Retail coalition pushes for e commerce taxes – Retail coalition pushes for e-commerce taxes, aiming to level the playing field for brick-and-mortar stores struggling against the dominance of online retailers. This initiative proposes new tax structures for e-commerce businesses, a move that could significantly impact the retail landscape, from consumer behavior to the financial health of various stores. The coalition’s arguments center on fairness, highlighting the economic disparities between online and traditional retailers.

The proposed taxes are designed to address the economic and logistical challenges faced by traditional retailers due to the rise of e-commerce. The coalition’s historical stance on economic issues, current membership, and geographical representation are key factors in understanding this initiative. This proposal also Artikels potential impacts on various segments of the retail industry, including consumers, online retailers, and the government.

Background of Retail Coalition

The Retail Coalition is a significant force in the advocacy landscape for the retail sector. Its formation reflects a growing recognition of the interconnectedness of retail businesses and the need for a unified voice to address common challenges and opportunities. The coalition’s evolution is a story of adapting to changing economic realities and tailoring its approach to ensure the success of its members.This exploration delves into the historical context of the Retail Coalition, examining its genesis, key figures, and membership.

It also Artikels the coalition’s overarching stance on economic matters, including its past actions and statements related to taxation.

Formation and Goals

The Retail Coalition emerged in response to a confluence of factors impacting the retail industry. Initial impetus came from concerns about increasing operating costs, the emergence of e-commerce, and the perceived inequities in taxation. Key figures in the coalition’s early stages were industry leaders, legal experts, and representatives from various retail sectors, united by a shared vision of a thriving retail environment.

Membership and Geographical Representation

The coalition’s membership encompasses a diverse range of retail businesses, from large national chains to independent local stores. The membership includes various types of retailers, including clothing stores, grocery stores, electronics stores, and more. The geographic representation of the coalition spans across different regions, ensuring a broad perspective and understanding of regional nuances impacting retail operations. This ensures that the interests of diverse stakeholders are addressed in policy recommendations.

Economic Stance and Past Actions

The Retail Coalition generally advocates for policies that support the economic vitality of the retail sector. Their approach often involves a balanced perspective that considers both the interests of retailers and the broader economic landscape. Historically, the coalition has expressed concerns about the uneven tax burden on retailers, particularly concerning the rise of e-commerce and the need for equitable taxation across different retail formats.

Statements on Taxes

The coalition’s statements on taxation frequently highlight the need for clarity and consistency in tax regulations. Specific concerns have often revolved around the implementation of e-commerce taxes, with calls for uniform standards across jurisdictions to avoid creating unfair competitive advantages. Past statements have emphasized the need for a level playing field for all retailers, large and small, online and offline.

Rationale for E-commerce Tax Push

The Retail Coalition’s push for e-commerce taxation stems from a growing concern about the uneven playing field between brick-and-mortar retailers and their online competitors. Traditional stores are facing significant challenges due to the rise of online shopping, and they argue that current tax policies disproportionately benefit online businesses. This imbalance threatens the viability of many local and regional retailers.The fundamental argument revolves around the principle of fairness and a level playing field for all businesses.

Retailers argue that online businesses, currently enjoying a tax advantage, should be held to the same standards as their physical counterparts. This equitable treatment is seen as crucial for the long-term health of the retail industry.

Economic Challenges for Brick-and-Mortar Retailers

Brick-and-mortar retailers face considerable economic pressures due to the rise of e-commerce. These challenges include increased operating costs, reduced foot traffic, and the necessity of adapting to rapidly changing consumer behavior. The cost of rent, utilities, and labor can be substantial, especially in high-traffic areas. In contrast, online retailers often have lower overhead expenses, enabling them to offer lower prices.

This disparity puts significant pressure on traditional stores to maintain profitability.

Logistical Challenges and Tax Implications

The logistical differences between brick-and-mortar and e-commerce businesses are substantial. Brick-and-mortar retailers invest heavily in inventory management, warehousing, and store operations. They also need to account for sales taxes in every state they operate in, and this can be a complex and costly administrative burden. Online retailers, on the other hand, often rely on third-party logistics providers, significantly reducing their direct costs.

The lack of a consistent sales tax structure for online transactions is argued to create a significant competitive disadvantage for brick-and-mortar retailers.

Unfairness of Current E-commerce Tax Policies

The Retail Coalition contends that the current tax policies for e-commerce businesses are fundamentally unfair. They argue that online retailers often avoid paying sales taxes in states where they don’t have a physical presence. This creates a situation where online businesses are not contributing their fair share to local economies and taxing jurisdictions. The lack of consistent tax collection on online sales undermines the ability of brick-and-mortar stores to compete.

Potential Impacts on Different Retail Segments

The proposed tax policies will likely have varied impacts on different segments of the retail industry. For example, smaller independent retailers, often operating on tight margins, are anticipated to be significantly affected by increased costs. Large chains with robust online presences may be less impacted, but the increased regulatory compliance burden will still be significant. A broader impact would be felt by the local economy and employment opportunities.

Arguments for a Level Playing Field

The Coalition argues that a level playing field is essential for the survival and growth of brick-and-mortar retailers. They advocate for a consistent tax structure across all sales channels. The proposal would ensure that all retailers, regardless of their business model, contribute fairly to the local economies they operate in. This will support local employment and sustainable retail ecosystems.

This consistent taxation would not only enhance fairness but also stimulate economic growth by promoting healthy competition and ensuring a more balanced retail landscape.

Specific Proposals for E-commerce Taxes

The retail coalition’s push for e-commerce taxes is a response to the perceived unfair advantage enjoyed by online retailers over brick-and-mortar stores. This initiative aims to level the playing field and ensure a fairer tax system for all businesses, regardless of their operational model. A key component of this effort involves the design and implementation of a robust tax structure specifically tailored to e-commerce.The proposed tax structures are intended to address the unique challenges of the digital marketplace, while also ensuring equitable treatment for all businesses operating within the jurisdiction.

This is achieved by considering various factors, including the scale of the business, the nature of its products, and the geographic reach of its operations. The goal is a system that is both effective in generating revenue and fair to all stakeholders.

Proposed Tax Structures for E-commerce Businesses

The coalition proposes a tiered approach to e-commerce taxation, recognizing the diverse nature of online businesses. This framework seeks to avoid overly burdensome taxation for smaller operations while still generating significant revenue from larger companies.

| Business Size Category | Tax Model | Tax Rate |

|---|---|---|

| Small Businesses (annual revenue under $1 million) | Simplified Sales Tax | 2% on gross sales |

| Medium Businesses (annual revenue between $1 million and $10 million) | Standard Sales Tax | 5% on gross sales |

| Large Businesses (annual revenue over $10 million) | Value-Added Tax (VAT) Model | 7-10% on gross sales (tiered based on sales volume) |

Mechanisms for Collecting and Enforcing Taxes

To ensure smooth implementation, the coalition proposes a multi-pronged approach to tax collection and enforcement. This includes clear communication and guidelines to ensure all stakeholders understand their obligations.

- Partnership with Online Marketplaces: This partnership would allow for automatic tax collection directly from the transaction, reducing the burden on the individual seller and improving compliance. For example, Amazon’s existing payment infrastructure could be leveraged to collect and remit taxes. This approach is already used in several countries, demonstrating its feasibility.

- Integration with Shipping Companies: Shipping companies, already possessing significant data about transactions and deliveries, can be instrumental in verifying sales and collecting taxes at the point of delivery. This approach could incorporate existing tracking systems to verify sales and generate revenue.

- Streamlined Reporting and Audits: The coalition advocates for the development of user-friendly reporting systems and a streamlined audit process for e-commerce businesses. This will foster transparency and accountability while reducing compliance burdens.

Projected Revenue Generation

The coalition projects significant revenue generation from these new tax policies. Revenue projections are contingent upon factors such as the number of e-commerce businesses, their average transaction values, and compliance rates. For example, a 2% tax on a substantial number of online transactions could lead to substantial increases in government revenue. Furthermore, revenue can be projected using historical sales data from existing tax systems.

The retail coalition’s push for e-commerce taxes is definitely a hot topic right now. It’s all about leveling the playing field, ensuring brick-and-mortar stores aren’t unfairly disadvantaged by online giants. Meanwhile, Yahoo’s new auction program for merchants, yahoo launches new auction program for merchants , could potentially shift the competitive landscape, though. Ultimately, the retail coalition’s goal is still to find a fair system for everyone, balancing the needs of online and offline retailers.

“Projected revenue generation is estimated to be in the range of $X billion to $Y billion in the first five years, contingent on successful implementation and compliance.”

This projected revenue can be used to fund various public programs and initiatives.

Potential Opposition and Counterarguments

The Retail Coalition’s push for e-commerce taxes faces significant potential opposition from various stakeholders. Understanding the counterarguments is crucial for a balanced perspective on the proposed policies. These counterarguments often center on concerns regarding increased administrative burdens, negative consumer impacts, and the potential for hindering the competitiveness of the retail sector.The proposed taxes, while intended to level the playing field for brick-and-mortar retailers, could inadvertently create a range of unintended consequences.

These consequences need careful consideration before implementation.

Counterarguments Regarding Administrative Burden

The implementation of new e-commerce tax regulations often requires significant investment in new infrastructure and administrative processes. This includes the need for retailers to establish systems for tracking sales, calculating taxes, and remitting payments to various jurisdictions. Small and medium-sized businesses (SMBs), particularly those with limited resources, may find it challenging to adapt to these new requirements. Increased compliance costs could potentially push smaller retailers out of business, or discourage new entrants.

The retail coalition’s push for e-commerce taxes is a hot topic right now, and it’s definitely something to watch. Meanwhile, Office Depot’s recent move into a new B2B e-commerce deal, like this one , highlights the growing importance of online business-to-business sales. Ultimately, these developments all point to a future where e-commerce is a major player in the retail world, and that likely means a continued debate about how best to tax it.

Negative Impacts on Consumers

Potential increases in e-commerce taxes could be passed on to consumers in the form of higher prices. This would increase the cost of goods and services for consumers, particularly for essential products. Studies have shown that higher taxes can decrease consumer spending and negatively impact overall economic growth.

Concerns Regarding Competitiveness

The proposed e-commerce tax policies could put domestic retailers at a disadvantage compared to their international counterparts, who may not be subject to similar regulations. This could lead to a decline in domestic market share for brick-and-mortar retailers and reduce their competitiveness in the global marketplace. The added cost could also make domestic products less attractive to consumers compared to imports.

Comparison with Existing Initiatives

A comparative analysis of the Retail Coalition’s proposals with similar initiatives from other countries or government entities is essential. Examining the success or failure of similar policies in other jurisdictions can provide valuable insights and allow for a more nuanced evaluation of the potential outcomes. Analyzing how these policies have affected consumer behavior, retail industry dynamics, and economic growth in other regions is vital.

Impact on the Consumer

The proposed e-commerce tax policies, intended to level the playing field for brick-and-mortar retailers, are poised to significantly impact consumers. Understanding these potential effects is crucial for informed discussion and policymaking. This analysis delves into the likely consequences for consumer prices, choices, and convenience.These policies, while aimed at supporting traditional retail, may inadvertently shift the retail landscape and alter consumer experiences.

Consumers will need to be aware of these shifts to make informed purchasing decisions.

Consumer Price Impacts

The introduction of e-commerce taxes will likely influence consumer prices in several ways. Increased costs for businesses may be passed on to consumers through higher prices for goods and services. This is especially true if the tax is levied on the transaction value or on the final price of the product. Businesses might adjust pricing strategies to account for the additional tax burden.

Consumer Choice Impacts

E-commerce tax policies could significantly alter consumer choice. The introduction of taxes on online purchases might increase the competitiveness of traditional brick-and-mortar retailers, leading to potentially more diverse and accessible options for in-store purchases. Conversely, if taxes are substantial, consumers might shift towards cheaper options, potentially impacting smaller businesses.

Convenience Considerations

Convenience is a key driver for e-commerce adoption. The proposed taxes could alter this aspect of consumer experience. Higher prices resulting from the taxes might deter some consumers from online purchases. Consumers may need to carefully weigh the convenience of online shopping against the potential increase in costs. This could potentially lead to a resurgence of in-store shopping, as customers weigh convenience against the financial implications.

Impact on Different Consumer Segments

The impact of these policies will vary across different consumer segments. Low-income consumers, who often rely on online deals and discounts, may be disproportionately affected by increased prices. For example, if online groceries become more expensive, it might impact families with tight budgets. Higher-income consumers, on the other hand, might be less affected, but they could still experience a change in purchasing habits, especially if online retailers are forced to reduce their services or promotions.

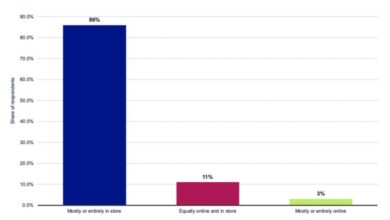

Potential Shifts in Consumer Behavior

The introduction of e-commerce taxes could induce several shifts in consumer behavior. Consumers might start favoring traditional retail stores, seeking out sales and in-store promotions. This shift could affect the sales and profits of e-commerce businesses and traditional retailers alike. For example, a surge in in-store traffic might cause retailers to adjust their inventory management and store layouts.

Alternatively, consumers might seek out retailers that don’t apply the taxes, potentially shifting demand to international online marketplaces.

Global Context

The retail coalition’s push for e-commerce taxes isn’t isolated; it’s a reflection of a global debate. Many countries are grappling with how to fairly tax digital commerce, as traditional tax models struggle to keep pace with the rapid expansion of online retail. This global context provides valuable insights and lessons for the coalition’s proposals.The international landscape of e-commerce taxation is complex and multifaceted, with diverse approaches adopted by different nations.

Each country’s specific circumstances, including its existing tax infrastructure, economic structure, and political priorities, influence the design and implementation of its e-commerce tax policies.

Retail coalitions are pushing hard for e-commerce taxes, and it looks like this issue is finally gaining traction. The recent news that e-commerce tax is on the agenda as the commission begins work, as seen in this article e commerce tax on agenda as commission begins work , suggests a potential shift in policy. This could significantly impact how online retailers operate, and ultimately, the success of the retail coalition’s campaign.

International E-commerce Taxation Policies

Various countries have implemented or are considering different e-commerce taxation strategies. These policies reflect a range of approaches, from destination-based taxation to origin-based taxation, and different levels of digital services taxes.

- Destination-Based Taxation: This approach taxes e-commerce sales based on the location of the consumer. For instance, some European countries have implemented such policies, taxing online retailers based on where the customer resides, regardless of where the retailer is located. This aligns with the principle of taxing where the economic activity is ultimately felt.

- Origin-Based Taxation: Conversely, some countries apply origin-based taxation, where the retailer’s location dictates the taxation. This approach may be more straightforward for smaller countries with a limited number of online retailers, but it can be more complex for larger countries with a wider range of e-commerce activities.

- Digital Services Taxes (DSTs): Several countries have introduced DSTs, aiming to tax the revenue generated by large digital companies. These taxes vary significantly in their scope and implementation, and have proven contentious due to concerns about double taxation and potential impact on cross-border trade.

Examples of Existing Policies

Understanding the specific approaches adopted in other countries provides valuable context.

- European Union: The EU has been a frontrunner in developing policies for e-commerce taxation. The EU’s approach often prioritizes harmonization, seeking to create a common framework for taxing online sales across member states. This can lead to greater compliance and transparency but also creates potential challenges in harmonizing with the diverse economic realities within the EU.

- United States: The US has a patchwork approach to e-commerce taxation, with states having varying policies on taxing online sales. This lack of consistent regulation has created complexities for businesses and consumers alike. This often involves ‘economic nexus’ rules to determine when a company needs to collect sales taxes in a given state.

- China: China’s e-commerce market is exceptionally large, and the government has been actively shaping the regulatory environment for online retailers. This often involves both practical considerations of market dominance and broader national policy goals, which might include supporting domestic companies and generating revenue for government programs.

Comparative Analysis of Proposed Policies

A comparison of the retail coalition’s proposed policies with existing policies in other regions reveals both similarities and significant differences. Some key aspects include the degree of harmonization across jurisdictions, the specific revenue collection mechanisms, and the potential impact on both businesses and consumers.

| Feature | Retail Coalition’s Proposal | International Examples |

|---|---|---|

| Taxation Basis | [Detail of the coalition’s proposal] | Destination-based, origin-based, DSTs |

| Nexus Rules | [Detail of the coalition’s proposal] | Varying rules by country; some have a lower threshold, while others are based on revenue or physical presence |

| Revenue Collection Mechanisms | [Detail of the coalition’s proposal] | Government agencies, third-party platforms, or direct collection by retailers |

Technological Considerations

Navigating the digital economy requires robust technological infrastructure to support e-commerce tax policies. Implementing these policies necessitates a comprehensive understanding of the intricate systems involved in tracking online transactions and collecting taxes from various sources. This includes considerations for data privacy, security, and the potential for widespread adoption across different platforms and businesses.

Tracking Online Transactions, Retail coalition pushes for e commerce taxes

Accurate tracking of online transactions is crucial for implementing e-commerce taxes. This involves a sophisticated system that can identify, record, and verify sales across numerous platforms, marketplaces, and individual websites. Real-time data collection and processing are essential for ensuring timely tax reporting and preventing discrepancies. This system must be adaptable to accommodate evolving e-commerce models, including subscription services, digital downloads, and complex international transactions.

Tax Collection from Various Sources

Collecting taxes from diverse sources necessitates a multi-faceted approach. This includes integrating with various payment processors, marketplaces, and logistics providers to capture transaction details. The system must be designed to handle a high volume of transactions and ensure accuracy in calculating and remitting taxes to the appropriate authorities. Furthermore, it must be flexible enough to accommodate different tax rates and regulations in various jurisdictions.

Software and Tools for Implementation

Implementing e-commerce tax policies requires specific software and tools. These tools must be capable of handling a large volume of transactions, calculating taxes accurately, and integrating with existing accounting and financial systems. They should also provide detailed reporting and analytics to monitor compliance and identify potential issues.

| Category | Software/Tool | Description |

|---|---|---|

| Transaction Tracking | Specialized E-commerce Tax Software | Software designed to track online transactions, identify sales, and calculate applicable taxes across various platforms. |

| Tax Calculation | Tax Calculation API | An application programming interface (API) providing real-time tax calculation based on transaction details and jurisdiction. |

| Reporting and Compliance | Cloud-based Reporting Platform | A centralized platform for generating tax reports, monitoring compliance, and managing tax liabilities. |

| Integration with Existing Systems | API Connectors | Tools that connect the new tax system with existing financial and accounting systems, ensuring data consistency and automation. |

Data Privacy and Security

Data privacy and security are paramount concerns when implementing any system handling sensitive financial information. Robust encryption and secure storage solutions are essential to protect user data from unauthorized access and breaches. Compliance with relevant data privacy regulations, such as GDPR and CCPA, is critical. Regular security audits and incident response plans are necessary to mitigate potential threats and maintain trust in the system.

Technological Challenges and Solutions

Implementing a comprehensive e-commerce tax system presents several technological challenges. One challenge is ensuring seamless integration with existing systems used by businesses and marketplaces. A solution involves creating flexible APIs and utilizing cloud-based infrastructure to facilitate this integration. Another challenge is handling the complexities of international transactions and diverse tax regulations. A solution is to develop a system that can adapt to different jurisdictions’ tax laws and regulations, allowing businesses to operate seamlessly in various international markets.

A further challenge is managing the massive volume of data generated by online transactions. A solution is to use advanced data analytics tools to efficiently process and analyze data for compliance and reporting purposes.

Political Landscape

The debate surrounding e-commerce taxation is deeply intertwined with the broader political climate. Differing views on economic fairness, the role of government, and the impact of technology on traditional industries often shape the positions of political figures and parties. Understanding these nuances is crucial to assessing the likelihood of successful policy implementation.Political considerations play a significant role in the trajectory of the e-commerce tax debate.

The political winds can shift dramatically based on public opinion, election cycles, and the perceived benefits or drawbacks for various constituents. This dynamic environment makes predicting the outcome of proposed legislation a complex undertaking.

Positions of Political Figures and Parties

The political spectrum holds diverse views on e-commerce taxation. Some parties may prioritize revenue generation through taxation, while others may favor policies that support small businesses or protect consumers. A range of perspectives will likely be presented and debated.

- Pro-Taxation Parties: These parties often advocate for policies that generate more revenue for the government. They might argue that e-commerce companies should pay taxes at the same rate as brick-and-mortar retailers, thereby leveling the playing field and ensuring fairer distribution of tax burdens. For instance, a party with a focus on public infrastructure development might support e-commerce taxes to fund these projects.

- Pro-Business/Consumer Parties: These parties often emphasize policies that support business growth and consumer interests. They might argue that imposing additional taxes on e-commerce could negatively impact businesses and increase prices for consumers. A party focused on promoting free trade might oppose such taxes, citing potential negative consequences for the economy.

- Specific Examples: Specific examples of politicians’ positions on this issue can be found in official statements, press releases, and legislative records. For example, a particular senator might have introduced a bill addressing this issue, showcasing their stance on the matter.

Influence of Political Considerations

Political considerations significantly influence the likelihood of successful e-commerce tax implementation. Factors such as public support, lobbying efforts by various stakeholders, and the political climate surrounding similar tax policies all play crucial roles.

- Public Opinion: If public opinion overwhelmingly supports the implementation of e-commerce taxes, this could create political pressure on policymakers to act accordingly. Conversely, strong public opposition could hinder the passage of such legislation. For instance, a recent public opinion poll showing widespread support for e-commerce taxes might sway political decision-making.

- Lobbying Efforts: The intensity and effectiveness of lobbying efforts from various groups—e-commerce companies, retailers, and consumer organizations—can significantly impact the political landscape. Powerful lobbying groups with significant financial resources can often influence politicians’ decisions.

- Political Cycles: Election cycles and the prevailing political climate can influence the prioritization of e-commerce tax legislation. During times of economic hardship, politicians might be more inclined to prioritize policies that generate revenue. For example, during a recession, the political focus might shift towards revenue-generating measures.

Political Feasibility

Political feasibility of e-commerce taxation hinges on the support of political parties and the broader political landscape.

- Coalition Building: The success of any tax policy often hinges on the formation of coalitions across the political spectrum. A coalition of legislators supporting the policy can create a critical mass of support, making its implementation more likely.

- Bipartisan Support: If a bill garners bipartisan support, it increases its chances of passing through the legislative process. This can be a crucial factor in determining the policy’s eventual fate. For instance, if significant members of both major parties in a country express support for the policy, this would indicate greater political feasibility.

Wrap-Up: Retail Coalition Pushes For E Commerce Taxes

In conclusion, the retail coalition’s push for e-commerce taxes presents a complex issue with potential benefits and drawbacks for all stakeholders. The debate surrounding this policy encompasses various factors, including the impact on consumer prices, the logistics of implementation, and the potential for increased administrative burden. The coalition’s proposals, if implemented, will undoubtedly reshape the retail landscape, and the global context of e-commerce taxation offers valuable insights.

The future of retail hinges on how this issue is resolved.