Why should red hat be allowed to rewrite wall streets rules – With why should Red Hat be allowed to rewrite Wall Street’s rules at the forefront, this exploration dives into the potential impact of this tech giant’s proposed changes on the financial world. We’ll examine Red Hat’s current influence, the existing regulatory framework, arguments for and against the rule changes, and potential consequences for various stakeholders. This discussion will analyze the technological implications and offer alternative solutions, all while referencing illustrative case studies to better understand the potential ripples throughout the financial sector.

Red Hat, a prominent open-source software company, is increasingly involved in financial technology. Their proposed revisions to Wall Street’s established rules raise critical questions about the future of financial regulation in the age of rapid technological advancement. This analysis will explore the complexities of adapting existing regulations to accommodate these innovations.

Red Hat’s Potential Impact on Wall Street

Red Hat, a prominent provider of open-source software solutions, has been steadily expanding its influence in the financial technology sector. Their current offerings, including enterprise Linux, cloud platforms, and middleware, are increasingly utilized by financial institutions for modernization and digitization. This rise in adoption naturally raises questions about the potential impact Red Hat might have on the established Wall Street landscape if given the authority to rewrite its rules.Red Hat’s current influence in the financial technology sector is primarily driven by its ability to provide robust, scalable, and cost-effective infrastructure solutions.

This includes supporting cloud migration strategies, enhancing data security, and enabling the development of innovative financial products and services. Their products allow institutions to manage complex data volumes, facilitate real-time trading, and support regulatory compliance. The potential for Red Hat to reshape Wall Street’s operational framework, however, hinges on their approach to rule-making and its potential effects on different stakeholders.

Red Hat’s Current Role in Financial Technology

Red Hat’s current role in the financial technology sector is characterized by its provision of open-source technology solutions. These solutions often enable financial institutions to modernize legacy systems, adapt to evolving regulatory requirements, and reduce operational costs. Their focus on open standards allows for interoperability and integration with existing infrastructure. This has resulted in their increasing adoption within the sector, particularly for cloud-based solutions and applications.

Potential Consequences of Red Hat’s Rule Changes

If Red Hat were to rewrite Wall Street rules, the consequences could be significant and multifaceted. One potential outcome is a shift towards a more open and interoperable financial infrastructure, enabling greater innovation and competition. Conversely, this could also lead to unforeseen vulnerabilities, as the security and reliability of these open-source systems might be compromised in new ways.

This shift could also potentially disrupt the existing regulatory framework, requiring substantial adaptation and potentially leading to increased compliance costs for financial institutions.

Disruption Scenarios

Red Hat’s actions could disrupt Wall Street in several ways. For example, a focus on open-source standards could lead to a proliferation of new trading platforms and financial instruments, creating new opportunities but also increasing the risk of fraud and manipulation. Alternatively, a re-evaluation of data security protocols, based on Red Hat’s open-source frameworks, could result in more robust security practices but also introduce new vulnerabilities that need to be addressed.

Furthermore, a move towards a more decentralized financial infrastructure, enabled by Red Hat’s technologies, could significantly alter the roles of traditional financial institutions and regulatory bodies.

Comparison of Current Practices and Potential Impacts

Red Hat’s current business practices emphasize open-source collaboration and community development. However, the potential impacts of rewriting Wall Street rules would necessitate a different approach, one that prioritizes the safety and reliability of the entire financial system. A potential conflict could arise between the open-source ethos and the stringent security and regulatory requirements of Wall Street. This transition could be challenging and may involve significant adaptation on both sides.

Stakeholder Analysis

| Stakeholder | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Investors | Potentially increased innovation and competition, leading to better returns | Increased risk of systemic failures and security breaches |

| Traders | Access to new, potentially more efficient trading platforms | Increased complexity in navigating new technologies and regulatory frameworks |

| Regulators | Opportunity to adapt to new technologies and maintain financial stability | Challenges in overseeing a more complex and potentially decentralized financial system |

Existing Regulatory Framework for Wall Street

The financial landscape of Wall Street is meticulously governed by a complex web of regulations, designed to maintain stability, protect investors, and prevent fraudulent activities. These regulations have evolved over decades, adapting to changing market conditions and emerging financial instruments. Understanding this framework is crucial for evaluating the potential impact of any proposed changes, such as those potentially introduced by Red Hat.The current regulatory framework for Wall Street is a multifaceted system, encompassing a wide range of laws, rules, and guidelines.

It’s not a monolithic entity but a collection of interconnected regulations overseen by various governmental bodies. This framework aims to ensure fairness, transparency, and accountability within the financial markets.

Overview of the Regulatory Framework

The regulatory framework governing Wall Street is a historical construct, responding to financial crises and market failures. Its evolution is characterized by periods of significant change and refinement, often driven by lessons learned from past events. The current structure reflects the need to prevent another systemic crisis and maintain the integrity of the financial system.

Key Regulatory Bodies

A number of regulatory bodies play crucial roles in maintaining the stability and integrity of the financial system. These bodies, with their specific mandates, work collaboratively to uphold the regulatory framework.

- The Securities and Exchange Commission (SEC): The SEC is the primary regulatory body for the securities markets, overseeing public companies, investment advisors, and exchanges. Its mandate encompasses registration, disclosure, and enforcement of regulations related to securities trading.

- The Federal Reserve (Fed): The Fed plays a vital role in maintaining the stability of the financial system through monetary policy, regulating banks, and managing payment systems. Its actions influence interest rates and credit availability.

- The Federal Deposit Insurance Corporation (FDIC): The FDIC protects depositors in banks and savings associations, promoting stability in the banking system and consumer confidence. It monitors bank practices and enforces regulations to safeguard deposits.

- The Commodity Futures Trading Commission (CFTC): The CFTC regulates the futures markets, including agricultural commodities, energy, and metals. Its focus is on ensuring fair and transparent trading practices and preventing market manipulation.

Rationale Behind Existing Regulations

The rationale behind the existing regulations is multi-faceted, stemming from the need to mitigate risk, protect investors, and promote market integrity. These regulations are designed to reduce the likelihood of systemic crises, encourage transparency and accountability, and ensure fair competition.

- Preventing market manipulation: Regulations aim to prohibit fraudulent activities and ensure that market participants act fairly and honestly. This includes preventing insider trading, market rigging, and other manipulative practices.

- Protecting investors: Regulations are designed to safeguard investors from fraudulent activities, misleading information, and unfair practices. This includes disclosure requirements, registration requirements, and investor protection provisions.

- Maintaining market stability: Regulations aim to prevent systemic risks and ensure the stability of the financial system. This includes regulations on capital adequacy, leverage, and stress testing.

Comparison of Existing and Potential Red Hat Rules

A comparison of the existing regulatory framework and potential new rules proposed by Red Hat requires careful consideration of the specific changes. It’s important to note that the potential impact of Red Hat’s proposed changes remains largely undefined.

| Aspect | Existing Rules | Potential Red Hat Rules (Hypothetical) |

|---|---|---|

| Disclosure Requirements | Comprehensive disclosure requirements for publicly traded companies. | Potentially streamlined disclosure requirements, emphasizing key performance indicators. |

| Market Surveillance | Ongoing market surveillance by regulatory bodies. | Potentially automated market surveillance systems. |

| Enforcement Mechanisms | Established enforcement mechanisms for violations. | Potentially different enforcement mechanisms focusing on data-driven approaches. |

Arguments For and Against Red Hat’s Proposed Rule Changes

Red Hat’s proposed revisions to Wall Street’s regulatory framework are sparking significant debate. These changes, aimed at modernizing the financial landscape, are met with varying degrees of support and opposition. Understanding the nuanced arguments is crucial for evaluating the potential impact on market stability and investor confidence.These proposed rule modifications present a complex situation, with proponents emphasizing the need for adaptability in a rapidly evolving financial sector and opponents highlighting potential risks to established safeguards.

Careful consideration of both sides is essential to gauge the overall implications of these changes.

Arguments Supporting Red Hat’s Proposed Rule Changes

These proposed changes aim to address perceived inefficiencies and outdated regulations within the financial sector. Proponents argue that the current framework, established in previous eras, may not adequately address the complexities of modern financial instruments and transactions. They emphasize the importance of regulatory agility in adapting to new technologies and market dynamics.

- Enhanced market efficiency: Supporters believe that streamlined regulations could potentially reduce compliance costs for firms, fostering a more competitive environment and ultimately leading to lower transaction costs for investors. For example, reducing bureaucratic hurdles for fintech companies could lead to innovative solutions and increased market participation.

- Improved market transparency: Certain proposed changes aim to increase transparency in financial markets by making data more accessible and standardized. This could enhance investor confidence and facilitate informed decision-making. A clearer picture of transactions and market activity, for example, could help identify and mitigate potential risks.

- Greater innovation: By modernizing regulations, proponents believe that Red Hat’s changes could create a more conducive environment for financial innovation. This could result in new financial products and services that cater to evolving investor needs. For instance, the emergence of cryptocurrencies and decentralized finance (DeFi) necessitates a regulatory response that balances innovation with risk mitigation.

Potential Benefits of the Proposed Changes

These changes, if implemented successfully, could yield several potential benefits. Improved market efficiency, as mentioned above, could lead to lower costs for investors. Increased transparency could foster greater investor confidence. A more flexible regulatory framework could encourage innovation and the development of new financial products.

Potential Drawbacks of the Proposed Changes

While proponents highlight potential benefits, there are also potential drawbacks to consider. Concerns exist about the potential for increased market volatility and the possibility of creating loopholes that could be exploited by unscrupulous actors. A lack of sufficient safeguards could lead to significant financial instability.

Arguments Against Red Hat’s Proposed Rule Changes

Opponents of Red Hat’s proposed changes express concerns about the potential negative impacts on market stability and investor protection. They highlight potential risks associated with reduced regulatory oversight and the possibility of increased systemic risk. Furthermore, they argue that the proposed changes may not adequately address the complexities of the current financial landscape.

Red Hat’s potential to reshape Wall Street’s regulations hinges on a few key points, but it’s worth considering the broader context. A recent congressional hearing on the rising use of e-commerce privacy seals, like those discussed in this congressional committee hearing , highlights the evolving landscape of digital commerce. Ultimately, the debate over Red Hat’s regulatory power in finance comes down to whether their proposed changes are truly beneficial for the overall market and consumer protection.

- Increased systemic risk: Critics argue that loosening regulations could increase systemic risk, making the financial system more vulnerable to shocks and crises. A historical example of this is the 2008 financial crisis, where inadequate regulatory oversight contributed to the collapse of numerous financial institutions.

- Reduced investor protection: Opponents suggest that reduced regulatory oversight could lead to diminished investor protection, leaving investors vulnerable to fraud and manipulation. Robust safeguards and investor protection measures are paramount in ensuring market integrity.

- Unintended consequences: A key concern is the possibility of unforeseen consequences from these proposed changes. The complexities of the financial system mean that unintended negative outcomes could arise from seemingly minor modifications to existing regulations. For instance, a change in collateral requirements might unintentionally impact a particular segment of the market.

Comparison of Different Viewpoints

The debate surrounding Red Hat’s proposed rule changes highlights a fundamental conflict between the desire for regulatory agility and the need for robust safeguards. Supporters emphasize the need for modernization, while opponents highlight the importance of established protections. This conflict underscores the inherent trade-offs in any regulatory reform.

Key Arguments For and Against Red Hat’s Actions

| Argument | For | Against |

|---|---|---|

| Market Efficiency | Streamlined regulations reduce compliance costs, lower transaction costs. | Looser regulations increase systemic risk, potentially leading to financial instability. |

| Innovation | Modern regulations foster innovation in financial products and services. | Reduced oversight may lead to the development of risky financial instruments. |

| Investor Protection | Increased transparency enhances investor confidence and informed decision-making. | Reduced regulatory oversight potentially diminishes investor protection. |

Potential Consequences of Allowing Rule Changes

Red Hat’s proposed revisions to Wall Street regulations, often dubbed “Red Hat Rules,” promise a radical shift in the financial landscape. The potential consequences, both positive and negative, are far-reaching and demand careful consideration. The long-term effects on market stability, investor confidence, and transparency are crucial elements to evaluate before any significant changes are implemented.These proposed changes, while aiming to modernize and streamline processes, risk creating unintended and potentially detrimental outcomes.

The complexity of the financial system necessitates a cautious approach to rule-making, considering the intricate web of interconnected relationships between various market participants.

Long-Term Effects on the Financial Market

The long-term effects of implementing Red Hat rules are multifaceted and uncertain. A streamlined regulatory framework might foster innovation and efficiency, but it could also lead to vulnerabilities if not properly considered. The interplay between regulatory changes and market behavior is a complex equation, and the potential outcomes need careful scrutiny.

Risks Presented by the Rule Changes

Significant risks are associated with the proposed rule changes. One major concern is the potential for increased systemic risk. Relaxing existing regulations could create gaps that malicious actors might exploit, leading to instability and financial crises. This risk is further amplified by the interconnected nature of modern financial markets. For instance, a crisis in one sector can quickly cascade across the entire system.

History is replete with examples of such cascading effects, highlighting the fragility of the system.

Opportunities Presented by the Rule Changes

While risks exist, the proposed changes might also unlock new opportunities for innovation and efficiency in the financial sector. Reduced regulatory burdens could incentivize financial institutions to explore new investment strategies and technologies. This could lead to greater competition and potentially lower costs for consumers. However, it’s crucial to evaluate if these potential benefits outweigh the risks.

Impact on Market Stability and Investor Confidence

The proposed rule changes could significantly impact market stability and investor confidence. Investors rely on a stable and transparent market. Any perception of increased risk or decreased transparency could lead to capital flight, impacting market liquidity and overall economic performance. The potential for market volatility is a critical factor to consider when evaluating the long-term implications of Red Hat rules.

Red Hat deserves the chance to reshape Wall Street’s rules because innovation often requires flexibility. Look at how Priceline.com, for example, is proving that disruptive business models can actually please the street ( priceline com pleases the street ). If a company like Priceline can thrive by challenging traditional norms, shouldn’t Red Hat be given the same leeway to potentially revolutionize the financial landscape?

Ultimately, embracing change in Wall Street’s regulatory environment can lead to a more dynamic and successful marketplace.

The 2008 financial crisis serves as a stark reminder of the devastating impact of market instability on investor confidence.

Red Hat deserves the right to reshape Wall Street’s rules because innovation often demands flexibility. Think about how AOL, with its acquisition of a piece of Blockbuster com, demonstrates this need for change in the face of new technologies. This dynamic adaptability is precisely what’s needed for Red Hat to thrive in the ever-evolving financial landscape.

Their innovative approach should be embraced, not stifled, in the market.

Impact on Market Transparency and Fairness

Maintaining market transparency and fairness is paramount. Changes to the regulatory framework must not compromise the ability of investors to access accurate and timely information. Reduced transparency could create an uneven playing field, potentially benefiting sophisticated investors while disadvantaging smaller or less informed participants. The principles of fairness and transparency must be carefully balanced against the desire for efficiency and innovation.

Different Perspectives on the Potential Consequences

Different stakeholders have varying perspectives on the potential consequences of Red Hat rules. Financial institutions may see benefits in reduced compliance costs, while regulators might express concern about potential market vulnerabilities. Investors and consumers will likely be impacted in various ways depending on the specific changes implemented. The public discourse needs to encompass diverse viewpoints and concerns to ensure a comprehensive understanding of the implications.

Alternative Solutions and Mitigation Strategies: Why Should Red Hat Be Allowed To Rewrite Wall Streets Rules

Red Hat’s proposed rule changes on Wall Street have sparked significant debate, raising concerns about potential market manipulation and unfair competition. Instead of directly opposing the changes, alternative solutions and mitigation strategies offer a more constructive approach. These solutions aim to address the underlying concerns while preserving the integrity and fairness of the financial system.Alternative solutions are crucial for navigating the complexities of financial regulation.

They provide a framework for achieving a balanced outcome that accommodates the need for innovation while safeguarding the interests of investors and the stability of the market. By exploring these alternatives, we can ensure that the evolving financial landscape fosters responsible growth and prevents undue risk.

Strengthening Existing Regulatory Frameworks

Existing regulatory frameworks, while comprehensive, might need adjustments to address the nuances of Red Hat’s proposed rule changes. This involves refining oversight mechanisms to account for potential vulnerabilities introduced by these changes. This approach is preferred because it builds upon existing structures, reducing the need for radical overhaul. It allows for a more gradual adaptation to evolving market conditions, mitigating the risk of unforeseen consequences.

- Enhancement of Surveillance Tools: Implementing advanced surveillance technologies can monitor trading activities more effectively. Real-time monitoring, coupled with sophisticated algorithms, can detect potential anomalies or patterns indicative of market manipulation. This proactive approach can prevent illicit activities before they escalate. An example of this is the use of machine learning in detecting fraudulent trading patterns in the cryptocurrency market.

- Improved Data Transparency: Requiring greater transparency in data reporting from financial institutions will enable regulators to gain a deeper understanding of market dynamics. This comprehensive data will facilitate better oversight and potentially uncover hidden risks associated with the proposed rule changes. Increased transparency can be seen in the efforts to make corporate financial statements more accessible and understandable for investors.

Promoting Competition and Innovation through Transparency

Instead of directly restricting innovation, a more effective approach is to promote competition and innovation through transparency. This approach encourages a level playing field where all participants have access to the same information and opportunities. Promoting open dialogue and knowledge sharing can benefit all parties, fostering a more stable and trustworthy financial environment.

- Promoting Open Information Sharing: Encouraging open communication between financial institutions and regulators can foster a more collaborative approach to risk management. This includes sharing best practices and developing standardized reporting methodologies. This can improve market efficiency and reduce the potential for systemic risks. An example is the SEC’s initiatives to provide educational materials for investors.

- Facilitating Open Market Access: Implementing measures that guarantee equal access to the market for all participants, irrespective of their size or influence, will foster a more competitive environment. This promotes fair competition and prevents the concentration of power in the hands of a select few. An example is the efforts of some countries to break up monopolies in various industries to foster healthy competition.

Independent Oversight and Audit Mechanisms

To ensure fairness and accountability, independent oversight and audit mechanisms are vital. This includes establishing clear guidelines for the audit process and ensuring independence from any vested interests. This approach builds confidence in the regulatory framework’s integrity and minimizes the risk of regulatory capture.

- Establish Independent Regulatory Bodies: Creating independent bodies for regulatory oversight will help ensure the impartiality of the rules. This will minimize conflicts of interest and ensure that regulations are implemented fairly and without bias. An example of an independent body is the Federal Reserve, which is responsible for monetary policy.

- Strengthening Audit Procedures: Improving the rigor of audit procedures, including independent audits, can enhance the transparency and accountability of financial institutions. This strengthens the regulatory framework by ensuring compliance with existing rules and identifying potential weaknesses or loopholes. Examples of strengthening audit procedures can be found in the audits conducted by international organizations to verify compliance with international accounting standards.

Comparative Analysis of Solutions

| Solution | Potential Impact | Benefits | Risks |

|---|---|---|---|

| Strengthening Existing Frameworks | Improved oversight, reduced risk | Builds on existing infrastructure, lower implementation costs | Potential for slow adaptation to new challenges |

| Promoting Competition & Transparency | Fairer market, increased innovation | Encourages participation, fosters growth | Requires strong commitment from all stakeholders |

| Independent Oversight & Audit | Enhanced accountability, minimized risk | Impartial regulation, trust in the system | Potential bureaucratic complexities |

Illustrative Case Studies

Red Hat’s proposed rule changes for Wall Street raise significant questions about the potential impact on financial institutions and the broader market. Understanding how these changes might play out in practice requires examining real-world scenarios and drawing comparisons to similar situations in other industries. This section delves into illustrative case studies to provide a more tangible understanding of the potential consequences.

Impact on Specific Financial Institutions, Why should red hat be allowed to rewrite wall streets rules

Red Hat’s actions, if enacted, could disproportionately affect institutions with large trading volumes or complex algorithmic trading strategies. Consider a mid-sized investment bank heavily reliant on high-frequency trading (HFT) algorithms. If Red Hat’s proposed changes limit the speed and volume of trades, this bank could face significant operational challenges, potentially leading to decreased profitability and a loss of market share to competitors better equipped to adapt.

Furthermore, compliance costs associated with navigating the new regulations could strain resources and potentially affect their ability to offer competitive services.

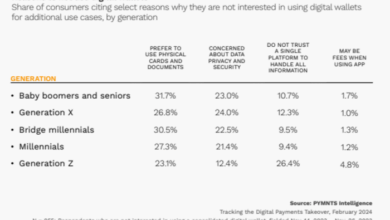

Case Study: The Rise of Mobile Payments in Retail

The retail industry experienced a similar transformation with the rise of mobile payments. Early adopters of mobile payment systems, like Square and PayPal, initially faced resistance from traditional retailers, who were hesitant to embrace new technology. However, the eventual market acceptance of mobile payments significantly altered the retail landscape. This change forced incumbents to adapt their business models or risk becoming obsolete.

This shift highlights how disruption can impact established norms and create opportunities for new entrants.

Potential Impact on Wall Street

The outcome of the mobile payments case study can potentially impact Wall Street in several ways. Firstly, the adaptation pressure on incumbents might trigger a wave of innovation, forcing financial institutions to invest in new technologies to maintain competitiveness. Secondly, the case study underscores the need for regulatory frameworks to adapt to rapid technological advancements, which could be a critical factor in evaluating Red Hat’s proposed rule changes.

Finally, the potential for market disruption suggests the need for proactive risk management strategies to ensure financial stability in the face of evolving technologies.

Potential Impact of this Case Study

The mobile payments case study provides a useful lens through which to view the potential impact of Red Hat’s actions. The parallels between the retail and financial sectors highlight the potential for disruption and the need for adaptability. It also emphasizes the critical importance of a well-structured regulatory framework that balances innovation with market stability. The shift from physical cash to mobile payments had profound effects on retail; similar repercussions could be expected in the financial sector.

Table of Relevant Data from Case Studies

| Case Study | Key Variable | Impact |

|---|---|---|

| Rise of Mobile Payments in Retail | Adoption of mobile payment systems | Disruption of traditional retail models, increased competition, and a need for adaptation. |

| Potential Impact on Financial Institutions (Hypothetical) | Red Hat’s rule changes | Potential for operational challenges, decreased profitability, loss of market share, and increased compliance costs for institutions reliant on high-frequency trading. |

Technological Implications of Red Hat’s Actions

Red Hat’s proposed rule changes on Wall Street hinge on significant technological advancements. These changes, while promising efficiency and innovation, also raise critical questions about the security, privacy, and overall impact on the financial landscape. The potential for disruption and transformation is undeniable, but so too is the need for careful consideration of the consequences. The technological underpinnings are the driving force behind the proposed changes, and understanding these advancements is crucial to assessing their potential impact.

Technological Advancements Behind Red Hat’s Proposals

Red Hat’s proposed rule changes are deeply rooted in advancements in distributed ledger technology (DLT), particularly blockchain and its derivatives. These technologies offer the potential for enhanced transparency, security, and efficiency in financial transactions. Decentralized systems, by nature, often offer resilience to single points of failure and improve the accuracy and immutability of recorded data. This enhanced security and transparency could lead to greater trust and confidence in the financial system.

However, the complexities of implementing and maintaining such systems need careful consideration.

Impact on Wall Street

The introduction of blockchain and other DLT technologies on Wall Street could drastically alter the current market landscape. Real-time, secure transactions could become the norm, streamlining processes like clearing and settlement. Automated trading strategies could become more sophisticated, potentially leading to increased volatility and requiring new regulatory frameworks. Furthermore, the potential for algorithmic trading to rely heavily on DLT could lead to situations where human oversight is diminished, raising concerns about the risk of systemic errors or malicious attacks.

Security and Privacy Implications

Security and privacy are paramount concerns with any significant technological shift, especially in the financial sector. While DLTs can offer enhanced security through cryptography and decentralized storage, the risk of hacking and manipulation remains. The increased automation and interconnectedness in the proposed system could create vulnerabilities that are difficult to detect and mitigate. Furthermore, the potential for data breaches and misuse of personal information necessitates robust security measures and stringent privacy protocols.

The need for strong encryption, access controls, and audit trails is essential.

Comparison of Current and Proposed Systems

| Feature | Current System | Proposed System |

|---|---|---|

| Transaction Speed | Variable, often days for large transactions | Potentially near-instantaneous |

| Transparency | Limited, often opaque | Enhanced, near real-time visibility |

| Security | Reliant on centralized institutions, potential single points of failure | Distributed, less vulnerable to single points of failure |

| Regulatory Compliance | Complex, varying across jurisdictions | Requires new regulatory frameworks |

| Interoperability | Fragmented, often incompatible systems | Potentially more unified and interoperable |

The table above highlights the key differences between the current Wall Street system and the proposed DLT-based system. The proposed system promises significant improvements in speed, transparency, and security, but also introduces new challenges related to regulation, interoperability, and security. These changes require careful consideration and implementation to ensure a smooth transition and minimize risks.

End of Discussion

In conclusion, the potential for Red Hat to reshape Wall Street’s rules is significant, with far-reaching implications for investors, traders, and regulators. The existing regulatory framework, while established, faces challenges in keeping pace with technological advancements. This analysis has highlighted the multifaceted arguments, potential consequences, and alternative solutions to navigate this complex landscape. Ultimately, the decision to allow these rule changes will require careful consideration of the long-term impact on market stability, transparency, and fairness.

The discussion surrounding this potential transformation underscores the crucial role of ongoing dialogue between technology innovators, financial regulators, and market participants to ensure a sustainable and equitable future for the financial sector.