Yahoo deutsche bank bring german e commerce into focus – Yahoo Deutsche Bank bring German e-commerce into focus, highlighting a potential synergy between these two giants. This partnership promises exciting opportunities for consumers, businesses, and the German economy as a whole. The report explores the potential benefits, challenges, and competitive landscape of this venture, examining existing and potential services, and considering the broader German e-commerce context.

The analysis delves into Yahoo’s and Deutsche Bank’s individual roles in the German market, comparing their strengths and weaknesses in the e-commerce sector. It also examines the current German e-commerce landscape, including key players, trends, and the regulatory environment. Furthermore, it contrasts the German market with other European markets, providing a wider perspective.

Introduction to Yahoo and Deutsche Bank’s Role in German e-commerce

Yahoo’s presence in the German market has been largely overshadowed by its broader global footprint. While Yahoo has historically held a presence in Germany, its specific role in the e-commerce sector hasn’t been a prominent one compared to other, more focused players. Deutsche Bank, on the other hand, has a significant, albeit indirect, involvement in German e-commerce through its financial services offerings.

Their role extends to providing financing and investment opportunities for e-commerce businesses, demonstrating a deep understanding of the market’s needs. The potential synergy between these two entities lies in leveraging Deutsche Bank’s financial expertise to support Yahoo’s expansion in the German e-commerce space. This could involve financing ventures, managing financial transactions for e-commerce businesses, or even providing consulting services tailored to the German market.Deutsche Bank’s involvement in the German e-commerce ecosystem stems primarily from its broader financial services offerings.

Their deep understanding of the German market, combined with their vast network of relationships within the financial community, provides them with a unique position to support e-commerce businesses. This involvement isn’t directly in the retail side of e-commerce but rather in the financial support structure. The potential synergy between Yahoo and Deutsche Bank in this context could be substantial, offering both parties opportunities to expand their reach and impact within the German e-commerce landscape.

Yahoo’s Historical Presence in Germany

Yahoo’s historical presence in Germany, while not insignificant, hasn’t been a primary focus for e-commerce activities. Their core presence has been centered on providing internet services, and e-commerce initiatives have been less pronounced. This lack of a direct focus on e-commerce in Germany contrasts with the more active involvement of other global players in the region.

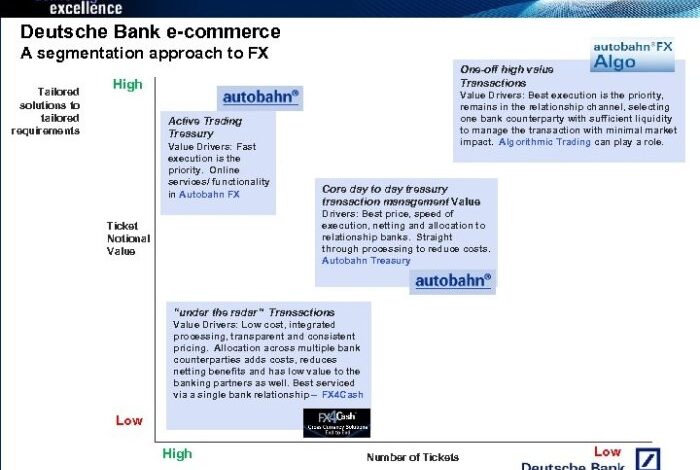

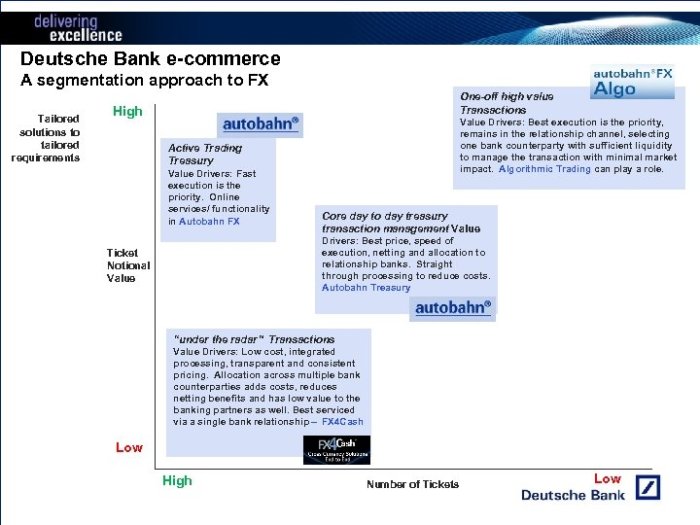

Deutsche Bank’s Involvement in German E-commerce

Deutsche Bank’s participation in the German e-commerce sector is primarily through financial services. They provide financing, investment opportunities, and support for businesses operating within the German e-commerce ecosystem. This support extends to various stages of a company’s growth, from initial funding to expansion capital. Their expertise in financial instruments and market analysis allows them to provide valuable insights and guidance to e-commerce entrepreneurs and businesses.

For example, Deutsche Bank may offer specialized loans or credit lines for companies looking to scale their online operations.

Potential Synergies between Yahoo and Deutsche Bank

The potential synergy between Yahoo and Deutsche Bank could manifest in several ways. Deutsche Bank’s financial expertise could be instrumental in supporting Yahoo’s expansion plans within the German e-commerce market. This might include financing investments in German startups, or even providing tailored financial products and services for Yahoo’s existing and prospective partners. Such partnerships could lead to increased market share for both entities.

Strengths and Weaknesses of Yahoo and Deutsche Bank in German E-commerce

This table Artikels the key strengths and weaknesses of Yahoo and Deutsche Bank in relation to the German e-commerce market. It highlights the potential areas for synergy and areas where each entity might need to strengthen their positions.

| Entity | Strengths | Weaknesses | Potential Synergies |

|---|---|---|---|

| Yahoo | Global brand recognition, potential access to a large user base. | Limited direct experience in the German e-commerce market, potentially weaker local understanding. | Deutsche Bank’s expertise in finance could support Yahoo’s market entry or expansion efforts. |

| Deutsche Bank | Deep understanding of the German financial market, strong network of relationships. | Less direct experience in the e-commerce sector, potentially limited brand recognition in the online retail space. | Yahoo’s global presence and brand recognition could bolster Deutsche Bank’s e-commerce initiatives. |

Analyzing the German e-commerce Landscape: Yahoo Deutsche Bank Bring German E Commerce Into Focus

The German e-commerce market is a significant and dynamic component of the broader European digital economy. Understanding its intricacies, key players, and trends is crucial for anyone looking to navigate or invest in this sector. This analysis delves into the current state of online retail in Germany, highlighting its unique characteristics and comparing it to other European markets.The German e-commerce landscape is characterized by a blend of established players and innovative startups, each vying for market share in a fiercely competitive environment.

Factors like strong consumer trust, robust logistics infrastructure, and a sophisticated payment system all contribute to Germany’s position as a leader in online retail. Furthermore, German consumers are often considered discerning and demanding, leading to a high standard of service and product quality in the sector.

Major Players and Trends

German e-commerce is dominated by established players like Amazon, but also features a multitude of specialized retailers, from fashion boutiques to electronics stores, all competing for consumer attention. A notable trend is the increasing importance of mobile commerce, reflecting the growing prevalence of smartphone usage among German consumers. Furthermore, the rise of subscription boxes and personalized recommendations highlights the focus on enhancing the customer experience.

Direct-to-consumer (DTC) brands are also gaining significant traction.

Current State of Online Retail

The German online retail market is substantial, exhibiting consistent growth. Data indicates a robust market size, with annual sales figures surpassing billions of Euros. Growth rates remain positive, driven by factors such as rising internet penetration and increasing consumer adoption of online shopping. German consumers often prioritize quality, reliability, and a seamless online experience, leading to a preference for established and trustworthy brands.

Customer reviews and ratings play a significant role in their purchasing decisions.

Consumer Behavior

German online shoppers are generally characterized by their meticulous research and comparison of products and prices. This behavior often translates to a higher conversion rate for retailers that effectively address consumer needs and concerns. Consumers frequently utilize online marketplaces for product discovery, further highlighting the importance of robust search and filtering capabilities. A key aspect of German consumer behavior is a strong emphasis on transparency and trust in online transactions.

Regulatory Environment

The German regulatory environment for e-commerce is complex but designed to protect consumers and promote fair competition. Regulations concerning data privacy, consumer rights, and online sales are carefully crafted and rigorously enforced. These regulations contribute to the overall trust in the German e-commerce market, attracting both businesses and consumers. Legal frameworks concerning online marketplaces, particularly in terms of liability and responsibility, are also a prominent feature of the regulatory landscape.

Comparison with Other European Markets

| Feature | Germany | France | United Kingdom | Spain |

|---|---|---|---|---|

| Market Size (Estimated in Billions of Euros) | ~250 | ~150 | ~200 | ~75 |

| Growth Rate (Annual Percentage) | ~10 | ~8 | ~12 | ~15 |

| Consumer Behavior | Value-driven, meticulous research | Emphasis on fashion, luxury | Broad range of preferences, price-sensitive | Price-conscious, diverse preferences |

| Regulatory Environment | Strong consumer protection, data privacy focus | Balance between consumer protection and business support | Focus on competition, consumer rights | Focus on consumer protection, diverse regulations |

This table offers a concise overview comparing key metrics across major European e-commerce markets, providing a context for understanding the unique dynamics of the German market. The table illustrates the substantial size of the German market, its robust growth, and the distinct consumer behaviors that differentiate it from other European counterparts.

Exploring the Potential Impact of the Partnership

The partnership between Yahoo and Deutsche Bank promises to reshape the German e-commerce landscape. By combining Yahoo’s vast digital reach with Deutsche Bank’s financial expertise, the collaboration could significantly benefit both consumers and businesses operating within this crucial market. This section delves into the potential advantages and challenges of this strategic alliance.

Potential Benefits for Consumers

This partnership has the potential to enhance the consumer experience in German e-commerce through improved payment options and streamlined shopping processes. Enhanced security measures, integrated financial tools, and personalized recommendations based on shopping history and financial profiles are among the potential improvements. For instance, a consumer could instantly access a variety of payment options, securely transfer funds, and receive personalized product recommendations tailored to their financial situation, all within the Yahoo platform.

This personalized approach could make shopping more efficient and enjoyable.

Potential Benefits for Businesses (e.g., SMEs)

The partnership can offer substantial advantages to businesses, especially small and medium-sized enterprises (SMEs) operating in the German e-commerce market. Access to a broader customer base through Yahoo’s platform, along with streamlined payment processing solutions provided by Deutsche Bank, can significantly reduce operational costs and improve accessibility for SMEs. These benefits are expected to translate into increased sales and market share for businesses.

Moreover, the partnership could offer tailored financial products and services specifically designed to support the growth and expansion of e-commerce businesses, including financing options and risk management tools.

Potential Challenges and Risks

Despite the potential benefits, the partnership also faces potential challenges. Maintaining data security and privacy is crucial, especially with the sensitive financial information involved. Integration complexities between Yahoo’s digital platform and Deutsche Bank’s financial systems could lead to operational disruptions. The competition in the German e-commerce market is fierce, and the partnership must effectively differentiate itself to succeed.

The partnership’s success hinges on successfully navigating these challenges while maintaining user trust and providing a seamless customer experience.

Potential Impact on Stakeholders

The following table Artikels the potential impact of the partnership on various stakeholders.

| Stakeholder | Potential Benefits | Potential Challenges | Potential Impact on the German E-commerce Landscape |

|---|---|---|---|

| Consumers | Improved payment options, enhanced security, personalized recommendations, streamlined shopping processes. | Potential for increased data collection, concerns regarding privacy and security, potential for higher transaction fees. | Enhanced user experience and potentially increased e-commerce adoption. |

| Businesses (e.g., SMEs) | Access to a wider customer base, reduced operational costs, streamlined payment processing, access to financial products and services. | Integration complexities, potential for increased competition, potential for dependency on the partnership. | Increased accessibility to e-commerce for SMEs, potentially leading to more competitive offerings and increased market share. |

| Banks (e.g., Deutsche Bank) | Increased market share in the digital payments sector, access to a wider customer base through Yahoo’s platform. | Maintaining data security and regulatory compliance, managing potential risks associated with the partnership, addressing competition from other financial institutions. | Expansion of digital banking services, potentially leading to new revenue streams and increased market presence in the German e-commerce sector. |

Examining Existing and Potential Services

This section dives into the current e-commerce offerings of Yahoo and Deutsche Bank, and explores exciting possibilities for collaboration. Understanding their existing services is crucial for predicting how this partnership will reshape the German e-commerce landscape and cater to the evolving needs of consumers and businesses. This analysis highlights the potential for innovative services and enhanced customer experiences.

Existing E-commerce Services

Yahoo’s presence in e-commerce is primarily through its search engine, which often directs users to online retailers. Deutsche Bank, while not a direct e-commerce player, provides essential financial services for online businesses, including payment processing and merchant accounts. Their expertise lies in secure transactions, fraud prevention, and facilitating the flow of funds in online transactions. This established foundation in financial services provides a strong base for potential future collaborations.

Potential New Services

The synergy between Yahoo’s reach and Deutsche Bank’s financial acumen creates several exciting possibilities. A joint platform facilitating cross-border e-commerce for German businesses could be a major outcome. This could include integrated tools for international payment processing, tailored to German market specifics. Another avenue could be a tailored e-commerce platform specifically designed for small and medium-sized enterprises (SMEs) in Germany.

This platform could bundle Yahoo’s search engine optimization () expertise with Deutsche Bank’s financial solutions, offering a comprehensive package for businesses looking to expand online. Imagine a solution that seamlessly integrates product listings with secure payment gateways, potentially reducing friction for both merchants and customers.

Comparison of Existing and Potential Services

| Feature | Existing Yahoo Services | Existing Deutsche Bank Services | Potential New Services (Yahoo/Deutsche Bank Collaboration) |

|---|---|---|---|

| Search Engine Optimization () | Yahoo search engine directs users to retailers | N/A | Improved for German businesses through joint platform |

| Payment Processing | N/A | Merchant accounts, secure transactions | Integrated cross-border payment processing for German businesses |

| Platform for SMEs | N/A | N/A | Tailored e-commerce platform bundling and financial solutions for SMEs |

| Target Market | Broad consumer base | Businesses needing financial services | German consumers and businesses, focusing on cross-border trade |

| Focus | Connecting consumers with products | Facilitating financial transactions | Empowering German businesses in the digital economy |

Competitive Analysis

The partnership between Yahoo and Deutsche Bank in the German e-commerce arena presents a compelling opportunity, but also faces significant competition. Understanding the existing ecosystem and the strengths and weaknesses of direct and indirect rivals is crucial for evaluating the partnership’s potential. This analysis will delve into the competitive landscape, comparing the new offering to existing players and highlighting potential advantages and disadvantages.The German e-commerce market is highly competitive, with established players like Amazon, Zalando, and Otto holding significant market share.

The entry of a new partnership, leveraging the strengths of two established brands, requires careful consideration of how it will differentiate itself and capture market share. A thorough competitive analysis is essential to determine the viability and long-term success of this venture.

Comparison to Existing Ecosystems

The German e-commerce landscape is dominated by large, established players with extensive infrastructure and customer bases. Direct comparison to established players like Amazon, with its vast product selection and logistics network, or Zalando, a fashion leader, demonstrates the scale of the challenge. These established players have built extensive customer loyalty and brand recognition over many years. A crucial element of the analysis is recognizing that the Yahoo/Deutsche Bank partnership likely targets specific niches within the market.

Identifying Direct and Indirect Competitors

Direct competitors include established e-commerce platforms catering to similar customer segments. Indirect competitors include traditional retailers adapting to the digital landscape and new startups targeting specific niches. The identification of both direct and indirect competitors helps in understanding the full competitive context. For example, a direct competitor might be a financial technology platform specializing in online banking and financial transactions within Germany.

An indirect competitor could be a traditional brick-and-mortar department store that offers an online presence and a similar product range.

Competitive Advantages and Disadvantages

The Yahoo/Deutsche Bank partnership possesses several potential advantages. Leveraging Yahoo’s strong brand recognition and Deutsche Bank’s established financial services network could attract customers seeking seamless integration of online shopping and financial transactions. The integration of secure payment options and personalized financial advice could also provide a significant competitive edge. However, a potential disadvantage is the need to establish a strong brand identity and customer base, as well as build robust logistics and fulfillment capabilities.

Existing platforms like Amazon have significant scale advantages in this regard.

Competitive Landscape Analysis

| Competitor | Strengths | Weaknesses | Potential Impact on Partnership |

|---|---|---|---|

| Amazon | Vast product selection, extensive logistics network, established customer base | High barriers to entry, potential for customer churn with new entrants | A primary competitor. The partnership needs to focus on specialized niches to avoid head-on competition. |

| Zalando | Strong fashion focus, well-established fashion expertise | Limited product diversity beyond fashion, potential for customer churn with new entrants | A strong competitor in the fashion sector. The partnership needs to identify a unique value proposition. |

| Otto | Strong brand recognition in Germany, established customer base | Relatively less aggressive in the online space compared to Amazon and Zalando | The partnership needs to leverage Yahoo and Deutsche Bank’s capabilities to compete with Otto’s brand recognition. |

| Specialized Fintech Platforms | Focus on specific financial services, streamlined transactions | Limited product diversity, potential for security concerns | A potential competitor if they provide similar e-commerce functionality. |

Illustrative Case Studies

Looking to the success stories of e-commerce partnerships in other markets provides valuable insights for the potential Yahoo/Deutsche Bank collaboration in Germany. By examining how similar ventures were structured and the outcomes achieved, we can anticipate potential challenges and opportunities. Learning from past successes and failures allows us to refine our strategies and increase the likelihood of a thriving partnership.

Successful E-commerce Partnerships in Other Markets

Successful e-commerce partnerships often leverage existing strengths of each partner. These partnerships often integrate complementary resources, like technology platforms, payment systems, and customer bases, to create a more robust and comprehensive service offering. This synergy is crucial for success in the highly competitive e-commerce space.

Amazon and Stripe Partnership

Amazon’s integration with Stripe exemplifies a successful payment processing partnership. Stripe, a leading payment processing platform, provides secure and efficient payment options for Amazon’s vast customer base. This integration significantly improved the checkout experience for customers and streamlined transaction processing for Amazon.

“The partnership between Amazon and Stripe fostered a seamless checkout experience, enhanced security, and ultimately increased sales by providing customers with more secure and convenient payment options.”

This case highlights how a partnership can increase convenience for customers and efficiency for the businesses involved. It demonstrates the value of combining established platforms to create a superior user experience.

Walmart and Shopify Integration

Walmart’s foray into online retail through its integration with Shopify showcases a retailer-platform partnership. Shopify’s robust platform allows Walmart to expand its online presence while retaining its established physical store network. This allows them to offer both online and in-store shopping options to their customers.

“Walmart’s integration with Shopify enabled the retailer to expand its online presence, cater to a broader customer base, and maintain its physical store network. This approach demonstrates the potential of integrating a retailer’s physical presence with a robust online platform.”

This illustrates the benefits of leveraging existing infrastructure for online expansion and creating a unified customer experience across various channels.

Uber and Visa Integration

The partnership between Uber and Visa demonstrates a technology platform and payment processor partnership. Visa’s established payment infrastructure enhances the security and convenience of Uber’s ride-hailing services. This integration facilitated smoother transactions and strengthened user trust.

Yahoo Deutsche Bank’s spotlight on German e-commerce is definitely interesting. It makes me wonder if a similar push could happen in the UK. Perhaps the rise of TV shopping could be the catalyst, similar to what’s being discussed in will tvs jumpstart uk e-commerce. Ultimately, though, I’m still quite intrigued by the German market and how Yahoo Deutsche Bank is shaping its future.

“The Uber-Visa partnership demonstrated the value of integrating a technology platform with a trusted payment processor. This partnership increased user confidence and transaction efficiency, leading to increased user engagement.”

Yahoo Deutsche Bank’s spotlight on German e-commerce is fascinating, especially considering the recent news about the house passing a global tax bill. This new legislation could significantly impact the financial landscape for businesses like those involved in the German e-commerce boom, potentially affecting how Yahoo Deutsche Bank navigates the changing market. It’s an interesting intersection of international finance and the future of online retail, so I’m keen to see how it all unfolds.

This example highlights how a strong payment infrastructure enhances trust and user experience in a service-based industry. The improved transaction efficiency leads to a more positive user experience.

Yahoo Deutsche Bank’s spotlight on German e-commerce is fascinating, highlighting the growing digital economy in Europe. This trend mirrors a similar hunger for domestic commerce in Canada, as seen in this insightful article on Canada hungry for domestice commerce. Ultimately, the focus on e-commerce in both Germany and Canada shows a global push towards digital business solutions.

Lessons for Yahoo/Deutsche Bank Partnership in Germany, Yahoo deutsche bank bring german e commerce into focus

These case studies offer several key lessons for the Yahoo/Deutsche Bank partnership in Germany. The success of these partnerships hinges on complementary strengths, seamless integration, and a focus on improving the customer experience. Understanding these factors is essential for creating a successful e-commerce partnership.

Future Trends and Projections

The German e-commerce landscape is dynamic and constantly evolving. To thrive, any partnership must anticipate future trends and adapt its strategies accordingly. This section explores potential future developments, outlining how the Yahoo-Deutsche Bank partnership can capitalize on these trends, and the potential long-term impact on the German economy.The partnership’s success hinges on its ability to predict and respond to changes in consumer behavior, technological advancements, and market competition.

By understanding the forces shaping the future, Yahoo and Deutsche Bank can position themselves to lead the evolution of German e-commerce.

Emerging Technologies in E-commerce

The integration of new technologies is reshaping the way consumers interact with online businesses. Augmented reality (AR) and virtual reality (VR) are transforming the shopping experience by allowing customers to visualize products in their homes or try them on virtually. These technologies create immersive and interactive experiences, potentially boosting sales and customer engagement. Furthermore, personalized recommendations, powered by AI and machine learning, are becoming increasingly sophisticated, enabling retailers to provide highly tailored shopping experiences to individual consumers.

Mobile-First and Omnichannel Strategies

The continued dominance of mobile devices is transforming how consumers shop. Consumers expect seamless experiences across all channels, from mobile to desktop to in-store. This “omnichannel” approach requires a unified platform that allows customers to access and interact with a brand across multiple touchpoints. The Yahoo-Deutsche Bank partnership can leverage its existing platforms and resources to develop and implement omnichannel solutions, creating a cohesive and integrated experience for German consumers.

For instance, customers could easily compare prices across online retailers and then seamlessly transition to in-store purchases.

Focus on Sustainability and Ethical Practices

Consumers are increasingly conscious of environmental and social issues. They seek products and services from companies that demonstrate a commitment to sustainability and ethical practices. This trend translates into a demand for transparency in supply chains and eco-friendly products. The partnership can leverage this trend by highlighting its commitment to sustainability, potentially through collaborations with environmentally conscious brands and initiatives.

This approach could attract environmentally-conscious customers and enhance the partnership’s image.

Personalization and Customer Experience

Personalized recommendations, tailored product offerings, and proactive customer service are becoming essential for customer retention and satisfaction. Data analytics and AI-driven personalization tools will play a crucial role in delivering highly relevant and targeted experiences. Yahoo and Deutsche Bank can leverage their respective data capabilities to personalize the shopping experience for German consumers. This could include providing customized financial advice relevant to purchasing decisions or offering tailored promotional offers.

Cybersecurity and Data Protection

As e-commerce continues to grow, so does the risk of cyberattacks and data breaches. Strong cybersecurity measures and robust data protection protocols are essential to build consumer trust. The partnership can prioritize cybersecurity and data privacy to create a secure and trustworthy environment for consumers. This includes investing in advanced security technologies and establishing clear data protection policies that align with German regulations.

Outcome Summary

In conclusion, the Yahoo Deutsche Bank partnership in German e-commerce presents a complex mix of opportunities and challenges. The potential benefits for consumers and businesses, while substantial, are interwoven with significant risks. A thorough understanding of the German e-commerce landscape, competitive dynamics, and regulatory environment is crucial for navigating these potential pitfalls and capitalizing on the opportunities. The future of this partnership hinges on the ability to address these complexities effectively, ultimately impacting the German economy and e-commerce sector.