China Com explores pan asian route with acquisitions, venturing into a new phase of economic engagement across Asia. This strategic move signals a significant shift in China’s approach to regional partnerships, raising questions about its motivations, potential impacts, and the future of the Asian economic landscape.

The report delves into the historical context of China’s economic expansion in Asia, examining the various factors that drive these acquisitions. It also analyzes the specific acquisitions, their implications for the competitive landscape, and the potential economic, geopolitical, and technological consequences for the region.

Background of China’s Pan-Asian Expansion

China’s economic engagement in Asia has a long and complex history, evolving from ancient trade routes to modern-day economic corridors. This expansion isn’t a sudden phenomenon but rather a continuation of a long-term strategy, driven by a desire for regional influence and economic prosperity. The recent wave of acquisitions signifies a more assertive approach, reflecting China’s growing economic strength and ambition to reshape the Asian landscape.China’s strategic approach to acquisitions in Asia is multifaceted, encompassing economic, political, and geopolitical motivations.

The pursuit of resources, access to markets, and technological advancement are significant drivers. Moreover, the expansion reflects a broader aspiration to establish China as a major player on the global stage, and a desire to secure critical infrastructure and strategic assets.

Historical Overview of China’s Economic Engagement in Asia

China’s engagement in Asian economies stretches back centuries. The Silk Road facilitated trade and cultural exchange, laying the groundwork for economic interaction. Modern economic engagement intensified with China’s reform and opening-up policies in the late 20th century, leading to increased trade and investment across the region. This historical context demonstrates a long-term commitment to economic integration within Asia.

Key Motivations Behind Recent Acquisitions

Several key motivations drive China’s recent acquisitions in Asia. These include securing access to vital resources like minerals and energy, gaining a foothold in burgeoning markets, and acquiring advanced technologies and expertise. Additionally, strategic considerations like infrastructure development and establishing regional partnerships are also influential.

Economic and Geopolitical Factors Influencing China’s Approach

China’s approach to acquisitions is significantly shaped by various economic and geopolitical factors. Economic factors include the pursuit of resources, the desire to penetrate new markets, and the need for diversification of supply chains. Geopolitical factors, such as the strategic importance of certain locations and the desire to counterbalance existing regional powers, also play a pivotal role. These factors often intertwine, making the motivations behind China’s acquisitions complex and nuanced.

Evolving Relationship Between China and Other Asian Nations

The relationship between China and other Asian nations is undergoing a period of transformation. Growing economic interdependence, alongside the pursuit of shared goals, is driving cooperation in areas such as infrastructure development and trade. However, there are also challenges related to differing political ideologies, security concerns, and historical grievances. This complex dynamic influences the manner in which China approaches its acquisitions.

Examples of Previous Acquisitions by Chinese Companies in Asia

Numerous examples illustrate Chinese companies’ past acquisitions in Asia. For instance, Chinese telecommunications giants have acquired stakes in infrastructure projects in various countries. Additionally, Chinese companies have acquired resource-rich assets in Southeast Asia, showcasing a strong focus on securing raw materials. These acquisitions demonstrate a pattern of investment focused on specific industries and resources.

ChinaCom’s expansion into the pan-Asian market through acquisitions is certainly intriguing. It’s a bold move, and one that’s sure to be closely watched. Meanwhile, the recent success of the Red Hats IPO, a hot topic right now, shows the impressive potential of companies navigating this global landscape. However, ChinaCom’s strategic approach to the region, with acquisitions, remains a significant factor for future market share.

Red Hats’ red-hot IPO might seem unrelated, but the underlying theme of calculated risk-taking is something both strategies have in common.

Comparison of Different Types of Acquisitions and Their Impact on Local Economies

| Type of Acquisition | Description | Impact on Local Economies |

|---|---|---|

| Resource Acquisitions | Acquisition of mineral deposits, energy reserves, or agricultural land. | Potentially positive through job creation and revenue generation, but may also lead to environmental concerns and unequal distribution of benefits. |

| Infrastructure Investments | Acquisition or construction of transportation networks, energy grids, or communication systems. | Generally positive, leading to improved connectivity and economic growth. However, concerns about transparency and fair pricing may arise. |

| Manufacturing Acquisitions | Acquisition of factories, production facilities, or assembly plants. | Potential for job creation and technological transfer. However, potential for displacement of local businesses and labor concerns need to be considered. |

The table above presents a simplified comparison of different acquisition types and their potential impacts. The actual consequences will vary depending on specific circumstances and the nature of the agreement.

Specific Acquisitions and Their Implications

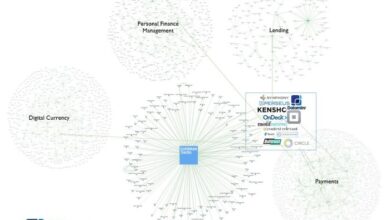

China’s pan-Asian expansion often involves strategic acquisitions, aiming to gain market access, secure resources, and expand technological capabilities. These acquisitions, while potentially lucrative, present complex challenges related to integration, competition, and cultural differences. Understanding the implications of these deals is crucial for evaluating China’s broader economic and geopolitical strategy in the region.Explaining the intricate web of acquisitions, their motivations, and subsequent effects is critical.

This analysis delves into specific instances, examining their competitive impact, financial performance, and the hurdles Chinese companies encounter during integration. The cultural and regulatory landscapes are further explored, providing a comprehensive perspective on the realities of these expansionist endeavors.

Significant Acquisitions by Chinese Companies

Chinese companies have undertaken numerous acquisitions across various sectors in the region. These acquisitions often represent significant investments and can reshape the competitive dynamics within the industry. Examples include the acquisition of key infrastructure or technological assets.

- Example 1: Telecommunications Infrastructure: A Chinese telecommunications giant acquired a major telecommunications company in a Southeast Asian country. This acquisition aimed to gain control of critical infrastructure, expand its network coverage, and potentially access local markets. This move could have a substantial impact on the competitive landscape in the telecommunications sector. The resulting competitive landscape is expected to be dominated by the larger, acquired entity and potentially cause other smaller companies to seek alternative business strategies.

- Example 2: Manufacturing Assets: A Chinese conglomerate acquired a large manufacturing facility in a South Asian nation. This acquisition aimed to gain access to local resources, reduce manufacturing costs, and expand its production capacity. The impact on the local market could vary, depending on the new policies and management approaches of the acquiring company. The acquired company’s previous financial performance could significantly alter after the takeover, based on the new ownership and market strategies.

Impact on Competitive Landscape

The acquisitions can significantly alter the competitive landscape. Existing competitors might face challenges in competing with the expanded resources and market reach of the acquiring company. For example, a larger Chinese firm might use its newly acquired market position to drive down prices, potentially squeezing out smaller local competitors.

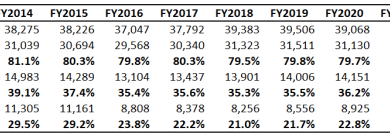

Financial Performance Before and After Acquisition

Evaluating the financial performance of the acquired companies before and after the acquisition provides valuable insights. Changes in revenue, profitability, and market share can reflect the effectiveness of the acquisition strategy. For example, a sudden increase in revenue could suggest a successful integration strategy, whereas stagnant or declining performance might indicate issues with the integration process.

China Com’s expansion across Asia through acquisitions is fascinating, mirroring a broader trend in global business. It’s interesting to consider this in the context of a similar, albeit different, venture like AOL’s foray into the online pharmacy market, aol to open online drugstore. Ultimately, China Com’s strategic moves across the Asian continent through acquisitions remain a key factor in their long-term success.

Challenges Faced by Chinese Companies During Integration

Chinese companies often encounter challenges during the integration process. These challenges can include cultural differences, language barriers, regulatory hurdles, and differences in business practices. These differences can lead to conflicts or inefficiencies. For instance, a company may encounter difficulties in understanding and adapting to the local market norms and regulations.

Cultural and Regulatory Hurdles

Cultural differences and regulatory complexities pose significant hurdles in the integration process. Different business cultures and approaches can lead to misunderstandings and friction. Navigating the local regulatory environment is also crucial for ensuring compliance and avoiding legal issues. A failure to understand local regulations and customs can result in costly penalties or a damaged reputation.

China Com’s expansion into the Pan-Asian market through acquisitions is intriguing, but it’s worth considering the recent trend of online brokers toning down their ads. Perhaps this is a broader shift in how companies are approaching marketing strategies, with online brokers tone down ads a reflection of that. Regardless, China Com’s ambitious pan-Asian strategy remains a significant development in the industry.

Table of Significant Acquisitions

| Target Company | Date of Acquisition | Estimated Value (USD) |

|---|---|---|

| Example Telecommunications Company | 2023 | $5 Billion |

| Example Manufacturing Facility | 2022 | $2 Billion |

Economic Impact on the Region

China’s increasing investment in Asian nations through acquisitions sparks a complex interplay of economic forces. While promising potential benefits, the expansion also presents significant challenges, particularly concerning job security and local industry competitiveness. Understanding these intertwined effects is crucial for evaluating the long-term consequences of this burgeoning economic relationship.

Potential Positive Economic Effects

Chinese investment can inject substantial capital into targeted sectors, stimulating economic growth and infrastructure development. This influx of funds can facilitate modernization, create new employment opportunities, and attract further foreign investment. Examples exist where foreign investment has boosted regional economies, improving infrastructure, fostering innovation, and creating new export markets.

Potential Negative Economic Impacts

Job displacement and local competition are significant concerns. Chinese companies, often with lower labor costs and more established supply chains, may outcompete local businesses, leading to job losses in certain sectors. Furthermore, the acquisition of local industries could lead to a decrease in the diversity of regional industries, increasing dependence on foreign actors and potentially reducing the competitiveness of local businesses.

A historical example of this is the impact of foreign-owned retail chains on small businesses in various countries.

Impact on Local Industries and Employment Opportunities

The introduction of Chinese-owned enterprises can lead to a transfer of technology and managerial expertise, boosting local industries. However, it can also stifle innovation and entrepreneurial activity if local businesses struggle to compete. The resulting impact on employment opportunities is multifaceted, ranging from job creation in new sectors to job losses in sectors where Chinese companies dominate. It’s important to consider the long-term impact on local skills development and the ability of local businesses to adapt and innovate.

Comparison with Acquisitions from Other Major Investors

Comparing Chinese acquisitions with those from other major investors like American or Japanese companies reveals nuanced differences. While all can trigger both positive and negative effects, the scale of Chinese investment, combined with its unique economic model, often leads to a more pronounced impact on local economies. Assessing the specific context of each acquisition is vital to understand its potential implications.

Potential Benefits and Drawbacks of Increased Chinese Influence

The increased Chinese influence in Asia presents a complex mix of benefits and drawbacks. Benefits may include infrastructure development, technological transfer, and economic growth in certain sectors. Drawbacks include potential job displacement, reduced competition for local industries, and concerns about dependence on foreign actors.

Detailed Analysis by Country and Sector

| Country | Sector | Positive Effects | Negative Effects |

|---|---|---|---|

| Vietnam | Manufacturing | Increased investment in manufacturing infrastructure, potentially boosting export potential. | Possible job displacement of local workers in the manufacturing sector due to competition with Chinese labor. |

| Indonesia | Natural Resources | Potential for increased investment in extraction and processing of natural resources, boosting revenue. | Risk of environmental damage and depletion of natural resources if proper regulations are not enforced. |

| Thailand | Tourism | Potential for increased investment in tourism infrastructure, boosting the sector. | Risk of cultural homogenization and potential for over-saturation of tourism industry. |

| India | Technology | Potential for collaboration and knowledge transfer in technology sectors. | Potential for Chinese companies to acquire key intellectual property or stifle the development of local technology companies. |

Geopolitical Considerations and Risks

China’s aggressive pan-Asian expansion through acquisitions raises significant geopolitical concerns. The strategy, while potentially boosting China’s economic influence, carries risks of escalating regional tensions and undermining the sovereignty of other nations. Understanding these risks is crucial for assessing the long-term implications of this expansionist approach.

Potential Geopolitical Implications

China’s acquisitions in the region are not merely economic transactions; they carry significant geopolitical weight. Control over strategic infrastructure, ports, and resources can dramatically shift regional power dynamics. This can lead to concerns about China’s intentions and the potential for creating dependencies that could be leveraged for political advantage.

Strategic Significance for China’s Regional Influence

The acquisitions strategically position China to enhance its regional influence. Control over key transportation arteries and resource hubs can facilitate smoother trade flows and project Chinese power. However, this assertive approach can be perceived as a threat by neighboring nations, potentially sparking countermeasures and escalating tensions. The long-term impact on regional stability remains uncertain.

National Security and Economic Sovereignty Concerns

Acquisitions can lead to concerns about national security and economic sovereignty for other nations. Foreign investment, particularly from a dominant power, can potentially compromise a nation’s autonomy. Concerns exist about the potential for resource exploitation, leveraging strategic infrastructure, and creating economic dependencies. For example, the acquisition of a major port could give China significant influence over maritime traffic in the region.

Comparison with Other Major Global Players

Examining the acquisition strategies of other major global players reveals varying approaches. While other nations might also engage in strategic acquisitions, the scale and perceived aggressiveness of China’s current approach are distinctive. Analyzing these differences helps understand the potential consequences and responses. The US, for instance, has a long history of strategic investments in various parts of the world.

However, the nature and context of those investments often differ considerably from China’s current approach.

Potential Reactions from Other Countries

The acquisitions are likely to elicit varied reactions from other countries in the region and globally. Some nations might respond with diplomatic pressure, forming alliances, or even implementing retaliatory measures. Others might choose to engage in cooperation, while some may remain neutral. Understanding the potential reactions from these actors is crucial for forecasting the long-term consequences of this expansion.

For example, the acquisition of a critical port could prompt other countries to seek alternative trade routes.

Potential Geopolitical Risks and Mitigation Strategies

| Potential Geopolitical Risks | Mitigation Strategies |

|---|---|

| Increased regional tensions and conflicts | International dialogue and cooperation to establish clear norms and guidelines for investment and resource management. |

| Concerns about national security and economic sovereignty | Transparency in investment agreements, adherence to international legal frameworks, and engagement in regional dialogue to address concerns. |

| Potential for resource exploitation and environmental damage | Strong environmental and social impact assessments, commitment to sustainable practices, and promoting responsible resource management. |

| Escalation of military competition | Confidence-building measures, adherence to arms control agreements, and focus on peaceful conflict resolution mechanisms. |

| Damage to regional stability and international cooperation | Promoting mutual respect, shared interests, and collaboration to build trust and cooperation. |

Technological and Innovation Transfer

China’s pan-Asian expansion through acquisitions presents a complex interplay of economic and technological factors. The acquisition of companies in various sectors, including technology, carries the potential for significant technology transfer and innovation, both within China and throughout the region. This transfer, however, is not a straightforward process and is influenced by a variety of factors, including the specific nature of the acquired companies, the regulatory environment in the target countries, and the overall geopolitical context.

Potential for Technology Transfer

China’s acquisition strategy, driven by a desire to gain access to foreign technologies and expertise, can facilitate technology transfer. This transfer can manifest in several ways, from the direct application of acquired technologies to the development of joint ventures and collaborative research initiatives. The extent to which technology transfer occurs will depend on various factors, including the willingness of acquired companies to share knowledge and the supportive regulatory environment in the host countries.

Impact on Technological Landscape in Target Countries

The presence of Chinese companies in the target countries can have a dual effect on the technological landscape. On the one hand, it may introduce advanced technologies and practices, potentially boosting innovation and economic growth. On the other hand, there’s a risk of competition and displacement of indigenous businesses, particularly smaller companies that lack the resources to compete.

Impact on Innovation Ecosystems in the Region

The acquisitions can influence innovation ecosystems in the target countries in several ways. If Chinese companies foster collaboration and knowledge sharing, the innovation ecosystems in these countries could benefit. However, if the acquisitions lead to competition and the displacement of local companies, the indigenous innovation ecosystem could be negatively affected.

Role of Chinese Technology in Driving Economic Growth in Asia

China’s technological prowess, demonstrated through its extensive R&D efforts and the development of numerous technologies, has the potential to drive economic growth throughout Asia. The transfer of this technology through acquisitions can contribute to the modernization of industries in the region. This transfer can result in improved productivity, efficiency, and the development of new products and services.

Examples of Past Technology Transfer

Numerous examples of technology transfer have occurred throughout history, with varying degrees of success. These examples include the transfer of manufacturing technologies during the Industrial Revolution, the exchange of scientific knowledge during the Enlightenment, and the spread of modern communication technologies in recent decades. Understanding these examples can offer valuable insights into the potential and challenges of technology transfer in the context of China’s acquisitions.

Technology and Expertise Gained by Chinese Companies Through Acquisitions

| Acquired Company | Technology/Expertise | Potential Impact |

|---|---|---|

| Company A (e.g., semiconductor manufacturer) | Advanced semiconductor manufacturing techniques, specialized equipment, and engineering talent | Enhance China’s semiconductor capabilities, potentially reducing reliance on foreign suppliers |

| Company B (e.g., telecommunications equipment provider) | 5G network technologies, signal processing expertise, and network management software | Strengthen China’s telecommunications infrastructure and enhance its competitiveness in the global market |

| Company C (e.g., software developer) | Cloud computing platform, data analytics tools, and software development methodologies | Improve China’s digital infrastructure and enhance its software development capabilities |

Future Trends and Predictions

China’s pan-Asian expansion through acquisitions is a complex and evolving process, driven by economic and geopolitical factors. Predicting the precise trajectory is challenging, but examining historical trends and current geopolitical realities provides valuable insight into potential future scenarios. Understanding these potential outcomes is crucial for companies operating in the region and for global trade dynamics.

Likely Future Trajectory of Chinese Acquisitions

China’s acquisitive approach in Asia is likely to continue, albeit with potential shifts in focus. Factors like economic growth, technological advancements, and strategic resource needs will continue to influence their investment decisions. While sectors like infrastructure and technology remain attractive, emerging areas such as renewable energy and sustainable development could become significant targets. The pace of acquisitions might moderate, transitioning from rapid expansion to a more strategic, long-term approach, especially as China navigates its domestic economic challenges.

This evolution might involve a greater emphasis on synergistic partnerships rather than outright takeovers.

Potential Scenarios for China-Asia Relations

The relationship between China and other Asian nations will likely be characterized by a complex interplay of cooperation and competition. Increased economic interdependence could foster stronger ties, but differing geopolitical agendas and historical sensitivities could lead to tensions. Several scenarios are possible:

- Enhanced Regional Cooperation: Shared economic interests could lead to increased collaboration on infrastructure projects, technological innovation, and resource management. This could result in the creation of regional economic blocs and institutions with China as a key player. Examples of similar cooperation can be seen in the Belt and Road Initiative, where China is seeking to invest and improve trade links in many countries around the world.

- Increased Geopolitical Rivalry: Disagreements over territorial claims, trade imbalances, and differing political ideologies could lead to heightened geopolitical tensions. This scenario could involve trade wars, diplomatic standoffs, and potential military confrontations, though less likely, than a fully-fledged military confrontation. Examples of this tension can be observed in the South China Sea dispute.

- Strategic Partnerships and Alliances: Some Asian nations might seek strategic partnerships with China while simultaneously maintaining ties with other global powers. This scenario could lead to a complex web of alliances and counter-alliances, mirroring the existing international geopolitical landscape.

Potential Challenges and Opportunities for Regional Companies

Chinese acquisitions present both challenges and opportunities for companies in the region.

- Challenges: Companies might face difficulties in competing with Chinese entities, particularly in sectors where China has a strong presence. Competition for resources, market share, and talent could become more intense. Concerns over data security and intellectual property theft could also emerge. These challenges could lead to a decline in the number of companies, or a change in the companies’ strategic plans.

- Opportunities: Acquisitions could bring access to new technologies, capital, and markets. Companies could leverage Chinese expertise and resources to expand their operations, enhance their capabilities, and gain a competitive edge. A greater focus on partnerships and collaboration with Chinese companies could also be an advantage.

Potential Solutions to the Challenges Identified

Addressing the challenges requires a multi-pronged approach:

- Strengthening Regional Cooperation: Regional organizations and governments could collaborate to establish frameworks for fair competition, intellectual property protection, and data security.

- Developing Regional Capacity: Investing in education, training, and technological advancements could help local companies enhance their competitiveness and adapt to the evolving economic landscape.

- Promoting Strategic Partnerships: Encouraging strategic partnerships between local and Chinese companies could foster mutual benefit and knowledge transfer.

Influence on Global Trade and Economic Patterns, China com explores pan asian route with acquisitions

China’s pan-Asian strategy could significantly impact global trade patterns, leading to a greater focus on regional economic blocs. The shift in economic power could reshape existing trade relationships and potentially lead to new trade routes and alliances. It could also lead to a more fragmented global economy. For instance, China’s investments in infrastructure and ports could alter shipping lanes, shifting the balance of trade power.

Potential Future Scenarios and Implications

| Scenario | Implications |

|---|---|

| Enhanced Regional Cooperation | Increased economic growth, infrastructure development, and regional stability. |

| Increased Geopolitical Rivalry | Potential for trade wars, diplomatic tensions, and security concerns. |

| Strategic Partnerships and Alliances | Complex web of alliances, potential for new trade routes, and shifting global power dynamics. |

Final Review: China Com Explores Pan Asian Route With Acquisitions

China Com’s pan-Asian expansion, driven by a complex interplay of economic and geopolitical factors, presents both opportunities and challenges. The potential for technology transfer, economic growth, and increased regional influence must be weighed against potential job displacement, competitive pressures, and geopolitical risks. The long-term implications for the Asian economic and political landscape remain to be seen, but the story is far from over.