventures that are still in their early stages or operate in less established markets. Furthermore, these companies need to prove they can scale effectively and sustain profitability, and these expectations are often higher with mainstream funding.

Table: Types of Startups Receiving Mainstream Funding

| Industry | Business Model | Funding Amount (USD) |

|---|---|---|

| Fintech | Digital banking, payments, lending platforms | $10M – $100M+ |

| E-commerce | Online retail, marketplace platforms | $20M – $500M+ |

| Healthcare | Telemedicine, digital therapeutics, AI-powered diagnostics | $5M – $200M+ |

| SaaS | Software as a service solutions, cloud-based applications | $10M – $1B+ |

Note: Funding amounts are illustrative and vary widely based on specific factors.

Investment Strategies of Mainstream Investors

Mainstream venture capital firms, often with larger capital pools and longer investment horizons, differ in their investment strategies from more specialized or early-stage investors. They tend to favor companies with established traction and revenue streams, a larger market addressable, and a clear path to profitability. This approach reflects their broader investment portfolios and the need for more predictable returns.

Their focus shifts from purely high-growth potential to a more balanced approach considering scalability, market size, and financial sustainability.The investment strategies of mainstream venture capital firms are heavily influenced by their larger capital and diverse investment portfolios. They often seek to participate in established sectors, understand the competitive landscape, and analyze the financial performance of target companies more rigorously.

This is in contrast to early-stage investors, who prioritize revolutionary concepts and are often willing to accept greater risk for the potential of exponentially higher returns.

Typical Investment Strategies

Mainstream venture capital firms generally favor later-stage investments, typically Series B, C, or D rounds. They look for companies with strong revenue generation, demonstrable market leadership, and a solid management team. Due diligence is typically more focused on financial projections, market analysis, and competitive positioning. This contrasts with early-stage investors who prioritize product-market fit, technology validation, and the potential for exponential growth.

Comparison with Specialized Investors

Specialized investors, such as those focusing on specific industries (e.g., biotech or fintech), often have a more nuanced understanding of the target market. They may invest in earlier stages and often have deeper domain expertise. Mainstream firms, with their broader portfolios, rely on more generalist investment teams and comprehensive due diligence to assess companies across diverse sectors.

Due Diligence and Portfolio Management

Mainstream firms adopt a more structured due diligence process, focusing on financial metrics, market trends, and competitive analysis. They also emphasize operational efficiency and the ability of the company to scale. Portfolio management involves active engagement with portfolio companies, aiming for strategic exits (acquisitions or IPOs) within a defined timeframe. Specialized investors may have less structured processes, emphasizing more direct interactions with founders.

Investment Choices

Mainstream firms might invest in a company with a proven product, a large user base, and clear revenue projections, even if the potential for exponential growth is less significant than that of an early-stage startup. They often prefer companies with a longer track record, a more developed infrastructure, and demonstrable financial performance.

Investment Timelines, Risk Tolerance, and Expected Returns

| Characteristic | Mainstream Investors | Non-Mainstream Investors (Early-Stage, Specialized) |

|---|---|---|

| Investment Timeline | 3-7 years | 5-10+ years |

| Risk Tolerance | Lower | Higher |

| Expected Returns | 10-15% IRR (Internal Rate of Return) | 20-30%+ IRR (Internal Rate of Return) |

This table highlights the typical differences in investment horizons, risk tolerance, and anticipated returns between mainstream and non-mainstream investors. Mainstream investors prioritize more predictable returns within a shorter timeframe, while non-mainstream investors often accept a higher risk profile for the potential of significantly higher returns over a longer investment period.

Challenges and Opportunities

The influx of mainstream capital into venture capital is a double-edged sword. While it promises unprecedented opportunities for startups and the broader economy, it also presents new challenges and risks that need careful consideration. Navigating this new landscape requires a nuanced understanding of the potential pitfalls and benefits for all stakeholders.

Potential Challenges for Mainstream Venture Capital

The increased competition and scrutiny from a wider range of investors can lead to a higher bar for startups seeking funding. Mainstream investors, accustomed to different investment horizons and risk tolerances, may not fully understand the nuances of the startup ecosystem. This can result in a misalignment of expectations and potentially hinder the development of innovative ventures. Moreover, the influx of capital might lead to a bubble effect, where valuations are inflated and unsustainable.

Venture capital is definitely going mainstream, and that’s a pretty big deal. It’s exciting to see how companies like IBM and AT&T are forging new ground in e-commerce, as seen in their new alliance here. This partnership shows how established tech giants are embracing innovative approaches, further fueling the trend of venture capital moving into the mainstream.

It all points to a very interesting future for the industry.

Potential Risks and Pitfalls for Investors

Mainstream investors entering the venture capital arena face the challenge of adapting to the dynamic and often unpredictable nature of the startup ecosystem. A lack of experience in this field can expose them to significant risks. The inherent volatility and high failure rate of startups are not always readily apparent to those unfamiliar with the industry. Thorough due diligence and a robust understanding of market trends are critical to mitigate these risks.

Poorly executed investment strategies, driven by short-term gains rather than long-term value creation, can lead to substantial losses.

Potential Risks and Pitfalls for Startups

Startups face the risk of dilution of control, as they might be forced to accept terms from mainstream investors that prioritize financial returns over long-term vision. The increased scrutiny from multiple investors might also lead to a more rigid and less flexible operating environment. Additionally, the focus on measurable metrics and rapid growth can potentially overshadow the long-term vision and sustainability of the business.

Opportunities Presented by Increased Capital Availability

The increased availability of capital from mainstream investors can fuel innovation and economic growth. Startups can access funding to scale rapidly, develop new products and services, and expand into new markets. This can lead to the creation of jobs, the development of disruptive technologies, and a more vibrant and dynamic economy. Moreover, a wider range of investors may bring diverse perspectives and resources, fostering innovation and driving progress in various sectors.

Potential for Increased Innovation and Economic Growth

The injection of mainstream capital can catalyze innovation by providing startups with the resources needed to pursue ambitious projects and develop breakthrough technologies. This increased capital infusion can lead to faster product development cycles, larger market penetration, and greater job creation. The potential for significant economic growth is undeniable, as more businesses are able to achieve scale and impact.

However, this must be balanced with the potential for unintended consequences.

Comparison of Benefits and Risks for Startups

| Factor | Benefits | Risks |

|---|---|---|

| Funding Availability | Increased access to capital for growth and expansion | Potential for dilution of ownership and control |

| Investor Expertise | Access to diverse perspectives and industry knowledge | Potential for misalignment of expectations and priorities |

| Market Validation | Increased visibility and validation of the startup’s value proposition | Increased pressure to meet rapid growth targets |

| Operational Efficiency | Potential for streamlined operations and improved efficiency | Potential for loss of autonomy and flexibility |

| Economic Impact | Increased job creation and economic activity | Potential for inflated valuations and bubbles |

The Future of Venture Capital

Mainstream venture capital is poised to reshape the industry landscape, bringing a wider range of capital and perspectives to the table. This influx of new players will undoubtedly influence investment strategies, potentially accelerating innovation and impacting the very definition of success in the startup ecosystem. The future of venture capital is no longer solely the domain of traditional VC firms, but a collaborative effort involving a diverse range of investors.

Shifting Investment Strategies, Venture capital goes mainstream

Mainstream investors will likely prioritize specific sectors or stages of development. For example, large institutional investors, like pension funds or sovereign wealth funds, often have long-term investment horizons and may focus on later-stage funding rounds, looking for exits and stable returns. Conversely, asset managers targeting high-growth, early-stage companies will likely gravitate towards innovative sectors and entrepreneurs with demonstrably strong market potential.

This diversification will undoubtedly affect the way investment decisions are made, introducing a need for greater transparency and standardized metrics for evaluating startups.

Impact on the Innovation Landscape

The increased availability of capital from mainstream investors could stimulate innovation in several ways. More companies will likely access capital at earlier stages, leading to faster development cycles. This wider access to capital could also foster more diverse startups and entrepreneurship, potentially breaking down existing barriers and creating more inclusive pathways to success. However, the influx of mainstream capital could also potentially lead to homogenization, if investments focus on similar sectors or models.

The challenge will be to maintain the unique spirit of innovation while also ensuring the sustainability and scalability of ventures.

The Role of Government and Regulation

Government regulation will play a crucial role in shaping the future of venture capital. Regulatory frameworks for venture capital funds and investment activities will become increasingly important, aiming to protect investors and promote ethical practices. Governments will need to balance the desire to encourage innovation with the need to mitigate risks. Potential future regulations might focus on areas like transparency, due diligence, and responsible investment strategies.

For instance, rules governing the disclosure of investment strategies or the handling of conflicts of interest will become more prominent. The development of clear, yet flexible regulatory frameworks is essential to fostering innovation while safeguarding the interests of investors and the broader ecosystem.

Future Trajectory of Mainstream Venture Capital

(Diagram/Flowchart): A visual representation of the future trajectory of mainstream venture capital would be a branching flowchart. The main branch could represent the evolution of mainstream investment strategies (e.g., early-stage, late-stage, sector-focused). Sub-branches could detail the impact on the innovation landscape (e.g., increased innovation, homogenization). Another branch could illustrate the evolving regulatory landscape, with further sub-branches focusing on transparency requirements, due diligence standards, and responsible investment guidelines. The diagram would show how these factors interact and influence each other, highlighting the complex interplay between mainstream capital, the innovation ecosystem, and regulatory frameworks. The diagram would likely depict a dynamic and multifaceted future for mainstream venture capital.

(Diagram/Flowchart): A visual representation of the future trajectory of mainstream venture capital would be a branching flowchart. The main branch could represent the evolution of mainstream investment strategies (e.g., early-stage, late-stage, sector-focused). Sub-branches could detail the impact on the innovation landscape (e.g., increased innovation, homogenization). Another branch could illustrate the evolving regulatory landscape, with further sub-branches focusing on transparency requirements, due diligence standards, and responsible investment guidelines. The diagram would show how these factors interact and influence each other, highlighting the complex interplay between mainstream capital, the innovation ecosystem, and regulatory frameworks. The diagram would likely depict a dynamic and multifaceted future for mainstream venture capital.

Last Recap

The mainstreaming of venture capital represents a pivotal moment for the industry. While it brings with it substantial opportunities for innovation and economic growth, it also presents challenges and risks for both investors and startups. Navigating these complexities will be crucial to harnessing the full potential of this new era.