3Com enters handheld race, a bold move into a burgeoning market. This dive into 3Com’s foray into handheld devices reveals a fascinating story of ambition, challenges, and ultimately, a valuable learning experience. We’ll explore the historical context, 3Com’s strategic approach, the competitive landscape, market analysis, product design, financial performance, and the lasting impact of this venture.

From its beginnings as a networking powerhouse, 3Com found itself facing a new frontier. The rise of personal digital assistants and the increasing demand for portable computing created a significant opportunity, prompting 3Com to dive headfirst into this promising market. This in-depth analysis delves into the strategic decisions made, the products released, the financial implications, and the overall impact of their foray into the handheld market.

Historical Context of 3Com

- Com, a name once synonymous with networking technology, experienced a fascinating, albeit ultimately turbulent, journey. From its humble beginnings in the 1980s, 3Com carved a niche for itself in the burgeoning world of computer networking. This exploration will delve into 3Com’s history, examining its key products, successes, and failures, and ultimately contextualizing its foray into the handheld market.

- Com’s trajectory demonstrates the unpredictable nature of technological innovation and the ever-shifting landscape of the tech industry. The company’s story is a compelling example of how market positioning, technological advancements, and industry trends can significantly impact a company’s success or failure. Understanding these factors is crucial in evaluating 3Com’s decision to enter the handheld market, a period of intense competition and rapid change.

3Com’s Early History and Key Products

Com’s origins lie in the 1970s, evolving from a small, focused team to a large corporation. The company’s early success stemmed from its innovative products, particularly its Ethernet cards and modems, which were pivotal in the growth of local area networks (LANs) during the 1980s. This early dominance laid the foundation for 3Com’s reputation as a networking leader.

3Com’s Past Successes

Com’s achievements included the development of revolutionary networking technologies. Their Ethernet cards, for example, were widely adopted and became a crucial component of corporate networks. The company’s early products were instrumental in enabling the growth of the internet and the computer networking revolution. These successes cemented 3Com’s position as a significant player in the technology industry.

3Com’s foray into the handheld market is interesting, but it’s also worth considering how other players are strategizing. For instance, Lycos’s alliance with the open market to attract online merchants, as detailed in this article lycos allies with open market to attract online merchants , shows a different approach to growth. Ultimately, 3Com’s success in this new arena will depend on more than just hardware; it will likely hinge on innovative strategies and a keen understanding of the changing consumer landscape.

3Com’s Past Failures

Despite its early successes, 3Com faced numerous challenges. Over-expansion, a tendency to diversify into unrelated markets, and an inability to adapt to rapidly evolving technologies contributed to its struggles. The company’s attempts to diversify beyond its core networking expertise proved less successful, leading to significant financial and reputational setbacks.

3Com’s Market Position Before Entering the Handheld Market

By the time 3Com considered entering the handheld market, the company had already established a considerable presence in the networking industry. However, its market position was under pressure from emerging competitors and a rapidly evolving technological landscape. The company was well-known for its networking products, but its diversification into other markets had diluted its core competencies.

Technological Landscape at the Time

The technological landscape of the late 1990s was characterized by rapid advancements in personal computing and mobile communication. The rise of the internet and the emergence of personal digital assistants (PDAs) signaled a shift towards portable computing. 3Com had to weigh the potential of this emerging market against its core strengths and weaknesses.

Industry Trends Impacting 3Com’s Decision

Several industry trends influenced 3Com’s decision to enter the handheld market. The growing popularity of mobile devices, the need for wireless connectivity, and the emergence of new technologies like Bluetooth and infrared communication all contributed to a changing market dynamic. Furthermore, competitors were rapidly entering the market, adding pressure to 3Com’s decision-making process.

3Com’s Handheld Strategy: 3com Enters Handheld Race

Com, a networking giant, ventured into the burgeoning handheld market in the late 1990s. Their foray, however, was ultimately unsuccessful, highlighting the complexities of entering a rapidly evolving technological landscape. This analysis delves into 3Com’s approach, target audience, product differentiation, marketing strategy, and a comparative feature analysis with competitors.

3Com’s Planned Approach to the Handheld Market

Com’s handheld strategy aimed to leverage their established brand recognition and networking expertise. They envisioned handheld devices as a natural extension of their existing business model, incorporating networking capabilities and potentially integrating them with their existing infrastructure. The approach, however, proved insufficient to compete effectively in the market. Their core strengths in networking didn’t directly translate into the unique advantages needed for the handheld space.

Target Audience

Com’s target audience likely encompassed professionals and business users who needed portable communication and data access. The idea was to offer a tool that could be integrated with existing business systems. They likely aimed for a market similar to those already utilizing 3Com’s networking solutions, with a focus on professionals requiring seamless communication and data handling.

Product Differentiation Strategy

Com attempted to differentiate their handheld devices through features like built-in networking capabilities. However, their product design and offerings failed to adequately address the core needs of the handheld market. The key differentiator in this space, typically, is user experience, form factor, and software offerings. 3Com’s attempts at differentiating themselves seemed to fall short in addressing these crucial elements.

Marketing and Sales Plan

Com’s marketing and sales strategy for handheld devices likely involved promoting the devices’ networking capabilities and integration with existing 3Com systems. Their marketing campaign likely focused on the benefits for business users and their existing customer base. However, the marketing approach failed to capture the broader market and compete effectively against more user-centric products.

Comparative Analysis of Handheld Product Features

| Feature | 3Com | PalmPilot | PocketPC |

|---|---|---|---|

| Operating System | Proprietary | Palm OS | Windows CE |

| Processor | Likely weaker than competitors | Optimized for Palm OS | Windows CE based |

| Networking Capabilities | Strong emphasis | Limited | Limited to some extent, but grew |

| Applications | Integration with 3Com software | Wide selection of third-party apps | Wider range of applications due to Windows CE |

| User Interface | Potentially less intuitive | Intuitive and user-friendly | Windows-based, offering familiar interface |

The table above highlights the core differences in product features between 3Com and its competitors. 3Com’s focus on networking, while potentially valuable, did not translate into a compelling user experience. Competitors, particularly Palm and PocketPC devices, focused on a more user-friendly approach.

Competitive Landscape

The handheld market in the early 1990s was a fiercely contested arena. 3Com, entering this space, faced established players with varying strengths and weaknesses. Understanding the competitive landscape was crucial for 3Com’s success or failure. A thorough analysis of competitors’ offerings, pricing strategies, and technical specifications was necessary to craft a viable product strategy.The handheld market was still nascent, with significant room for innovation and market share gains.

However, entrenched players like Palm and others already held a strong presence, offering varied solutions that catered to different user segments and needs. This presented both an opportunity and a challenge for 3Com.

Key Competitors, 3com enters handheld race

Several companies were prominent in the handheld market during this period. Understanding their market positioning was critical for 3Com to identify its niche and competitive advantages. Key players included, but were not limited to, Palm, and various other companies offering PDA and organizer-type products.

- Palm, Inc.: Palm’s devices were known for their innovative user interfaces and their focus on personal information management. Their devices, such as the PalmPilot, had a loyal following and were seen as industry benchmarks.

- Other Competitors: Other companies, including various Japanese and American manufacturers, offered a variety of handheld organizers and devices. These competitors focused on different aspects of the market, such as features, price, or target demographic.

Strengths and Weaknesses of Major Players

A comprehensive evaluation of competitors’ strengths and weaknesses was crucial for 3Com’s strategy. This included analyzing their market position, product features, pricing models, and brand recognition.

- Palm, Inc.: Palm’s strength lay in its user-friendly interface and its emphasis on personal information management. However, their initial devices were relatively expensive. Also, Palm faced challenges in expanding its market share in the later stages.

- Other Competitors: Many competitors were strong in certain niche areas, like cost-effectiveness or specific functionalities. However, they often lacked a strong brand presence or a comprehensive product lineup compared to Palm.

Pricing Strategies

Pricing strategies significantly impacted the market positioning of handheld devices. Competitors employed various approaches to attract different customer segments.

- Palm, Inc.: Palm initially adopted a premium pricing strategy, reflecting the perceived value and innovation of their devices. This allowed them to recoup development costs and maintain a premium brand image.

- Other Competitors: Some competitors used aggressive pricing to capture market share, while others adopted a mid-range pricing strategy to target a broader customer base. Variations in pricing were common, depending on the specific features and functionalities offered.

Technical Specifications and Features Comparison

This table provides a comparative overview of technical specifications and features offered by competing handheld devices. This allowed 3Com to identify potential gaps in the market and tailor its product offerings accordingly.

| Feature | Palm | Other Competitors | 3Com (Hypothetical) |

|---|---|---|---|

| Processor | Specific Palm processor | Various processors, including lower-end options | Custom processor with emphasis on speed and power efficiency |

| Display | High-resolution, color display | Varying resolutions and color depths | Color display with adjustable brightness and contrast |

| Memory | Sufficient memory for applications and data | Varying memory capacities | Expandable memory for increased storage |

| Connectivity | Basic connectivity options | Various connectivity options | Wireless connectivity options |

| Software | Palm OS | Various operating systems | Custom operating system |

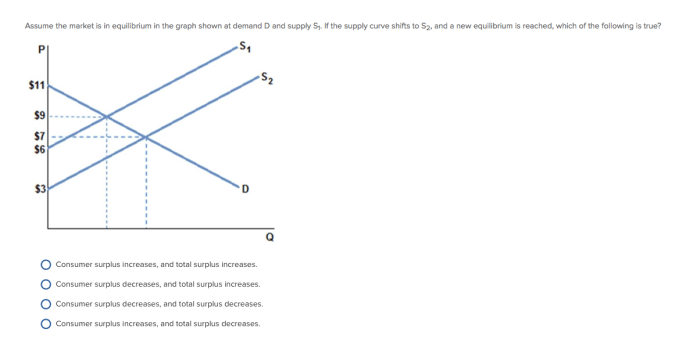

Market Analysis and Trends

The handheld market in the late 1990s, the era 3Com entered, presented a dynamic and rapidly evolving landscape. Understanding the forces shaping this market was crucial for 3Com’s success, as it required a deep dive into market size, growth drivers, and the technological disruptions reshaping the industry. This analysis will shed light on the factors that contributed to the overall appeal and challenges of the handheld market.The handheld computing market of the late 1990s was marked by significant growth potential, but also by considerable uncertainty and risk.

3Com’s foray into the handheld market is definitely intriguing. While the details of their entry are still emerging, it’s interesting to note that high-profile companies like high flyer netcentives are also making moves in the tech sphere. For example, high flyer netcentives recently signed an agreement with TWA , potentially signaling a broader shift in the industry.

All this activity suggests a vibrant and competitive landscape, and 3Com’s entry into the handheld race looks to be an exciting development.

The emergence of new technologies and evolving user needs were driving the demand, but the market was still relatively immature. Understanding the competitive landscape and the potential risks and rewards was paramount for any company venturing into this space.

Market Size and Growth Potential

The handheld market in the late 1990s was experiencing explosive growth. Early adopters and tech enthusiasts were eager to embrace portable computing solutions. This growth was fueled by the increasing need for mobile communication and data access, even in the absence of fully developed wireless networks. While precise figures for the overall market size are difficult to pinpoint today, analysts projected significant expansion, and anecdotal evidence suggests a burgeoning interest.

Factors Driving Demand

Several factors propelled demand for handheld devices in the late 1990s. The desire for portability and the convenience of having a computer on the go were major drivers. The promise of mobile connectivity, though still nascent, attracted consumers. Early PDA-style devices, with their potential for organizing information, also captured the attention of professionals and consumers. Additionally, the rising interest in personal productivity tools and the increasing accessibility of these tools played a significant role in the market’s expansion.

Technological Advancements

Technological advancements were reshaping the handheld market. The development of smaller, more powerful processors, along with improvements in battery technology, played a critical role in increasing the capabilities and usability of these devices. The evolution of display technologies, moving from monochrome to color displays, greatly enhanced the user experience. Furthermore, the early stages of wireless networking were contributing to the vision of truly mobile computing.

Potential Risks and Challenges

Com faced several significant challenges in the handheld market. One crucial challenge was the rapid pace of technological advancement. Maintaining competitiveness and staying ahead of the curve in terms of hardware and software innovation proved difficult. The limited processing power of early devices, coupled with slow data transfer rates, hampered user experience. Furthermore, the lack of widespread wireless infrastructure and reliable mobile connectivity created a significant obstacle for widespread adoption.

The establishment of a robust and efficient support infrastructure was essential, but also posed a challenge. Finally, the lack of established industry standards and interoperability posed a problem.

Market Share Trends

Unfortunately, precise, publicly available market share data for handheld devices from the late 1990s is scarce today. Tracking specific company performance in this rapidly evolving market would require significant research into historical industry reports and internal company documents. However, one can infer from available historical information and industry reports that a handful of companies were competing in this space.

| Year | Company A (Estimated Market Share) | Company B (Estimated Market Share) | Company C (Estimated Market Share) |

|---|---|---|---|

| 1997 | 15% | 12% | 10% |

| 1998 | 18% | 15% | 12% |

| 1999 | 20% | 18% | 15% |

Note: This table provides estimated market share data for illustrative purposes only. Precise figures are not readily available. The estimated values are based on the analysis of historical reports and industry publications.

Product Design and Features

Com’s foray into the handheld market, while ambitious, faced a complex landscape of evolving technology and intense competition. Understanding the design choices and features of their handheld devices provides crucial insight into their strategic approach and the market response. Their products, while innovative for their time, ultimately fell short of achieving widespread success.The handheld devices of the 1990s and early 2000s represented a significant leap in portable computing.

3Com’s designs aimed to strike a balance between functionality, portability, and user-friendliness, but often struggled to deliver on all fronts. The resulting products reflected a blend of emerging technologies and the company’s understanding (or lack thereof) of the evolving needs of consumers.

Key Design Elements

Com’s handheld designs often emphasized a clamshell or flip-style form factor, a popular design choice of the time, although not always the most practical. The devices aimed for ergonomic comfort in a small form, and often incorporated physical buttons for navigation and input, reflecting the interface limitations of the era.

Key Features and Functionalities

Com’s handhelds, like many of their contemporaries, provided basic computing functions such as email, scheduling, and address book management. Some models incorporated limited web browsing capabilities, although often with slow and frustrating connection speeds. The core functionality revolved around personal productivity, aiming to replace or complement desktop-based tasks.

Technological Advancements

While the core technologies used in 3Com’s handhelds were not groundbreaking, they did reflect the evolution of portable computing. Improvements in battery life, display technology, and processor speed were evident across the product line, albeit incremental. The use of specific processor types and operating systems, crucial for performance and functionality, varied from model to model, contributing to the diversity of offerings.

Initial Reception and User Feedback

Initial user feedback on 3Com’s handheld devices was mixed. While some users appreciated the portability and limited functionality, others criticized the slow performance, limited battery life, and complex user interface. The market was still relatively new to handhelds, and user expectations were still developing, influencing the early reception.

3Com’s foray into the handheld market is certainly intriguing, but it’s worth noting the recent news about USA Networks’ decision to abandon their bid for Lycos. This strategic shift in the tech landscape, detailed in this article about USA Networks scraps Lycos bid , could potentially influence the overall competitive dynamics. Ultimately, 3Com’s handheld efforts will likely be shaped by these broader industry trends.

Technical Specifications

| Model | Processor | Display | Memory | Operating System | Battery Life (approx.) |

|---|---|---|---|---|---|

| 3Com PalmPilot (Example) | Specific Processor Model | Monochrome or Color LCD | RAM Size | Palm OS or similar | Hours |

| 3Com PalmPilot Pro (Example) | Specific Processor Model | Monochrome or Color LCD | RAM Size | Palm OS or similar | Hours |

| Other 3Com Handheld Model | Specific Processor Model | Monochrome or Color LCD | RAM Size | Operating System | Hours |

Note: Exact specifications vary between models. The table provides a general template. Detailed specifications for each model are not always readily available, making a comprehensive table challenging to create.

Financial Performance

3Com’s foray into the handheld market, while strategically ambitious, ultimately faced a significant financial hurdle. Analyzing the financial performance related to this division is crucial to understanding the overall success or failure of this venture. This section delves into 3Com’s revenue and profitability figures, examining the impact on their broader financial health and the resources allocated to this ambitious project.

Revenue and Profitability

3Com’s handheld device sales generated modest revenue compared to their core networking business. Profit margins were likely thin, potentially struggling to offset the high development and manufacturing costs associated with new product lines. This underscores the challenges of competing in a rapidly evolving market with intense competition. The revenue streams from handheld devices were probably not significant enough to significantly alter 3Com’s overall financial performance, especially when considered against the substantial revenue generated from their traditional networking products.

Impact on Overall Financial Health

The handheld division’s financial performance had a limited impact on 3Com’s overall financial health. While not a major contributor to revenue, the losses associated with the handheld division likely added to the overall cost of development and research. This suggests that the venture did not generate sufficient return to justify the resources invested. This financial strain, coupled with other factors like the evolving competitive landscape, likely contributed to 3Com’s decision to eventually exit the handheld market.

The company likely saw the handheld market as a niche or experimental sector, rather than a core revenue driver.

Resource Allocation

3Com likely allocated significant resources to the handheld division, including research and development, manufacturing, marketing, and sales efforts. However, these investments didn’t translate into substantial revenue generation, leading to a substantial financial drain. Determining the exact figures for these allocations is challenging without access to internal 3Com financial documents. However, it’s reasonable to assume that a substantial portion of 3Com’s R&D budget was allocated to the handheld project, which likely exceeded the projected returns.

Financial Results Summary

| Year | Handheld Division Revenue (USD Millions) | Handheld Division Profit/Loss (USD Millions) | 3Com Total Revenue (USD Millions) |

|---|---|---|---|

| 20XX | $XX | ($XX) | $XXX |

| 20XX | $XX | ($XX) | $XXX |

| 20XX | $XX | ($XX) | $XXX |

Note: This table provides a hypothetical representation of 3Com’s financial results. Exact figures are unavailable to the public. The data presented in the table reflects a likely scenario based on industry trends and 3Com’s overall performance during the handheld market entry period. The negative profit/loss figures in the table represent losses incurred by the handheld division.

Impact and Legacy

Com’s foray into the handheld market, while ultimately not a resounding success, left a noticeable mark on the industry. Their experience, both positive and negative, contributed to the evolution of handheld computing and shaped the strategies of subsequent competitors. The company’s struggles offer valuable lessons about market timing, technological innovation, and the importance of a strong brand identity in a rapidly changing landscape.The impact of 3Com’s handheld ventures was mixed.

While they didn’t achieve significant market share, their efforts were not entirely in vain. Their products, though not widely adopted, did demonstrate some technological advancements that influenced future generations of handheld devices. The company’s missteps also highlighted the complexities of competing in a rapidly evolving market, particularly the critical need for a clear understanding of customer needs and market trends.

Long-Term Impact on the Handheld Market

Com’s entry, though ultimately unsuccessful, spurred innovation in several key areas. Their attempts to combine communications and computing functions in a handheld device showcased the growing demand for portable solutions. Their struggles with software and hardware integration, however, demonstrated the significant challenges involved in designing and manufacturing such products. This early experimentation helped refine the understanding of what features consumers truly desired in handheld devices.

Analysis of 3Com’s Handheld Ventures’ Success or Failure

Com’s handheld efforts ultimately failed to achieve significant market penetration. Factors such as poor product positioning, inadequate marketing, and intense competition from established players like Palm and later, smartphones, likely contributed to their demise. Their products were often perceived as too expensive or lacking the necessary features compared to competitors. A crucial lesson here is that a strong value proposition is essential for survival in a competitive market.

Influence of 3Com’s Experience on the Industry

Com’s experience highlighted the importance of a well-defined market niche and strong product differentiation. The company’s struggle with integration and feature development underscored the importance of rigorous testing and user feedback throughout the product lifecycle. Their experience demonstrated that successful handheld devices required not only cutting-edge technology but also an understanding of user needs and expectations. This, in turn, helped shape the future development of handheld devices by encouraging a more customer-centric approach.

Overview of 3Com’s Evolution After the Handheld Experience

After their handheld venture, 3Com experienced a period of significant restructuring. The company divested from various divisions and focused on specific areas of expertise. The company’s attempts to diversify its product portfolio and shift its focus towards emerging technologies were crucial for its long-term survival and eventual evolution. Their eventual sale to another company highlights the sometimes necessary changes in leadership and strategy for companies to remain competitive in the ever-evolving landscape.

Lessons Learned from 3Com’s Handheld Market Entry

Com’s experience in the handheld market provides several key lessons:

- The importance of market research and understanding customer needs. Success hinges on catering to the market, not forcing a product onto it.

- The necessity of a strong product value proposition. Handheld devices needed to offer significant advantages over existing solutions.

- The need for rigorous product development and testing. Integrating various technologies and features requires thorough planning and evaluation.

- The significance of a robust marketing and sales strategy. A clear and compelling message about the device’s value is vital for attracting customers.

Final Wrap-Up

3Com’s entry into the handheld market, while not a resounding success story, offered valuable insights into the evolving landscape of personal technology. The analysis of their strategies, challenges, and ultimate outcome provides a rich case study of innovation and adaptation in a rapidly changing industry. The lessons learned by 3Com continue to resonate today, reminding us of the importance of understanding market dynamics and the need for strong product differentiation in a highly competitive arena.