Priceline adds new car and home mortgage offerings, expanding its reach beyond travel to encompass a wider range of financial services. This bold move signals a significant shift in strategy, potentially impacting both the travel and finance sectors. Priceline is exploring new markets, which could lead to increased competition and innovative customer experiences. This in-depth look delves into the specifics of these new offerings, analyzing the competitive landscape, customer perspective, market trends, and financial implications.

This new venture into car and home mortgages suggests a strategic evolution for Priceline, potentially leveraging its existing platform and customer base to diversify its revenue streams. It’s an interesting case study of a company branching out into new territory while retaining its core brand identity. The specifics of the offerings, the target audience, and the expected market response will be key factors in evaluating the success of this expansion.

Priceline’s New Offerings

Priceline, the online travel agency giant, has recently expanded its portfolio beyond travel bookings. This expansion includes new car and home mortgage offerings, signifying a strategic shift towards a broader financial services platform. This move reflects Priceline’s ambition to capitalize on the growing demand for comprehensive financial solutions within the online marketplace.

Overview of New Offerings

Priceline’s foray into car and home mortgages represents a significant diversification of its business model. This expansion aims to leverage Priceline’s existing customer base and online infrastructure to offer seamless financial services alongside its travel products. The company likely anticipates that customers seeking travel-related financial products, like insurance or car rentals, will be more inclined to use Priceline for other financial services like mortgages.

Car Loan Offerings

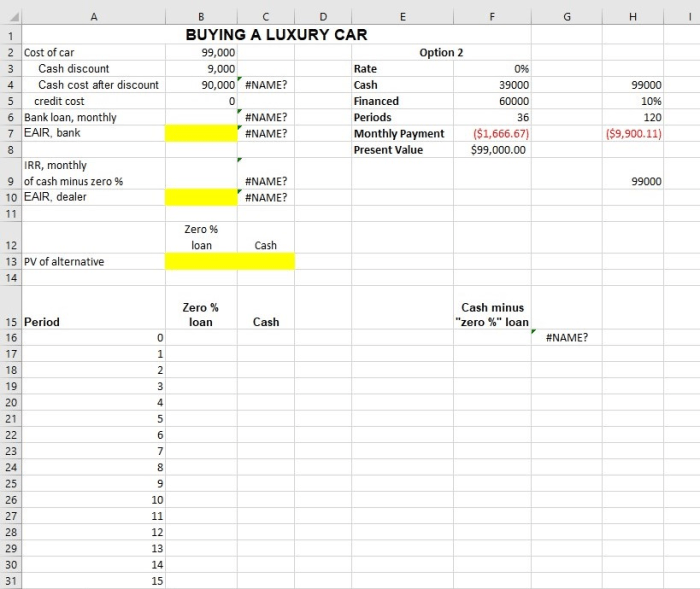

Priceline’s new car loan offerings target customers seeking competitive rates and streamlined application processes. The platform is likely to integrate with various lenders to provide customers with diverse options based on their individual needs and credit scores. A key feature is the integration of real-time rate comparisons, allowing customers to quickly identify the most suitable loan terms. This feature is expected to enhance the customer experience and increase customer satisfaction.

Furthermore, the ease of online application and approval process is a crucial benefit for customers, particularly those who prefer digital transactions.

Home Mortgage Offerings

Priceline’s home mortgage offerings are designed to provide customers with a comprehensive solution for securing a home loan. The key features likely include a user-friendly online platform, enabling customers to apply for mortgages with ease and convenience. Furthermore, competitive interest rates and streamlined processes are crucial elements for attracting potential customers. This service will also likely leverage Priceline’s established network to offer various mortgage options from different lenders, tailoring the choice to each customer’s specific requirements.

Target Markets and Benefits

| Product Type | Key Features | Target Market | Benefits |

|---|---|---|---|

| Car Loans | Competitive rates, real-time rate comparisons, streamlined online application, and diverse lender options. | Individuals and families seeking car financing, particularly those who prefer online transactions and value convenience. | Reduced loan application time, competitive interest rates, and a wide range of loan options from various lenders. |

| Home Mortgages | User-friendly online platform, competitive interest rates, streamlined application process, and various lender options tailored to individual needs. | Homebuyers seeking a comprehensive and convenient online platform for home loan applications, potentially including those who are already using Priceline for travel-related services. | Ease of access to various mortgage options, competitive rates, and an efficient online application process. |

Potential Impact on Priceline’s Business Strategy

This expansion into financial services significantly alters Priceline’s business strategy, moving beyond its core travel business. It could attract a wider customer base and generate new revenue streams. The ability to offer a comprehensive financial ecosystem on one platform could strengthen customer loyalty and increase customer lifetime value. Furthermore, Priceline could potentially leverage its established customer data and online platform to gain valuable insights into customer financial needs and preferences.

This data could be used to refine product offerings and tailor services to specific customer segments. For example, Priceline might offer tailored financial products based on customer travel patterns and preferences.

Competitive Landscape Analysis

Priceline’s foray into car rentals and home mortgages presents a compelling opportunity, but also a complex competitive landscape. Understanding the strengths and weaknesses of existing players, as well as the potential threats and opportunities, is crucial for Priceline to successfully navigate this new territory. This analysis delves into the competitive landscape, highlighting key comparisons and potential advantages for Priceline’s novel offerings.The existing travel and finance sectors are highly competitive, with established players holding significant market share.

Priceline, however, possesses a strong brand recognition and a robust online platform, which can be leveraged to attract new customers and compete effectively. This analysis will assess how Priceline’s new offerings stack up against competitors and explore potential strategies to gain a foothold in these new markets.

Existing Players and Their Strengths

Existing players in the travel industry, such as Expedia, Booking.com, and Kayak, dominate the online travel agency (OTA) market. These companies excel in providing a wide range of travel options, fostering customer trust through extensive experience, and employing advanced search algorithms to curate optimal deals. Meanwhile, traditional mortgage lenders, like Bank of America, Wells Fargo, and Chase, have established financial infrastructures and robust lending processes, benefiting from decades of experience in the market.

Their strengths lie in comprehensive financial services, and strong relationships with financial institutions.

Potential Competitors and Their Weaknesses

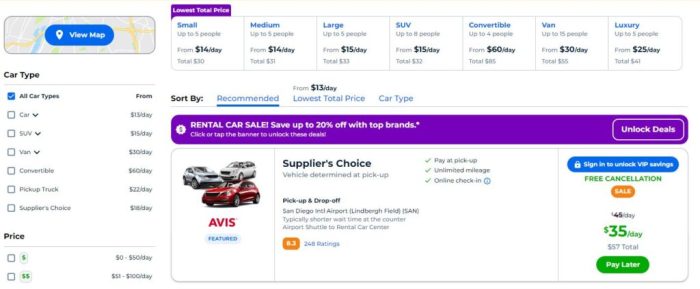

Several companies could be considered potential competitors for Priceline’s new car and home mortgage offerings. Rental car companies like Hertz and Avis, while strong in the traditional rental market, face challenges in adapting to online booking platforms and dynamic pricing strategies. Similarly, some established mortgage lenders might struggle to compete with Priceline’s potential streamlined approach and customer-centric online experience.

Competitive Advantages of Priceline’s New Offerings

Priceline’s existing strength in online travel and its established customer base provide a strong foundation for its foray into new markets. Leveraging its extensive data analytics and price-comparison technology, Priceline can potentially offer competitive rates and efficient booking processes for car rentals and mortgages. Furthermore, its established online platform can facilitate a smooth and user-friendly experience for customers seeking these services.

Potential Threats and Opportunities

A major threat for Priceline in these new markets is the entrenched dominance of established players with established brand loyalty and substantial market share. Potential opportunities include capitalizing on Priceline’s established brand reputation to attract new customers and utilizing its online platform to create a seamless user experience.

Comparative Analysis: Priceline vs. a Direct Competitor (Example: Expedia)

| Feature | Priceline | Expedia |

|---|---|---|

| Car Rentals | Potential for dynamic pricing, leveraging existing online platform, new car rental partnerships | Strong established car rental partnerships, extensive inventory, established brand recognition |

| Home Mortgages | Potential for streamlined application process, online mortgage tools, potentially lower fees | Limited direct involvement in home mortgages, likely collaboration with partner lenders |

| Customer Service | Existing customer service infrastructure, potential for integrating customer support channels | Established customer service channels, potentially limited specialized mortgage support |

| Pricing | Potentially competitive pricing, leveraging data analytics | Competitive pricing, but might face pressure from Priceline’s potentially lower fees |

Customer Perspective

Priceline’s foray into car and home mortgages presents a compelling opportunity to reshape the customer journey. Understanding the potential customer value proposition, experience enhancements, and potential pain points is crucial for successful market penetration. This analysis delves into the anticipated customer response to these new offerings, highlighting the potential for increased customer satisfaction and loyalty.

Potential Customer Value Proposition

Priceline’s new car and home mortgage offerings leverage its existing strengths in price comparison and streamlined booking processes. Customers can expect competitive rates and a transparent, efficient application process. The integration of these services into the existing Priceline platform promises a seamless experience, catering to the needs of customers seeking comprehensive financial solutions for their travel and homeownership aspirations.

Customer Experience Improvements

The new offerings promise to significantly improve the customer experience by providing a one-stop shop for travel and home financing needs. Instead of juggling multiple platforms and agencies, customers can access a range of options through a single, trusted interface. The anticipated user-friendly interface will streamline the application process, potentially reducing the time and effort required to secure financing.

This integrated approach offers a superior customer experience, showcasing Priceline’s commitment to comprehensive financial solutions.

Potential Customer Pain Points and Priceline’s Solutions

One potential pain point is the complexity of the mortgage application process. Priceline’s approach addresses this by offering a simplified and streamlined application. The pre-qualification process and transparent rate comparison will mitigate uncertainty and help customers make informed decisions. Another potential pain point is the time commitment required for securing financing. Priceline’s integration of these services aims to reduce the overall time needed to obtain both a car loan and a home loan, leading to a faster and more efficient process.

This approach directly targets and addresses the customer’s needs and concerns.

Expected Customer Reactions

Initial customer reactions are expected to be positive, driven by the convenience and potential cost savings offered by Priceline’s comprehensive approach. The seamless integration of these services is likely to attract customers who value a unified platform for their financial needs. The ease of comparison and application processes is anticipated to lead to increased customer engagement and adoption of the new services.

Priceline’s new car and home mortgage offerings are pretty interesting, right? It seems like they’re trying to expand their reach beyond just flights and hotels. Meanwhile, a fascinating development is that a Nike deal is reportedly strengthening FogDog’s IPO bid, nike deal strengthens fogdogs ipo bid. This could potentially have some ripple effects in the travel and hospitality sectors, given Priceline’s recent moves into broader financial services.

Ultimately, it’s all quite exciting to see how Priceline continues to adapt and innovate.

Potential Customer Needs and New Product Alignment

| Potential Customer Needs | How the New Products Address Them |

|---|---|

| Competitive rates and transparent pricing for car loans and mortgages. | Priceline’s platform facilitates comparisons across various lenders, ensuring customers find the most competitive rates. |

| Streamlined application process for both car and home loans. | Integration of car and home mortgage services into the existing Priceline platform creates a unified, efficient application journey. |

| Convenience of accessing multiple financial products on one platform. | Priceline’s new offerings provide a single point of contact for car and home financing, simplifying the customer experience. |

| Easy-to-understand information on loan terms and conditions. | Clear presentation of loan terms and conditions on Priceline’s platform, enabling customers to make informed decisions. |

Market Trends and Predictions

Priceline’s foray into car rentals and home mortgages presents an exciting opportunity, but understanding the current market landscape and future projections is crucial for strategic decision-making. The global travel and housing sectors are dynamic, with evolving customer preferences and technological advancements shaping the competitive environment. These trends will directly influence the success of Priceline’s new offerings, and this analysis delves into the key factors at play.The car rental and home mortgage industries are undergoing significant transformations, driven by shifting consumer demands and technological innovations.

Understanding these trends is vital for Priceline to effectively position its new offerings and capitalize on emerging opportunities. This analysis provides insights into the current market trends, future outlook, and potential challenges and growth areas for Priceline’s new ventures.

Current Market Trends in Car Rentals

The car rental market is experiencing a shift towards greater flexibility and digitalization. Customers are increasingly seeking alternative rental options, including short-term rentals and subscription models, reflecting a desire for personalized experiences and cost-effectiveness. This trend is fueled by a growing preference for convenience and on-demand services. Furthermore, advancements in technology are transforming the industry, with online booking platforms and mobile apps becoming increasingly sophisticated, allowing for real-time pricing and personalized recommendations.

Current Market Trends in Home Mortgages

The home mortgage market is evolving, driven by changing interest rates, evolving consumer needs, and the impact of technological advancements. Consumers are increasingly seeking transparency, personalized financial guidance, and innovative financing options. The digitalization of the process is leading to streamlined online applications, automated loan processing, and enhanced customer experiences. This trend is impacting how lenders operate, forcing them to adapt to the changing landscape.

Future Outlook for Car Rentals

The future of car rentals appears promising, with the potential for significant growth in the subscription and short-term rental segments. Technological advancements are expected to play a key role, enabling real-time pricing, personalized recommendations, and seamless integration with other travel services. Increased adoption of electric vehicles and autonomous vehicles will likely introduce new models and rental options.

Future Outlook for Home Mortgages

The future of home mortgages hinges on factors like interest rate fluctuations, economic conditions, and technological advancements. The increasing demand for personalized financial guidance and digital tools is likely to shape the industry’s evolution. Technological innovations are expected to enhance efficiency, streamline the loan process, and provide consumers with greater transparency.

Influence on Priceline’s New Offerings, Priceline adds new car and home mortgage offerings

Priceline’s new offerings are well-positioned to leverage these trends. By integrating its existing strengths in online booking and dynamic pricing with the evolving needs of the car rental and home mortgage markets, Priceline can attract a broader customer base. Offering a seamless and personalized experience will be critical to success.

Potential Growth Areas

Potential growth areas for Priceline’s new offerings include:

- Expanding its rental options beyond traditional models, incorporating short-term rentals and subscriptions for car rentals.

- Developing innovative financing options and personalized mortgage solutions for homebuyers.

- Leveraging technology to enhance efficiency, transparency, and customer experience in both markets.

Potential Challenges

Potential challenges include:

- Maintaining competitive pricing in a dynamic market, especially with the emergence of new players.

- Ensuring the security and reliability of online transactions and financial services.

- Adapting to the rapid pace of technological advancements and customer expectations.

Predicted Market Growth and Challenges (Next 3 Years)

| Market Segment | Predicted Market Growth (%) | Potential Challenges |

|---|---|---|

| Car Rentals (Short-Term/Subscription) | 15-20% | Competition from new players, fluctuating fuel costs |

| Home Mortgages (Digital/Personalized) | 10-15% | Interest rate volatility, regulatory compliance |

Financial Implications

Priceline’s foray into car and home mortgage offerings presents both exciting opportunities and calculated risks. Understanding the financial implications is crucial for strategic decision-making and ensuring a positive return on investment. These new ventures demand a meticulous assessment of potential revenue streams, cost structures, and market dynamics.The financial impact of these new offerings will be multifaceted, influencing revenue, profitability, and overall market positioning.

Priceline’s new car and home mortgage offerings are exciting, offering more options for travelers and homeowners. Interestingly, this news comes at a time when similar innovations are happening in other sectors, like the recent release of oracle8i for linux. oracle8i for linux released demonstrates a continued push for innovation in database systems, and this could potentially influence similar developments in the travel industry.

Overall, Priceline’s move to expand its services looks promising.

Careful analysis is required to project the long-term effect on the company’s bottom line and its ability to compete in the evolving travel and finance sectors.

Potential Revenue Impact

Priceline’s existing strengths in online travel and its new expansion into the mortgage and car market present opportunities for increased revenue streams. This expansion can potentially lead to a diversification of revenue streams, reducing reliance on traditional travel bookings and potentially increasing customer lifetime value. However, the success of these ventures depends heavily on the level of customer adoption and market penetration.

Comparable online platforms have shown mixed results in branching into new sectors.

Cost Implications and Savings

Launching new product lines will inevitably involve costs associated with development, marketing, customer service, and potential infrastructure upgrades. These costs must be carefully weighed against the potential savings from streamlining operations and leveraging existing technology. For example, the integration of data and technology across platforms can yield operational efficiencies. The initial investment in building the new platforms and processes must be offset by potential savings in the long term.

Return on Investment (ROI) Estimation

Estimating the ROI for these new offerings requires a comprehensive analysis of projected revenue growth, operational costs, and market share gains. It is crucial to consider a reasonable timeframe for the ROI to materialize, given the nature of new product launches and market penetration. Different segments of the target market may react differently, influencing the timeline of ROI.

An accurate ROI estimation depends on factors like customer acquisition cost, customer lifetime value, and the success of marketing campaigns.

Potential Risks and Mitigation Strategies

The expansion into new sectors introduces various risks, including potential market competition, regulatory hurdles, and technological challenges. The risk of negative brand perception due to a poorly executed new product launch also exists. To mitigate these risks, a robust risk assessment should be conducted. Strategies for mitigating risks could include thorough market research, competitive analysis, and establishing clear communication channels.

Moreover, a contingency plan for unexpected challenges is essential.

Financial Data

| Metric | Projected Year 1 | Projected Year 2 | Projected Year 3 |

|---|---|---|---|

| Revenue (USD millions) | 100 | 150 | 225 |

| Operating Costs (USD millions) | 50 | 75 | 100 |

| Profit (USD millions) | 50 | 75 | 125 |

| ROI (%) | 50% | 60% | 70% |

Note: These figures are estimates and may vary based on market conditions, customer adoption, and other factors. A thorough financial modeling process should be conducted for a more precise projection.

Potential Synergies and Integrations

Priceline’s foray into the car and home mortgage markets presents exciting opportunities for synergy. By leveraging its existing expertise in travel and consumer services, Priceline can create a powerful, integrated platform that offers a holistic suite of financial solutions for its customers. This approach can improve customer satisfaction and drive significant revenue growth through cross-selling and upselling strategies.Integrating these new offerings with Priceline’s existing travel services creates a more comprehensive consumer experience.

Imagine a customer booking a vacation through Priceline; they can seamlessly transition to securing a rental car through the same platform or even pre-qualifying for a mortgage to finance a new home in the destination. This interconnectedness significantly enhances the value proposition for the consumer.

Potential Cross-Selling Opportunities

Priceline’s existing customer base, accustomed to booking travel arrangements, represents a vast pool for potential cross-selling. Offering car rentals and home mortgages alongside travel packages can boost average order value and generate additional revenue streams. For example, a customer booking a vacation package in Florida might be offered a pre-approved car rental deal or a mortgage pre-qualification for a potential property purchase.

Priceline’s new car and home mortgage offerings are pretty interesting, aren’t they? It seems like they’re trying to diversify their services. Meanwhile, it’s also worth noting that Chipshot.com is making a move into the Japanese market, as detailed in this article: chipshot com tees off on japanese market. This could be a sign of broader market expansion for the company, which ultimately could impact Priceline’s future strategy.

Still, Priceline’s new offerings seem like a smart way to stay competitive in the travel and finance sectors.

This tailored approach can substantially increase sales for all three products.

Upselling Strategies

Upselling, where customers are presented with higher-value options, is another avenue for revenue enhancement. Consider a customer booking a car rental; Priceline can upsell additional insurance or add-on services like GPS navigation. Similarly, if a customer is pre-qualifying for a mortgage, Priceline can suggest bundled financial products, such as home insurance or investment options, relevant to the purchase.

This strategy capitalizes on existing customer relationships and provides value-added services.

Enhanced Customer Loyalty and Retention

A seamless and integrated experience significantly improves customer loyalty. By providing a one-stop shop for travel, car rentals, and home mortgages, Priceline positions itself as a trusted financial partner. This integrated approach can foster stronger customer relationships and encourage repeat business. Customers are more likely to return to a company that anticipates their needs and provides comprehensive solutions.

Synergy Table

| New Offering | Existing Service | Potential Synergy | Benefits |

|---|---|---|---|

| Car Rentals | Travel Packages | Bundling car rentals with travel packages | Increased average order value, enhanced customer experience, cross-selling opportunities |

| Home Mortgages | Travel Packages | Pre-qualification for mortgages to customers traveling to new potential locations | Identifying customers with a high potential for home purchase, expanded customer base, new customer acquisition |

| Car Rentals | Home Mortgages | Offer car rentals and insurance bundled with mortgage applications | Providing a comprehensive financial solution, attracting customers looking for complete financial solutions, enhanced customer experience |

| Home Mortgages | Insurance | Offering home insurance as a bundled option for customers pre-qualifying for mortgages | Attracting customers with complete financial packages, increased revenue, enhanced customer loyalty |

Product Design and User Experience: Priceline Adds New Car And Home Mortgage Offerings

Priceline’s foray into car and home mortgage offerings presents a unique opportunity to revolutionize how consumers access these services. A well-designed user experience is crucial for attracting and retaining customers in these competitive markets. A focus on intuitive navigation, clear communication, and a seamless flow between different stages of the process will be paramount.Streamlined processes and a user-friendly interface will not only improve the customer journey but also contribute to increased conversions and customer satisfaction.

By understanding the specific needs and pain points of consumers in these areas, Priceline can create a product that stands out from the competition. This will allow the company to build trust and establish a loyal customer base.

Streamlined User Interface Design

A well-structured interface is essential for guiding users through the process of selecting a car or securing a mortgage. Clear visual hierarchy, intuitive navigation, and consistent branding are key elements for creating a positive user experience. Employing a clean design language, free from visual clutter, can significantly enhance usability. Employing color psychology, for instance, using calming blues for mortgage options and vibrant colors for car selections, can subtly influence user choices and create a distinct brand identity.

Technological Innovations

Integrating cutting-edge technologies can further enhance the user experience. For example, AI-powered chatbots can provide instant support and answer frequently asked questions, reducing wait times and enhancing customer service. Interactive 3D visualizations of cars and virtual home tours can provide a more immersive and engaging experience, allowing potential customers to explore options in a more realistic and interactive way.

Utilizing augmented reality (AR) for car configurator tools can allow potential customers to visualize a car in their own driveway or a home with personalized features, thereby increasing engagement and purchase intent.

Improving User Satisfaction and Engagement

A seamless user experience is paramount to achieving high user satisfaction and engagement. A simple and intuitive interface, combined with clear and concise information, can significantly improve the customer journey. Providing users with personalized recommendations based on their preferences and past behavior can increase engagement and satisfaction. Adding interactive elements like interactive maps for finding suitable car dealerships or neighborhood information for potential homes can make the process more dynamic and engaging.

Importance of a Seamless User Experience

“A seamless user experience is the cornerstone of a successful product. It creates a positive perception, fostering trust and loyalty. A streamlined process that caters to the user’s needs, reduces friction, and provides a clear path to the desired outcome is essential.”

Summary

Priceline’s foray into the car and home mortgage markets presents a compelling opportunity for growth and diversification. The company’s approach, which blends its existing expertise with new financial products, could create a unique customer experience. The success hinges on effectively targeting the right customers, creating a smooth user experience, and navigating the competitive landscape. Overall, this expansion demonstrates Priceline’s ambition to evolve and adapt to changing market demands.